Amend Federal Individual Tax Return If you used TurboTax ... - Intuit

Amend Federal Individual Tax Return If you used TurboTax ... - Intuit

Amend Federal Individual Tax Return If you used TurboTax ... - Intuit

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

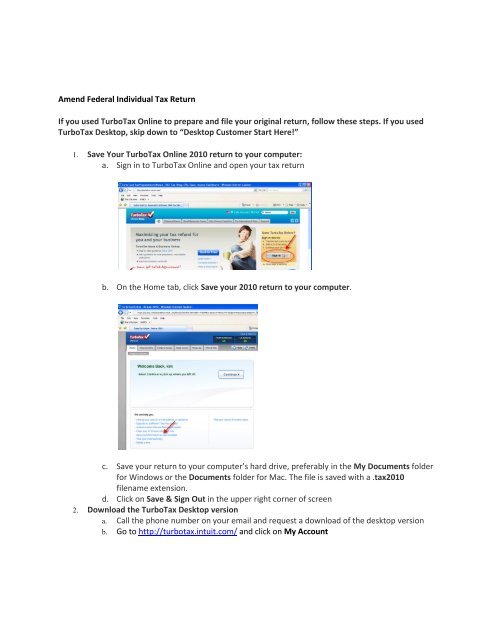

<strong>Amend</strong> <strong>Federal</strong> <strong>Individual</strong> <strong>Tax</strong> <strong>Return</strong><strong>If</strong> <strong>you</strong> <strong>used</strong> Turbo<strong>Tax</strong> Online to prepare and file <strong>you</strong>r original return, follow these steps. <strong>If</strong> <strong>you</strong> <strong>used</strong>Turbo<strong>Tax</strong> Desktop, skip down to “Desktop Customer Start Here!”1. Save Your Turbo<strong>Tax</strong> Online 2010 return to <strong>you</strong>r computer:a. Sign in to Turbo<strong>Tax</strong> Online and open <strong>you</strong>r tax returnb. On the Home tab, click Save <strong>you</strong>r 2010 return to <strong>you</strong>r computer.c. Save <strong>you</strong>r return to <strong>you</strong>r computer’s hard drive, preferably in the My Documents folderfor Windows or the Documents folder for Mac. The file is saved with a .tax2010filename extension.d. Click on Save & Sign Out in the upper right corner of screen2. Download the Turbo<strong>Tax</strong> Desktop versiona. Call the phone number on <strong>you</strong>r email and request a download of the desktop versionb. Go to http://turbotax.intuit.com/ and click on My Account

c. Click on the Downloads and Unlocksd. Sign in using <strong>you</strong>r User ID and Password.e. Click on the Downloads that are available

f. Click the Sign Out in the upper right hand corner of the screen3. Open Your <strong>Tax</strong> File in Desktopa. Open <strong>you</strong>r desktop Turbo<strong>Tax</strong> productb. On the 1 st screen select Find a <strong>Tax</strong> Filec. Go to the folder or location where <strong>you</strong> saved the .tax2010 filed. Select the .tax2010 file, and then select Opene. From the File menu, choose SaveDesktop Customers Start Here!All customers (Turbo<strong>Tax</strong> Online and Desktop) follow these steps to begin to amend <strong>you</strong>r federalreturn:1. Open <strong>you</strong>r 2010 Turbo<strong>Tax</strong> return2. Click on the Personal Info tab3. Select Forms

4. Click on Open Form5. In the type a form name box, enter 1040X and double click on Form 1040X:<strong>Amend</strong>ed <strong>Tax</strong><strong>Return</strong>6. On the Form 1040X, check the box for 2010.7. Scroll down to “Manual Selection of Lines Calculated Smart Worksheet.Check box A for Line 1-22Now it’s time to handle Column A on the Form 1040X.You will need to change the amounts in Column A to match the amounts from <strong>you</strong>r original tax return.Scroll down to Income and Deductions

1. Enter these amount in Column A for Income and Deductions section:Line: Description: Enter from original return:Line 1 Adjusted Gross Income Form 1040, line 37Line 2 Itemized deduction or standarddeductionForm 1040, line 40Line 4 Exemptions Form 1040, line 422. Scroll down to the <strong>Tax</strong> Liability section; enter these amounts in column A:Line: Description: Enter from original return:Line 6 <strong>Tax</strong> Form 1040, line 46Line 7 Credits Form 1040, line 54Line9 Other <strong>Tax</strong>es Form 1040, lines 56 + 57 +58 + 593. Scroll down to the Payments section and enter these amounts in column ALine: Description: Enter from originalreturn:Line 11 <strong>Federal</strong> income tax withheld … Form 1040, line 61 + 69Line 12 Estimated tax payments… Form 1040, line 62Line 13 Earned income credit Form 1040, line 64aLine 14 Refundable credits Form 1040, line 63 + 65 +66 + 67 + 70 + 71

4. In the Original 2010 <strong>Return</strong> Payments Smart Worksheet, enter these amounts in Column A:Line: Description: Enter from original return:A Total amount paid with extension Form 1040, line 68B <strong>Tax</strong> Paid with original return Form 1040, line 76 less line 77 orthe amount <strong>you</strong> paid, if differentC Additional tax paid after return was filed Amount <strong>you</strong> paid after filing thereturn (not with the return).5. In the Original 2010 <strong>Return</strong> Overpayment Smart Worksheet, enter any overpayment amount onthe original return, Form 1040, line 73.6. Scroll down page 2, Part III, Explanation of Changes sectionEnter this wording: “The original return included an incorrect credit for child and dependentcare expenses.”NOTE: <strong>If</strong> <strong>you</strong>r state return is impacted, please return to the Turbo<strong>Tax</strong> support article to download thestate amend instructions.Now it’s time to print and mail <strong>you</strong>r federal and state amended returns. Follow these steps:1) On the toolbar, click on File and then Print2) Choose All official forms required for filing3) Check the box for Form 1040: <strong>Individual</strong>4) <strong>If</strong> <strong>you</strong> are also amending a state return, check the box for that state.