advisormonthly - Franklin Templeton Investments

advisormonthly - Franklin Templeton Investments

advisormonthly - Franklin Templeton Investments

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

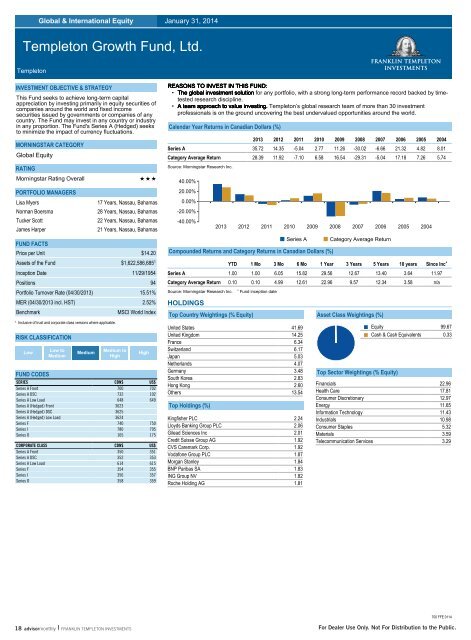

Global & International Equity January 31, 2014<strong>Templeton</strong> Growth Fund, Ltd.<strong>Templeton</strong>INVESTMENT OBJECTIVE & STRATEGYThis Fund seeks to achieve long-term capitalappreciation by investing primarily in equity securities ofcompanies around the world and fixed incomesecurities issued by governments or companies of anycountry. The Fund may invest in any country or industryin any proportion. The Fund's Series A (Hedged) seeksto minimize the impact of currency fluctuations.MORNINGSTAR CATEGORYGlobal EquityRATINGMorningstar Rating OverallPORTFOLIO MANAGERSLisa MyersNorman BoersmaTucker ScottJames Harper17 Years, Nassau, Bahamas28 Years, Nassau, Bahamas22 Years, Nassau, Bahamas21 Years, Nassau, BahamasFUND FACTSPrice per Unit $14.20Assets of the Fund $1,622,586,685 1Inception Date 11/29/1954Positions 94Portfolio Turnover Rate (04/30/2013) 15.51%MER (04/30/2013 incl. HST) 2.52%BenchmarkMSCI World Index1 Inclusive of trust and corporate class versions where applicable.RISK CLASSIFICATIONLowLow toMediumMediumMedium toHighHighFUND CODESSERIES CDN$ US$Series A Front 700 702Series A DSC 732 102Series A Low Load 648 649Series A (Hedged) Front 3623Series A (Hedged) DSC 3625Series A (Hedged) Low Load 3624Series F 740 750Series I 780 795Series O 165 175CORPORATE CLASS CDN$ US$Series A Front 350 351Series A DSC 352 353Series A Low Load 614 615Series F 354 355Series I 356 357Series O 358 359REASONS TO INVEST IN THIS FUND:• The global investment solution for any portfolio, with a strong long-term performance record backed by timetestedresearch discipline.• A team approach to value investing. <strong>Templeton</strong>’s global research team of more than 30 investmentprofessionals is on the ground uncovering the best undervalued opportunities around the world.Calendar Year Returns in Canadian Dollars (%)2013 2012 2011 2010 2009 2008 2007 2006 2005 2004Series A 35.72 14.35 -5.04 2.77 11.26 -30.02 -6.66 21.32 4.82 8.01Category Average Return 28.39 11.92 -7.10 6.58 16.54 -29.31 -5.04 17.18 7.26 5.74Source: Morningstar Research Inc.40.00%20.00%0.00%-20.00%-40.00%2013 2012 2011 2010 2009 2008 2007 2006 2005 2004• Series ACompounded Returns and Category Returns in Canadian Dollars (%)• Category Average ReturnYTD 1 Mo 3 Mo 6 Mo 1 Year 3 Years 5 Years 10 years Since Inc^Series A 1.00 1.00 6.05 15.82 29.56 12.67 13.40 3.64 11.97Category Average Return 0.10 0.10 4.99 12.61 22.96 9.57 12.34 3.58 n/aSource: Morningstar Research Inc.HOLDINGSTop Country Weightings (% Equity)^ Fund inception dateUnited States 41.69United Kingdom 14.25France 6.34Switzerland 6.17Japan 5.03Netherlands 4.07Germany 3.48South Korea 2.83Hong Kong 2.60Others 13.54Top Holdings (%)Kingfisher PLC 2.24Lloyds Banking Group PLC 2.06Gilead Sciences Inc 2.01Credit Suisse Group AG 1.92CVS Caremark Corp. 1.92Vodafone Group PLC 1.87Morgan Stanley 1.84BNP Paribas SA 1.83ING Group NV 1.82Roche Holding AG 1.81Asset Class Weightings (%)Top Sector Weightings (% Equity)• Equity 99.67• Cash & Cash Equivalents 0.33Financials 22.96Health Care 17.81Consumer Discretionary 12.97Energy 11.65Information Technology 11.43Industrials 10.98Consumer Staples 5.32Materials 3.59Telecommunication Services 3.29700 FFE 011418 <strong>advisormonthly</strong> FRANKLIN TEMPLETON INVESTMENTS For Dealer Use Only. Not For Distribution to the Public.