2001 Annual Report - Investor Relations - Sherwin Williams

2001 Annual Report - Investor Relations - Sherwin Williams

2001 Annual Report - Investor Relations - Sherwin Williams

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

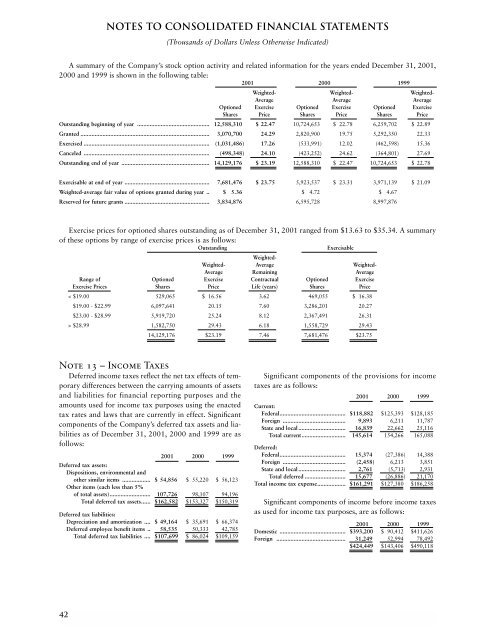

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS(Thousands of Dollars Unless Otherwise Indicated)A summary of the Company’s stock option activity and related information for the years ended December 31, <strong>2001</strong>,2000 and 1999 is shown in the following table:<strong>2001</strong> 2000 1999Weighted- Weighted- Weighted-Average Average AverageOptioned Exercise Optioned Exercise Optioned ExerciseShares Price Shares Price Shares PriceOutstanding beginning of year .............................................. 12,588,310 $ 22.47 10,724,653 $ 22.78 6,259,702 $ 22.89Granted .................................................................................. 3,070,700 24.29 2,820,900 19.75 5,292,350 22.33Exercised ................................................................................ (1,031,486) 17.26 (533,991) 12.02 (462,598) 15.36Canceled ................................................................................ (498,348) 24.10 (423,252) 24.62 (364,801) 27.69Outstanding end of year ........................................................ 14,129,176 $ 23.19 12,588,310 $ 22.47 10,724,653 $ 22.78Exercisable at end of year ...................................................... 7,681,476 $ 23.75 5,923,537 $ 23.31 3,971,139 $ 21.09Weighted-average fair value of options granted during year .. $ 5.36 $ 4.72 $ 4.67Reserved for future grants ...................................................... 3,834,876 6,595,728 8,997,876Exercise prices for optioned shares outstanding as of December 31, <strong>2001</strong> ranged from $13.63 to $35.34. A summaryof these options by range of exercise prices is as follows:OutstandingExercisableWeighted-Weighted- Average Weighted-Average Remaining AverageRange of Optioned Exercise Contractual Optioned ExerciseExercise Prices Shares Price Life (years) Shares Price< $19.00 529,065 $ 16.56 3.62 469,055 $ 16.38$19.00 - $22.99 6,097,641 20.15 7.60 3,286,201 20.27$23.00 - $28.99 5,919,720 25.24 8.12 2,367,491 26.31> $28.99 1,582,750 29.43 6.18 1,558,729 29.4314,129,176 $23.19 7.46 7,681,476 $23.75Note 13 – Income TaxesDeferred income taxes reflect the net tax effects of temporarydifferences between the carrying amounts of assetsand liabilities for financial reporting purposes and theamounts used for income tax purposes using the enactedtax rates and laws that are currently in effect. Significantcomponents of the Company’s deferred tax assets and liabilitiesas of December 31, <strong>2001</strong>, 2000 and 1999 are asfollows:<strong>2001</strong> 2000 1999Deferred tax assets:Dispositions, environmental andother similar items .................. $ 54,856 $ 55,220 $ 56,123Other items (each less than 5%of total assets).......................... 107,726 98,107 94,196Total deferred tax assets...... $162,582 $153,327 $150,319Deferred tax liabilities:Depreciation and amortization .... $ 49,164 $ 35,691 $ 66,374Deferred employee benefit items .. 58,535 50,333 42,785Total deferred tax liabilities .... $107,699 $ 86,024 $109,159Significant components of the provisions for incometaxes are as follows:<strong>2001</strong> 2000 1999Current:Federal.......................................... $118,882 $125,393 $128,185Foreign ........................................ 9,893 6,211 11,787State and local .............................. 16,839 22,662 25,116Total current............................ 145,614 154,266 165,088Deferred:Federal.......................................... 15,374 (27,386) 14,388Foreign ........................................ (2,458) 6,213 3,851State and local .............................. 2,761 (5,713) 2,931Total deferred .......................... 15,677 (26,886) 21,170Total income tax expense.................. $161,291 $127,380 $186,258Significant components of income before income taxesas used for income tax purposes, are as follows:<strong>2001</strong> 2000 1999Domestic .......................................... $393,200 $ 90,412 $411,626Foreign ............................................ 31,249 52,994 78,492$424,449 $143,406 $490,11842