2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

2011 Annual Report Financial Supplements - BDO

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

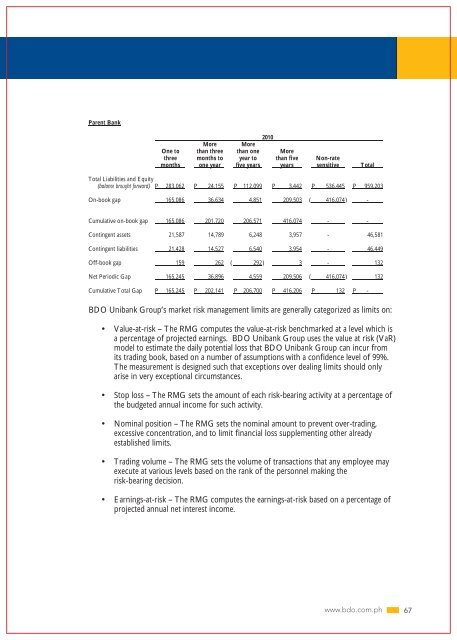

Parent Bank2010More MoreOne to than three than one Morethree months to year to than five Non-ratemonths one year five years years sensitive TotalTotal Liabilities and Equity(balance brought forward) P 283,062 P 24,155 P 112,099 P 3,442 P 536,445 P 959,203On-book gap 165,086 36,634 4,851 209,503 ( 416,074) -Cumulative on-book gap 165,086 201,720 206,571 416,074 - -Contingent assets 21,587 14,789 6,248 3,957 - 46,581Contingent liabilities 21,428 14,527 6,540 3,954 - 46,449Off-book gap 159 262 ( 292) 3 - 132Net Periodic Gap 165,245 36,896 4,559 209,506 ( 416,074) 132Cumulative Total Gap P 165,245 P 202,141 P 206,700 P 416,206 P 132 P -<strong>BDO</strong> Unibank Group’s market risk management limits are generally categorized as limits on:Value-at-risk – The RMG computes the value-at-risk benchmarked at a level which isa percentage of projected earnings. <strong>BDO</strong> Unibank Group uses the value at risk (VaR)model to estimate the daily potential loss that <strong>BDO</strong> Unibank Group can incur fromits trading book, based on a number of assumptions with a confidence level of 99%.The measurement is designed such that exceptions over dealing limits should onlyarise in very exceptional circumstances.Stop loss – The RMG sets the amount of each risk-bearing activity at a percentage ofthe budgeted annual income for such activity.Nominal position – The RMG sets the nominal amount to prevent over-trading,excessive concentration, and to limit financial loss supplementing other alreadyestablished limits.Trading volume – The RMG sets the volume of transactions that any employee mayexecute at various levels based on the rank of the personnel making therisk-bearing decision.Earnings-at-risk – The RMG computes the earnings-at-risk based on a percentage ofprojected annual net interest income.www.bdo.com.ph 67