You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

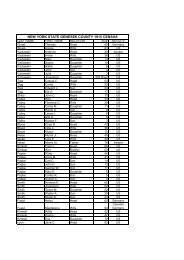

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 1COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 13.-1-31 *******************4974 East Main St Rd 0000009750013.-1-31 453 Large retail COUNTY TAXABLE VALUE 600,0001515 Management Co, Inc <strong>Batavia</strong> City Sc 180200 80,000 TOWN TAXABLE VALUE 600,00017556 Lake Estates Dr ACRES 3.10 600,000 SCHOOL TAXABLE VALUE 600,000Boca Raton, FL 33496 EAST-1263474 NRTH-1090578 FD005 <strong>Batavia</strong> fire 600,000 TODEED BOOK 512 PG-00123 WD004 <strong>Batavia</strong> water #4 600,000 TO CFULL MARKET VALUE 600,000******************************************************************************************************* 13.-1-32 *******************East Main St Rd 0000009740013.-1-32 330 Vacant comm COUNTY TAXABLE VALUE 4,0001515 Management Co, Inc <strong>Batavia</strong> City Sc 180200 4,000 TOWN TAXABLE VALUE 4,00017556 Lake Estates Dr ACRES 0.58 4,000 SCHOOL TAXABLE VALUE 4,000Boca Raton, FL 33496 EAST-1263642 NRTH-1090690 FD005 <strong>Batavia</strong> fire 4,000 TODEED BOOK 512 PG-00123 WD004 <strong>Batavia</strong> water #4 4,000 TO CFULL MARKET VALUE 4,000******************************************************************************************************* 13.-1-33 *******************East Main St Rd 0000009730013.-1-33 330 Vacant comm COUNTY TAXABLE VALUE 60,0001515 Management Co, Inc <strong>Batavia</strong> City Sc 180200 60,000 TOWN TAXABLE VALUE 60,00017556 Lake Estates Dr 13-1-34.2 (L579-P33) 60,000 SCHOOL TAXABLE VALUE 60,000Boca Raton, FL 33496 ACRES 0.71 FD005 <strong>Batavia</strong> fire 60,000 TOEAST-1263671 NRTH-1090540 WD004 <strong>Batavia</strong> water #4 60,000 TO CDEED BOOK 612 PG-218FULL MARKET VALUE 60,000******************************************************************************************************* 9.-1-33.11 *****************5121 Clinton St Rd 000000763009.-1-33.11 416 Mfg hsing pk STAR EN 41834 0 0 354,9502007 Country Meadows NY LLC Byron-Bergen Sc 183001 1637,000 STAR B 41854 0 0 1019,525Marcella Steele 9-1-33.12 9-1-56 3328,950 COUNTY TAXABLE VALUE 3328,95031200 Northwestern Hwy 9-1-38 9-1-34 TOWN TAXABLE VALUE 3328,950Farmington Hills, MI 48334 ACRES 70.04 BANKFAR0100 SCHOOL TAXABLE VALUE 1954,475EAST-1265863 NRTH-1095887 FD005 <strong>Batavia</strong> fire 3328,950 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 3328,950 TO CFULL MARKET VALUE 3328,950 WD003 <strong>Batavia</strong> water #3 3328,950 TO C******************************************************************************************************* 9.-1-33.11/A ***************Clinton St Rd9.-1-33.11/A 270 Mfg housing AGED C/S 41805 8,450 0 8,4502007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 8,450Park Investors LLC 10 Briarwood Terr. 16,900 COUNTY TAXABLE VALUE 8,4504600 Cox Rd Ste 400 Russ Hebell TOWN TAXABLE VALUE 16,900Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 16,900 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 16,900 TO CFULL MARKET VALUE 16,900 WD003 <strong>Batavia</strong> water #3 16,900 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 2COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-33.11/B ***************Clinton St Rd9.-1-33.11/B 270 Mfg housing AGED C/S 41805 1,950 0 1,9502007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 1,950Park Investors LLC 1 Forest Edge Dr. 3,900 COUNTY TAXABLE VALUE 1,9504600 Cox Rd Ste 400 Jean Mccoy TOWN TAXABLE VALUE 3,900Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 3,900 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 3,900 TO CFULL MARKET VALUE 3,900 WD003 <strong>Batavia</strong> water #3 3,900 TO C******************************************************************************************************* 9.-1-33.11/C ***************Clinton St Rd9.-1-33.11/C 270 Mfg housing VETS-CV-C 41132 1,056 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-CV-T 41133 0 1,056 0Park Investors LLC 12 Shady Lane 4,225 VETS-DV-C 41142 1,901 0 04600 Cox Rd Ste 400 John Corrado VETS-DV-T 41143 0 1,901 0Glen Allen, VA 23060 ACRES 0.01 STAR EN 41834 0 0 4,225EAST-0617445 NRTH-1095885 COUNTY TAXABLE VALUE 1,268DEED BOOK 867 PG-338 TOWN TAXABLE VALUE 1,268FULL MARKET VALUE 4,225 SCHOOL TAXABLE VALUE 0FD005 <strong>Batavia</strong> fire 4,225 TOSD001 <strong>Batavia</strong> sewer #1 4,225 TO CWD003 <strong>Batavia</strong> water #3 4,225 TO C******************************************************************************************************* 9.-1-33.11/D ***************Clinton St Rd9.-1-33.11/D 270 Mfg housing VETS-WV-C 41122 4,800 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-WV-T 41123 0 4,800 0Park Investors LLC 19 Orange Grove Dr 32,000 STAR EN 41834 0 0 32,0004600 Cox Rd Ste 400 Francis Farrell COUNTY TAXABLE VALUE 27,200Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 27,200EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0DEED BOOK 867 PG-338 FD005 <strong>Batavia</strong> fire 32,000 TOFULL MARKET VALUE 32,000 SD001 <strong>Batavia</strong> sewer #1 32,000 TO CWD003 <strong>Batavia</strong> water #3 32,000 TO C******************************************************************************************************* 9.-1-33.11/E ***************Clinton St Rd9.-1-33.11/E 270 Mfg housing VETS-WV-C 41122 3,120 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-WV-T 41123 0 3,120 0Park Investors LLC 4 Valley View Dr 20,800 STAR EN 41834 0 0 20,8004600 Cox Rd Ste 400 Robert & Rose Stachowski COUNTY TAXABLE VALUE 17,680Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 17,680EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0DEED BOOK 832 PG-506 FD005 <strong>Batavia</strong> fire 20,800 TOFULL MARKET VALUE 20,800 SD001 <strong>Batavia</strong> sewer #1 20,800 TO CWD003 <strong>Batavia</strong> water #3 20,800 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 3COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-33.11/F ***************Clinton St Rd9.-1-33.11/F 270 Mfg housing AGED C/S 41805 5,850 0 5,8502007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 5,850Park Investors LLC 11 Briarwood Terr. 11,700 COUNTY TAXABLE VALUE 5,8504600 Cox Rd Ste 400 Diana Porter TOWN TAXABLE VALUE 11,700Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 11,700 TODEED BOOK 832 PG-506 SD001 <strong>Batavia</strong> sewer #1 11,700 TO CFULL MARKET VALUE 11,700 WD003 <strong>Batavia</strong> water #3 11,700 TO C******************************************************************************************************* 9.-1-33.11/G ***************Clinton St Rd9.-1-33.11/G 270 Mfg housing VETS-WV-C 41122 3,750 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-WV-T 41123 0 3,750 0Park Investors LLC 5 Orange Grove Dr 25,000 STAR B 41854 0 0 25,0004600 Cox Rd Ste 400 David and Janet Miller COUNTY TAXABLE VALUE 21,250Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 21,250EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0DEED BOOK 832 PG-506 FD005 <strong>Batavia</strong> fire 25,000 TOFULL MARKET VALUE 25,000 SD001 <strong>Batavia</strong> sewer #1 25,000 TO CWD003 <strong>Batavia</strong> water #3 25,000 TO C******************************************************************************************************* 9.-1-33.11/M ***************Clinton St Rd9.-1-33.11/M 270 Mfg housing VETS-CV-C 41132 1,950 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-CV-T 41133 0 1,950 0Park Investors LLC 17 College View Dr. 7,800 AGED C/S 41805 2,925 0 3,9004600 Cox Rd Ste 400 Dolores Kosiorek STAR EN 41834 0 0 3,900Glen Allen, VA 23060 ACRES 0.01 COUNTY TAXABLE VALUE 2,925EAST-0617445 NRTH-1095885 TOWN TAXABLE VALUE 5,850DEED BOOK 867 PG-338 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 7,800 FD005 <strong>Batavia</strong> fire 7,800 TOSD001 <strong>Batavia</strong> sewer #1 7,800 TO CWD003 <strong>Batavia</strong> water #3 7,800 TO C******************************************************************************************************* 9.