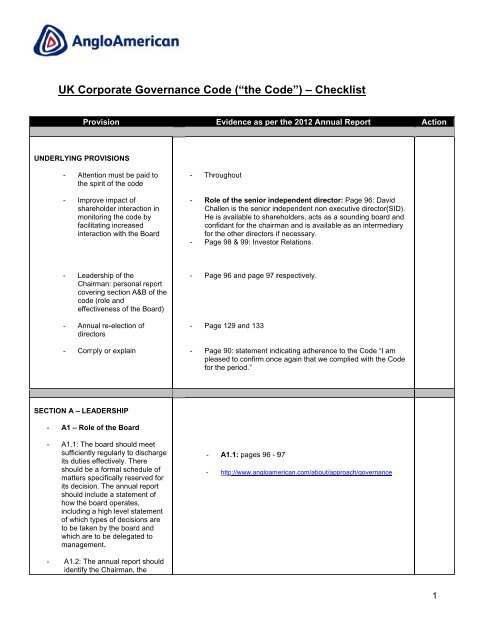

UK Corporate Governance Code Checklist PDF - Anglo American

UK Corporate Governance Code Checklist PDF - Anglo American

UK Corporate Governance Code Checklist PDF - Anglo American

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

If, exceptionally, a boarddecides that a chief executiveshould become Chairman, theboard should consult majorshareholders in advanceandshould set out its reasons toshareholders at the timeof theappointment and in the nextannual report.- A.4 Non executiveeDirectors- MainPrinciple(a). As part of their role asmembers of a unitaryboard, non executivedirectors shouldconstructively challengeand help develop proposalson strategy.- A4( (a): page 96 - The Role Of The Board: Every year theBoard holds a twoo day strategy meeting at which the nonexecutive directors (NEDs) contribute their expertise andindependent perspective in developingthe strategy of thee Company.- (b). Non executive directorsshould scrutinise theperformance ofmanagement in meetingagreed goals and objectivesand monitor the reporting ofperformance.-- (c). They should satisfythemselves on the integrityof financial information andthat financial controls andsystems of riskmanagement are robustand defensible. They areresponsible for determiningappropriate levels ofremuneration of executivedirectors and have a primerole in i appointing and,where necessary, removingexecutive directors, and insuccession planning.- A4( (b): page 105 - During 2013 the Audit Committee willcontinue its role inn monitoring the integrity of the financialstatements and reviewing the effectiveness of theCompany’s internal control and risk managementsystems. An item of key interestt to the Audit Committeewill be to understand how the risk and audit processesoperate in De Beers and how these will be integrated into<strong>Anglo</strong> <strong>American</strong> at the appropriate time- A4( (c):.See abovee- A.4.1The board shouldappoint one of theindependent non executivedirectors to be the seniorindependent director toprovide a sounding board- A4. .1: page 96 - Role of the senior independentdirector: David Challen is the senior independent nonexecutive director. He is available to shareholders, acts asa sounding board and confidant for the Chairman and isavailable as an intermediary for the other directors if3

for the Chairman and toservee as an intermediary forthe other directors whennecessary. The seniorindependent director shouldbe available toshareholders if theyhaveconcerns which contactthrough the normalchannels of Chairman, chiefexecutive or other executivedirectors has failed toresolve or for whichh suchcontact is inappropriate.necessary.Page 99 – Institutional investors: David Challen in hiscapacity as the SID works closely with the chairman tomaintain his understanding of the issues and concerns ofmajor shareholders. The chairman, SID and other nonexecutive directors are also available to shareholders todiscuss any matter they wish to raise.- A.4.2The Chairman shouldhold meetings with the nonexecutive directors withoutthe executives present. Ledby the senior independentdirector, the non executivedirectors should meetwithout the Chairmanpresent at least annually toappraise the Chairman’sperformance and on suchotheroccasions as aredeemed appropriate.- A.4.3Where directors haveconcerns which cannot beresolved about the runningof thecompany or aproposed action, theyshould ensure that theirconcerns are recorded inthe board minutes. Onresignation, a nonexecutivedirector should provide awritten statement totheChairman, for circulation tothe board, if they have anysuch concerns.- A4. .2: page 97 Board evaluation: At every Boardmeeting, time is set aside for a NEDs only discussion.- NotapplicableSECTION B – EFFECTIVENESSS- B1: Composition of theBoard – The boardand itscommittees should have theappropriate balanceofskills, experience,independence andknowledge of the companyto enable them to discharge- B1:page 91 - Wee continue to develop the mix ofskills and experience on the Board.During the year, itt included threeefemale directors (achieving a 27%representation of women on theBoard – excludingg the chairman)andcomprised individuals withengineering, banking, mining,4

