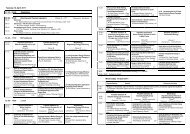

U.S.-FocUSed Biochar report - BioEnergy Lists

U.S.-FocUSed Biochar report - BioEnergy Lists

U.S.-FocUSed Biochar report - BioEnergy Lists

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Major Carbon MarketsThe Kyoto Protocol to the UNFCCC: Emissions Trading and the CDM MarketKyoto is a compliance market covering emissions from every developed country in the world, with the notableexception of the United States. Developed countries (called “Annex 1” countries in the cryptic language of thetreaty) must cut overall GHG emissions to roughly 5% below 1990 levels. Actual national targets vary. GHGs includedin Kyoto are CO 2 , methane, nitrous oxide, hydrofluorocarbons, perfluorocarbons, and sulfur hexafluoride.Kyoto’s compliance period runs from 2008-2012.Kyoto signatories are allowed to trade emissions allowances for compliance purposes, and may use offsets generatedthrough jointly implemented projects between two Annex 1 countries or through projects implemented indeveloping countries. The former mechanism is called “Joint Implementation” (JI) and its units of exchange areEmission Reduction Units (ERUs). The latter mechanism is the Clean Development Mechanism (CDM), whichgenerates Certified Emissions Reductions (CERs).Kyoto allows for the generation of offsets under CDM or JI for afforestation or reforestation of land that was notforested in 1990. So-called Land Use, Land Use Change and Forestry (LULUCF) offsets may only account for a1% decrease in a capped country’s total emissions. To manage permanence concerns, Kyoto allows such projectsto earn either temporary CERs (tCERs), which must be reissued every 5 years, or long-term CERs (lCERs), whichhave 20 year life spans and 5 year re-verification intervals. The UNFCCC has approved 11 LULUCF methodologies,all of them related to reforestation or afforestation.Parties that have ratified Kyoto must establish their own compliance regulations and domestic or regional tradingschemes. The European Union, for example, opted to form a regional compliance market, the EU EmissionsTrading System (EU ETS), so that its member states could meet their Kyoto commitments. Such domestic orregional systems place caps on individual companies that have compliance obligations to the State that areanalogous to the commitments of the State to the Kyoto Protocol.Kyoto’s offset markets (both CDM and JI) produced 832 MtCO 2 e of reductions in 2007, valued at USD 13.4 billion.The quantity of reductions was a 43% increase from the previous year. The CDM market in 2007 accounted for87% of the volume of the overall project-based offset market. The average price for a project based CER was USD13.60/tCO 2 e in 2007.Since 2008, considerable efforts have been taken to make projects aiming to avoid deforestation (entitled “ReducedEmissions from Deforestation and Forest Degradation (REDD)”) eligible for Kyoto offset credits. Thesecredits currently trade on the voluntary carbon markets. (Katoomba Group 2010).EU Emissions Trading SystemThe EU ETS includes the 27 member states of the EU, as well as Iceland, Lichtenstein, and Norway. Nationalgovernments create National Allocation Plans (NAPs), which set emissions targets for the country and allocateallowances to domestic emitters, including energy companies, ferrous metals, pulp and paper, and building materials.EU ETS’s current compliance period runs from 2008-2012. A linking directive allows emitters to utilizeCERs and ERUs generated through Kyoto’s CDM and JI to meet their domestic compliance obligations, thoughforestry projects are not allowed. In 2007, 2061 MtCO 2 e traded on the ETS, at a total value of USD 50.1 billion.(Katoomba Group 2010).Chicago Climate Exchange (CCX)The Chicago Climate Exchange is a legally binding, voluntary market for North America and Brazil. Membersjoin the CCX voluntarily and sign a legally-binding agreement to reduce emissions. The CCX trades CarbonFinancial Instruments (CFI), one of which equals 100 tCO 2 e, either allowance-based or offset-based. Offsets may<strong>Biochar</strong> relevance in GHG markets in: Carbon Market Implications for <strong>Biochar</strong>71