Golfer's Insurance - Pacific & Orient Berhad

Golfer's Insurance - Pacific & Orient Berhad

Golfer's Insurance - Pacific & Orient Berhad

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

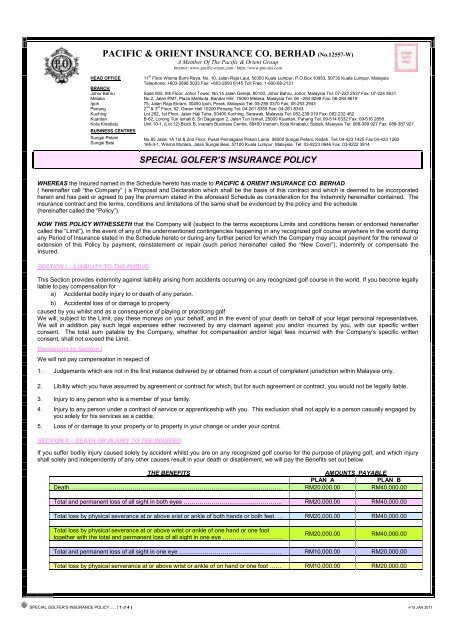

PACIFIC & ORIENT INSURANCE CO. BERHAD (No.12557-W)A Member Of The <strong>Pacific</strong> & <strong>Orient</strong> GroupInternet: www.pacific-orient.com / https://www.pno-ins.comHEAD OFFICEBRANCHJohor BahruMelakaIpohPenangKuchingKuantanKota KinabaluBUSINESS CENTRESSungai PetaniSungai Besi11 th Floor Wisma Bumi Raya, No. 10, Jalan Raja Laut, 50350 Kuala Lumpur, P.O.Box 10953, 50730 Kuala Lumpur, MalaysiaTelephone: +603-2698 5033 Fax: +603-2693 8145 Toll Free: 1-800-88-2121Suite 905, 9th Floor, Johor Tower, No.15 Jalan Gereja, 80100, Johor Bahru, Johor, Malaysia Tel: 07-222 2537 Fax: 07-224 5631No.2, Jalan PM7, Plaza Mahkota, Bandar Hilir, 75000 Melaka, Malaysia Tel: 06 –284 8298 Fax: 06-284 961975, Jalan Raja Ekram, 30450 Ipoh, Perak, Malaysia Tel: 05-255 0370 Fax: 05-253 29432 nd & 3 rd Floor, 52, Green Hall 10200 Penang Tel: 04-261 8355 Fax: 04-261 8343Lot 262, 1st Floor, Jalan Haji Taha, 93400 Kuching, Sarawak, Malaysia Tel: 082-239 019 Fax: 082-232 462B-62, Lorong Tun Ismail 8, Sri Dagangan 2, Jalan Tun Ismail, 25000 Kuantan, Pahang Tel: 09-514 6332 Fax: 09-516 2858Unit 10-1, (Lot 12) Block B, Inanam Business Centre, 88450 Inanam, Kota Kinabalu, Sabah, Malaysia Tel: 088-389 927 Fax: 088-387 927No.85 Jalan 1A 1st & 2nd Floor, Pusat Perniagaan Pekan Lama 08000 Sungai Petani, Kedah. Tel: 04-423 1425 Fax:04-423 1260165-3-1, Wisma Mutiara, Jalan Sungai Besi, 57100 Kuala Lumpur, Malaysia. Tel: 03-9223 0646 Fax: 03-9222 3914SPECIAL GOLFER’S INSURANCE POLICYWHEREAS the Insured named in the Schedule hereto has made to PACIFIC & ORIENT INSURANCE CO. BERHAD( hereinafter call “the Company” ) a Proposal and Declaration which shall be the basis of this contract and which is deemed to be incorporatedherein and has paid or agreed to pay the premium stated in the aforesaid Schedule as consideration for the Indemnity hereinafter contained. Theinsurance contract and the terms, conditions and limitations of the same shall be evidenced by the policy and the schedule(hereinafter called the “Policy”).NOW THIS POLICY WITHESSETH that the Company will (subject to the terms exceptions Limits and conditions herein or endorsed hereinaftercalled the “Limit”), in the event of any of the undermentioned contingencies happening in any recognized golf course anywhere in the world duringany Period of <strong>Insurance</strong> stated in the Schedule hereto or during any further period for which the Company may accept payment for the renewal orextension of