-1-33.11/N ***************Clinton St Rd9.-1-33.11/N 270 Mfg housing AGED C/S 41805 4,225 0 4,2252007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 4,225Park Investors LLC 37 Overlook Dr. 8,450 COUNTY TAXABLE VALUE 4,2254600 Cox Rd Ste 400 Stephanie Sage TOWN TAXABLE VALUE 8,450Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 8,450 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 8,450 TO CFULL MARKET VALUE 8,450 WD003 <strong>Batavia</strong> water #3 8,450 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 4COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-33.11/O ***************Clinton St Rd9.-1-33.11/O 270 Mfg housing AGED C/S 41805 1,950 0 1,9502007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 1,950Park Investors LLC 4 Crystal Lane 3,900 COUNTY TAXABLE VALUE 1,9504600 Cox Rd Ste 400 Margaret Rumery TOWN TAXABLE VALUE 3,900Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 3,900 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 3,900 TO CFULL MARKET VALUE 3,900 WD003 <strong>Batavia</strong> water #3 3,900 TO C******************************************************************************************************* 9.-1-33.11/S ***************Clinton St Rd9.-1-33.11/S 270 Mfg housing AGED C/S 41805 650 0 6502007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 650Park Investors LLC 14 Shady Lane 1,300 COUNTY TAXABLE VALUE 6504600 Cox Rd Ste 400 Joan Long TOWN TAXABLE VALUE 1,300Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 1,300 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 1,300 TO CFULL MARKET VALUE 1,300 WD003 <strong>Batavia</strong> water #3 1,300 TO C******************************************************************************************************* 9.-1-33.11/T ***************Clinton St Rd9.-1-33.11/T 270 Mfg housing AGED C/S 41805 1,105 0 1,1052007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 9,945Park Investors LLC 12 Crystal Lane 11,050 COUNTY TAXABLE VALUE 9,9454600 Cox Rd Ste 400 Joseph Forti TOWN TAXABLE VALUE 11,050Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 11,050 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 11,050 TO CFULL MARKET VALUE 11,050 WD003 <strong>Batavia</strong> water #3 11,050 TO C******************************************************************************************************* 9.-1-33.11/V ***************Clinton St Rd9.-1-33.11/V 270 Mfg housing AGED C/S 41805 2,113 0 2,1132007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 2,112Park Investors LLC 13 College View Dr. 4,225 COUNTY TAXABLE VALUE 2,1124600 Cox Rd Ste 400 Doris Hartwig TOWN TAXABLE VALUE 4,225Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 4,225 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 4,225 TO CFULL MARKET VALUE 4,225 WD003 <strong>Batavia</strong> water #3 4,225 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 5COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-33.11/X ***************Clinton St Rd9.-1-33.11/X 270 Mfg housing AGED C/S 41805 1,788 0 1,7882007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 STAR EN 41834 0 0 1,787Park Investors LLC 7 Orangegrove 3,575 COUNTY TAXABLE VALUE 1,7874600 Cox Rd Ste 400 Francis Dwyer TOWN TAXABLE VALUE 3,575Glen Allen, VA 23060 ACRES 0.01 SCHOOL TAXABLE VALUE 0EAST-0617445 NRTH-1095885 FD005 <strong>Batavia</strong> fire 3,575 TODEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 3,575 TO CFULL MARKET VALUE 3,575 WD003 <strong>Batavia</strong> water #3 3,575 TO C******************************************************************************************************* 9.-1-33.11/HH **************Clinton St Rd9.-1-33.11/HH 270 Mfg housing VETS-CV-C 41132 1,138 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-CV-T 41133 0 1,138 0Park Investors LLC Lot# 17 Briarwood Terr. 4,550 STAR EN 41834 0 0 4,5504600 Cox Rd Ste 400 Cheryl Hyback COUNTY TAXABLE VALUE 3,412Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 3,412EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0DEED BOOK 867 PG-338 FD005 <strong>Batavia</strong> fire 4,550 TOFULL MARKET VALUE 4,550 SD001 <strong>Batavia</strong> sewer #1 4,550 TO CWD003 <strong>Batavia</strong> water #3 4,550 TO C******************************************************************************************************* 9.-1-33.11/II **************Clinton St Rd9.-1-33.11/II 270 Mfg housing VETS-CV-C 41132 4,875 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-CV-T 41133 0 4,875 0Park Investors LLC Lot# 9 Briarwood Terr. 19,500 STAR B 41854 0 0 19,5004600 Cox Rd Ste 400 Byron Parker COUNTY TAXABLE VALUE 14,625Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 14,625EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0DEED BOOK 867 PG-338 FD005 <strong>Batavia</strong> fire 19,500 TOFULL MARKET VALUE 19,500 SD001 <strong>Batavia</strong> sewer #1 19,500 TO CWD003 <strong>Batavia</strong> water #3 19,500 TO C******************************************************************************************************* 9.-1-33.11/JJ **************Clinton St RD9.-1-33.11/JJ 270 Mfg housing VETS-WV-C 41122 1,658 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-WV-T 41123 0 1,658 0Park Investors LLC 25 Briarwood Terrace 11,050 VETS-DV-C 41142 553 0 04600 Cox Rd Ste 400 David Tresco VETS-DV-T 41143 0 553 0Glen Allen, VA 23060 EAST-0617445 NRTH-1095885 STAR B 41854 0 0 11,050FULL MARKET VALUE 11,050 COUNTY TAXABLE VALUE 8,839TOWN TAXABLE VALUE 8,839SCHOOL TAXABLE VALUE 0FD005 <strong>Batavia</strong> fire 11,050 TOSD001 <strong>Batavia</strong> sewer #1 11,050 TO CWD003 <strong>Batavia</strong> water #3 11,050 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 6COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-33.11/KK **************Clinton St Rd9.-1-33.11/KK 270 Mfg housing VETS-WV-C 41122 634 0 02007 Country Meadows NY LLC Byron-Bergen Sc 183001 0 VETS-WV-T 41123 0 634 0Park Investors LLC Diane Bostwick 4,225 STAR EN 41834 0 0 4,2254600 Cox Rd Ste 400 22 Overlook COUNTY TAXABLE VALUE 3,591Glen Allen, VA 23060 ACRES 0.01 TOWN TAXABLE VALUE 3,591EAST-0617445 NRTH-1095885 SCHOOL TAXABLE VALUE 0FULL MARKET VALUE 4,225 FD005 <strong>Batavia</strong> fire 4,225 TOSD001 <strong>Batavia</strong> sewer #1 4,225 TO CWD003 <strong>Batavia</strong> water #3 4,225 TO C******************************************************************************************************* 9.-1-69 ********************5115 Clinton St Rd9.-1-69 485 >1use sm bld COUNTY TAXABLE VALUE 80,0002007 Country Meadows NY LLC <strong>Batavia</strong> City Sc 180200 50,000 TOWN TAXABLE VALUE 80,000Park Investors LLC ACRES 3.80 BANKFAR0100 80,000 SCHOOL TAXABLE VALUE 80,00010879 Millington Ln EAST-1265901 NRTH-1095009 FD005 <strong>Batavia</strong> fire 80,000 TORichmond, VA 23238 DEED BOOK 867 PG-338 SD001 <strong>Batavia</strong> sewer #1 80,000 TO CFULL MARKET VALUE 80,000 WD003 <strong>Batavia</strong> water #3 80,000 TO C******************************************************************************************************* 2.-1-21.2 ******************3500 Harl<strong>of</strong>f Rd 000000491752.-1-21.2 522 Racetrack COUNTY TAXABLE VALUE 75,0003500 Harl<strong>of</strong>f Corp Pembroke School 184202 75,000 TOWN TAXABLE VALUE 75,000<strong>Genesee</strong> Entertainment ACRES 22.00 75,000 SCHOOL TAXABLE VALUE 75,000PO Box 22934 EAST-1232621 NRTH-1100151 FD003 East pembroke fire 75,000 TORochester, NY 14692 DEED BOOK 827 PG-65FULL MARKET VALUE 75,000******************************************************************************************************* 8.-1-24.12 *****************8314 Park Rd8.