FORM 20-F/A Brookfield Property Partners L.P. - Brookfield Asset ...

FORM 20-F/A Brookfield Property Partners L.P. - Brookfield Asset ...

FORM 20-F/A Brookfield Property Partners L.P. - Brookfield Asset ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

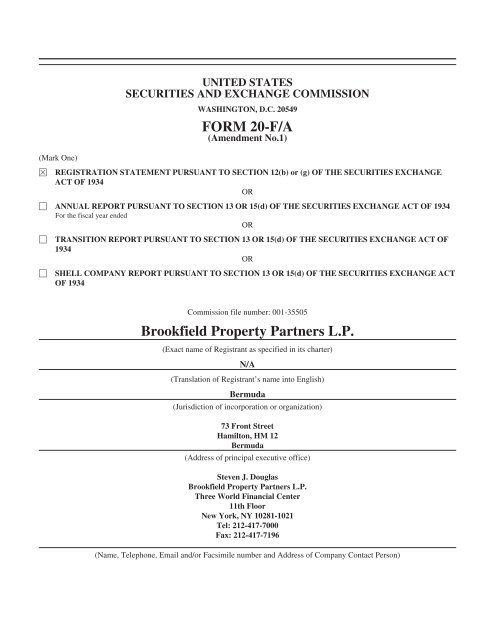

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWASHINGTON, D.C. <strong>20</strong>549<strong>FORM</strong> <strong>20</strong>-F/A(Amendment No.1)(Mark One)ÈREGISTRATION STATEMENT PURSUANT TO SECTION 12(b) or (g) OF THE SECURITIES EXCHANGEACT OF 1934OR‘ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934For the fiscal year endedOR‘ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF1934OR‘ SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACTOF 1934Commission file number: 001-35505<strong>Brookfield</strong> <strong>Property</strong> <strong>Partners</strong> L.P.(Exact name of Registrant as specified in its charter)N/A(Translation of Registrant’s name into English)Bermuda(Jurisdiction of incorporation or organization)73 Front StreetHamilton, HM 12Bermuda(Address of principal executive office)Steven J. Douglas<strong>Brookfield</strong> <strong>Property</strong> <strong>Partners</strong> L.P.Three World Financial Center11th FloorNew York, NY 10281-1021Tel: 212-417-7000Fax: 212-417-7196(Name, Telephone, Email and/or Facsimile number and Address of Company Contact Person)

Copy to:Mile T. KurtaTorys LLP1114 Avenue of the Americas, 23rd FloorNew York, New York 10036-7703(212) 880-6000Securities registered or to be registered pursuant to Section 12(b) of the Act.Title of each classLimited <strong>Partners</strong>hip UnitsName of each exchange on which registeredNew York Stock ExchangeSecurities registered or to be registered pursuant to Section 12(g) of the Act.NoneSecurities for which there is a reporting obligation pursuant to Section 15(d) of the Act.NoneIndicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the periodcovered by the annual report.N/AIndicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.Yes ‘No ÈIf this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant toSection 13 or 15(d) of the Securities Exchange Act of 1934.Yes ‘ No ‘Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of theSecurities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required tofile such reports), and (2) has been subject to such filing requirements for the past 90 days.Yes ‘No ÈIndicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, everyInteractive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter)during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).Yes ‘ No ‘Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. Seedefinition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):Large accelerated filer ‘ Accelerated filer ‘ Non-accelerated filer ÈIndicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in thisfiling:U.S. GAAP ‘International Financial Reporting Standards asissued by the International Accounting Standards BoardÈ Other ‘If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item theregistrant has elected to follow.Item 17 ‘ Item 18 ‘If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of theExchange Act).Yes ‘ No ‘

TABLE OF CONTENTSINTRODUCTION AND USE OF CERTAIN TERMS ......................................... 1SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS ......................... 4PART I .............................................................................. 6ITEM 1. IDENTITY OF DIRECTORS, SENIOR MANAGEMENT ANDADVISERS .................................................... 61.A. DIRECTORS AND SENIOR MANAGEMENT ......................... 61.B. ADVISERS ...................................................... 61.C. AUDITORS ..................................................... 6ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE .................. 6ITEM 3. KEY IN<strong>FORM</strong>ATION ............................................. 63.A. SELECTED FINANCIAL DATA .................................... 63.B. CAPITALIZATION AND INDEBTEDNESS ........................... 73.C. REASONS FOR THE OFFER AND USE OF PROCEEDS ................ 73.D. RISK FACTORS ................................................. 7ITEM 4. IN<strong>FORM</strong>ATION ON THE COMPANY ............................... 364.A. HISTORY AND DEVELOPMENT OF THE COMPANY ................. 364.B. BUSINESS OVERVIEW ........................................... 394.C. ORGANIZATIONAL STRUCTURE ................................. 604.D. PROPERTY, PLANTS AND EQUIPMENT ............................ 65ITEM 5. OPERATING AND FINANCIAL REVIEW AND PROSPECTS ........... 655.A. OPERATING RESULTS ........................................... 655.B. LIQUIDITY AND CAPITAL RESOURCES ........................... 1125.C. RESEARCH AND DEVELOPMENT, PATENTS AND LICENSES, ETC. . . . 1145.D. TREND IN<strong>FORM</strong>ATION .......................................... 1145.E. OFF-BALANCE SHEET ARRANGEMENTS .......................... 1155.F. TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS ......... 115ITEM 6. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEES ............ 1156.A. DIRECTORS AND SENIOR MANAGEMENT ......................... 1156.B. COMPENSATION ................................................ 1176.C. BOARD PRACTICES ............................................. 1176.D. EMPLOYEES .................................................... 1216.E. SHARE OWNERSHIP ............................................. 121ITEM 7. MAJOR SHAREHOLDERS AND RELATED PARTY TRANSACTIONS . . . 1227.A. MAJOR SHAREHOLDERS ........................................ 1227.B. RELATED PARTY TRANSACTIONS ................................ 1237.C. INTERESTS OF EXPERTS AND COUNSEL .......................... 135ITEM 8. FINANCIAL IN<strong>FORM</strong>ATION ...................................... 1358.A. CONSOLIDATED STATEMENTS AND OTHER FINANCIALIN<strong>FORM</strong>ATION ............................................... 1358.B. SIGNIFICANT CHANGES ......................................... 135ITEM 9. THE OFFER AND LISTING ........................................ 1359.A. OFFER AND LISTING DETAILS ................................... 1359.B. PLAN OF DISTRIBUTION ......................................... 1359.C. MARKETS ...................................................... 1359.D. SELLING SHAREHOLDERS ....................................... 1359.E. DILUTION ...................................................... 135-i-Page

