A Guide to CalPERS Partial Service Retirement - Dpa

A Guide to CalPERS Partial Service Retirement - Dpa

A Guide to CalPERS Partial Service Retirement - Dpa

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

#$,1$.Ì:È;.iw,!.;,'t1,

TABLE OF CONTENTSf ntroduction.... .....2How lt WorksEligibility RequirementsHow<strong>to</strong>Apply ........3EstimatingYourAllowance.. ......4<strong>Service</strong>Credit .....4BenefitFac<strong>to</strong>r ..... +FinalCompensation ......4Allowance EstimatesExample I: State First Tier and Public Agency MembersCoordinated with Social Securiry.Example II: State First Tier and Public Ag.tty MembersNot Coordinated with Social Security . . .Example III: State Second Tier MembersEstimate Your CaseOther ConsiderationsAllowance AdjustmentsChangingJobs. . . .Separating from EmploymentFull <strong>Service</strong> <strong>Retirement</strong>Important Tax Information . .Mailing of \ØarrantsPayroll DeductionsHealth, Dental, and Long-Term Ca¡e Coverage .SocialSecurity....Injury lllness, Or Leaves of Absence.Provisions for Beneficiaries. . . .555666668899999Become a More Informed Member ...... 10CaIPERSOn-Line. ......10ReachingUrByPhone... i0myICaIPERS .....10CalPERsEduc¿tionCenter ......10Visit Your Nea¡est CaIPERS Regional Office. . . . . . 11fnformation Practices Statement .......12www.carpers.ca.gov

INTRODUCTION<strong>Partial</strong> service retirement is a benefit available <strong>to</strong> full-time State Miscellaneous,State Industrial, and public agency members (if your employer contracts forthis benefit) who meet the normal retirement age and se¡vice requirements.Vith partial service retirement, you can reduce your work dme, continueworking, and receive a "pardal" service retirement allowance.HOW IT WORKSIf you are eligible, you may reduce your work time by at least 20 percent, butnot more than 60 percent. In other words, you must work at least 40 percen<strong>to</strong>f full time, but not more than B0 percent. Your agency musr approve yourrequest <strong>to</strong> reduce your work time for paftial retirement.Your allowance is based on the reduction of your work time. For example, ifyou reduce your work time by 30 percent (working 70 percent of full time),your allowance would be 30 percent of what you would receive if you <strong>to</strong>ok afull service retirement.Once your partial service retirement begins, you may decrease your alreadyreducedwork time once each fiscal year. You may increase your work time onlyonce every five years.\With your employer's approval, you may end your pardal service retirement atany time and return <strong>to</strong> full-time employment. Once you withdraw, you cannorreapply for five years.888 CaIPERS (or 888-225-t377].

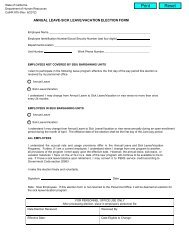

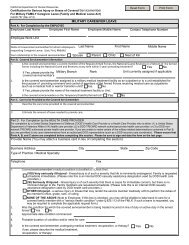

ELIG IBI LITY REOU IREMENTSYou are eligible for partial service retirement if you meet the followingrequirements:. You work full-time in one of the following CaIPERS membershipcategories: State Miscellaneous, State Industriai, or public agency member(if the public agency employer contracts for this benefit).. You have ¡eached the normal retirement age for your retirement benefitformula. The normal retirement age is the age at which you can retirewithout a reduction for retiring early. If your benefit formula is 2o/o@55,your normal retirement age is 55. If your benefit formula is 2o/o at 60, yournormal retirement age is 60.. You have accrued the minimum number of years of service credit <strong>to</strong> beeligible for service retirement in your membership category. For most StateMiscellaneous, State Industrial, and public agency members, you must havea minimum of five years of <strong>CalPERS</strong>-credited service.Note: University of California and California State University employees arenot eligible for partial service retirement.HOW TO APPLYYour Human Resources Department has the necessary <strong>Partial</strong> <strong>Service</strong><strong>Retirement</strong> Application form (DPA-062). This form is also available on theDepartment of Personnel Administrationt website at www.dpa.ca.gov. Toensure timely processing, submit your completed application <strong>to</strong> CaIPERS atleast 60 days before the efFective date of partial retirement. The effective datemust be the same date of your work time reduction and can be the first dayof any pay period.Remember, you must receive employer approval before you can apply.Note: \Øhen corresponding with CaIPERS be sure <strong>to</strong> include your SocialSecurity and daytime telephone numbers on all written inquiries anddocuments.www.calpers.ca.gov

