INFRASTRUCTURE - UAE Interact

INFRASTRUCTURE - UAE Interact

INFRASTRUCTURE - UAE Interact

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

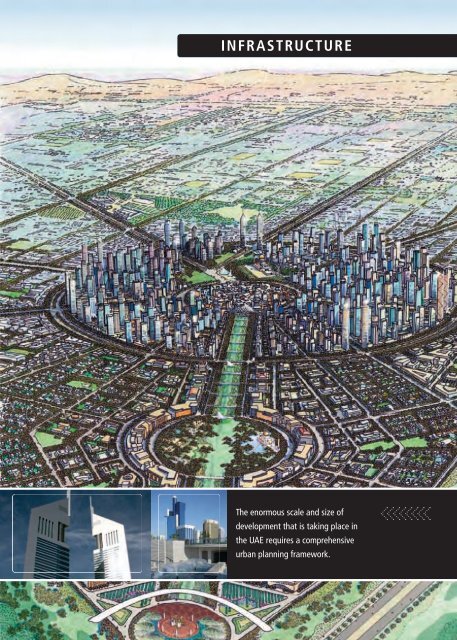

<strong>INFRASTRUCTURE</strong>The enormous scale and size ofdevelopment that is taking place inthe <strong>UAE</strong> requires a comprehensiveurban planning framework.

165<strong>INFRASTRUCTURE</strong>URBAN DEVELOPMENTWHEN THE FEDERATION WAS ESTABLISHED IN 1971, the population wasprimarily rural and infrastructure was minimal. The new Governmentimmediately focused on providing facilities for its populationcommensurate with twentieth-century living. Housing, roads,airports and ports, schools and hospitals were built and power, waterand telecommunications supplied through the judicious use of oilwealth. By the time the twenty-first century had arrived, all thesefacilities were well developed, most of the population was urbanisedand it was time to bring the private sector into the picture so thatthe requirements of an increasingly diversified economy and rapidlyburgeoning cities could be met.In emirates with greater land areas whole new urban conurbationscomplete with the requisite infrastructure are being built toaccommodate a rising population. One of the most significantimpacts, however, on physical infrastructure in recent years has beenthe building of dedicated industrial areas, commercial clusters, freezones and massive mixed-use developments designed to provideadditional tourist facilities and vastly increase retail and officespace. Liberalised real estate and property laws have generatedunprecedented development in this sector. In addition, alreadyexisting airports are being extended and new airports and ports builtto cater for the projected rise in tourism and trade. When the scaleof these developments is appreciated, it is not difficult to understandthe enormous influence that they are having on urban developmentin the <strong>UAE</strong>, literally changing the face of the country, quite apart fromthe investment that is required in transport, sewerage, electricity,water and telecommunications to service these projects.It is not surprising, therefore, that the <strong>UAE</strong> accounts for the bulk ofthe ongoing and planned infrastructure projects in the GCC countries,amounting to an estimated US$1.3 trillion plus of investment overthe 2007/2012 period.Urban development inthe <strong>UAE</strong> is proceedingat an unprecedentedpace with the privatesector working hand inhand with government.@www.uaeinteract.com/urban

168 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Dubai StrategicPlan 2015 recognisesthat urban planningis a prerequisite tooptimise land use inorder to meet theneeds of sustainabledevelopment.Saadiyat IslandDubai Strategic Plan 2015 recognises that urban planning is aprerequisite to optimise land use in order to meet the needs ofsustainable development while preserving natural resources. This, itpoints out, involves comprehensive and integrated planning of theelements of urban development. To implement the strategy, Dubai’sUrban Planning Committee, which includes key stakeholders suchas Dubai Municipality, the Road and Transport Authority (RTA),Dubai Electricity and Water Authority (DEWA), Dubai LandDepartment, and The Executive Office, as well as developers likeDubai Holdings, Emaar and Nakheel, are in the process of drawingup the Dubai Urban Development Framework (DUDF), an integratedmaster plan that will offer a comprehensive roadmap for Dubai'sfuture up to 2020 and beyond, hopefully solving the main concernsof today's urban life. The Emirate-wide 'City and Regional PlanningFramework' will seek to establish a strong integration betweenthe increasingly complex governmental, quasi-governmental andprivate stakeholder relationships of the city. Key elements of theframework will include integrated land use and mobility, housingprovision, economic and demographic growth, urban characterand design, heritage management, integrated community facilitiesprovision, civic harmony and sustainability strategy.PROJECTS IN ABU DHABIOne of the most exciting of the many urban projects in Abu Dhabiis the development by Abu Dhabi Tourism Authority (ADTA), throughits commercial arm Tourism Development and Investment Company(TDIC), of Saadiyat Island (‘Island of Happiness’), a natural islandoff the north-eastern shores of Abu Dhabi City. As already indicated,TDIC is focusing on a cultural theme for part of the island and majormuseums, among them an outpost of The Louvre, in Paris, and aGuggenheim art museum, art galleries and performing arts centreshave been designed by world-famous architects for the CulturalDistrict, which will be part of an innovative, environmentallysustainable, mixed-use leisure and retail community (see Culture &Heritage). Two ten-lane highways will connect Saadiyat Island to thecity and the airport. The first tourist attractions will be open in 2012,and the entire project is scheduled for completion in 2018.

I N F R A S T R U C T U R E169Saadiyat will also be linked with Al Reem Island where the Dh30billion Najmat Abu Dhabi or ‘Star of Abu Dhabi’ is the maidenproject of Reem Developers, the real estate subsidiary of ReemInvestments. Najmat Abu Dhabi is community-focused with amixture of traditional and contemporary architecture. The plansencompass business, leisure and residential areas, with marinas,educational campuses, health and well-being facilities, plus retailand hospitality destinations.Shams Abu Dhabi on Al Reem was launched as Sorouh's firstprestige development in Abu Dhabi. When completed in 2011 it willbe home to approximately 70,000 people. Surouh’s Sky Tower isdestined to be the highest skyscraper in Abu Dhabi and Surouh isalso responsible for the Dh729 million Golf Gardens luxury residentialdevelopment adjoining Abu Dhabi Golf Club. In addition Surouhhas launched Saraya Abu Dhabi, a new Dh3.5 billion mixed-usedevelopment in Abu Dhabi City, next to the Corniche Hospital.Aldar’s flagship Central Market redevelopment in Abu Dhabicity centre has been divided into several construction packages,all of which are significant in their own right, with the first phase, amodern version of the traditional Arabian Souq, due for completionby mid-2008. Aldar's target for 2007 is to finish the massiveunderground car park and basement structure, as well as installationof some of the largest pile foundations in the Middle East. Thesesupport the retail section, and the three tall towers designed byworld-famous architect Foster & Partners that will accommodateresidences, offices and hotels.Aldar is also developing a largely-reclaimed island near Abu DhabiInternational Airport. The Dh147 billion Yas Island development willbe a prestigious leisure destination with mixed-use tourismattractions, including beaches, entertainment, shopping, hotels,residences, golf courses, equestrian facilities, and an exclusiveFerrari Theme Park (to be completed by 2009). Yas Island will alsohave a Formula 1 racetrack, where the inaugural Abu Dhabi GrandPrix will be staged in 2009 (see Sports & Leisure).Nearby, Aldar has already handed over properties in the firstphases of the Al Raha Gardens project, the first freehold, residentialdevelopment in Abu Dhabi for <strong>UAE</strong> nationals. Construction is alsoAl Reem IslandYas Island will behome to a Formula 1racetrack where theinaugural Abu DhabiGrand Prix will bestaged in 2009.@www.uaeinteract.com/urban

172 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Al Ain Zoo at night.bridges; and Abu Dhabi Golf Hotel Residences and Spa. TDIC is alsosetting environmental example by ensuring that the design of itsnew office headquarters in Abu Dhabi is being built to the higheststandards in sustainable development.In addition, Abu Dhabi Municipality has announced that it isdeveloping, in partnership with the private sector, the unique Dh7billion Emerald Gateway project located along the Coast Roadhalfway between downtown Abu Dhabi and Abu Dhabi InternationalAirport. The development includes 88 towers on both sides of a 3.5kilometre segment of the arterial highway.Abu Dhabi Island and its surrounds are not the only area of focusin the building boom. As already indicated, TDIC are planning majorreal estate projects to develop tourist facilities both on and offshoreAbu Dhabi’s Western Region (see section on Tourism), a vast areawith a rich natural and cultural heritage that has enormous potential,and in the Liwa.Major real estate development is also taking place in the inlandoasis-city of Al Ain. Aldar has unveiled a Dh2 billion mixed-useintegrated complex, Noor Al Ain, planned for the existing Al JimiMall in Al Ain. Extensive work is also being undertaken to transformAl Ain Zoo into a Wildlife Park & Resort, a mixed-use developmentbased on the ideas of conservation and education.DEVELOPMENTS IN DUBAIDevelopments in Dubai continue at breakneck speed with manyhuge projects nearing completion. Most of these are mixed-usedevelopments, incorporating, retail, residential, entertainmentand tourist facilities. Dubai is ranked third, just behind Moscow andShanghai, in terms of global office space construction activity andthe emirate has more than 23 million square metres of confirmedreal estate development projects currently under way.Creekside projects are progressing smoothly, including DubaiFestival City. About 10 kilometres of the Creek extension work,from Ra’s al-Khor to Sheikh Zayed Road near interchange two,was completed in 2007 to allow construction of Business Bay, theDh110 billion mixed-use commercial and residential freehold projectcomprising 220 towers being undertaken by Dubai Properties.