TABLE OF CONTENTS(continued)Page9.F. EXPENSES OF THE ISSUE ........................................ 136ITEM 10. ADDITIONAL IN<strong>FORM</strong>ATION ..................................... 13610.A. SHARE CAPITAL ................................................ 13610.B. MEMORANDUM AND ARTICLES OF ASSOCIATION ................. 13610.C. MATERIAL CONTRACTS ......................................... 15910.D. EXCHANGE CONTROLS ......................................... 16010.E. TAXATION ..................................................... 16010.F. DIVIDENDS AND PAYING AGENTS ............................... 18610.G. STATEMENT BY EXPERTS ....................................... 18910.H. DOCUMENTS ON DISPLAY ....................................... 18910.I. SUBSIDIARY IN<strong>FORM</strong>ATION ..................................... 189ITEM 11. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKETRISK ........................................................... 190ITEM 12. DESCRIPTION OF SECURITIES OTHER THAN EQUITY SECURITIES . . . 19012.A. DEBT SECURITIES .............................................. 19012.B. WARRANTS AND RIGHTS ........................................ 19012.C. OTHER SECURITIES ............................................. 19012.D. AMERICAN DEPOSITARY SHARES ................................ 190PART II .............................................................................. 191ITEM 13. DEFAULTS, DIVIDEND ARREARAGES AND DELINQUENCIES ........ 191ITEM 14. MATERIAL MODIFICATIONS TO THE RIGHTS OF SECURITYHOLDERS AND USE OF PROCEEDS ............................... 191ITEM 15. CONTROLS AND PROCEDURES ................................... 191ITEM 16. [RESERVED] .................................................... 19116.A. AUDIT COMMITTEE FINANCIAL EXPERTS ........................ 19116.B. CODE OF ETHICS ............................................... 19116.C. PRINCIPAL ACCOUNTANT FEES AND SERVICES ................... 19116.D. EXEMPTIONS FROM THE LISTING STANDARDS FOR AUDIT16.E.COMMITTEES .................................................. 191PURCHASES OF EQUITY SECURITIES BY THE ISSUER ANDAFFILIATED PURCHASERS ....................................... 19116.F. CHANGE IN REGISTRANT’S CERTIFYING ACCOUNTANT ........... 19116.G. CORPORATE GOVERNANCE ..................................... 19116.H MINING SAFETY DISCLOSURE ................................... 191PART III ............................................................................. 192ITEM 17. FINANCIAL STATEMENTS ....................................... 192ITEM 18. FINANCIAL STATEMENTS ....................................... 192ITEM 19. EXHIBITS ...................................................... 192SIGNATURES ........................................................................ 193INDEX TO FINANCIAL STATEMENTS .................................................. F-1UNAUDITED PRO <strong>FORM</strong>A FINANCIALSTATEMENTS OF BROOKFIELD PROPERTY PARTNERS L.P. .......................PF-1-ii-

INTRODUCTION AND USE OF CERTAIN TERMSWe have prepared this Form <strong>20</strong>-F using a number of conventions, which you should consider whenreading the information contained herein. Unless otherwise indicated or the context otherwise requires, in thisForm <strong>20</strong>-F:• the disclosure assumes that the spin-off has been completed;• operating and other statistical information with respect to our portfolio is presented as of March 31,<strong>20</strong>12, as if we owned our portfolio as of such date although we will not acquire the commercialproperty operations of <strong>Brookfield</strong> <strong>Asset</strong> Management until shortly before the spin-off;• all operating and other statistical information is presented as if we own 100% of each property inour portfolio, regardless of whether we own all of the interests in each property, but unlessotherwise specified excludes interests in <strong>Brookfield</strong>-sponsored real estate opportunity and financefunds and our interest in Canary Wharf Group plc, or Canary Wharf;• all financial information is presented in accordance with International Financial ReportingStandards as issued by the International Accounting Standards Board, or IFRS, other than certainnon-IFRS financial measures which are defined under “Use of Non-IFRS Measures”; and• the disclosure on <strong>Brookfield</strong> <strong>Asset</strong> Management’s ownership in our business following the spin-offdoes not reflect the nominal amount of our units that <strong>Brookfield</strong> <strong>Asset</strong> Management will withholdin connection with the satisfaction of Canadian federal and U.S. “backup” withholding taxrequirements for non-Canadian registered shareholders.In this Form <strong>20</strong>-F, unless the context suggests otherwise, references to “we”, “us” and “our” are to ourcompany, the <strong>Property</strong> <strong>Partners</strong>hip, the Holding Entities and the operating entities, each as defined below, takentogether. Unless the context suggests otherwise, in this Form <strong>20</strong>-F references to:• an “affiliate” of any person are to any other person that, directly or indirectly through one or moreintermediaries, controls, is controlled by or is under common control with such person;• “assets under management” are to assets managed by us or by <strong>Brookfield</strong> on behalf of our thirdparty investors, as well as our own assets, and also include capital commitments that have not yetbeen drawn. Our calculation of assets under management may differ from that employed by otherasset managers and, as a result, this measure may not be comparable to similar measures presentedby other asset managers;• “Australia” are to Australia and New Zealand;• the “BPY General Partner” are to the general partner of our company, which prior to the spin-offwill be 1648285 Alberta ULC, a wholly-owned subsidiary of <strong>Brookfield</strong> <strong>Asset</strong> Management, andfollowing completion of the spin-off will be <strong>Brookfield</strong> <strong>Property</strong> <strong>Partners</strong> Limited, a wholly-ownedsubsidiary of <strong>Brookfield</strong> <strong>Asset</strong> Management;• “<strong>Brookfield</strong>” are to <strong>Brookfield</strong> <strong>Asset</strong> Management and any subsidiary of <strong>Brookfield</strong> <strong>Asset</strong>Management, other than us;• “<strong>Brookfield</strong> <strong>Asset</strong> Management” are to <strong>Brookfield</strong> <strong>Asset</strong> Management Inc.;• “our business” are to our business of owning, operating and investing in commercial property, bothdirectly and through our operating entities;• “our company” or “our partnership” are to <strong>Brookfield</strong> <strong>Property</strong> <strong>Partners</strong> L.P., a Bermuda exemptedlimited partnership;• “commercial property” or “commercial properties” are to commercial and other real property whichgenerates or has the potential to generate income, including office, retail, multi-family andindustrial assets, but does not include, among other things, residential land development, homebuilding, construction, real estate advisory and other similar operations or services;1

• “Holding Entities” are to the direct subsidiaries of the <strong>Property</strong> <strong>Partners</strong>hip, from time to time,through which it indirectly holds all of our interests in our operating entities;• “our limited partnership agreement” are to the amended and restated limited partnership agreementof our company to be entered into on or about the date of the spin-off;• the “Managers” are to the affiliates of <strong>Brookfield</strong> that provide services to us pursuant to our MasterServices Agreement, which are expected to be <strong>Brookfield</strong> <strong>Asset</strong> Management (Barbados) Inc.,BGRE <strong>Partners</strong> LP, <strong>Brookfield</strong> Developments Europe Ltd. and <strong>Brookfield</strong> Global Real Estate LLC,which are subsidiaries of <strong>Brookfield</strong> <strong>Asset</strong> Management, and unless the context otherwise requires,include any other affiliate of <strong>Brookfield</strong> that is appointed by the Managers from time to time to actas a Manager pursuant to our Master Services Agreement;• “Master Services Agreement” are to the master services agreement among the Service Recipients,the Managers, and certain other subsidiaries of <strong>Brookfield</strong> <strong>Asset</strong> Management who are partiesthereto;• “operating entities” are to the entities in which the Holding Entities hold interests and that directlyor indirectly hold our real estate assets other than entities in which the Holding Entities holdinterests for investment purposes only of less than 5% of the equity securities;• “our portfolio” are to the commercial property assets in our office, retail, multi-family andindustrial and opportunistic investment platforms, as applicable;• the “<strong>Property</strong> General Partner” are to the general partner of the <strong>Property</strong> GP LP, which prior to thespin-off will be 1648287 Alberta ULC, a wholly-owned subsidiary of <strong>Brookfield</strong> <strong>Asset</strong>Management, and following completion of the spin-off will be <strong>Brookfield</strong> <strong>Property</strong> General PartnerLimited, a wholly-owned subsidiary of <strong>Brookfield</strong> <strong>Asset</strong> Management;• the “<strong>Property</strong> GP LP” are to <strong>Brookfield</strong> <strong>Property</strong> GP L.P., a wholly-owned subsidiary of <strong>Brookfield</strong><strong>Asset</strong> Management, which serves as the general partner of the <strong>Property</strong> <strong>Partners</strong>hip;• the “<strong>Property</strong> <strong>Partners</strong>hip” are to <strong>Brookfield</strong> <strong>Property</strong> L.P.;• the “Redemption-Exchange Mechanism” are to the mechanism by which <strong>Brookfield</strong> may requestredemption of its Redemption-Exchange Units in whole or in part in exchange for cash, subject tothe right of our company to acquire such interests (in lieu of such redemption) in exchange for unitsof our company, as more fully described in Item 10.B. “Additional Information — Memorandumand Articles of Association — Description of the <strong>Property</strong> <strong>Partners</strong>hip Limited <strong>Partners</strong>hipAgreement — Redemption-Exchange Mechanism”;• the “Redemption-Exchange Units” are to the non-voting limited partnership interests in the<strong>Property</strong> <strong>Partners</strong>hip with a right of redemption or exchange pursuant to the Redemption-ExchangeMechanism;• “Service Recipients” are to our company, the <strong>Property</strong> <strong>Partners</strong>hip, the Holding Entities and, at theoption of the Holding Entities, any wholly-owned subsidiary of a Holding Entity excluding anyoperating entity;• “spin-off” are to the special dividend of our units by <strong>Brookfield</strong> <strong>Asset</strong> Management as describedunder Item 4.A. “Information on the Company — History and Development of the Company —The Spin-Off”; and• “our units” and “units of our company” are to the non-voting limited partnership units in ourcompany and references to “our unitholders” and “our limited partners” are to the holders of ourunits.2