ESTI MATING YOU R ALLOWANCEThe easiest way <strong>to</strong> estimate your partial service retirement allowance is <strong>to</strong>use the <strong>Retirement</strong> Planning Calcula<strong>to</strong>r at www.calpers.ca.gov <strong>to</strong> determineyour full service retirement benefit. Then, multiply your paftial retirementpercentage times the Unmodified Allowance.To manually estimate your pa-rtial service retirement allowance, you will need<strong>to</strong> know your years of service credit, benefit fac<strong>to</strong>r, and final compensation.Examples and space <strong>to</strong> estimate your allowance are on page 5.<strong>Service</strong> CreditThis is the amount of CaIPERS-covered service you have earned. Refer <strong>to</strong> yourlatest CaIPERS A¡nual Member Statement and add anv service credit you haveearned since that time.Benefit Fac<strong>to</strong>rYour benefit fac<strong>to</strong>r is the percentage ofpay you are entitled <strong>to</strong> receive foreach year of service. It is determined by your age at paftial service retirement.Refer <strong>to</strong> your Member Benefit publication for your benefit fac<strong>to</strong>r table. Thispublication is available through your employer, any CaIPERS office, or atwww.ca-lpers.ca.gov.Final Compensat¡onThis is your average monthly pay rate for a one-year or consecutive threeyearperiod of employment (whichever your agency has contracted for). Youmay elect a different one-year or consecutive three-year period if it producesa higher ayerage monthly pay rate.If your CaIPERS State FirstTier or publica9enÇy service was coordinated with Social Security, you must reduce your finalcompensationby $133.33 when computing your allowance. (You did not paycontributions on the first $133.33 of your earnings.)If your CaIPERS State First Tier or public agenq service was not coordinatedwith Social Security, or you are a State Second Tier member, do nor reduceyour fi nal compensation.888 CaIPERS (or 888-225-137t]l

ALLOWANCE ESTIMATES\Øe have used the following information for our examples:<strong>Retirement</strong> formulaAge at partial service retirementYears ofservice creditFinal compensationReduction of work time= 2o/o at 55-')

OTHER CONSIDERATIONSAllowance AdjustmentsYour partial service retirement allowance will be based on your age, salary andservice at the date of your initial entry in<strong>to</strong> the program. A salary increase afterentering the program will not change your partial service retiremenr allowance.If you increase or decrease your work time, your new allowance will be basedon t}re original allowance calculation. There are no provisions for cost-oÊlivingincreases for partial service retirement allowances.Changing JobsYou may transfer from one agency <strong>to</strong> another and continue your partialservice retirement, with employer approval, as long as you remain a StateMiscellaneous, State Industria.l, or contracting public agency member.Separating from EmploymentIf you permanendy sepa-rate from State or public agency employment, youcânnot continue your partial service retirement. You ma¡ however, apply fora frrll service retirement (see your CaIPERS Member Benefit publication),terminate your CaIPERS membership and receive a refund of yourcontributions plus interest, or leave your contributions on deposit withCaIPERS and apply for retirement or a refu.nd at some time in the future.Full <strong>Service</strong> <strong>Retirement</strong>You may apply for full service retirement at any time by submitting theretirement application in the publication A Gaide <strong>to</strong> CompletingYoarCaIPERS Seruice <strong>Retirement</strong> El¿ction Apltlication However, it is <strong>to</strong> youradvantage <strong>to</strong> earn at least one year of service credit under paftial retirementbefore doing so. Ifyou have earned at least one year ofservice credit afterentering partial service retirement, we will provide you with a brand newretirement calculation when you go <strong>to</strong> full service retirement. This is basedon your age, final compensation, and <strong>to</strong>tal years of service as of the fullservice retirement effêctive date.Ifyou have earned less than one year ofservice credit before going <strong>to</strong> fullservice retirement, your retirement will be calculated differently. The newservice earned will be calculated based on your age and final compensationas of the full service retirement effective date. That amount will be added <strong>to</strong>the original full service retirement unmodified allowance used for the partialretirement calculation <strong>to</strong> get your full service retirement allowance. Memberswho earn less than a full year of service credit during their partial serviceretirement may see a substantial reduction in their full service retirementallowance compared <strong>to</strong> members who have ea¡ned at least one full year ofservice credit.888 CaIPERS (or 888-225-1371\