I N F R A S T R U C T U R E173The creation of seven interconnected islands near the Ra’s al-Khor Wildlife Sanctuary is enabling Sama Dubai, the internationalreal estate investment and development arm of Dubai Holding, tobuild the Dh65 billion mixed-use The Lagoons project spread overan area of 65 million square metres. However, the most criticalpart of the extension work is the next 2.2 kilometre stretch thatwill take the Creek from Sheikh Zayed Road back to the sea. Workon this phase commenced at the end of 2007 and is planned forcompletion in November 2010.The recently constructed Dubai International Financial Centre(DIFC) is fully operational but is already undergoing extension,whilst Dubai World Trade Centre (DWTC) has started work on theDh16 billion Dubai Trade Centre (DTC) District. The plan is totransform the entire area surrounding the DWTC Tower at thebeginning of Sheikh Zayed Road into a new business quarter inparallel with construction of Dubai Exhibition City. The first phaseof both these projects is scheduled for completion in 2010.Burj DubaiWork on Downtown Burj Dubai, which is being developed by theinternationally successful Dubai-based property group Emaar, is alsocontinuing swiftly. At the centre of this mixed-use community is BurjDubai, which is growing ever larger in its quest to rank as the tallestbuilding in the world. At 564.9 metres (1853 feet) in late September2007, the building height exceeded the 1670 feet Taipei 101 inTaiwan, until then the world’s tallest skyscraper. It is reported thatBurj Dubai’s finished height will be 818 metres. Designed byChicago-based Skidmore, Owings & Merrill, Downtown Burj Dubaifeatures The Armani Hotel and the massive shopping complexDubai Mall, and Sofitel's ‘The Palace', which opened its doors inthe last quarter of 2007.Ambitious ProjectsOffshore, Dubai’s ambitious offshore projects are rapidly becominga reality. Six years after commencing work on the now famousPalm Jumeirah, developer Nakheel will have handed over 4000villas and apartments by the end of 2007 and work is progressingWork on DowntownBurj Dubai, beingdeveloped by theinternationallysuccessful Dubai-basedproperty groupEmaar, is alsocontinuing swiftly.BURJ DUBAI FACT FILE• At peak cooling towerwill require 10,000 tons ofwater per hour.• System will deliver250,000 gallons of waterper day.• Peak electrical demand= 36 mVA equivalent to360,000 100 watt lightbulbs simultaneouslyswitched on.• Condensation waterwill be collected, creating15 million gallons ofsupplemental waterper year.• World’s longest andfastest lifts.• 230,000 cu. m of concreteequivalent to a 6900kilometre sidewalk or theweight of 100,000elephants!@www.uaeinteract.com/urban

Palm Deira in Dubai.The Palm Jumeirah willfeature over 100 luxuryhotels, 5000 exclusiveresidential beach-sidevillas, 5000 shorelineapartments, marinas,water theme parks,shopping malls,sports facilities andhealth spas.on the second phase. Reclamation is under way on the Palm, JebelAli, which is twice the size of the Jumeirah version and Nakheel hasrevised its plans for The Palm Deira, the last and the largest of ThePalm trilogy, aligning it with the Deira Corniche project that willreshape the stretch of land between the Hyatt Regency hotel andAl Mamzar Park. Meanwhile, The World, a group of 300 islandsarranged to reflect the continents, is also taking shape 4 kilometresoff the coast to the west of The Palm Jumeirah.Onshore and further inland, Dubailand, comprising six themedworlds focusing on tourism, leisure and entertainment, is also takingshape on Emirates Road. The 2.7 billion square-metre area willencompass Mall of Arabia, set to become one of the largest shoppingcentres in the world and Dubailand’s developer Tatweer, part ofDubai Holding, is doubling its initial investment in Bawadi, a hugehospitality and leisure development that will include a 37-millionsquare-metreshopping mall and 51 hotels accommodating morethan 60,000 rooms.More than Dh20 billion worth of residential projects will be underconstruction in Dubai Investment Park by the end of 2007, bringingthe park's total investment value to almost Dh21 billion. Phase 1 ofResidential City, the mid-cost housing component of Dubai WorldCentral (DWC), a hugely ambitious 140 square-kilometre urbanaviation community under construction in Jebel Ali, has been soldout. The first residents are expected to live in Residential City by

I N F R A S T R U C T U R E175June 2009, a move timed to coincide with full-fledged operationsat the world's largest airport, Al Maktoum International Airport,construction of which is currently well under way.Nearby, Nakheel is planning Dubai Waterfront on an area biggerthan Manhattan and Beirut, offering investors over 250 masterplannedwaterside communities with mixed-use, commercial,residential, resort and amenity areas. The handover to investors ofthe first phase of development, Madinat Al Arab, the planned urbandowntown at the heart of Dubai Waterfront, commenced in 2007.Nakheel is buildingDubai Waterfront on anarea bigger thanManhattan, offeringinvestors over 250master-plannedwaterside communities.REAL ESTATE IN THE NORTHERN EMIRATESSharjah, a short distance from Dubai, has also been the locationof a considerable amount of development in the past few years,including hotels and mixed-use developments. One such work-inprogressis Hanoo Holdings’ extensive Nujoom Islands developmentoff Hamriyah beach along the Sharjah coast, which will cost Dh18billion and cover over 5 million square metres. Comprisingresidential, entertainment, retail and leisure developments on tenislands, all to be constructed in several phases, the project includesan International Business and Financial Centre (IBFC). Hanoo arealso developing the Dh3 billion Emirates Industrial City project inthe emirate.Ajman is striving to make a name for itself in real estate andtourism, spearheaded by Ajman Investment and DevelopmentAuthority (AIDA) in conjunction with its development arm Aqaar.The intention is to transform the emirate into a popular destinationfor both tourism and business.Approximately 200 freehold residential towers are either underconstruction or have been completed since the city's freeholdregulations opened up the possibility of 100 per cent ownershiprights. Developments include the 15-tower Al Naeymiyah Towers;Rashidiya Towers, a complex of 11 buildings and the nine-buildingAl Khor Towers development completed at the end of 2007. Othermajor projects scheduled for delivery by 2010 include HorizonTowers, Falcon Tower, Ajman One and Corniche Tower. In addition,Star Giga Establishment has launched a Dh700 million freehold@www.uaeinteract.com/urban

176 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Umm al-QaiwainMarina waterfrontdevelopmentincorporates residential,retail, and recreationalfacilities, sport andyacht clubs, waterfrontresorts, boutique hotels,schools, communitycentres, beachesand parks.Ra’s al-Khaimah City.residential property development at Paradise Lakes on the EmiratesRoad and Goldcrest Dreams is scheduled for delivery in mid-2009.Dubai-based Emaar’s Dh12 billion Umm al-Qaiwain Marinawaterfront project, which is being developed in agreement withthe Umm al-Qaiwain government, has real potential to increaseemployment and boost the tourism, trade and real-estate-poweredlocal economy.Having successfully concluded a number of real estate deals withthe government of Sharjah, the regional property developer Tameeris involved in the Dh30.5 billion Al Salaam City development, anintegrated residential and commercial city off Emirates Road. Ummal-Qaiwain government and the Emirates Investments Group LLC(EIG) have also signed an agreement that will see the establishmentof White Bay, a master-planned community and tourism resorton the shores of the Khor al-Beida lagoon. In addition, Umm al-Qaiwain’s development plan includes the establishment of an airport,a University City, a Business City, Medical City and Industrial City.The country's northernmost emirate Ra’s al-Khaimah has entereda determined phase of development. More than Dh50 billion worthof projects are at various stages of planning and construction. Over60 per cent of these are lifestyle projects that focus on boomingsectors such as tourism and real estate. Industrial developmentwill account for the remaining 40 per cent. RAK's Investment andDevelopment Office (IDO) expects investment to generate morethan 40,000 jobs in the next three to five years.The Dh5.5 billion Saraya Islands residential and tourism projectis a joint initiative of the RAK government, Saraya Holdings andArab Bank.A major beachfront resort costing Dh400 million is taking shapeby Al Hamra Palace Hotel, Nearby RAK Properties have contractedwith China-based China Harbor Engineering Company to carryout the marine works for the private master-planned Dh67 millionwaterfront community, Mina Al Arab. Egyptian developers arebuilding The Cove and Khoie Properties are involved in the Dh2.93billion La Hoya Bay master development on Marjan Island andhave launched a Dh550 million freehold commercial development,La Hoya Bay Business Park, as part of the project.

