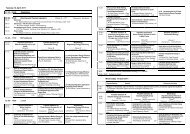

It is far easier to measure emissions from large emitters, such as power plants, where a gauge can be installedin an emissions pipe. Second, despite the difficulties of measuring emissions from distributed sources, manyof them can achieve emissions reductions more cheaply than large emitters. Offset methodologies allow suchnon-capped, distributed entities to quantify and verify actions taken to reduce their emissions, and then sell theverified reductions to capped entities in need of extra emissions entitlements. In the absence of offsets, cappedemitters above their own emissions thresholds must purchase allowances from other capped emitters. Offsetsoffer the covered over-emitter a cheaper alternative: purchase offset credits.The US Congressional Budget Office estimates that the use of offsets within the national cap & trade systemcontemplated under ACESA would reduce the net costs of compliance in 2030 from $248 billion to $101 billion(estimates are in 2007 dollars), a reduction of about 60 percent. Under such a scheme, CBO estimates that 52percent of required emission reductions from ACESA could be met by a combination of domestic andinternational offsets by 2030. (CBO 2009). The Clean Development Mechanism (CDM) is Kyoto’s offset system,wherein offsets generated in non-capped developing countries are referred to as Certified Emission Reductions(CERs), and may be used by capped developed countries for compliance. CERs may also be used to satisfyEU ETS obligations for capped emitters. (Lokey 2009).Carbon offsets may be generated through land management practices in both the agricultural and forestrysectors, as well as through a range of other methods, but a number of monitoring and verificationchallenges must be addressed through an offset verification or certification scheme. Land managementpractices such as low- or no-till agriculture can remove carbon dioxide from the atmosphere and store it in plantsor soils. Offsets of any kind require substantial care in the design of verification schemes, and land managementoffsets require even more care. This is because a capped entity is already monitoring its emissions, and so longas its emissions are below the entity’s allocation and the monitoring equipment is functioning properly, it is notthe regulator’s concern how the emissions were reduced. A non-capped entity claiming emissions reductionsfor offset certification presents a different set of challenges to the regulator. When the emissions reductions areattributable to land use practices, additional challenges such as permanence concerns and increased leakage riskarise. (CBO 2009, Olander & Galik ##). These challenges are discussed below.• Did the entity really do anything differently, that they would not have done anyway? This is the additionalityquestion. A true offset must come from an activity that would not have occurred under a business-asusualscenario. Additionality can be proven in any number of ways, and the allowable methods dependon the carbon market into which the offset is to be sold. Some additionality arguments (any one of whichmight be used to prove additionality, depending on the offset certification scheme) include:» Activity not mandated by other laws;» Activity reduces GHGs after a particular date;» Activity is not common in the industry;» Activity is not profitable (or is less profitable than another regular activity) without carbon credit revenue;» Activity is the first of its kind;» Activity is subject to social, political, institutional, or technical barriers; or» Many others.• Can we reliably measure the emissions reductions claimed by the offsetting entity? This is the quantifiabilityquestion. The measure of how many emissions are being abated by the activity in question is acomplicated one, and is easily manipulated by a number of factors: selection of the baseline, determinationof the life cycle analysis boundary, etc. Emission reductions can be quantified through a calculation thatmodels a reasonably well- understood process, or might be measured directly through sampling. Mostoffset schemes require a third party to verify emission reductions before credits are awarded, often on anannual basis.• Are the emissions offsets simply delaying the release of GHGs, or are they permanent? This is the per-68U.S.-Focused <strong>Biochar</strong> Report:Assessment of <strong>Biochar</strong>’s Benefits for the United States of America

manence question. Land management offsets are particularly problematic here, as carbon stored in soilsor trees can be released if the soils are reverted to till-intensive agriculture or if the trees are cut down anddecompose. Fire, pests, and other environmental changes are of concern as well. Offset programs may addresspermanence in a number of ways:» Requiring legal assurances that the carbon will remain stored, such that if reversal occurs the projectdeveloper must sequester more carbon or buy offset credits to cover her position;» Assigning expiration dates to each offset;» pooling a portion of credits from each project into a reserve, to be used in the event that any one project’soffsets are reversed; or» requiring project developers to deposit money into a regional shared liability fund that will pay out to anyproject reversed by an act of nature.• Is the activity that allegedly reduces emissions in fact merely pushing those emissions to another location,or another economic sector? This is the leakage question. Again, land management presents special challenges:practices that wholly displace emissions generating activities to other areas are not providing anynet savings in GHG emissions. Leakage is extremely difficult to control, and is often beyond the abilitiesof the offset generator to manage. Offset programs may choose to “discount” carbon credits to accountfor unavoidable leakage. This process involves awarding the developer only a portion of the emissions reductionsachieved, on the assumption that a percentage of them are probabilistically likely to be reversed.(CBO 2009).Offset verification schemes (for voluntary markets) and certification schemes (for compliance markets)allow offset generators to prove the legitimacy of an emissions-reducing activity through thedesignation of “methodologies” or “protocols” specific to that activity type. A typical methodology willrequire an offset generator to prove the additionality, quantifiability, permanence, and non-leakage of a particularproject or set of similar projects before carbon credits are awarded. This process can be long, arduous, complicated,risky, and extremely expensive. Lokey estimates that certifying a CDM project can cost between USD58,000 and 500,000 per year, depending on the complexity of the project. (Lokey 2009). Even after all the moneyand time has been spent on offset certification, there is still a risk that the project may not be awarded credits.Cost and risk are even higher in the absence of an established methodology, because the developer must proposea new methodology that the CDM Executive Board might accept, reject, or modify significantly before acceptance.(Lokey 2009). A schematic of the CDM process is included below for illustrative purposes. In the eventthat ACESA becomes law, and a U.S. carbon market is created, the US Environmental Protection Agency and USDepartment of Agriculture will have joint responsibility for establishing offset verification procedures for themarket. (CBO 2009).<strong>Biochar</strong> relevance in GHG markets in: Carbon Market Implications for <strong>Biochar</strong>69