-1-24.12 483 Converted Re COUNTY TAXABLE VALUE 150,00061 Swan Street <strong>of</strong> <strong>Batavia</strong> Inc <strong>Batavia</strong> City Sc 180200 80,000 TOWN TAXABLE VALUE 150,0008314 Park Rd ACRES 1.53 150,000 SCHOOL TAXABLE VALUE 150,000<strong>Batavia</strong>, NY 14020 EAST-1250013 NRTH-1097804 FD005 <strong>Batavia</strong> fire 150,000 TODEED BOOK 827 PG-106 SD002 <strong>Batavia</strong> sewer #2 150,000 TO CFULL MARKET VALUE 150,000 WD003 <strong>Batavia</strong> water #3 150,000 TO C******************************************************************************************************* 8.-1-27.2 ******************8276 Park Rd 000000570008.-1-27.2 465 Pr<strong>of</strong>. bldg. COUNTY TAXABLE VALUE 145,0008276 Park Road Inc <strong>Batavia</strong> City Sc 180200 20,000 TOWN TAXABLE VALUE 145,000Beth Travis ACRES 1.10 145,000 SCHOOL TAXABLE VALUE 145,00049 Stutzman Rd EAST-1250756 NRTH-1098946 FD005 <strong>Batavia</strong> fire 145,000 TOBowmansville, NY 14026 DEED BOOK 774 PG-344 SD004 <strong>Batavia</strong> sewer #2a .00 MTFULL MARKET VALUE 145,000 WD003 <strong>Batavia</strong> water #3 145,000 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 7COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 12.-1-42 *******************8794 Alexander Rd 0000018300012.-1-42 220 2 Family Res COUNTY TAXABLE VALUE 130,0008794 Alexander Road, LLC <strong>Batavia</strong> City Sc 180200 15,700 TOWN TAXABLE VALUE 130,0008794 Alexander Rd ACRES 1.70 130,000 SCHOOL TAXABLE VALUE 130,000<strong>Batavia</strong>, NY 14020 EAST-1251176 NRTH-1089056 FD005 <strong>Batavia</strong> fire 130,000 TODEED BOOK 860 PG-206 WD003 <strong>Batavia</strong> water #3 130,000 TO CFULL MARKET VALUE 130,000******************************************************************************************************* 14.-1-54.2 *****************Wilkinson Rd14.-1-54.2 322 Rural vac>10 COUNTY TAXABLE VALUE 5,000Abaire Larry Pembroke School 184202 5,000 TOWN TAXABLE VALUE 5,0003282 West Main St Rd FRNT 912.12 DPTH 5,000 SCHOOL TAXABLE VALUE 5,000<strong>Batavia</strong>, NY 14020 ACRES 9.60 FD003 East pembroke fire 5,000 TOEAST-1223976 NRTH-1082243 WD015 Wilkinson Water .10 UNDEED BOOK 820 PG-909FULL MARKET VALUE 5,000******************************************************************************************************* 3.-1-79.11 *****************3498 Galloway Rd 000000500003.-1-79.11 210 1 Family Res STAR B 41854 0 0 30,000Abdella Christopher Oakfield-Alabam 183801 20,000 COUNTY TAXABLE VALUE 109,000Abdella Kristy ACRES 6.00 109,000 TOWN TAXABLE VALUE 109,0003498 Galloway Rd EAST-1237419 NRTH-1104999 SCHOOL TAXABLE VALUE 79,000<strong>Batavia</strong>, NY 14020 DEED BOOK 722 PG-29 FD005 <strong>Batavia</strong> fire 109,000 TOFULL MARKET VALUE 109,000 WD003 <strong>Batavia</strong> water #3 109,000 TO C******************************************************************************************************* 18.-1-82 *******************9040 Alexander Rd 0000018240018.-1-82 240 Rural res STAR B 41854 0 0 30,000Abrams Marshall Neale <strong>Batavia</strong> City Sc 180200 25,000 COUNTY TAXABLE VALUE 85,000Abrams Barbara FRNT 1120.00 DPTH 85,000 TOWN TAXABLE VALUE 85,0009040 Alexander Rd ACRES 49.60 SCHOOL TAXABLE VALUE 55,000<strong>Batavia</strong>, NY 14020 EAST-1247859 NRTH-1084769 FD005 <strong>Batavia</strong> fire 85,000 TODEED BOOK 521 PG-00018 WD011 Alexander/Pike Water 1.00 UNFULL MARKET VALUE 85,000******************************************************************************************************* 8.-1-40.11/A ***************8106 State St Rd 000000605508.-1-40.11/A 470 Misc service COUNTY TAXABLE VALUE 100,000ABS Realty Of <strong>Batavia</strong> LLC <strong>Batavia</strong> City Sc 180200 25,000 TOWN TAXABLE VALUE 100,0008106 State St ACRES 5.30 100,000 SCHOOL TAXABLE VALUE 100,000<strong>Batavia</strong>, NY 14020 EAST-1256077 NRTH-1100655 FD005 <strong>Batavia</strong> fire 100,000 TODEED BOOK 699 PG-155FULL MARKET VALUE 100,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 8COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 8.-2-57 ********************4126 Colonial Blvd 000000278008.-2-57 210 1 Family Res STAR B 41854 0 0 30,000Ace Christopher <strong>Batavia</strong> City Sc 180200 7,400 COUNTY TAXABLE VALUE 106,500Ace Lisa FRNT 50.00 DPTH 204.60 106,500 TOWN TAXABLE VALUE 106,5004126 Colonial Blvd ACRES 0.23 BANKFAR0100 SCHOOL TAXABLE VALUE 76,500<strong>Batavia</strong>, NY 14020 EAST-1248481 NRTH-1095821 FD005 <strong>Batavia</strong> fire 106,500 TODEED BOOK 768 PG-196 SD002 <strong>Batavia</strong> sewer #2 106,500 TO CFULL MARKET VALUE 106,500 WD002 <strong>Batavia</strong> water #1 106,500 TO C******************************************************************************************************* 8.-3-18 ********************4120 West Main St Rd 000000005008.-3-18 471 Funeral home BUS >1997 47615 97,500 0 97,500ACME Holdings <strong>of</strong> WNY, Inc. <strong>Batavia</strong> City Sc 180200 25,000 COUNTY TAXABLE VALUE 252,5004120 West Main St Rd FRNT 128.50 DPTH 337.32 350,000 TOWN TAXABLE VALUE 350,000<strong>Batavia</strong>, NY 14020 EAST-1248332 NRTH-1095301 SCHOOL TAXABLE VALUE 252,500DEED BOOK 862 PG-754 FD005 <strong>Batavia</strong> fire 350,000 TOFULL MARKET VALUE 350,000 SD002 <strong>Batavia</strong> sewer #2 350,000 TO CWD002 <strong>Batavia</strong> water #1 350,000 TO C******************************************************************************************************* 8.-3-19 ********************4124 West Main St Rd 000000004008.-3-19 210 1 Family Res COUNTY TAXABLE VALUE 173,000ACME Holdings <strong>of</strong> WNY, Inc. <strong>Batavia</strong> City Sc 180200 16,300 TOWN TAXABLE VALUE 173,0004120 West Main St Rd mixed use 173,000 SCHOOL TAXABLE VALUE 173,000<strong>Batavia</strong>, NY 14020 2nd fl efficiency FD005 <strong>Batavia</strong> fire 173,000 TO1st fl "Grieving Center" SD002 <strong>Batavia</strong> sewer #2 173,000 TO CFRNT 75.00 DPTH 335.00 WD002 <strong>Batavia</strong> water #1 173,000 TO CEAST-1248419 NRTH-1095284DEED BOOK 874 PG-535FULL MARKET VALUE 173,000******************************************************************************************************* 19.-1-24.11 ****************Dorman Rd19.-1-24.11 321 Abandoned ag COUNTY TAXABLE VALUE 12,585Acomb Barbara Alexander Schoo 182202 12,585 TOWN TAXABLE VALUE 12,5859262 Dorman Rd ACRES 83.90 12,585 SCHOOL TAXABLE VALUE 12,585<strong>Batavia</strong>, NY 14020 EAST-1251141 NRTH-1079235 AG001 Ag. District #1 1.00 UNDEED BOOK 582 PG-259 FD005 <strong>Batavia</strong> fire 12,585 TOFULL MARKET VALUE 12,585******************************************************************************************************* 19.-1-26.1 *****************9262 Dorman Rd 0000019630019.-1-26.1 241 Rural res&ag STAR B 41854 0 0 30,000Acomb Barbara Alexander Schoo 182202 49,100 COUNTY TAXABLE VALUE 61,1009262 Dorman Rd ACRES 114.60 61,100 TOWN TAXABLE VALUE 61,100<strong>Batavia</strong>, NY 14020 EAST-1251563 NRTH-1081679 SCHOOL TAXABLE VALUE 31,100DEED BOOK 582 PG-259 AG001 Ag. District #1 1.00 UNFULL MARKET VALUE 61,100 FD005 <strong>Batavia</strong> fire 61,100 TO************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 9COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-15.2 ******************2732 Galloway Rd 000000525001.-1-15.2 210 1 Family Res STAR B 41854 0 0 30,000Adamczyk Richard Oakfield-Alabam 183801 12,600 COUNTY TAXABLE VALUE 142,000Adamczyk Kathleen 1-1-15.112 (L590-P40) 142,000 TOWN TAXABLE VALUE 142,0002732 Galloway Rd FRNT 400.00 DPTH 175.25 SCHOOL TAXABLE VALUE 112,000<strong>Batavia</strong>, NY 14020 ACRES 1.61 FD003 East pembroke fire 142,000 TOEAST-1224625 NRTH-1105406DEED BOOK 449 PG-00527FULL MARKET VALUE 142,000******************************************************************************************************* 15.-1-1.2 ******************3268 Pearl St Rd 0000014800015.