I N F R A S T R U C T U R E177Ra’s al-Khaimah will also be the location of a Dh850 million,120-acre theme park, Wow RAK. Emirates Flag is a cluster of 21commercial buildings bearing the <strong>UAE</strong> flag on the rooftops thatare being built at the Dream Industrial Park in the Ra’s al-KhaimahFree Trade Zone. Rakeen, another leading Ra’s al-Khaimah developer,has announced that it is to develop Ra’s al-Khaimah Financial Cityas part of the RAK Offshore project, the financial, legal, logistic andinsurance services free zone that is currently under development bythe RAK Investment Authority (RAKIA).In the stunningly beautiful Emirate of Fujairah, the real estateemphasis is naturally on improving tourism infrastructure, with theEgyptian group Iberotel planning to spend Dh1.2 billion on six hotelsand retail facilities in the emirate.Mina Al Fajer Real Estate LLC, a leading property developer in the<strong>UAE</strong>, is developing a Dh600 million mountain-sea resort propertyMina Al Fajer Resort which will be completed before the end of2009, giving Fujairah the first of what is expected to be a growingnumber of world-class, exclusive real estate projects.Abu Dhabi-based Escan PJSC’s developments in Fujairah includeAl Fanar Towers, a 30-floor residential tower, a 25-floor commercialtower, and a 300-room hotel in the centre of Fujairah City, anddevelopments in the extremely scenic Wadi Al Wurrayah Valleynorth of Fujairah. In agreement with Riyadh Golden Investment andDevelopment, Escan Properties will manage and market the Dh2billion Fujairah Paradise development near Dibba.Several new hotels are also being planned in the northern AlAqqah area, close to Dibba, where the Al Aqqah Meridien, a Rotanahotel and a JAL hotel have already paved the way for what isintended to become the focus of the emirate's tourist industry.Currently underconstruction in the KhorQurm area,WOW RAKboasts a 12,000 squaremetre shopping mall,an entertainmentplaza and a resort.TRANSPORTAl Aqqah Meridien Hotelin Fujairah.‘Whether a new factory needs to move its global products to market,a professional worker wants to get to work on time, or a tourist seeksfresh air at a pristine beach, an efficient and well-planned transportsystem is the critical factor to meeting these diverse needs.’@www.uaeinteract.com/urban

Abu Dhabi has completed a majorupgrading of the arterial expressway along theCorniche to Mina Zayed. A modern roadnetwork has been developed throughout the<strong>UAE</strong>. Strategic plans for all emirates focus onimproving transport infrastructure.

I N F R A S T R U C T U R E179As Abu Dhabi Executive Council stresses in its policy agenda forthe next couple of years, a sophisticated transport system is criticalto the ongoing growth and diversification of the <strong>UAE</strong>’s and AbuDhabi’s economy. A newly created Department of Transport in AbuDhabi will ensure fully coordinated planning in all aspects oftransport policy and development. The Executive Council hascharged the department to meet its objectives in ways that areconsistent with the council’s stated pillars, emphasising privatisationand cost-efficiency, achieving world-class standards, employing moreEmiratis, and enhancing accountability in a transparent regulatoryenvironment. The department will not only have responsibility forplanning and regulation in road safety, highways management andpublic transport, it will also cover the aviation and maritime sectors.Dubai Strategic Plan 2015 focuses on the need to provide anintegrated road and transportation system to facilitate the movementof people and goods while improving safety levels for all systemusers. This involves addressing current traffic congestion problemsand accommodating future needs by increasing the use of publictransport and decreasing reliance on private vehicles, at the sametime improving the capacity of road networks and transportationsystems, whilst securing optimal use through demand managementand accident and emergency management.A sophisticatedtransport system iscritical to the ongoinggrowth of the<strong>UAE</strong>'s economy.ROADS & BRIDGESNew highways connecting Abu Dhabi City with the mainland via AlSuwwah, Saadiyat and other islands, including ten additionalbridges, as well as new routes out of the city for heavy vehicles areproposed under Abu Dhabi’s new urban framework. The truckroads will connect the new port and industrial areas with the restof the country without intersecting with city roads. Other measuresinclude improving pedestrian pathways and reconfiguring streets toimprove traffic flow.To date, Abu Dhabi has completed a major upgrading of thearterial expressway along the Corniche to Mina Zayed, relievingtraffic congestion in the city centre and improving access to MinaZayed. Numerous underpasses are designed to make the area@www.uaeinteract.com/roads

180 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8New transport systemshave also beendesigned for AbuDhabi’s recently builturban areas, such asKhalifa bin Zayedand Mohammed binZayed cities. Sincemajor infrastructuredevelopments aretaking place in theWestern Region, thereis also a renewedemphasis ontransportation there.pedestrian friendly and give easy access to the delightful walksalong the seaside Corniche or in the many landscaped parks andactivity areas in the new development. Internal roads in the cityhave also been upgraded, a third bridge is nearing completion toimprove access from the mainland to Abu Dhabi Island and roadsand interchanges have been remodelled around the airport toaccommodate major developments there.Construction of the regional network of roads and bridges on AlReem commenced in June 2007. To ease the pressure on the roads,Al Reem will have its own mass transit system linked to the proposedmass transit system for Abu Dhabi.New transport systems have also been designed for Abu Dhabi’srecently built urban areas, such as Khalifa bin Zayed and Mohammedbin Zayed cities. Since major infrastructure developments are takingplace in the Western Region, there is also a renewed emphasis ontransportation there.Massive building projects in Dubai have increased traffic and ledto heavy congestion, especially at peak times. This is being tackledby the rolling out of new bridges, road improvements and a focus onpublic transport, including a new metro system, all part of Dubai’sRoads and Transport Authority’s (RTA) comprehensive strategictransportation plan that covers Dubai’s needs up to the year 2020.Under the plan RTA intends to spend Dh44.04 billion (US$12 billion)on upgrading the emirate’s road network, building 500 kilometresof new roads, 95 interchanges, nine ring roads and increase thenumber of lanes crossing the Creek, a notorious bottleneck.The number of traffic lanes crossing the Creek that runs throughthe heart of Dubai is being increased from 19 in 2006 to 47 by 2008,and to 100 by 2020. The first phase of Business Bay Crossing wasopened to the public in early 2007 to try to ease traffic flow on theMaktoum and Garhoud bridges, and a temporary floating bridgeopened in June 2007 to assist with traffic while the capacity ofGarhoud Bridge is being doubled to 16,000 vehicles per hour. Oncecompleted, the Dh800 million, 15-metre-high Business Bay Crossinglinking Deira with Bur Dubai will stretch for 1.6 kilometres with 13lanes both ways capable of carrying 26,000 vehicles per hour.

I N F R A S T R U C T U R E181The RTA has awarded a Dh289 million contract for phase three ofthe strategically important Dubai bypass road that links the NorthernEmirates with Abu Dhabi. The RTA is also working on projects toexpand the 35-kilometre stretch of Emirates Road between theSharjah–Dubai border and Arabian Ranches roundabout and istransforming Al Ittihad Road into an expressway from Al GarhoudBridge to facilitate motorists commuting between the two emirates.In cooperation with the RTA, Sharjah Town Planning and SurveyDepartment (STPS) is expanding Emirates Road within its ownborders from the existing three to four lanes and will have completedits section of the Dh800 million Al Ittihad Road expressway projectby the end of 2008. The opening of the new King Faisal Bridge at theintersection of King Faisal and Al Wahda Roads at the end ofFebruary 2007 was welcome news for commuters between Dubai,Sharjah and Ajman. Construction was carried out by the Departmentof Public Works as part of the Dh2.1 billion Sharjah governmentroad improvement scheme.Another strategy employed by Dubai RTA in 2007 to effectivelymanage traffic in Dubai and minimise congestion was the institutionof Salik, a free-flow system allowing traffic to move speedily throughtwo tolling points at Al Garhoud Bridge and Sheikh Zayed Roadnear Mall of the Emirates. The RTA has also introduced the DubaiAward for Sustainable Transport (DAST) to encourage the publicand private sector to play a constructive role in realising the RTA'sobjectives in easing traffic congestion and increasing the use ofpublic transport in the city.PUBLIC TRANSPORTTo meet the needs of a rising urban population, Abu Dhabi’s newurban planning initiative envisages a layered interconnectedpublic transportation network that would reduce reliance on cars.The plan includes a high-speed passenger rail line, originating froma train station in the Central Souq, connecting the downtown to thenew Capital District, airport and ultimately Dubai. A freight rail linewill also operate between the new port, airport, Jebel Ali and theGCC countries. The rail link will be augmented by two high capacityConstruction of a<strong>UAE</strong>-wide, high-speedrailway serviceis to begin early in2008. The first phaseof the 800-kilometrepassenger and cargonetwork will startoperating in 2013.@www.uaeinteract.com/roads

