Volatility Smiles

Volatility Smiles

Volatility Smiles

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

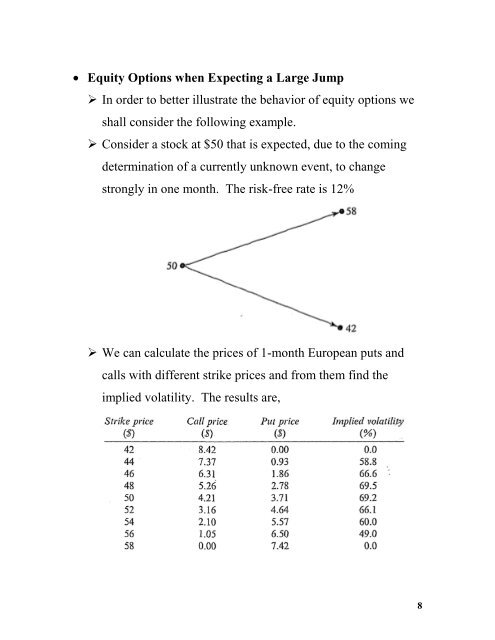

Equity Options when Expecting a Large Jump‣ In order to better illustrate the behavior of equity options weshall consider the following example.‣ Consider a stock at $50 that is expected, due to the comingdetermination of a currently unknown event, to changestrongly in one month. The risk-free rate is 12%‣ We can calculate the prices of 1-month European puts andcalls with different strike prices and from them find theimplied volatility. The results are,8