-1-1.2 312 Vac w/imprv COUNTY TAXABLE VALUE 25,000Adamczyk Richard <strong>Batavia</strong> City Sc 180200 19,700 TOWN TAXABLE VALUE 25,000Adamczyk Kathleen A FRNT 550.00 DPTH 25,000 SCHOOL TAXABLE VALUE 25,0002732 Galloway Rd ACRES 9.50 FD003 East pembroke fire 25,000 TO<strong>Batavia</strong>, NY 14020 EAST-1233716 NRTH-1087698 WD007 <strong>Batavia</strong> Pearl St #2 25,000 TO CDEED BOOK 888 PG-14FULL MARKET VALUE 25,000******************************************************************************************************* 15.-1-68 *******************9012 Wortendyke Rd 75 PCT OF VALUE USED FOR EXEMPTION PURPOSES 0000017230015.-1-68 120 Field crops AGED C 41802 50,400 0 0Adamczyk Richard <strong>Batavia</strong> City Sc 180200 54,500 AGED S 41804 0 0 40,320Adamczyk Kathaleen A Life Use Reserved 134,400 STAR EN 41834 0 0 62,2002732 Galloway Rd (Henry & Ann) COUNTY TAXABLE VALUE 84,000<strong>Batavia</strong>, NY 14020 FRNT 903.68 DPTH TOWN TAXABLE VALUE 134,400ACRES 46.00 SCHOOL TAXABLE VALUE 31,880EAST-1234024 NRTH-1085821 AG001 Ag. District #1 1.00 UNDEED BOOK 884 PG-485 FD003 East pembroke fire 134,400 TOFULL MARKET VALUE 134,400 WD017 Wortendyke / Pike 1.00 UN******************************************************************************************************* 15.-1-69.2 *****************Wortendyke Rd 0000017220015.-1-69.2 105 Vac farmland COUNTY TAXABLE VALUE 3,500Adamczyk Richard <strong>Batavia</strong> City Sc 180200 3,500 TOWN TAXABLE VALUE 3,500Adamczyk Kathleen A ACRES 12.10 3,500 SCHOOL TAXABLE VALUE 3,5002732 Galloway Rd EAST-1234651 NRTH-1085885 FD003 East pembroke fire 3,500 TO<strong>Batavia</strong>, NY 14020 DEED BOOK 870 PG-444 WD017 Wortendyke / Pike .00 UNFULL MARKET VALUE 3,500******************************************************************************************************* 9.-1-39 ********************5163 Sunset Ter 000000911009.-1-39 210 1 Family Res STAR B 41854 0 0 30,000Adams Nora L Byron-Bergen Sc 183001 9,200 COUNTY TAXABLE VALUE 82,0005163 Sunset Ter Also L371/394 82,000 TOWN TAXABLE VALUE 82,000<strong>Batavia</strong>, NY 14020 FRNT 70.00 DPTH 185.00 SCHOOL TAXABLE VALUE 52,000BANKFAR0100 FD005 <strong>Batavia</strong> fire 82,000 TOEAST-1266501 NRTH-1095704 SD001 <strong>Batavia</strong> sewer #1 82,000 TO CDEED BOOK 874 PG-803 WD003 <strong>Batavia</strong> water #3 82,000 TO CFULL MARKET VALUE 82,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 12COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 13.-1-60 *******************5238 East Main St Rd 0000009480013.-1-60 210 1 Family Res STAR B 41854 0 0 30,000Albee Denise <strong>Batavia</strong> City Sc 180200 8,000 COUNTY TAXABLE VALUE 75,0005238 East Main St Rd FRNT 75.00 DPTH 200.00 75,000 TOWN TAXABLE VALUE 75,000<strong>Batavia</strong>, NY 14020 BANKBAC0100 SCHOOL TAXABLE VALUE 45,000EAST-1268249 NRTH-1089535 FD005 <strong>Batavia</strong> fire 75,000 TODEED BOOK 726 PG-208 WD004 <strong>Batavia</strong> water #4 75,000 TO CFULL MARKET VALUE 75,000******************************************************************************************************* 8.-3-27.1 ******************4117 South Main St Rd 000001420008.-3-27.1 210 1 Family Res STAR B 41854 0 0 30,000Alderman Daniel <strong>Batavia</strong> City Sc 180200 8,000 COUNTY TAXABLE VALUE 125,000Alderman Penny D FRNT 105.00 DPTH 200.00 125,000 TOWN TAXABLE VALUE 125,0004117 S Main St EAST-1248668 NRTH-1094310 SCHOOL TAXABLE VALUE 95,000<strong>Batavia</strong>, NY 14020 DEED BOOK 467 PG-00078 FD005 <strong>Batavia</strong> fire 125,000 TOFULL MARKET VALUE 125,000 WD003 <strong>Batavia</strong> water #3 125,000 TO C******************************************************************************************************* 2.-1-9 *********************3246 Galloway Rd 000000506002.-1-9 220 2 Family Res AGED C 41802 41,000 0 0Alexander Constance A Oakfield-Alabam 183801 11,500 AGED S 41804 0 0 24,600Alexander Sean P 2-1-11.2 (L412-P1152) 82,000 STAR EN 41834 0 0 57,4003246 Galloway Rd FRNT 200.00 DPTH 190.00 COUNTY TAXABLE VALUE 41,000<strong>Batavia</strong>, NY 14020 ACRES 0.87 TOWN TAXABLE VALUE 82,000EAST-1232982 NRTH-1105134 SCHOOL TAXABLE VALUE 0DEED BOOK 853 PG-523 FD005 <strong>Batavia</strong> fire 82,000 TOFULL MARKET VALUE 82,000******************************************************************************************************* 10.-2-1.1 ******************2952 West Main St Rd 0000000920010.-2-1.1 210 1 Family Res VETS-WV-C 41122 13,500 0 0Alexander John R Pembroke School 184202 14,800 VETS-WV-T 41123 0 9,000 0Alexander Judy A ACRES 3.00 BANKFNG0100 90,000 STAR EN 41834 0 0 62,2002952 W Main St Rd EAST-1228168 NRTH-1091983 COUNTY TAXABLE VALUE 76,500<strong>Batavia</strong>, NY 14020 DEED BOOK 639 PG-169 TOWN TAXABLE VALUE 81,000FULL MARKET VALUE 90,000 SCHOOL TAXABLE VALUE 27,800FD003 East pembroke fire 90,000 TOWD003 <strong>Batavia</strong> water #3 90,000 TO C******************************************************************************************************* 16.-1-2 ********************2623 Brown Rd 0000016090016.-1-2 210 1 Family Res STAR B 41854 0 0 30,000Allen Daniel J Pembroke School 184202 8,100 COUNTY TAXABLE VALUE 90,000Allen Elaine K FRNT 120.00 DPTH 200.00 90,000 TOWN TAXABLE VALUE 90,0002623 Brown Rd BANKFAR0100 SCHOOL TAXABLE VALUE 60,000Corfu, NY 14036 EAST-1222299 NRTH-1078317 FD003 East pembroke fire 90,000 TODEED BOOK 660 PG-202FULL MARKET VALUE 90,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 13COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 12.05-1-34 *****************64 Edgewood Dr12.05-1-34 210 1 Family Res STAR B 41854 0 0 30,000Allen Jennifer A <strong>Batavia</strong> City Sc 180200 32,000 COUNTY TAXABLE VALUE 224,00064 Edgewood Dr ACRES 0.37 224,000 TOWN TAXABLE VALUE 224,000<strong>Batavia</strong>, NY 14020 EAST-1245551 NRTH-1092052 SCHOOL TAXABLE VALUE 194,000DEED BOOK 853 PG-414 FD005 <strong>Batavia</strong> fire 224,000 TOFULL MARKET VALUE 224,000 SD002 <strong>Batavia</strong> sewer #2 224,000 TO CSW002 Sewer / water relevy .00 MTWD003 <strong>Batavia</strong> water #3 224,000 TO C******************************************************************************************************* 18.-1-56.111 ***************3747 Pike Rd 19240518.-1-56.111 240 Rural res STAR EN 41834 0 0 62,200Allen John W 11 Alexander Schoo 182202 22,000 COUNTY TAXABLE VALUE 142,000Allen Carole Jane ACRES 15.40 142,000 TOWN TAXABLE VALUE 142,0003747 Pike Rd EAST-1241722 NRTH-1081283 SCHOOL TAXABLE VALUE 79,800<strong>Batavia</strong>, NY 14020 DEED BOOK 583 PG-317 FD005 <strong>Batavia</strong> fire 142,000 TOFULL MARKET VALUE 142,000 WD011 Alexander/Pike Water 1.00 UN******************************************************************************************************* 9.-1-141 *******************8446 Stringham Dr 000000722559.-1-141 210 1 Family Res STAR B 41854 0 0 30,000Allen Justin <strong>Batavia</strong> City Sc 180200 18,000 COUNTY TAXABLE VALUE 105,0008446 Stringham Dr FRNT 120.00 DPTH 160.00 105,000 TOWN TAXABLE VALUE 105,000<strong>Batavia</strong>, NY 14020 EAST-1264434 NRTH-1096242 SCHOOL TAXABLE VALUE 75,000DEED BOOK 878 PG-289 FD005 <strong>Batavia</strong> fire 105,000 TOFULL MARKET VALUE 105,000 SD001 <strong>Batavia</strong> sewer #1 105,000 TO CWD003 <strong>Batavia</strong> water #3 105,000 TO C******************************************************************************************************* 9.-1-219 *******************Bank St Rd9.-1-219 310 Res Vac COUNTY TAXABLE VALUE 100Allen Lynn A <strong>Batavia</strong> City Sc 180200 100 TOWN TAXABLE VALUE 100404 Bank St Rear parcel to 404 Bank S 100 SCHOOL TAXABLE VALUE 100<strong>Batavia</strong>, NY 14020 in the City <strong>of</strong> <strong>Batavia</strong> FD005 <strong>Batavia</strong> fire 100 TOFRNT 10.00 DPTH 9.50EAST-1259151 NRTH-1097164DEED BOOK 882 PG-674FULL MARKET VALUE 100******************************************************************************************************* 11.