NOTICE OF MEETING AND AGENDA - Metro Transit

NOTICE OF MEETING AND AGENDA - Metro Transit

NOTICE OF MEETING AND AGENDA - Metro Transit

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

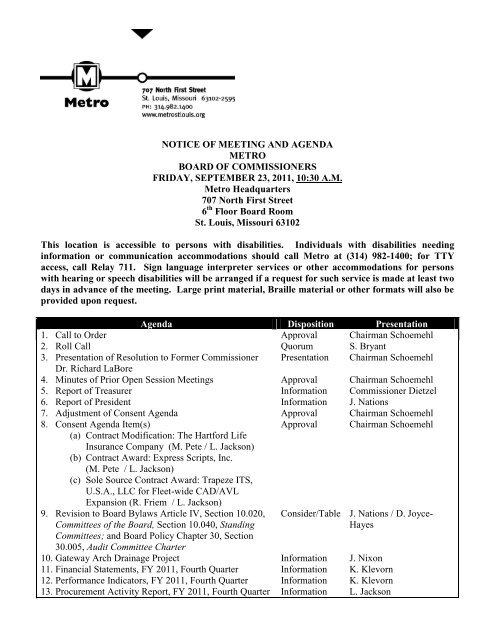

<strong>NOTICE</strong> <strong>OF</strong> <strong>MEETING</strong> <strong>AND</strong> <strong>AGENDA</strong>METROBOARD <strong>OF</strong> COMMISSIONERSFRIDAY, SEPTEMBER 23, 2011, 10:30 A.M.<strong>Metro</strong> Headquarters707 North First Street6 th Floor Board RoomSt. Louis, Missouri 63102This location is accessible to persons with disabilities. Individuals with disabilities needinginformation or communication accommodations should call <strong>Metro</strong> at (314) 982-1400; for TTYaccess, call Relay 711. Sign language interpreter services or other accommodations for personswith hearing or speech disabilities will be arranged if a request for such service is made at least twodays in advance of the meeting. Large print material, Braille material or other formats will also beprovided upon request.Agenda Disposition Presentation1. Call to Order Approval Chairman Schoemehl2. Roll Call3. Presentation of Resolution to Former CommissionerDr. Richard LaBore4. Minutes of Prior Open Session Meetings5. Report of Treasurer6. Report of PresidentQuorumPresentationApprovalInformationInformationS. BryantChairman SchoemehlChairman SchoemehlCommissioner DietzelJ. Nations7. Adjustment of Consent Agenda8. Consent Agenda Item(s)(a) Contract Modification: The Hartford LifeInsurance Company (M. Pete / L. Jackson)(b) Contract Award: Express Scripts, Inc.(M. Pete / L. Jackson)(c) Sole Source Contract Award: Trapeze ITS,U.S.A., LLC for Fleet-wide CAD/AVLExpansion (R. Friem / L. Jackson)9. Revision to Board Bylaws Article IV, Section 10.020,Committees of the Board, Section 10.040, StandingCommittees; and Board Policy Chapter 30, Section30.005, Audit Committee Charter10. Gateway Arch Drainage Project11. Financial Statements, FY 2011, Fourth Quarter12. Performance Indicators, FY 2011, Fourth Quarter13. Procurement Activity Report, FY 2011, Fourth QuarterApprovalApprovalConsider/TableInformationInformationInformationInformationChairman SchoemehlChairman SchoemehlJ. Nations / D. Joyce-HayesJ. NixonK. KlevornK. KlevornL. Jackson

Board of Commissioners MeetingSeptember 23, 2011Page 2Agenda Disposition PresentationApproval Chairman SchoemehlInformation Chairman SchoemehlApproval Chairman Schoemehl14. Unscheduled Business15. Public Comment*16. Executive SessionIf such action is approved by a majority vote of TheBi-State Development Agency’s Board ofCommissioners who constitute a quorum, the Boardmay go into closed session to discuss legal,confidential, or privileged matters under§610.021(1), RSMo 1988 Supp.; leasing, purchaseor sale of real estate under §610.021(2); personnelactions under §610.021(3); discussions regardingnegotiations with employee groups under§610.021(9); personnel records or applicationsunder §610.021(13); or records under§610.021(14) which are otherwise protected fromdisclosure by law; or confidential or privilegedcommunications with the District’s auditor,including auditor work products under§610.021(17).17. Approval of Executive Session Items18. Executive Session Authorization for Next Meeting19. Call of Dates for Future Board Meetings20. AdjournmentApprovalApprovalInformationApprovalChairman SchoemehlChairman SchoemehlS. BryantChairman Schoemehl*Public comment may be made at the written request of a member of the public specifying thetopic(s) to be addressed and provided to the Agency’s information officer at least 48 hours prior tothe meeting.

BI-STATE DEVELOPMENT AGENCYTREASURER’S REPORT, JUNE 2011INVESTMENTS:YieldsAgency investments had an average yield of .20% in June, which compares to .19% in May. Forreference, the yield on the ninety day U.S. Treasury Bill was .03% in June and .04% in May. Variousfactors, including continued global economic and political uncertainty, have caused interest rates to remainexceptionally low.Invested FundsThe Agency had invested funds of approximately $143 million at June 30 th , which compares to $146million at May 31 st . Investments with trustees were $29 million at June 30 th , which compares to $26million at May 31 st . All investments were in compliance with board policy.DEBT MANAGEMENT:Debt Service Reserve Fund, 2002 BondsIn 2002, <strong>Metro</strong> issued $414 million in bonds to fund the <strong>Metro</strong>Link Cross-County Extension. Theindenture for the bonds specified that a $28 million Debt Service Reserve Fund (DSRF) be established.<strong>Metro</strong> had the option of cash funding this requirement or purchasing an AAA rated surety. <strong>Metro</strong> chose topurchase a surety from Financial Security Assurance Corporation (FSA, now Assured) which at the time ofissuance had an AAA rating from all three credit rating agencies. On October 25, 2010, Assured lost itslast AAA rating. This requires <strong>Metro</strong> to cash fund the DSRF by October 25, 2011. <strong>Metro</strong> finance staffpresented a recommendation regarding funding the DSRF to the Board in March, which involved usingFTA grant money ($18 million), a loan from the State of Missouri Infrastructure Bank ($5 million), and<strong>Metro</strong> cash reserves ($5 million). The Board approved the plan and staff is now working on implementingit. <strong>Metro</strong>’s loan application with the State Infrastructure Bank has been approved.Variable Rate BondsIn November 2010, the Letter of Credit (LOC) for the $150 million Series 2005 Variable Rate Cross-County Bonds expired. In October, the bonds were refunded in two different issues: the $75 million SeriesA Variable Rate (weekly reset) Bonds, with a J.P. Morgan Chase LOC; and the $75 million Series B FixedRate Bonds (fixed for three years at a yield of 1.70%) The $75 million Series A Weekly Variable RateBonds were issued at an initial rate of .27%, and <strong>Metro</strong> pays J.P. Morgan 1.075% for the LOC. The rateon the Series A Bonds was .13% at June 30 th , a decline of six basis points from the prior month (a basispoint equals $7,500 annually on $75 million.). For comparison purposes, the SIFMA index (an index ofhigh quality weekly variable rate municipal debt) was .09% at June 30 th .Capital LeasesThe Agency has terminated two of its three leveraged lease (capital lease) transactions. In February 2011,staff negotiated a default cure with the lease investor on the C1 and C2 tranche of the ’01 Lease and thistransaction was closed on February 4. The Agency has no exposure at this time to default issues with leasetransactions.FUEL HEDGING:In June, in conjunction with its fuel-hedging program, the Agency realized gains of approximately$190,000 on the sale of Home Heating Oil #2 futures contracts which compares to $165,000 for the priormonth. Unrealized gains in June on the Agency’s futures positions were approximately $1.2 million,compared to $1.6 million at May 31 st . Generally, as the price of oil increases, the value of the Agency’sfutures positions also increases, and acts to partially offset the actual price paid for fuel. The opposite istrue, and if oil prices drop the value of Agency’s future’s positions decreases. An increase in unrealizedgains would generally indicate that the price of fuel is rising, and losses would indicate fuel prices arefalling.Prepared by Treasury Services, August 15, 20111