Abu Dhabi's plannedpublic transportationnetwork includes highspeedrail links, highcapacitymetro linesand a fine-grainednetwork of streetcars,buses and ferries.metro lines running between all the main districts in Abu Dhabi:one originating on Saadiyat Island and Al Mina, turning left atCentral Station and onto the Airport Road, Capital District and RahaBeach; the other line crossing downtown from east to west,connecting Al Reem and Al Suwwah to the Central Station andMarina Mall. In addition, a fine-grained network of streetcars, busesand ferries will ensure that no-one will have to walk more than fiveminutes to use public transport.Dubai Road Transport Authority operated 504 buses on 69 lines,transporting 88 million passengers over approximately two milliontrips during 2006. Joining the fleet in 2007 and 2008 will be 620new luxury buses to run on intra-city and inter-city routes, including300 articulated (long) buses and 170 double-deckers, for which theRTA has paid Dh1.9 billion.Projections are that public transport buses will cover 95 per centof Dubai City with a total of 160 routes by 2010. At present,however, the RTA is working determinedly to increase the current6 per cent public bus use to 30 per cent. Enticements to usersinclude air-conditioned bus stops, luxury buses, dedicated bus lanesand an increased number of routes. These will be integrated withmetro stations and water transport to create an effective publictransport system.

I N F R A S T R U C T U R E183Traditional abras are used by commuters and tourists as aconvenient and picturesque method of crossing Dubai Creek.However, these have now been supplemented by a water busservicethat commenced on 15 July 2007 and the RTA has signeda two-year, Dh8.9 million agreement with Singapore’s PenguinCompany to operate and maintain the service.Dubai MetroDubai’s Dh15.5 billion, 74.6-kilometre metro project launched inOctober 2005 is on schedule with work taking place around-theclock.Trial runs are timetabled for June to August 2009 before themetro actually commences operations in September 2009.Major construction work is in evidence on the 52.1-kilometre RedLine between Jebel Ali Port and Al Rashidiya. Progress is most visiblein the construction of the 44.1 kilometres of elevated track on whichthe trains will travel. However, work is also proceeding apace on the12.6 kilometres of track that will run underground, 300 metres ofwhich will be under the Creek. Tunnelling using highly specialisedequipment commenced in February 2007 on the 4.7 kilometresunderground section of the Red Line and tunnelling for the 7.9kilometres of underground Green Line beneath Deira and Bur Dubaiwill start in April 2008, to be completed in October 2008.When finished, 87 fully automated driverless trains will initiallyrun on the Red and Green Lines and a fully functional metro systemwill be able to carry about 1.8 million passengers per working day.The RTA is also working on plans for Blue and Purple Lines toprovide transport coverage to other areas of the city. Constructionwill start in March 2009 and is scheduled to finish in December 2012on the Dh10 billion, 49-kilometre Purple Line, running betweenDubai International Airport and Al Maktoum Airport.ELECTRICITY & WATERDubai Road TransportAuthority operated504 buses on 69 lines,transporting 88 millionpassengers overapproximately twomillion trips during2006. Joining the fleetin 2007 and 2008 willbe 620 new luxurybuses to run onintra-city and inter-cityroutes, including 300articulated (long)buses and 170double-deckers.Dubai Metro is currently underconstruction and is due tocommence operations inSeptember 2009.The massive number of tourism and real estate projects underdevelopment, increased industrialisation, expanding agricultureand a rapidly growing population have placed severe pressures@www.uaeinteract.com/transport

184 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8The current totalcapacity for electricityproduction in the <strong>UAE</strong>is around 16,670 MWcompared to 9600 MWin 2001. Industryestimates expect thecapacity to rise by 60per cent to almost26,000 MW by 2010.90008000700060005000400030002000100002003 2004 2005 2006 2007IWPPnon-IWPPAbu Dhabi IWPP andnon-IWPP electricity ingross megawatt.on electricity and water supply in the <strong>UAE</strong> and considerableeffort, including heavy investment in power generation and waterdesalination, is being expended to meet the burgeoning demand.The <strong>UAE</strong> consumes more than 3.2 billion cubic metres of waterevery year and is near the top of the global index for the highestwater consumption per capita. At a conservatively estimatedminimum of 10 per cent per annum until 2010, the <strong>UAE</strong> has thehighest projected increase in demand within the GCC region. Mostof the <strong>UAE</strong>’s water is produced by desalination, usually in conjunctionwith power generation, and older plants are being expanded andnew plants are being built to meet the enormous demand.The current total capacity for electricity production in the <strong>UAE</strong> isaround 16,670 MW compared to 9600 MW in 2001. Industryestimates expect the capacity to rise by 60 per cent to almost26,000 MW by 2010. Abu Dhabi Water and Electricity Authority(ADWEA) accounts for the bulk of capacity, followed by DubaiElectricity and Water Authority (DEWA), Sharjah Electricity andWater Authority (SEWA), and the Federal Electricity and WaterAuthority (FEWA). At present, each service provider operates as aseparate entity but a common federal framework for the waterand electricity sector is under study by the Ministry of Energy.The need for power and water is in turn pushing up demand fornatural gas to fire most of the power and desalination plants. InJuly 2007 the Emirates began importing gas from Qatar throughthe new Dolphin pipeline. The next step is to carefully ramp upproduction until the targeted pipeline throughput of 2 billion standardcubic feet per day is reached in early 2008.The increasing demand has also brought a new awareness of theneed for diversification of energy resources. While power generationfrom renewable energy sources is still relatively uncommon inthe Middle East, the number of pilot projects, hybrid plants andrenewable energy research areas is on the increase. Progress hasalso been made in deliberations on a proposed GCC commonnuclear programme for peaceful purposes and on-going discussionsare taking place with the International Atomic Energy Agency in theframework of the 'Jabir summit’ held in Riyadh in December 2006.

The <strong>UAE</strong> consumes more than3.2 billion cubic metres ofwater every year.

186 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Excessive pumping andthe lack of rainfall havebeen depletinggroundwater levelsand affecting waterquality in many aquifersin the country.GROUNDWATERAlthough domestic water, especially in the larger emirates of AbuDhabi and Dubai, is mainly produced by desalination, groundwateris a very important water resource, especially for agriculture andforestry. However, excessive pumping and the lack of rainfall havebeen depleting groundwater levels and affecting water quality inmany aquifers in the country. To assist in remedying this, 115rainfall-retention dams have been constructed, primarily in theNorthern Emirates, to enhance the groundwater recharge. A largenumber of monitoring wells have also been installed within thevicinity of recharge dams to assess their efficiency and groundwaterlevels are measured monthly.Since mid-2005, the Environment Agency – Abu Dhabi (EAD) hasbeen responsible for groundwater resources management. Theagency's monitoring activities include development of a waterresources database, a well inventory and registration process, a newregistration process for water-well contractors and water resourcesconsultants, establishment of a groundwater resources monitoringnetwork, and development of a water resources atlas. EAD isalso in the process of developing an integrated water resourcesmanagement plan. And finally, as a major step towards controllinggroundwater development, a water well drilling law was passed inMarch 2006 and the well-permitting policy is managed by EAD.A satellite imagery project run by the Centre for Remote Sensing,Boston University, USA, in cooperation with SEWA, which has beenin operation for five years, is also crucial in preparing a long-termstrategic plan for the rational use of groundwater resources inSharjah and other Northern Emirates.CONSERVATIONGiven the scarcity of the country’s water resources and the acuteawareness that regional water shortages are a major environmentalchallenge, water resource management and water conservation isa priority.Proper management of limited available water resources was thesubject in 2007 of a number of conferences and seminars, includingthe Water Resources Development, Conservation and Management

