Forecasting for the Love Boat: Royal Caribbean Cruises in 1998(

Forecasting for the Love Boat: Royal Caribbean Cruises in 1998( Forecasting for the Love Boat: Royal Caribbean Cruises in 1998(

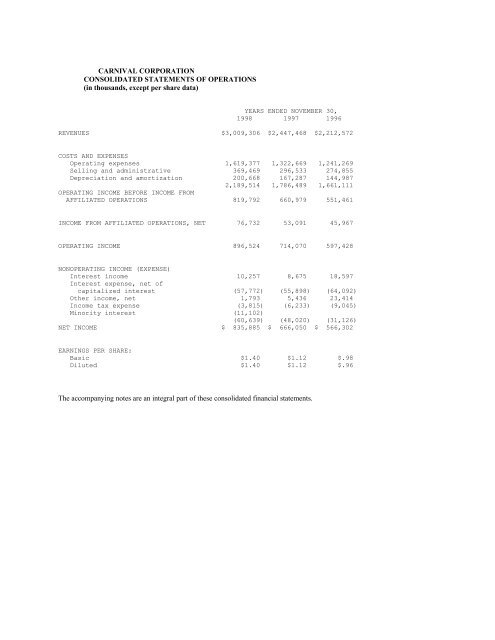

CARNIVAL CORPORATIONCONSOLIDATED STATEMENTS OF OPERATIONS(in thousands, except per share data)YEARS ENDED NOVEMBER 30,1998 1997 1996REVENUES $3,009,306 $2,447,468 $2,212,572COSTS AND EXPENSESOperating expenses 1,619,377 1,322,669 1,241,269Selling and administrative 369,469 296,533 274,855Depreciation and amortization 200,668 167,287 144,9872,189,514 1,786,489 1,661,111OPERATING INCOME BEFORE INCOME FROMAFFILIATED OPERATIONS 819,792 660,979 551,461INCOME FROM AFFILIATED OPERATIONS, NET 76,732 53,091 45,967OPERATING INCOME 896,524 714,070 597,428NONOPERATING INCOME (EXPENSE)Interest income 10,257 8,675 18,597Interest expense, net ofcapitalized interest (57,772) (55,898) (64,092)Other income, net 1,793 5,436 23,414Income tax expense (3,815) (6,233) (9,045)Minority interest (11,102)(60,639) (48,020) (31,126)NET INCOME $ 835,885 $ 666,050 $ 566,302EARNINGS PER SHARE:Basic $1.40 $1.12 $.98Diluted $1.40 $1.12 $.96The accompanying notes are an integral part of these consolidated financial statements.

CARNIVAL CORPORATIONCONSOLIDATED STATEMENTS OF CASH FLOWS(in thousands)YEARS ENDED NOVEMBER 30,1998 1997 1996OPERATING ACTIVITIESNet income $ 835,885 $666,050 $566,302Adjustments to reconcile net income tonet cash provided from operating activities:Depreciation and amortization 200,668 167,287 144,987Income from affiliates in excess ofdividends received (63,059) (46,569) (43,224)Minority interest 11,102Other (8,428) 2,540 19,639Changes in operating assets and liabilities,excluding businesses acquired and consolidated:Decrease (increase) in:Receivables 137 (21,229) (4,432)Consumable inventories (3,913) (1,689) (4,461)Prepaid expenses and other (15,369) 903 (4,919)Increase (decrease) in:Accounts payable 18,758 22,035 (5,489)Accrued liabilities 42,401 20,042 13,028Customer deposits 73,658 68,210 60,092Net cash provided from operatingactivities 1,091,840 877,580 741,523INVESTING ACTIVITIESAdditions to property and equipment, net (1,150,413) (497,657) (901,905)Proceeds from sale of assets 47,028 17,041 94,291Proceeds from litigation settlementsapplied to cost of ships 43,050Acquisition of consolidated subsidiaries, net (242,868)Purchase of equity interests in affiliates (38,378) (163,112)Other (additions to) reductions ininvestments in and advances toaffiliates, net (380) 39,540 (23,903)Decrease in short-term investments, net 4,052 2,748 37,710Other, net 21,528 21,805 94,644Net cash used for investing activities (1,321,053) (454,901) (819,225)FINANCING ACTIVITIESProceeds from long-term debt 1,404,395 155,366 971,361Principal payments of long-term debt (1,006,586) (424,391) (735,246)Dividends paid (178,458) (130,456) (103,877)Proceeds from issuance of Common Stock 11,399 5,162 3,728Other (4,253)Net cash provided from (used for)financing activities 226,497 (394,319) 135,966Net (decrease) increase in cash andcash equivalents (2,716) 28,360 58,264Cash and cash equivalents at beginningof year 139,989 111,629 53,365Cash and cash equivalents at end of year $ 137,273 $139,989 $111,629The accompanying notes are an integral part of these consolidated financial statements.

