2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

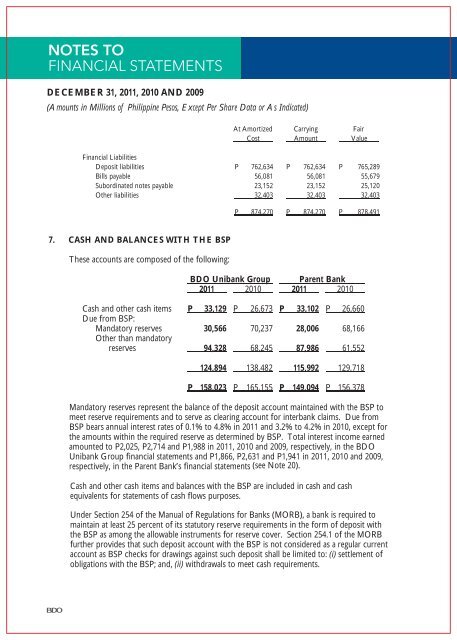

NOTES TOFINANCIAL STATEMENTSDECEMBER 31, <strong>2011</strong>, 2010 AND 2009(Amounts in Millions of Philippine Pesos, Except Per Share Data or As Indicated)At Amortized Carrying FairCost Amount Value<strong>Financial</strong> LiabilitiesDeposit liabilities P 762,634 P 762,634 P 765,289Bills payable 56,081 56,081 55,679Subordinated notes payable 23,152 23,152 25,120Other liabilities 32,403 32,403 32,403P 874,270 P 874,270 P 878,4917. CASH AND BALANCES WITH THE BSPThese accounts are composed of the following:<strong>BDO</strong> Unibank Group Parent Bank<strong>2011</strong> 2010 <strong>2011</strong> 2010Cash and other cash items P 33,129 P 26,673 P 33,102 P 26,660Due from BSP:Mandatory reserves 30,566 70,237 28,006 68,166Other than mandatoryreserves 94,328 68,245 87,986 61,552124,894 138,482 115,992 129,718P 158,023 P 165,155 P 149,094 P 156,378Mandatory reserves represent the balance of the deposit account maintained with the BSP tomeet reserve requirements and to serve as clearing account for interbank claims. Due fromBSP bears annual interest rates of 0.1% to 4.8% in <strong>2011</strong> and 3.2% to 4.2% in 2010, except forthe amounts within the required reserve as determined by BSP. Total interest income earnedamounted to P2,025, P2,714 and P1,988 in <strong>2011</strong>, 2010 and 2009, respectively, in the <strong>BDO</strong>Unibank Group financial statements and P1,866, P2,631 and P1,941 in <strong>2011</strong>, 2010 and 2009,respectively, in the Parent Bank’s financial statements (see Note 20).Cash and other cash items and balances with the BSP are included in cash and cashequivalents for statements of cash flows purposes.Under Section 254 of the Manual of Regulations for Banks (MORB), a bank is required tomaintain at least 25 percent of its statutory reserve requirements in the form of deposit withthe BSP as among the allowable instruments for reserve cover. Section 254.1 of the MORBfurther provides that such deposit account with the BSP is not considered as a regular currentaccount as BSP checks for drawings against such deposit shall be limited to: (i) settlement ofobligations with the BSP; and, (ii) withdrawals to meet cash requirements.