-2-86.111 ***************8487 Lovers Lane Rd 0000017290011.-2-86.111 220 2 Family Res STAR B 41854 0 0 30,000Allen Scott A Pembroke School 184202 12,000 COUNTY TAXABLE VALUE 143,0008487 Lovers Lane Rd *11.-2-86.11+114.2=86.111 143,000 TOWN TAXABLE VALUE 143,000<strong>Batavia</strong>, NY 14020 ACRES 2.00 BANKFAR0100 SCHOOL TAXABLE VALUE 113,000EAST-1239052 NRTH-1093884 FD003 East pembroke fire 143,000 TODEED BOOK 873 PG-341 WD009 Lovers Lane Water 1.50 UNFULL MARKET VALUE 143,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 14COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 15.-1-1.12 *****************8850 Wortendyke Rd 017245015.-1-1.12 442 MiniWhseSelf BUS >1997 47615 7,020 0 7,020Alvord David R <strong>Batavia</strong> City Sc 180200 20,000 BUS >1997 47615 4,563 0 4,5631162 Broadway Rd FRNT 231.78 DPTH 941.24 322,500 BUS >1997 47615 27,000 0 27,000Darien Center, NY 14040 ACRES 4.90 COUNTY TAXABLE VALUE 283,917EAST-1234433 NRTH-1087605 TOWN TAXABLE VALUE 322,500DEED BOOK 766 PG-94 SCHOOL TAXABLE VALUE 283,917FULL MARKET VALUE 322,500 FD003 East pembroke fire 322,500 TOWD007 <strong>Batavia</strong> Pearl St #2 322,500 TO C******************************************************************************************************* 15.-1-58.1 *****************Rose Rd 0000018830015.-1-58.1 105 Vac farmland AG DIST-CO 41720 12,081 12,081 12,081Alvord Ronald David <strong>Batavia</strong> City Sc 180200 30,000 COUNTY TAXABLE VALUE 17,919Alvord Kimberly A ACRES 39.70 30,000 TOWN TAXABLE VALUE 17,9191162 Broadway Rd EAST-1241836 NRTH-1085302 SCHOOL TAXABLE VALUE 17,919Darien Center, NY 14020 DEED BOOK 892 PG-540 AG001 Ag. District #1 1.00 UNFULL MARKET VALUE 30,000 FD005 <strong>Batavia</strong> fire 30,000 TOPRIOR OWNER ON 3/01/2012 WD003 <strong>Batavia</strong> water #3 24,000 TO CLoder Victoria K WD012 Rose Rd Wate Dist .00 UNMAY BE SUBJECT TO PAYMENTUNDER AGDIST LAW TIL 2016******************************************************************************************************* 18.-1-30.12 ****************9375 Alexander Rd 0000017930018.-1-30.12 220 2 Family Res STAR B 41854 0 0 30,000Amico Richard J Alexander Schoo 182202 15,000 COUNTY TAXABLE VALUE 129,000Amico Christine A 18-1-30.21 (L634-P276) 129,000 TOWN TAXABLE VALUE 129,0009375 Alexander Rd FRNT 348.92 DPTH SCHOOL TAXABLE VALUE 99,000Alexander, NY 14005 ACRES 9.80 FD005 <strong>Batavia</strong> fire 129,000 TOEAST-1245543 NRTH-1079058 WD011 Alexander/Pike Water 1.50 UNDEED BOOK 704 PG-225FULL MARKET VALUE 129,000******************************************************************************************************* 14.-1-56 *******************9226 Wilkinson Rd 0000016180014.-1-56 210 1 Family Res STAR B 41854 0 0 30,000Ammirati Joseph A Pembroke School 184202 12,200 COUNTY TAXABLE VALUE 57,000Ammirati Mary E FRNT 210.00 DPTH 225.25 57,000 TOWN TAXABLE VALUE 57,0009226 Wilkinson Rd ACRES 1.20 BANKFAR0100 SCHOOL TAXABLE VALUE 27,000<strong>Batavia</strong>, NY 14020 EAST-1224093 NRTH-1081266 FD003 East pembroke fire 57,000 TODEED BOOK 739 PG-90 WD015 Wilkinson Water 1.00 UNFULL MARKET VALUE 57,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 15COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 12.05-1-14 *****************57 Edgewood Dr12.05-1-14 210 1 Family Res STAR B 41854 0 0 30,000Anderson Michael A <strong>Batavia</strong> City Sc 180200 20,000 COUNTY TAXABLE VALUE 215,000Anderson Korinne A MC Change from 12.5-1-14 215,000 TOWN TAXABLE VALUE 215,00057 Edgewood Dr ACRES 0.40 SCHOOL TAXABLE VALUE 185,000<strong>Batavia</strong>, NY 14020 EAST-1246052 NRTH-1091870 FD005 <strong>Batavia</strong> fire 215,000 TODEED BOOK 867 PG-756 SD002 <strong>Batavia</strong> sewer #2 215,000 TO CFULL MARKET VALUE 215,000 WD003 <strong>Batavia</strong> water #3 215,000 TO C******************************************************************************************************* 11.-2-41 *******************3720 West Main St Rd 0000000420011.-2-41 210 1 Family Res AGED C/S 41805 17,500 0 17,500Anderson Sandra Pembroke School 184202 5,000 STAR EN 41834 0 0 17,5003720 West Main St Rd FRNT 60.00 DPTH 35,000 COUNTY TAXABLE VALUE 17,500<strong>Batavia</strong>, NY 14020 ACRES 0.15 TOWN TAXABLE VALUE 35,000EAST-1241362 NRTH-1095699 SCHOOL TAXABLE VALUE 0DEED BOOK 814 PG-176 FD005 <strong>Batavia</strong> fire 35,000 TOFULL MARKET VALUE 35,000 SD008 West Main Sewer .00 UNWD003 <strong>Batavia</strong> water #3 35,000 TO C******************************************************************************************************* 14.-1-20 *******************2832 Pearl St Rd 0000014930014.-1-20 240 Rural res STAR B 41854 0 0 30,000Anderson Stacey L Pembroke School 184202 26,000 COUNTY TAXABLE VALUE 102,0002832 Pearl St Rd ACRES 25.20 102,000 TOWN TAXABLE VALUE 102,000<strong>Batavia</strong>, NY 14020 EAST-1225960 NRTH-1085507 SCHOOL TAXABLE VALUE 72,000DEED BOOK 734 PG-183 FD003 East pembroke fire 102,000 TOFULL MARKET VALUE 102,000 WD006 HHP Water District 1.00 UN******************************************************************************************************* 20.-2-61 *******************9257 Putnam Rd 0000010856520.-2-61 210 1 Family Res STAR B 41854 0 0 30,000Anderson Timothy M <strong>Batavia</strong> City Sc 180200 13,200 COUNTY TAXABLE VALUE 138,000Anderson Linda C ACRES 2.24 138,000 TOWN TAXABLE VALUE 138,0009257 Putnam Rd EAST-1262917 NRTH-1080515 SCHOOL TAXABLE VALUE 108,000<strong>Batavia</strong>, NY 14020 DEED BOOK 571 PG-00204 FD005 <strong>Batavia</strong> fire 138,000 TOFULL MARKET VALUE 138,000 WD013 Putnam/Shepard Water 1.00 UN******************************************************************************************************* 13.-1-149 ******************Seven Springs Rd 11768513.-1-149 311 Res vac land COUNTY TAXABLE VALUE 12,000Andrews Richard <strong>Batavia</strong> City Sc 180200 12,000 TOWN TAXABLE VALUE 12,000Andrews Marcia R ACRES 1.00 12,000 SCHOOL TAXABLE VALUE 12,0002700 Clark Rd EAST-1268498 NRTH-1092152 FD005 <strong>Batavia</strong> fire 12,000 TOBath, MI 48808 DEED BOOK 651 PG-106FULL MARKET VALUE 12,000************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 16COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 13.12-1-7.1 ****************8798 Haven Ln13.12-1-7.1 210 1 Family Res STAR B 41854 0 0 30,000Antinore Thomas C <strong>Batavia</strong> City Sc 180200 20,000 COUNTY TAXABLE VALUE 205,000Antinore Kathy A ACRES 0.75 BANKFAR0100 205,000 TOWN TAXABLE VALUE 205,0008798 Haven Ln EAST-1267441 NRTH-1089004 SCHOOL TAXABLE VALUE 175,000<strong>Batavia</strong>, NY 14020 DEED BOOK 773 PG-337 FD005 <strong>Batavia</strong> fire 205,000 TOFULL MARKET VALUE 205,000 WD004 <strong>Batavia</strong> water #4 205,000 TO C******************************************************************************************************* 20.-1-7 ********************5061 Ellicott St Rd 0000009900020.-1-7 210 1 Family Res STAR B 41854 0 0 30,000Antonelli Kathleen J <strong>Batavia</strong> City Sc 180200 9,400 COUNTY TAXABLE VALUE 130,0005061 Ellicott St 20-1-8 130,000 TOWN TAXABLE VALUE 130,000<strong>Batavia</strong>, NY 14020 FRNT 135.00 DPTH SCHOOL TAXABLE VALUE 100,000ACRES 0.60 AG001 Ag. District #1 1.00 UNEAST-1265179 NRTH-1082707 FD005 <strong>Batavia</strong> fire 130,000 TODEED BOOK 647 PG-255 WD010 Ellicott St Water 1.00 UNFULL MARKET VALUE 130,000******************************************************************************************************* 20.-1-117 ******************Ellicott St Rd 0000009890020.