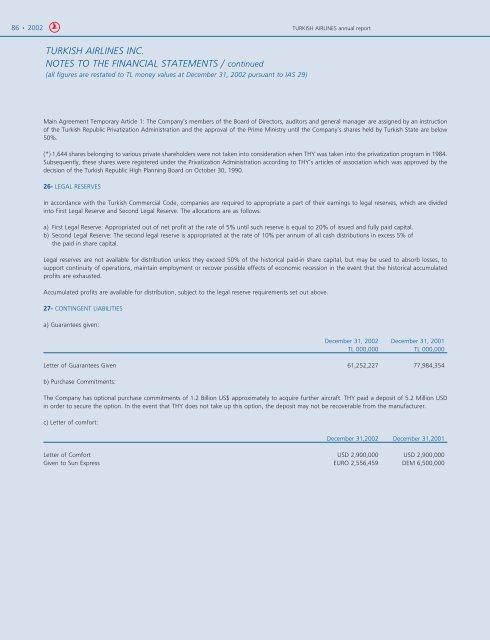

86 • <strong>2002</strong> TURKISH AIRLINES annual reportTURKISH AIRLINES INC.NOTES TO THE FINANCIAL STATEMENTS / continued(all figures are restated to TL money values at December 31, <strong>2002</strong> pursuant to IAS 29)Main Agreement Temporary Article 1: The Company’s members of the Board of Directors, auditors and general manager are assigned by an instructionof the <strong>Turkish</strong> Republic Privatization Administration and the approval of the Prime Ministry until the Company’s shares held by <strong>Turkish</strong> State are below50%.(*) 1,644 shares belonging to various private shareholders were not taken into consideration when THY was taken into the privatization program in 1984.Subsequently, these shares were registered under the Privatization Administration according to THY’s articles of association which was approved by thedecision of the <strong>Turkish</strong> Republic High Planning Board on October 30, 1990.26- LEGAL RESERVESIn accordance with the <strong>Turkish</strong> Commercial Code, companies are required to appropriate a part of their earnings to legal reserves, which are dividedinto First Legal Reserve and Second Legal Reserve. The allocations are as follows:a) First Legal Reserve: Appropriated out of net profit at the rate of 5% until such reserve is equal to 20% of issued and fully paid capital.b) Second Legal Reserve: The second legal reserve is appropriated at the rate of 10% per annum of all cash distributions in excess 5% ofthe paid in share capital.Legal reserves are not available for distribution unless they exceed 50% of the historical paid-in share capital, but may be used to absorb losses, tosupport continuity of operations, maintain employment or recover possible effects of economic recession in the event that the historical accumulatedprofits are exhausted.Accumulated profits are available for distribution, subject to the legal reserve requirements set out above.27- CONTINGENT LIABILITIESa) Guarantees given:December 31, <strong>2002</strong> December 31, 2001TL 000,000 TL 000,000Letter of Guarantees Given 61,252,227 77,984,354b) Purchase Commitments:The Company has optional purchase commitments of 1.2 Billion US$ approximately to acquire further aircraft. THY paid a deposit of 5.2 Million USDin order to secure the option. In the event that THY does not take up this option, the deposit may not be recoverable from the manufacturer.c) Letter of comfort:December 31,<strong>2002</strong> December 31,2001Letter of Comfort USD 2,900,000 USD 2,900,000Given to Sun Express EURO 2,556,459 DEM 6,500,000

<strong>2002</strong> • 87TURKISH AIRLINES INC.NOTES TO THE FINANCIAL STATEMENTS / continued(all figures are restated to TL money values at December 31, <strong>2002</strong> pursuant to IAS 29)d) Land and buildings built on State Airports Administration (DHMI) lands, and their legal structure:The majority of THY’s airport and terminal buildings, repair and maintenance centers, data processing centers, and training facilities are located on theland leased from the State Airports Administration (DHMI). The buildings and facilities on these leased lands have been constructed by THY and arerecorded as fixed assets of the Company. However the land on which all these buildings were built is not registered as THY’s property. The title of theproperty on which all these buildings were built belongs to the Ministry of Finance. However the land was allocated to DHMI for its use and DHMIleased the land to THY and the Company pays rent to DHMI for the land. There were informal claims from DHMI that THY should start paying rent forthe buildings after 10 years from the date of construction. The latest claim was made by DHMI in 1996 for one building and no further claim was madefor other buildings built by THY on this land. The directors believe that they do not need to pay rent for buildings built on DHMI land with THY financing.The authority to resolve this conflict rests with the Ministry of Finance.In the event the dispute is resolved against THY, it may cause THY to pay rent for the airport facilities in the future.e) The Company discounted its retirement pay provision to TL 76,721,751 Million (see note 24) according to IAS 19 (revised). The Company’s totalundiscounted liability for retirement pay would be TL 118,539,547 Million as of December 31, <strong>2002</strong>, if all employees had been terminated as at thatdate.28- OPERATING LEASE COMMITMENTSCommitments for future operating leases are as follows:December 31, <strong>2002</strong> December 31, 2001TL 000,000 TL 000,000Aircraft Lease PayableNot later than one year 64,058,392 365,934,163Between 1 & 2 years 219,087,697 304,695,982Between 2 & 5 years 140,632,466 41,594,142Over 5 years - 45,403,083423,778,555 757,627,37029- EVENTS SUBSEQUENT TO THE BALANCE SHEET DATE• As at May 7, 2003 the market price of France Telecom shares which was included in marketable securities as at December 31,<strong>2002</strong>, has increasedto 19.17 Euro from 17.15 Euro at December 31, <strong>2002</strong>. For this reason, the market value of France Telecom shares held by the Company has increasedby TL 808,700 million compared to December 31, <strong>2002</strong>.• As at May 7, 2003 the market price of USAfi shares which was included in other financial assets as at December 31,<strong>2002</strong>, has decreased to TL 12,361from TL 14,020 at December 31, <strong>2002</strong>. For this reason, the market value of USAfi shares held by the Company has decreased by TL 949,024 millioncompared to December 31, <strong>2002</strong>.• RJ100 aircraft with serial number E3241 that was rented through operational leasing crashed on January 8, 2003 in Diyarbak›r and the number of RJaircrafts in the fleet has decreased from 9 to 8.• On January 14, 2003 a decision was taken for the cancellation of A type-handling license by the Ministry of Transport of the <strong>Turkish</strong> Republic andfor the return to the Company of the amounts paid to DHMI, in USD and for the annulment of the remaining debt. Therefore the Company cancelledthe expenses of TL 10,544,532 million related to the A type handling license that it had registered for the year <strong>2002</strong> and it recorded on <strong>2002</strong> as otherextra-ordinary income TL 7,761,707 that it had expensed in 2001.• On January 2003 the statutory maximum amount of retirement and severance payable in respect of each year of employment is increased from TL1,260 million to TL 1,324 million.