2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

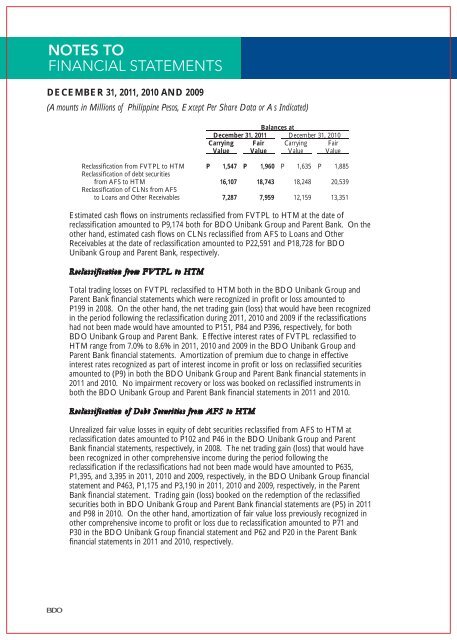

NOTES TOFINANCIAL STATEMENTSDECEMBER 31, <strong>2011</strong>, 2010 AND 2009(Amounts in Millions of Philippine Pesos, Except Per Share Data or As Indicated)Balances atDecember 31, <strong>2011</strong> December 31, 2010Carrying Fair Carrying FairValue Value Value ValueReclassification from FVTPL to HTM P 1,547 P 1,960 P 1,635 P 1,885Reclassification of debt securitiesfrom AFS to HTM 16,107 18,743 18,248 20,539Reclassification of CLNs from AFSto Loans and Other Receivables 7,287 7,959 12,159 13,351Estimated cash flows on instruments reclassified from FVTPL to HTM at the date ofreclassification amounted to P9,174 both for <strong>BDO</strong> Unibank Group and Parent Bank. On theother hand, estimated cash flows on CLNs reclassified from AFS to Loans and OtherReceivables at the date of reclassification amounted to P22,591 and P18,728 for <strong>BDO</strong>Unibank Group and Parent Bank, respectively.Reclassification from FVTPL to HTMTotal trading losses on FVTPL reclassified to HTM both in the <strong>BDO</strong> Unibank Group andParent Bank financial statements which were recognized in profit or loss amounted toP199 in 2008. On the other hand, the net trading gain (loss) that would have been recognizedin the period following the reclassification during <strong>2011</strong>, 2010 and 2009 if the reclassificationshad not been made would have amounted to P151, P84 and P396, respectively, for both<strong>BDO</strong> Unibank Group and Parent Bank. Effective interest rates of FVTPL reclassified toHTM range from 7.0% to 8.6% in <strong>2011</strong>, 2010 and 2009 in the <strong>BDO</strong> Unibank Group andParent Bank financial statements. Amortization of premium due to change in effectiveinterest rates recognized as part of interest income in profit or loss on reclassified securitiesamounted to (P9) in both the <strong>BDO</strong> Unibank Group and Parent Bank financial statements in<strong>2011</strong> and 2010. No impairment recovery or loss was booked on reclassified instruments inboth the <strong>BDO</strong> Unibank Group and Parent Bank financial statements in <strong>2011</strong> and 2010.Reclassification of Debt Securities from AFS to HTMUnrealized fair value losses in equity of debt securities reclassified from AFS to HTM atreclassification dates amounted to P102 and P46 in the <strong>BDO</strong> Unibank Group and ParentBank financial statements, respectively, in 2008. The net trading gain (loss) that would havebeen recognized in other comprehensive income during the period following thereclassification if the reclassifications had not been made would have amounted to P635,P1,395, and 3,395 in <strong>2011</strong>, 2010 and 2009, respectively, in the <strong>BDO</strong> Unibank Group financialstatement and P463, P1,175 and P3,190 in <strong>2011</strong>, 2010 and 2009, respectively, in the ParentBank financial statement. Trading gain (loss) booked on the redemption of the reclassifiedsecurities both in <strong>BDO</strong> Unibank Group and Parent Bank financial statements are (P5) in <strong>2011</strong>and P98 in 2010. On the other hand, amortization of fair value loss previously recognized inother comprehensive income to profit or loss due to reclassification amounted to P71 andP30 in the <strong>BDO</strong> Unibank Group financial statement and P62 and P20 in the Parent Bankfinancial statements in <strong>2011</strong> and 2010, respectively.