THE BI-STATE DEVELOPMENT AGENCYMONTHLY TREASURER'S REPORTBANK / ISSUER SUMMARYas of 6/30/11Summary Page 1/2BANK /ISSUER:CREDIT Bi-State Directed CERTIFICATES REPURCHASE GOVERNMENT COMMERCIAL MARKETRATING all non debt/lease assets, inc. Prop M: CASH <strong>OF</strong> DEPOSIT AGREEMENTS OTHER SECURITIES PAPER\ BA's TOTAL VALUE NOTESC#, A+, AAA^ BANK <strong>OF</strong> AMERICA (BOA) 4,039,994 0 15,000,000 2,757,318 0 0 21,797,312 21,797,312 FDIC\tri-party collateral(deposits).AAA ^ BLACK ROCK (BOA\PNC\BARCLAYS) 0 0 0 3,988,854 0 0 3,988,854 3,988,854 Money Market Fund (Govt. Securities).AAA ^ MERRILL LYNCH (BOA) 0 0 0 4,143,794 0 0 4,143,794 4,143,794 Money Market Fund (First Tier ).CENTRAL BANK KC.(FRM.GATEWAY) 0 100,000 0 0 0 0 100,000 100,000 FDIC Insured.A+ ^* COMMERCE BANK 0 12,007,482 0 0 0 0 12,007,482 12,007,482 FDIC\FRB collateral.AAA ^ FEDERATED SECURITIES 0 0 0 774,472 0 0 774,472 774,472 Money Market Fund (Govt. Securities).1ST CLOVERLEAF(FRM PARTNERS) 0 650,000 0 0 0 0 650,000 650,000 FDIC\AAA rated surety bond.JEFFERSON BANK & TRUST 24,791 0 187,413 0 0 0 212,204 212,204 FDIC; repo coll. held at JBT.B# AAA JP MORGAN (87,655) 0 0 0 0 0 (87,655) (87,655) FDIC (bank acct.) Mon. Markt Fund (1st Tier)RBC DAIN RAUSCHER 0 0 0 5,307,229 0 0 5,307,229 5,307,229 Commodities Margin Acct. (fuel hedging)RJ O'BRIEN 0 0 0 1,045,064 0 0 1,045,064 1,045,064 Commodities Trading Acct. (fuel hedging)C#,BBB+^ REGIONS BANK 81,418 0 0 0 0 0 81,418 81,418 FDIC Insured.C#,AAA ^ UBS FINANCIAL 0 0 0 8,100,353 0 0 8,100,353 8,100,353 Money Market Fund (First Tier ).B#,A ^ UMB BANK (608,971) 0 16,670,000 0 0 0 16,061,029 16,061,029 FDIC\FRB Collateral.A/B#, AA- # U.S. BANK 22,485 0 0 674,245 0 0 696,730 696,730 FDIC\FRB Collateral.AAA ^ ILLINOIS FUNDS 0 0 0 196,004 0 0 196,004 196,004 Illinois State Treasurer Investment Pool.AAA ^ FARM CREDIT BANK 0 0 0 0 4,496,345 0 4,496,345 4,502,065 Safekept at Bank of America.AAA ^ FEDERAL HOME LOAN BANK 0 0 0 0 35,490,259 0 35,490,259 35,522,625 Safekept at Bank of America.U.S. TREASURY 0 0 0 0 27,962,052 0 27,962,052 28,002,925 Safekept by BOA or designated agent.sub-total this page 3,472,062 12,757,482 31,857,413 26,987,333 67,948,656 0 143,022,946 143,101,905Bi-State directed, inc. Prop MKEY TO CREDIT RATINGS: ABBREVIATIONS (notes):^ Standard and Poors- Moody's Ratings * Commerce no longer rated by Fitch. FDIC- Federal Deposit Insurance Corp.Senior debt of, Issuer and\or specific Money Market Fund used. FRB - Federal Reserve Bank# Fitch (formerlyThomson) BankWatch BANK rating3

THE BI-STATE DEVELOPMENT AGENCYMONTHLY TREASURER'S REPORTBANK / ISSUER SUMMARY as of 6/30/11Summary Page 2/2CREDIT BANK/ISSUER(Trustee Directed) CERTIFICATES REPURCHASE GOVERNMENT COMMER- MARKETRATING debt or lease related assets: CASH <strong>OF</strong> DEPOSIT AGREEMENTS OTHER SECURITIES CIAL PAPER TOTAL VALUE NOTESDEBT ISSUES/LOANSArch Garage Ref. Bonds 1997:UMB TRUSTB#,A ^ UMB BANK 17,699 0 0 12,423 0 0 30,122 30,122 FDIC\FRB Collateral.U.S. TREASURY 0 0 0 0 649,177 0 649,177 649,961AAA ^ FEDERATED 0 0 0 1,147,451 0 0 1,147,451 1,147,451 Money Market Fund (Treasury Securities).sub-total 17,699 0 0 1,159,874 649,177 0 1,826,750 1,827,534Cross County Bonds '02,'05.'07:A\B # BANK <strong>OF</strong> NEW YORK -MELLON TRUSTAAA ^ BLACK ROCK (BOA\MERRILL\PNC) 0 0 0 21,237,629 0 0 21,237,629 21,237,629 Money Market Fund (First Tier).AAA ^ COLUMBIA (BOA) 0 0 0 0 0 0 0 0 Money Market Fund (First Tier).AAA ^ DREYFUS 0 0 0 2,082,010 0 0 2,082,010 2,082,010 Money Market Fund (Govt.Agncy).FHLB 0 0 0 0 4,000,725 0 4,000,725 4,004,080 "SLGS" Safekept by Trustee.sub-total 0 0 0 23,319,639 4,000,725 0 27,320,364 27,323,719SUB-TOTAL TRUSTEE (BONDS&LOANS) 17,699 0 0 24,479,513 4,649,902 0 29,147,114 29,151,253SUB-TOTAL BI-STATE <strong>AND</strong> TRUSTEE 3,489,761 12,757,482 31,857,413 51,466,846 72,598,558 0 172,170,060 172,253,158LEASE FINANCINGSLRV Lease\Leaseback 1995:A- ^ AIG FINANCIAL PRODUCTS 0 0 0 0 0 0 0 0 Guaranteed Investment Contract.AAA RESOLUTION TRUST CORP. 0 0 0 0 0 0 0 0 Held by Trust Agent per agreement.sub-total 0 0 0 0 0 0 0 0LRV Lease\Leaseback 2001:A- ^ (AIG) FSA\PREMIER\AIG 0 0 0 78,280,933 0 0 78,280,933 78,280,933U.S. TREASURY 0 0 0 0 8,721,177 0 8,721,177 8,737,717sub-total 0 0 0 78,280,933 8,721,177 0 87,002,110 87,018,650sub-total leases 0 0 0 78,280,933 8,721,177 0 87,002,110 87,018,650GR<strong>AND</strong> TOTAL $3,489,761 $12,757,482 $31,857,413 $129,747,779 $81,319,735 $0 $259,172,170 $259,271,8084

INVESTMENT CATEGORY DESCRIPTIONSCASH: Demand deposit accounts. Some accounts are consolidated by bank for presentation purposes.Negative balances generally reflect check float. The Agency’s bank accounts are protected either byFederal Deposit Insurance Corporation (FDIC) insurance, or collateralized with securities pledged to theAgency and held either in a segregated customer account, tri-party account, or at the Federal Reserve.CERTIFICATES <strong>OF</strong> DEPOSIT: Non-negotiable certificates of deposit, protected by FDIC insurance,AAA rated surety or Letter of Credit, or collateralized with securities placed in joint safekeeping with theAgency at the Federal Reserve Bank.BANKER’S ACCEPTANCE (BAs): Negotiable investment instruments created by banks to financecommercial trade transactions. The Agency investment policy permits purchase of BAs only from banksrated “B” or better by Fitch Ratings (formerly Thomson BankWatch-see ratings descriptions below).REPURCHASE AGREEMENTS: An investment created by the simultaneous sale and repurchase of asecurity (usually a government security) for different settlement dates.OTHER: Interest checking, money market funds, guaranteed investment contracts (GICs) andinvestment agreements. Also includes fuel hedging related accounts. Agency policy restricts use ofmoney market funds to Triple A rated institutional funds which have over $500 million in assets.GOVERNMENT SECURITIES: Securities (bills, discount notes, strips, coupon notes and bonds),issued by the U.S. Treasury or U.S. Government Agencies. Some securities are subject to “call”(redemption before stated final maturity).COMMERCIAL PAPER: Short-term unsecured promissory note that is the obligation of the issuingentity, generally a large corporation (see ratings descriptions below).NOTE: Permitted Agency investments are specified in Board Policy 30.040. All investments areshown at cost, unless otherwise noted. Market values shown for government securities orcommercial paper are considered “subject to market” and provided for informational use only.Cost or par approximates market for other investments, and some of these may be subject topenalty for early redemption.CREDIT QUALITY RATING DEFINITIONSFitch Bank Ratings (formerly Thomson/Keefe BankWatch):A A very strong bank.B A strong bank.C An adequate bank.D A bank that has weaknesses of internal and/or external origin.E A bank with very serious problems that either requires or is likely to require support.Standard & Poor’s and Moody’s Investor Services:AAA Standard & Poor’s and Moody’s rate credit quality on an A to C scale, with A regarded as“investment grade” and C as “speculative.” The triple A rating (AAA by Standard andPoor’s or Aaa by Moody’s) indicates that the issuer or specific investment instrument isof the highest credit quality (lowest expectation of risk.) This rating is assigned onlywhen there is exceptionally strong capacity for timely payment of financial commitments.A1-P1 Commercial Paper issues rated “A-1 by Standard and Poor’s and “P-1” by Moody’s havethe greatest capacity for timely payment (least risk).A2-P2 Commercial Paper issues rated “A-2” by Standard and Poor’s and P-2 by Moody’s have asatisfactory capacity for timely payment. The Agency’s investment policy permitspurchase of A2-P2 commercial paper from issuers with a business presence in the St.Louis region.5

BI-STATE DEVELOPMENT AGENCYANNUAL INVESTMENT REPORTFOR MOST CURRENT 12 MONTHSFunds (ooo's omitted) Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11Bi-State Investments 67,294 66,978 71,473 73,262 78,434 81,202 82,885 84,971 91,915 98,124 93,797 90,719Bi-State Prop M Investments 55,862 55,873 55,798 62,530 60,703 54,330 54,671 53,824 52,143 52,099 52,623 53,025Total 123,156 122,851 127,271 135,792 139,137 135,532 137,556 138,795 144,058 150,223 146,420 143,744Projected Total 125,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000 125,000Trustee Investments 38,445 41,066 43,773 19,062 21,790 24,006 26,636 29,436 32,514 23,210 25,962 29,147Yields\Rates Information Jul-10 Aug-10 Sep-10 Oct-10 Nov-10 Dec-10 Jan-11 Feb-11 Mar-11 Apr-11 May-11 Jun-11Bi-State 0.15% 0.17% 0.18% 0.18% 0.17% 0.17% 0.17% 0.17% 0.15% 0.11% 0.10% 0.12%Prop M 0.31% 0.31% 0.28% 0.26% 0.24% 0.23% 0.24% 0.30% 0.29% 0.26% 0.34% 0.33%Average 0.22% 0.24% 0.22% 0.21% 0.20% 0.20% 0.20% 0.22% 0.19% 0.16% 0.19% 0.20%Projected Yield 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30% 0.30%Trustee 0.14% 0.15% 0.21% 0.18% 0.15% 0.15% 0.15% 0.15% 0.13% 0.10% 0.18% 0.14%3-Month T-Bills 0.16% 0.16% 0.15% 0.13% 0.14% 0.14% 0.14% 0.13% 0.10% 0.06% 0.04% 0.03%Fed Funds (target) 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25% 0.25%20-Year Municipals 4.32% 4.03% 3.87% 3.87% 4.40% 4.92% 5.28% 5.15% 4.92% 4.99% 4.59% 4.59%SIFMA (BMA) Index (month end) 0.28% 0.25% 0.27% 0.28% 0.27% 0.34% 0.29% 0.27% 0.25% 0.26% 0.18% 0.09%ANNUAL YIELDSP e r c e n t5.5%5.0%4.5%4.0%3.5%3.0%2.5%2.0%1.5%1.0%0.5%0.0%Average Projected Yield 3-Month T-Bills6