-1-117 311 Res vac land COUNTY TAXABLE VALUE 4,000Antonelli Kathleen J <strong>Batavia</strong> City Sc 180200 4,000 TOWN TAXABLE VALUE 4,0005061 Ellicott St Rd ACRES 0.60 4,000 SCHOOL TAXABLE VALUE 4,000<strong>Batavia</strong>, NY 14020 EAST-1265129 NRTH-1082782 AG001 Ag. District #1 1.00 UNDEED BOOK 808 PG-277 FD005 <strong>Batavia</strong> fire 4,000 TOFULL MARKET VALUE 4,000 WD010 Ellicott St Water .10 UN******************************************************************************************************* 11.-2-81 *******************3633 Pearl St Rd 0000015440011.-2-81 210 1 Family Res STAR B 41854 0 0 30,000Anzalone Ricky J <strong>Batavia</strong> City Sc 180200 17,200 COUNTY TAXABLE VALUE 94,000Anzalone Joyce A ACRES 3.25 BANKFAR0100 94,000 TOWN TAXABLE VALUE 94,0003633 Pearl St Rd EAST-1239824 NRTH-1089870 SCHOOL TAXABLE VALUE 64,000<strong>Batavia</strong>, NY 14020 DEED BOOK 645 PG-140 FD003 East pembroke fire 18,800 TOFULL MARKET VALUE 94,000 FD005 <strong>Batavia</strong> fire 75,200 TOWD007 <strong>Batavia</strong> Pearl St #2 75,200 TO C******************************************************************************************************* 3.-1-48 ********************8004 Lewiston Rd 000000335003.-1-48 210 1 Family Res STAR B 41854 0 0 30,000Anziano Victor Oakfield-Alabam 183801 8,800 COUNTY TAXABLE VALUE 106,000Anziano Cheryl FRNT 100.00 DPTH 215.00 106,000 TOWN TAXABLE VALUE 106,0008004 Lewiston Rd EAST-1243103 NRTH-1102860 SCHOOL TAXABLE VALUE 76,000<strong>Batavia</strong>, NY 14020 DEED BOOK 519 PG-00221 FD005 <strong>Batavia</strong> fire 106,000 TOFULL MARKET VALUE 106,000 WD003 <strong>Batavia</strong> water #3 106,000 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 17COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 2.-1-22.2/A ****************3207 Pratt Rd 000000452002.-1-22.2/A 416 Mfg hsing pk STAR EN 41834 0 0 96,000Applegrove MHP LLC Pembroke School 184202 790,000 STAR B 41854 0 0 459,500PO Box 1660 Apple Grove Mobil 1543,000 COUNTY TAXABLE VALUE 1543,000Pittsford, NY 14534 Home Park TOWN TAXABLE VALUE 1543,0002.-1-22.121 SCHOOL TAXABLE VALUE 987,500ACRES 23.70 FD003 East pembroke fire 1543,000 TOEAST-1232184 NRTH-1098210 WD003 <strong>Batavia</strong> water #3 1543,000 TO CDEED BOOK 845 PG-94FULL MARKET VALUE 1543,000******************************************************************************************************* 2.-1-22.2/D ****************3207 Pratt Rd2.-1-22.2/D 270 Mfg housing VETS-CV-C 41132 3,500 0 0Applegrove MHP LLC Pembroke School 184202 0 VETS-CV-T 41133 0 3,500 0PO Box 1660 Robert & Sandra Colson #3 14,000 VETS-DV-C 41142 7,000 0 0Pittsford, NY 14534 ACRES 0.01 VETS-DV-T 41143 0 7,000 0EAST-1232184 NRTH-1098210 COUNTY TAXABLE VALUE 3,500FULL MARKET VALUE 14,000 TOWN TAXABLE VALUE 3,500SCHOOL TAXABLE VALUE 14,000FD003 East pembroke fire 14,000 TOWD003 <strong>Batavia</strong> water #3 14,000 TO C******************************************************************************************************* 11.-2-24 *******************3645 South Main St Rd 0000014030011.-2-24 210 1 Family Res STAR B 41854 0 0 30,000Aquina Fredrick J 11 Pembroke School 184202 10,100 COUNTY TAXABLE VALUE 95,000Aquina Lori K FRNT 100.00 DPTH 215.00 95,000 TOWN TAXABLE VALUE 95,0003645 South Main St Rd EAST-1240069 NRTH-1095230 SCHOOL TAXABLE VALUE 65,000<strong>Batavia</strong>, NY 14020 DEED BOOK 818 PG-177 FD003 East pembroke fire 95,000 TOFULL MARKET VALUE 95,000 WD003 <strong>Batavia</strong> water #3 95,000 TO C******************************************************************************************************* 20.-1-91 *******************9373 Shepard Rd 0000010700020.-1-91 210 1 Family Res STAR EN 41834 0 0 62,200Aquino Carl Alexander Schoo 182202 12,800 COUNTY TAXABLE VALUE 77,000Aquino Mark A FRNT 157.80 DPTH 77,000 TOWN TAXABLE VALUE 77,0009373 Shepard Rd ACRES 1.80 SCHOOL TAXABLE VALUE 14,800<strong>Batavia</strong>, NY 14020 EAST-1263713 NRTH-1078901 FD005 <strong>Batavia</strong> fire 77,000 TODEED BOOK 821 PG-551 WD013 Putnam/Shepard Water 1.00 UNFULL MARKET VALUE 77,000******************************************************************************************************* 8.-1-27.12 *****************8282 Park Rd 000000571008.-1-27.12 422 Diner/lunch COUNTY TAXABLE VALUE 110,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 50,000 TOWN TAXABLE VALUE 110,00017 Arena Pkwy ACRES 2.30 110,000 SCHOOL TAXABLE VALUE 110,000<strong>Batavia</strong>, NY 14020 EAST-1250490 NRTH-1098576 FD005 <strong>Batavia</strong> fire 110,000 TODEED BOOK 550 PG-00100 SD004 <strong>Batavia</strong> sewer #2a .00 MTFULL MARKET VALUE 110,000 WD003 <strong>Batavia</strong> water #3 110,000 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 18COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 8.-2-29 ********************Arena Pkwy8.-2-29 311 Res vac land COUNTY TAXABLE VALUE 25,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 25,000 TOWN TAXABLE VALUE 25,00017 Arena Pkwy 8.-2-28.1 25,000 SCHOOL TAXABLE VALUE 25,000<strong>Batavia</strong>, NY 14020 ACRES 4.50 FD005 <strong>Batavia</strong> fire 25,000 TOEAST-1247940 NRTH-1096521 SD002 <strong>Batavia</strong> sewer #2 25,000 TO CDEED BOOK 787 PG-252 WD003 <strong>Batavia</strong> water #3 25,000 TO CFULL MARKET VALUE 25,000******************************************************************************************************* 8.-2-31 ********************Arena Pkwy 000000295508.-2-31 311 Res vac land COUNTY TAXABLE VALUE 25,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 25,000 TOWN TAXABLE VALUE 25,00017 Arena Pkwy ACRES 3.60 25,000 SCHOOL TAXABLE VALUE 25,000<strong>Batavia</strong>, NY 14020 EAST-1248166 NRTH-1096319 FD005 <strong>Batavia</strong> fire 25,000 TODEED BOOK 787 PG-252 SD002 <strong>Batavia</strong> sewer #2 25,000 TO CFULL MARKET VALUE 25,000 WD003 <strong>Batavia</strong> water #3 25,000 TO C******************************************************************************************************* 8.-2-32 ********************8360 Lewiston Rd 000000295008.-2-32 422 Diner/lunch COUNTY TAXABLE VALUE 85,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 30,000 TOWN TAXABLE VALUE 85,00017 Arena Pkwy FRNT 75.00 DPTH 200.00 85,000 SCHOOL TAXABLE VALUE 85,000<strong>Batavia</strong>, NY 14020 EAST-1248467 NRTH-1096495 FD005 <strong>Batavia</strong> fire 85,000 TODEED BOOK 432 PG-00144 SD002 <strong>Batavia</strong> sewer #2 85,000 TO CFULL MARKET VALUE 85,000 WD003 <strong>Batavia</strong> water #3 85,000 TO C******************************************************************************************************* 8.-2-97.1 ******************Arena Pkwy 000000294508.-2-97.1 311 Res vac land COUNTY TAXABLE VALUE 20,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 20,000 TOWN TAXABLE VALUE 20,00017 Arena Pkwy ACRES 9.90 20,000 SCHOOL TAXABLE VALUE 20,000<strong>Batavia</strong>, NY 14020 EAST-1246825 NRTH-1096480 FD005 <strong>Batavia</strong> fire 20,000 TODEED BOOK 611 PG-205 SD004 <strong>Batavia</strong> sewer #2a .00 MTFULL MARKET VALUE 20,000 WD003 <strong>Batavia</strong> water #3 20,000 TO C******************************************************************************************************* 8.-2-97.2 ******************17 Arena Pkwy 294408.-2-97.2 210 1 Family Res STAR B 41854 0 0 30,000Arena Jerry J <strong>Batavia</strong> City Sc 180200 12,200 COUNTY TAXABLE VALUE 120,00017 Arena Pkwy ACRES 1.23 120,000 TOWN TAXABLE VALUE 120,000<strong>Batavia</strong>, NY 14020 EAST-1247397 NRTH-1096343 SCHOOL TAXABLE VALUE 90,000DEED BOOK 589 PG-309 FD005 <strong>Batavia</strong> fire 120,000 TOFULL MARKET VALUE 120,000 SD004 <strong>Batavia</strong> sewer #2a .00 MTWD003 <strong>Batavia</strong> water #3 120,000 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 19COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 9.-1-66.2 ******************5145 Clinton St Rd 000000751009.