PDF (3.77 Mo) - Le Crédit Agricole

PDF (3.77 Mo) - Le Crédit Agricole

PDF (3.77 Mo) - Le Crédit Agricole

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

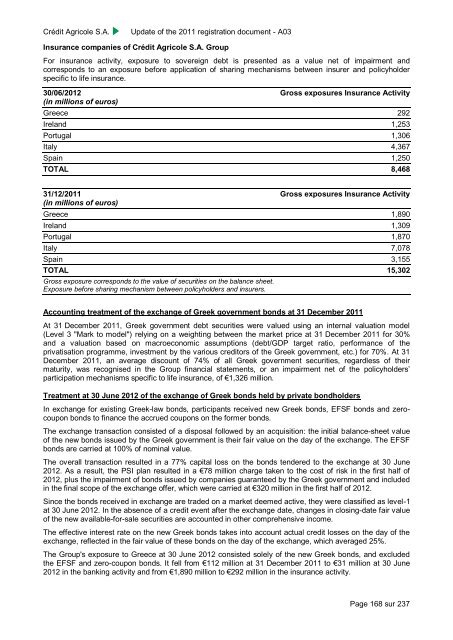

Crédit <strong>Agricole</strong> S.A.Update of the 2011 registration document - A03Insurance companies of Crédit <strong>Agricole</strong> S.A. GroupFor insurance activity, exposure to sovereign debt is presented as a value net of impairment andcorresponds to an exposure before application of sharing mechanisms between insurer and policyholderspecific to life insurance.30/06/2012(in millions of euros)Gross exposures Insurance ActivityGreece 292Ireland 1,253Portugal 1,306Italy 4,367Spain 1,250TOTAL 8,46831/12/2011(in millions of euros)Gross exposures Insurance ActivityGreece 1,890Ireland 1,309Portugal 1,870Italy 7,078Spain 3,155TOTAL 15,302Gross exposure corresponds to the value of securities on the balance sheet.Exposure before sharing mechanism between policyholders and insurers.Accounting treatment of the exchange of Greek government bonds at 31 December 2011At 31 December 2011, Greek government debt securities were valued using an internal valuation model(<strong>Le</strong>vel 3 "Mark to model") relying on a weighting between the market price at 31 December 2011 for 30%and a valuation based on macroeconomic assumptions (debt/GDP target ratio, performance of theprivatisation programme, investment by the various creditors of the Greek government, etc.) for 70%. At 31December 2011, an average discount of 74% of all Greek government securities, regardless of theirmaturity, was recognised in the Group financial statements, or an impairment net of the policyholders’participation mechanisms specific to life insurance, of €1,326 million.Treatment at 30 June 2012 of the exchange of Greek bonds held by private bondholdersIn exchange for existing Greek-law bonds, participants received new Greek bonds, EFSF bonds and zerocouponbonds to finance the accrued coupons on the former bonds.The exchange transaction consisted of a disposal followed by an acquisition: the initial balance-sheet valueof the new bonds issued by the Greek government is their fair value on the day of the exchange. The EFSFbonds are carried at 100% of nominal value.The overall transaction resulted in a 77% capital loss on the bonds tendered to the exchange at 30 June2012. As a result, the PSI plan resulted in a €78 million charge taken to the cost of risk in the first half of2012, plus the impairment of bonds issued by companies guaranteed by the Greek government and includedin the final scope of the exchange offer, which were carried at €320 million in the first half of 2012.Since the bonds received in exchange are traded on a market deemed active, they were classified as level-1at 30 June 2012. In the absence of a credit event after the exchange date, changes in closing-date fair valueof the new available-for-sale securities are accounted in other comprehensive income.The effective interest rate on the new Greek bonds takes into account actual credit losses on the day of theexchange, reflected in the fair value of these bonds on the day of the exchange, which averaged 25%.The Group's exposure to Greece at 30 June 2012 consisted solely of the new Greek bonds, and excludedthe EFSF and zero-coupon bonds. It fell from €112 million at 31 December 2011 to €31 million at 30 June2012 in the banking activity and from €1,890 million to €292 million in the insurance activity.Page 168 sur 237