Bi-State Development AgencyMonthly Investment ReportReport of Term Investment* Purchases: June 2011`Item Investments- Bi-State: Par Amount Purchased Maturity Date Term(days) Yield Purchased From Fund1 FHLB Discount Note $2,000,000 06/28/11 12/21/11 176 0.09% UMB Bank <strong>Transit</strong> Working Capital2 FHLB Discount Note $2,000,000 06/28/11 12/21/11 176 0.09% UMB Bank Prop M County3 Commerce Bank CD $1,000,000 06/28/11 12/28/11 183 0.08% Commerce Bank <strong>Transit</strong> Working Capital4 FHLB (step-callable, .5% to 1.50% if not called) $1,500,000 06/29/11 12/15/13 900 0.50% Bank of America Prop M County5 FHLB Bond (callable) $500,000 06/28/11 12/23/13 909 0.86% UMB Bank Prop M CountyTotal $7,000,000NOTES:* Only investments with an original term of over 14 days.7

<strong>Metro</strong> Diesel Fuel Hedging Program - FY2011Diesel Fuel Budget \ Actual Comparison: Jun 2011 Year to Date Life to Datea Gallons consumed-actual 517,164 5,501,333 41,989,366b Average cost per gallon-actual $ 3.12 $ 2.67 $2.06c=(a*b) Total Diesel Fuel Cost-Actual $ 1,611,288 $ 14,661,453 $ 86,383,778d Gallons consumed- budget 450,167 5,398,824 44,730,459e Average cost per gallon- budget $ 2.59 $ 2.56 $2.00f=(d*e) Total Diesel Fuel Cost- Budget $ 1,323,998 $ 13,835,843 $ 89,608,218g=(f-c) Budget Variance (Unfavorable) $ (287,290) $ (825,610) $ 3,224,440h Realized Futures Gains (Losses) $ 190,363 $ 1,478,660 $ 3,451,438i=(c-h) Net Cost of Fuel $ 1,420,925 $ 13,182,793 $ 82,932,340j=(i-f) Net Budget Variance (Unfavorable) $ (96,927) $ 653,050 $ 6,675,878j=(i/f) Net Cost of Fuel, Per Gallon, inc. Hedge $ 2.75 $ 2.40 $1.98k=(e-i) Net Budget Variance Per Gallon $ (0.16) $ 0.16 $0.02Futures Activity:Futures Contracts Purchased 35Futures Contracts Sold 18Futures Contracts Net Change at month end 17Total Open Futures Contracts, at month end 71Futures Contracts Unrealized Gain/(Loss) * $1,236,740(% of Estimated Future Consumption) 44%* = At month endExplanatory Notes:Consumption budgeted at approximately 110,000 gallons per week.Current diesel contracts: diesel =Platts + 10.02 cents per gal.; B2 diesel= Platts + 16.07 cents per gal.A futures contract equals 42,000 gallons.Numbers above rounded.Amounts do not include transaction or consulting costs.Futures Contracts are purchased from Aug, 2011 through Oct, 2012 (15 months).Background:Linwood Capital is a consultant retained by <strong>Metro</strong> since April 2004 to assist with its energy price risk management program.<strong>Metro</strong> manages the cost of fuel by utilizing purchase of exchange traded futures, specifically NYMEX Heating Oil#2 (HO#2) futures.Generally, as oil prices increase, the value of the futures goes up, and acts to partially offset the actual increase in the price of fuel.8

Bi‐State Development AgencyProjected <strong>Transit</strong> System Cash Flow (draft, discussion only)(dollars in thousands)Actuals Actuals Actuals Actuals Actuals Actuals Actuals Actuals Actuals Actuals Actuals Actuals ActualsNote‐ Figures are estimates and subject Fiscal Yr JUL AUG SEPT OCT NOV DEC JAN FEB MAR APR MAY JUNE Fiscal Yr JULY AUG SEPT OCT NOV DEC FY'12to change. 2010 2010 2010 2010 2010 2010 2010 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 2011 Six monthsBEGINNING CASH BAL. OPER.&REV. FUNDS $7,836 $15,000 $5,800 $3,201 $7,800 $5,500 $14,500 $16,300 $17,900 $19,500 $25,200 $32,034 $27,391 $15,000 $23,701 $14,817 $5,186 $27,268 $29,928 $32,994 $23,701CASH RECEIPTS:1/2 Cent Sales Tax ‐ St Louis County 34,732 0 5,156 3,960 2,929 1,998 3,016 2,919 3,506 2,214 3,731 2,595 3,353 35,377 0 0 6,925 3,198 3,734 3,758 17,6151/2 Cent Sales Tax ‐ St Louis City 16,685 1,799 769 1,848 1,620 852 1,642 1,308 1,146 1,042 2,157 1,064 1,527 16,774 0 0 3,450 1,599 1,371 1,971 8,3911/4 Cent Sales Tax ‐ City & Cnty Prop M1 42,615 4,661 2,562 4,798 3,934 2,537 2,550 3,720 4,221 2,809 5,181 3,317 5,300 45,590 3,994 2,130 4,500 4,221 4,492 2,952 22,290NEW Sales Tax ‐ Cnty & City (Prop A,M2) 0 0 0 758 836 16,376 6,736 6,593 7,789 4,654 1,078 553 891 46,264 0 0 19,000 5,234 5,571 3,660 33,466Debt Service Intercept (X‐County Bonds) (31,089) (2,684) (2,562) (2,829) (2,970) (2,975) (2,978) (2,900) (2,887) (2,887) (2,880) (2,880) (2,876) (34,308) (2,950) (2,950) (2,950) (2,950) (2,950) (2,950) (17,700)Sub‐total Sales Tax receipts less debt $62,943 $3,776 $5,925 $8,535 $6,349 $18,788 $10,966 $11,640 $13,775 $7,832 $9,267 $4,649 $8,195 $109,697 $1,044 ($820) $30,925 $11,303 $12,218 $9,391 $64,061Passenger Revenue, inc. Paratransit 53,470 4,259 5,156 4,412 4,453 4,318 3,865 4,862 3,489 6,189 4,400 4,292 4,660 54,355 4,300 5,200 4,500 4,500 4,400 4,750 27,650Auxiliary /Other / Interest 6,470 565 222 344 85 139 775 122 1,100 522 35 335 58 4,302 120 120 120 220 378 333 1,291St. Clair County ‐ Contract 35,832 562 0 7,044 3,888 3,412 3,860 3,487 3,109 3,311 3,500 3,322 1,797 37,292 3,000 3,000 3,000 3,000 3,000 3,500 18,500State of Missouri 1,025 0 22 79 80 61 0 80 39 430 80 151 0 1,022 50 50 50 50 50 50 300State of Missouri‐Special Assistance 7,975 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0Federal Assistance: 0Maintenance 30,000 0 0 0 0 0 0 0 0 0 14,419 0 0 14,419 0 0 0 0 0 0 0CMAQ\JARC\ARRA\Other grants 17,285 1,860 5,738 1,786 1,182 3,412 1,961 2,127 2,015 4,282 799 3,913 1,492 30,566 1,250 1,250 1,250 1,250 1,250 1,250 7,500TOTAL CASH RECEIPTS $215,000 $11,022 $17,063 $22,200 $16,037 $30,130 $21,427 $22,318 $23,527 $22,566 $32,500 $16,662 $16,202 $251,654 $9,764 $8,800 $39,845 $20,323 $21,296 $19,274 $119,302CASH DISBURSEMENTS:Payroll & Payroll Related (not inc. OPEB) (84,833) (8,395) (8,865) (7,737) (7,700) (7,900) (7,911) (8,874) (8,886) (8,009) (9,760) (7,677) (6,997) (98,711) (8,395) (8,865) (7,737) (7,700) (7,900) (7,911) (48,508)Accounts Payable (94,092) (9,574) (9,231) (7,837) (8,675) (10,900) (9,021) (9,700) (10,718) (6,172) (12,663) (11,643) (7,708) (113,842) (8,000) (8,000) (8,000) (8,000) (8,000) (8,000) (48,000)Self‐Insurance (20,818) (2,088) (1,502) (1,555) (1,812) (1,605) (1,895) (1,644) (1,823) (2,202) (2,036) (1,501) (1,750) (21,413) (2,088) (1,502) (1,555) (1,812) (1,605) (1,895) (10,457)Other (June inc. $3.0 mm OPEB) (8,093) (165) (64) (471) (150) (725) (800) (500) (500) (483) (1,208) (484) (3,438) (8,988) (165) (64) (471) (150) (725) (800) (2,375)TOTAL CASH DISBURSEMENTS ($207,836) ($20,222) ($19,662) ($17,600) ($18,337) ($21,130) ($19,627) ($20,718) ($21,927) ($16,866) ($25,667) ($21,305) ($19,893) ($242,954) ($18,648) ($18,431) ($17,763) ($17,662) ($18,230) ($18,606) ($109,340)CASH SURPLUS (DEFICIT) $7,164 ($9,200) ($2,599) $4,600 ($2,300) $9,000 $1,800 $1,600 $1,600 $5,700 $6,833 ($4,643) ($3,691) $8,700 ($8,884) ($9,631) $22,082 $2,661 $3,066 $668 $9,962CUMULATIVE CASH SURPLUS (DEFICIT) $15,000 $5,800 $3,201 $7,800 $5,500 $14,500 $16,300 $17,900 $19,500 $25,200 $32,034 $27,391 $23,700 $23,701 $14,817 $5,186 $27,268 $29,928 $32,994 $33,663 $33,663STABILIZATION FUND:Beginning Balance 3,500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 500 0Fund Transfer ‐ OPEB Trust (3,000) 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0Ending Balance $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $500 $0INTERNALLY RESTRICTED FUND:Beginning Balance 14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $ 14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $ 14,659Cumulative 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0 0Ending Balance (1) $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659 $14,659(1) = Additional temporary working capital for operations is provided, if needed, by Sales Tax Capital, Self‐Insurance and Prop M Funds. Current balances: Sales Tax Capital $15 million; Prop M $61 million; Self Insurance $15 million.A large portion of these funds are encumbered for long range capital projects, local match, liability claims, or restricted for debt service or lease issues, but are currently liquid.98/17/2011 C:\Documents and Settings\bwalker\Desktop\Treasury\pg 9 june treas fy11-12 cash flow proj