their respective duties andresponsibilities effectively.- B1.1: Identification ofindependent NEDs,reference to character &judgement and possiblerelationships which couldaffect judgementtelecoms, construction and automotivesector backgrounds, hailing fromthe US, <strong>UK</strong>, Southh Africa, France,Germany, Ireland and Hong Kong.- B1. .1: page 91– table,page 97 - Dealing with Conflicts of Interest: : If directorsbecome aware that they have a direct or indirect interestin an existing or proposed transaction with <strong>Anglo</strong><strong>American</strong>, they notify the Board at the next board meetingor by a written declaration. Directors have a continuingdutyto update anyy changes in these interests. During2012 Mr Nhleko recused himselff from a discussion on anitemof business where there was a potential conflictof interest.In accordance with the Company’s Articles andrelevant legislation, a quorum off the Board, which doesnot include the director with the potential conflict ofinterest ,can authorise potential conflicts and suchauthorisations cann be limited in scope and are reviewedon an annual basis. During the year under review, theconflicts register was updated and the conflictmanagement procedures were adhered to andoperatedeffectively.- B1.2: At least half the boardshould be made upofindependent NEDs- B1. .2: page 91- table and page 96 - Independence ofdirectors: The Board has a strong independent elementandcurrently comprises, in addition to the chairman, twoexecutive directors and eight NEDs, all of whom areindependent according to the definition contained in the<strong>Code</strong>. Full biographical details for each director are givenon pages 92 and 93. The letters of appointmenof theNEDs (as well as the executive directors’ servicecontracts) are available for inspection at the egisteredoffice of the Company.None of the NEDs has served concurrentlywith anexecutive director for more than nine years. AsDavidChallen has been on the Board for over six years his reappointmentis subject to particularly rigorous review. TheBoard believes that through his challenging andquestioning of management he continues to display all ofthe qualities of independence pursuant to the criteria setout in the <strong>Code</strong>.- B2: Appointmentsto theBoard: board should besatisfied that plans are inplaceor orderly succession- B2:Page 97- Board evaluation: Directors alsosuggested a number of areas that might be programmedintothe Board’s agenda to allowa deeper discussion,including: business unit (BU) presentations;competitorbenchmarking; succession planning; retrospective reviewof major project decisions to establish key learnings; andexternal political and market updates.- B2.1: There should be aPage 102 Sir Johnn Parker describes role of theNomination Committee (“Nomco”).5

Nomination Committeewhich should lead theprocess for boardappointments and makerecommendations to theboard. A majority ofmembers of the NominationCommittee should beindependent non executivedirectors. The Chairman oran independent nonnexecutive director shouldchairthe committee, but theChairman should not chairthe Nomination Committeewhenit is dealing with theappointment of a successorto theChairmanship. TheNomination Committeeshould make available itstermsof reference,explaining its role and theauthority delegatedd to it bythe board.- B2.2: The NominationCommittee should evaluatethe balance of skills,experience, independenceand knowledge on theboard and, in the light ofthis evaluation, prepare adescription of the role andcapabilities requiredfor aparticular appointment.- B2. .1, B2.2 : Pagee 102 – Extractt on the Role andresponsibilities of the NomcoRoles and responsibilitiesSetting guideliness (with the approval of the Board) for thetypes of skills, experience and diversity being soughtwhen making a search for new directors and, with theassistance of external consultants, identifying andreviewing in detaill each potential candidate available inthe market. The Committee thenagrees a ‘longlist’ ofcandidates for each directorshipand following furtherdiscussion and research decidess upon a shortlist ofcandidates for interview. Shortlisted candidatesare eachinterviewed by thee Committee members who thenconvene to discuss their impressions and conclusions,culminating in a recommendation to the Board;- Terms of reference available on the Company website:http://www.angloamerican.com/about/approach/~/media/Files/ /A/<strong>Anglo</strong>-<strong>American</strong>-- Seee Plc/ /about/approach/governance/terms_of_ref_nom.pdfabove- B2.3: Non executivedirectors should beappointed for specifiedtermssubject to re-electiotostatutory provisionsrelating to the removal of aanddirector. Any term beyondsix years for a nonexecutive director should besubject to particularlyrigorous review, and shouldtake into account the needfor progressive refreshing ofthe board.- B2. .3: Page 96: As David Challen has been on the Boardfor over six years his re-appointment is subjecttoparticularly rigorous review. TheBoard believes thatthrough his challenging and questioning of managementhe continues to display all of thequalities of independencepursuant to the criteria set out inthe <strong>Code</strong>.- B2.4: A separate section ofthe annual report shoulddescribe the work of theNomination Committee,including the process it hasB2. .4: page 1026