Historical Performance and Market DataThis Form <strong>20</strong>-F contains information relating to our business as well as historical performance andmarket data for <strong>Brookfield</strong> <strong>Asset</strong> Management and certain of its operating platforms. When considering this data,you should bear in mind that historical results and market data may not be indicative of the future results that youshould expect from us.Financial InformationThe financial information contained in this Form <strong>20</strong>-F is presented in U.S. Dollars and, unless otherwiseindicated, has been prepared in accordance with IFRS. All figures are unaudited unless otherwise indicated. Inthis Form <strong>20</strong>-F, all references to “$” are to U.S. Dollars. Canadian Dollars, Australian Dollars, New ZealandDollars, British Pounds, Euros and Brazilian Reais are identified as “C$”, “A$”, “NZ$”, “£”, “€” and “R$”,respectively.Use of Non-IFRS MeasuresIn addition to results reported in accordance with IFRS, we use certain non-IFRS financial measures, suchas property net operating income (“NOI”), funds from operations (“FFO”) and total return (“Total Return”) toevaluate our performance and to determine the net asset values of our business. These terms do not have standardmeanings prescribed by IFRS and therefore may not be comparable to similar measures presented by othercompanies. NOI, FFO and Total Return should not be regarded as alternatives to other financial reportingmeasures prepared in accordance with IFRS and should not be considered in isolation or as substitutes formeasures prepared in accordance with IFRS.We define NOI as revenues from operations of consolidated properties less direct operating costs, whichinclude all expenses attributable to the commercial property operations, such as property maintenance, utilities,insurance, realty taxes and property administration costs, and exclude interest expense, depreciation andamortization, income taxes, fair value gains (losses) and general and administrative expenses that do not relatedirectly to operations of a commercial property. NOI is used as a key indicator of performance as it represents ameasure over which management has a certain degree of control. We evaluate the performance of our officesegment by evaluating NOI from “Existing properties”, or “same store” basis, and NOI from “Additions,dispositions and other” due to, among other things, the consolidation of the U.S. Office Fund during the period asdiscussed in Item 5.A. “Operating and Financial Review and Prospects — Operating Results — Overview of OurBusiness”. NOI from existing properties compares the performance of the property portfolio by excluding theeffect of current and prior period dispositions and acquisitions, including developments, and “one-time items ”,which for the historical periods presented consists primarily of lease termination income. NOI presented within“Additions, dispositions and other” includes the results of current and prior period acquired, developed and soldproperties, as well as the one-time items excluded from the “Existing properties” portion of NOI. We do notevaluate the performance of the operating results of the retail segment on a similar basis as the majority of ourinvestments in the retail segment are accounted for under the equity method and, as a result, are not included inNOI. Similarly, we do not evaluate the operating results of our other segments on a same store basis based on thenature of the investments as the variances between same store and total NOI are not material. For a reconciliationof NOI to IFRS measures, see Item 5.A. “Operating and Financial Review and Prospects — Operating Results —Reconciliation of Performance Measures to IFRS Measures”.Our definition of FFO includes all of the adjustments that are outlined in the National Association of RealEstate Investment Trusts, or NAREIT, definition of funds from operations, including the exclusion of gains (orlosses) from the sale of real estate property, the add back of any depreciation and amortization related to realestate assets and the adjustment for unconsolidated partnerships and joint ventures. In addition to the adjustmentsprescribed by NAREIT, we also exclude any unrealized fair value gains (or losses) that arise as a result of3

eporting under IFRS, certain other non cash items, if any, and income taxes that arise as certain of oursubsidiaries are structured as corporations as opposed to real estate investment trusts, or REITs. Because FFOexcludes fair value gains (losses) (including equity accounted fair value gains (losses)), realized gains (losses)and income tax expense (benefits), it provides a performance measure that, when compared year over year,reflects the impact to operations from trends in occupancy rates, rental rates, operating costs and interest costs,providing perspective not immediately apparent from net income. For a reconciliation of FFO to net income, seeItem 5.A. “Operating and Financial Review and Prospects — Reconciliation of Performance Measures to IFRSMeasures”. We reconcile FFO to net income attributable to <strong>Brookfield</strong> rather than cash flow from operatingactivities as we believe net income is the most comparable measure.We define Total Return as income before income tax expense (benefit) and the related non-controllinginterests. Total Return is used as a key indicator of performance as we believe that our performance is bestassessed by considering FFO plus the increase or decrease in the value of our assets over a period of timebecause that is the basis on which we make investment decisions and operate our business. For reconciliations ofNOI, FFO and Total Return to IFRS measures, see Item 5.A. “Operating and Financial Review and Prospects —Operating Results — Reconciliation of Performance Measures to IFRS Measures”.We urge you to review the IFRS financial measures in this Form <strong>20</strong>-F, including the financial statements,the notes thereto, our pro forma financial statements and the other financial information contained herein, and notto rely on any single financial measure to evaluate our company.SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTSThis Form <strong>20</strong>-F contains certain forward-looking statements. Forward-looking statements relate toexpectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressionsconcerning matters that are not historical facts. Forward-looking statements in this Form <strong>20</strong>-F include statementsregarding the anticipated benefits of the spin-off, the quality of our assets, our anticipated financial performance,our company’s future growth prospects, our ability to make distributions and the amount of such distributions,the listing and liquidity of our units and our company’s access to capital. In some cases, you can identifyforward-looking statements by terms such as “anticipate”, “believe”, “could”, “estimate”, “expect”, “intend”,“may”, “plan”, “potential”, “should”, “will” and “would” or the negative of those terms or other comparableterminology.The forward-looking statements are based on our beliefs, assumptions and expectations of our futureperformance, taking into account all information currently available to us. These beliefs, assumptions andexpectations can change as a result of many possible events or factors, not all of which are known to us or withinour control. If a change occurs, our business, financial condition, liquidity and results of operations may varymaterially from those expressed in our forward-looking statements. The following factors, among others, couldcause our actual results to vary from our forward-looking statements:• changes in the general economy;• the cyclical nature of the real estate industry;• actions of competitors;• failure to attract new tenants and enter into renewal or new leases with tenants on favorable terms;• our ability to derive fully anticipated benefits from future or existing acquisitions, joint ventures,investments or dispositions;• actions or potential actions that could be taken by our co-venturers, partners, fund investors orco-tenants;• the bankruptcy, insolvency, credit deterioration or other default of our tenants;• actions or potential actions that could be taken by <strong>Brookfield</strong>;4

