Question and Answers (updated) - Bureau of Contract Administration

Question and Answers (updated) - Bureau of Contract Administration Question and Answers (updated) - Bureau of Contract Administration

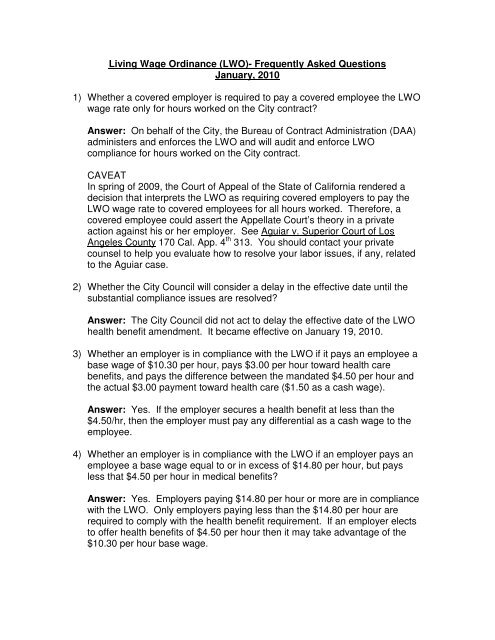

Living Wage Ordinance (LWO)- Frequently Asked QuestionsJanuary, 20101) Whether a covered employer is required to pay a covered employee the LWOwage rate only for hours worked on the City contract?Answer: On behalf of the City, the Bureau of Contract Administration (DAA)administers and enforces the LWO and will audit and enforce LWOcompliance for hours worked on the City contract.CAVEATIn spring of 2009, the Court of Appeal of the State of California rendered adecision that interprets the LWO as requiring covered employers to pay theLWO wage rate to covered employees for all hours worked. Therefore, acovered employee could assert the Appellate Court’s theory in a privateaction against his or her employer. See Aguiar v. Superior Court of LosAngeles County 170 Cal. App. 4 th 313. You should contact your privatecounsel to help you evaluate how to resolve your labor issues, if any, relatedto the Aguiar case.2) Whether the City Council will consider a delay in the effective date until thesubstantial compliance issues are resolved?Answer: The City Council did not act to delay the effective date of the LWOhealth benefit amendment. It became effective on January 19, 2010.3) Whether an employer is in compliance with the LWO if it pays an employee abase wage of $10.30 per hour, pays $3.00 per hour toward health carebenefits, and pays the difference between the mandated $4.50 per hour andthe actual $3.00 payment toward health care ($1.50 as a cash wage).Answer: Yes. If the employer secures a health benefit at less than the$4.50/hr, then the employer must pay any differential as a cash wage to theemployee.4) Whether an employer is in compliance with the LWO if an employer pays anemployee a base wage equal to or in excess of $14.80 per hour, but paysless that $4.50 per hour in medical benefits?Answer: Yes. Employers paying $14.80 per hour or more are in compliancewith the LWO. Only employers paying less than the $14.80 per hour arerequired to comply with the health benefit requirement. If an employer electsto offer health benefits of $4.50 per hour then it may take advantage of the$10.30 per hour base wage.

- Page 2 and 3: 5) Whether an employer is in compli

- Page 4 and 5: 15) Whether an employer who pays hi

- Page 6 and 7: (c) Compliance with this article sh

Living Wage Ordinance (LWO)- Frequently Asked <strong>Question</strong>sJanuary, 20101) Whether a covered employer is required to pay a covered employee the LWOwage rate only for hours worked on the City contract?Answer: On behalf <strong>of</strong> the City, the <strong>Bureau</strong> <strong>of</strong> <strong>Contract</strong> <strong>Administration</strong> (DAA)administers <strong>and</strong> enforces the LWO <strong>and</strong> will audit <strong>and</strong> enforce LWOcompliance for hours worked on the City contract.CAVEATIn spring <strong>of</strong> 2009, the Court <strong>of</strong> Appeal <strong>of</strong> the State <strong>of</strong> California rendered adecision that interprets the LWO as requiring covered employers to pay theLWO wage rate to covered employees for all hours worked. Therefore, acovered employee could assert the Appellate Court’s theory in a privateaction against his or her employer. See Aguiar v. Superior Court <strong>of</strong> LosAngeles County 170 Cal. App. 4 th 313. You should contact your privatecounsel to help you evaluate how to resolve your labor issues, if any, relatedto the Aguiar case.2) Whether the City Council will consider a delay in the effective date until thesubstantial compliance issues are resolved?Answer: The City Council did not act to delay the effective date <strong>of</strong> the LWOhealth benefit amendment. It became effective on January 19, 2010.3) Whether an employer is in compliance with the LWO if it pays an employee abase wage <strong>of</strong> $10.30 per hour, pays $3.00 per hour toward health carebenefits, <strong>and</strong> pays the difference between the m<strong>and</strong>ated $4.50 per hour <strong>and</strong>the actual $3.00 payment toward health care ($1.50 as a cash wage).Answer: Yes. If the employer secures a health benefit at less than the$4.50/hr, then the employer must pay any differential as a cash wage to theemployee.4) Whether an employer is in compliance with the LWO if an employer pays anemployee a base wage equal to or in excess <strong>of</strong> $14.80 per hour, but paysless that $4.50 per hour in medical benefits?Answer: Yes. Employers paying $14.80 per hour or more are in compliancewith the LWO. Only employers paying less than the $14.80 per hour arerequired to comply with the health benefit requirement. If an employer electsto <strong>of</strong>fer health benefits <strong>of</strong> $4.50 per hour then it may take advantage <strong>of</strong> the$10.30 per hour base wage.