usedin relation to boardappointments. Anexplanation should be givenif neither an external searchconsultancy nor openadvertising has been usedin theappointment of aChairman or a nonexecutive director.- B3: Commitment- B3.1: For the appointmentof a Chairman, theNomination Committeeshould prepare a jobspecification, including anassessment of the timecommitment expected,recognising the need foravailability in the event ofcrises. A Chairman’s othersignificant commitmentsshould be disclosedd to theboard before appointmentand included i in the annualreport. Changes to suchcommitments should bereported to the boardas they arise, and theirimpact explained inthe nextannual report.- B3. .1: page 92 - Biography – Sir John Parker: He is anon-executive director of Carnival Corporation and EADSas well as deputy chairman of DP World. Sir John is alsoPresident of the RoyalAcademyof Engineeringg and aVisiting Fellow of the University of Oxford. Sir John waspreviously chairman ofNational Grid plc, seniornon-executive directorr and chair of the Court of theBank ofEngland, joint chair of Mondi andchair of BVT and P&Oplc.- B.3.2The terms andconditions of appointmentof non executive directorsshould be made availablefor inspection. The letter ofappointment shouldset outthe expected timecommitment. Non executivedirectors should undertakethat they will have sufficienttime to meet what isexpected of them. Theirothersignificantcommitments should bedisclosed to the boardbefore appointment, with abroad indication of the timeinvolved and the boardshould be informedofsubsequent changes.- B3. .2: Available for inspection at t the Company’ ’s registeredoffice- B.3.33 The board should notagree to a full time7

executive director taking onmorethan one nonexecutive directorship in aFTSE100 companynor theChairmanship of such acompany.- Notapplicable- B4: Development:Chairman should ensuredirectors update their skillsand the knowledge andfamiliarity with the companyrequired to fulfil their role onthe board and oncommittees- B.4.1The Chairman shouldensure that new directorsreceive a full, formal andtailored induction on joiningthe board. As part of this,directors should availthemselves of opportunitiesto meet major shareholders.- B4:Page 97- B4. .1, B4.2: page 97- B.4.2The Chairman shouldregularly review and agreewith each director theirtraining and developmentneeds.- B4. .2: page 97 - The directors are given the opportunityto discuss their development needs with the chairman inindividual feedback meetings.- B5: Information andSupport:Supporting Principles:- B5:page 97- The Chairman isresponsible for ensuringthat the directors receiveaccurate, timely and clearinformation. Managementhas an obligation toprovidesuch information butdirectors should seekclarification or amplificationwhere necessary. Underthe direction of theChairman, the companysecretary’s responsibilitiesinclude ensuring goodinformation flows within theboard and its committeesand between seniormanagement andnonexecutive directors, aswell as facilitating induction8

and assisting withprofessional developmentas equired.- The company secretaryshould be responsible foradvising the board throughthe Chairman on allgovernance matters.- Page 97: The Board receives regular governance updatesfromthe companyy secretary highlighting developments incompany law, corporate governance and best practice.- B5.1: The board shouldensure that directors,especially non executivedirectors, have access toindependent professionaladvice at the company’sexpense where they judge itnecessary to dischargetheir responsibilitiess asdirectors. Committeesshould be provided withsufficient resourcess toundertake their duties.- B5. .1: page 97 - Furthermore, all directors are entitled toseek independentt professional advice concerning theaffairs of <strong>Anglo</strong> <strong>American</strong> at the Company’s expense,although no such advice was sought during 2012. Regularpresentations are made to the Board by businessmanagement on the activities off operations.- B5.2: All directors shouldhaveaccess to the adviceand services of thecompany secretary, who isresponsible to the board forensuring that boardprocedures are compliedwith. Both the appointmentand removal of thecompany secretaryshouldbe a matter for the board asa whole.- B5. .2: page 97 – Directors also have access tomanagement, andd to the advice of the company secretary.- Seee also Article 106 of the Company’s Articles.- B6: Evaluation: The boardshould undertake a formaland rigorous annualevaluation of its ownperformance and that of itscommittees and individualdirectors.- B6.1: The board shouldstatein the annual reporthow performanceevaluation of the board, itscommittees and itsindividual directors hasbeenconducted.- B6.3: The non executivedirectors, led by theseniorindependent director,should be responsible for- B6. .1: page 96 - Board evaluationAn evaluation of the Board by anexternal facilitator, withno prior relationship with <strong>Anglo</strong> <strong>American</strong>, wascompletedin February 2012. .This involved a series of one- to-oneinterviews with board members to gather views, andattendance at a Board meeting by the facilitator.- B6 3: page 96 – Board evaluation9