I N F R A S T R U C T U R E187conference ‘Challenges for Water Sustainability’ organised by theCollege of Graduate Studies at the <strong>UAE</strong> University Al Ain with thecooperation of Schlumberger Water Services. One of the conclusionsreached was that a great deal of scientific and applied research isneeded if sound management policies are to be implemented toaddress problems related to the quantity and quality of waterresources in the <strong>UAE</strong> and the GCC countries.Public awareness campaigns are also employed to advise onhow to use water wisely and avoid water waste or over-use ofwater. In particular, a drive to cut down water usage in certainhigh consumption areas, such as labour camps and hospitals, isunder way.In line with the overall federal strategy, during the next threeyears the Ministry for Environment and Water (MEW) will focuson reducing the use of groundwater and shift to alternative sourcessuch as desalination. Also, the ministry will increase its groundwatersurveillance network to more than 183 wells, increase the numberof observation networks by 35 per cent and complete the buildingof 11 freshwater channels. The ministry’s plans include a renewedfocus on modern irrigation methods, the reuse of waste water anda national plan for the maintenance of dams. The ministry will alsoseek to train <strong>UAE</strong> nationals in and foster an increased awareness ofrational water use.A great deal ofscientific and appliedresearch is needed ifsound managementpolicies are to beimplemented toaddress problemsrelated to thequantity and qualityof water resourcesin the <strong>UAE</strong>.ALTERNATIVE ENERGYNature may be able to assist the <strong>UAE</strong> in meeting rising utility needs,with solar and wind energy possibly offering not only a way to meetdemand but at the same time assist in reducing carbon emissions:the generation of 200 MW of renewable energy would cut annualcarbon emission rates by 1.5 million tonnes. Studies are beingundertaken into the wider use of solar power, especially for use indesalination, and the private sector is also being encouraged todevelop alternative systems with the result that many new buildingsare being designed and built with energy efficiency in mind.With the recent launch of the Masdar alternative energy initiative,Abu Dhabi is intending to diversify the <strong>UAE</strong>’s energy and technologyofferings, becoming not only a world leader in oil but energy more@www.uaeinteract.com/elec_h 2 o

188 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Masdar, the landmarkinitiative by the AbuDhabi government topromote advancedenergy andsustainabilityworldwide, has beennamed 'SustainableCity of the Year' at theEuromoney and Ernst &Young GlobalRenewable EnergyAwards 2007.broadly (see sections on Economic Development and Environment).Masdar is building a complete walled ‘city’ in Abu Dhabi, which willbe solar powered and will house 47,000 people. The city, which isplanned to open in late 2009, will be a zero-carbon, zero-waste zone.Projects already in active development include both photovoltaics(PV) and concentrating solar power (CSP) and Masdar has formeda key partnership with Conergy AG of Germany, which will enableit to provide up to 40 MW of capacity, enough to power 10,000homes, through the use of photovoltaic systems. As the demand forgreen energy increases Masdar, with Conergy’s assistance, hopes tofurther develop, design and roll-out advanced alternative energysystems, including state-of-the-art solar cooling, wind and biomasstechnologies for both household and industrial purposes.The alternative energy movement is in its infancy, but a numberof interesting projects are up and running already. For example, inpursuit of the emirate’s goal of developing real solar poweredsolutions for daily living, Abu Dhabi Public Transport Departmenthas erected a prototype solar-powered bus shelter in the capital.The public can enjoy facilities such as cash withdrawal machines,access to the internet, coffee and soft drinks vending machines,and public telephones inside the shelters.In Dubai, solar-powered parking meters have been in use for sometime. These are now being joined by solar-powered street lights andsolar-powered water taxis.Dubai is also focusing on alternative ways of meeting soaringenergy demands brought about by its huge construction programme.Plans have been unveiled to build a 68-storey building with arevolving 312-metre-high tower carrying solar panels and windturbines that will generate enough electricity to meet the energyneeds of five other similarly-sized buildings.In addition, property developer Tecom Investments is investigatingthe use of solar energy to provide electricity to some of its newprojects. A prototype of a floating solar island, which could be usedto feed a thermal plant, to power a desalination plant, or both, iscurrently being developed at the headquarters of the Swiss centreof electronic and micro technology (CSEM or Centre Suissed'Electronique et de Microtechnique) in Ra’s al-Khaimah. The US$5

I N F R A S T R U C T U R E189million (Dh18.35 million) project is funded by the Ra’s al-Khaimahgovernment and the prototype, due to be operational by the end of2008, will be tested in the desert before being launched at sea.ABU DHABIAbu Dhabi Water and Electricity Authority (ADWEA) estimates thatreal estate and industrial projects planned for Abu Dhabi will requirea formidable expansion in power generation capacity up to 2020.With the fast pace of growth in Abu Dhabi, early assessment of thefuture power demand is a prerequisite as three and half to four yearsare required to build and commission new power and water stations.From a current peak demand of 4790 MW, ADWEA is presentlyforecasting that the total system peak demand in Abu Dhabi Emiratewill rise to 8735 MW by 2010 and to 14,340 MW by 2020 (baseforecast). The demand for power in Abu Dhabi is expected to growby 900 MW or 10 per cent per annum from 2010 to 2013. Atpresent, available capacity is 8400 MW.To meet the discrepancy, optimisation and expansion of existingfacilities as well as development of greenfield sites is ongoing. OverDh50 billion has been pumped into the water and power sectorsince Abu Dhabi embarked upon its privatisation drive in 1998pushing the emirate's generating capacity to more than 7000 MWand 500 MIGW daily from these projects.Sceptics had originally voiced concern over Abu Dhabi’s pioneeringprivatisation plans, particularly the <strong>UAE</strong>'s first independent waterand power project (IWPP), Taweelah A-2. Today, Taweelah A-2 isbeing used across the region as a blueprint for a successfulprivatisation strategy and Abu Dhabi will soon be 100 per centprivatised in this sector.France's Total and Belgium-based Suez Energy are investingUS$400 million (Dh1.46 billion) to expand Abu Dhabi's secondindependent water and power project adding 250 MW of power tothe Taweelah A1 plant. When the expansion is completed, totalcapacity will rise to 1600 MW. Commercial operations at theexpanded plant will commence in 2009. Taweelah A1, which wascommissioned in 2003, has a current capacity of 1350 MW of powerand 84 MIGD of water.From January 2008, allnew buildings in Dubaiwill be constructed inaccordance withinternational,environment-friendlygreen-buildingstandards.Solar powered road sign.@www.uaeinteract.com/elec_h 2 o

190 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8ADWEA also plans toprivatise Abu Dhabiemirate's seweragesector. Here too,major companies areinvited to own40 per cent as wellas to provide finance,management andoperation for twonew sewagetreatment plants.ELECTRICITY PEAK DEMANDHIGH FORECAST2010 2015 2020ABUDHABI 7,011 10,412 11,412AL AIN 1,741 2,136 2,460WESTERNREGION 9,822 13,947 14,340Singapore's SembCorp Utilities is developing the Dh6 billionFujairah I project. After takeover and expansion, the project willhave a capacity of 880 MW and 102 MIGD daily. In addition, amidsttough competition, international consortia competed to bid for AbuDhabi's Dh11 billion eighth independent water and power project(IWPP), Fujairah II. The deal was acquired by a consortium ofInternational Power, of the UK, and Marubeni, of Japan. Thissecond-phase of development calls for the addition of 2000 MWof electricity and 130 MIGD. As with the previous privatisationparadigms, the successful bidder acquired a 40 per cent stake inthe project and will finance, build and operate the plant, which willbe financed by a group of local, regional and international banksand financial institutions.ADWEA is also implementing a series of projects in the WesternRegion, in Zayed City, Ghiyathi, Abu Al Abyadh Island, JenanahIsland and other areas, in addition to a desalination plant of 2million gallons capacity on Al Yasat al-Soghra Island. In January2007 ADWEA awarded a Dh346.68 million (US$94.33 million)contract to India's Larsen & Toubro (L&T) for the construction ofsix 33/11kV primary electrical substations in Al Ain. The project willbe completed by mid-2008.TAQAThe Abu Dhabi National Energy Company (TAQA) is an energyinvestment company founded in June 2005 in which the governmentof Abu Dhabi through ADWEA owns 51 per cent. Because of its 90per cent stake in six of the nine independent water and powerproducers (IWPP) in the Emirates (the remaining 10 per cent isowned by ADWEA), TAQA has been instrumental in providing over85 per cent of Abu Dhabi's power and water desalination needs.TAQA’s interests include oil and natural gas exploration andproduction as well as power generation, and its shares are traded onAbu Dhabi Securities Market (ADSM).TAQA has also ventured into overseas acquisitions (see section onEconomic Development). Major deals in 2007 included the purchaseof CMS Generation, a subsidiary of the US integrated energy firmCMS Energy (CMS). The transaction solidifies TAQA's interests in two

