Wills and Trusts Basics - National Association of Legal Assistants

Wills and Trusts Basics - National Association of Legal Assistants

Wills and Trusts Basics - National Association of Legal Assistants

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

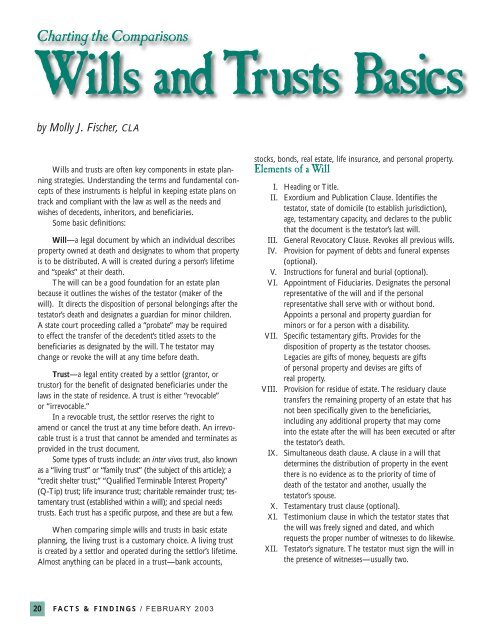

Charting the Comparisons<strong>Wills</strong> <strong>and</strong> <strong>Trusts</strong> <strong>Basics</strong>by Molly J. Fischer, CLA<strong>Wills</strong> <strong>and</strong> trusts are <strong>of</strong>ten key components in estate planningstrategies. Underst<strong>and</strong>ing the terms <strong>and</strong> fundamental concepts<strong>of</strong> these instruments is helpful in keeping estate plans ontrack <strong>and</strong> compliant with the law as well as the needs <strong>and</strong>wishes <strong>of</strong> decedents, inheritors, <strong>and</strong> beneficiaries.Some basic definitions:Will—a legal document by which an individual describesproperty owned at death <strong>and</strong> designates to whom that propertyis to be distributed. A will is created during a person’s lifetime<strong>and</strong> “speaks” at their death.The will can be a good foundation for an estate planbecause it outlines the wishes <strong>of</strong> the testator (maker <strong>of</strong> thewill). It directs the disposition <strong>of</strong> personal belongings after thetestator’s death <strong>and</strong> designates a guardian for minor children.A state court proceeding called a “probate” may be requiredto effect the transfer <strong>of</strong> the decedent’s titled assets to thebeneficiaries as designated by the will. The testator maychange or revoke the will at any time before death.Trust—a legal entity created by a settlor (grantor, ortrustor) for the benefit <strong>of</strong> designated beneficiaries under thelaws in the state <strong>of</strong> residence. A trust is either “revocable”or “irrevocable.”In a revocable trust, the settlor reserves the right toamend or cancel the trust at any time before death. An irrevocabletrust is a trust that cannot be amended <strong>and</strong> terminates asprovided in the trust document.Some types <strong>of</strong> trusts include: an inter vivos trust, also knownas a “living trust” or “family trust” (the subject <strong>of</strong> this article); a“credit shelter trust;” “Qualified Terminable Interest Property”(Q-Tip) trust; life insurance trust; charitable remainder trust; testamentarytrust (established within a will); <strong>and</strong> special needstrusts. Each trust has a specific purpose, <strong>and</strong> these are but a few.When comparing simple wills <strong>and</strong> trusts in basic estateplanning, the living trust is a customary choice. A living trustis created by a settlor <strong>and</strong> operated during the settlor’s lifetime.Almost anything can be placed in a trust—bank accounts,stocks, bonds, real estate, life insurance, <strong>and</strong> personal property.Elements <strong>of</strong> a WillI. Heading or Title.II. Exordium <strong>and</strong> Publication Clause. Identifies thetestator, state <strong>of</strong> domicile (to establish jurisdiction),age, testamentary capacity, <strong>and</strong> declares to the publicthat the document is the testator’s last will.III. General Revocatory Clause. Revokes all previous wills.IV. Provision for payment <strong>of</strong> debts <strong>and</strong> funeral expenses(optional).V. Instructions for funeral <strong>and</strong> burial (optional).VI. Appointment <strong>of</strong> Fiduciaries. Designates the personalrepresentative <strong>of</strong> the will <strong>and</strong> if the personalrepresentative shall serve with or without bond.Appoints a personal <strong>and</strong> property guardian forminors or for a person with a disability.VII. Specific testamentary gifts. Provides for thedisposition <strong>of</strong> property as the testator chooses.Legacies are gifts <strong>of</strong> money, bequests are gifts<strong>of</strong> personal property <strong>and</strong> devises are gifts <strong>of</strong>real property.VIII. Provision for residue <strong>of</strong> estate. The residuary clausetransfers the remaining property <strong>of</strong> an estate that hasnot been specifically given to the beneficiaries,including any additional property that may comeinto the estate after the will has been executed or afterthe testator’s death.IX. Simultaneous death clause. A clause in a will thatdetermines the distribution <strong>of</strong> property in the eventthere is no evidence as to the priority <strong>of</strong> time <strong>of</strong>death <strong>of</strong> the testator <strong>and</strong> another, usually thetestator’s spouse.X. Testamentary trust clause (optional).XI. Testimonium clause in which the testator states thatthe will was freely signed <strong>and</strong> dated, <strong>and</strong> whichrequests the proper number <strong>of</strong> witnesses to do likewise.XII. Testator’s signature. The testator must sign the will inthe presence <strong>of</strong> witnesses—usually two.20FACTS & FINDINGS / FEBRUARY 2003