this Policy by payment, reinstatement or repair (such period hereinafter called the “New Cover”), indemnify or compensate theInsured.SECTION I – LIABILITY TO THE PUBLICThis Section provides indemnity against liability arising from accidents occurring on any recognized golf course in the world. If you become legallyliable to pay compensation fora) Accidental bodily injury to or death of any person.b) Accidental loss of or damage to propertycaused by you whilst and as a consequence of playing or practicing golfWe will, subject to the Limit, pay these moneys on your behalf, and in the event of your death on behalf of your legal personal representatives.We will in addition pay such legal expenses either recovered by any claimant against you and/or incurred by you, with our specific writtenconsent. The total sum patable by the Company, whether for compensation and/or legal fees incurred with the Company’s specific writtenconsent, shall not exceed the Limit.Exclusions to Section IWe will not pay compensation in respect of1. Judgements which are not in the first instance delivered by or obtained from a court of completent jurisdiction within Malaysia only.2. Libility which you have assumed by agreement or contract for which, but for such agreement or contract, you would not be legally liable.3. Injury to any person who is a member of your family.4. Injury to any person under a contract of service or apprenticeship with you. This exclusion shall not apply to a person casually engaged byyou solely for his services as a caddie.5. Loss of or damage to your property or to property in your change or under your control.SECTION II – DEATH OR INJURY TO THE INSUREDIf you suffer bodily injury caused solely by accident whilst you are on any recognized golf course for the purpose of playing golf, and which injuryshall solely and independently of any other causes result in your death or disablement, we will pay the Benefits set out below.THE BENEFITSAMOUNTS PAYABLEPLAN APLAN BDeath……………………………………………………………………………………………… RM20,000.00 RM40,000.00Total and permanent loss of all sight in both eyes ………………………………………….. RM20,000.00 RM40,000.00Total loss by physical severance at or above srist or ankle of both hands or both feet. … RM20,000.00 RM40,000.00Total loss by physical severance at or above wrist or ankle of one hand or one foottogether with the total and permanent loss of all sight in one eye ………………………….RM20,000.00RM40,000.00Total and permanent loss of all sight in one eye ……………………………………………. RM10,000.00 RM20,000.00Total loss by physical serverance at or above wrist or ankle of on hand or one foot …… RM10,000.00 RM20,000.00SPECIAL GOLFER’S INSURANCE POLICY….. ( 1 of 4 ) 4-15 JAN 2011