-1-66.2 210 1 Family Res COUNTY TAXABLE VALUE 86,000Argulski Raymond E Byron-Bergen Sc 183001 8,000 TOWN TAXABLE VALUE 86,000Argulski Dorothy H FRNT 60.00 DPTH 190.00 86,000 SCHOOL TAXABLE VALUE 86,0005145 Clinton St Rd EAST-1266356 NRTH-1095165 FD005 <strong>Batavia</strong> fire 86,000 TO<strong>Batavia</strong>, NY 14020 DEED BOOK 306 PG-239 SD001 <strong>Batavia</strong> sewer #1 86,000 TO CFULL MARKET VALUE 86,000 WD003 <strong>Batavia</strong> water #3 86,000 TO C******************************************************************************************************* 3.-1-91 ********************3645 Galloway Rd 000000537003.-1-91 210 1 Family Res STAR B 41854 0 0 30,000Armbrewster Chad M Oakfield-Alabam 183801 14,900 COUNTY TAXABLE VALUE 136,000Armbrewster Sonja B 3-1-92(Liber373/page377) 136,000 TOWN TAXABLE VALUE 136,0003645 Galloway Rd ACRES 3.90 BANKFAR0100 SCHOOL TAXABLE VALUE 106,000<strong>Batavia</strong>, NY 14020 EAST-1239555 NRTH-1105937 FD005 <strong>Batavia</strong> fire 136,000 TODEED BOOK 824 PG-349 WD003 <strong>Batavia</strong> water #3 136,000 TO CFULL MARKET VALUE 136,000******************************************************************************************************* 4.-1-22.115 ****************Saile Dr 000000595004.-1-22.115 330 Vacant comm COUNTY TAXABLE VALUE 13,600Armison Family Rev. Liv. Trust Elba School 183401 13,600 TOWN TAXABLE VALUE 13,600532 Ruth Circle ACRES 2.90 13,600 SCHOOL TAXABLE VALUE 13,600West Melbourne, FL 32904 EAST-1254970 NRTH-1104183 FD005 <strong>Batavia</strong> fire 13,600 TODEED BOOK 864 PG-197 WD019 <strong>Batavia</strong> NE Water .10 UNFULL MARKET VALUE 13,600******************************************************************************************************* 4.-1-48 ********************Saile Dr4.-1-48 330 Vacant comm COUNTY TAXABLE VALUE 5,000Armison Family Rev. Liv. Trust Elba School 183401 5,000 TOWN TAXABLE VALUE 5,000532 Ruth Circle ACRES 3.50 5,000 SCHOOL TAXABLE VALUE 5,000West Melbourne, FL 32940 EAST-1253793 NRTH-1103630 FD005 <strong>Batavia</strong> fire 5,000 TODEED BOOK 864 PG-197FULL MARKET VALUE 5,000******************************************************************************************************* 5.-1-103.11 ****************State St Rd 000000674005.-1-103.11 311 Res vac land COUNTY TAXABLE VALUE 4,400Armison Family Rev. Liv. Trust Elba School 183401 4,400 TOWN TAXABLE VALUE 4,400532 Ruth Circle ACRES 3.50 4,400 SCHOOL TAXABLE VALUE 4,400West Melbourne, FL 32904 EAST-1256964 NRTH-1103720 FD005 <strong>Batavia</strong> fire 4,400 TODEED BOOK 864 PG-197FULL MARKET VALUE 4,400************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 20COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 8.-3-37.11 *****************South Main St Rd8.-3-37.11 311 Res vac land COUNTY TAXABLE VALUE 2,000Armitage David H <strong>Batavia</strong> City Sc 180200 2,000 TOWN TAXABLE VALUE 2,0004024 South Main St Rd *8.-3-37.1+8.-3-37.21* 2,000 SCHOOL TAXABLE VALUE 2,000<strong>Batavia</strong>, NY 14020 FRNT 338.00 DPTH 52.00 FD005 <strong>Batavia</strong> fire 2,000 TOACRES 0.36 WD003 <strong>Batavia</strong> water #3 2,000 TO CEAST-1247663 NRTH-1094415FULL MARKET VALUE 2,000******************************************************************************************************* 8.-3-87.1 ******************4024 South Main St Rd 000001285008.-3-87.1 210 1 Family Res STAR B 41854 0 0 30,000Armitage David H <strong>Batavia</strong> City Sc 180200 30,000 COUNTY TAXABLE VALUE 153,0004024 South Main St Rd *8.-1-87+8.-3-88=8.-3-87. 153,000 TOWN TAXABLE VALUE 153,000<strong>Batavia</strong>, NY 14020 8.-3-40 SCHOOL TAXABLE VALUE 123,000FRNT 324.84 DPTH FD005 <strong>Batavia</strong> fire 153,000 TOACRES 1.70 WD003 <strong>Batavia</strong> water #3 153,000 TO CEAST-1247632 NRTH-1094186DEED BOOK 890 PG-167FULL MARKET VALUE 153,000******************************************************************************************************* 8.-2-11 ********************8274 Lewiston Rd 000000313008.-2-11 210 1 Family Res STAR B 41854 0 0 30,000Arnetova-Panzone Tereza <strong>Batavia</strong> City Sc 180200 16,600 COUNTY TAXABLE VALUE 127,000Panzone David E FRNT 101.00 DPTH 225.00 127,000 TOWN TAXABLE VALUE 127,0008274 Lewiston Rd BANKWFB0100 SCHOOL TAXABLE VALUE 97,000<strong>Batavia</strong>, NY 14020 EAST-1247145 NRTH-1098032 FD005 <strong>Batavia</strong> fire 127,000 TODEED BOOK 880 PG-741 SD002 <strong>Batavia</strong> sewer #2 127,000 TO CFULL MARKET VALUE 127,000 WD003 <strong>Batavia</strong> water #3 127,000 TO C******************************************************************************************************* 10.-1-41 *******************Read Rd 0000001450010.-1-41 440 Warehouse COUNTY TAXABLE VALUE 13,000Arnold Edward Pembroke School 184202 13,000 TOWN TAXABLE VALUE 13,000Arnold Daryln FRNT 72.00 DPTH 225.00 13,000 SCHOOL TAXABLE VALUE 13,0002216 Angling Rd EAST-1221612 NRTH-1090751 FD003 East pembroke fire 13,000 TOCorfu, NY 14036 DEED BOOK 428 PG-171 WD003 <strong>Batavia</strong> water #3 13,000 TO CFULL MARKET VALUE 13,000******************************************************************************************************* 1.-1-5.1 *******************<strong>Batavia</strong>-Oakfield <strong>Town</strong>line 000001269001.-1-5.1 105 Vac farmland AG DIST-CO 41720 38,052 38,052 38,052Arnold Farm Family LLC Oakfield-Alabam 183801 88,600 COUNTY TAXABLE VALUE 50,5482947 Bat-Oak Tnln Rd ACRES 99.10 88,600 TOWN TAXABLE VALUE 50,548<strong>Batavia</strong>, NY 14020 EAST-1226534 NRTH-1107762 SCHOOL TAXABLE VALUE 50,548DEED BOOK 688 PG-162 AG002 Ag. District #2 .00 MTMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 88,600 FD005 <strong>Batavia</strong> fire 88,600 TOUNDER AGDIST LAW TIL 2016************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 21COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 1.-1-8 *********************3110 <strong>Batavia</strong>-Oakfield <strong>Town</strong>line 000001266001.-1-8 120 Field crops AG DIST-CO 41720 50,462 50,462 50,462Arnold Farm Family LLC Oakfield-Alabam 183801 117,300 STAR B 41854 0 0 30,0002947 Batv-Oakf Twln Rd ACRES 99.90 195,900 COUNTY TAXABLE VALUE 145,438<strong>Batavia</strong>, NY 14020 EAST-1229933 NRTH-1107879 TOWN TAXABLE VALUE 145,438DEED BOOK 688 PG-162 SCHOOL TAXABLE VALUE 115,438MAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 195,900 AG002 Ag. District #2 .00 MTUNDER AGDIST LAW TIL 2016 FD005 <strong>Batavia</strong> fire 195,900 TO******************************************************************************************************* 1.-1-17.1 ******************Galloway Rd 000000521001.-1-17.1 105 Vac farmland AG DIST-CO 41720 59,801 59,801 59,801Arnold Farm Family LLC Oakfield-Alabam 183801 129,800 COUNTY TAXABLE VALUE 80,9992947 Batv-Oakf Twln Rd ACRES 129.70 140,800 TOWN TAXABLE VALUE 80,999<strong>Batavia</strong>, NY 14020 EAST-1221885 NRTH-1107175 SCHOOL TAXABLE VALUE 80,999DEED BOOK 781 PG-44 AG002 Ag. District #2 .00 MTMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 140,800 FD003 East pembroke fire 140,800 TOUNDER AGDIST LAW TIL 2016******************************************************************************************************* 3.-1-3 *********************3432 <strong>Batavia</strong>-Oakfield <strong>Town</strong>line 000001261003.-1-3 120 Field crops AG DIST-CO 41720 73,476 73,476 73,476Arnold Farm Family LLC Oakfield-Alabam 183801 152,000 COUNTY TAXABLE VALUE 106,7242947 Batv-Oakf Twln Rd ACRES 101.00 180,200 TOWN TAXABLE VALUE 106,724<strong>Batavia</strong>, NY 14020 EAST-1236116 NRTH-1108103 SCHOOL TAXABLE VALUE 106,724DEED BOOK 688 PG-162 AG002 Ag. District #2 .00 MTMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 180,200 FD005 <strong>Batavia</strong> fire 180,200 TOUNDER AGDIST LAW TIL 2016 WD018 <strong>Batavia</strong> NW Water .10 UN******************************************************************************************************* 6.-1-23 ********************3059 West Main St Rd 000000176006.