• the departure of some or all of <strong>Brookfield</strong>’s key professionals;• the threat of litigation;• changes to legislation and regulations;• possible environmental liabilities and other possible liabilities;• our ability to obtain adequate insurance at commercially reasonable rates;• our financial condition and liquidity;• downgrading of credit ratings and adverse conditions in the credit markets;• changes in financial markets, foreign currency exchange rates, interest rates or political conditions;• the general volatility of the capital markets and the market price of our units; and• other factors described in this Form <strong>20</strong>-F, including those set forth under Item 3.D. “KeyInformation — Risk Factors”, Item 5. “Operating and Financial Review and Prospects” andItem 4.B. “Information on the Company — Business Overview”.Except as required by applicable law, we undertake no obligation to update or revise publicly any forwardlookingstatements, whether as a result of new information, future events or otherwise. We qualify any and all ofour forward-looking statements by these cautionary factors. Please keep this cautionary note in mind as you readthis Form <strong>20</strong>-F.5

PART IITEM 1.IDENTITY OF DIRECTORS, SENIOR MANAGEMENT AND ADVISERS1.A. DIRECTORS AND SENIOR MANAGEMENTFor information regarding our directors and senior management, see Item 6.A. “Directors, SeniorManagement and Employees — Directors and Senior Management”.1.B. ADVISERSOur U.S. and Canadian legal counsel is Torys LLP, 1114 Avenue of the Americas, 23 rd Floor, New York,New York 10036. Our Bermuda legal counsel is Appleby, Canon’s Court, 22 Victoria Street, PO Box HM 1179,Hamilton, Bermuda.1.C. AUDITORSThe BPY General Partner has retained Deloitte & Touche LLP to act as our company’s independentregistered chartered accountants. The address for Deloitte & Touche LLP is <strong>Brookfield</strong> Place, 181 Bay Street,Suite 1400, Toronto, Ontario, M5J 2V1.ITEM 2.OFFER STATISTICS AND EXPECTED TIMETABLENot applicable.ITEM 3.KEY IN<strong>FORM</strong>ATION3.A. SELECTED FINANCIAL DATAThe following tables present selected financial data for <strong>Brookfield</strong>’s commercial property operations thatwill be contributed to us prior to the spin-off. The information in this section is derived from, and should be readin conjunction with, the carve-out financial statements of <strong>Brookfield</strong>’s commercial property operations as atMarch 31, <strong>20</strong>12, and for the three months ended March 31, <strong>20</strong>12 and <strong>20</strong>11, and the notes thereto, and as atDecember 31, <strong>20</strong>11 and <strong>20</strong>10, and for the years ended December 31, <strong>20</strong>11, <strong>20</strong>10 and <strong>20</strong>09, and the notes thereto,each of which is included elsewhere in this Form <strong>20</strong>-F. The information in this section should also be read inconjunction with our unaudited pro forma financial statements (“Unaudited Pro Forma Financial Statements”) asat March 31, <strong>20</strong>12 and for the three months ended March 31, <strong>20</strong>12 and for the year ended December 31, <strong>20</strong>11,included elsewhere in this Form <strong>20</strong>-F.(US$ Millions) Three months ended March 31, <strong>20</strong>12 <strong>20</strong>11Total revenue $ 775 $ 603Net income 710 532Net income attributable to parent company 383 337FFO (1) 141 136(US$ Millions) Years ended December 31, <strong>20</strong>11 <strong>20</strong>10 <strong>20</strong>09Total revenue $ 2,8<strong>20</strong> $ 2,270 $ 1,999Net income (loss) 3,745 2,109 (734)Net income (loss) attributable to parent company 2,323 1,026 (477)FFO (1) 576 426 3916

(US$ Millions) Mar. 31, <strong>20</strong>12 Dec. 31, <strong>20</strong>11 Dec. 31, <strong>20</strong>10Investment properties $ 28,138 $ 27,594 $ <strong>20</strong>,960Equity accounted investments 7,466 6,888 4,402Total assets 41,049 40,317 30,567<strong>Property</strong> debt 15,266 15,387 11,964Total equity 22,599 21,494 15,144Equity in net assets attributable to parent company 12,575 11,881 7,464(1) FFO is a non-IFRS financial measure. See Item 5.A. “Operations and Financial Review and Prospects – Reconciliation of PerformanceMeasures to IFRS Measures”.3.B. CAPITALIZATION AND INDEBTEDNESSThe following table sets forth our company’s pro forma capitalization and indebtedness as at the datesindicated below on an actual basis and as adjusted to give effect to the spin-off as well as the other transactionsreferred to in the Unaudited Pro Forma Financial Statements included elsewhere in this Form <strong>20</strong>-F, as thoughthey had occurred on March 31, <strong>20</strong>12.This information should be read in conjunction with Item 5.A. “Operating and Financial Review andProspects — Operating Results” and Item 5.B. “Operating and Financial Review and Prospects — Liquidity andCapital Resources” and the Unaudited Pro Forma Financial Statements included elsewhere in this Form <strong>20</strong>-F.As at March 31, <strong>20</strong>12(US$ Millions) Actual (1) Pro FormaTotal <strong>Asset</strong>s – $ 40,297Debt<strong>Property</strong> debt – 14,627Capital securities – 1,612Total Debt – 16,239Other liabilities – 2,421Total Liabilities – 18,660Equity<strong>Partners</strong>hip equity – 11,615Non-controlling interests – 10,022Total Equity – 21,637Debt to total capitalization (total debt / total assets) – 40%(1) Balance sheet of our company as at May 31, <strong>20</strong>12, which includes partnership equity of $0.001 million which is not presented due torounding.3.C. REASONS FOR THE OFFER AND USE OF PROCEEDSNot applicable.3.D. RISK FACTORSYour holding of units of our company will involve substantial risks. You should carefully consider thefollowing factors in addition to the other information set forth in this Form <strong>20</strong>-F. If any of the following risksactually occur, our business, financial condition and results of operations and the value of your units wouldlikely suffer.7

