Bad Cheques - Banking Info

Bad Cheques - Banking Info

Bad Cheques - Banking Info

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

“<strong>Bad</strong>” <strong>Cheques</strong>YOUR ACCOUNTSAND SERVICES“<strong>Bad</strong>” <strong>Cheques</strong>A consumer education programme by:

contents1 Introduction2 “<strong>Bad</strong>” cheques are bad newsBank Negara Malaysia and cheques3 What is a “bad” cheque?What happens when you issue“bad” cheques?6 Prohibition periodProbation periodProhibition and probation periods forvarious offence levels7 “Special accounts”8 How to avoid issuing “bad” cheques9 Your rights as a customer10 Frequently asked questions15 GlossaryDisclaimerThis document is intended for your general informationonly. It does not contain exhaustive advice orinformation relating to the subject matter nor shouldit be used as a substitute for legal advice.Date: 21 January 2003

Introduction<strong>Cheques</strong> are widelyacceptedespecially in business<strong>Cheques</strong> are widely accepted, as a convenient mode of making paymentsin the business community. However, sometimes they may be returned by thedrawee bank due to insufficient funds in the account, cheques depositedbut funds are not yet available for use by accountholder or the accountholder’scurrent account has been closed. Such cheques are commonly referred to as“bad” cheques. The issuance of “bad” cheques can have serious consequenceson your ability to operate a current account.This booklet provides information on the resultant consequences if you issue“bad” cheques.

The BMC alsopromotes the use ofcheques as anacceptablemode ofpayment“ BAD” CHEQUES ARE BAD NEWSIssuing “bad” cheques can createproblems. The accountholder on issuingthree “bad” cheques over a 12-monthperiod will not be allowed to operate acurrent account in Malaysia for a specifiedperiod of 6 months to 24 months dependingon the level of offence committed.A “bad” cheque may affect the relationshipbetween the issuer and recipient of thecheque, as it may lead to a loss of a businessdeal because of a loss of trust between theissuer and the payee. More importantly, theissuance of a “bad” cheque will affect thecredibility of cheques as a mode of paymentin Malaysia.Although, banks have imposed penalties for“bad” cheques, this has not deterred someaccountholders from issuing “bad” cheques.BANK NEGARA MALAYSIA ANDCHEQUESThe increasing incidence of chequesdishonoured due to insufficient fundsprompted the Association of Banks inMalaysia, in consultation with Bank NegaraMalaysia (BNM), to look into effectivemeasures to deal with the problem. BNMestablished Biro Maklumat Cek (BMC) in1988 as a central bureau to monitor “bad”cheque issuers and to promote the useof cheques as an acceptable mode ofpayment. In order to ensure a standardpractice among the banks, the “BiroMaklumat Cek Operational Framework andReporting Guidelines” were issued by BNMto address the issuance of "bad" cheques.In March 2002, consistent with theamendments to the Central Bank ofMalaysia Act 1958, BNM consolidated theoperations of the BMC with the CreditBureau, which is a bureau set up to collectand disseminate credit information(including information on “bad” cheques)2

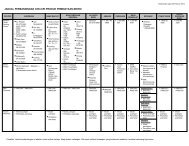

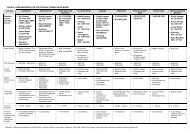

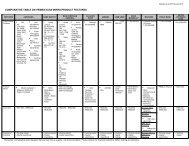

• Your name will be included in the listof “bad” cheque offenders and will becirculated to all banks in the country• When the banks receive the list fromthe Credit Bureau, all your other currentaccounts maintained with the banks willbe closed within one month (referred toas Nationwide Closure) as follows:<strong>Bad</strong> Cheque DrawerIndividualSole-proprietorship(owned by individual)Sole-proprietorship(owned by company-forSabah & Sarawak only)Joint-Account (A & B)PartnershipCompanyAccounts Affected by Nationwide ClosureAll your individual current accountsAll your sole-proprietorship(s) current accountsAll your individual current accountsAll your sole-proprietorship(s) current accountsAll the company’s current accountsAll the company’s other sole proprietorship(s) current accountsAll A’s individual current accountsAll B’s individual current accountsAll of A’s sole-proprietorship(s) current accountsAll of B’s sole-proprietorship(s) current accountsAll other joint current accounts of A & BAll current accounts with the same partnership name andregistration numberAll current accounts with the same company name andregistration number4