From:Subject:Disposition:Presentation:<strong>Metro</strong> Agenda ItemBoard of CommissionersSeptember 23, 2011John M. NationsPresident & CEOContract Modification: The Hartford Life Insurance CompanyApprovalMelva Pete, Vice President – Human Resources; Larry B. Jackson, VicePresident – Procurement, Inventory Management & Supplier DiversityObjective:To obtain approval of the Board of Commissioners to increase the three-year not-to-exceedcontract award amount to The Hartford Life Insurance Company for <strong>Metro</strong>’s fully-funded lifeinsurance for active and retired employees from $1,000,000 to $1,700,000.Background:Aon (now Aon Hewitt) issued Solicitation No. 10-RFP-5554-DR Life and Disability InsuranceServices on July 9, 2009, to obtain a qualified firm to provide basic and voluntary life, accidentaldeath and dismemberment (AD&D) and long term disability (LTD) insurance for <strong>Metro</strong>’semployees and retirees.AON Hewitt, <strong>Metro</strong>’s provider of benefit plan consulting services, conducted a marketing searchfor the current basic and voluntary life, AD&D and LTD programs. A detailed Request forProposal (RFP) was prepared and released by AON to 23 vendors who were approved inadvance by <strong>Metro</strong>. Seventeen (17) proposals were received. A summary of the vendorscontacted and their responses is available to interested parties.Analysis:The contract with Hartford, effective October 1, 2009, initially included Basic Life (active andretired), AD&D (salaried and IBEW employees), and LTD (salaried employees only). Thesupplemental life was added later and includes employee supplemental for Salaried and Call-A-Ride. Dependent life for Salaried only was added as of open enrollment for calendar year 2011.Both employee supplemental and dependent life elections are funded 100% by employee payrolldeductions, but are reflected in <strong>Metro</strong>’s contract costs. Average monthly expenditure for thoseitems is $5,400.00.The initial contract value was established using a census count of 2,470 participants; however,average enrollment in the plan has exceeded 3,000 participants since inception of the contract.This discrepancy combined with the addition of employee funded elections has created ashortfall in the amount authorized. The solicitation/bid categories, dollars and quantity ofemployees are compared with what is current for these areas:

Contract Modification: The Hartford Life Insurance CompanyBoard of CommissionersSeptember 23, 2011Page 2CategoryQty. ofParticipants per BidAnalysisAverageCost PerEmployeeQty. ofParticipantsCurrentAverageAverageCurrent AnnualAmountBasic Life 2,389 $140.34 3037 $426,212.58AD & D 524 $21.13 551 $11,642.63LTD 425 $134.34 444 $59,646.96Supplemental - N/A 176 $58,344.00Employee PaidDependent Life – N/A 73 $6,780.00Employee PaidAnnual Total $562,626.17Three (3) Year Total $1,687,878.51Procurement Policy:Board Procurement Policy requires Board approval of Negotiated Procurements exceeding$500,000. On September 25, 2009, Board of Commissioners’ approval was requested andreceived to award a three (3) year contract to the Hartford Life Insurance Company for <strong>Metro</strong>’sfully-funded life insurance for active and retired employees, effective October 1, 2009, in anamount not to exceed $1,000,000. However, based on current information, it is now estimatedthat the contract not-to-exceed amount should be increased to $1.7 million.Management Recommendation:Recommend the President & CEO be authorized to increase the original three-year contract notto-exceedamount from $1,000,000 to $1,700,000.

Resolution459Hartford Life ContractA RESOLUTION <strong>OF</strong> THE BOARD <strong>OF</strong> COMMISSIONERS <strong>OF</strong> THEBI-STATE DEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICT AUTHORIZINGMODIFICATION <strong>OF</strong> CONTRACT WITH THE HARTFORD LIFEINSURANCE COMPANYPREAMBLES:The Bi-State Development Agency of the Missouri-Illinois <strong>Metro</strong>politan District (the “Agency”) is a bodycorporate and politic, created by an interstate compact between the States of Missouri and Illinois, actingby and through its Board of Commissioners (the “Board”); and is authorized by interstate compact andunder Mo. Rev. Stat. §§ 70.370 et. seq. and 45 Ill. Comp. Stat. 100/1 et. seq. to contract and be contractedwith.Chapter 50 of the Collected Board Policies Section requires the Board to approve any competitivelynegotiated procurement exceeding $500,000.00.On September 25, 2009 the Board approved a three (3) year contract with The Hartford Life InsuranceCompany for <strong>Metro</strong>’s fully-funded life insurance plan for active and retired employees.The initial contract value of $1 million dollars ($1,000,000.00) was established based on a census count of2,470 participating employees, but the average enrollment in the plan now exceeds 3,000 employees.This growth in plan enrollees, plus the addition of employee funded electives, has created a shortfall in thecontract amount authorized by the Board in 2009.Based on current information, Agency staff estimates that the value of the 3-year contract should beincreased to $1.7 million dollars ($1,700,000.00).It is feasible, necessary and in the public interest for the Board to authorize the President & CEO toincrease the contract award amount to The Hartford Life Insurance Company from $1,000.000.00 to$1,700,000.00.NOW, THEREFORE, THE BOARD <strong>OF</strong> COMMISSIONERS <strong>OF</strong> THE BI-STATE DEVELOPMENTAGENCY <strong>OF</strong> THE MISSOURI-ILLINOIS METROPOLITAN DISTRICT DOES HEREBY RESOLVE,DETERMINE <strong>AND</strong> ORDER AS FOLLOWS:Section 1. Findings. The Board of Commissioners hereby finds and determines those matters setforth in the preambles as fully and completely as if set out in full in this Section.Section 2. Approval of a Amended Procurement Contract. The Board of Commissioners herebyauthorizes the Agency to amend the 3-year contract with The Hartford Life Insurance Company to increase theaward amount from $1,000,000.00 to an amount not to exceed $1,700.000.00.Section 3. Actions of Officers Authorized. The officers of the Agency, including, withoutlimitation, the President and CEO, the Vice President of Procurement, Inventory Management and SupplierDiversity, and the Vice President of Human Resources are hereby authorized and directed to execute all documents,pay or cause to be paid all costs, expenses and fees incurred, and take such actions as they may deem necessary oradvisable in order to carry out and perform the purposes of this Resolution, the execution of which shall beconclusive evidence of such necessity or advisability.Section 4. Severability. It is hereby declared to be the intention of the Board of Commissioners thateach and every part, section and subsection of this Resolution shall be separate and severable from each and everyother part, section and subsection hereof and that the Board of Commissioners intends to adopt each said part,section and subsection separately and independently of any other part, section and subsection. In the event that any

part, section or subsection of this Resolution shall be determined to be or to have been unlawful or unconstitutional,the remaining parts, sections and subsections shall be and remain in full force and effect, unless the court makingsuch finding shall determine that the valid portions standing alone are incomplete and are incapable of beingexecuted in accordance with the intent of this Resolution.Section 5. Rights Under Resolution Limited. No rights shall be conferred by this Resolution uponany person or entity other than the Agency and The Hartford Life Insurance Company.Section 6.Governing Law. The laws of the State of Missouri shall govern this Resolution.Section 7. No Personal Liability. No member of the Board of Commissioners, officer, employee oragent of the Agency shall have any personal liability for acts taken in accordance with this Resolution.Section 8.This Resolution shall be in full force and effect from and after its passage and approval.September, 2011.ADOPTED by the Board of Commissioners of the Bi-State Development Agency this 23rd day ofTHE BI-STATE DEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICTByIts[SEAL]ATTEST:ByResolution459Hartford Life Contract

From:Subject:Disposition:Presentation:<strong>Metro</strong> Agenda ItemBoard of CommissionersSeptember 23, 2011John NationsPresident & CEOContract Award: Express Scripts, Inc.ApprovalMelva Pete, Vice President – Human Resources; Larry B. Jackson, VicePresident – Procurement, Inventory Management & Supplier DiversityObjectiveTo obtain approval of the Board of Commissioners to award a contract to Express Scripts, Inc.,for Pharmacy Benefits Management services for <strong>Metro</strong>’s self-funded prescription drug benefitplan for employees and retirees for the period of December 1, 2011 through November 30, 2014.Background<strong>Metro</strong> provides three self-funded medical plans for its employees and retirees. Each of these hasthe same Prescription Drug Benefit. In Plan Year 2010, ending December 31, 2010, <strong>Metro</strong>’spaid claims for Pharmacy benefits were approximately $4.8 million, 31.5% of the totalexpenditures for health plan benefits. Prescription drug costs have been escalating faster thanmedical costs in general; and medical costs have been escalating significantly faster than theconsumer price index and wage inflation.<strong>Metro</strong> joined The St. Louis Area Business Health Coalition (BHC) and engaged Express Scripts,Inc. as our Pharmacy Benefit Manager (PBM) on December 1, 2007, under the terms of the BHCcontract for a period of three years. The BHC was founded over 25 years ago to bring areaemployers together to use their combined purchasing power to ensure transparency,accountability, and the best in class pricing.The BHC engaged Aon/Hewitt in November 2010 to conduct a request for proposal (RFP)process including designing all bidding requirements. The RFP was released to eight vendors onJanuary 27, 2011. Results were presented in March 2011, and through extensive review andnegotiations between two finalists, the BHC will be entering into a new contract with ExpressScripts effective October 1, 2011. Express Scripts was found to offer the most competitivepricing and cost management capabilities, while still maintaining flexibility for employers tocraft their own plan of benefits. Express Scripts Inc. is headquartered in St. Louis, and throughthis new contract, will provide services to participating area employers which include the City ofSt. Louis, Ameren, Laclede Gas, Doe Run, Brown Shoe, Energizer, Graybar, and others. Eachcompany maintains complete control over its benefit designs and clinical programs. TheBHC/Express Scripts contract includes a provision for annual market checks to ensure pricingcompetitiveness.

