1N – Claim Form for Repayment of Jamaican Income Tax

1N – Claim Form for Repayment of Jamaican Income Tax

1N – Claim Form for Repayment of Jamaican Income Tax

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

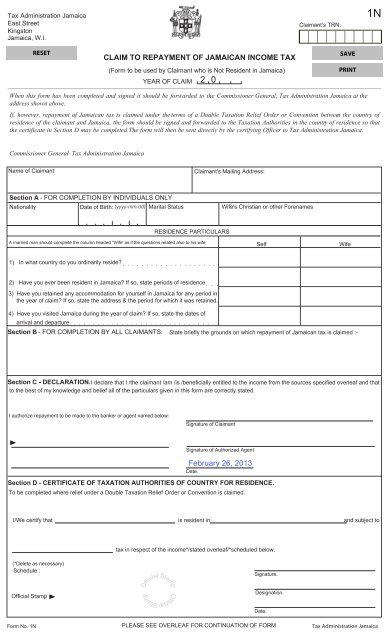

OOfficial Stamp<strong>Tax</strong> Administration JamaicaEast StreetKingstonJamaica, W.I.<strong>Claim</strong>ant’s TRN:<strong>1N</strong>CLAIM TO REPAYMENT OF JAMAICAN INCOME TAX(<strong>Form</strong> to be used by <strong>Claim</strong>ant who is Not Resident in Jamaica)YEAR OF CLAIMWhen this <strong>for</strong>m has been completed and signed it should be <strong>for</strong>warded to the Commissioner General, <strong>Tax</strong> Administration Jamaica at theaddress shown above.If, however, repayment <strong>of</strong> <strong>Jamaican</strong> tax is claimed under the terms <strong>of</strong> a Double <strong>Tax</strong>ation Relief Order or Convention between the country <strong>of</strong>residence <strong>of</strong> the claimant and Jamaica, the <strong>for</strong>m should be signed and <strong>for</strong>warded to the <strong>Tax</strong>ation Authorities in the country <strong>of</strong> residence so thatthe certificate in Section D may be completed.The <strong>for</strong>m will then be sent directly by the certifying Officer to <strong>Tax</strong> Administration Jamaica.2 0Commissioner General <strong>Tax</strong> Administration JamaicaName <strong>of</strong> <strong>Claim</strong>ant:<strong>Claim</strong>ant's Mailing Address:Section A. - FOR COMPLETION BY INDIVIDUALS ONLYNationalityDate <strong>of</strong> Birth: (yyyy-mm-dd) Marital StatusWife's Christian or other ForenamesRESIDENCE PARTICULARSA married man should complete the column headed "Wife' as if the questions related also to his wifeSelfWife1) In what country do you ordinarily reside? . . . . . . . . . . . . . . . . . . . . .2) Have you ever been resident in Jamaica? If so, state periods <strong>of</strong> residence. . .3) Have you retained any accommodation <strong>for</strong> yourself in Jamaica <strong>for</strong> any period inthe year <strong>of</strong> claim? If so, state the address & the period <strong>for</strong> which it was retained.4) Have you visited Jamaica during the year <strong>of</strong> claim? If so, state the dates <strong>of</strong>arrival and departure. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Section B - FOR COMPLETION BY ALL CLAIMANTS: State briefly the grounds on which repayment <strong>of</strong> <strong>Jamaican</strong> tax is claimed :-Section C - DECLARATION. I declare that I /the claimant /am /is /beneficially entitled to the income from the sources specified overleaf and thatto the best <strong>of</strong> my knowledge and belief all <strong>of</strong> the particulars given in this <strong>for</strong>m are correctly stated.I authorize repayment to be made to the banker or agent named below:Signature <strong>of</strong> <strong>Claim</strong>antSignature <strong>of</strong> Authorized AgentSection D - CERTIFICATE OF TAXATION AUTHORITIES OF COUNTRY FOR RESIDENCE.Date.To be completed where relief under a Double <strong>Tax</strong>ation Relief Order or Convention is claimed.I/We certify that is resident in and subject totax in respect <strong>of</strong> the income*/stated overleaf/*scheduled below.(*Delete as necessary)Schedule :Signature.Official Stampfficial StampDesignation.Date.<strong>Form</strong> No. <strong>1N</strong>PLEASE SEE OVERLEAF FOR CONTINUATION OF FORM<strong>Tax</strong> Administration Jamaica

STATEMENT OF INCOME ACCRUING IN OR DERIVED FROM JAMAICAYEAR ENDED 31ST DECEMBER , 201. Employment or Office - Enter gross earnings.Self($)INCOMEWife($)<strong>Jamaican</strong> <strong>Tax</strong>Deducted($)Employers Name. Self . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .Wife . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .DEDUCTIONS CLAIMED:Self ($) Wife ($)Expenses (attach list <strong>of</strong> expenses). . . . . . . . . . . . . . . . . . . . . . .Superannuation Contributions.2. Trade, Pr<strong>of</strong>ession or Vocation - State nature, where and in whatname carried on.the year ended in the year <strong>of</strong> claim shouldbe stated. If<strong>for</strong> some period other than this you should statethe period covered. A copy <strong>of</strong> your trading accounts should be attached. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3. Pensions & Purchased Annuities.Date Payable By whom payable (state name & address)Amount ($). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .4. Rents etc.- All rents, premiums and any other from propertyare to be stated. Enclose a list <strong>of</strong> expenses <strong>for</strong> each property.Properties. . . . . . . . . . . . . .TotalsGross RentsExpensesNet Rent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .5. Interest- received by or accrued due to you. Interest includes incomefrom Government Securities, from bonds or debentures whether or notsecured by mortgage or from any other <strong>for</strong>m <strong>of</strong> indebtedness.Description <strong>of</strong> loan & from WhomInterest Due DateInterest Rate (%)Gross Interest ($). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . .Total6. Royalties:Description <strong>of</strong> royalties Contract Date Name & Address <strong>of</strong> payer in Jamaica. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7. Dividends: - Enter the name <strong>of</strong> the company paying the dividend, thegross dividend and the <strong>Jamaican</strong> tax deducted. Attach all relevant vouchers.Paying Company:. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .8. Trust income - or annuities (other tahn purchased annuities), alimony,or other annual sums. Give details and attach all relevant vouchers.9. Pr<strong>of</strong>its or Gains - From the provision <strong>of</strong> industrial or commercialin<strong>for</strong>mation or advice or management or technical services or similarservices or facilities or plant or equipment on hire (other than under ahire-purchase agreement) to any person resident in Jamaica. Givedetails <strong>of</strong> the nature <strong>of</strong> services etc..10. Other <strong>Income</strong> - derived from or accrued in Jamaica not stated above.Total