Corporate Newsletter of Bajaj Allianz General Insurance

Corporate Newsletter of Bajaj Allianz General Insurance

Corporate Newsletter of Bajaj Allianz General Insurance

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NEWSTRACK<strong>Corporate</strong> <strong>Newsletter</strong> <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong> March 2006

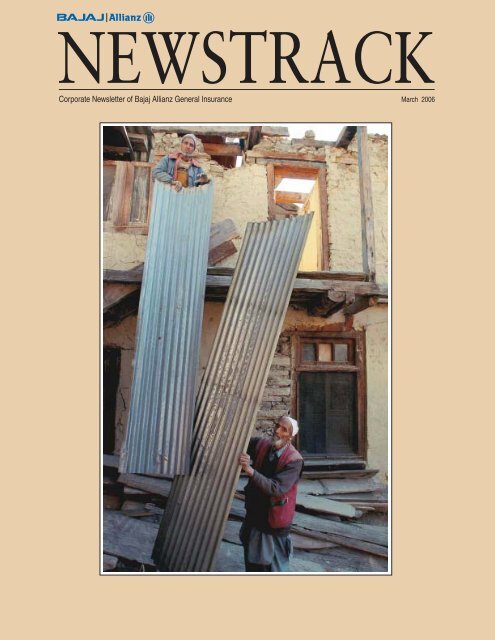

1000 crores Premium IncomeFront CoverDILDAAR, INDIA: An IndianKashmiri family begins todisassemble their damaged homein Dildaar village, some 205 kmswest <strong>of</strong> Srinagar, 20 October2005.(Photo credit: DeshakalyanChowdhury/AFP/Getty Images)Issue date: March 2006Published by: <strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong>Editorial Team:Santosh BalanAjay VarmaPrinted at: Pragati Art Printers, Hyderabad<strong>Bajaj</strong> <strong>Allianz</strong> Newstrack, a quarterly newsmagazine <strong>of</strong><strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong> Company Limited,provides current information on the activities <strong>of</strong> <strong>Bajaj</strong><strong>Allianz</strong>, India and it's affiliates.For further information on the articles and newsappearing in this magazine please contact SantoshBalan at +91-20-56026603or email santosh.balan@bajajallianz.co.inVisit our website: www.bajajallianz.co.inViews / Information expressed herein are illustrative andinformative in nature and not binding on the company. <strong>Insurance</strong> isthe subject matter <strong>of</strong> solicitation.<strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong> Company LimitedGE Plaza, Airport Road, Yerawada, Pune - 411006<strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong> crossed amajor milestone by garnering an annualpremium income <strong>of</strong> over Rs. 1000 crores.The Gross Written Premium as on 31stJanuary, 2006 rose to Rs. 1067 crores, whichis a growth <strong>of</strong> over 53% over the previousyear for the same period. The company hasissued over 3 million policies in the currentfiscal.This is a significant milestone in thecompany's corporate journey and has beenachieved within a short span <strong>of</strong> five years.The performance has also been consistentwith all round growth.<strong>Bajaj</strong> <strong>Allianz</strong> in its five years has built aformidable reputation and displayed its riskappetite by underwriting big projects likeIndian Oil Refineries, Essar Refinery project,Infrastructure projects including Thermal andHydroelectric projects and has a share inunderwriting the new Bangalore Airport,Kingfisher Airlines and Delhi Metro projects.<strong>Bajaj</strong> <strong>Allianz</strong> is the only private sectorinsurance company to be active in issuingFilm, TV productions and, Event insurancefor sporting events such as golf, cricket andeven Stage Shows and Product launches.In the retail sector, the company launchedseveral new and innovative products likeWedding <strong>Insurance</strong>, Travel Asia for travelersto Asian countries, Credit <strong>Insurance</strong> in tie-upwith Euler Hermes, E-Opinion, Silver Health– the only health insurance plan specificallyfor people above 45 years, amongst manyothers.

BancassuranceSuccessful PartnershipsKamesh Goyal - CEOGreetings!Till the year 2000, the <strong>General</strong> <strong>Insurance</strong> Industry had onlyone distribution channel- Agency. This channel contributedless than 20% <strong>of</strong> the business. Most <strong>of</strong> the business wasbasically done on a direct basis. When the <strong>Insurance</strong> sectoropened up and new companies started their operations, settingup multiple distribution channels became imperative.Bancassurance - selling insurance through banks, has beenquite successful in Europe and all new insurance companieswere keen to develop this. <strong>Bajaj</strong> <strong>Allianz</strong> has focused ondeveloping this channel since the inception <strong>of</strong> it’s business.Over a period <strong>of</strong> time, we understood the channel better, andhave now developed a robust business model. The channel hasa few peculiarities, allow me to explain them.Bank branches have been dealing with individual development<strong>of</strong>ficers for over 15-20 years for insurance purpose. Withprivatisation, Banks started becoming corporate agents <strong>of</strong>insurance companies (through national tie-ups) and startedrouting business through these companies directly. Thisobviously disrupted the existing relationship with thedevelopment <strong>of</strong>ficer at the local level. Thus, the initial reaction<strong>of</strong> bank branches was not too cooperative, and every smallissue would get exploded into a crisis for which the insurancecompany would be held responsible. However, we have noticedthat strong direction from a bank's top management andtactful handling by the insurancecompany can correct the situation in just3-4 months time.The premium per policy from a bank istypically low. This means that thenumber <strong>of</strong> policy documents is veryhigh, making policy issuance a bigchallenge. Till the year 2003, our <strong>of</strong>ficesused to struggle to keep pace withdocumentation. Today, after makingsuitable changes in our systems, we areable to handle this aspect fairlysatisfactorily.Banks have tie-ups with only oneinsurance company and they expect thatinsurance company to accept all thebusiness, which at times insurancecompany can not underwrite, as everyinsurance company has its ownunderwriting philosophy and reinsurancearrangement. We have realised that beingtransparent and flexible with banks helpssort issues over a period <strong>of</strong> time.When we started doing business withNewstrack March 20063