Limitations as to payment of BenefitsWe will not pay the Benefits:1.Unless you have obtained and complied with proper medical advice from a duly qualified medical practitioner as soon as possible aftersustaining the injury.2. Unless the death or loss takes place within twelve (12) calendar months from the date of the accident and is directly attrutable to theaccident.3. We will not pay more than one of the aforesaid Benefits in respect of any one accident. After the occurrence an accident. After theoccurrence an accident resulting in a bodily injury by reason of which a claim under any one of the Benefits is payable, this policy shall bedeemed automatically cancelled from the date of that accident and shall be of no further effect subject to New Cover.Exclusions to Section II1. We will not cover you against any occurrence directly or indirectly caused by or resulting from:a) HIV (Human Immundeficiency Virus) and / or any HIV related illness including AIDS (Acquired Immune Deficiency Syndrome)and / or any mutant derivatives or variations thereof.b) Any pre-existing physical or mental defect; diseases or sickness of any kind; parasitic, bacterial or viral infection; pregnancy orchildbirth.c) Intentional self-injury; suicide or attempt while sane or insane.d) Age limitation – Below the age of 16 or above the age of 65 years.SECTION III – GOLFING EQUIPMENTIf golfing equipment owned by you (including clubs, bags and caddie cars), is lost or damaged by any accident or misfortune at any recognizedgolf cource or in transit thereto or therefrom we will indemnify you against such loss or damage up to an amount not exceeding the limits set outin the Schedule, in respect of any one golf club or for all loss or damage occurring during any one Period of <strong>Insurance</strong>.SECTION IV – PERSONAL EFFECTSIf personal effects owned by you (not being property insured under Section III) are lost or damaged by any accident or misfortune at anyrecognized Golf Club we will indemnify you against such loss or damage up to an amount subject to the Limits set out in the Schedule during anyone Period of <strong>Insurance</strong>.Basis of settlement – Applying to Sections III and IVWe will at our optiona) Pay in cash the amount of the loss or damage to your golfing equipment and/or personal effects, orb) Pay the cost of repairs to your golfing equipment and/or personal effects, orc) Reinstate or replace your golfing equipment and / or personal effects.Exclusions to Sections III and IVWe will not cover you against loss or damagea) Arising from wear and tear or damageb) To golf balls in playc) To golfing equipment left overnight whether in a motor vehicle or in any area/place which is not a secured storge area.d) To watches, jewellery, trinkets, field and other glasses, cameras, binoculars portable radio and / or audio/visual sets, motorvehicles and accessories.e) To deeds, bonds, bills of exchange, promissory notes, cheques, cash, currency notes, bank notes, manuscripts, medals andcoins, money, securities, stamps and documents of any kind.f) Arising from Larceny.SECTION V – INDEMNITY FOR A ‘HOLE IN ONE’If you score a ‘hole out in one’ whilst playing gold at any recognized golf course and by local tradition you are required to extend your hospitalityto members in the club, we will indemnify you for such expenses as you may incur subject always to the Limit mentioned in the Schedule.SECTION VI – MEDICAL EXPENSES TO GOLF CADDIEIf a person who is casually engaged by you soley for his services as a caddie suffers accidental bodily injury arising out of and in the course of hiservices to you and you are required to pay for his medical expenses, we will , subject to presentation of original medical bills, reimburse you forthe cost of medical, surgical and hospital espenses necessarily and reasonably incurred and expended up to an amount not exceeding the summentioned in the Schedule.GENERAL EXCEPTIONSThis Policy does not cover any occurrence directly or indirectly caused by or resulting from:1. War, invasion, act of foreign enemy, hostilities (whether war be declared or not), civil war, rebellion, mutiny, revolution, insurrection, militaryor usurped power or terrorism.2. Nuclear weapons material, lonising radiations or contaminations by radioactivity from any nuclear waste from the combustion of anynuclear fuel. For the purposes of this exclusion combustion shall include any self-sustaining process of nuclear fission.SPECIAL GOLFER’S INSURANCE POLICY….. ( 2 of 4 ) 4-15 JAN 2011

