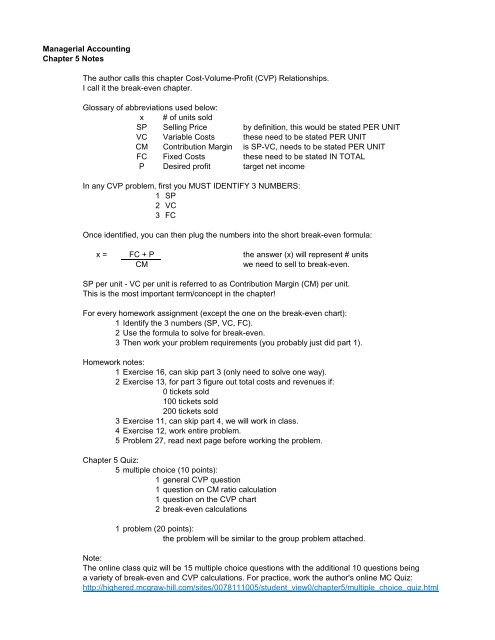

Managerial Accounting Chapter 5 Notes The author calls this ...

Managerial Accounting Chapter 5 Notes The author calls this ...

Managerial Accounting Chapter 5 Notes The author calls this ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

ACCT2203 - <strong>Managerial</strong> <strong>Accounting</strong>Interpretation of the CVP GraphRead <strong>this</strong> before working Problem 5-27Total RevenuesOnly 3 things can move the lines (therefore change break-even)1 Change in SELLING PRICE2 Change in VARIABLE EXPENSES3 Change in FIXED EXPENSESTotal ExpensesTotal Revenue Line - can only change it's SLOPE if change in SELLING PRICE- SLOPE becomes STEEPER if INCREASE in Selling Price per unit- SLOPE becomes FLATTER if DECREASE in Selling Price per unit$$ Total Expense Line - includes BOTH Variable and Fixed ExpensesDollarsCan change SLOPE and also can SHIFT(Sales &Expenses)Can change it's SLOPE if change in VARIABLE EXPENSES- SLOPE becomes STEEPER if INCREASE in Variable Expenses per unit- SLOPE becomes FLATTER if DECREASE in Variable Expenses per unitBreak-even pointCan SHIFT if change in FIXED EXPENSES- Line SHIFTS UPWARD if INCREASE in total Fixed Expenses- Line SHIFTS DOWNWARD if DECREASE in total Fixed Expenses# of Units

<strong>Chapter</strong> 5 Group ProblemMonthly Income Statement (Traditional Format):Sales (4500 units @ $140 per unit) 630,000Less Manufacturing costs:Direct materials 180,000Direct labor (variable) 108,000Variable factory overhead 72,000Fixed factory overhead 20,000Total manufacturing costs (Product costs): 380,000Gross Margin 250,000Less selling and administrative expenses:Variable selling & administrative 36,000Fixed selling & administrative 156,000Total S&A expenses (Period costs): 192,000Net Income 58,000Required:1Compute monthly break-even in units.2Compute net income if sales increase 10% (no change in FC).3What DOLLAR sales per month to earn $50,000?4If we double fixed overhead, can reduce direct labor costsby 50%. What is new break-even in units?

<strong>Chapter</strong> 5 Group ProblemSolutionStep # 1:Find the 3 numbers (SP, VC, FC)Monthly Income Statement (Traditional Format): SP VC FCUnits per unit per unit in totalSales (4500 units @ $140 per unit) 630,000 4,500 140Less Manufacturing costs:Direct materials 180,000 4,500 40Direct labor (variable) 108,000 4,500 24Variable factory overhead 72,000 4,500 16Fixed factory overhead 20,000 20,000Total manufacturing costs (Product costs): 380,000Gross Margin 250,000Less selling and administrative expenses:Variable selling & administrative 36,000 36,000 4,500 8Fixed selling & administrative 156,000 156,000Total S&A expenses (Period costs): 192,000 Totals 140 88 176,000Net Income 58,000 Step #2:Make a good-looking (condensed)contribution format Income Statement.Required: Units per unit TotalSales 4,500 140 630,0001Compute monthly break-even in units. - VC 4,500 88 396,000= CM 4,500 52 234,000- FC 176,000= Net Income 58,0002Compute net income if sales increase 10% (no change in FC). Step #3:Solve the problem1 FC 176,000 3,384.62CM 52 unitsProof: Units per unit TotalSales 3,385 140 473,9003What DOLLAR sales per month to earn $50,000? - VC 3,385 88 297,880= CM 3,385 52 176,020- FC 176,000= Net Income (>0, rounding) 204If we double fixed overhead, can reduce direct labor costsby 50%. What is new break-even in units?2Units per unit TotalSales 4,950 140 693,000- VC 4,950 88 435,600= CM 4,950 52 257,400- FC 176,000= Net Income 81,4003 226,000 4,346.1552 unitsProof: Units per unit TotalSales 4,347 140 608,580- VC 4,347 88 382,536= CM 4,347 52 226,044- FC 176,000= Net Income 50,0444FC increase 20,000VC decrease 12old newFC 176,000 196,000 3,062.50CM 52 64 unitsProof: Units per unit TotalSales 3,063 140 428,820- VC 3,063 76 232,788= CM 3,063 64 196,032- FC 196,000= Net Income 32