performance evaluation ofthe Chairman, taking intoaccount the views ofexecutive directors.- B7: Re-election: directorsshould be submitted for re-subject to continuedsatisfactory performanceelection at regular interval,- B7:Page 129: In accordance with the <strong>Code</strong>, <strong>Anglo</strong><strong>American</strong> will continue to propose the re-election of alldirectors on an annual basis.- B7.1: All directors of FTSE350 companies should besubject to annual electionby shareholders. All otherdirectors should be subjectto election by shareholdersat thefirst annual generalmeeting after theirappointment, and toreatintervals of no morethanelection thereafterthreee years. Non executivedirectors who have servedlonger than nine yearsshould be subject toannualre-election. The names ofdirectors submitted forelection or re-electionshould be accompanied bysufficient biographicaldetails and any otherrelevant informationn toenable shareholders to takean informed decision ontheir election.- B7. .1:Seee abovePages 92 - 93 – Biographies- B7.2 The board should setout toshareholderss in thepapers accompanying aresolution to elect a nonexecutive director why theybelieve an individual shouldbe elected. The Chairmanshould confirm toshareholders whenproposing re-election that,following formalperformance evaluation, theindividual’s performancecontinues to be effectiveand to demonstrateecommitment to the role.- B7. .2: page 93 – Biography of Nominated IndependentNon-Executive DirectorPage 3 – <strong>Governance</strong>Alsosee Notice off Annual General Meeting10

SECTION C:ACCOUNTABILITY- MainPrincipleThe board is responsible fordetermining the nature andextent of the significantrisks it is willing to take inachieving its strategicobjectives. The boardshould maintain sound riskmanagement and internalcontrol systems.- C1.1: Responsibilitystatement from directors inthe Annual Report andAccounts should contain astatement by the auditorsabout their reportingresponsibilities- C1.2Directors explanationregarding preservation ofvalueover the long termand strategy to deliverobjectives- C1.3: Directors shouldreport in half-yearlyyfinancial statementss that thebusiness is a goingg concernwith the necessarysupporting evidence- C.2 Risk Management andInternal ControlMainPrincipleThe board is responsible fordetermining the nature andextent of the significantrisks it is willing to take inachieving its strategicobjectives. The boardshould maintain sound riskmanagement and internalcontrol systems.- C.2.1The board should, atleastannually, conduct areview of the effectivenessof thecompany’s riskmanagement and internalcontrol systems andshould- Page 48: Effective Risk Management- Audit Committeee Report: page104 - 105- C1. .1: page 137- C1. .2: page 2- Chairman’s Statement: Delivering value- C1. .3: See the Company’s half yearly financial report- C2:page 48 - Effective Risk ManagementPage 104-105 – Audit Committee ReportC2.1: page 105 - A summary of audit results and riskmanagement information was presented to the Committee andGroup senior management at regular intervals throughout theyear. The Group’s head of internal audit reports to the AuditCommittee on the internal audit function’s performance againstthe agreed internal audit plan. During2012, 440 audit projectswere completed covering a variety off financial, operational,strategicand compliance-related business processes acrossall business units and functions. In addition, the internal audit11

eport to shareholders thatthey have done so. Thereview should cover allmaterial controls, ncludingfinancial, operational andcompliance controls.department respondedd to a number of management requeststo investigate alleged breaches of our business principles.- C.3 Audit Committee andAuditorsMainPrincipleThe board should establishformal and transparentarrangements forconsidering how theyshould apply the corporatereporting and riskmanagement and internalcontrol principles and formaintaining an appropriaterelationship with thecompany’s auditor.<strong>Code</strong>Provisions- C.3.1The board shouldestablish an AuditCommittee of at least three,or in the case of smallercompanies, two,independent non executivedirectors. The board shouldsatisfy itself that at leastone member of the AuditCommittee has recent andrelevant financialexperience.- C3. .1: page 102 - Composition Compliant withthe <strong>Code</strong>andcomprises only independent non executivee directors:David Challen – ChairmanSir Philip HamptonPhuthuma NhlekooRayO’RourkeAnne Stevens- Sir Philip Hamptonn has significant financial experience, asperhis biography on page 92- C.3.2(a). The main role andresponsibilities of the AuditCommittee should be setout inwritten terms ofreference and shouldinclude: to monitor theintegrity of the financialstatements of the companyand any formalannouncements relating tothe company’s financialperformance, reviewingsignificant financialreporting judgementscontained in them;- (b). to review the- C3. .2: Page 102Roles and responsibilities- (a), (c) Monitoringg the integrity of the annual and interimfinancial statements, the accompanying reportstoshareholders and corporate governance statements.- (c) Making recommendations to the Board concerning theadoption of the annual and interim financial statements.- (c) Overseeing thee Group’s relations with the externalauditors.- (d) Making recommendations to the Board on theappointment, retention and removal of the externalauditors.12