anks, we focused a lot on giving the right MIS tothem. Thus they know which assets are covered andthose that are not, premium per branch, getting theright documentation etc. During the recent floods inMumbai and earthquake in Kashmir - we receivedover 1500 claims on policies issued through banks.We settled most <strong>of</strong> the claims to the satisfaction <strong>of</strong>the bank and the customers. However, goingforward, receiving complete and correct informationabout risks is very critical. This is an area where werequire more support from the banks.The number <strong>of</strong> branches for a mid sized bankexceeds 500. <strong>Bajaj</strong> <strong>Allianz</strong> has tie-ups with over 20banks and is servicing over 5000 bank branches.Coordinating with these branches, servicing themand training the bank staff becomes a big task. Overa period <strong>of</strong> time we have developed a SOP (StandardOperating Procedure) to service bank branches.Despite the progress, we still have a lot <strong>of</strong> scope forimprovement.These are just a few examples which show thatBancassurance is a different business that requiresoperational excellence and a flexible approach fromthe insurance company. We are committed to developthis channel and are already recognised as a leader inthe same. In this issue <strong>of</strong> Newstrack you will read alot more about Bancassurance. Personally for meBancassurance <strong>of</strong>fers a great opportunity to meetsome <strong>of</strong> the best people in the financial servicesindustry and to learn something new. Besides it <strong>of</strong>fersme the opportunity to travel to beautiful places likeSrinagar (on work)!In January 2006, we crossed Rs. 1000 crores inannual premium income for the first time. To achievethis milestone in less than five years since the start <strong>of</strong>the company is a big achievement. We would nothave reached here but for the trust <strong>of</strong> our customers,support <strong>of</strong> our intermediaries, encouragement fromour reinsurers and hard work <strong>of</strong> my colleagues. Ithank you all!kamesh.goyal@bajajallianz.co.in"We started our relationship in March2005, and the same is running quitesmoothly for over eleven months. Thingshave stabilized and our customers are quitehappy with the services being <strong>of</strong>fered by<strong>Bajaj</strong> <strong>Allianz</strong>. However now that thebusiness has stabilized, we shall also beselling insurance to clients from our branchcounters."Mr. Jyotindra MehtaChairmanRajkot Nagrik Shakari Bank Ltd."KVB has taken a lead in promotingBancassurance business in 2003 itself. Ithas tied up with <strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong><strong>Insurance</strong> to sell non –life insuranceproducts. The business relationship hasbeen growing strength to strength, Because<strong>of</strong> mutual trust <strong>of</strong> the partners, KVBforecasts a bright growth both for Bankand <strong>Insurance</strong> Company in the days tocome."Mr. P. T. KuppuswamyChairmanKarur Vysya Bank Limited"We have been associated with <strong>Bajaj</strong><strong>Allianz</strong> since the last one-year and we areproud to be associated with <strong>Bajaj</strong> <strong>Allianz</strong>.This partnership has worked well for ourcustomers as well as improved ourbottomline. "Mr. R .U. KhetanChairmanThe Akola Janata Commercial Bank"The privileged partnership with <strong>Bajaj</strong><strong>Allianz</strong> will enable us to <strong>of</strong>fer insuranceproducts with our <strong>of</strong>ferings, and devisecustomised products for our clients acrossall segments."Mr. Rana KapoorManaging Director & CEOYES Bank4<strong>Bajaj</strong> <strong>Allianz</strong>

CONTENTSBancassurance - Successful PartnershipsA brief overview on Bancassurance by Kamesh Goyal, CEO - <strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong><strong>Insurance</strong>.Special Feature- Bancassurance<strong>Bajaj</strong> <strong>Allianz</strong> - Banking SectorMr. Atanu Singh Mukherjee, Head - Institutional Relationships - <strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong><strong>Insurance</strong> gives us a detailed insight into the running <strong>of</strong> the Bancassurance channelfrom the perspective <strong>of</strong> the <strong>Insurance</strong> company, it's benefits to both partners and thechallenges faced and overcome by the players involved.Point <strong>of</strong> ViewDr. H. A. Drabu, Chairman - Jammu & Kashmir BankThe Bancassurance channel - From our Banking Partner's point <strong>of</strong> view.Disaster Strikes Jammu & KashmirOur cover story on the earthquake that struck J & K in October <strong>of</strong> 2005, causingwidespread destruction and the efforts <strong>of</strong> the company to minimise suffering for thoseinsured.ClaimstrackA Fact and Figures analysis <strong>of</strong> the kind <strong>of</strong> claims made, how many <strong>of</strong> those weresettled and the time taken to settle such claims.International ReportNurturing Bancassurance in AsiaAn article featured in the January edition <strong>of</strong> <strong>Allianz</strong> Journal 2004 on the growingsuccess <strong>of</strong> the Bancassurance channel in the Asian financial markets.Interviews with our Bancassurance PartnersMr. Ananthakrishna, Chairman- Karnataka Bank, in an interview with Newstrack.Mr. P. K. Gupta, CMD - UBI, talks about his bank’s association with <strong>Bajaj</strong> <strong>Allianz</strong>.Mr. Hemant Kaul, President - Retail Banking - UTI Bank, shares his Bancassuranceexperience with Baja <strong>Allianz</strong>.36810121316Spotlight: – Rajkot OfficeFrom near failure to astounding success, this <strong>of</strong>fice <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong> has seen aturnaround that has everybody talking.19Newstrack March 2006 5

