The University System of Georgia ORP Transition Guide

The University System of Georgia ORP Transition Guide The University System of Georgia ORP Transition Guide

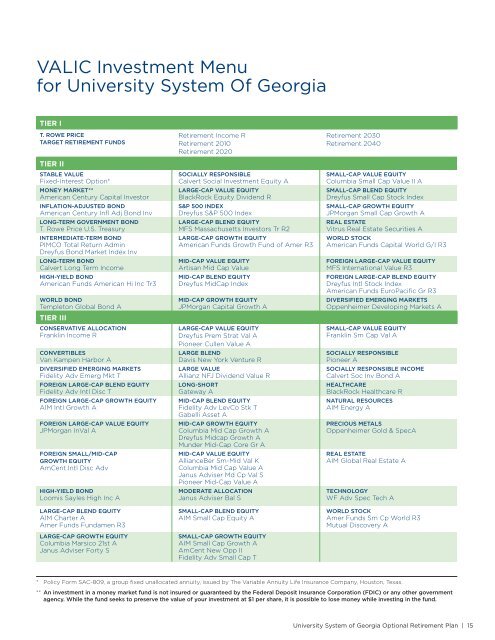

VALIC Investment ChoicesVALIC’s mission is to help Americans plan for and enjoy a secure retirement. That iswhy we have chosen a diverse set of mutual funds in multiple classes to help you createa personalized investment mix that best fits your individual situation.Tier 1: T. Rowe Price Target Retirement FundsThese target-dated funds offer instant diversification. Each fund is automatically adjusted to become moreconservative as you approach the Fund’s target retirement date.Tier 2: Diversified SelectionThis mix of mutual funds, selected from VALIC’s open-architecture mutual fund model, offers choices that spanall investment sectors.Tier 3: Increased DiversificationOver 40 additional mutual funds in multiple classifications increase your flexibility to customize your investmentmix to suit your individual situation.For more information about the broad, diversified menu of VALIC investment options available to you,please visit VALIC.com or call 800 448-2542, Monday to Friday from 7 a.m. to 8 p.m. CT.Income taxes are payable upon withdrawal. Federal restrictions may apply to early withdrawals.Investment values will fluctuate and there is no assurance that the objective of any fund will be achieved. Mutual fund shares are redeemable atthe then-current net asset value, which may be more or less than their original cost.Generally, higher potential returns involve greater risk and short-term volatility. For example, small-cap, mid-cap, sector and emerging funds canexperience significant price fluctuation due to business risks and adverse political developments. International (global) and foreign funds canexperience price fluctuation due to changing market conditions, currency values, and economic and political climates. High-yield bond funds,which invest in bonds that have lower ratings, typically experience price fluctuation and a greater risk of loss of principal and income than wheninvesting directly in U.S. government securities such as U.S. Treasury bonds and bills, which are guaranteed by the government for repayment ofprincipal and interest if held to maturity. Mortgage-related funds’ underlying mortgages are more likely to be prepaid during periods of declininginterest rates, which could hurt the fund’s share price or yield and may be prepaid more slowly during periods of rapidly rising interest rates, whichmight lengthen the fund’s expected maturity. Investors should carefully assess the risks associated with an investment in the fund. Fund shares arenot insured and are not backed by the U.S. government, and their value and yield will vary with market conditions.To view or print a prospectus, visit www.VALIC.com and click on ePrint SM under Links to Login. Enter 25002001 in the Login field and click go.Click on “Funds” in Quick Links, and funds available for your plan are displayed. The prospectus contains the investment objectives, risks, charges,expenses and other information about the respective investment companies that you should consider carefully before investing. Please read theprospectus carefully before investing or sending money. You can also request a copy by calling 800 448-2542.Securities and investment advisory services are offered by VALIC Financial Advisors, Inc., member FINRA and an SEC-registered investment advisor.The Plan provider is VALIC Retirement Services Company. VALIC represents The Variable Annuity Life Insurance Company and its subsidiaries,VALIC Financial Advisors, Inc. and VALIC Retirement Services Company.Copyright © The Variable Annuity Life Insurance Company.All rights reserved.VC 23069 (02/2010) J77173 EE14 | University System of Georgia Optional Retirement Plan

