Reports IFB INDUSTRIES LTD. - Nayan M Vala Securities Pvt. Ltd.

Reports IFB INDUSTRIES LTD. - Nayan M Vala Securities Pvt. Ltd.

Reports IFB INDUSTRIES LTD. - Nayan M Vala Securities Pvt. Ltd.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

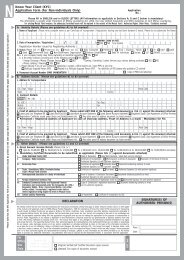

NAYAN M. VALA SECURITIES PVT. <strong>LTD</strong>.Telephones022-26105973/74/32549230/32448788 403-404, Cosmos Court,Fax.26124310/E-Mail: vala@bom3.vsnl.net.inAbove Waman Hari Pethe Jewellers,Website: www.nayanmvala.comS. V. Road, Vile-Parle (west),Mumbai-400056.Key Indicators as on 28/12/2010Closing Price (Rs.) 124.6EPS (Rs.) 12.75P/E 9.77BV per Share (Rs.) 47.6PB 2.62Mkt Cap (Rs. Crore) 441.79Beta 1.06Mkt Cap/Sales 0.69Mkt Cap/PBIDTA 6.65Mkt Cap/PBDT 6.67Mkt Cap/PAT 8.22Mkt Cap/Cash Profit 7.18PBDITA ` in Crores 66.45Face Value 10Shares Outstanding crores 3.55Share holding (%)Sep-10Promoters 42.73Public 11.43FIIs 15.5Others 30.34Source: CMIE<strong>IFB</strong> Industries <strong>Ltd</strong>.BUYInvestment Highlights:EBIDTA margin have doubledfrom 4.28% in 2008 to9.25% in 2010. ROCE at 30% for past 3years. Debt free company sinceMarch, 2009.Capex to fuel growth. December quarter is the bestquarter for the companyCompany profile:<strong>IFB</strong> Industries <strong>Ltd</strong>. (originally knowas Indian Fine Blanks <strong>Ltd</strong>.) has overthe last 35 years of presence inIndia witnessed various ups and downs in its business and is now on its movetowards becoming a sustainable and stronger player in the Indian consumer durablespace. The company’s business can be divided into 2 categories, namely HomeAppliances and Fine Blanking (auto ancillaries & components business. The HomeAppliances division is basically into retail, selling various products like washingmachine, microwave, dish washer, dryer and kitchen appliances. Within the HomeAppliances segment, <strong>IFB</strong> manufactures washing machines and imports and marketsthe rest appliances under its brand. The Home Appliances sector accounts foralmost 85% of revenues. The Fine Blanking division is a manufacturing segment,manufacturing various high quality fine blanked components catering mainly to theautomobile sector. This segment contributes the remaining 15% of the revenues.<strong>IFB</strong> has facilities in Kolkata, Goa and Bangalore.MEMBER: NATIONAL STOCK EXCHANGE OF INDIA <strong>LTD</strong>CODE NO.23/13511/13