fairly new to them. We have developed training modulesspecifically for bank staff, which are conducted atmutually agreed times. A ready reckoner- <strong>of</strong> productswith features and benefits, and other publicity materialis regularly sent to all partners.IT and MISThe channel brings with it massive challenges inactivating far flung remote branches, besides the highlevel <strong>of</strong> documentation since the premium amount islow. The investment we have made in IT to developcustomized s<strong>of</strong>tware for this channel is significant andnow we are capable <strong>of</strong> handling over one milliontransactions!Some <strong>of</strong> the challenges in IT were:• Location and connectivity – Integration <strong>of</strong> largenumber <strong>of</strong> branches across difficult terrain inIndia involved a networking with our main hubfor policy issuance and servicing. This wasachieved by developing a customised modulesolely for Bancassurance, which included a webbasedand <strong>of</strong>f-line system to take care <strong>of</strong>connectivity issues, in remote areas, therebyreducing TAT(Turn around time) fordocumentation to four days.• Product line – Given the diversity <strong>of</strong> our vastproduct portfolio, customizing the same to thebanks’ requirement is also an operationalchallenge. A special module for Fire andBurglary (being the most common retailproducts) was developed. Our expertise led tothe development <strong>of</strong> over 18 different modulesfor various bundled products in health insurancealone.• MIS for bank partners -A robust MIS whichcould easily be transported in MS-Excel fordetailed business analysis and timely decisionmaking was created with channel partners’requirements in mind giving product-wise,<strong>of</strong>fice-wise revenue generation andpr<strong>of</strong>itability.Flexibility in Developing Customized <strong>Insurance</strong>ProductsDesigning customized products for a particularbank’s customers has been given emphasis. Someexamples are K-Secure, K-Home Secure forKarnataka Bank; Safe Guard, Safe Home andFamily Health for UTI Bank; Family Care for IDBIBank; Special Health coverage plans for Yes Bankand Deutsche Bank; Home Loan Portfolio coverageetc.The customer can simply tick and buy any <strong>of</strong> theseproducts at the time <strong>of</strong> opening up <strong>of</strong> an account oranytime thereafter.Decentralisation <strong>of</strong> Claims and ServicingAll operating <strong>of</strong>fices have the authority to issuepolicies and settle claims for faster turnaround timeby closely working with bank staff and thecustomers.The success <strong>of</strong> the partnership would depend onhow the insurer and the bank can integrate systems,culture and targets towards a common goal.Accomplishment <strong>of</strong> joint goals comes from a strongfoundation <strong>of</strong> mutual trust, accessibility at all timesfrom top management and willingness to resolveissues with flexibility.<strong>Bajaj</strong> <strong>Allianz</strong> has worked with this concept,straddling retail, SME and corporate segmentsuccessfully with the bank for business generation.Our flexibility to tailor make the joint workingmodule, to suit a wide array <strong>of</strong> banking entities isamplified by our current partners ranging from PSU,Private Sector, Foreign, Co-operative, District Cooperativebanks, Regional Rural banks andFinancial institutions."Our flexibility to tailor make the joint working module, to suit a wide array <strong>of</strong>banking entities is amplified by our current partners ranging from PSU, PrivateSector, Foreign, Co-operative, District Co-operative banks, Regional Ruralbanks and Financial institutions."atanusingh.mukherjee@bajajallianz.co.inNewstrack March 2006 7