Risks Relating to Us and Our CompanyOur company is a newly formed partnership with no separate operating history and the historical and proforma financial information included herein does not reflect the financial condition or operating results wewould have achieved during the periods presented, and therefore may not be a reliable indicator of our futurefinancial performance.Our company was formed on January 3, <strong>20</strong>12 and has only recently commenced its activities and has notgenerated any significant net income to date. Our lack of operating history will make it difficult to assess ourability to operate profitably and make distributions to unitholders. Although some of our assets and operationshave been under <strong>Brookfield</strong>’s control prior to the formation of our company, their combined results have notpreviously been reported on a stand-alone basis and the historical and pro forma financial statements included inthis Form <strong>20</strong>-F may not be indicative of our future financial condition or operating results. We urge you tocarefully consider the basis on which the historical and pro forma financial information included herein wasprepared and presented.Our company relies on the <strong>Property</strong> <strong>Partners</strong>hip and, indirectly, the Holding Entities and our operatingentities to provide us with the funds necessary to pay distributions and meet our financial obligations.Our company’s sole direct investment is its limited partnership interest in the <strong>Property</strong> <strong>Partners</strong>hip, whichowns all of the common shares or equity interests, as applicable, of the Holding Entities, through which we holdall of our interests in the operating entities. Our company has no independent means of generating revenue. As aresult, we depend on distributions and other payments from the <strong>Property</strong> <strong>Partners</strong>hip and, indirectly, the HoldingEntities and our operating entities to provide us with the funds necessary to pay distributions on our units and tomeet our financial obligations. The <strong>Property</strong> <strong>Partners</strong>hip, the Holding Entities and our operating entities arelegally distinct from our company and they will generally be required to service their debt obligations beforemaking distributions to us or their parent entity, as applicable, thereby reducing the amount of our cash flowavailable to pay distributions on our units, fund working capital and satisfy other needs. Any other entitiesthrough which we may conduct operations in the future will also be legally distinct from our company and maybe restricted in their ability to pay dividends and distributions or otherwise make funds available to our companyunder certain conditions.We anticipate that the only distributions our company will receive in respect of our limited partnershipinterests in the <strong>Property</strong> <strong>Partners</strong>hip will consist of amounts that are intended to assist our company in makingdistributions to our unitholders in accordance with our company’s distribution policy and to allow our companyto pay expenses as they become due.We are subject to foreign currency risk and our risk management activities may adversely affect theperformance of our operations.Some of our assets and operations are in countries where the U.S. Dollar is not the functional currency.These operations pay distributions in currencies other than the U.S. Dollar which we must convert to U.S. Dollarsprior to making distributions on our units. A significant depreciation in the value of such foreign currencies mayhave a material adverse effect on our business, financial condition and results of operations.When managing our exposure to such market risks, we may use forward contracts, options, swaps, caps,collars and floors or pursue other strategies or use other forms of derivative instruments. The success of anyhedging or other derivative transactions that we enter into generally will depend on our ability to structurecontracts that appropriately offset our risk position. As a result, while we may enter into such transactions inorder to reduce our exposure to market risks, unanticipated market changes may result in poorer overallinvestment performance than if the transaction had not been executed. Such transactions may also limit theopportunity for gain if the value of a hedged position increases.8

Our company is not, and does not intend to become, regulated as an investment company under the U.S.Investment Company Act of 1940 (and similar legislation in other jurisdictions) and if our company weredeemed an “investment company” under the U.S. Investment Company Act of 1940, applicable restrictionswould make it impractical for us to operate as contemplated.The U.S. Investment Company Act of 1940 and the rules thereunder (and similar legislation in otherjurisdictions) provide certain protections to investors and impose certain restrictions on companies that areregistered as investment companies. Among other things, such rules limit or prohibit transactions with affiliates,impose limitations on the issuance of debt and equity securities and impose certain governance requirements. Ourcompany has not been and does not intend to become regulated as an investment company and our companyintends to conduct its activities so it will not be deemed to be an investment company under the U.S. InvestmentCompany Act of 1940 (and similar legislation in other jurisdictions). In order to ensure that our company is notdeemed to be an investment company, we may be required to materially restrict or limit the scope of ouroperations or plans, we will be limited in the types of acquisitions that we may make and we may need to modifyour organizational structure or dispose of assets that we would not otherwise dispose of. Moreover, if anythingwere to happen which would potentially cause our company to be deemed an investment company under the U.S.Investment Company Act of 1940, it would be impractical for us to operate as intended, agreements andarrangements between and among us and <strong>Brookfield</strong> would be impaired and our business, financial condition andresults of operations would be materially adversely affected. Accordingly, we would be required to takeextraordinary steps to address the situation, such as the amendment or termination of our Master ServicesAgreement, the restructuring of our company and the Holding Entities, the amendment of our limited partnershipagreement or the termination of our company, any of which would materially adversely affect the value of ourunits. In addition, if our company were deemed to be an investment company under the U.S. InvestmentCompany Act of 1940, it would be taxable as a corporation for U.S. federal income tax purposes, and suchtreatment would materially adversely affect the value of our units. See Item 10.E. “Additional Information —Taxation — U.S. Tax Considerations — <strong>Partners</strong>hip Status of Our Company and the <strong>Property</strong> <strong>Partners</strong>hip”.Our company is a “foreign private issuer” under U.S. securities laws and as a result is subject to disclosureobligations different from requirements applicable to U.S. domestic registrants listed on the New York StockExchange, or NYSE.Although our company is subject to the periodic reporting requirement of the U.S. Securities ExchangeAct, as amended, or the Exchange Act, the periodic disclosure required of foreign private issuers under theExchange Act is different from periodic disclosure required of U.S. domestic registrants. Therefore, there may beless publicly available information about us than is regularly published by or about other public companies in theUnited States and our company is exempt from certain other sections of the Exchange Act that U.S. domesticregistrants would otherwise be subject to, including the requirement to provide our unitholders with informationstatements or proxy statements that comply with the Exchange Act. In addition, insiders and large unitholders ofour company will not be obligated to file reports under Section 16 of the Exchange Act and certain of thegovernance rules imposed by the NYSE will be inapplicable to our company.Our company is expected to be an “SEC foreign issuer” under Canadian securities regulations and exemptfrom certain requirements of Canadian securities laws.Although our company will become a reporting issuer in Canada, we expect it will be an “SEC foreignissuer” and exempt from certain Canadian securities laws relating to continuous disclosure obligations and proxysolicitation if our company complies with certain reporting requirements applicable in the United States,provided that the relevant documents filed with the U.S. Securities and Exchange Commission, or the SEC, arefiled in Canada and sent to our company’s unitholders in Canada to the extent and in the manner and within thetime required by applicable U.S. requirements. Therefore, there may be less publicly available information inCanada about us than is regularly published by or about other reporting issuers in Canada.9

Risks Relating to Our BusinessOur economic performance and the value of our assets are subject to the risks incidental to the ownership andoperation of real estate assets.Our economic performance, the value of our assets and, therefore, the value of our units are subject to therisks normally associated with the ownership and operation of real estate assets, including but not limited to:• downturns and trends in the national, regional and local economic conditions where our propertiesand other assets are located;• the cyclical nature of the real estate industry;• local real estate market conditions, such as an oversupply of commercial properties, includingspace available by sublease, or a reduction in demand for such properties;• changes in interest rates and the availability of financing;• competition from other properties;• changes in market rental rates and our ability to rent space on favorable terms;• the bankruptcy, insolvency, credit deterioration or other default of our tenants;• the need to periodically renovate, repair and re-lease space and the costs thereof;• increases in maintenance, insurance and operating costs;• civil disturbances, earthquakes and other natural disasters, or terrorist acts or acts of war which mayresult in uninsured or underinsured losses;• the decrease in the attractiveness of our properties to tenants;• the decrease in the underlying value of our properties; and• certain significant expenditures, including property taxes, maintenance costs, mortgage payments,insurance costs and related charges that must be made regardless of whether a property is producingsufficient income to service these expenses.We are dependent upon the economic conditions of the markets where our assets are located.We are affected by local, regional, national and international economic conditions and other events andoccurrences that affect the markets in which we own assets. A protracted decline in economic conditions willcause downward pressure on our operating margins and asset values as a result of lower demand for space.Substantially all of our properties are located in North America, Europe, Australia and Brazil. Aprolonged downturn in one or more of these economies or the economy of any other country where we ownproperty would result in reduced demand for space and number of prospective tenants and will affect the abilityof our properties to generate significant revenue. If there is an increase in operating costs resulting from inflationand other factors, we may not be able to offset such increases by increasing rents.10