Board of CommissionersContract Award: Express Scripts, Inc.September 23, 2011Page 2Under the new agreement, <strong>Metro</strong> anticipates a 4.93% savings in plan costs (approximately$246,000 in the first year) representing negotiated improvements in discounts and a reduction inprocessing fees, which will help mitigate prescription drug trend and cost inflation in 2012 andbeyond.Procurement PolicyBoard Procurement Policy requires Board approval of negotiated procurements exceeding$500,000.Management RecommendationThe Board of Commissioners is requested to approve a three-year contract renewal (December 1,2011 to November 30, 2014) in an amount not to exceed $16,600,000 to Express Scripts, Inc.for the cost of both prescription drugs and administration of a prescription drug benefit programfor <strong>Metro</strong> employees, retirees, and eligible dependents.

A RESOLUTION <strong>OF</strong> THE BOARD <strong>OF</strong> COMMISSIONERS <strong>OF</strong> THE BI-STATE DEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICT AUTHORIZINGAWARD <strong>OF</strong> CONTRACT TO EXPRESS SCRIPTS, INC.PREAMBLES:The Bi-State Development Agency of the Missouri-Illinois <strong>Metro</strong>politan District (the “Agency”) is a bodycorporate and politic, created by an interstate compact between the States of Missouri and Illinois, actingby and through its Board of Commissioners (the “Board”); and is authorized by interstate compact andunder Mo. Rev. Stat. §§ 70.370 et. seq. and 45 Ill. Comp. Stat. 100/1 et. seq. to contract and be contractedwith.Under Board Policy Section 50.010-E 1(a), the Board must approve any competitively negotiatedprocurement exceeding $500,000.00.The Agency currently provides three self-funded medical plans for its active and retired employees. Eachof the plans has the same prescription drug benefit.On December 1, 2007 the Agency entered into a 3-year contract with Express Scripts to act as its PharmacyBenefit Manager (PBM).The St. Louis Area Business Health Coalition (BHC) is a regional consortium of employers of which theAgency is a member. The purpose of BHC is to use its combined purchasing to obtain the best possiblepricing for its members.In January 2011 the BHC released a request for proposals (RFP) from vendors for pharmacy benefitsmanagement services, after which it entered into an agreement with Express Scripts on behalf of the BHCmembership. The new contract will become effective October 1, 2011.By utilizing the agreement between BHC and Express Scripts and renewing its contract with ExpressScripts to administer <strong>Metro</strong>’s prescription drug benefit plan, the Agency anticipates that it will be able toreduce its projected prescription drug costs by 4.93%.It is feasible, necessary and in the public interest for the Agency to renew its contract with Express ScriptsInc. for a period of 3 years for the provision of prescription drugs and the administration of <strong>Metro</strong>’sprescription drug benefit plan.NOW, THEREFORE, THE BOARD <strong>OF</strong> COMMISSIONERS <strong>OF</strong> THE BI-STATE DEVELOPMENTAGENCY <strong>OF</strong> THE MISSOURI-ILLINOIS METROPOLITAN DISTRICT DOES HEREBY RESOLVE,DETERMINE <strong>AND</strong> ORDER AS FOLLOWS:Section 1. Findings. The Board of Commissioners hereby finds and determines those matters setforth in the preambles as fully and completely as if set out in full in this Section.Section 2. Approval of a Negotiated Procurement Contract. The Board of Commissioners herebyauthorizes the Agency to renew its contract with Express Scripts, Inc. for a period of three (3) years (December 1,2011 – November 30, 2014) for the provision of prescription drugs and the administration of <strong>Metro</strong>’s prescriptiondrug benefit plan.Section 3. Actions of Officers Authorized. The officers of the Agency, including, withoutlimitation, the President and CEO, the Vice President of Procurement, Inventory Management and SupplierDiversity and the Vice President of Human Resources are hereby authorized and directed to execute all documents,Resolution460Express Scripts Contract

pay or cause to be paid all costs, expenses and fees incurred, and take such actions as they may deem necessary oradvisable in order to carry out and perform the purposes of this Resolution, the execution of which shall beconclusive evidence of such necessity or advisability.Section 4. Severability. It is hereby declared to be the intention of the Board of Commissioners thateach and every part, section and subsection of this Resolution shall be separate and severable from each and everyother part, section and subsection hereof and that the Board of Commissioners intends to adopt each said part,section and subsection separately and independently of any other part, section and subsection. In the event that anypart, section or subsection of this Resolution shall be determined to be or to have been unlawful or unconstitutional,the remaining parts, sections and subsections shall be and remain in full force and effect, unless the court makingsuch finding shall determine that the valid portions standing alone are incomplete and are incapable of beingexecuted in accordance with the intent of this Resolution.Section 5. Rights Under Resolution Limited. No rights shall be conferred by this Resolution uponany person or entity other than the Agency and Express Scripts, Inc.Section 6.Governing Law. The laws of the State of Missouri shall govern this Resolution.Section 7. No Personal Liability. No member of the Board of Commissioners, officer, employee oragent of the Agency shall have any personal liability for acts taken in accordance with this Resolution.Section 8.This Resolution shall be in full force and effect from and after its passage and approval.September, 2011.ADOPTED by the Board of Commissioners of the Bi-State Development Agency this 23rd day ofTHE BI-STATE DEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICTByIts[SEAL]ATTEST:ByResolution460Express Scripts Contract

From:Subject:<strong>Metro</strong> Agenda ItemBoard of CommissionersSeptember 23, 2011John Nations, President & CEOSole Source Contract Award – Trapeze ITS, U.S.A., LLC for Fleet-wideCAD/AVL ExpansionDisposition: ApprovalPresentation: Raymond A. Friem, Chief Operating Officer – <strong>Transit</strong>; Larry Jackson, VicePresident – Procurement, Inventory Management & Supplier DiversityObjective: To obtain the Board of Commissioners approval to enter into sole source contractsfor upgrade and expansion of the Intelligent Transportation System (ITS) with Trapeze ITS,U.S.A., LLC.Background: <strong>Metro</strong>, in cooperation with the Missouri Department of Transportation (MODOT)and the East-West Gateway Council of Governments (EWGCG), conducted a competitiveprocurement in 2003 for a demonstration project aimed at determining the efficacy of ComputerAided Dispatch/Automated Vehicle Location (CAD/AVL) Systems in <strong>Metro</strong>’s <strong>Transit</strong>application. It was determined the technology has the potential to radically alter the operatingprocesses currently employed at <strong>Metro</strong>, as well as several key public information and safetyfeatures deemed highly desirable by <strong>Metro</strong> staff.<strong>Metro</strong> has since continued to work with the manufacturer to refine the product to meet <strong>Metro</strong>’sspecific requirements and has made several additional purchases of CAD/AVL software andequipment. To date <strong>Metro</strong>’s direct investment in equipment and technology associated with theCAD/AVL system is approximately $3.5 million including a $1.1 million network and softwareupgrade that was recently approved by the Board of Commissioners in March 2011.The major benefits that <strong>Metro</strong> expects to recognize from a complete implementation ofCAD/AVL are:‣ Near real-time vehicle location and status updates allowing better control of <strong>Metro</strong>’sfixed route assets;‣ Complete control of communication traffic, both voice and data;‣ Provide clear and concise announcements internally and externally for customers,increasing our ADA compliance;‣ Provide historical information regarding the efficiency of current route structures andstop timing, allowing for improved route planning and scheduling;‣ Provide passenger count information for use with planning future route optimization; and‣ Provide real-time and historical mechanical problem reports, reducing the number ofcustomer delays.Analysis: <strong>Metro</strong>’s existing CAD/AVL system is a transit specific proprietary system initiallydeveloped and marketed by Siemens. Siemens subsequently sold its ITS business venture toContinental AG who subsequently sold to Trapeze ITS, U.S.A., LLC. Trapeze ITS is the onlyavailable source for equipment and software for this system.

Board of CommissionersSole Source Contract Award – Trapeze ITS U.S.A., LLC for Fleet-wide CAD/AVL ExpansionSeptember 23, 2011Page 2As <strong>Metro</strong> proceeds with procurement and build-out of its radio system upgrade, we willconcurrently add additional equipment to complete integration and build-out of the CAD/AVLsystem. <strong>Metro</strong> expects to be able to complete the build-out of the CAD/AVL system over thenext 36 months for a cost not to exceed $ 8,700,000.Funding Source: Funding for this project has been approved in the <strong>Metro</strong> Capital Budget.Funding is provided by FTA Grants MO-05-0028 & MO-90-X231(80%) and local fundingcomprised of Illinois and Missouri sales tax receipts (20%).Procurement Policy: Board Policy Chapter 50 – Purchasing requires Board approval of all noncompetitiveprocurements exceeding $100,000.Operations Committee Recommendation: The Operations Committee approved this SoleSource Procurement, and recommends the Board of Commissioners also approve this request.Management Recommendation: It is recommended that the Board of Commissioners approvethe sole source procurement with Trapeze ITS U.S.A., LLC for the infrastructure upgrade andexpansion in support of full bus and LRV fleet expansion of the CAD/AVL System in theamount not to exceed $8,700,000.