Point <strong>of</strong> ViewJammu & Kashmir Bank - Bancassurance ChannelDr. H. A. DrabuChairman - Jammu & Kashmir Bankhe convergence <strong>of</strong> financial services in Indiais in keeping with the global trend that hasrevolutionized the services sector. Thisconvergence is increasingly blurring theboundaries between banking and non-bankingfinancial services. The trend is exemplified bywidespread distribution <strong>of</strong> <strong>Insurance</strong> productsthrough bank branches – a phenomenon knownas Bancassurance, precursor to formation <strong>of</strong>conglomerates that provide all types <strong>of</strong> financialproducts and services.Bancassurance as a concept gained currency in thegrowing global insurance market and it’s felt need fornew channels <strong>of</strong> distribution. In order to satiate theever-growing demand from customers for superiorservices, competitive pricing and convenient access to arange <strong>of</strong> delivery channels is being <strong>of</strong>fered by the banks.Banks with their geographical spread, multipledistribution channels and penetration in terms <strong>of</strong>customer reach <strong>of</strong> all segments, have emerged as a viablesource for distribution <strong>of</strong> <strong>Insurance</strong> products.The main drivers for banks in India to jump on to theBancassurance bandwagon is to increase return on assetsthrough fee income, cross-selling financial products,leveraging their strong distribution and processcapabilities and more so taking advantage <strong>of</strong> proprietarydata bases.Keeping this in focus Jammu & Kashmir Bank Ltd and<strong>Bajaj</strong> <strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong> started businessrelationship with a Direct Marketing Arrangement inJuly 2002, which continued till 28th <strong>of</strong> April 2003,when the Bank became its <strong>Corporate</strong> Agent & startedselling <strong>Insurance</strong> products through its branch networkunder 'Bancassurance Model'. Initially the productssuitable to the bank’s loan customers like Motor,Personnel Accident, Consumer credit, Householders’ &Shopkeepers Polices were sold through J&K bankbranches and gradually the product range was extendedto Health <strong>Insurance</strong>, Cargo <strong>Insurance</strong>, etc.Despite all risk factors like adaptability <strong>of</strong> Bankstaff to sell insurance products at branches and stiffcompetition from other insurance companies, wehave succeeded in achieving positive business resultsin the non-life insurance sector. The gross writtenpremium during the period from April 2003 toDecember 2005 has been Rs. 5266.46 lacs, fetchinga substantial commission as income to the Bank.Presently we have a team <strong>of</strong> trained & licensed<strong>Insurance</strong> Managers whose services are utilized inprospecting the insurance customers forBancassurance business. It has so far been a win-winsituation for <strong>Bajaj</strong> <strong>Allianz</strong> & the Bank, as theCompany while taking advantage <strong>of</strong> Jammu &Kashmir Bank branch network and the trust reposedin the institution by its customers has not only madea headway in the insurance market <strong>of</strong> the state, buthas given stiff competition to its competitors whohave been operating in the state for over the lastfour decades. <strong>Bajaj</strong> <strong>Allianz</strong> has tapped about 85%<strong>of</strong> the <strong>General</strong> <strong>Insurance</strong> Business, which waspreviously undertaken by various <strong>Insurance</strong>companies operating in the state & outside.Here are some <strong>of</strong> our success stories:• Before our tie-up with <strong>Bajaj</strong> <strong>Allianz</strong>, providing ahassle free insurance cover to Amarnath Yatriswas an uphill task for the J&K Government. Itbecame easier when <strong>Bajaj</strong> <strong>Allianz</strong> in associationwith J&K Bank agreed to provide the insurance8<strong>Bajaj</strong> <strong>Allianz</strong>

Cover StoryDisaster strikes Jammu & Kashmiron the morning <strong>of</strong> 8th October 2005, a massiveearthquake measuring 7.6 struck Jammu &Kashmir. To date over 80,000 people have losttheir lives and there has been widespread damageto property. In Jammu & Kashmir state, the worstaffected areas were Uri, Kupwara, Baramulla andPoonch, and many <strong>of</strong> the interior areas <strong>of</strong> thestate. The tremor was felt as far as the states <strong>of</strong>Uttar Pradesh, Madhya Pradesh, Rajasthan andGujarat. The magnitude <strong>of</strong> the earthquakecompares with the 2001 Gujarat earthquake.Kashmir is located on the northern edge <strong>of</strong> theIndian techtonic plate which collides withthe Eurasian Plate. In the past this regionhas commonly experienced earthquakes <strong>of</strong>smaller magnitude.called to appraise them about the urgency <strong>of</strong> thesituation. Each <strong>of</strong> the surveyors was allotted onearea so as to save on time and also to <strong>of</strong>fer thepeople <strong>of</strong> that area, a single-window service. Onreaching the sites <strong>of</strong> devastation, the biggestproblem faced was the absence <strong>of</strong> originalinsurance policy and other documentary pro<strong>of</strong>. Allinsurance policies for business done throughJammu & Kashmir Bank was traced through theManager (Advances) <strong>of</strong> the concerned J&KBankbranch to identify all those properties, which wereinsured with us. These were then surveyed. In someThe army and local administrationimmediately swung into action and beganthe process <strong>of</strong> resettling the affected andlooking after the injured.cases the <strong>of</strong>fice was provided with the numberand date <strong>of</strong> the credit advices sent by thebranches and the policies were tracked.Deepak Dhar, Area Manager- Jammu, wholead the team, said, “In some cases, wesearched the policies from our own database.The idea was to make it least cumbersome forthe affected clients.”On our part a decision was made to extend helpand to reassure the people who were insured by us.A small team was formed in our <strong>of</strong>fices at Jammuand Srinagar, primarily to respond to the telephonecalls from the affected. It was important to conveythe message to all these families that we were thereto help in their hour <strong>of</strong> need.Policy TrackingOn the second day a meeting <strong>of</strong> surveyors wasServicing Remote AreasThe earthquake struck in the midst <strong>of</strong> the severewinter. The snowfall and the severe cold wave onlymade matters worse. There were only a handful <strong>of</strong>surveyors and reaching many <strong>of</strong> the affectedinaccessible areas was a challenge in itself. Some <strong>of</strong>the areas were 120 kms away from the maincity/town. The average claims size was Rs. 50,000and as the claimants were mainly from the lowermiddle class, the claims if not settled on time10<strong>Bajaj</strong> <strong>Allianz</strong>