XIII. Attestation clause <strong>of</strong> witnesses. Witnesses state thatthey have attested the testator’s signature on the will.XIV. Witnesses’ signatures <strong>and</strong> addresses. State statutes maygovern proper wording for the attestation clause <strong>and</strong>proper procedure for witnesses’ signatures. Somestates require the witnesses’ signatures to be notarized.Elements <strong>of</strong> a TrustI. Declaration/Creation <strong>of</strong> the trust. A settlor is anindividual who intends to create the trust. To be asettlor, a person must own a transferable interest inproperty, have the right or power <strong>of</strong> disposing <strong>of</strong> aproperty interest, <strong>and</strong> have the ability to make a validcontract. The same person cannot be the settlor,trustee, <strong>and</strong> beneficiary, but the same person could bethe settlor <strong>and</strong> trustee, or the settlor <strong>and</strong> beneficiary.II. Designation or appointment <strong>of</strong> one or more trusteeswho are named to administer <strong>and</strong> manage the trust.The trustee(s) hold legal title to the trust property forthe benefit <strong>of</strong> the beneficiary. The trustee is afiduciary <strong>and</strong>, as such owes fiduciary duties to acthonestly <strong>and</strong> loyally for the sole benefit <strong>of</strong> the beneficiary.III. Create powers <strong>of</strong> the trustee. Most state statutesspecify fiduciary powers, but also permit the creatorto exp<strong>and</strong> or limit those powers by inserting aprovision to that effect in the trust. The specificduties <strong>of</strong> the trustee should be clearly spelledout (Helewitz 77).IV. A legal purpose for the trust must exist. The trust’spurpose may serve the private interests <strong>of</strong> the creatorto benefit private persons, known as a private trust, ormay be established to provide charitable benefits,known as a public trust.V. There must be trust property, real or personal, thatmust be transferred to the trust. The trust cannotexist until the property has been legally transferred tothe trust. After the creation <strong>of</strong> a trust, title toproperty placed in the trust must pass to at least twopersons. The title is “split” into legal title <strong>and</strong>equitable title. The trustee receives the legal title, <strong>and</strong>the beneficiary receives the equitable title.VI. One or more beneficiaries must be named to receivethe benefits (income <strong>and</strong>/or principal).VII. A termination point must be established. Privatetrusts terminate within a statutorily determinedperiod <strong>of</strong> time, <strong>and</strong> the trust should indicate thepoint at which the trust will end, either by particulardate or contingent event.VIII. The trust should indicate a remainder interest. Theperson or persons in whom the legal <strong>and</strong> equitabletitles will merge.IX. Signature <strong>of</strong> the creator(s). Many jurisdictions requirethe document to be signed by at least one trustee <strong>and</strong>witnessed or notarized. If the trust is a testamentarytrust, the creating document is the will, which mustmeet statutory requirements for the execution <strong>of</strong> wills.Alternatives to a Will or TrustThere are other ways to hold title to property that avoidprobate <strong>and</strong> are transferred to the beneficiary without anyadministration or trust necessary.I. Joint tenancy with rights <strong>of</strong> survivorship.II. Community property with rights <strong>of</strong> survivorship(an alternative in community property states).III. Tenancy by the entireties—joint owners are husb<strong>and</strong><strong>and</strong> wife (check state laws).IV. “Pay on Death” (POD) provision to bondregistration, bank accounts, savings accounts or“transfer on death” (TOD) registration for stocks,brokerage accounts <strong>and</strong> mutual funds. (See UniformTransfer On-Death Security Registration Act).V. Proceeds <strong>of</strong> a life insurance policy payable to anamed beneficiary.VI. Employment benefits contracts that contain anamed beneficiary.VII. Annuity contracts with a named beneficiary.VIII. IRA’s with a named beneficiary.See charts on Pages 22 <strong>and</strong> 23References:Hower, Dennis R. <strong>Wills</strong>, <strong>Trusts</strong>, <strong>and</strong> Estate Administrationfor the Paralegal, Minnesota: West Publishing Company, 1996.Koerselman, Virginia. CLA Review Manual, SecondEdition, New York, West Publishing, 1998.Helewitz, Jeffrey A. “A Matter <strong>of</strong> <strong>Trusts</strong>—What it takes toproperly draft a legal trust,” <strong>Legal</strong> Assistant Today, May/June2000, Volume 17, Issue 5: pp. 77–78.Molly J Fischer, CLA, works in the areas <strong>of</strong> estate planning, wills,trusts, probates, guardianships, <strong>and</strong> Medicaid planning with the Law Offices<strong>of</strong> Patricia F. Winnie, Esq., Reno, NV. She holds BS <strong>and</strong> MS degrees inDesign, Merch<strong>and</strong>ising <strong>and</strong> Consumer Sciences from Colorado StateUniversity, <strong>and</strong> has an Associates Degree in Applied Science in <strong>Legal</strong>Assistant studies from Truckee Meadows Community College. She teachesEthics for paralegals at Truckee Meadows Community College <strong>and</strong> is amember <strong>of</strong> the Sierra Nevada <strong>Association</strong> <strong>of</strong> Paralegals, having served aspresident <strong>and</strong> current NALA liaison.FACTS & FINDINGS / FEBRUARY 2003 21