Note: The less than one year of service calculation also applies if you endedyour partial retirement, returned <strong>to</strong> full-time employment, and earned lessthan one year of service credit before applying for retirement.Your full service retirement will be based mainly on the initial partial serviceretirement calculation if you have earned less than one year of service creditunder partial service retirement.Visit CaIPERS On-Line website at www.calpers.cÍr.gov <strong>to</strong> calculate yourown full service retirement estimate online. You may also initiate a CaIPERSgeneratedestimate on our website by downloading the <strong>Retirement</strong> AllotaanceEstìrnate Requestform <strong>to</strong> complete and mail <strong>to</strong> us, or log in <strong>to</strong> myl<strong>CalPERS</strong>using your lJsername and Password <strong>to</strong> submit your request online. 'We ca¡ alsomail the form <strong>to</strong> you upon request when you call us <strong>to</strong>ll free at 888 CaIPERS(or 888-225-7377).Note: Since your work time under paftial service retirement is less than fi¡ll time,it will take more than one fiscal year <strong>to</strong> earn one year of CaIPERS service credit.Percent of<strong>Partial</strong> <strong>Retirement</strong>Required months <strong>to</strong> earnone year ofservice credit2025T4304050601720)\www.calpers.ca.gov

lm portant Tax lnformation<strong>Partial</strong> service retirement allowance is taxable income and must be reported <strong>to</strong>the tax authorities annually. A partial retiree remains in active member status.Distributions received by active members prior <strong>to</strong> age 59Yz from a qualifiedretirement plan such as CaIPERS are considered "early'' distributions underSection 72(t) of the Internal Revenue Code (IRC). Early distributions froma qualified retirement plan are subject <strong>to</strong> an additional 10% federal tax and2Yz o/o Caltfornia state tax on the taxable portion of the distribution, PLUSany income tax due on the distribution.Only federal and California state taxes can be deducted from your partialservice retirement allowance. You may elect not <strong>to</strong> have tax withholding.However, if we do not receive a signed withholding election, CaIPERS isrequired <strong>to</strong> withhold taxes based on the tax tables for a ma¡ried person with3 exemptions. California residents who do not file a tax withholding electionwill have an additional 2olo with-treld for state taxes when early distributionsapply. For individuals who reside outside of California, no California statetax will be withheld unless specifically requested.You will receive an annual Form 1099R that reports the gross amount ofpartial service retirement allowance you have received and the amount offederal and/or California state tax deductions for each tax year in which youparticipate. The Form 1099R filed by CaIPERS will report your paftial serviceretir€ment allowance as an early distribution until you attain age 59Vz as ofDecember 3 1 of the tax year being reported.\Vhile CaIPERS can provide you with information on some tax laws that relate<strong>to</strong> your partial retirement, you should request additional information regardingthe taxability of your partial service retirement allowance from the InternalRevenue <strong>Service</strong> (IRS), California Franchise Tax Board, or your tax advisor.You may contact the IRS by calling <strong>to</strong>ll free, (800) 829-1040, orby visitingtheir website at wwr¡¡.irs.ustreas.gov. If you have California state tax questions,please contact the California Franchise Tâx Board at (800) 852-5711 or byvisiting their website at www.ftb.ca.gov.Mailing of WarrantsCurrentl¡ partial service redrement payments are processed manually. Awarrant is mailed <strong>to</strong> you on or shortly after the first of each month. There isno provision for Direct Deposit (electronic fund transfer) of these payments.They can be mailed <strong>to</strong> your financial institution for deposit in<strong>to</strong> your account;however, the only available space for the checking/savings account number isin the mailing address. Since the information is visible in the window of theenvelope, this is not recommended.888 CaIPERS (or 888-225-7377r.