would only compound their problems. The <strong>of</strong>ficemade a decision to camp some <strong>of</strong> the surveyors inthe affected area for days together so that theycould survey the affected area on a continuous dayto day basis.On-the-Spot Claims SettlementGiven the trauma that the residents wereundergoing after the massive earthquake, the <strong>of</strong>ficetried to settle the losses on-the-spot by taking aliberal view on completion <strong>of</strong> various formalitiesand procedures. In case <strong>of</strong> stock losses, the <strong>of</strong>ficetried to segregate the damaged stocks from thegood one and made an inventory <strong>of</strong> the same. Anegotiated settlement was taken on-the-spot.Similarly for smaller losses- up to Rs. 1 lac, in case<strong>of</strong> property damage, were also settled on the spot.The Chairman and Executive Director <strong>of</strong> the J&Kbank were constantly kept updated about thespeedy settlement <strong>of</strong> claims.Delhi and Deepak Dhar from Kanpur was formed,to process and approve earthquake claims. Thisgroup cleared a record 200 claims in a matter <strong>of</strong> 3days. Within 15 days <strong>of</strong> the earthquake,dispatching <strong>of</strong> the claim chequeswas started and within one month<strong>of</strong> the tragedy more than 100 claimswere settled.As on 31st January, we havereceived 800 claims and settled 476.Rs. 1.25 crores worth <strong>of</strong> claimshave been settled and theoutstanding amount is Rs. 1 crore.Intimations <strong>of</strong> the claims took overa period <strong>of</strong> 2 months, and hence theno. <strong>of</strong> claims settled would appearless. But as a matter <strong>of</strong> fact out <strong>of</strong>all the intimations which werereceived in Oct 2005, nearly 95%have been settled.Lower the TAT in Claims SettlementThe surveyors were given a time frame forsubmitting the survey reports and each one <strong>of</strong> themsubmitted the reports in record time. In order t<strong>of</strong>urther reduce the TAT (turn around time) insettlement <strong>of</strong> claims the services <strong>of</strong> personnel fromother locations were engaged to provide technicalsupport. The experience from the recent floods inother parts <strong>of</strong> the country was also put to good usein lowering the TAT. Besides Manzoor Dar <strong>of</strong>Srinagar <strong>of</strong>fice and Mr. Deepak Dhar <strong>of</strong> Jammu<strong>of</strong>fice, a team comprising <strong>of</strong> Marut Dhar fromAppreciation <strong>of</strong> Good WorkLooking to the magnitude <strong>of</strong> the calamity, thejudiciary <strong>of</strong> the state also geared up andconstituted LOK ADALATS at Uri, Kupwara andJammu. Deepak Dhar who attended one suchmeeting, said, “It is a matter <strong>of</strong> pride for us thatthe Registrar <strong>General</strong> went on record inappreciation <strong>of</strong> the good work done by ourcompany. At the same time he severely criticizedthe working <strong>of</strong> the other insurance companies,going to the extent <strong>of</strong> issuing non-bailablewarrants against them.”Newstrack March 2006 11

CLAIMSTRACKCLAIMS SETTLEMENT RECORD Dec '04 - Dec '05Line <strong>of</strong> BusinessO/sason1stDec 2004Registered fromDec04-Dec05Paid till 31stDec 2005O/s as on 31stDec 2005Aviation 7 2 1 8Engineering 202 2109 1835 476Health 1030 36344 34379 2995Liability 6 75 19 62Marine 620 7959 7491 1088Motor 6785 159851 153620 13016Property 449 5987 5019 1417Travel 297 3064 2895 466Workmen Compensation 94 623 536 181Misc and Others 1180 6635 6286 1529Total 10670 222649 212081 21238Claims settlement ratio stands at 91% for Dec '04 - Dec '05CLAIMS PAID ANALYSIS - AGEING Oct '05 - Dec '05Line <strong>of</strong> BusinessNo. <strong>of</strong> Claims paidTotalTotal Paid AmountClaims(Rs.)0-30 days 31-90 days 91-180 days >180 days PaidEngineering 166 117 105 48 436 25997960Health 8054 1379 281 45 9759 156888435Liability 1 1 3 3 8 257948Marine 1014 442 230 138 1824 85949882Motor 32059 6362 2069 671 41161 560280868Property 399 645 383 93 1520 662689644Travel 362 209 132 79 782 26261390Workmen Compensation 41 34 22 13 110 3464187Misc and Others 791 435 190 107 1523 46379082Total 42887 9624 3415 1197 57123 156816939692% <strong>of</strong> the claims were settled within 90 days <strong>of</strong> intimationCASES REFERRED TO CONSUMER FORUMAs on Dec '05Total No. <strong>of</strong> CasesNo. <strong>of</strong> Cases Settled <strong>Bajaj</strong> <strong>Allianz</strong> Won <strong>Bajaj</strong> <strong>Allianz</strong> Lost421 205 158 4712<strong>Bajaj</strong> <strong>Allianz</strong>