• You will be required to return all unusedcheques to your bank(s)• You will be subject to a prohibitionperiod, whereby you will not be allowedto open or operate any current accountwith any bank in Malaysia• In addition, you will also be subjected toa probation period on expiry of theprohibition period5

PROHIBITION PERIODThe prohibition period refers to the periodduring which you will not be allowed tooperate or open a new current accountwith any bank. The prohibition period willcommence from the date of the third“bad” cheque incident. The length of theprohibition period depends on the levelof the offence committed. For example,for a first "bad" cheque offence, theprohibition period is six months from thedate of the third “bad” cheque incident.For further information on the prohibitionperiod, please refer to the Table below.PROBATION PERIODThe probation period commencesimmediately after the expiry of theprohibition period. During the probationperiod, you can operate a currentaccount. However, a further issuance ofthree “bad” cheques during this periodwill result in you being classified as asecond level “bad” cheque offender, whichwould result in an extended prohibitionperiod. Please refer to Table below forfurther details.PROHIBITION AND PROBATION PERIODS FOR VARIOUSOFFENCE LEVELSOffence LevelProhibitionPeriodNationwideClosureSpecialAccountProbationPeriodFirst Level6 monthsYesYes2 yearsSecond Level12 monthsYesYes2 yearsThird Level12 monthsYesNo3 yearsFourth &Subsequent Levels24 monthsYesNo3 years6

A “special account”is an account whichwould enable you tomake andreceivepaymentsduring theprohibition period“SPECIAL ACCOUNTS”A “special account” is a current accountwithout checking facilities. This wouldenable you to make and receivepayments during the prohibition period.The opening of special accounts,however, is at the discretion of each bankand subject to the following conditions:• Applicable only for companies,partnerships, sole-proprietors andindividuals with overdraft facilities.The latter can also open a savingsaccount• Only first and second level offendersare eligible• All unused cheques must be surrenderedto the bank. Thus, payments from“special accounts” can only be madethrough cash withdrawals, bankers’cheques, bank drafts or cashiers orders7

HOW TO AVOID ISSUING“BAD” CHEQUESTo avoid a “bad” cheque incident, thefollowing precautionary measures shouldbe observed:• Always check that there are sufficient fundsin your current account before issuingany cheques• If you need to transfer money from anaccount into your current account to makea payment, always check with your bank toensure that the money has been creditedbefore issuing a cheque• If you wish to issue a cheque using fundsfrom a cheque deposited earlier, check withyour bank to ensure that the cheque thatwas deposited had been cleared forpayment. Be aware that clearing periodsfor local and outstation cheques differ• Keep your cheque book in a safe place toavoid the risk of theft• Notify the bank on the change of youraddress. This ensures that you will beinformed by the bank on important matterswithout unnecessary delay and preventwrongful delivery of correspondences• <strong>Info</strong>rm your bank by making a stop paymentorder on a cheque that is stolen or missingto avoid the cheque from being paid orpresented and dishonoured8

YOUR RIGHTS AS A CUSTOMER• To inquire from the bank the balance inyour current account before issuing anycheques. This is to ensure that all chequesissued will be honoured i.e. paid• To be notified in writing on the first,second and third bad cheques incidentsand the reason(s) for the respectivereturned chequesCheckthat there aresufficient fundsin your currentaccount• To be notified in writing before youraccount is closed• To check your current account’s blacklistingstatus with your bank9

FREQUENTLY ASKED QUESTIONSWhat is a “bad” cheque incident?Will the bank return a chequeif the amount overdrawn is notsubstantial?&AYes. The bank will return the cheque irrespective of the amount overdrawn.A “bad” cheque incident is where the drawee bank returns a cheque for thefollowing reasons:• There are insufficient funds in the account that the cheque is drawn on; or•A cheque is issued based on cheque(s) deposited for which the funds were not availableas yet for use by the accountholder (this is known as “Effects not Cleared”); or•A cheque is issued on an account, which had been closed for reasons other than beingblacklisted under the Credit Bureau or closed for legal reasons10