Charting the Comparisons: <strong>Wills</strong> <strong>and</strong> <strong>Trusts</strong> <strong>Basics</strong>continued from page 22Terms & DefinitionsDefinition<strong>and</strong>/or condition Term Used in <strong>Wills</strong> Term Used in <strong>Trusts</strong>Creator <strong>of</strong> the legal document Testator / Testatrix Trustor, Grantor or SettlorFiduciary managing the “estate” Personal Representative, Trustee orExecutor, ExecutrixSuccessor TrusteeAdministrator, AdministrarixAny person to whom the decedent’s Beneficiary Beneficiaryproperty is given or distributed.Two or more persons who attest Witnesses [A trust does not require<strong>and</strong> also sign the will, in somewitnesses. However, thestates the witnesses signaturestrustor’s signatures areare notarized.usually notarized.]Personal <strong>and</strong> real property. Estate Trust property /corpus.The form <strong>of</strong> ownership <strong>of</strong> trustEquitable Title to propertyproperty held by the trusteegiving the trustee the right tocontrol the property.A right <strong>of</strong> the party to whom it (the<strong>Legal</strong> Title to propertyequitable or beneficial title) belongsto the benefits <strong>of</strong> the trust.Comparative Advantages/Disadvantages/Effectiveness<strong>Wills</strong>Upon death, the will becomes a public document.The probate process is controlled by the court.The court insures that creditors are paid,administrative fees <strong>and</strong> costs are paid, <strong>and</strong>beneficiaries are paid according to the will.The court’s probate process protects the fiduciaryfrom further creditors claims after the time periodfor notice has expired. All claims against the estateare forever barred. Creditors are barred from assertingclaims against the heirs.<strong>Trusts</strong>A trust is a private document. The courts do nothave any control over trust assets.However, if there is a dispute between beneficiaries <strong>and</strong>trustees or if a trustee’s h<strong>and</strong>ling <strong>of</strong> the trust principle orincome is in question, the issues may be taken before theprobate court. If the court accepts jurisdiction, the trust isno longer a private document.The trustee has the fiduciary responsibility to ensure thatthe settlor’s bequests are fulfilled exactly as prescribed inthe trust document. The distribution process is controlledby the trustee, unsupervised <strong>and</strong> with no guarantee to thebeneficiaries that the trustee is following the trustinstructions exactly.The trustee <strong>and</strong> beneficiaries are liable to creditors <strong>of</strong> thetrust. Some jurisdictions provide statutes for notice tocreditors in a trust administration that serve to protect thetrustee <strong>and</strong> beneficiary from perpetual creditor claimsagainst the trust.22FACTS & FINDINGS / FEBRUARY 2003