Interviews withOur Bancassurance PartnersMr. Ananthakrishna Chairman - Karnataka BankKarnataka Bank, a premier bank, has developed acomprehensive range <strong>of</strong> customised products &services suitable for every kind <strong>of</strong> market, trade orperceived need - Business or Personal. Theyinclude, borrowing facilities, deposits, providingoptimum returns on surplus funds or helping withoverseas transactions.The bank believes in total quality at all levels and hasdeployed the most modern information technologysystem to deliver products & services with an aim todevelop an effective long-term relationship.Q1.Karnataka Bank has been our partnersince the last 2 years. Sometime ago, itwas noticed that the business numbersdid not grow initially and it plateaued.How is the situation now?A 1. Yes, in the initial months <strong>of</strong> ourpartnership, the bank collected amodest amount <strong>of</strong> premium and thesame level <strong>of</strong> business continued till December 2004. Weanalysed the reasons for this stagnation and a ‘SteeringCommittee’ comprising <strong>of</strong> top executives <strong>of</strong> the bank andinsurance company was formed to review the businessperiodically and to initiate measures for enhancing thebusiness. After one <strong>of</strong> the steering committee meetings, thefollowing steps were initiated.• Karnataka Bank mapped its requirement for additionalrequirement <strong>of</strong> sales force, which <strong>Bajaj</strong> <strong>Allianz</strong> agreed toprovide.• <strong>Bajaj</strong> <strong>Allianz</strong> initiated the process for prompt issuing <strong>of</strong>cover notes, policies, endorsements, sending <strong>of</strong> due notices,fast settlement <strong>of</strong> claims, etc.• Banacassurance Cell compiled branchwise data <strong>of</strong> all creditsanctions and provided the same to <strong>Bajaj</strong> <strong>Allianz</strong> for followup with respective branches.• Banacassurance Cell is also providing the branches withdetails <strong>of</strong> renewals well in time and follow up is being madefor big cases.Q2.A 2.Q4.A 4.The above initiatives have started yielding good results,which is reflected in increased premium collection by 50%from January 2005. For the last 3 months we have doubledpremium collection, which is quite commendable. Furtherto the decision <strong>of</strong> designating bank branches for marketing<strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong> products, out <strong>of</strong> 387 branches, 379branches have generated business and 8 branches whichhave not generated business are either located in remoterural areas or are newly opened branches.How did our association help in your bagging largecustomers?The increase in premium collection is due to higher rate <strong>of</strong>loan book conversion and at present nearly 75% <strong>of</strong>insurable assets <strong>of</strong> bank borrowers are covered under <strong>Bajaj</strong><strong>Allianz</strong> covers. In respect <strong>of</strong> high value cases, the joint callsfrom branches and <strong>Bajaj</strong> <strong>Allianz</strong> sales team and competitivepricing have played a vital role in convincing customers.What are the steps taken to ensure business is generatedfrom each Bank branch?Our success today is due to frequent interaction <strong>of</strong> bank’sRegional Heads with <strong>Bajaj</strong> <strong>Allianz</strong> sales team, which helpedin increasing the business as well as resolving various serviceissues. In order to get big volumes co-branded OTC productsviz ‘K-Health Care’ ‘K-Health Secure’ and ‘K-Home Secure’16<strong>Bajaj</strong> <strong>Allianz</strong>

Q5.A 5.were launched. However, the said OTC products have nottaken <strong>of</strong>f as expected and hence much focus will beextended to market these products in the coming days byinitiating required steps.Would you like to give us suggestions for improvement <strong>of</strong>our services?Apart from quoting competitive price, the credibility <strong>of</strong> aninsurance company is measured on claim settlement andpayout ratio. Here we are happy to note that <strong>Bajaj</strong> <strong>Allianz</strong>has a dedicated team for settlement <strong>of</strong> claims, which isworking on target to settle claims. The action initiated by<strong>Bajaj</strong> <strong>Allianz</strong> in settling large number <strong>of</strong>claims <strong>of</strong> the flood affected in Vadodara-Gujarat and Mumbai is appreciated.The relationship is getting stronger day byday with better understanding. The Non-Life <strong>Insurance</strong> industry is poised forsweeping change with detariffing to comeinto effect from January 2007 and to combatthe competition, other developments likeimprovement in customer service levels andnewer standards <strong>of</strong> underwriting are alsolooked forward to.UTI Bank, the first <strong>of</strong> the new private banks to have begun operationsin 1994, after the Government <strong>of</strong> India allowed new private banks to beestablished, has a very wide network <strong>of</strong> more than 415 branch <strong>of</strong>ficesand Extension Counters. The Bank has a network <strong>of</strong> over 1825 ATMsproviding one <strong>of</strong> the largest ATM networks in the country. The Bankhas strengths in both retail and corporate banking.Mr. Hemant Kaul, President (Retail Banking-UTI Bank), shares hisexperience with <strong>Bajaj</strong> <strong>Allianz</strong>- UTI Bank's Bancassurance partner.Mr. Hemant KaulQ1.A 1.Q2.A 2.<strong>Bajaj</strong> <strong>Allianz</strong> has launched several customizedproducts like Safe Guard, Safe Home, FamilyHealth, Smart Advantage, etc. Are you satisfiedwith our level <strong>of</strong> product customization foryour customers?The customized products for UTI Bank areinnovative and <strong>of</strong>fer convenience, simplicitywith easy auto debit and auto renewal featuresand these have been well received by ourcustomers. The easy to choose and selectoptions makes it possible to sell the productsover the counter. The customization hasprovided thrust to our retail initiatives and weare also looking at more customized productsfor our other segments, especially non-retail,very soon.Did you find any problems in integrating ourprocesses and systems with yours?It did take some time for the integration <strong>of</strong>processes and systems but the IT Teams <strong>of</strong> bothcompanies handled the challenges quite well. Asthe co-branded products were selling well itresulted in large number <strong>of</strong> policy applications.There was a challenge <strong>of</strong> policy issuance withinthe specified time, but was handled well by theinvolvement <strong>of</strong> a responsive team.Q3.A 3. There were several parameters considered forchoosing <strong>Bajaj</strong> <strong>Allianz</strong> as our partner. However moreimportant among other reasons was the fact that thecompany was willing to provide special customisedproducts for UTI Bank customers. Technologysuperiority was also an important factor in ourconsideration which we are using now to issuepolicies like farmer’s package from our branchesQ4.A 4.What was the single most reason for choosing <strong>Bajaj</strong><strong>Allianz</strong> as your partner?What are the innovative steps you have taken toensure customers are retained?We have provided to our customers the convenience<strong>of</strong> payments by auto debit and also provided theoption <strong>of</strong> auto renewal <strong>of</strong> policy. The customer,therefore, does not have to remember renewal date <strong>of</strong>policy, and is secure in the knowledge that the policywill be automatically renewed every year throughauto renewal facility provided at the time <strong>of</strong> purchase<strong>of</strong> the policy.Newstrack March 2006 17