Additionally, as part of our strategy for our office property platform is to focus on markets underpinnedby major financial, energy and professional services businesses, a significant downturn in one or more of theindustries in which these businesses operate would also adversely affect our results of operations.We face risks associated with the use of debt to finance our business, including refinancing risk.We incur debt in the ordinary course of our business and therefore are subject to the risks associated withdebt financing. These risks, including the following, may adversely affect our financial condition and results ofoperations:• cash flows may be insufficient to meet required payments of principal and interest;• payments of principal and interest on borrowings may leave insufficient cash resources to payoperating expenses;• we may not be able to refinance indebtedness on our properties at maturity due to business andmarket factors, including: disruptions in the capital and credit markets; the estimated cash flows ofour properties and other assets; the value of our properties and other assets; and financial,competitive, business and other factors, including factors beyond our control; and• if refinanced, the terms of a refinancing may not be as favorable as the original terms of the relatedindebtedness.Our operating entities have a significant degree of leverage on their assets. Highly leveraged assets areinherently more sensitive to declines in revenues, increases in expenses and interest rates, and adverse marketconditions. A leveraged company’s income and net assets also tend to increase or decrease at a greater rate thanwould otherwise be the case if money had not been borrowed. As a result, the risk of loss associated with aleveraged company, all other things being equal, is generally greater than for companies with comparatively lessdebt.We rely on our operating entities to provide our company with the funds necessary to make distributionson our units and meet our financial obligations. The leverage on our assets may affect the funds available to ourcompany if the terms of the debt impose restrictions on the ability of our operating entities to make distributionsto our company. In addition, our operating entities will generally have to service their debt obligations beforemaking distributions to our company or their parent entity.Leverage may also result in a requirement for liquidity, which may force the sale of assets at times of lowdemand and/or prices for such assets.We may also incur indebtedness under future credit facilities, such as the revolving credit facility weexpect to obtain from <strong>Brookfield</strong>, or other debt-like instruments, in addition to any asset-level indebtedness. Wemay also issue debt or debt-like instruments in the market in the future, which may or may not be rated. Shouldsuch debt or debt-like instruments be rated, a credit downgrade will have an adverse impact on the cost of suchdebt.If we are unable to refinance our indebtedness on acceptable terms, or at all, we may need to dispose ofone or more of our properties or other assets upon disadvantageous terms. In addition, prevailing interest rates orother factors at the time of refinancing could increase our interest expense, and if we mortgage property to securepayment of indebtedness and are unable to make mortgage payments, the mortgagee could foreclose upon suchproperty or appoint a receiver to receive an assignment of our rents and leases. This may adversely affect ourability to make distributions or payments to our unitholders and lenders.11

Restrictive covenants in our indebtedness may limit management’s discretion with respect to certain businessmatters.Instruments governing any of our indebtedness or indebtedness of our operating entities or theirsubsidiaries may contain restrictive covenants limiting our discretion with respect to certain business matters.These covenants could place significant restrictions on, among other things, our ability to create liens or otherencumbrances, to make distributions to our unitholders or make certain other payments, investments, loans andguarantees and to sell or otherwise dispose of assets and merge or consolidate with another entity. Thesecovenants could also require us to meet certain financial ratios and financial condition tests. A failure to complywith any such covenants could result in a default which, if not cured or waived, could permit acceleration of therelevant indebtedness.If we are unable to manage our interest rate risk effectively, our cash flows and operating results may suffer.Advances under credit facilities and certain property-level mortgage debt bear interest at a variable rate.We may incur further indebtedness in the future that also bears interest at a variable rate or we may be requiredto refinance our debt at higher rates. In addition, though we attempt to manage interest rate risk, there can be noassurance that we will hedge such exposure effectively or at all in the future. Accordingly, increases in interestrates above that which we anticipate based upon historical trends would adversely affect our cash flows.We face potential adverse effects from tenant defaults, bankruptcies or insolvencies.A commercial tenant may experience a downturn in its business, which could cause the loss of that tenantor weaken its financial condition and result in the tenant’s inability to make rental payments when due or, forretail tenants, a reduction in percentage rent payable. If a tenant defaults, we may experience delays and incurcosts in enforcing our rights as landlord and protecting our investments.We cannot evict a tenant solely because of its bankruptcy. In addition, in certain jurisdictions where weown properties, a court may authorize a tenant to reject and terminate its lease. In such a case, our claim againstthe tenant for unpaid, future rent would be subject to a statutory cap that might be substantially less than theremaining rent owed under the lease. In any event, it is unlikely that a bankrupt or insolvent tenant will pay thefull amount it owes under a lease. The loss of rental payments from tenants and costs of re-leasing wouldadversely affect our cash flows and results of operations. In the case of our retail properties, the bankruptcy orinsolvency of an anchor tenant or tenant with stores at many of our properties would cause us to suffer lowerrevenues and operational difficulties, including difficulties leasing the remainder of the property. Significantexpenses associated with each property, such as mortgage payments, real estate taxes and maintenance costs, aregenerally not reduced when circumstances cause a reduction in income from the property. In the event of asignificant number of lease defaults and/or tenant bankruptcies, our cash flows may not be sufficient to pay cashdistributions to our unitholders and repay maturing debt or other obligations.Reliance on significant tenants could adversely affect our results of operations.Many of our properties are occupied by one or more significant tenants and, therefore, our revenues fromthose properties will be materially dependent on the creditworthiness and financial stability of those tenants. Ourbusiness would be adversely affected if any of those tenants failed to renew certain of their significant leases,became insolvent, declared bankruptcy or otherwise refused to pay rent in a timely fashion or at all. In the eventof a default by one or more significant tenants, we may experience delays in enforcing our rights as landlord andmay incur substantial costs in protecting our investment and re-leasing the property. If a lease of a significanttenant is terminated, it may be difficult, costly and time consuming to attract new tenants and lease the propertyfor the rent previously received.12

Our inability to enter into renewal or new leases with tenants on favorable terms or at all for all or asubstantial portion of space that is subject to expiring leases would adversely affect our cash flows andoperating results.Our properties generate revenue through rental payments made by tenants of the properties. Upon theexpiry of any lease, there can be no assurance that the lease will be renewed or the tenant replaced. The terms ofany renewal or replacement lease may be less favorable to us than the existing lease. We would be adverselyaffected, in particular, if any major tenant ceases to be a tenant and cannot be replaced on similar or better termsor at all. Additionally, we may not be able to lease our properties to an appropriate mix of tenants. Retail tenantsmay negotiate leases containing exclusive rights to sell particular types of merchandise or services within aparticular retail property. When leasing other space after the vacancy of a retail tenant, these provisions may limitthe number and types of prospective tenants for the vacant space.Our competitors may adversely affect our ability to lease our properties which may cause our cash flows andoperating results to suffer.Each segment of the real estate industry is competitive. Numerous other developers, managers andowners of commercial properties compete with us in seeking tenants and, in the case of our multi-familyproperties, there are numerous housing alternatives which compete with our properties in attracting residents.Some of the properties of our competitors may be newer, better located or better capitalized. These competingproperties may have vacancy rates higher than our properties, which may result in their owners being willing tomake space available at lower prices than the space in our properties, particularly if there is an oversupply ofspace available in the market. Competition for tenants could have an adverse effect on our ability to lease ourproperties and on the rents that we may charge or concessions that we must grant. If our competitors adverselyimpact our ability to lease our properties, our cash flows and operating results may suffer.Our ability to realize our strategies and capitalize on our competitive strengths are dependent on theability of our operating entities to effectively operate our large group of commercial properties, maintain goodrelationships with tenants, and remain well-capitalized, and our failure to do any of the foregoing would affectour ability to compete effectively in the markets in which we do business.Our insurance may not cover some potential losses or may not be obtainable at commercially reasonable rates,which could adversely affect our financial condition and results of operations.We maintain insurance on our properties in amounts and with deductibles that we believe are in line withwhat owners of similar properties carry; however, our insurance may not cover some potential losses or may notbe obtainable at commercially reasonable rates in the future.There also are certain types of risks (such as war, environmental contamination such as toxic mold, andlease and other contract claims) which are either uninsurable or not economically insurable. Should anyuninsured or underinsured loss occur, we could lose our investment in, and anticipated profits and cash flowsfrom, one or more properties, and we would continue to be obligated to repay any recourse mortgageindebtedness on such properties.Possible terrorist activity could adversely affect our financial condition and results of operations and ourinsurance may not cover some losses due to terrorism or may not be obtainable at commercially reasonablerates.Possible terrorist attacks in the markets where our properties are located may result in declining economicactivity, which could reduce the demand for space at our properties, reduce the value of our properties and couldharm the demand for goods and services offered by our tenants.Additionally, terrorist activities could directly affect the value of our properties through damage,destruction or loss. Our office portfolio is concentrated in large metropolitan areas, some of which have been or13