VALIC Investment Menufor University System Of GeorgiaTIER IT. ROWE PRICETARGET RETIREMENT FUNDSTIER IISTABLE VALUEFixed-Interest Option*MONEY MARKET**American Century Capital InvestorINFLATION-ADJUSTED BONDAmerican Century Infl Adj Bond InvLONG-TERM GOVERNMENT BONDT. Rowe Price U.S. TreasuryINTERMEDIATE-TERM BONDPIMCO Total Return AdminDreyfus Bond Market Index InvLONG-TERM BONDCalvert Long Term IncomeHIGH-YIELD BONDAmerican Funds American Hi Inc Tr3WORLD BONDTempleton Global Bond ATIER IIICONSERVATIVE ALLOCATIONFranklin Income RCONVERTIBLESVan Kampen Harbor ADIVERSIFIED EMERGING MARKETSFidelity Adv Emerg Mkt TFOREIGN LARGE-CAP BLEND EQUITYFidelity Adv Intl Disc TFOREIGN LARGE-CAP GROWTH EQUITYAIM Intl Growth AFOREIGN LARGE-CAP VALUE EQUITYJPMorgan InVal AFOREIGN SMALL/MID-CAPGROWTH EQUITYAmCent Intl Disc AdvHIGH-YIELD BONDLoomis Sayles High Inc ALARGE-CAP BLEND EQUITYAIM Charter AAmer Funds Fundamen R3LARGE-CAP GROWTH EQUITYColumbia Marsico 21st AJanus Adviser Forty SRetirement Income RRetirement 2010Retirement 2020SOCIALLY RESPONSIBLECalvert Social Investment Equity ALARGE-CAP VALUE EQUITYBlackRock Equity Dividend RS&P 500 INDEXDreyfus S&P 500 IndexLARGE-CAP BLEND EQUITYMFS Massachusetts Investors Tr R2LARGE-CAP GROWTH EQUITYAmerican Funds Growth Fund of Amer R3MID-CAP VALUE EQUITYArtisan Mid Cap ValueMID-CAP BLEND EQUITYDreyfus MidCap IndexMID-CAP GROWTH EQUITYJPMorgan Capital Growth ALARGE-CAP VALUE EQUITYDreyfus Prem Strat Val APioneer Cullen Value ALARGE BLENDDavis New York Venture RLARGE VALUEAllianz NFJ Dividend Value RLONG-SHORTGateway AMID-CAP BLEND EQUITYFidelity Adv LevCo Stk TGabelli Asset AMID-CAP GROWTH EQUITYColumbia Mid Cap Growth ADreyfus Midcap Growth AMunder Mid-Cap Core Gr AMID-CAP VALUE EQUITYAllianceBer Sm-Mid Val KColumbia Mid Cap Value AJanus Adviser Md Cp Val SPioneer Mid-Cap Value AMODERATE ALLOCATIONJanus Adviser Bal SSMALL-CAP BLEND EQUITYAIM Small Cap Equity ASMALL-CAP GROWTH EQUITYAIM Small Cap Growth AAmCent New Opp IIFidelity Adv Small Cap TRetirement 2030Retirement 2040SMALL-CAP VALUE EQUITYColumbia Small Cap Value II ASMALL-CAP BLEND EQUITYDreyfus Small Cap Stock IndexSMALL-CAP GROWTH EQUITYJPMorgan Small Cap Growth AREAL ESTATEVitrus Real Estate Securities AWORLD STOCKAmerican Funds Capital World G/I R3FOREIGN LARGE-CAP VALUE EQUITYMFS International Value R3FOREIGN LARGE-CAP BLEND EQUITYDreyfus Intl Stock IndexAmerican Funds EuroPacific Gr R3DIVERSIFIED EMERGING MARKETSOppenheimer Developing Markets ASMALL-CAP VALUE EQUITYFranklin Sm Cap Val ASOCIALLY RESPONSIBLEPioneer ASOCIALLY RESPONSIBLE INCOMECalvert Soc Inv Bond AHEALTHCAREBlackRock Healthcare RNATURAL RESOURCESAIM Energy APRECIOUS METALSOppenheimer Gold & SpecAREAL ESTATEAIM Global Real Estate ATECHNOLOGYWF Adv Spec Tech AWORLD STOCKAmer Funds Sm Cp World R3Mutual Discovery A* Policy Form SAC-809, a group fixed unallocated annuity, issued by The Variable Annuity Life Insurance Company, Houston, Texas.** An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmentagency. While the fund seeks to preserve the value of your investment at $1 per share, it is possible to lose money while investing in the fund.University System of Georgia Optional Retirement Plan | 15