A RESOLUTION <strong>OF</strong> THE BOARD <strong>OF</strong> COMMISSIONERS <strong>OF</strong> THE BI-STATEDEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICT AUTHORIZING <strong>AND</strong>APPROVING A SOLE SOURCE PROCUREMENT FROMTRAPEZE ITS, U.S.A., LLCPREAMBLESBi-State Development Agency of the Missouri-Illinois <strong>Metro</strong>politan District (the “Agency”) is a bodycorporate and politic, created by an interstate compact between the States of Missouri and Illinois, actingby and through its Board of Commissioners (the “Board”); andThe Agency is authorized by Mo. Rev. Stat. §§ 70.370 et seq. and 45 Ill. Comp. Stat. 100/1 et seq. (jointlyreferred to herein as the “Compact”) to plan, construct, maintain, own and operate passenger transportationfacilities, and perform all other necessary and incidental functions, and to disburse funds for its lawfulactivities, and to contract and be contracted with.Pursuant to Board Policy §50.010 E-1-b, the Board must approve the award of any non-competitivecontract with a value of $100,000 or more.In 2003 the Agency, in cooperation with MDOT and EWGCC, conducted a competitive procurement for aproject aimed at determining the efficacy of the application of a Computer Aided Dispatch/AutomatedVehicle Location (“CAD/AVL”) System for <strong>Metro</strong>.Since that time the Agency has continued to refine its needs and has made purchases of CAD/AVLsoftware and equipment, including a $1million network and software upgrade that was approved by theBoard in March, 2011.<strong>Metro</strong>’s existing CAD/AVL system is a transit specific, proprietary system that was originally developedby Siemens. The Siemens ITS business has been acquired by Trapeze ITS, U.S.A., LLC, and thereforeTrapeze is the only available source of system-compatible equipment and software.As the Agency proceeds with the upgrade of its radio system, it will require additional equipment tocomplete integration and build-out of its CAD/AVL system. This will take approximately 36 months andwill be accomplished at a cost not to exceed $8,700,000.00.Funding for this project is contained in the <strong>Metro</strong> Capital Budget. 80% of the funding will be providedthrough FTA grants, with 20% to be provided through local (Missouri and Illinois) sales tax receipts.It is feasible, necessary and in the public interest for <strong>Metro</strong> to proceed with its infrastructure upgrade of theCAD/AVL system in conjunction with the build-out of its radio system upgrade, and to purchase thenecessary additional equipment from Trapeze ITS U.S.A, LLC, the sole source provider, in an amount notto exceed $8,700.000.00.NOW, THEREFORE, THE BOARD <strong>OF</strong> COMMISSIONERS DOES HEREBY RESOLVE,DETERMINE <strong>AND</strong> ORDER AS FOLLOWS:Section 1. Findings. The Board hereby finds and determines those matters set forth in thepreambles as fully and completely as if set out in fully in this Section.Section 2. Approval of the Sole Source Contract. The Board hereby authorizes the officers of theAgency, including, without limitation, the President and CEO, the Chief Operating Officer, and the Vice Presidentof Procurement, Management & Supplier Diversity to purchase the equipment required to upgrade <strong>Metro</strong>’sResolution461Trapeze ITS USASole Source Contract

CAD/AVL system from Trapeze ITS U.S.A, LLC, a sole source provider,$8,700,000.00 over the next 36 months.in an amount not to exceedSection 3. Actions of Officers Authorized. The officers of the Agency are hereby authorized anddirected to execute all documents and take such actions as they may deem necessary or advisable in order to carryout and perform the purposes of this Resolution, including the payment of all costs, expenses and fees incurred inconnection with or incidental to this Resolution; and the execution of such documents or taking of such actions shallbe conclusive evidence of such necessity or advisability.Section 4. Severability. It is the Board’s intention that every part, section and subsection of thisResolution shall be separate and severable from every other part, section and subsection hereof, and each said part,section and subsection is adopted separately and independently. In the event that any part, section or subsectionshall be determined to be, or to have been, unlawful or unconstitutional, the remaining parts, sections andsubsections shall remain in full force and effect, unless the court making such finding shall determine that the validportions standing alone are incomplete and are incapable of being executed in accordance with the intent of thisResolution.[Section 5. Rights Under Resolution Limited. No rights shall be conferred by this Resolution uponany person or entity other than the Agency and Trapeze ITS U.S.A, LLC.Section 6.Governing Law. The laws of the State of Missouri shall govern this Resolution.Section 7. No Personal Liability. No member of the Board of Commissioners, officer, employee oragent of the Agency shall have any personal liability for acts taken in accordance with this Resolution.Section 8.This Resolution shall be in full force and effect from and after its passage and approval.September, 2011.ADOPTED by the Board of Commissioners of the Bi-State Development Agency this 23rd day ofTHE BI-STATE DEVELOPMENT AGENCY <strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICTSEALByTitleATTEST:By, SecretaryResolution461Trapeze ITS USASole Source Contract

<strong>Metro</strong> Agenda ItemBoard of CommissionersSeptember 23, 2011From: John M. NationsPresident & CEOSubject: Revision to Board Bylaws, Article IV, Section 10.020, Committees of the Board;Section 10.040, Standing Committees; and Board Policy Chapter 30, Section30.005, Audit Committee CharterDisposition: Consider / TablePresentation: John M. Nations, President & CEO, and Dee Joyce-Hayes, General CounselObjective:To obtain Board of Commissioners’ approval, at the November 18, 2011 meeting, ofamendments to Board Bylaws and to Board Policies, revising the Board’s standing committeestructure and the responsibilities assigned to each standing committee (see attached redlinedamendment). <strong>Metro</strong> Bylaws require that the Board consider and table any proposed policyrevision for one month, unless otherwise designated by the Chairman. The proposed policyrevisions will be submitted for final approval at the November 18, 2011 Board meeting.Background:Article IV of the Board’s Bylaws establishes the standing committees of the Board, provides forthe appointment of committee members by the Board Chairperson, and establishes the terms ofservice of committee members. Section 10.040 of the Bylaws reiterates the standing committeesand enumerates the purpose and responsibilities of each committee.The Board has agreed to establish new standing committees and to realign the committees’responsibilities. These changes, however, have not yet been formalized in the Board’s governingdocuments – its Bylaws and Policies. In order to implement the new committee structure, therequisite changes to the Board’s Bylaws and Policies should be made.The amendment to Chapter 30, Section 30.005 of the Board Policies, is being made simply torevise the name of the committee.Management Recommendation:Management recommends that the proposed revisions, as attached, be considered and tabled.The proposed revisions to the Bylaws and Policies will be submitted for final review andapproval at the November 18, 2011 Board meeting.

SECTION 10.020 BOARD BYLAWS (revised 9/23/11)ARTICLE IV – COMMITTEES <strong>OF</strong> THE BOARDB. Other Committees. Unless otherwise provided by Board Policy, applicable law,or agreements providing the establishment of committees, the Board Chairman shall,subject to such conditions as may be prescribed by the Board, appoint BoardCommissioners to serve as members of standing committees of the Board. All standingcommittee members shall be appointed for a term of two years beginning in June ofalternate years, or until their successors are appointed. Unless otherwise provided byBoard Policy, or applicable law or agreement, the Board Chairman shall designate oneCommissioner to serve as the chairman of each committee.In appointing both committee members and committee chairmen, the Board Chairmanshall ensure that both Missouri and Illinois Commissioners who reside in both Missouriand Illinois are fairly represented. Each committee shall be comprised of three or moreCommissioners, and shall be supported by Agency staff members whose positions in theAgency are appropriate to the purposes and responsibilities of that committee. Should aCommissioner vacate a committee position for any reason during his/her appointed term,or should the Board create a new committee, the Board Chairman shall appoint anotherCommissioner or Commissioners to fill such vacancy, or new committee positions, assoon as practicable.Standing committees shall include a Nominating Committee, an Audit and FinanceCommittee, a Pension, Health and WelfareFinance & Administration Committee, anOperations Planning Committee, an Sales and Marketing Operations Committee, aGovernment Affairs and Communications Committee, and a Strategic PlanningBusinessServices & Economic Development Committee. In addition, the Board may, by motionor resolution, appoint other standing or temporary committees as it deems necessary andassign them such duties and powers as may be required to fulfill their purpose.ARTICLE V – <strong>MEETING</strong>S <strong>OF</strong> THE BOARDA. Regular Board Meetings. The regular meetings of the Board shall be heldaccording to a schedule proposed by the Board Chairman and approved by the Board.The time of the meetings shall be 9:00 A.M. unless stated otherwise in the meetingnotice.B. Committee Meetings. Committees shall meet as determined by the committeechairman or by the Board for the conduct of its business. Committees may recommendmatters for action to the full Board, but such a recommendation is not required for the1

Board to act on a matter. A quorum of committee members is not required for acommittee to meet or to make recommendations to the Board. Two or more Boardcommittees may meet jointly when it is expedient to mutually discuss and recommendaction on a particular matter. Unless otherwise prohibited by Board Policy, or applicablelaw or agreement, any Board member may attend any committee meeting and may voteon matters presented for that committee’s consideration regardless of whether he/she is amember of that committee.Each committee will be assisted by Agency employees designated by the President/CEOfor the purpose of providing staff support to that committee. Pursuant to the statutoryrequirements governing public meetings, each committee shall provide advance publicnotice of the date, time and place of its upcoming meeting, and shall keep minutes of allof its proceedings. Minutes are to include the date, time and place of the meeting, themembers present and absent, matters discussed by the committee, and the votes attributedto each member of the committee who is eligible to vote. All minutes shall be kept in theAgency’s offices of the Agency, and the proceedings of each committee meeting shall bereported to the full Board at the Board’s next regularly-scheduled or special meeting.SECTION 10.040 Standing Committees (revised 9/23/11)A. Executive Committee. The Executive Committee shall be composed of theofficers of the Board, and shall perform its functions pursuant to the provisions of theBoard Bylaws.B. Committee Formation and Appointment of Members. The committees of theBoard shall consist of those established pursuant to the Board Bylaws., and theappointment of members to the committees is governed by the provisions of the Bylaws.In addition to the regular assigned committee staff, a committeeC. Standing Committees.1. NOMINATING COMMITTEE. The purpose of this Committee is to recommend aslate of officers to serve for the following year, which slate shall be presented to theBoard for approval in June of each year. The Chairman of the Board shall appoint themembers of the Nominating Committee, which shall be comprised of two MissouriCommissioners and two Illinois Commissioners.2