I N F R A S T R U C T U R E191power/water plants in the <strong>UAE</strong> and introduces TAQA to four newcountries in its global network.DUBAIDubai Electricity and Water Authority (DEWA) currently holds amonopoly to produce and sell electricity in the emirate. But Dubaimay open its power generation industry to private foreign investmentin an effort to meet demand that is surging by a minimum of 12 to14 per cent annually, with some commentators suggesting thatdemand growth was in the region of 30 per cent in 2006 and couldbe up to 20 per cent annually. Dubai may, therefore, need foreigncompanies to help fund the estimated Dh135.79 billion (US$37billion) required to double generating capacity to 11,100 MW by2011 and quadruple projected capacity to 25,000 MW, by 2017. Asalready mentioned, alternatives such as renewable energies couldalso assist with satisfying runaway demand.DEWA is already investing heavily in conventional powergeneration to expand capacity: Phase III of Aweer Power Station(Station H), costing Dh1.64 billion, is scheduled for completion inmid-April 2008 when its production capacity will be 1800 MW,bringing DEWA’s total production capacity to 7200 MW by thesummer of 2008.DEWA also awarded contracts worth US$1.7 billion in March2007 to South Korea's Doosan Heavy Industries & Construction andItaly's Fisia Italimpianti to build phase one of Jebel Ali M adding1330 MW of power and 70 MIGD water of water to capacity.Doosan also signed a new new US$500 million deal for phase two,bringing its combined orders at Jebel Ali to 2000 MW. Constructionbegan in March 2007 and completion is scheduled for 1 March 2010.In addition, Fisia has been awarded a contract worth US$247 millionfor the M3 plant.Dubai is also planning to build a multi-billion dollar plant thatwould be capable of producing 9000 MW of electricity and 600MIGD of desalinated water. The new complex will be located nextto the Dubai World Central complex and the giant Jebel Ali portand free zone where most of the emirate's power generationcapacity of about 5000 MW is presently situated. In the next threeDubai Electricity andWater Authority(DEWA) currently holdsa monopoly to produceand sell electricity inthe emirate. But Dubaimay open its powergeneration industry toprivate foreigninvestment in an effortto meet demand thatis surging by aminimum of 12 to14 per cent annually.@www.uaeinteract.com/elec_h 2 o

192 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8years, DEWA intends to undertake additional projects to meet theremaining deficit, including the addition of 5000 MW at new sitesat Al Habab power facility.Other avenues being explored to satisfy demand include thepossibility of importing electricity: in April 2007 Dubai and Iransigned a memorandum of understanding (MoU) that could seeIran supply Dubai with electricity via a 180-kilometre (110-mile)underwater cable.SHARJAHSharjah Electricity and Water Authority (SEWA) has earmarkedDh4 billion for the Hamriyah power and water project to assist incatering to the spiralling demand for these utilities due to economicand industrial development in the emirate. In May, SEWAcommissioned the third and fourth units with combined capacityof 200 MW at Hamriyah power station. The new projects increasedpower-generating capacity to 2382 MW during the summer. SEWAalso commenced operations at two new power-generating unitswith combined capacity of 80 MW at Wasit Power Station in August2007, boosting total capacity at the Station to 960 MW.In addition, SEWA announced plans later in 2007 to expand a400 MW power plant to 2580 MW by 2014 to meet demand, whichit claims is surging as much as 9 per cent annually.FEWA is planningto constructadditionaldesalination plantsin the NorthernEmirates in anoverall shift towardsdesalinationdependence.NORTHERN EMIRATESThe fast developing Northern Emirates are also set to see an increasein water supply in the next few years as the Federal Electricity andWater Authority (FEWA), the utility body for Ajman, Ra’s al-Khaimah,Fujairah and Umm al-Qaiwain, is planning to construct majordesalination plants in the region in an overall shift towardsdesalination dependence. These include a 6 MIGD desalinationplant in Ajman, which will cost about Dh80 million.A plant that will produce 10 MIGD, with an additional expansioncapacity of 20 MIGD, is being considered for Ra’s al-Khaimah. Asmaller Dh40 million facility has been set up in Fujairah, giving theemirate access to an additional 3 MIGD.

I N F R A S T R U C T U R E193FEWA will also provide 960 MW of additional power to theNorthern Emirates by the end of 2007, including six gas turbines of100 MW each between October 2007 and April 2008. By 2009 theywill have built two more steam turbines of 180 MW each. The IWPPprojects at Fujairah 1 and 11, managed by Abu Dhabi's ADWEA inassociation with foreign investors, will also significantly increase theavailability of power and water in the Northern Emirates.In addition to FEWA’s input, a 16 million gallon water desalinationplant is being constructed by IMDAD, a joint venture between thegovernment of Umm al-Qaiwain and the Saudi based Al RajhiInvestment Group, in Umm al-Qaiwain. Another tender for the 35MIGD transmission and distribution network was floated at theend of June 2007.CONNECTING GRIDSFEWA is focusing on completing the <strong>UAE</strong>'s Dh840 million (US$228.7million) nationwide power grid by May 2008. The power linkbetween Dubai and Abu Dhabi was completed in May 2006 and theinterconnection with Sharjah was inaugurated at the end of May2007, following the commissioning of a new 400 kilo volt sub-stationin Dhaid. The next phase will be to connect the Dhaid station toFujairah. The grid will provide more stable electricity supply andallow energy exchange among emirates.In addition, the US$1.1 billion first phase of the US$7 billion GulfCooperation Council (GCC) power grid linking the six member statesis expected to be commissioned by the first quarter of 2009. Morethan 30 per cent of the construction in the first phase, which will linkSaudi Arabia to Bahrain, Kuwait and Qatar through 800 kilometresof transmission lines, was completed at the end of June 2007. Thesecond phase will link the <strong>UAE</strong> with Oman, and the resulting twomega grids will be joined in the final phase.Once the grid is ready, Kuwait and Saudi Arabia will each receivean extra 1200 MW of power capacity, the <strong>UAE</strong> will receive 900 MW,Qatar 750 MW, Bahrain 600 MW and Oman 450 MW. The projectis expected to reduce the cost of power generation for each countryand offer a channel for emergency assistance when needed.Electricity and water plant inFujairah.MWTAPCO 1,232AMPC 295ECPC 763GTTPC 1,415SCIPCO 1,577APC 2,444FujairahIWPP 641TOTAL 8,367The new GCC powergrid is expected toreduce the cost ofpower generation formember countries andoffer a channel foremergency assistance.@www.uaeinteract.com/elec_h 2 o

194 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8TELECOMMUNICATIONSTelecommunications across all platforms in the <strong>UAE</strong> are fast andeffective with fixed-line, internet and mobile connectivity amongstthe best in the world. The 2007 Global Information TechnologyReport (GITR), commissioned by the World Economic Forum (WEF)in cooperation with Insead business school, puts the <strong>UAE</strong> at the topof the ‘Net-worked Readiness Index’ in the Middle East and NorthAfrica (MENA) region and ranks the <strong>UAE</strong> in twenty-ninth positionworldwide out of 122 countries, beating many European nations.The <strong>UAE</strong>’s high-ranking is directly related to the growing emphasisthat the country has been placing on the role of ICT fordevelopment in recent years with the launch of a number of ICTinitiatives and the promotion of ICT penetration and usage.TELECOMMUNICATIONS REGULATIONThe Telecommunications Regulatory Authority (TRA), establishedby Federal Decree No. 3 of 2003, is tasked with the challenge ofoperating a regulatory framework to facilitate competition inthe <strong>UAE</strong>’s telecoms market, at the same time enhancing, promotingand ensuring quality of services. The TRA, governed by a Board ofDirectors, answers to the Supreme Committee for the Supervision ofthe Telecommunications Sector (SCTS), which is empowered toestablish and oversee the <strong>UAE</strong> National Telecom Policy.Since its establishment, the TRA has become an active memberof the UN’s International Telecommunication Union (ITU), haschaired its seventh Global Symposium for Regulators hosted byTRA from 5 to 7 February 2007, at Dubai World Trade Centre;and it has become the President of the Arab TelecommunicationsAuthorities Union for the year 2007.Prior to the establishment of the TRA, Etisalat, which was formedin 1976, was the sole telecoms operator in the country. The newregulatory body has already facilitated the launch of du, an integratedtelecommunications provider, into the market. Under the powersconferred on it by federal law, the TRA has now licensed Etisalatand du, and the latter was formally activated on 12 February 2007.Since population growth targets are set to hit 5 million by 2010, thelaunch of a third telecoms provider in the Emirates is inevitable.