- Page 1 and 2: Maximize Your Retirement Savings:Th

- Page 3 and 4: The University System of GeorgiaOpt

- Page 5 and 6: What’s Changing and WhyIn order t

- Page 7 and 8: Who Can I Contact if I Need Assista

- Page 9 and 10: About TIAA-CREFWith $414 billion in

- Page 11 and 12: University System of Georgia ORP In

- Page 13 and 14: Fidelity Investment Menufor Univers

- Page 15: TIAA-CREF Investment Menufor Univer

- Page 19: Take the Next StepTo learn more abo

VALIC Investment Menufor <strong>University</strong> <strong>System</strong> Of <strong>Georgia</strong>TIER IT. ROWE PRICETARGET RETIREMENT FUNDSTIER IISTABLE VALUEFixed-Interest Option*MONEY MARKET**American Century Capital InvestorINFLATION-ADJUSTED BONDAmerican Century Infl Adj Bond InvLONG-TERM GOVERNMENT BONDT. Rowe Price U.S. TreasuryINTERMEDIATE-TERM BONDPIMCO Total Return AdminDreyfus Bond Market Index InvLONG-TERM BONDCalvert Long Term IncomeHIGH-YIELD BONDAmerican Funds American Hi Inc Tr3WORLD BONDTempleton Global Bond ATIER IIICONSERVATIVE ALLOCATIONFranklin Income RCONVERTIBLESVan Kampen Harbor ADIVERSIFIED EMERGING MARKETSFidelity Adv Emerg Mkt TFOREIGN LARGE-CAP BLEND EQUITYFidelity Adv Intl Disc TFOREIGN LARGE-CAP GROWTH EQUITYAIM Intl Growth AFOREIGN LARGE-CAP VALUE EQUITYJPMorgan InVal AFOREIGN SMALL/MID-CAPGROWTH EQUITYAmCent Intl Disc AdvHIGH-YIELD BONDLoomis Sayles High Inc ALARGE-CAP BLEND EQUITYAIM Charter AAmer Funds Fundamen R3LARGE-CAP GROWTH EQUITYColumbia Marsico 21st AJanus Adviser Forty SRetirement Income RRetirement 2010Retirement 2020SOCIALLY RESPONSIBLECalvert Social Investment Equity ALARGE-CAP VALUE EQUITYBlackRock Equity Dividend RS&P 500 INDEXDreyfus S&P 500 IndexLARGE-CAP BLEND EQUITYMFS Massachusetts Investors Tr R2LARGE-CAP GROWTH EQUITYAmerican Funds Growth Fund <strong>of</strong> Amer R3MID-CAP VALUE EQUITYArtisan Mid Cap ValueMID-CAP BLEND EQUITYDreyfus MidCap IndexMID-CAP GROWTH EQUITYJPMorgan Capital Growth ALARGE-CAP VALUE EQUITYDreyfus Prem Strat Val APioneer Cullen Value ALARGE BLENDDavis New York Venture RLARGE VALUEAllianz NFJ Dividend Value RLONG-SHORTGateway AMID-CAP BLEND EQUITYFidelity Adv LevCo Stk TGabelli Asset AMID-CAP GROWTH EQUITYColumbia Mid Cap Growth ADreyfus Midcap Growth AMunder Mid-Cap Core Gr AMID-CAP VALUE EQUITYAllianceBer Sm-Mid Val KColumbia Mid Cap Value AJanus Adviser Md Cp Val SPioneer Mid-Cap Value AMODERATE ALLOCATIONJanus Adviser Bal SSMALL-CAP BLEND EQUITYAIM Small Cap Equity ASMALL-CAP GROWTH EQUITYAIM Small Cap Growth AAmCent New Opp IIFidelity Adv Small Cap TRetirement 2030Retirement 2040SMALL-CAP VALUE EQUITYColumbia Small Cap Value II ASMALL-CAP BLEND EQUITYDreyfus Small Cap Stock IndexSMALL-CAP GROWTH EQUITYJPMorgan Small Cap Growth AREAL ESTATEVitrus Real Estate Securities AWORLD STOCKAmerican Funds Capital World G/I R3FOREIGN LARGE-CAP VALUE EQUITYMFS International Value R3FOREIGN LARGE-CAP BLEND EQUITYDreyfus Intl Stock IndexAmerican Funds EuroPacific Gr R3DIVERSIFIED EMERGING MARKETSOppenheimer Developing Markets ASMALL-CAP VALUE EQUITYFranklin Sm Cap Val ASOCIALLY RESPONSIBLEPioneer ASOCIALLY RESPONSIBLE INCOMECalvert Soc Inv Bond AHEALTHCAREBlackRock Healthcare RNATURAL RESOURCESAIM Energy APRECIOUS METALSOppenheimer Gold & SpecAREAL ESTATEAIM Global Real Estate ATECHNOLOGYWF Adv Spec Tech AWORLD STOCKAmer Funds Sm Cp World R3Mutual Discovery A* Policy Form SAC-809, a group fixed unallocated annuity, issued by <strong>The</strong> Variable Annuity Life Insurance Company, Houston, Texas.** An investment in a money market fund is not insured or guaranteed by the Federal Deposit Insurance Corporation (FDIC) or any other governmentagency. While the fund seeks to preserve the value <strong>of</strong> your investment at $1 per share, it is possible to lose money while investing in the fund.<strong>University</strong> <strong>System</strong> <strong>of</strong> <strong>Georgia</strong> Optional Retirement Plan | 15