FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

FirstCaribbean International Bank (Bahamas) Limited

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

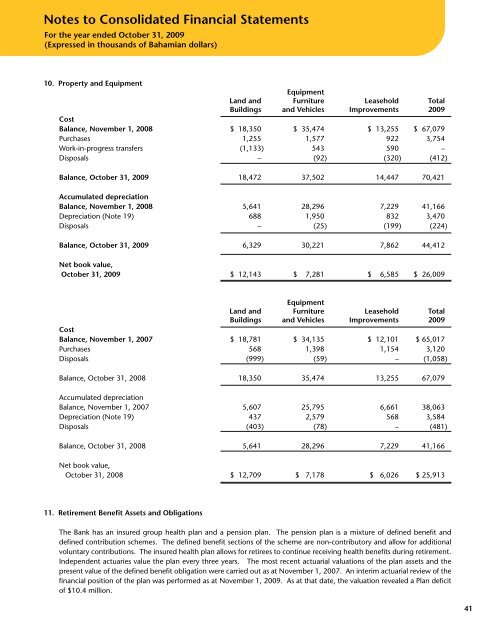

Notes to Consolidated Financial StatementsFor the year ended October 31, 2009(Expressed in thousands of Bahamian dollars)10. Property and EquipmentEquipmentLand and Furniture Leasehold TotalBuildings and Vehicles Improvements 2009CostBalance, November 1, 2008 $ 18,350 $ 35,474 $ 13,255 $ 67,079Purchases 1,255 1,577 922 3,754Work-in-progress transfers (1,133) 543 590 –Disposals – (92) (320) (412)Balance, October 31, 2009 18,472 37,502 14,447 70,421Accumulated depreciationBalance, November 1, 2008 5,641 28,296 7,229 41,166Depreciation (Note 19) 688 1,950 832 3,470Disposals – (25) (199) (224)Balance, October 31, 2009 6,329 30,221 7,862 44,412Net book value,October 31, 2009 $ 12,143 $ 7,281 $ 6,585 $ 26,009EquipmentLand and Furniture Leasehold TotalBuildings and Vehicles Improvements 2009CostBalance, November 1, 2007 $ 18,781 $ 34,135 $ 12,101 $ 65,017Purchases 568 1,398 1,154 3,120Disposals (999) (59) – (1,058)Balance, October 31, 2008 18,350 35,474 13,255 67,079Accumulated depreciationBalance, November 1, 2007 5,607 25,795 6,661 38,063Depreciation (Note 19) 437 2,579 568 3,584Disposals (403) (78) – (481)Balance, October 31, 2008 5,641 28,296 7,229 41,166Net book value,October 31, 2008 $ 12,709 $ 7,178 $ 6,026 $ 25,91311. Retirement Benefit Assets and ObligationsThe <strong>Bank</strong> has an insured group health plan and a pension plan. The pension plan is a mixture of defined benefit anddefined contribution schemes. The defined benefit sections of the scheme are non-contributory and allow for additionalvoluntary contributions. The insured health plan allows for retirees to continue receiving health benefits during retirement.Independent actuaries value the plan every three years. The most recent actuarial valuations of the plan assets and thepresent value of the defined benefit obligation were carried out as at November 1, 2007. An interim actuarial review of thefinancial position of the plan was performed as at November 1, 2009. As at that date, the valuation revealed a Plan deficitof $10.4 million.41