company’s internal financialcontrols and, unlessexpressly addressed by aseparate board riskcommittee composed ofindependent directors, or bythe board itself, to reviewthe company’s internalcontrol and riskmanagement systems;- (c). to monitor and reviewthe effectiveness ofthecompany’s internal auditfunction;- (d). to makerecommendations to theboard, for it to put to theshareholders for theirapproval in generallmeeting, in relation to theappointment, re-and removal ofappointmentthe external auditorand toapprove the remunerationand terms of engagementof theexternal auditor;- (c) Reviewing andd monitoring the effectivenesss of theGroup’s internal control and risk k management systemsincluding reviewing the process for identifying, assessingandreporting all key risks.- (b),(c) Approvingg the terms of reference and plans of theinternal audit function.- Approving the internal audit planand reviewingregularreports from the head of internall audit on effectiveness ofthe internal control system.- Receiving reports from management on the key risksof the Group and management- (e) Page 104: <strong>Anglo</strong> <strong>American</strong>’s policy on auditors’independence, is consistent withthe ethical standardspublished by the AuditPractices Board.- (f) Page 104: “prior approval byy the Audit CommitteeChairman of non audit services where the costof theproposed assignment is likely toexceed $50,000.- (f) <strong>Anglo</strong> <strong>American</strong>’s policy on the provision of non auditservices is regularly reviewed. The definition of prohibitednonn audit servicess corresponds with the EuropeanCommission’s recommendationss on auditors’independence andd with the Ethical Standardsissued by the Audit Practices Board in the <strong>UK</strong>”- (e). to review and monitorthe external auditor’sindependence andobjectivity and theeffectiveness of theauditprocess, taking intoconsideration relevant <strong>UK</strong>professional and regulatoryrequirements;- (f). todevelop andimplement policy ontheengagement of the externalauditor to supply non-auditservices, taking intoaccount relevant ethicalguidance regardingg theprovision of non-auditservices by the externalauditfirm, and to report tothe board, identifying anymatters in respect of whichit considers that action orimprovement is needed andmaking recommendationsas tothe steps to be taken.13

- C.3.33 The terms ofreference of the AuditCommittee, including itsrole and the authoritydelegated to it by the board,should be made available.A separate section of theannual report shoulddescribe the work of thecommittee in dischargingthoseresponsibilities.- C3. .3: page 102 – Roles and responsibilities:Terms of reference for the Audit t Committee can be foundon the <strong>Anglo</strong> <strong>American</strong> website:http://www.angloamerican.com/about/approach/~/media/Files/ /A/<strong>Anglo</strong>-<strong>American</strong>-Plc/ /siteware/docs/audit_committee_ToR.pdf- C.3.4The Audit Committeeshould reviewarrangements by whichstaff of the company may,in confidence, raiseconcerns about possibleimproprieties in matters offinancial reporting or othermatters. The AuditCommittee’s objectiveshould be to ensuree thatarrangements are in placefor the proportionate andindependent investigation ofsuch matters and forappropriate follow-upaction.- C 3.4: page 106: Whistleblowing programmeTheGroup has had a whistleblowing programme in placefor a number of years in all its managed operations. Thisfacility operates inn addition to a standardized Group-widestakeholder complaints and grievance procedure that isoperated at all managed operations (see the 2012Sustainable Development Report for more details).Thewhistle-blowing programme, which is monitored by theAudit Committee, is designed to enable employees,customers, suppliers, managerss or other stakeholders ona confidential basis to raise concerns in cases whereconduct is deemed to be contrary to our values. It mayinclude:• Actions that mayy result in danger to the health and/orsafety of people or damage to the environment• Unethical practice in accounting, internal accountingcontrols, financial reporting andauditing matters• Criminal offences, including money laundering, fraud,bribery and corruption• Failure to complyy with any legal obligation• Miscarriage of justice• Any conduct contrary to the ethical principles embracedin our Business Principles or any similar policy• any other legal or ethical concern• concealment of any of the above.- C.3.5The Audit Committeeshould monitor andreviewthe effectiveness ofthe- page 106 - Reports received were kept strictly confidentialandwere referredd to appropriateline managerswithin theGroup for resolution. Where appropriate, actionwas takento address the issues raised. The reports are analysedandmonitored to ensure the process is effective.- C 3.5: page 106 - The Board also receives assurance14