I N F R A S T R U C T U R E195ETISALATSince its foundation, Etisalat has been investing in infrastructureproviding fixed-line telephony, fixed and wireless secure internetaccess and mobile coverage to the <strong>UAE</strong>. By late 2007, the corporationhad more than 6.3 million customers on its mobile phone network,1 million active users of 3.5G and 3G data services. 1.3 millionsubscribers to the fixed line network, 800,000 subscribers andover 2.5 million internet users. When du’s 1 million mobilecustomers are included, the telecom sector’s penetration rate is thehighest in the region, and comparable to the highest in the world.The corporation announced strong results for the nine-monthperiod, posting a 30 per cent jump in consolidated revenues to reachDh15.38 billion. Etisalat's net profit for the period stood at Dh5.534billion. Net assets increased in value by 21 per cent in the period,reaching Dh25.828 billion by the end of September. Capitalexpenditure was Dh2,28 billion during this period.Etisalat has also established a significant geographical footprintstretching from West Africa to Pakistan, signing managementcontracts and obtaining significant stakes in telecommunicationsoperators in numerous countries. The Etisalat brand was taken toEgypt in 2007 with Etisalat Misr launched on 1 May 2007 and EtisalatAfghanistan commencing operations later in the year. In September2007 it announced plans for a point of presence in Singapore, itsfirst in east Asia and sixth worldwide.Middle East Magazine ranked Etisalat as the largest company inthe <strong>UAE</strong> and fourth largest in the Middle East based on financialperformance and capital growth, and the Financial Times continuesto place Etisalat in the leading 500 companies in the world. It wasalso ranked as the sixth best performing Arab company by ForbesArabia magazine for 2006 from amongst over 1600 Arab joint stockcompanies in various sectors.Etisalat's latest awards include ‘Customer Service Provider of theYear 2006’ and overall ‘Service Provider of the Year 2006’ in theMiddle East and Africa by Comms MEA magazine. Arabian Businesshas also awarded Etisalat for its contribution to the local communitywith a special award for corporate social responsibility in 2006.Etisalat providesfixed-line telephony,fixed and wirelesssecure internet accessand mobile coverageto the <strong>UAE</strong>. By late2007, the corporationhad more than 6.3million customers onits mobile network.Middle East Magazineranked Etisalat as thelargest companyin the <strong>UAE</strong> and fourthlargest in the MiddleEast based on financialperformance andcapital growth.@www.uaeinteract.com/telecomms

196 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8DUAs already outlined, in the interests of competition a political decisionwas made to open up the telecommunications market. EmiratesIntegrated Telecommunications Company or du was subsequentlyformed with a paid-up capital of US$1.1 billion, offering voice, dataand entertainment on mobile networks and converged broadband,TV, and landline.In January 2006 the takeover of the Tecom telecommunicationscompany that formerly operated Dubai free zone networks, andEmaar's former Sahm Telecom network gave du a good workingbase to develop the company.Prior to an IPO in 2006, 50 per cent of du was owned by the<strong>UAE</strong> Government, and the remaining 50 per cent split equallybetween Abu Dhabi's Mubadala Development Company andEmirates Communications Technology Company. Post-IPO upto 20 per cent of the company can be controlled by foreignindividuals and institutions permitted to purchase du shares on theDubai Financial Market.du has made a significant investment in building infrastructureand operational capabilities as well as recruiting and developingstaff, amassing nearly 250,000 mobile customers in the first sixweeks of the launch of its network in February 2007. At this pointdu covered 80 per cent of the populated areas of the <strong>UAE</strong>, falling alittle short of the 85 per cent required under the telecom licenceissued by the TRA. By late November, du had one million mobilephone subscribers and had strengthened its network coverage acrossthe <strong>UAE</strong>. du also launched its fixed-line network in July, servingDubai, Abu Dhabi and Sharjah only. However, the company nowprovides fixed-line services to the whole of the Emirates.VOIPAt present, Etisalat and du are only permitted to use voice overinternet protocol (VoIP) to provide local calls to their subscribers.Computer-to-computer calls are also allowed, but computer-tophonescalls, or vice versa, will not be considered for introductionin the <strong>UAE</strong> until the TRA has concluded a public consultationprocess in mid-2008. The consultations will involve the <strong>UAE</strong>’s

two current operators, Etisalat and du, as well other companiesinterested in offering the service. There is no time-frame forcompleting the process.THURAYAAbu Dhabi-based Thuraya Satellite Telecommunications Company,a leading provider of cost-effective, satellite-based mobile telephoneservices to nearly one-third of the globe through dual-mode handsetsand satellite payphones, is majority owned by Etisalat.Thuraya-1, the first satellite initiated from the Middle East and theheaviest satellite launched to date, was successfully deployed in2000. A second satellite, Thuraya 2, was launched in 2003 and athird Thuraya 3, costing between Dh551 million to Dh734.62 million(US$150–US$200 million), was launched on 18 November 2007.Thuraya 3 replaces the ageing Thuraya 1, while Thuraya 2 willcontinue providing coverage for the Middle East, Europe, North@www.uaeinteract.com/telecomms

198 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Thuraya has continuedto make strides byexpanding commercialoperations in coremarkets, particularlythe huge untappedAfrican market.Africa and some other markets. Thuraya 3 will bring countries ofthe Asia-Pacific region under Thuraya's footprint and extend itscoverage to nearly two-thirds of the globe's population.Thuraya has continued to make strides by expanding commercialoperations in core markets, particularly the huge untapped Africanregion. Additionally, the company reinforced its distribution networkby signing service provider agreements in countries such asKuwait, Turkey, Egypt, Sri Lanka, Pakistan and the Netherlands,and broadened its delivery channels with several new internationalsatellite service distributors.Starting an aggressive marketing campaign in the Asia–Pacificregion ahead of launching the third satellite, Thuraya Maritime waslaunched in August 2007 and Thuraya IP at the end of 2007. Theformer is a second-generation communications technology package,to be used widely by fishing boats in China and by leisure boatsowned by other subscribers, while the latter is a USB (universal serialbus) connector data terminal with a speed of 444 kbps (kilobit persecond). Thuraya hopes to double its current subscribers of 250,000within a three-year period after the launch of its third satellite.EMIRATES POSTEmirates Postal Corporation (EPC) was formed in 2001 followingrestructuring of the <strong>UAE</strong> General Postal Authority. Since then amajor change in the corporation’s business model and operationalstrategies, including the introduction of integrated IT systems,automated sorting centres and agreements with internationalpostal authorities, as well as the addition of new business streamsin logistics, financial services, direct marketing, mail fulfilmentand other areas, has resulted in a remarkable turnaround in thecompanies fortunes.Emirates Post recorded a net profit of Dh161 million (US$43.87million) for the year 2006, an increase of 19 per cent over theprevious year. During this period, the postal network expandedby 4 per cent to 83 branches. Overall, mail rose by 16 per cent,and the parcel segment increased by 15 per cent. The number of

I N F R A S T R U C T U R E199total services went up to 52, an increase of 18 per cent. There wasalso a significant increase in the number of government servicesprovided at post offices. For example, Ministry of Labour transactionsrose by 108 per cent and remittances rose by 95 per cent.Emirates Post subsidiaries include Empost, the <strong>UAE</strong>’s nationalcourier company, the Electronic Documentation Centre, EmiratesMarketing and Promotions, and the Wall Street Exchange Centre.During 2007, Emirates Post entered a new phase of diversificationthat will see Dh1 billion being spent on a major expansion plan andthe company entering new areas of activity, including air freighterservices, a Middle East trucking service to complement its otherground delivery operations, and money management solutions.Emirates Post currently provides remittance services through itsWall Street Exchange Centre, but is poised to emerge as a majorplayer in the US$40 billion remittances market as it plans to openmultiple offices in Asia and Europe.Empost announced the launch of its cargo and logistics servicein February 2007. Al Ain International Airport has been selected asthe main hub for the international courier and cargo business. Plansare to acquire 50 aircraft by 2012 in order to expand the service.The scheduled freighter operations, which will be implementedin four phases, will network with major cities in the Indiansubcontinent, Middle East and Europe by the end of 2008.The government service is in the process of forming a parentcompany called Emirates Post Group to oversee its rapidly expandingfamily of subsidiaries. Also in the pipeline is an IPO proposal that willbe open to all investors, including expatriates. The IPO's publicgovernmentratio is yet to be decided.During 2007, EmiratesPost entered a newphase of diversificationthat will see Dh1 billionbeing spent on a majorexpansion plan.AIRPORTSThe region’s airports are undergoing a massive capacity expansiondrive with the ten leading Middle East airports investing US$23.5billion (Dh86.2 billion) in new airport capacity by 2012, providingspace for 318 million passengers per year, up 292 per cent oncurrent levels, and taking total annual airport capacity to 339 million.@www.uaeinteract.com/post

Dh75.3 billion(US$20.5 billion) isbeing spent to developand expand sevenairports in the <strong>UAE</strong>. Theprojects include Dh26billion (US$7.08 billion)on Abu DhabiInternational Airport.New airport projects in the <strong>UAE</strong> account for 60 per cent ofall airport investment in the Gulf. This is hardly surprising:geographically, the country’s reach is considerable, sweepingthrough Africa and the Middle East and linking these regions toEurope, Asia, Australia and the Americas.Over Dh77.5 billion (US$28.4 billion) is being spent to developseven airports in the <strong>UAE</strong>. The projects include Dh26 billion(US$7.08 billion) on Abu Dhabi International Airport; Dh16.5 billion(US$4.5 billion) on Dubai International Airport; Dh36.7 billion(US$10 billion) for the development of Al Maktoum InternationalAirport) at Jebel Ali, part of the Dh121.1billion (US$33 billion) DubaiWorld Central complex; Dh227.64 million (US$62 million) on SharjahAirport; Dh2.9 billion (US$800 million) on Ajman InternationalAirport; Dh183.6 million (US$50 million) on Fujairah Airport; andDh1 billion (US$272 million) on Ra’s al-Khaimah Airport.ABU DHABIAbu Dhabi Airports Company (ADAC) assumed management andcontrol of Abu Dhabi International Airport (ADIA) and Al AinInternational Airport (AIA) as of 28 September 2006. ADAC is apublic joint-stock company wholly owned by the Abu Dhabi

