PDF (3.77 Mo) - Le Crédit Agricole

PDF (3.77 Mo) - Le Crédit Agricole

PDF (3.77 Mo) - Le Crédit Agricole

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

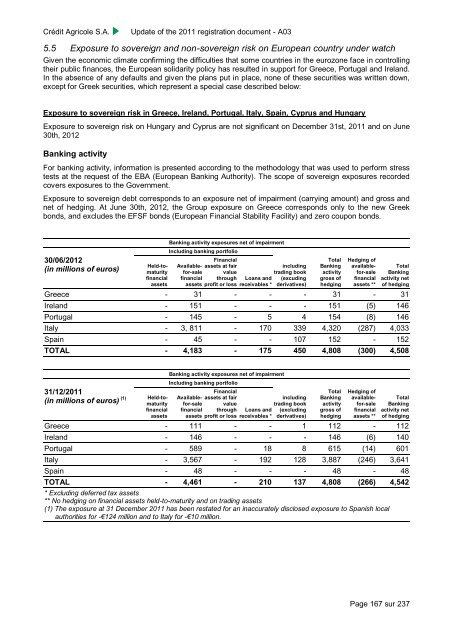

Crédit <strong>Agricole</strong> S.A.Update of the 2011 registration document - A035.5 Exposure to sovereign and non-sovereign risk on European country under watchGiven the economic climate confirming the difficulties that some countries in the eurozone face in controllingtheir public finances, the European solidarity policy has resulted in support for Greece, Portugal and Ireland.In the absence of any defaults and given the plans put in place, none of these securities was written down,except for Greek securities, which represent a special case described below:Exposure to sovereign risk in Greece, Ireland, Portugal, Italy, Spain, Cyprus and HungaryExposure to sovereign risk on Hungary and Cyprus are not significant on December 31st, 2011 and on June30th, 2012Banking activityFor banking activity, information is presented according to the methodology that was used to perform stresstests at the request of the EBA (European Banking Authority). The scope of sovereign exposures recordedcovers exposures to the Government.Exposure to sovereign debt corresponds to an exposure net of impairment (carrying amount) and gross andnet of hedging. At June 30th, 2012, the Group exposure on Greece corresponds only to the new Greekbonds, and excludes the EFSF bonds (European Financial Stability Facility) and zero coupon bonds.30/06/2012(in millions of euros)Held-tomaturityfinancialassetsBanking activity exposures net of impairmentIncluding banking portfolioAvailablefor-salefinancialassetsFinancialassets at fairvaluethroughprofit or lossLoans andreceivables *includingtrading book(excudingderivatives)TotalBankingactivitygross ofhedgingHedging ofavailablefor-salefinancialassets **TotalBankingactivity netof hedgingGreece - 31 - - - 31 - 31Ireland - 151 - - - 151 (5) 146Portugal - 145 - 5 4 154 (8) 146Italy - 3, 811 - 170 339 4,320 (287) 4,033Spain - 45 - - 107 152 - 152TOTAL - 4,183 - 175 450 4,808 (300) 4,50831/12/2011(in millions of euros) (1)Held-tomaturityfinancialassetsBanking activity exposures net of impairmentIncluding banking portfolioAvailablefor-salefinancialassetsFinancialassets at fairvaluethroughprofit or lossLoans andreceivables *includingtrading book(excludingderivatives)TotalBankingactivitygross ofhedgingHedging ofavailablefor-salefinancialassets **TotalBankingactivity netof hedgingGreece - 111 - - 1 112 - 112Ireland - 146 - - - 146 (6) 140Portugal - 589 - 18 8 615 (14) 601Italy - 3,567 - 192 128 3,887 (246) 3,641Spain - 48 - - - 48 - 48TOTAL - 4,461 - 210 137 4,808 (266) 4,542* Excluding deferred tax assets** No hedging on financial assets held-to-maturity and on trading assets(1) The exposure at 31 December 2011 has been restated for an inaccurately disclosed exposure to Spanish localauthorities for -€124 million and to Italy for -€10 million.Page 167 sur 237