internal audit activities.Where there is no internalauditfunction, the AuditCommittee should considerannually whether there is aneedfor an internal auditfunction and make arecommendation totheboard, and the reasons forthe absence of such afunction should beexplained in the relevantsection of the annual report.- C.3.6The Audit Committeeshould have primaryresponsibility for making arecommendation ontheappointment, reappointmentand removal of the externalauditor. If the boarddoesnot accept the AuditCommittee’srecommendation, itshouldinclude in the annual report,and in i any papersrecommending appointmentor re-appointment,astatement from the AuditCommittee explaining therecommendation andshould set out reasons whythe board has takenadifferent position.- C.3.7The annual reportshould explain toshareholders how, if theauditor provides non-auditservices, auditor objectivityand independenceiissafeguarded.fromthe Audit Committee, whichh derives its information, inpart, from regular internal audit reports on risk and internalcontrol throughoutt the Group and external audit reporting.TheGroup’s internal audit function has a formalcollaboration process in place with the external auditors toensure efficient coverage of internal controls.- C 3.6: page 104 - The Audit Committee has primaryresponsibility for making recommendations to the Boardon the appointment, re-appointment and removal of theexternal auditors.- C 3.7: page 104 -<strong>Anglo</strong> <strong>American</strong> addresses this issue through threeprimary measures, namely:• Disclosure of thee extent and nature of non-audit services• The prohibition of selected services – this includes theundertaking of internal audit services• Prior approval byy the Audit Committee chairman of nonaudit services where the cost of the proposedassignment is likely to exceed $50,000.15

SECTION D: REMUNERATIONPage 108 –127- Remunerationn Report of theDirectorsD.1 The Level andComponentsofRemuneration- MainPrincipleLevels of remunerationshould be sufficienttoattract, retain and motivatedirectors of the qualityrequired to run thecompany successfully, buta company should avoidpaying more than isnecessary for this purpose.A significant proportion ofexecutive directors’ ’remuneration should bestructured so as to linkrewards to corporate andindividual performance.- (A1) The RemunerationCommittee should considerwhether the directorsshould be eligible for annualbonuses. If so, performanceconditions should berelevant, stretching anddesigned to promote thelong-tercompany. Upper limits shouldbe setsuccess of theand disclosed. There maybe a case for part paymentin shares to be heldfor a<strong>Code</strong> Provisions- D.1.11 In designing schemesof performance-relatedremuneration for executivedirectors, the RemunerationCommittee should followthe provisions in ScheduleA to this <strong>Code</strong>.- SCHEDULE A THEDESIGN OFPERFORMANCE-RELATEDREMUNERATIONFOREXECUTIVE DIRECTORS- A1:page 110 – Key Aspects off the remunerationpolicy for executive directors. .16

significant period.- (A2) The RemunerationCommittee should considerwhether the directorsshould be eligible forbenefits under long-termincentive schemes.Traditional share optionschemes should beweighed against other kindsof long-term incentivescheme.- A2:page 110 – Key Aspects of the remuneration policyfor for executive directors.- (A3) Executive shareoptions should not beoffered at a discount saveas permitted by therelevantprovisions of the ListingRules. In normalcircumstances, sharesgranted or other forms ofdeferred remunerationshould not vest, and optionsshould not be exercisable,in less than three years.Directors should beencouraged to holdtheirshares for a furtherr periodafter vesting or exercise,subject to the need tofinance any costs ofacquisition and associatedtax liabilities.- A3:page 110 – Key Aspects off the remunerationpolicy for for executive directors.- (A4) Any new long-termschemes whichincentiveare proposed should beapproved by shareholdersand should preferablyreplace any existingschemes or, at least, formpart of a well consideredoverall plan incorporatingexisting schemes. The totalpotentially availablerewards should notbeexcessive.- A4:No new long term incentive schemes weree proposedduring the year under review17

- (A5) Payouts or grantsunder all incentiveschemes, includingnewgrants under existing shareoption schemes, should besubject to challengingperformance criteriareflecting the company’sobjectives, including non-metrics where appropriate.Remuneration incentivesshould be compatible withfinancial performancerisk policies and systems.- A5:page 110 – Key Aspects off the remunerationpolicy for executive directors. .- (A6) Grants underexecutive share option andotherlong-term incentiveschemes should normallybe phased rather thanawarded in one large block.- A6:page 110 – Key Aspects off the remunerationpolicy for executive directors. .- (A7) Consideration shouldbe given to the use ofprovisions that permit thecompany to reclaimvariablecomponents in exceptionalcircumstances ofmisstatement ormisconduct.- A7:page 110 – Key Aspects off the remunerationpolicy for executive directors. .- (A 8)In general, only basicsalary should bepensionable. TheRemuneration Committeeshould consider thepensionconsequences andassociated costs tothecompany of basic salaryincreases and any otherchanges in pensionableremuneration, especially fordirectors close toretirement.- A8:page 111 – Pension- D.1.2Where a companyreleases an executivedirector to serve asanonexecutive directorelsewhere, theremuneration report shouldinclude a statement as towhether or not the directorwill retain such earnings- D1. .2: page 113 - External DirectorshipsPage 119 Figure 12, footnote (1) In addition to the basicsalaries above, Cynthia Carroll and René Médori eachretained fees amounting to £98,000 and £92,000respectively in respect of external directorshipss18