NAYAN M. VALA SECURITIES PVT. <strong>LTD</strong>.Telephones022-26105973/74/32549230/32448788 403-404, Cosmos Court,Fax.26124310/E-Mail: vala@bom3.vsnl.net.inAbove Waman Hari Pethe Jewellers,Website: www.nayanmvala.comS. V. Road, Vile-Parle (west),Mumbai-400056.Investment Rationale:‣ EBIDTA Margin have doubled since 2008: Companies EBIDTA margins have beenimproving since the year 2007 as seen from the table below:Source: CMIE Mar‐07 Mar‐08 Mar‐09 Mar‐10Sales 366.83 473.94 538.02 643.87Prior period income & extraordinary income 47.73 26.65 280.2 6.91Adj PBIDTA (Excluding extra ordinary income 1.39 20.27 43.65 59.54Adj EBIDTA Margin 0.38% 4.28% 8.11% 9.25%‣ ROCE more then 30% for the past 3 years: Company has posted a ROCE of more then30% for the past three years despite it is trading at a low P/E multiple. No majordown side seen as the company is in domestic appliance space and Indianconsumption story is very likely to grow by leaps and bonds in years to come.‣ Debt Free: The Company’s net worth had become positive and it had also managedto convert itself into a debt free company by March 09. The company has reportedprofits and is seeing constant improvements in its top line and bottom-lines over thepast couple of years. Net turnover of the company increased 19.6% to `643.87 crs inFY10 from `538.02 crs in FY09. Adjusted PAT also increased by 34.32% for the sameperiod to `46.85 crs.‣ Capex to fuel growth: The company has jotted its up gradation & expansion plans andis going to invest `. 52 crores towards its washing machine plant for itsmodernization & expansion, it would also invest `. 10 crores for its auto componentsplants at Goa & Banglore in 2010-2011 and around `. 25 crores in 2011-2012. Thecompany would be able to add up its capacities and see revenue growth by end of2010 – 2011.Last Ten quarter results: As seen from the table below it can be inferred thatcompany posts best sales every December quarter.Source: CMIE Jun‐08 Sep‐08 Dec‐08 Mar‐09 Jun‐09 Sep‐09 Dec‐09 Mar‐10 Jun‐10 Sep‐10Total Income 112.62 149.2 355.43 153.83 111.87 132.9 187.5 158.9 132.86 169.63Net Sales 111.73 123.84 145.19 106.62 110.87 131.88 181.83 145.06 131.53 169.09Other Income 0.89 1.11 0.95 2.67 1 1.02 5.67 13.84 1.33 0.54Extra‐ordinary Income 0 24.25 209.29 44.54 0 0 0 10 0 0Change in stock ‐9.67 23.36 ‐2.57 ‐11.86 ‐2.92 7.5 8.31 5.78 29.46 ‐7.25Expenditure 93.34 142.68 131.64 86.4 100.72 133.61 178.79 142.96 154.56 153.68Consp. raw mat. 47.99 86.85 75.6 53.05 61.71 83.55 95.33 89.45 96.7 94.79Personnel cost 8.2 11.02 9.6 10.6 11.87 12.66 11 15.2 19.91 13.69Other expenses 35.04 43 44.64 20.91 25.28 32.82 66.61 27.91 31.42 38.98Extra‐ordinary exp. 0 0 0 0 0 0 0 0 0 0PBDIT 11.72 31.69 223.02 57.41 10.09 11.37 22.87 32.12 14.29 14.92Interest 0 0 0 0 0 0 0.22 0.04 0.09 0.12PBDT 11.72 31.69 223.02 57.41 10.09 11.37 22.65 32.08 14.2 14.8Depreciation 2.11 1.81 1.8 1.84 1.86 1.87 2.05 2.9 2.11 2.23PBT 9.61 29.88 221.22 55.57 8.23 9.5 20.6 29.18 12.09 12.57Tax 0.15 0.41 0.33 0.32 0 2.71 3.58 7.46 4.33 3.87PAT 9.46 29.47 220.89 55.25 8.23 6.79 17.02 21.72 7.76 8.7MEMBER: NATIONAL STOCK EXCHANGE OF INDIA <strong>LTD</strong>CODE NO.23/13511/13

NAYAN M. VALA SECURITIES PVT. <strong>LTD</strong>.Telephones022-26105973/74/32549230/32448788 403-404, Cosmos Court,Fax.26124310/E-Mail: vala@bom3.vsnl.net.inAbove Waman Hari Pethe Jewellers,Website: www.nayanmvala.comS. V. Road, Vile-Parle (west),Mumbai-400056.From NAYAN M. VALA SECURITIES PVT.<strong>LTD</strong>.RESEARCHBy Dharmesh N. <strong>Vala</strong> & Harsh B. ChauhanDisclaimer: The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access; use, reproduction, disclosure ordissemination is prohibited. This information does not constitute or form part of and should not be construed as, any offer for sale or subscription of or any invitationto offer to buy or subscribe for any securities. The information and opinions on which this communication is based have been complied or arrived at from sourcesbelieved to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, correctness and are subject to changewithout notice. NAYAN M. VALA SECURITIES PVT.<strong>LTD</strong>. and/ or its clients may have positions in or options on the securities mentioned in this report or anyrelated investments, may effect transactions or may buy, sell or offer to buy or sell such securities or any related investments. Recipient/s should not consider thisreport as only a single factor in making their investment decision. Neither NAYAN M. VALA SECURITIES PVT.<strong>LTD</strong>. nor any of its affiliates shall assume any legalliability or responsibility for any incorrect, misleading or altered information contained herein.Past Recommendations:Company NameRecommendedPriceMarket Price as on28/12/2010High AfterRecommendationReliance Infrastructure <strong>Ltd</strong>. 795 - -Alok Industries 27.9 25.60 29.25Madras Cement 117.3 105.90 133Provogue India <strong>Ltd</strong> 64.95 61.95 83Elecon Engineering <strong>Ltd</strong> 91.9 75.45 103.75Himatsingka Seide <strong>Ltd</strong>. 38.5 47.45 64.45Deepak Fertilizers andPetrochemicals <strong>Ltd</strong>. 122.95 162 212.8Karnataka Bank <strong>Ltd</strong>. 155.8 155.30 209.25MEMBER: NATIONAL STOCK EXCHANGE OF INDIA <strong>LTD</strong>CODE NO.23/13511/13