8. SUBROGATIONWe shall at our absolute discretion, be entitled if we so desire to take over and conduct at our own expense in your name the defence orsettlement of any claim or to prosecute in your name for our benefit any claim for indemnity or damages or otherwise and you shall give allsuch information and assistance as we may require.9. RENEWALWe shall not be bound to renew this Policy or to send any notice of the renewal Premium becoming due.10. CANCELLATIONa) You may cancel this Policy at any time by notifying us in writing and, provided that no claim has during the then current .Period of <strong>Insurance</strong>, we will refund you any Premium for the unexpired Period of <strong>Insurance</strong> calculated at our usual short-termrates.b) We may cancel this Policy at any time by giving you seven (7) days written notice by Registeres Letter at your address last knowto us. Upon cacellation of the Policy, we will refund to you a proportionate part of the Premium corresponding to the unexpiredPeriod of <strong>Insurance</strong>.11. ARBITRATIONAll differences arising out of this Policy shall be referred for the decision of an Arbitrator to be appointed in writing by you and us. If there isno agreement on a single Arbitrator, then two Arbitrators are to be appointed in writing, one by you and the other by us, within one calendarmonth of the disagreement. In case of disagreement between the Arbitrators, an Umpire is to be appointed by the Arbitrators in writingbefore hearing the reference. Any suit by you against us on the Policy for whatever reason can only be made subsequent to an Award bythe Arbitrator or Arbitrators and/or Umpire.12. ABANDONMENTIf we disclaim liability for any claim, you must refer the claim to arbitrator as provided under condition 11 within twelve (12) calendar monthsfrom the date of our disclaimer. If you do not do not do so then the claim shall for all purposes be deemed to have been abandoned andshall not thereafter be recoverable under this Policy.13. REINSTATEMENT OF SUM INSUREDIn the event of the Company being liable to make payment for any loss of or damage covered under Sections I, III, IV and V, the limits ofthe Company’s liability set out in the Schedule hereto shall be deemed to be reduced by such payment. Accordingly the reinstatement ofthe full sum insured upon payment of additional premium shall be at sole discretion of the Company.14. SHORT PERIODThis policy may be cancelled at any time by the Insured on written notice to the Company and in such event the Insured shall be entitled toa return of the premium less premium at the Short Period rates for the period the policy has been in force.The following Short Period rates shall be used for the purpose:PeriodNot exceeding 1 week - 12.5% of the Annual PremiumNot exceeding 1 Month - 25.0% of the Annual PremiumNot exceeding 2 Month - 37.5% of the Annual PremiumNot exceeding 3 Month - 50.0% of the Annual PremiumNot exceeding 4 Month - 62.5% of the Annual PremiumNot exceeding 6 Month - 75.0% of the Annual PremiumNot exceeding 8 Month - 87.5% of the Annual PremiumExceeding 8 Month - 100.0% of the Annual PremiumDATE RECOGNITION (Y2K EXCLUSION)It is noted and agreed this policy is hereby amended as follows:-A. The Company will not pay for any loss or damage including loss of use with or without physical damage, injury (including bodily injury),expenses incurred or any consequential loss directly or indirectly caused by; consisting of, or arising from, the failure or inability of anycomputer, data processing equipment, media microchip, operating systems, microprocessors (computer chip), integrated circuit or similardevice, or any computer software, whether the property of the Insured or not and whether occurring before, during or after the year 2000 thatresults from the failure or inability of such device and/or software as listed above to:1. Correctly recognize any dateas its true calendar date;2. Capture, save, or retain, and/or correctly manipulate, interpret or process any datas or information or command or instruction as a resultof treating any date other than its true calendar date; and/or3. Capture, save, retain or correctly process any data as a result of the operation of any command which has been programmed into anycomputer software, being a command which causes the loss of data or the inability to capture, save, retain or correctly process such dataon or after any date.B. It is further understood that the Company will not pay for the repair or modification of any part of any electronic data processing system or anypart of any device and/or software as listed above in A.C. It is further understood that the company will not pay for any loss or damage including loss of use with or without physical damage, injury(including bodily injury) expenses incurred or any consequential loss directly or indirectly arising from any device, consultation, design,evaluation, inspection, installation, maintenance, repair or supervision done by the Insured or for the Insured or by or for others to determine,rectify or test, any potential or actual failure, malfunction or inadequacy described in A above.D. It is further understood that the Company will not pay for any consequential loss resulting from any continuing inability of the computer andequipment described in A above to correctly recognize any data as its true calendar date after the loss or damaged property has been replacedor repaired.Such loss or damage, injury (including bodily injury), expenses incurred or any consequential loss referred to in A, B, C, or D above, is excludedregardless of any other cause that contributed concurrently or in any other sequence to the same.IMPORTANTDisputes can be referred to Financial Mediation Bureau (FMB) Tel No : 03-2272 2811The Policyholder shall read this Policy carefully, and if any error or misdescription be found herein or if the cover were not in accordance with the wishes of thePolicyholder, advice should at once be given to the Company and the Policy returned for attention.SPECIAL GOLFER’S INSURANCE POLICY….. ( 4 of 4 ) 4-15 JAN 2011