and, if so, what theremuneration is.- D.1.3Levels ofremuneration for nonexecutive directors shouldreflect the time commitmentand responsibilitiess of therole. Remunerationn fornonexecutive directorsshould not include shareoptions or otherperformance-relatedelements. If, exceptionally,options are granted,shareholder approvalshould be sought inadvance and any sharesacquired by exercise of theoptions should be held untilat least one year after thenon executive directorleaves the board. Holdingof share options could berelevant to thedetermination of a nonexecutive director’sindependence (as set out inprovision B.1.1).- D1. .3: page 112: Non-executivedirectors – Fees- D.1.4The RemunerationCommittee should carefullyconsider whatcompensation commitments(including pensioncontributions and all otherelements) their directors’termsof appointment wouldentail in the event of earlytermination. The aimshouldbe toavoid rewarding poorperformance. They shouldtake a robust line onreducing compensation toreflect departing directors’obligations to mitigate loss.- D.1.5Notice or contractperiods should be set atone year or less. If it isnecessary to offer longernotice or contract periods tonew directors recruited fromoutside, such periods- D1. .4: page 114 - Should CynthiaCarroll not berequiredto work her full notice, <strong>Anglo</strong> <strong>American</strong> Services is able todischarge its liability for the unexpired portion of her noticeperiod by making a payment in lieu of her salary and othercontractual benefits; in the case of René Médori, whosecontract dates from2005, the payment would also includea pro-rated bonus.Page 125 – Termination arrangements for outgoingchief executive- D1. .5: page 114 - Cynthia Carroll and René Médori are19

should reduce to one yearor less after the initialperiod.- D.2 ProcedureMainPrincipleThere should be a formaland transparent procedurefor developing policy onexecutive remuneration andfor fixing the remunerationpackages of individualdirectors. No directorshould be involved indeciding his or her ownremuneration.employed by <strong>Anglo</strong> <strong>American</strong> Services (<strong>UK</strong>) Ltd (AAS). Itis the Company’s policy that the period of notice forexecutive directors will not exceed 12 months andaccordingly the employment contracts of the executivedirectors are terminable at 12 months’ notice by eitherparty.- D2 : page 108 – 127 - Remuneration Report of theDirectors- <strong>Code</strong>ProvisionsD.2.1The board shouldestablish a RemunerationCommittee of at least three,or in the case of smallercompanies two,independent non executivedirectors. In addition thecompany Chairmanmayalso be a member of, butnot chair, the committee ifhe orshe was consideredindependent onappointment as Chairman.- The RemunerationCommittee should makeavailable its terms ofreference, explaining itsrole and the authoritydelegated to it by the board.Where remunerationconsultants are appointed,a statement should bemadeavailable of whetherthey have any otherconnection with thecompany.- D2. .1: page 101 - Composition- Thefull Terms of Reference of the Committee can befound on the <strong>Anglo</strong> <strong>American</strong> website and copies areavailable on request.http://www.angloamerican.com/about/approach/~/media/Files/ /A/<strong>Anglo</strong>-<strong>American</strong>-e_Terms_of_Reference_Dec2011.pdf- Page 126 – Figuree 25 sets out the external adviceprovided to the Committee and other services provided toPlc/ /about/approach/governance/Remuneration_Committethe Company.- D.2.22 The RemunerationCommittee should havedelegated responsibility forsetting remuneration for allexecutive directors and theChairman, includingpension rights and any- D 2.2: The full Terms of Reference of the Committee can20

compensation payments.The committee should alsorecommend and monitorthe level and structure ofremuneration for seniormanagement. The definitionof ‘senior management’ forthis purpose shouldbedetermined by the boardbut should normallyincludethe first layer ofmanagement belowboardlevel.be found on the <strong>Anglo</strong> <strong>American</strong>website and copies areavailable on request.http://www.angloamerican.com/about/approach/~/media/Files/ /A/<strong>Anglo</strong>-<strong>American</strong>-e_Terms_of_Reference_Dec2011.pdfPlc/ /about/approach/governance/Remuneration_Committe- D.2.3The board itself or,where required by theArticles of Association, theshareholders shoulddetermine the remunerationof thenon executivedirectors within the limitsset inthe Articles ofAssociation. Whereepermitted by the Articles,the board may howeverdelegate this responsibilityto a committee, which mightinclude the chief executive.- D2. .3: page 112 -Non-executivee directors – Fees- D.2.4Shareholdersshouldbe invited specifically toapprove all new long-termincentive schemes (asdefined in the ListingRules26) and significantchanges to existingschemes, save in thecircumstances permitted bythe Listing Rules- D2. .4: There was no need in 2012. The 2010 AnnualReport included the new LTIP rules.21

