Managerial Accounting Chapter 2 Notes

Managerial Accounting Chapter 2 Notes

Managerial Accounting Chapter 2 Notes

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

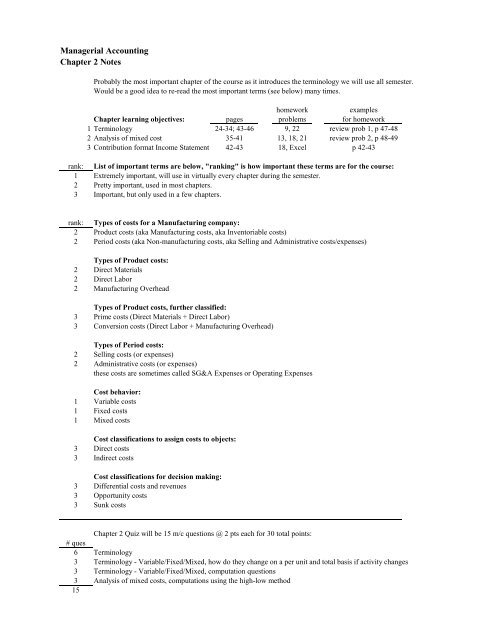

<strong>Managerial</strong> <strong>Accounting</strong><strong>Chapter</strong> 2 <strong>Notes</strong>Probably the most important chapter of the course as it introduces the terminology we will use all semester.Would be a good idea to re-read the most important terms (see below) many times.homeworkexamples<strong>Chapter</strong> learning objectives: pages problems for homework1Terminology 24-34; 43-46 9, 22 review prob 1, p 47-482Analysis of mixed cost 35-41 13, 18, 21 review prob 2, p 48-493Contribution format Income Statement 42-43 18, Excel p 42-43rank: List of important terms are below, "ranking" is how important these terms are for the course:1 Extremely important, will use in virtually every chapter during the semester.2 Pretty important, used in most chapters.3 Important, but only used in a few chapters.rank: Types of costs for a Manufacturing company:2 Product costs (aka Manufacturing costs, aka Inventoriable costs)2 Period costs (aka Non-manufacturing costs, aka Selling and Administrative costs/expenses)Types of Product costs:2 Direct Materials2 Direct Labor2 Manufacturing OverheadTypes of Product costs, further classified:3 Prime costs (Direct Materials + Direct Labor)3 Conversion costs (Direct Labor + Manufacturing Overhead)Types of Period costs:2 Selling costs (or expenses)2 Administrative costs (or expenses)these costs are sometimes called SG&A Expenses or Operating ExpensesCost behavior:1 Variable costs1 Fixed costs1 Mixed costsCost classifications to assign costs to objects:3 Direct costs3 Indirect costsCost classifications for decision making:3 Differential costs and revenues3 Opportunity costs3 Sunk costs<strong>Chapter</strong> 2 Quiz will be 15 m/c questions @ 2 pts each for 30 total points:# ques6 Terminology3 Terminology - Variable/Fixed/Mixed, how do they change on a per unit and total basis if activity changes3 Terminology - Variable/Fixed/Mixed, computation questions3 Analysis of mixed costs, computations using the high-low method15

<strong>Managerial</strong> <strong>Accounting</strong><strong>Chapter</strong> 2 <strong>Notes</strong> (continued, homework notes)HW # req #18 1 Below is the answer to requirement #1, which you need to do parts 2 & 3.How to identify cost behavior:FIXED is easiest - which costs were CONSTANT IN TOTAL each month?VARIABLE is next easiest - which costs were CONSTANT PER UNIT each month?COGS: Cost Units Cost per unitApr $ 168,000 3,000 $ 56.00May $ 210,000 3,750 $ 56.00Jun $ 252,000 4,500 $ 56.00Try to do the math above on the remaining costs (Shipping and Salaries & Commissions)You will find they are neither FIXED or VARIABLE, therefore must be MIXED.Variable Fixed MixedCOGS Advertising ShippingInsuranceSalaries & CommissionsDepreciation2 Using high-low, state the cost formula for ShippingUsing high-low, state the cost formula for Salaries & Commissions3 Re-do Income Statement (June only), similar to Exhibit 2-12 on page 42.Note that the two mixed costs will be split into Variable & Fixed.HW # req #21 1 Activity base 50,000 40,000 60,000 70,000(Machine hrs)March April May JuneUtilities (V) 52,000Supervisory (F) 60,000Maintenance (M) 58,200Total overhead 194,000 170,200 217,800 241,600These are the figures given in the text for Problem 2-21.They have been re-stated to a more understandable form.Step #1:Solve and fill in the 9 missing numbers in the above table.This is NOT done by doing a High-Low.It is completed by understanding Variable (V) and Fixed (F) costs.HINT: Easiest to solve is FIXED (hint: constant IN TOTAL).Next solve for VARIABLE (hint: constant PER UNIT).Last is Mixed. Pretty easy, total = 3 numbers, you now know 2 of them.Completing the 9 missing numbers is Part 1 of the assignment.Then use the completed table to answer Parts 2,3,4 in the text.