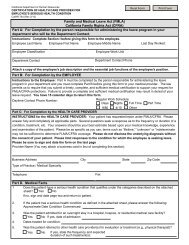

Payroll DeductionsAny payroll deductions you have (health and life insurance premiums, uniondues, credit union payments, deferred compensation, etc.) must be taken fromyour salary. Ifyou have any questions regarding payroll deductions, contactyour Human Resources Department.Health, Dental, and Long-Term Care CoverageYour health, dental, and long-term care (if enrolled) coverage are not affected bypartial service retirement. Remember, though, that any premium payments willbe deducted from your salary and not from your partial retirement allowance.Social SecurityYou may draw Social Security benefits while receiving your partial serviceretirement allowa¡ce; however, your earnings salary and partial retirement-allowance combined may cause an offset <strong>to</strong> your Social Security benefits.-Contact your local Social Security office for information.Injury, lllness, Or Leaves of AbsenceIfyou are unable <strong>to</strong> perform your job because ofan injury or illness,you may be eligible for disabiliry retirement. For more informadon see theCaIPERS publication A Guid¿ <strong>to</strong> Completing Your Disability RetirernentElcction Application.If your injury or illness requires that you take a leave of absence or go on Non-Industrial Disabiliry Leave, you can continue your partial service retirement withyour employer's consent. You may also remain in the program ifyou require othertypes of leave. Contact your Human Resources Department for information.Provisions for BeneficiariesThere is no provision under partial service retirement <strong>to</strong> provide benefits <strong>to</strong>someone after your death. AII death benefits payable will be paid in the samemanner as active member pre-retir€ment death benefits. See your CaIPERSMember Benefit publication for more information.www. ca lp e rs. ca . g ov

BECOME A MORE INFORMED MEMBERCaIPERS On-LineVisit our website at www.calpers.cír.gov for more information on all yourbenefits and programs.Reaching Us By PhoneCall us <strong>to</strong>ll free at 888 CaIPERS (or 888-225-7377).Monday through Frida¡ 8:00 a.m. <strong>to</strong> 5:00 p.m.TTY: For Speech Ec Hearing Impaired (916) 795-3240myl<strong>CalPERS</strong>Stay informed and be in control of the information you want and need-with myl<strong>CalPERS</strong>!mylCaIPERS is the personalized and secure website that provides all yourretirement, health, and financial information in one place. Tâke advantage of theconvenience of 2417 access <strong>to</strong> learn more about CaIPERS progra-ms and servicesthat are right for you in your career stage. '!7ith mylCaIPERS, you can:. Get quick and easy access <strong>to</strong> all your account information.. Manage and update your contact information and online account profile.. Access information about your health plan and family members enrolled inyour plan.. See all the information you need <strong>to</strong> make health plan decisions.. View, print, and save online statements.. Go "green" by opting out of receiving firture statements by mail.. Use financial planning <strong>to</strong>ols <strong>to</strong> calculate your retirement benefit estimate,estimâte your service credit cost, and even request a staËpreparedretirement estimate.. Check statuses of requests <strong>to</strong> purchase service credit or applications fordisabiliry retirement.. Keep informed with CaIPERS News so you dont miss a thing.CaIPERS Education Centermyl<strong>CalPERS</strong> is your gateway <strong>to</strong> the CaIPERS Education Center. -Vhether yourein the earþ stages of your career, starting <strong>to</strong> plan your retirement, or gettingready <strong>to</strong> retire, visit the CaIPERS Education Center <strong>to</strong>:. Täke online classes that help you make important decisions about yourCaIPERS benefits and your future.. Register for instruc<strong>to</strong>r-led classes at a location near you.. Download class materials and access information about your current andpast classes.. Browse our retirement fair schedule.. Make a personal appointment with a ¡etirement counselor.Log in <strong>to</strong>day at my.calpers.ca.gov.888 CaIPERS (or 888-225-7377\