SECTION E: RELATIONS WITHSHAREHOLDERS- E.1 Dialogue withShareholdersMainPrinciple(a). There should be adialogue with shareholdersbased on the mutualunderstanding of objectives.The board as a whole hasresponsibility for ensuringthat a satisfactory dialoguewith shareholders takesplace- E1 (a): page 98 - Communicating With Our Investors -The Company maintains an active engagement with its key financialaudiences, including institutional shareholderss andsell-side analysts, as well as potential shareholders.- Page 99 - Board oversight Anyy significant concernsraised by a shareholder in relation to the Company and itsaffairs are communicated to the Board. The Board isbriefed on a regular basis by theInvestor Relationsdepartment and analysts’ reportss are circulatedto thedirectors. Feedback from meetings held betweenexecutivemanagement, or the InvestorRelations department, and institutional shareholders isalsocommunicated to the Board.- E1( (b): page 99 - Any significantt concerns raised by ashareholder in relation to the Company and its affairs arecommunicated to the Board.- Supporting Principles(b). Whilst recognising thatmostshareholder contact iswith the chief executive andfinance director, theChairman should ensurethat all directors aremadeaware of their majorshareholders’ issues andconcerns.- E1( (c): page 99 - Feedback frommeetings heldbetweenexecutive management, or the Investor RelationsDepartment, and institutional shareholders is alsocommunicated to the Board…… ………… The Chairman,SIDand other nonn executive directors are alsoavailableto shareholders too discuss any matter they wish to raise.- (c). The board should keepin touch with shareholderopinion in whateverwaysare most practical andefficient.<strong>Code</strong>Provision- E.1. 1 (a) The Chairmanshould ensure that theviewsof shareholders arecommunicated to the boardas a whole.- E1. 1(a): page 99 - Any significant concerns raised by ashareholder in relation to the Company and its affairs arecommunicated to the Board.Page 98 - The Company maintains an active engagementwithits key financial audiences, including institutionalshareholders and sell side analysts as well as potentialshareholders. Thee Investor Relations departmentmanages the interaction with these audiences and regularpresentations takee place at the time of interim and finalresults as well as during the restt of the year.TheChairman, SID and other non executive directors arealsoavailable to shareholders todiscuss any matter theywish to raise- E1. 1(c): page 99 - Feedback from meetings held between22

- (b) The Chairman shoulddiscuss governancee andstrategy with majorshareholders.executive management, or the Investor RelationsDepartment, and institutional shareholders is alsocommunicated to the Board- page 98 and 99 - Communicating With Our Investors- (c) Non executive directorsshould be offered theopportunity to attendscheduled meetings withmajor shareholderss andshould expect to attendmeetings if requested bymajor shareholders.- E1( (c): page 99 - Feedback frommeetings heldbetweenexecutive management, or the Investor RelationsDepartment, and institutional shareholders is alsocommunicated to the Board- (d) The senior independentdirector should attendsufficient meetings with arange of majorshareholders to listen totheir views in order to helpdevelop a balancedunderstanding of the issuesand concerns of majorshareholders- E.1.2The board shouldstatein the annual reportthe steps they havetakento ensure that the membersof theboard, and, inparticular, the nonexecutivedirectors, develop anunderstanding of the viewsof major shareholders aboutthe company, for examplethrough direct face-to-faceanalysts’ orbrokers’ briefings andsurveys of shareholderopinion.contact, - E1. 1(d): page 999 – During 2012, the chairmanattendedinvestor roadshows in London and Cape Town. DavidChallen in his capacity as the SID works closely with thechairman to maintain his understanding of the issues andconcerns of majorr shareholders. . The Chairman, SID andother non executive directors arealso availabletoshareholders to discuss any matter they wish to raise.- E1. 2: page 99 - The Board is briefed on a regular basis bythe Investor Relations department and analysts’ reportsare circulated to the directors. Feedback from meetingsheldbetween executive management, or the InvestorRelations Department, and institutional shareholders isalsocommunicated to the Board.23

![English PDF [ 189KB ] - Anglo American](https://img.yumpu.com/50470814/1/184x260/english-pdf-189kb-anglo-american.jpg?quality=85)

![pdf [ 595KB ] - Anglo American](https://img.yumpu.com/49420483/1/184x260/pdf-595kb-anglo-american.jpg?quality=85)

![pdf [ 1.1MB ] - Anglo American](https://img.yumpu.com/49057963/1/190x240/pdf-11mb-anglo-american.jpg?quality=85)