-1-23 210 1 Family Res STAR EN 41834 0 0 62,200Arnold George W Pembroke School 184202 16,900 COUNTY TAXABLE VALUE 111,000Arnold Marlene ACRES 2.90 111,000 TOWN TAXABLE VALUE 111,0003059 W Main St Rd EAST-1229883 NRTH-1093195 SCHOOL TAXABLE VALUE 48,800<strong>Batavia</strong>, NY 14020 DEED BOOK 379 PG-92 FD003 East pembroke fire 111,000 TOFULL MARKET VALUE 111,000 WD003 <strong>Batavia</strong> water #3 111,000 TO C******************************************************************************************************* 6.-1-20.1 ******************3079 West Main St Rd 000000178006.-1-20.1 210 1 Family Res STAR B 41854 0 0 30,000Arnold George W Jr Pembroke School 184202 17,700 COUNTY TAXABLE VALUE 103,000Smart Janice A ACRES 4.60 BANKFAR0100 103,000 TOWN TAXABLE VALUE 103,0003079 West Main St Rd EAST-1230301 NRTH-1093164 SCHOOL TAXABLE VALUE 73,000<strong>Batavia</strong>, NY 14020 DEED BOOK 740 PG-228 FD003 East pembroke fire 103,000 TOFULL MARKET VALUE 103,000 WD003 <strong>Batavia</strong> water #3 103,000 TO C************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 22COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 6.-1-22 ********************3077 West Main St Rd 000000177006.-1-22 210 1 Family Res COUNTY TAXABLE VALUE 61,000Arnold George W Jr Pembroke School 184202 9,200 TOWN TAXABLE VALUE 61,0003079 West Main St Rd FRNT 127.00 DPTH 200.00 61,000 SCHOOL TAXABLE VALUE 61,000<strong>Batavia</strong>, NY 14020 EAST-1230002 NRTH-1093022 FD003 East pembroke fire 61,000 TODEED BOOK 876 PG-650 WD003 <strong>Batavia</strong> water #3 61,000 TO CFULL MARKET VALUE 61,000******************************************************************************************************* 3.-1-94 ********************7682 Lewiston Rd 000000365003.-1-94 210 1 Family Res COUNTY TAXABLE VALUE 58,000Arnold Robert J Oakfield-Alabam 183801 4,500 TOWN TAXABLE VALUE 58,000Arnold Dorothy FRNT 70.00 DPTH 165.00 58,000 SCHOOL TAXABLE VALUE 58,000Attn: Sandra Coe EAST-1238364 NRTH-1108357 FD005 <strong>Batavia</strong> fire 58,000 TO7682 Lewiston Rd DEED BOOK 313 PG-165 WD018 <strong>Batavia</strong> NW Water 1.00 UN<strong>Batavia</strong>, NY 14020 FULL MARKET VALUE 58,000******************************************************************************************************* 20.-1-49 *******************5126 Ellicott St Rd 0000010200020.-1-49 210 1 Family Res STAR B 41854 0 0 30,000Arnone Penney <strong>Batavia</strong> City Sc 180200 12,100 COUNTY TAXABLE VALUE 125,0005126 Ellicott St Rd FRNT 135.02 DPTH 336.60 125,000 TOWN TAXABLE VALUE 125,000<strong>Batavia</strong>, NY 14020 ACRES 1.10 SCHOOL TAXABLE VALUE 95,000EAST-1266121 NRTH-1081374 FD005 <strong>Batavia</strong> fire 125,000 TODEED BOOK 872 PG-528 WD010 Ellicott St Water 1.00 UNFULL MARKET VALUE 125,000******************************************************************************************************* 6.-1-51.1 ******************Stegman Rd6.-1-51.1 105 Vac farmland AG DIST-CO 41720 45,721 45,721 45,721Atherton Farms, Inc. Pembroke School 184202 77,000 COUNTY TAXABLE VALUE 31,279PO Box 248 ACRES 48.90 77,000 TOWN TAXABLE VALUE 31,279East Pembroke, NY 14056 EAST-1222045 NRTH-1094302 SCHOOL TAXABLE VALUE 31,279DEED BOOK 834 PG-784 AG002 Ag. District #2 .00 MTMAY BE SUBJECT TO PAYMENT FULL MARKET VALUE 77,000 FD003 East pembroke fire 77,000 TOUNDER AGDIST LAW TIL 2016******************************************************************************************************* 6.-1-52.11 *****************Stegman Rd 000000485006.-1-52.11 105 Vac farmland AG DIST-CO 41720 89,218 89,218 89,218Atherton Farms, Inc. Pembroke School 184202 166,600 COUNTY TAXABLE VALUE 77,382PO Box 249 *6.-1-52.1+52.2=52.11* 166,600 TOWN TAXABLE VALUE 77,382East Pembroke, NY 14056 6.-1-58 & 6.-1-51. SCHOOL TAXABLE VALUE 77,382ACRES 147.50 AG002 Ag. District #2 .00 MTMAY BE SUBJECT TO PAYMENT EAST-1223350 NRTH-1094724 FD003 East pembroke fire 166,600 TOUNDER AGDIST LAW TIL 2016 DEED BOOK 848 PG-52 WD020 Pratt Rd Water .10 UNFULL MARKET VALUE 166,600************************************************************************************************************************************

STATE OF NEW YORK 2 0 1 2 F I N A L A S S E S S M E N T R O L L PAGE 23COUNTY - <strong>Genesee</strong> T A X A B L E SECTION OF THE ROLL - 1 VALUATION DATE-JUL 01, 2011TOWN - <strong>Batavia</strong> TAXABLE STATUS DATE-MAR 01, 2012SWIS - 182400 OWNERS NAME SEQUENCEUNIFORM PERCENT OF VALUE IS 100.00TAX MAP PARCEL NUMBER PROPERTY LOCATION & CLASS ASSESSMENT EXEMPTION CODE------------------COUNTY--------TOWN------SCHOOLCURRENT OWNERS NAME SCHOOL DISTRICT LAND TAX DESCRIPTION TAXABLE VALUECURRENT OWNERS ADDRESS PARCEL SIZE/GRID COORD TOTAL SPECIAL DISTRICTS ACCOUNT NO.******************************************************************************************************* 3.-1-52 ********************7976 Lewiston Rd 000000339003.-1-52 210 1 Family Res STAR B 41854 0 0 30,000Athoe Daniel W Oakfield-Alabam 183801 14,900 COUNTY TAXABLE VALUE 98,000Athoe Debra A FRNT 200.00 DPTH 200.00 98,000 TOWN TAXABLE VALUE 98,0007976 Lewiston Rd EAST-1242712 NRTH-1103330 SCHOOL TAXABLE VALUE 68,000<strong>Batavia</strong>, NY 14020 DEED BOOK 877 PG-843 FD005 <strong>Batavia</strong> fire 98,000 TOFULL MARKET VALUE 98,000 WD003 <strong>Batavia</strong> water #3 98,000 TO C******************************************************************************************************* 15.-1-77 *******************3482 Pearl St Rd 14699015.-1-77 210 1 Family Res STAR B 41854 0 0 30,000Athoe John C <strong>Batavia</strong> City Sc 180200 26,300 COUNTY TAXABLE VALUE 140,000Athoe Vicki A FRNT 696.72 DPTH 140,000 TOWN TAXABLE VALUE 140,0003482 Pearl St ACRES 21.70 BANKFAR0100 SCHOOL TAXABLE VALUE 110,000<strong>Batavia</strong>, NY 14020 EAST-1237666 NRTH-1088354 FD005 <strong>Batavia</strong> fire 140,000 TODEED BOOK 860 PG-652 WD007 <strong>Batavia</strong> Pearl St #2 140,000 TO CFULL MARKET VALUE 140,000******************************************************************************************************* 20.-1-44.112 ***************5115 <strong>Batavia</strong>-Bethany <strong>Town</strong>line 0000010160020.-1-44.112 210 1 Family Res STAR B 41854 0 0 30,000Auricchio Joseph <strong>Batavia</strong> City Sc 180200 15,000 COUNTY TAXABLE VALUE 205,000Auricchio Michelle FRNT 175.00 DPTH 205,000 TOWN TAXABLE VALUE 205,0005115 <strong>Batavia</strong>-Bethany Tnln Rd ACRES 1.70 BANKWFR0100 SCHOOL TAXABLE VALUE 175,000East Bethany, NY 14054 EAST-1266406 NRTH-1078120 AG001 Ag. District #1 1.00 UNDEED BOOK 822 PG-72 FD005 <strong>Batavia</strong> fire 205,000 TOFULL MARKET VALUE 205,000******************************************************************************************************* 14.-1-25.1 *****************3108 Pearl St Rd 0000014860014.-1-25.1 240 Rural res STAR B 41854 0 0 30,000Auriemma Leopold J 111 <strong>Batavia</strong> City Sc 180200 82,800 COUNTY TAXABLE VALUE 170,0003108 Pearl St Rd ACRES 105.50 170,000 TOWN TAXABLE VALUE 170,000<strong>Batavia</strong>, NY 14020 EAST-1231139 NRTH-1086288 SCHOOL TAXABLE VALUE 140,000DEED BOOK 461 PG-00737 FD003 East pembroke fire 170,000 TOFULL MARKET VALUE 170,000 WD006 HHP Water District 1.00 UN******************************************************************************************************* 14.-1-5 ********************2698 Pearl St Rd 0000015000014.-1-5 210 1 Family Res STAR B 41854 0 0 30,000Austin Eugene R Pembroke School 184202 12,100 COUNTY TAXABLE VALUE 58,10012 Fisher Park ACRES 1.10 BANKBAC0100 58,100 TOWN TAXABLE VALUE 58,100<strong>Batavia</strong>, NY 14020 EAST-1223488 NRTH-1085326 SCHOOL TAXABLE VALUE 28,100DEED BOOK 571 PG-00340 FD003 East pembroke fire 58,100 TOFULL MARKET VALUE 58,100 WD014 Pearl St. Water 1.00 UN************************************************************************************************************************************