- Page 2 and 3: North America, but may fly to any p

- Page 4 and 5: Who’s OnboardObviously different

- Page 6 and 7: Demand for a Cruise VacationTo date

- Page 8 and 9: Appendix 1Cruise Industry, Demograp

- Page 10 and 11: -----------------------------------

- Page 12 and 13: According to CLIA and other trade p

- Page 14 and 15: Technological DevelopmentThe Compan

- Page 16 and 17: Cruise PricingThe Company's cruise

- Page 18 and 19: The Company has nine ships on order

- Page 20 and 21: In March 1998, the Company issued $

- Page 22 and 23: ROYAL CARIBBEAN CRUISES LTD.CONSOLI

- Page 24 and 25: ROYAL CARIBBEAN CRUISES LTD. CONSOL

- Page 26 and 27: Information about geographic areas

- Page 28 and 29: The Company's debt agreements conta

- Page 30 and 31: FORM 10-KSECURITIES AND EXCHANGE CO

- Page 32 and 33: The Company has signed agreements w

- Page 34 and 35: Depreciation and amortization incre

- Page 38 and 39: CARNIVAL CORPORATIONNOTES TO CONSOL

- Page 40 and 41: SELECTED FINANCIAL DATAThe selected

- Page 42 and 43: Company NameROYAL CARIBBEAN CRUISES

- Page 44: Company NameCARNIVAL CORPActual Act

CARNIVAL CORPORATIONCONSOLIDATED STATEMENTS OF OPERATIONS(<strong>in</strong> thousands, except per share data)YEARS ENDED NOVEMBER 30,<strong>1998</strong> 1997 1996REVENUES $3,009,306 $2,447,468 $2,212,572COSTS AND EXPENSESOperat<strong>in</strong>g expenses 1,619,377 1,322,669 1,241,269Sell<strong>in</strong>g and adm<strong>in</strong>istrative 369,469 296,533 274,855Depreciation and amortization 200,668 167,287 144,9872,189,514 1,786,489 1,661,111OPERATING INCOME BEFORE INCOME FROMAFFILIATED OPERATIONS 819,792 660,979 551,461INCOME FROM AFFILIATED OPERATIONS, NET 76,732 53,091 45,967OPERATING INCOME 896,524 714,070 597,428NONOPERATING INCOME (EXPENSE)Interest <strong>in</strong>come 10,257 8,675 18,597Interest expense, net ofcapitalized <strong>in</strong>terest (57,772) (55,898) (64,092)O<strong>the</strong>r <strong>in</strong>come, net 1,793 5,436 23,414Income tax expense (3,815) (6,233) (9,045)M<strong>in</strong>ority <strong>in</strong>terest (11,102)(60,639) (48,020) (31,126)NET INCOME $ 835,885 $ 666,050 $ 566,302EARNINGS PER SHARE:Basic $1.40 $1.12 $.98Diluted $1.40 $1.12 $.96The accompany<strong>in</strong>g notes are an <strong>in</strong>tegral part of <strong>the</strong>se consolidated f<strong>in</strong>ancial statements.