2. AUDIT <strong>AND</strong> FINANCE COMMITTEE. The purpose of this Committee is to assist theBoard in the oversight of the Agency’s financial management and operations,including the development of its capital and operating budgets, its cash managementpolicies and procedures, the integrity of its financial statements, the appointment andperformance of its internal and external auditors, and itsand its compliance with alllegal and regulatory requirements,. and its policies and procedure for investments andthe issuance of debt. It shall have the authority, to the extent it deems necessary, toconduct investigations and to retain independent consultants in connection with itsresponsibilities.Specific responsibilities include, but are not limited to the following:To periodically review the Agency’s financial status, its fiscal policies andprocedures, its guidelines for issuing debt, and the investment of its cash reserves,and report any significant findings to the Board.To review and discuss the Agency’s quarterly financial statements withAgency management and the Agency’s internal auditor.To review the Agency’s operating and capital budgets, its investmentprofile and performance, the Registration Statements filed with the SEC, and theAgency’s business plan.To review the Agency’s major financial risk exposures and the adequacyof the Agency’s risk management assessment and control policiesTo directly oversee the planning, staffing and work of any independentauditors retained to perform the annual financial audit of the Agency and issue anaudit report, or to perform other audits, reviews or attests services.To appoint and directly oversee the work of the Director of Internal Auditand the Internal Audit Department staff, including reviewing all significantreports prepared by the internal auditing department, reviewing the internal auditplan for each upcoming year, and annually evaluating the performance of theDirector of Internal Audit .OTHER RELEVANT BOARD POLICY SECTIONSSECTION 10.020 BOARD BY-LAWSSECTION 30.010 ANNUAL AUDITSECTION 30.020 INTERNAL AUDITSECTION 30.030 ANNUAL BUDGET[M1]SECTION 30.040 BANKING & INVESTMENTSECTION 30.050 FINANCIAL REPORTINGSECTION 30.060 RISK MANAGEMENT‘SECTION 30.070 HEDGINGSECTION 30.080 DEBT ISSUANCE <strong>AND</strong> ADMINISTRATIONSECTION 110.010 SWAP <strong>AND</strong> DERIVATIVE POLICY3. FINANCE & ADMINISTRATION COMMITTEE. The purpose of this Committee is toassist the Board in overseeing the Agency’s financial management, including thedevelopment of its capital and operating budgets, its cash management policies andprocedures, and its policies and procedure for investments and the issuance of debt;implementing its pension, health and welfare benefits; and providing input and3

advocacy for the implementation of the Agency’s legislative, regulatory and publicrelations plans. Specific responsibilities include, but are not limited to the following:To periodically review the Agency’s financial status, its fiscal policies andprocedures, its guidelines for issuing debt, and the investment of its cashreserves, and report any significant findings to the Board.To review the Agency’s operating and capital budgets, its investment profileand performance, the Registration Statements filed with the SEC, and theAgency’s business plan.To review and discuss the Agency’s quarterly financial statements withAgency management and the Agency’s internal auditor.To review all proposed changes or amendments to any of the Agency’spension or health plans, and will make recommendations to the Board regardingfurther Board actions that may be required.4

interfaces.Monitor system safety issues and system performance in conformancewith regulatory requirements under programs such as Title VI and ADA.Review management’s recommendations concerning developmentopportunities created by the Agency’s expansions of service and investments ininfrastructure, and review activities supporting the implementation of the Moving<strong>Transit</strong> Forward Plan including regular updates of same.Make regular reports of its findings and/or recommendations to the fullBoard of Commissioners.5. SALES & MARKETING COMMITTEE. The purpose of this Committee is to advise theBoard of Commissioners on issues relating to enhancing revenue through the growthof ridership and assisting the Agency’s goals of increasing community awareness ofthe benefits of public transit and maximizing support for the use of public transit; andidentifying and fostering partnerships with civic and business entities in the region.6. BUSINESS SERVICES & ECONOMIC DEVELOPMENT COMMITTEE. The purpose of thisCommittee is to oversee the operations of the Arch, Arch Parking Garage, St. LouisDowntown Airport, riverboats and any other of the Agency’s non-transit related businessentities; to advise the Agency on its goal of increasing community awareness of andsupport for public transit; and and to identify and foster partnerships with regional civicand business entities in order to enhance transit oriented economic development.Economic development should be focused on the Agency fostering a regional foundationfor private investment and job creation, and approaching such with an emphasis on theAgency’s return on project investment.[M2]5

COLLECTED BOARD POLICIES<strong>OF</strong> THEBI-STATE DEVELOPMENT AGENCY<strong>OF</strong> THEMISSOURI-ILLINOIS METROPOLITAN DISTRICTChapter 30, Audit, Finance and BudgetSection 30.005Audit Committee CharterA. GENERAL The purpose of the Audit Charter is to assist the BoardofCommissioners, through its Audit and Finance Committee, in fulfilling its fiduciary oversightresponsibilities as follows:(1) Audit Committee management and Reporting Responsibilities(2) External Audit of the Financial Statements(3) Internal Audit Process(4) System of Risk Management(5) Processes for Monitoring Compliance with Laws and Regulations and theEthics Policy, Code of Conduct, and Fraud Policy(6) Special Investigations and Whistleblower MechanismSource: Information to develop this Charter is from The AICPA Audit Committee TOOLKIT: GovernmentOrganizationsB. AUTHORITY The Audit and Finance Committee (“Committee”) has the authority toconduct or authorize investigations into any; matters within its scope of responsibility. It isempowered to perform the following functions, which are numbered according to the purposeslisted above.

<strong>Metro</strong> Agenda ItemBoard of CommissionersSeptember 23, 2011From: John M. NationsPresident & CEOSubject: Gateway Arch Drainage ProjectDisposition: InformationPresentation: Jennifer H. Nixon, Senior Vice-President, Business EnterprisesObjective:To inform the Board of Commissioners of an expenditure of $2,288,000 from the JeffersonNational Expansion Memorial Capital Improvement Fund for the Gateway Arch drainageproject.Background:In May 2009, Jefferson National Parks Association (JNPA) contracted with the design firmPGAV for planning services related to the development of strategies and concepts for theoperational and programmatic improvements of the interior public spaces at the Gateway Archand to make recommendations regarding improving the guest experience. This contract wasfunded at the request of the National Park Service (NPS) Superintendent Tom Bradley withmoney from the Jefferson National Expansion Memorial Capital Improvement Fund (the CapitalImprovement Fund).In researching the feasibility of moving the Arch entrance doors further up each ramp, thusallowing improvements to the guest security screening process, the storm water drains buried inthe ramps were evaluated for their condition and capacity. During this investigation, it wasfound that the storm water drainage systems were not functioning as intended. PGAV and theirconsultant Frontenac Engineering provided a series of hydraulic studies outlining the systemissues along with recommendations for repair. Through discussion with the NPS and <strong>Metro</strong>, ascope of work, preliminary cost estimate, and design and construction schedule have beendetermined.Funding Source:The Capital Improvement Fund has sufficient money available for the project to proceed.Attached is a letter from NPS Superintendent Bradley approving the expenditure of money fromthe Capital Improvement Fund for the completion of the drainage project.Management Recommendation:Board action is not required. The paper is being presented for information only.

<strong>Metro</strong> Quarterly Financial StatementsFiscal Year 2011Fourth Quarter • Ending June 30, 2011www.metrostlouis.orgBU10465

Bi-State Development Agency of theMissouri-Illinois <strong>Metro</strong>politan DistrictSummary Financial StatementsFor the Quarter Ended June 30, 2011Table of ContentsQuarterly Financials Transmittal ...................... 1Agency Financials ........................................... 3<strong>Transit</strong> Financials ............................................ 9Business Enterprises FinancialsGateway Arch Tram ................................ 22Gateway Arch Parking Facility ................. 28Gateway Arch Riverboats ........................ 35St. Louis Downtown Airport ...................... 41Staffing Level Report ..................................... 49

Page 2John M. NationsAugust 12, 2011The Gateway Arch Tram is generating Income before Depreciation of $879 thousand, whichis $622 thousand unfavorable to budget. The unfavorable variance to date is attributed tocontribution to others, which represents a contribution to the National Park Service for theArch Visitor’s Center Museum lobby renovation. Please see page 24 for the Statement ofRevenue and Expense.The Arch Parking Facility is generating Income before Depreciation of $678 thousand for theyear ended June 30, 2011. It exceeded its budget expectations by $138 thousand. Thisfavorable variance is attributed to controlling operating expenses and contributions fromothers, which includes reimbursement for the pedestrian crosswalk from the Arch. Pleasesee page 31 for the Statement of Revenue and Expense.Riverfront Attractions is generating a Loss before Depreciation for the year ended and notmeeting budget expectations. Net Loss before Depreciation is $376 thousand, which is $477thousand unfavorable to budget. Riverboat cruise revenue has declined at a higher rate thanrelated expenses and 54 days of operations have been lost to high water. Please see page37 for the Statement of Revenue and Expense.St. Louis Downtown Airport experienced Income before Depreciation of $60 thousand, whichis $54 thousand unfavorable to budget. This unfavorable variance is attributed to operatingrevenue being unfavorable to budget by $47 thousand. Revenues are affected by theeconomy. Please see page 44 for the Statement of Revenue and Expense.The General Agency has a Loss before Depreciation of $37 thousand, which is $178thousand unfavorable to budget. This is primarily the result of large audits performed byInternal Audit using outside contractors.Please contact me with any comments or questions regarding the financial statements.KSK/blkEnclosures