A Living Trust can help preserve <strong>and</strong> increase an estatewhile the settlor is alive, <strong>and</strong> <strong>of</strong>fers protection should thesettlor become disabled. A guardianship <strong>of</strong> an incapacitat-ed adult may be required to protect the person <strong>and</strong> tomake healthcare decisions.<strong>Wills</strong>Probate can be cumbersome, time-consuming, <strong>and</strong>expensive. However, most states have informaladministration <strong>of</strong> small estates which do not requireprobate or have shortened the probate process thusreducing the expense <strong>of</strong> probate.The will doesn’t take effect until the testator dies.Probate <strong>and</strong> estate settlement costs may decreasethe size <strong>of</strong> the estate.Trust assets that are not properly titled in the name <strong>of</strong>the trust are subject to probate.The Will has no administration during thetestator’s lifetime.Durable powers <strong>of</strong> attorney for estate management <strong>and</strong>health can be created for the testator that are valid evenif the testator becomes disabled or incapacitated. Aguardianship <strong>of</strong> an incapacitated adult may be requiredto protect the person <strong>and</strong> to make healthcare decisions.Interpretations <strong>of</strong> wills can vary from state to state.Assets left to a spouse are subject to federal estatetax upon the surviving spouse’s death.An ancillary probate must be established by the courtto transfer or sell real property in a state other thanthe testators domicile.A pr<strong>of</strong>essional manager <strong>of</strong> assets can be named as thepersonal representative <strong>of</strong> the testators estate,(i.e., a bank’s trust department).Federal Estate Taxes are not avoided with a will.However,in the case <strong>of</strong> a married couple leavingeverything to each other, no federal estate tax will bedue after the death <strong>of</strong> the first spouse no matter howlarge the estate.A Will contest is possible, although usuallydifficult to challenge.<strong>Trusts</strong>The initial cost to establish the trust <strong>and</strong> any amendmentsto the trust as the laws change can be expensive. Theliving trust, because <strong>of</strong> the transfer <strong>of</strong> documents <strong>and</strong> itsoperation as a viable entity during the grantor’s lifetime,make it more expensive to draft <strong>and</strong> implement than a Will.A living trust takes effect when the grantor/settlor signsit or on a date specified by the grantor/settlor.Trust litigation may decrease the size <strong>of</strong> the estate.A Living Trust avoids probate because the property isowned by the trust, so technically there is nothing for theprobate courts to administer. Careful management <strong>of</strong> thetrust assets is required to avoid probate.The living trust is a living document <strong>and</strong> careful ongoingadministration during the lifetime <strong>of</strong> the Trust is necessary.All assets must be transferred into the trust name. Realproperty deeds must be transferred <strong>and</strong> all lien holders(mortgagees) must be informed. All bank accountsreopened in the name <strong>of</strong> the trust, all partnership <strong>and</strong>stock interest must be transferred, <strong>and</strong> each <strong>of</strong> thetransfers typically requires special documentation bythe transfer agent.<strong>Trusts</strong> are established under the laws <strong>of</strong> the state wherethe trust is written. Statutes <strong>of</strong> a community property statediffer on the division <strong>and</strong> distribution <strong>of</strong> property <strong>and</strong>depending on if the character <strong>of</strong> the property hasremained community or separate property within the trust.Assets left to a spouse are subject to federal estate taxupon the surviving spouse’s death. A trust can <strong>of</strong>fer sometax relief for the trust after the last settlor’s death, thusbenefiting heirs <strong>of</strong> the trust.A trust can make the transfer <strong>of</strong> real property in morethan one state easier.Through a trust, an arrangement for assets to bepr<strong>of</strong>essionally managed by a trustee can be established.Federal Estate Taxes are not avoided with a trust.However, in the case <strong>of</strong> a married couple leavingeverything to each other, no federal estate tax will bedue after the death <strong>of</strong> the first spouse no matter howlarge the estate.It is very difficult for disgruntled heirs to challengea Living Trust.FACTS & FINDINGS / FEBRUARY 2003 23