I N F R A S T R U C T U R E201government that was incorporated by Emiri Decree No. 5 of 4March 2006 to spearhead the development of the emirate's aviationinfrastructure. Its creation was part of the government’s ambitiousrestructuring initiative aimed at delivering better services to supportthe emirate's long-term economic and tourism strategies and to helpbuild a more vibrant economy that attracts and promotes privatesector investment. ADAC subsequently appointed internationalairport investor and manager, Changi Airports International (CAI),to manage operations at ADIA for a period of 18 months followingan agreement signed in December 2006.Abu Dhabi’s rising popularity as a business centre, touristdestination and aviation hub has meant that passenger volumeshave been increasing steadily at the airport, especially since thelaunch of the Abu Dhabi-based national airline, Etihad Airways.ADIA registered a 25 per cent growth in passenger traffic in thefirst quarter of 2007 over the same period in 2006. Passengershandled by the airport in that time numbered 1.575 million,compared to 1.255 million in the first quarter of 2006. Abu DhabiDuty Free’s (ADDF) sales results for the first half of 2007 were33.26 per cent up on the same period in 2006. Underlining ADDF'sposition as the region's leading duty-free operation by averagespend, departing passengers increased their expenditure by 10.5per cent, spending an average of US$51 per passenger over thesame period. With new retail services coming on-stream, ADDFexpects to cross the Dh370 million (US$100 million) mark in termsof turnover by the end of the year. ADDF ranks second in theMiddle East and thirty-fourth worldwide by turnover.To cope with increased throughput, Dh26 billion (US$7.08 billion)is being invested in the re- development of the airport, which wasoriginally designed to handle 3.5 million passengers annually. Aninterim solution to the capacity dilemma was to build a newterminal (Terminal 2), adapt the original building to accommodateanother terminal (Terminal 1A), and overhaul all facilities, therebyincreasing passenger handling capacity to 6.8 million. This wasachieved in a record six months with Terminal IA and Terminal 2both in operation since September 2005. The interim terminalsADIA registered a25 per cent growth inpassenger traffic in thefirst quarter of 2007over the same periodin 2006. Passengershandled by the airportin that time numbered1.575 million.@www.uaeinteract.com/airports

202 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8ADIA was deemed tobe the best airport inAfrica and the MiddleEast, based on theresults of the AirportsCouncil International’sannual survey intopassenger satisfaction.have greatly contributed to improving passenger flow, especiallyat times of high-density flights.ADAC is now constructing a third terminal facility for EtihadAirways with eight gates capable of handling the new generation ofwide-bodied aircraft, two of them being Airbus A380 compatible.Plans also include a second runway 2 kilometres to the north of theexisting one. This is a category 3 all-weather runway measuring4100 metres in length, which will be capable of handling the newAirbus A380 double-decker aircraft. A new air traffic control towerwill be able to process up to 70 takeoffs and landings per hour.Scheduled for completion by April 2008, the new terminal willmeet Etihad's needs until a huge Midfield Terminal Complex(MTC) becomes operational at the end of 2010. Groundbreakingwork has already commenced on this new x-shaped facility, whichwill boost the airport's overall capacity to around 20 millionpassengers a year with room for further phased expansion to 40million. The project also includes new cargo facilities, an airportfree-trade zone, and retail and maintenance facilities.Phase one of the airport free zone – set to occupy 7 million squaremetres – will be up and running in June 2008. The ambitious projectwill offer investors a range of centralised facilities and services andis a logical choice to capitalise on ADIA’s strategic geographicalposition, and to accommodate the large-scale economic developmentthat is taking place in the emirate.Expansion and redevelopment of the existing cargo facilitieswill also be completed by mid-2008 and work on new cargofacilities will have begun. More than 50 hectares have beenreserved for building three new cargo terminals, two for EtihadAirways, and one for the use of other airlines, with an ultimatecombined capacity of around 2.5 million tonnes per year, up from150,000 tonnes per year at present.ADIA was deemed to be the best airport in Africa and the MiddleEast, based on the results of the Airports Council International’sannual survey into passenger satisfaction. It was also recognised asthe best airport in Africa and the Middle East in terms of courtesyand customer service.

I N F R A S T R U C T U R E203Al Ain International Airport, which serves Abu Dhabi’s EasternRegion, is not only a vibrant international airport with full facilitiesand an ideal base for low-cost and low-fare carriers, it is also a soughtaftercargo hub facility. Early in 2007, the Emirates Corporation forCommercial Postal Services (Empost) chose the airport as the homebase for their international air cargo operations.DUBAIDubai International Airport (DIA) has grown from a regional airportinto a major international aviation hub, experiencing a rapid increasein the number of passenger, freight and aircraft movements overthe past decade. From 1997 to 2006, passenger throughput roseby 316 per cent and in 2006 the airport handled 28.7 millionpassengers, with 31.7 million expected in 2007, and up to 60 millionpassengers, including 15 million tourists, expected by 2010. DubaiDuty Free's (DDF) sales in the first half of 2007 climbed 27 per centto Dh 1.5 billion (US$411 million) as the rise in air travellers helpedpush retail sales higher.Growing at an average of over 15 per cent per year since 2002,DIA has jumped from thirtieth position on the list of the world'sbusiest airports five years ago to among the top ten in 2007. To copewith this rapid growth, DIA is undergoing a massive Dh16.5 billion(US$4.5 billion) expansion. This includes the construction of a thirdterminal, two additional concourses, a second runway and a hugecargo terminal.Terminal 3, a multi-level underground structure and Concourse 2,which will be directly connected to Terminal 3, will be open forbusiness in the summer of 2008. Concourse 2 is dedicatedexclusively to Emirates and features five special aerobridgescapable of handling the forthcoming Airbus A380 super jumbos.Work has also begun on lengthening the airport’s second runway,and on Concourse 3, a scaled down version of Concourse 2, whichhas been added to the plans to accommodate additional A380s.Concourse 3 is scheduled to open in 2009.The expansion project also involves the construction of a hugecargo terminal with 1.4 million tonnes annual capacity, taking theDubai InternationalAirport handled 28.7million passengersin 2006, with 31.7million expectedin 2007.@www.uaeinteract.com/airports

204 U N I T E D A R A B E M I R AT E S Y E A R B O O K 2 0 0 8Dubai's new AlMaktoum InternationalAirport will initiallyaccommodate up to 7million passengers peryear, but will have thecapacity to extendto 120 million.Dubai World Centralwill comprise sixspecialised clusteredzones: Al MaktoumInternational Airport,Dubai Logistics City,DWC Commercial City,DWC Residential City,Dubai Aviation City andDWC Golf City.total annual capacity of Dubai Cargo Village (DCV) to 2.8 milliontonnes. The new facility became operational at the end of 2007.With over 10 per cent growth and 1.7 million tonnes of cargoprocessed, DCV is currently ranked eleventh worldwide in termsof cargo movement, and is the busiest in the region. The constantlyrising volume of cargo tonnage and the corresponding developmentof infrastructure at DCV also earned DIA the ‘Airport of the YearAward’ at the Air Cargo Week’s World Cargo Awards in 2007.Even more impressive are Dubai’s plans to construct a massiveDh121 billion (US$33 billion) aviation city at Jebel Ali with Dh36.7billion (US$10 billion) earmarked for a huge passenger and cargohub at the Dubai World Central comples. Phase one of the project isscheduled for completion in the third quarter of 2008 and the AlMaktoum International Airport will initially accommodate up to 7million passengers per year, but will have the capacity to expandto 120 million when completed. Work began early in 2007, with thefirst runways finished in October 2007 and the runway aprons dueto be completed in February 2008. Construction has also begunon the airport's headquarters, passenger terminal, control tower,and executive terminal. The airport will be linked to the existingDubai International via the light-rail metro and a dedicated roadnetwork. When completed, the complex will cover 140 squarekilometres, making it the largest airport facility in the world.The intention is to establish a supply chain community withinDubai World Central that will be capable of handling 12 milliontonnes of cargo each year. In pursuit of this aim, Dubai LogisticsCity (DLC) commenced construction of the first of 16 cargoterminals at the airport in 2007. When completed, the newDh2.77 billion (US$75.7 million), 41,000 square-metre cargoterminal with an annual handling capacity of 600,000 tonnes willhave direct interface with aircraft stands and aprons and will beadjacent to an A380-enabled runway.The airport will also house the Executive Jet Centre, which willfunction as a one-stop hub for business jet operations. Designed toinitially handle in excess of 100,000 aircraft movements a year, theEJC is due for completion in 2008.