5) Whether an employer is in compliance with the LWO if an employer pays themedical premiums associated with the health benefits it provides, but doesnot pay for the associated deductibles <strong>and</strong> co-pays?Answer: Yes. Living Wage Regulation #12, provides that an employer hasmet its obligation by covering the cost <strong>of</strong> any premiums for health benefits.Deductibles <strong>and</strong> co-pays are not “out-<strong>of</strong>-pocket costs” toward the provision <strong>of</strong>health benefits, which would allow an employee to opt out <strong>of</strong> the healthbenefit.6) If an employee has health benefits through a spouse/domestic partner, is theemployer still required to either pay the higher wage rate or provide therequired health benefits?Answer: Yes. LWO Section 10.37.3 (a) prohibits an employee fromdeclining the health benefits <strong>of</strong>fered by the employer provided that theemployee is not required to pay any out-<strong>of</strong>-pocket contribution. Therefore, anemployer may require all employees to accept the health benefit even if theemployee has health benefit coverage elsewhere.7) Due to the financial impact <strong>of</strong> the Living Wage increase to the existingconcessions, will LAWA allow the concessions to increase prices to cover theincrease in labor costs or considering reducing rent charged to theconcessions to help <strong>of</strong>f-set the costs?Answer: Price increases by LAWA concessionaires are governed by theconcession agreements.8) Whether Disadvantage Business Enterprises are exempt from the LWO?Answer: No. Companies certified as Disadvantage Business Enterprisesare not exempt from complying with the requirements <strong>of</strong> the LWO. Currently,the LWO allows contractors under a Public Lease/License to seek a “SmallBusiness Exemption”. In order to qualify, an employer must meet therequirements outlined in LAAC Section 10.37.1(i). Note, gross revenues areadjusted annually <strong>and</strong> is currently $454,016 as <strong>of</strong> July 1, 2009 for the 2008calendar year.9) Whether a company with a small number <strong>of</strong> employees is qualified for anexemption from the LWO?Answer: See the answer to question #8.

10) Whether an employer who <strong>of</strong>fers health benefits, which require the employeeto contribute “out-<strong>of</strong>-pocket costs” toward the premium, must increase thehourly pay rate to $14.80, if the employee declines the health benefits?Answer: Yes. Employers who require employees to contribute to the cost <strong>of</strong>the health benefit premium must allow employees the option <strong>of</strong> declining suchbenefits <strong>and</strong> pay the hourly rate <strong>of</strong> $14.80. If the premium exceeds the $4.50per hour <strong>and</strong> the employer absorbs the entire cost, the employee may not optout.11) Whether an employer may elect to pay employees $14.80 per hour instead <strong>of</strong>providing health benefits?Answer: Yes.12) Whether employers may delay providing health benefits to new hires until theemployee completes a probation or training type period?Answer: In the case <strong>of</strong> new hires, an employer wishing to delay the provision<strong>of</strong> health benefits, until the employee has completed a probationary or trainingperiod may do so; however, it must pay the full cash wage <strong>of</strong> $14.80 per houruntil the employee is extended health benefits. At the time that the employerprovides the health benefits, it may reduce the base wage accordingly.13) Whether employers may require employees to accrue the compensated <strong>and</strong>uncompensated time <strong>of</strong>f required by the LWO?Answer: LWO Section 10.37.2 (b) obligates an employer to provide at least12 compensated days <strong>of</strong>f per year <strong>and</strong> at least 10 uncompensated days <strong>of</strong>fper year. A full time employee shall accrue one eight hour day per month <strong>of</strong>compensated days <strong>of</strong>f. A part time employee is entitled to a compensated“day <strong>of</strong>f” <strong>and</strong> shall have accrued a “day <strong>of</strong>f” in increments proportional to thataccrued by a full-time employee. As for uncompensated days <strong>of</strong>f, the LWOrequires 10 days <strong>of</strong>f for personal or immediate family illness <strong>and</strong> are notaccrued <strong>and</strong> are not carried over.Revised 11/22/1114) How does the DAA determine whether a health benefit program is worth$4.50 per hour per employee?Answer: The DAA shall determine compliance based on the monthlypremiums paid by the employer which is then divided by the number <strong>of</strong> hoursworked by each employee to determine if the employer has met the $4.50 perhour rate.

