BUILDING ON THE PAST, READY FOR THE FUTURE: - MEMC

BUILDING ON THE PAST, READY FOR THE FUTURE: - MEMC

BUILDING ON THE PAST, READY FOR THE FUTURE: - MEMC

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

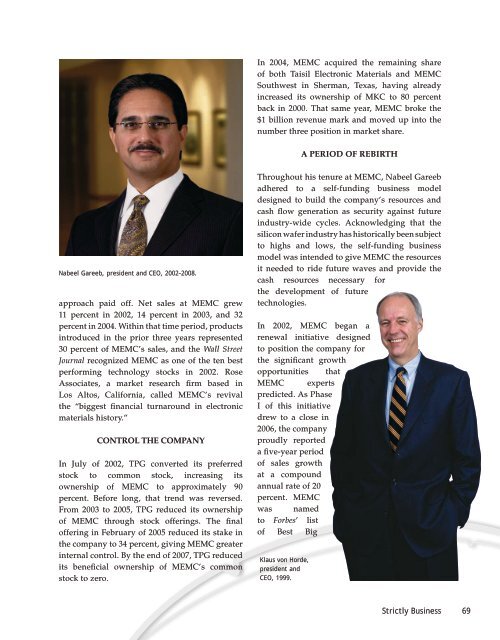

Nabeel Gareeb, president and CEO, 2002–2008.<br />

approach paid off. Net sales at <strong>MEMC</strong> grew<br />

11 percent in 2002, 14 percent in 2003, and 32<br />

percent in 2004. Within that time period, products<br />

introduced in the prior three years represented<br />

30 percent of <strong>MEMC</strong>’s sales, and the Wall Street<br />

Journal recognized <strong>MEMC</strong> as one of the ten best<br />

performing technology stocks in 2002. Rose<br />

Associates, a market research firm based in<br />

Los Altos, California, called <strong>MEMC</strong>’s revival<br />

the “biggest financial turnaround in electronic<br />

materials history.”<br />

Control the CoMPany<br />

In July of 2002, TPG converted its preferred<br />

stock to common stock, increasing its<br />

ownership of <strong>MEMC</strong> to approximately 90<br />

percent. Before long, that trend was reversed.<br />

From 2003 to 2005, TPG reduced its ownership<br />

of <strong>MEMC</strong> through stock offerings. The final<br />

offering in February of 2005 reduced its stake in<br />

the company to 34 percent, giving <strong>MEMC</strong> greater<br />

internal control. By the end of 2007, TPG reduced<br />

its beneficial ownership of <strong>MEMC</strong>’s common<br />

stock to zero.<br />

In 2004, <strong>MEMC</strong> acquired the remaining share<br />

of both Taisil Electronic Materials and <strong>MEMC</strong><br />

Southwest in Sherman, Texas, having already<br />

increased its ownership of MKC to 80 percent<br />

back in 2000. That same year, <strong>MEMC</strong> broke the<br />

$1 billion revenue mark and moved up into the<br />

number three position in market share.<br />

a PerIod oF reBIrth<br />

Throughout his tenure at <strong>MEMC</strong>, Nabeel Gareeb<br />

adhered to a self-funding business model<br />

designed to build the company’s resources and<br />

cash flow generation as security against future<br />

industry-wide cycles. Acknowledging that the<br />

silicon wafer industry has historically been subject<br />

to highs and lows, the self-funding business<br />

model was intended to give <strong>MEMC</strong> the resources<br />

it needed to ride future waves and provide the<br />

cash resources necessary for<br />

the development of future<br />

technologies.<br />

In 2002, <strong>MEMC</strong> began a<br />

renewal initiative designed<br />

to position the company for<br />

the significant growth<br />

opportunities that<br />

<strong>MEMC</strong> experts<br />

predicted. As Phase<br />

I of this initiative<br />

drew to a close in<br />

2006, the company<br />

proudly reported<br />

a five-year period<br />

of sales growth<br />

at a compound<br />

annual rate of 20<br />

percent. <strong>MEMC</strong><br />

was named<br />

to Forbes’ list<br />

of Best Big<br />

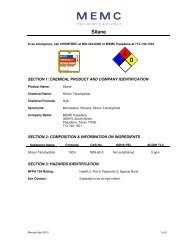

Klaus von Horde,<br />

president and<br />

CEO, 1999.<br />

Strictly Business 69