VisitYour Nearest CaIPERS Regional OfficeVisit the CaIPERS website for directions <strong>to</strong> your local office.Monday <strong>to</strong> Friday, 8:00 a.m. <strong>to</strong> 5:00 p.m.Fresno Regional Office10 River Park Place East, Suite 230Fresno, CA93720Glendale Regional OfficeGlendale Plaza655 North Central Avenue, Suite 1400Glendale, CA91203Orange Regional Office500 North State College Boulevard, Suite 750Orange, C492868Sacramen<strong>to</strong> Regional OfficeLincoln Plaza East400 QStreet, Room E1820Sacramen<strong>to</strong>, CA 95811San Bernardino Regional Office650 East Hospitaliry Lane, Suite 330San Bernardino, CA 92408San Diego Regional Office7676 Hazard Center Drive, Suite 350San Diego, CA 92108San Jose Regional Office181 Metro Drive, Suite 520San Jose, CA 951 10\ùl'alnut Creek Regional Office1340Treat Blvd., Suite 200'W'alnut Creek, CA 94597www.calpers.ca.gov

INFORMATION PRACTICES STATEMENTThe Information Practices Act of 1977 and the Federal Privacy Act requirethe California Public Employees' <strong>Retirement</strong> System <strong>to</strong> provide the followinginformation <strong>to</strong> individuals who are asked <strong>to</strong> supply information. Theinformation requested is collected pursuant <strong>to</strong> the Government Code(Sections 20000, et seq.) a¡d will be used for administration of the CaIPERSBoa¡d's duties under the California Public Employees' <strong>Retirement</strong> Law, theSocial SecuriryAct, and the Public Employees' Medical and Hospital Care Act,as the case may be. Submission of the requested information is manda<strong>to</strong>ry.Failure <strong>to</strong> supply the information may result in the System being unable <strong>to</strong>perform its function regarding your status and eligibility for benefits. Portionsof this information may be transferred <strong>to</strong> State and public agenc./ employers,State At<strong>to</strong>rney General, Ofûce of the State Controller, TêaIe Data Center,Franchise Tâx Board, Internal Revenue <strong>Service</strong>, \Øorkers' CompensationAppeals Board, State Compensation Insurance Fund, County DistrictAt<strong>to</strong>rneys, Social SecurityAdministration, beneficia¡ies of deceased members,physicians, insura¡ce carriers, and various vendors who prepare the microficheor microfilm for CaIPERS. Disclosure <strong>to</strong> the aforementioned entities is donein strict accordance with current statutes regarding confidentiality.You have the right <strong>to</strong> review your membership file maintained by the System.For questions concerning your rights under the Information Practices Act of1977, please contact the Information Practices Act Coordina<strong>to</strong>r, CaIPERS,400 Q Street, P.O. Box 9 427 02, Sacra-men<strong>to</strong>, CA 9 4229 -27 02.Whilz reøding this møteriøL, remember that we are gouerned fu the PublicEmployeei <strong>Retirement</strong> Løut and the Abernate <strong>Retirement</strong> Program prouisiorus intlte Gouernment Code, <strong>to</strong>gether referred <strong>to</strong> as the <strong>Retirement</strong> Law. The støtementsin this publication are general. The <strong>Retirement</strong> Law is complex and subject <strong>to</strong>change. If there is a conflict between the kw and this publicøtion, any decisiorcswill be based on the lzw and not this publication. Ifyoa haue a questioru that is notanswered by this general description, yza mql møþe a written request for aduiceregørding your specifc situation directþ <strong>to</strong> CaIPERS.888 CaIPERS (ot 888-225-7377],

iì'åtr .ii I I-+- lL r\ iH"WuüïtrÅ;