15) Whether an employer who pays his or her employee $14.80 as a cash wagemust calculate overtime on the $10.30 or the $14.80?Answer: The LWO requires the payment <strong>of</strong> $14.80/hr if health benefits arenot <strong>of</strong>fered. Therefore, an employee’s overtime hours are calculated basedon the $14.80/hr for an overtime rate <strong>of</strong> $22.20/hr. If health benefits are<strong>of</strong>fered, employers can use the $10.30/hr rate when calculating the overtimerate.16) What is the minimum health benefit an employer must provide?Answer: An employer must provide at least $4.50 per hour per employeetowards health benefits. An employer may provide a health benefit <strong>of</strong> lessthan $4.50/hr to cover employees, whether or not they have dependants.However, any differential in cost per employee must be added to theemployee’s hourly rate <strong>of</strong> pay.17) Does the LWO apply to those employers who have collective bargainingagreements with their employees? Can those businesses <strong>of</strong>fer a lower wage<strong>and</strong> provide for health benefits in a manner that is inconsistent with the LWO?Answer: The LWO does apply to an employer who has a collectivebargaining agreement in place. However, an employer <strong>and</strong> its employeesmay exempt themselves from the LWO by providing in writing that thecollective bargaining agreement supersedes the LWO.18) How does the DAA monitor compliance with the LWO?Answer: BCA administers a complaint driven program. However, employerssubject to the LWO are required to comply with the reporting requirements asstipulated in the LWO Regulation #4 Employer Requirements.19) If an employer has just finished open enrollment for group health benefits, theonly way to make a change to these benefits during the benefits year is tohave a “qualifying status change” per IRS regulations. Will the City <strong>of</strong> LosAngeles back an employer’s position that the LWO/LAWA is such a statuschange?Answer: The City <strong>of</strong> Los Angeles takes no position.20) Is there a compensated or uncompensated day <strong>of</strong>f accrual limit?Answer: The LWO compensated <strong>and</strong> uncompensated days <strong>of</strong>f requirementsare minimum requirements. There is no limit should an employer wish toallow more than the minimum required by the LWO.

21) Is there a carry over requirement for unused compensated or uncompensateddays <strong>of</strong>f?Answer: No. There is no obligation to carry over compensated oruncompensated days <strong>of</strong>f into the subsequent twelve months. However, anemployer must cash out the employee for unused accrued compensated days<strong>of</strong>f at the end <strong>of</strong> the twelve months, which are not carried over.22) If an employer <strong>of</strong>fers a two tier medical plan, with the base plan meeting the$4.50 requirement, <strong>and</strong> a better plan, which requires an employee tocontribute toward payment <strong>of</strong> the premium, may an employee waivecoverage?Answer: No. An employer <strong>of</strong>fering a base plan costing $4.50/hr to cover theemployee <strong>and</strong> their dependents has satisfied the health benefit <strong>of</strong> the LWO.If the employee wishes to upgrade his/her plan to the premium plan with anout-<strong>of</strong>-pocket cost, he/she may do so. The LWO does not give the employeethe option <strong>of</strong> waiving the base plan health benefits provided at the $4.50/hrrate.23) What is the penalty for non-compliance with the LWO LAWA health benefitsamendment?Answer: A company that fails to comply with the requirements <strong>of</strong> the LWOamendment that became operative January 19, 2010 will be considered to bein violation <strong>of</strong> the LWO <strong>and</strong> consequently subject to the provisions containedin LAAC Section 10.37.6 Enforcement, which provides:“(a) An employee claiming violation <strong>of</strong> this article may bring an action in theMunicipal Court or Superior Court <strong>of</strong> the State <strong>of</strong> California, as appropriate,against an employer <strong>and</strong> may be awarded:(1) For failure to pay wages required by this article – back pay foreach day during which the violation continued.(2) For failure to pay medical benefits – the differential between thewage required by this article withour benefits <strong>and</strong> such wagewith benefits, less amounts paid, if any, toward medicalbenefits.(3) For retaliation – reinstatement, back pay, or other equitablerelief the court may deem appropriate.(4) For willful violations, the amount <strong>of</strong> monies to be paid under (1)– (3) shall be trebled.(b) The court shall award reasonable attorney’s fees <strong>and</strong> costs to anemployee who prevails in any such enforcement action <strong>and</strong> to anemployer who so prevails if the employee’s suit was frivolous.