may be perceived to be subject to terrorist attacks. Many of our office properties consist of high-rise buildings,which may also be subject to this actual or perceived threat. Our insurance may not cover some losses due toterrorism or may not be obtainable at commercially reasonable rates.We are subject to risks relating to development and redevelopment projects.On a strategic and selective basis, we may develop and redevelop properties. The real estate developmentand redevelopment business involves significant risks that could adversely affect our business, financialcondition and results of operations, including the following:• we may not be able to complete construction on schedule or within budget, resulting in increaseddebt service expense and construction costs and delays in leasing the properties;• we may not have sufficient capital to proceed with planned redevelopment or expansion activities;• we may abandon redevelopment or expansion activities already under way, which may result inadditional cost recognition;• we may not be able to obtain, or may experience delays in obtaining, all necessary zoning, landuse,building, occupancy and other governmental permits and authorizations;• we may not be able to lease properties at all or on favorable terms, or occupancy rates and rents at acompleted project might not meet projections and, therefore, the project might not be profitable;• construction costs, total investment amounts and our share of remaining funding may exceed ourestimates and projects may not be completed and delivered as planned; and• upon completion of construction, we may not be able to obtain, or obtain on advantageous terms,permanent financing for activities that we have financed through construction loans.We are subject to risks that affect the retail environment.We are subject to risks that affect the retail environment, including unemployment, weak income growth,lack of available consumer credit, industry slowdowns and plant closures, low consumer confidence, increasedconsumer debt, poor housing market conditions, adverse weather conditions, natural disasters and the need to paydown existing obligations. All of these factors could negatively affect consumer spending and adversely affectthe sales of our retail tenants. This could have an unfavorable effect on our operations and our ability to attractnew retail tenants.In addition, our retail tenants face competition from retailers at other regional malls, outlet malls andother discount shopping centers, discount shopping clubs, catalogue companies, and through internet sales andtelemarketing. Competition of these types could reduce the percentage rent payable by certain retail tenants andadversely affect our revenues and cash flows. Additionally, our retail tenants are dependent on perceptions byretailers and shoppers of the safety, convenience and attractiveness of our retail properties. If retailers andshoppers perceive competing properties and other retailing options such as the internet to be more convenient orof a higher quality, our revenues may be adversely affected.Some of our retail lease agreements include a co-tenancy provision which allows the mall tenant to pay areduced rent amount and, in certain instances, terminate the lease, if we fail to maintain certain occupancy levelsat the mall. In addition, certain of our tenants have the ability to terminate their leases prior to the leaseexpiration date if their sales do not meet agreed upon thresholds. Therefore, if occupancy, tenancy or sales fallbelow certain thresholds, rents we are entitled to receive from our retail tenants would be reduced and our abilityto attract new tenants may be limited.14

The computation of cost reimbursements from our retail tenants for common area maintenance, insuranceand real estate taxes is complex and involves numerous judgments including interpretation of lease terms andother tenant lease provisions. Most tenants make monthly fixed payments of common area maintenance,insurance, real estate taxes and other cost reimbursements and, after the end of the calendar year, we computeeach tenant’s final cost reimbursements and issue a bill or credit for the full amount, after considering amountspaid by the tenant during the year. The billed amounts could be disputed by the tenant or become the subject of atenant audit or even litigation. There can be no assurance that we will collect all or any portion of these amounts.We are subject to risks associated with the multi-family residential industry.We are subject to risks associated with the multi-family residential industry, including the level ofmortgage interest rates which may encourage tenants to purchase rather than lease and housing and governmentalprograms that provide assistance and rent subsidies to tenants. If the demand for multi-family properties isreduced, income generated from our multi-family residential properties and the underlying value of suchproperties may be adversely affected.In addition, certain jurisdictions regulate the relationship of an owner and its residential tenants.Commonly, these laws require a written lease, good cause for eviction, disclosure of fees, and notification toresidents of changed land use, while prohibiting unreasonable rules, retaliatory evictions, and restrictions on aresident’s choice of landlords. Apartment building owners have been the subject of lawsuits under various“Landlord and Tenant Acts” and other general consumer protection statutes for coercive, abusive orunconscionable leasing and sales practices. If we become subject to litigation, the outcome of any suchproceedings may materially adversely affect us and may continue for long periods of time. A few jurisdictionsmay offer more significant protection to residential tenants. In addition to state or provincial regulation of thelandlord-tenant relationship, numerous towns and municipalities impose rent control on apartment buildings. Theimposition of rent control on our multi-family residential units could have a materially adverse effect on ourresults of operations.If we are unable to recover from a business disruption on a timely basis our financial condition and results ofoperations could be adversely affected.Our business is vulnerable to damages from any number of sources, including computer viruses,unauthorized access, energy blackouts, natural disasters, terrorism, war and telecommunication failures. Anysystem failure or accident that causes interruptions in our operations could result in a material disruption to ourbusiness. If we are unable to recover from a business disruption on a timely basis, our financial condition andresults of operations would be adversely affected. We may also incur additional costs to remedy damages causedby such disruptions.Because certain of our assets are illiquid, we may not be able to sell these assets when appropriate or whendesired.Large commercial properties like the ones that we own can be hard to sell, especially if local marketconditions are poor. Such illiquidity could limit our ability to diversify our assets promptly in response tochanging economic or investment conditions.Additionally, financial difficulties of other property owners resulting in distressed sales could depress realestate values in the markets in which we operate in times of illiquidity. These restrictions reduce our ability torespond to changes in the performance of our assets and could adversely affect our financial condition and resultsof operations.We face risks associated with property acquisitions.Competition from other well-capitalized real estate investors, including both publicly-traded real estateinvestment trusts and institutional investment funds, may significantly increase the purchase price of, or prevent15