Will the bank call me in theevent that a cheque is presentedagainst insufficient funds ?No. It is not the duty of the bank to call you in the event a cheque is presented againstinsufficient funds in your account.Will the bank hold a chequewhich is drawn on a chequedeposited for which the fundsare not available yet for useby the accountholder?No. The bank will not hold such cheque and will return the cheque as a cheque drawnagainst insufficient funds or “Effects not Cleared”.When will a current accountholder be blacklisted?A current account holder will be blacklisted and all his current accounts closed aftercommitting three “bad” cheque incidents on the same account over a 12-month period.The customer is then listed as a”bad” cheque offender and his name will be reported bythe drawee bank to the Credit Bureau.11

Can a “bad” cheque offenderoperate a current account tocash incoming cheques duringthe prohibition period?No. However, the customer can arrange for his blacklisted account to be designatedas a "special account” to receive and make payments during the prohibitionperiod. However, the opening of such “special accounts” is at the discretion of therespective banks.How soon after the prohibitionperiod can a “bad” chequeoffender open a new currentaccount?A new account can be opened on the first day after the prohibition period ends,subject to the bank’s discretion.When can a “bad” chequeoffender get a clean record?A current accountholder, who had been listed as a bad cheque offender, will be givena clean record if he does not issue three or more bad cheques over a 12-month periodduring the probation period.12

What is the differencebetween a local and anoutstation cheque?Local cheques are drawn and deposited in banks within the local clearing zone,while outstation cheques refer to cheques that are deposited with banks within thelocal clearing zone, but drawn on banks outside the local clearing zone.How long will it take fora local and an outstationcheque to be cleared?It takes two to three working days for a local cheque to be cleared and three to eightworking days for an outstation cheque. Please refer your query to your bank on theactual number of clearing days for your deposited cheques to be cleared to prevent yourcheques from being dishonoured due to "Effects not Cleared".13

What are the implications ifone is blacklisted as a “bad”cheque offender?In addition to the relevant current account being affected by “nationwide closure”,your applications for loans, credit cards and other banking facilities may be affectedas the occurrence of “bad” cheques may be adversely interpreted by banks. However,your name will be removed from the bad cheque listing once the prohibition periodis over. Nevertheless, you should take care to ensure proper conduct of your accountto maintain a clean financial record.Where can I make furtherinquiries about BMC?Members of the public can contact their bank for information on the BMC.They may also refer questions on returned cheques to the bank, where they maintaintheir account.In addition, members of the public may also forward queries in writing regardingthe BMC to:Ketua JabatanJabatan Sistem PembayaranTingkat 7, Blok CBank Negara MalaysiaJalan Dato’ Onn50480 Kuala Lumpuremail: info@bnm.gov.my14

GLOSSARYChequeA written order from one party (the drawer)to another (the drawee, normally a bank)requiring the drawee to pay a specified sumon demand to the drawer or to a third partyspecified by the drawer.ClearingThe process of exchanging cheques to establishfinal positions for settlement among thedrawee banks.DishonourThe act of refusing to pay a cheque whenpresented.Drawee BankA bank that is instructed by the drawer to paythe amount of a cheque drawn on it.DrawerAccountholder who directs a bank to pay a sumof money stated on a cheque drawn on it.Effects Not Cleared<strong>Cheques</strong> and other items paid in by a customerfor the credit of his/her account, of which thecheque is still pending clearance by the drawer’sbank. Although these amounts will be shown inthe customer’s balance, it is still not cleared inthe books of the bank. The bank is under noobligation to pay any cheques drawn againstitems not yet cleared.15

Insufficient FundsThe notation of dishonour (of a cheque)indicating that the drawer’s account does notcontain enough money to cover payment ofthe cheque.Special AccountAn account accorded to a current accountholderwho had been listed as a bad cheque offender toenable the accountholder to receive and makepayments during the prohibition period.16

Design Copyright © 2003 by Freeform Design Sdn Bhd. All rights reserved.

FOR MORE INFORMATIONLOG ON TOwww.bankinginfo.com.myOR VISIT OUR KIOSK AT MOST BANKSFirst Edition