(c) Compliance with this article shall be required in a City contracts to which itapplies, <strong>and</strong> such contracts shall provide that violation <strong>of</strong> this article shallconstitute a material breach there<strong>of</strong> <strong>and</strong> entitle the City to terminate thecontract <strong>and</strong> otherwise pursue legal remedies that may be available.Such contracts shall also include a pledge that there shall be compliancewith federal law proscribing retaliation for union organizing.(d) An employee claiming violation <strong>of</strong> this article may report such claimedviolation to the DAA which shall investigate such complaint. Whetherbased upon such a complaint or otherwise, where the DAA hasdetermined that an employer has violated this article, the DAA shall issuea written notice to the employer that the violation is to be corrected withinten (10) days. In the event that the employer has not demonstrated to theDAA within such period that it has cured such violation, the DAA maythen:(1) Request the awarding authority to declare a material breach <strong>of</strong> the[City agreement] <strong>and</strong> exercise contractual remedies there under,which are to include, but not be limited to, termination <strong>of</strong> the [Cityagreement] <strong>and</strong> the return <strong>of</strong> monies paid by the City for servicesnot yet rendered.(2) Request the City Council to debar the employer from future Citycontracts, leases <strong>and</strong> licenses for three (3) years or until allpenalties <strong>and</strong> restitution have been fully paid, whichever occurslast. Such debarment shall be to the extent permitted by, <strong>and</strong>under whatever procedures may be required by, law.(3) Request the City Attorney to bring a civil action against theemployer seeking:(i) Where applicable, payment <strong>of</strong> all unpaid wages or(ii)health premiums prescribed by this article; <strong>and</strong>/orA fine payable to the City in the amount <strong>of</strong> up tonehundred dollars ($100) for each violation for each daythe violation remains uncured.Where the alleged violation concerns non-payment <strong>of</strong> wages or healthpremiums, the employer will not be subject to debarment or civil penalties if itpays the monies in dispute into a holding account maintained by the City for suchpurpose. Such disputed monies shall be presented to a neutral arbitrator forbinding arbitration. . . . “

CITY OF LOS ANGELESDepartment <strong>of</strong> Public Works<strong>Bureau</strong> <strong>of</strong> <strong>Contract</strong> <strong>Administration</strong>1149 S. Broadway Street, Suite 300Los Angeles, CA 90015Phone: (213) 847-2625 – Fax: (213) 847-2777CALCULATING COMPENSATED & UNCOMPENSATED TIME OFFFOR PART-TIME EMPLOYEESLos Angeles Administrative Code Section 10.37 requires employers to provide at leasttwelve (12) compensated days <strong>of</strong>f per year for sick leave, vacation or personal necessityat the employee’s request, <strong>and</strong> an additional ten (10) days uncompensated time <strong>of</strong>f forsick leave when the compensated time <strong>of</strong>f is exhausted. Use the formulae below tocalculate the compensated/uncompensated time <strong>of</strong>f accrued. The formulae assume thatthe part-time employees work a regularly assigned schedule. The calculation for asneededor intermittent employees would be on the basis <strong>of</strong> hours worked.COMPENSATED TIME OFF:12 Days/Year Compensated Time x 8 Hours/Day = 96 HoursHours Worked In A Year: 52 Weeks x 40 Hours/Week = 2080 Hours96 Hours ÷ 2080 Hours = .04615 Hours Compensated Time Off For Every HourScheduled to Work; or2.769 Minutes For Every Hour Scheduled to WorkMultiply 2.769 x the number <strong>of</strong> hours scheduled to work to calculate the number <strong>of</strong>minutes <strong>of</strong> compensated time that have been accrued. Convert minutes to anhourly figure as appropriate.UNCOMPENSATED TIME OFF:10 Days/Year Uncompensated Time x 8 Hours/Day = 80 HoursHours Worked In A Year: 52 Weeks x 40 Hours/Week = 2080 Hours80 Hours ÷ 2080 Hours = .03846 Hours Uncompensated Time Off For Every HourScheduled to Work; or2.308 Minutes For Every Hour Scheduled to WorkMultiply 2.308 x the number <strong>of</strong> hours scheduled to work to calculate the number <strong>of</strong>minutes <strong>of</strong> uncompensated time that have been accrued. Convert minutes to anhourly figure as appropriate.