Agency FinancialsExecutive BranchFinancial Highlights ........................................... 3Balance Sheet ................................................... 4Income/Expense Analysis ................................. 5Consolidated Cash Receiptsand Disbursement Schedule .......................... 6Statement of Cash Flows .................................. 7Capital Expendituresfor Active Projects .......................................... 8

AgencyFiscal Year Ended June 30, 2011(preliminary, subject to audit)Agency, also known as Executive Services, is a servicecompany which supports all <strong>Metro</strong> operating companies.Agency consists of the Executive Office, Internal Audit,General Counsel, Government Affairs, and BusinessDevelopment.Operating loss of $38,229 is unfavorable to budget by$172,485 primarily as a result of expenses being higher thanbudget.Operating revenue is the total of management feeassessments to <strong>Metro</strong> operating companies plus the NationalPark Service. The absence of an assessment to the RiverfrontAttractions reflects a fee waiver for the fiscal year 2011.Operating ExpensesNational ParkServiceParking 16.0%Facility5.2%Airport2.5%Arch21.5%Operating Revenues<strong>Metro</strong> <strong>Transit</strong>System54.8%Wages and benefits, other post employment benefits are$51,353 or 3.4% unfavorable to budget.Wages &benefits56.7%Services36.1%Fuel, Supplies& Utilities0.9%Other6.3%Services include fees for legal, audit, consulting andtemporary employment services. These expenditures areunfavorable to budget by $197,296 due to special projectsperformed by internal audit contractors.Other expenses are $53,735 favorable to budget primarilydue to spending constraints for membership dues for transittrade organizations, employee meeting and travel expenseand staff training.3

General AgencyQuarterly Balance Sheet ComparisonJune 30, 2011(unaudited)AssetsCurrent Prior $ Change % Chg Prior Year $ Change % ChgCurrent assetsCash and investments $ 247,407 $ 436,622 $ (189,215) (43.3) $ 705,363 $ (457,956) (64.9)Restricted cash and investments 425,278 415,263 10,015 2.4 309,907 115,371 37.2Accounts and notes receivable 1,273,132 1,306,192 (33,060) (2.5) 820,100 453,032 55.2Prepaid expenses 18,445 18,985 (540) (2.8) 16,005 2,440 15.2Total current assets 1,964,262 2,177,062 (212,800) (9.8) 1,851,375 112,887 6.1Capital assetsCapital assets, net of accum deprec 14,721 16,524 (1,803) (10.9) 21,930 (7,209) (32.9)Total capital assets 14,721 16,524 (1,803) (10.9) 21,930 (7,209) (32.9)Total assets $ 1,978,983 $ 2,193,586 $ (214,603) (9.8) $ 1,873,305 $ 105,678 5.6Liabilities and net assetsCurrent liabilitiesAccounts payable $ 154,184184$ 113,427$ 40,75735.9 $ 126,458$ 27,72672621.9Accrued expenses 103,747 101,695 2,052 2.0 96,872 6,875 7.1Total current liabilities 257,931 215,122 42,809 19.9 223,330 34,601 15.5Non-current liabilitiesOther post employment benefits 425,278 415,263 10,015 2.4 309,907 115,371 37.2General self insurance liability 300 300 - - 300 - -Total non-current liabilities 425,578 415,563 10,015 2.4 310,207 115,371 37.2Total liabilities 683,509 630,685 52,824 8.4 533,537 149,972 28.1Net assetsInvested in capital assets 234,215 234,215 - - 234,215 - -Unrestricted 1,105,553 1,105,553 - - 526,993 578,560 109.8Net income (loss) (44,294) 223,133 (267,427) (119.9) 578,560 (622,854) (107.7)Total net assets 1,295,474 1,562,901 (267,427) (17.1) 1,339,768 (44,294) (3.3)Total liabilities and net assets $ 1,978,983 $ 2,193,586 $ (214,603) (9.8) $ 1,873,305 $ 105,678 5.64

General AgencyStatement of Revenue, Expense, and Income (Loss)For the Quarter Ended June 30, 2011(unaudited)CurrentYear to DateActual Budget $ Change % Chg Prior Yr Actual Budget $ Change % Chg Prior YrOperating revenuesAdmin fees - <strong>Transit</strong> $ 375,000 $ 375,000 $ -- $ 350,000 $ 1,500,000 $ 1,500,000 $ -- $ 1,400,000Admin fees - Arch 172,526 182,941 (10,415) (5.7) 183,873 589,057 550,578 38,479 7.0 597,491Admin fees - Airport 16,010 17,658 (1,648) (9.3) 16,491 68,730 71,341 (2,611) (3.7) 69,054Admin fees - Parking Facility 39,728 41,185 (1,457) (3.5) 42,814 142,557 146,961 (4,404) (3.0) 143,196National park service mgmt fee 120,369 126,327 (5,958) (4.7) 132,717 437,028 444,636 (7,608) (1.7) 447,745Total operating revenues 723,633 743,111 (19,478) (2.6) 725,895 2,737,372 2,713,516 23,856 0.9 2,657,486Operating expensesSalaries, wages and benefits 389,685 345,973 (43,712) (12.6) 294,875 1,428,425 1,376,697 (51,728) (3.8) 1,209,151Other post employment benefits 39,465 36,118 (3,347) (9.3) 36,091 144,821 145,196 375 0.3 121,539Services 523,895 196,442 (327,453) (166.7) 106,821 1,002,346 805,050 (197,296) (24.5) 599,322Fuel and lube consumed 355 230 (125) (54.3) 331 1,231 920 (311) (33.8) 1,062Materials and supplies 6,572 5,345 (1,227) (23.0) 5,396 18,153 15,501 (2,652) (17.1) 15,482Utilities 1,775 1,830 55 3.0 1,083 5,784 7,320 1,536 21.0 3,363Other expenses 27,786 26,825 (961) (3.6) 19,758 174,841 228,576 53,735 23.5 158,869Total operating expenses 989,533 612,763 (376,770) (61.5) 464,355 2,775,601 2,579,260 (196,341) (7.6) 2,108,788Operating income (loss) (265,900) 130,348 (396,248) (304.0) 261,540 (38,229) 134,256 (172,485) (128.5) 548,698Non-operating revenues (expenses)Interest income 275 1,750 (1,475) (84.3) 398 1,145 7,000 (5,855) (83.6) 7,081Other non-operating revenue (expense) - - - n/a 30,100 - - - n/a 30,100Total non-operating revenues (expenses) 275 1,750 (1,475) (84.3) 30,498 1,145 7,000 (5,855) (83.6) 37,181Income (loss) before depreciation (265,625) 132,098 (397,723) (301.1) 292,038 (37,084) 141,256 (178,340) (126.3) 585,879Depreciation and amortization 1,802 1,422 (380) (26.7) 1,802 7,210 5,687 (1,523) (26.8) 7,319Net income (loss) $ (267,427) $ 130,676 $ (398,103) (304.6) $ 290,236 $ (44,294) $ 135,569 $ (179,863) (132.7) $ 578,5605

General AgencyConsolidated Cash Receipts and Disbursements ScheduleFor the Quarter Ended June 30, 2011(unaudited)DescriptionAgencyRestrictedOperatingCashTotal Fund FundBalance at April 1, 2011Cash $ 851,885 $ 436,622 $ 415,263Add:Interest received 306 306 -St Louis Downtown Airport 466,000 466,000Gateway Arch 165,000 165,000 -Gateway Parking Facility 35,000 35,000 -666,306 666,306 -Interfund transfers - (10,015) 10,015Less:Cash disbursements (845,506) (845,506) -Balance at June 30, 2011Cash $ 672,685 $ 247,407 $ 425,2786

General AgencyStatement of Cash FlowsFor the Year Ended June 30, 2011(unaudited)Cash flows from operating activitiesReconciliation of operating loss toReceipts from customers $ 551,627net cash used for operating activitiesPayments to employees (1,451,000)Payments to vendors (1,176,896) Operating income (loss) $ (38,229)Receipts (payments) from inter-fund activity 1,732,539Adjustments to reconcile operatingNet cash provided by (used in)income (loss) to net cash providedoperating activities (343,730) by (used for) operating activitiesChange in assets and liabilitiesCash flow from noncapital financing activities Accounts and notes receivables 114,599None noted. Interfund accounts receivable (567,631)Prepaid expenses, deferred chargesand other current assets (2,440)Cash flow from capital and related financing activities Accounts payable 27,900None noted. Interfund accounts payable (174)Accrued expenses 6,875Other post employment benefits liability 115,370Cash flows from investing activitiesInterest received 1,145Total adjustments (305,501)Net cash provided by (used in)investing activities 1,145 Net cash provided by (used for)operating activities $ (343,730)Net increase (decrease) in cashand cash equivalents (342,585)Cash and cash equivalents, beginning of year 1,015,270Cash and cash equivalents, year to date $ 672,685Supplemental disclosure of cash flow informationNo disclosures.7

AgencyCapital Expenditures for Active ProjectsFor the Quarter Ended June 30, 2011(unaudited)Description Budget Current Year-To-Date Life-To-Date Balance$ - $ - $ - $ - $-Total Agency $ - $ - $ - $ - $-8

<strong>Transit</strong> SystemFinancialsRegional Economic Development throughExcellence in TransportationFinancial Highlights ........................................... 9Balance Sheet ................................................. 12Income/Expense Analysis ............................... 14Schedule of Grants and Assistance ................ 15Consolidated Cash Receiptsand Disbursement Schedule ........................ 16Cross County Consolidated Cash Receiptsand Disbursement Schedule ........................ 17Statement of Cash Flows ................................ 18Schedule of Aged Receivables – Invoices ...... 19Capital Expendituresfor Active Projects ......................................... 20