us from acquiring, a desired property. Acquisition agreements will typically contain conditions to closing,including completion of due diligence to our satisfaction or other conditions that are not within our control,which may not be satisfied. Acquired properties may be located in new markets where we may have limitedknowledge and understanding of the local economy, an absence of business relationships in the area orunfamiliarity with local government and applicable laws and regulations. We may be unable to financeacquisitions on favorable terms or newly acquired properties may fail to perform as expected. We mayunderestimate the costs necessary to bring an acquired property up to standards established for its intendedmarket position or we may be unable to quickly and efficiently integrate new acquisitions into our existingoperations. We may also acquire properties subject to liabilities and without any recourse, or with only limitedrecourse, with respect to unknown liabilities. Each of these factors could have an adverse effect on our results ofoperations and financial condition.We do not control certain of our operating entities, including General Growth Properties, Inc., or GGP andCanary Wharf, and therefore we may not be able to realize some or all of the benefits that we expect to realizefrom those entities.We do not have control of certain of our operating entities, including GGP and Canary Wharf. Ourinterests in those entities subject us to the operating and financial risks of their businesses, the risk that therelevant company may make business, financial or management decisions that we do not agree with, and the riskthat we may have differing objectives than the entities in which we have interests. Because we do not have theability to exercise control over those entities, we may not be able to realize some or all of the benefits that weexpect to realize from those entities. For example, we may not be able to cause such operating entities to makedistributions to us in the amount or at the time that we need or want such distributions. In addition, we rely on theinternal controls and financial reporting controls of the public companies in which we invest and the failure ofsuch companies to maintain effective controls or comply with applicable standards may adversely affect us.We do not have sole control over the properties that we own with co-venturers, partners, fund investors orco-tenants or over the revenues and certain decisions associated with those properties, which may limit ourflexibility with respect to these investments.We participate in joint ventures, partnerships, funds and co-tenancies affecting many of our properties.Such investments involve risks not present were a third party not involved, including the possibility that ourco-venturers, partners, fund investors or co-tenants might become bankrupt or otherwise fail to fund their shareof required capital contributions. The bankruptcy of one of our co-venturers, partners, fund investors orco-tenants could materially and adversely affect the relevant property or properties. Pursuant to bankruptcy laws,we could be precluded from taking some actions affecting the estate of the other investor without prior courtapproval which would, in most cases, entail prior notice to other parties and a hearing. At a minimum, therequirement to obtain court approval may delay the actions we would or might want to take. If the relevant jointventure or other investment entity has incurred recourse obligations, the discharge in bankruptcy of one of theother investors might result in our ultimate liability for a greater portion of those obligations than wouldotherwise be required.Additionally, our co-venturers, partners, fund investors or co-tenants might at any time have economic orother business interests or goals which are inconsistent with those of our company, and we could becomeengaged in a dispute with any of them that might affect our ability to develop or operate a property. In addition,we do not have sole control of certain major decisions relating to these properties, including decisions relating to:the sale of the properties; refinancing; timing and amount of distributions of cash from such properties; andcapital improvements.In some instances where we are the property manager for a joint venture, the joint venture retains jointapproval rights over various material matters such as the budget for the property, specific leases and our leasingplan. Moreover, in certain property management arrangements the other venturer can terminate the property16

management agreement in limited circumstances relating to enforcement of the property managers’ obligations.In addition, the sale or transfer of interests in some of our joint ventures and partnerships is subject to rights offirst refusal or first offer and some joint venture and partnership agreements provide for buy-sell or similararrangements. Such rights may be triggered at a time when we may not want to sell but we may be forced to doso because we may not have the financial resources at that time to purchase the other party’s interest. Such rightsmay also inhibit our ability to sell an interest in a property or a joint venture or partnership within our desiredtime frame or on any other desired basis.We are subject to risks associated with commercial property loans.We have interests in loans or participations in loans, or securities whose underlying performance depends onloans made with respect to a variety of commercial real estate. Such interests are subject to normal credit risks aswell as those generally not associated with traditional debt securities. The ability of the borrowers to repay theloans will typically depend upon the successful operation of the related real estate project and the availability offinancing. Any factors which affect the ability of the project to generate sufficient cash flow could have amaterial effect on the value of these interests. Such factors include, but are not limited to: the uncertainty of cashflow to meet fixed obligations; adverse changes in general and local economic conditions, including interest ratesand local market conditions; tenant credit risks; the unavailability of financing, which may make the operation,sale, or refinancing of a property difficult or unattractive; vacancy and occupancy rates; construction andoperating costs; regulatory requirements, including zoning, rent control and real and personal property tax laws,rates and assessments; environmental concerns; project and borrower diversification; and uninsured losses.Security underlying such interests will generally be in a junior or subordinate position to senior financing. Incertain circumstances, in order to protect our interest, we may decide to repay all or a portion of the seniorindebtedness relating to the particular interests or to cure defaults with respect to such senior indebtedness.We invest in mezzanine debt, which can rank below other senior lenders.We invest in mezzanine debt interests in real estate companies and properties whose capital structureshave significant debt ranking ahead of our investments. Our investments will not always benefit from the same orsimilar financial and other covenants as those enjoyed by the debt ranking ahead of our investments or benefitfrom cross-default provisions. Moreover, it is likely that we will be restricted in the exercise of our rights inrespect of our investments by the terms of subordination agreements with the debt ranking ahead of themezzanine capital. Accordingly, we may not be able to take the steps necessary to protect our investments in atimely manner or at all and there can be no assurance that the rate of return objectives of any particularinvestment will be achieved. To protect our original investment and to gain greater control over the underlyingassets, we may elect to purchase the interest of a senior creditor or take an equity interest in the underlying assets,which may require additional investment requiring us to expend additional capital.We are subject to risks related to syndicating or selling participations in our interests.The strategy of the finance funds in which we have interests depends, in part, upon syndicating or sellingparticipations in senior interests, either through capital markets collateralized debt obligation transactions orotherwise. If the finance funds cannot do so on terms that are favorable to us, we may not make the returns weanticipate.We face risks relating to the legal aspects of mortgage loans and may be subject to liability as a lender.Certain interests acquired by us will be subject to risks relating to the legal aspects of mortgage loans.Depending upon the applicable law governing mortgage loans (which laws may differ substantially), we may beadversely affected by the operation of law (including state or provincial law) with respect to our ability toforeclose mortgage loans, the borrower’s right of redemption, the enforceability of assignments of rents, due onsale and acceleration clauses in loan instruments, as well as other creditors’ rights provided in such documents.In addition, we may be subject to liability as a lender with respect to our negotiation, administration, collection17

and/or foreclosure of mortgage loans. As a lender, we may also be subject to penalties for violation of usurylimitations, which penalties may be triggered by contracting for, charging or receiving usurious interest.Bankruptcy laws may delay our ability to realize on our collateral or may adversely affect the priority thereofthrough doctrines such as equitable subordination or may result in a restructuring of the debt through principlessuch as the “cramdown” provisions of applicable bankruptcy laws.We have significant interests in public companies, and changes in the market prices of the stock of suchpublic companies, particularly during times of increased market volatility, could have a negative impact onour financial condition and results of operations.We hold significant interests in public companies, and changes in the market prices of the stock of suchpublic companies could have a material impact on our financial condition and results of operations. Globalsecurities markets have been highly volatile, and continued volatility may have a material negative impact on ourconsolidated financial position and results of operations.We have significant interests in <strong>Brookfield</strong>-sponsored real estate opportunity and finance funds, and poorinvestment returns in these funds could have a negative impact on our financial condition and results ofoperations.We have, and expect to continue to have in the future, significant interests in <strong>Brookfield</strong>-sponsored realestate opportunity and finance funds, and poor investment returns in these funds, due to either market conditionsor underperformance (relative to their competitors or to benchmarks), would negatively affect our financialcondition and results of operations. In addition, interests in such funds are subject to the risks inherent in theownership and operation of real estate and real estate-related businesses and assets generally.Our ownership of underperforming real estate properties involves significant risks and potential additionalliabilities.We hold interests in certain real estate properties with weak financial conditions, poor operating results,substantial financial needs, negative net worth or special competitive problems, or that are over-leveraged. Ourownership of underperforming real estate properties involves significant risks and potential additional liabilities.Our exposure to such underperforming properties may be substantial in relation to the market for those interestsand distressed assets may be illiquid and difficult to sell or transfer. As a result, it may take a number of years forthe fair value of such interests to ultimately reflect their intrinsic value as perceived by us.We face risks relating to the jurisdictions of our operations.We own and operate commercial properties in a number of jurisdictions, including but not limited toNorth America, Europe, Australia and Brazil. Our operations will be subject to significant political, economicand financial risks, which vary by jurisdiction, and may include:• changes in government policies or personnel;• restrictions on currency transfer or convertibility;• changes in labor relations;• political instability and civil unrest;• fluctuations in foreign exchange rates;• challenges of complying with a wide variety of foreign laws including corporate governance,operations, taxes and litigation;• differing lending practices;18