United Bank <strong>of</strong> India (UBI) with over Rs. 33,000 crores <strong>of</strong> business has an All-India distributionnetwork <strong>of</strong> over 1300 branches with a significant presence in rural, semi-urban, urban andmetropolitan areas. The Bank has 87% <strong>of</strong> it's branch network in Eastern and North EasternRegions <strong>of</strong> country. It has been the largest lender to the Tea Industry.Mr. P. K. Gupta, CMD - UBI Bank talks about the bank's association with <strong>Bajaj</strong> <strong>Allianz</strong>.understanding your needs or claims handling?A 3.We are happy that the policy documents are beingsent in time and the claims settlement is also fast.This has created confidence among the BankOfficials and Customers However, the issue <strong>of</strong>Policy issuance by our Regional Offices isbeing examined to avoid delays especially inremote rural areas.Q 1.A 1.Q 2.A 2.Mr. P. K. GuptaHow did you go about the entire exercise <strong>of</strong>rolling out tie-up arrangements in all yourbranches? How effective is the monitoring atvarious levels?The roll out was in phases. Initially it was rolledout in metro and important urban centres.Gradually more branches were added and now allour 1300 odd branches are eligible to conductgeneral insurance business. To determine theprogress <strong>of</strong> the tie-up, it is important to monitorthe progress on daily basis. In regard to this, theBank gets Region-wise Business figures on a dailybasis from <strong>Bajaj</strong> <strong>Allianz</strong>, which helps us inidentifying the performing Regions as well as thoseRegions that are lagging behind. It gives usdetailed information about the number <strong>of</strong> Policiessold and Premium Generated. Also the RegionalHeads are provided with branch-wise figures on afortnightly basis, which again helps them inmonitoring the growth in their Region.How was the issue <strong>of</strong> Policy Issuance integrated inyour systems and procedures?The Bank’s role is confined to providing leads forbusiness. Our dealing staff tries to match theinsurance needs <strong>of</strong> our customers and theBancassurance products available from <strong>Bajaj</strong><strong>Allianz</strong>. The policies are issued by <strong>Bajaj</strong> <strong>Allianz</strong>.Q 3. Are you satisfied with our response time inQ 4. Is adequate training being imparted to your<strong>of</strong>ficials?A 4. The Bank has been imparting training to itsemployees in all aspects <strong>of</strong> Bancassurancebusiness. The Bank is also imparting trainingto improve marketing skills so that theyachieve success in canvassing insurancebusiness. Our Nodal Officers have been givenproduct training. By March 2006, at least 20<strong>of</strong>ficers would be completing the stipulatedIRDA Training and would become Certified<strong>Insurance</strong> Personnel.The Officials <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong> also makepresentations and interact during the BranchHeads Review meets.Q 5. Would you like to give us your suggestionsfor improving the performance under the Tieup?A 5. There is always room for improvement in anygiven situation. For the areas where thebusiness has not picked up, there should bebetter coordination between the BranchManagers and the <strong>of</strong>ficials <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong>.The interaction between Regional Managerswith the <strong>of</strong>ficials <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong> should alsobe held regularly. Through prompt settlement<strong>of</strong> claims, <strong>Bajaj</strong> <strong>Allianz</strong> can demonstrate thatit is an <strong>Insurance</strong> company that is customerfriendly.Such measures will be beneficial forthe Customers, the Bank and <strong>Bajaj</strong> <strong>Allianz</strong>.18<strong>Bajaj</strong> <strong>Allianz</strong>

SPOTLIGHTRajkot Office<strong>Bajaj</strong> <strong>Allianz</strong>'s Rajkot <strong>of</strong>ficegeographically covers the entireSaurashtra region, which istraditionally known to be a verydifficult market! The initial period <strong>of</strong>the <strong>of</strong>fice saw very bleak times - Theoperation was sluggish within 6 months<strong>of</strong> its commencement in early 2002.Fast forward to 2006, and we see thatthe Rajkot <strong>of</strong>fice is in the top 3 <strong>of</strong>fices<strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong>!Newstrack traces this trailblazing<strong>of</strong>fice’s path from imminent failure toits awe inspiring success today.2002- With one Area manager and anIT coordinator, the first year <strong>of</strong>operations saw GWP (Gross writtenpremium) <strong>of</strong> Rs. 2 crores(cr).2003- A new team was brought instarting July 2003 to start turnaroundwork & increase business. Atul Mehta(Area Manager), Kandarp Mankad(Agency Head) and Jatin Jethva (AM -Technical) along with 3 operationsteam members started the drive to buildretail business for the <strong>of</strong>fice in Rajkotand nearby areas. The team couldachieve GWP <strong>of</strong> Rs. 9.56cr against thebudgeted Rs. 4.75cr GWP in 2003-04.2004- Rajkot team started work on‘chase an <strong>of</strong>fice’ concept whichessentially means to set itself a goal <strong>of</strong>surpassing an <strong>of</strong>fice doing morebusiness than itself on a month tomonth basis.2005- The team size grew from 6 to 24with the business growing at more than150% on a YoY(year on year) basis.Today Rajkot team is 32 membersstrong.For 2005-06, Atul & his team setthemselves an aggressive target <strong>of</strong>achieving Rs. 20cr GWP fromPY(previous year) <strong>of</strong> Rs. 9.54cr GWP,in order to capture 15%+ market sharein the region amongst all insurers."As on date the team has clocked Rs.17cr GWP and is on track to surpassthe targeted Rs. 20cr mark as well"said Vaibhav Vyas, the new areamanager. By March 2006, it will be thesingle biggest <strong>of</strong>fice <strong>of</strong> any insurer inthe region.Rajkot <strong>of</strong>fice is the only <strong>of</strong>fice tosuccessfully roll out a cooperativeBancassurance model in Saurashtra. Ithas networked with multiple cooperativebanks to ensure intensiveretail penetration.Rajkot's retail business which accountsto more than 80% in its entire book <strong>of</strong>business is due to the <strong>of</strong>fice'sexceptional service support. Policygeneration is governed by Six Sigmaprocesses and as such TAT (turnaround time) is not more than 1.5 daysfor any document. The team hasdivided work amongst themselves interms <strong>of</strong> area. Each member <strong>of</strong> theMarketing team has a fixed area <strong>of</strong>service under him/ her which he/shevisits. No business relationship isstruck unless processes are setbeforehand. All requisites like policyissuance, claims service, accounting,after sales service, etc. are clearlydivided and each team member has roleclarity.Rajkot <strong>of</strong>fice's success lies in sheerdedication and hard work which theentire team has put in over the past 2years. From being labeled as a "Underperforming <strong>of</strong>fice" in 2003 to featuringin the top 3 <strong>of</strong>fices <strong>of</strong> <strong>Bajaj</strong> <strong>Allianz</strong>today, Rajkot <strong>of</strong>fice has come a longway in terms <strong>of</strong> experience, learningand setting benchmarks in doing retailbusiness.<strong>Allianz</strong> CupSignature Campaign<strong>Allianz</strong> was the title sponsor for the recentIndia-Pakistan Test series. In India, acampaign intended to collect a wealth <strong>of</strong>signatures from the public containingmessages <strong>of</strong> support and good luck, forthe Indian team was initiated by <strong>Bajaj</strong><strong>Allianz</strong> <strong>General</strong> <strong>Insurance</strong>. The signaturecampaign was launched acrossnationwide.The Chief Ministers <strong>of</strong> Gujarat Mr.Narendra Modi (Pic 1) , Ms. VasundhraRaje <strong>of</strong> Rajasthan, Dr Raman Singh <strong>of</strong>Chattisgarh, Mr. Oommen Chandy (Pic 2)<strong>of</strong> Kerala kicked <strong>of</strong>f the campaigns in theirrespective states. Top industrialists likeour Chairman, Mr. Rahul <strong>Bajaj</strong>, Mr.Anjum Bhilakia-MD <strong>of</strong> Micro Ink, Mr.Jawaharlal Oswal <strong>of</strong> Oswal Woolen mills,Mr. Ashok Oswal <strong>of</strong> Vardhman Polytexand Sportsmen like Kapil Dev, AjayJadeja, Parthiv Patel, Milkha Singh, allparticipated in this campaign. In additionto this people from the Chambers <strong>of</strong>Commerce, our clients, Bancassurancechannel partners wholeheartedlyparticipated in the campaign.A similar campaign was carried out by<strong>Allianz</strong> in Pakistan and all the signaturesfrom various cities were woven togetherto be displayed in the stadium on the firstday <strong>of</strong> the first test match. Captains <strong>of</strong> thetwo teams exchanged replicas <strong>of</strong> thesignatures at the time <strong>of</strong> unveiling thetrophy (Pic 3).123Newstrack March 200619

Another Year, Another Milestone.....