Guidelines/Instructions for filling up of 8 Database Formats

Guidelines/Instructions for filling up of 8 Database Formats

Guidelines/Instructions for filling up of 8 Database Formats

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Page 1 <strong>of</strong> 9

GENERALThese <strong>for</strong>mats have been produced & derived from the <strong>for</strong>mats prescribed by C&AG.All <strong>for</strong>mats to be filled in <strong>for</strong> FY 2011- 2012 Financial In<strong>for</strong>mation only.Name & Code <strong>of</strong> the PRIs (ZP/ BP/GP) have already been pre- populated based on the in<strong>for</strong>mationderived from the NPD. In case <strong>of</strong> incorrect/ missing in<strong>for</strong>mation, please add a new row at the end <strong>of</strong>the table (be<strong>for</strong>e total row) and input the required in<strong>for</strong>mation. In no case whatsoever, delete anyrow or column from any <strong>for</strong>mats.Instruction are applicable <strong>for</strong> 3 tiers <strong>of</strong> PRIs (ZP/BP/GP) i.e. Zila Parishad/Panchayat Samiti/GramPanchayatTax Receipt: PRIs income due to taxation e.g. House Tax(MH 0035), Land Revenue(MH 0029), LiquorCess(MH 0045) etc.Non-Tax Receipt: Revenue not generated from tax e.g. Tower Fee (MH 0515) , rent from building(MH0515), Income from royalty(MH 0515), interest received(MH 0049), fee and fine(MH 0515) etc.Central Government Grant: Grant received from Government <strong>of</strong> India (Direct or through LineDepartment, PRIs)i.e MGNREGA, Indira Awas Yojna, 13 th Finance Commission, Total SanitationCampaign etc.State Government Grant: Grant received from State Government (Direct or through LineDepartment, PRIs)i.e 3 rd State Finance Commission, Vidhayak Kshetra Vikas Nidhi Yojna , Atal AwasYojna etc.Revenue Expenditure: Revenue Expenditure is that expenditure which is generally used <strong>for</strong> day to daysmall expenses i.e purchase <strong>of</strong> small items & maintenance, Repairs etc.Capital Expenditure: is an amount spent to acquire or improve a long term asset or is a money spentby a business as items that are going to be used more than on time i.e. machine , building etc.Page 2 <strong>of</strong> 9

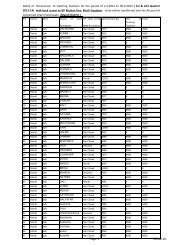

1. Format 1- Consolidated Financial PositionColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3 Area in Sq. Km Area (Square Kilometer)<strong>of</strong> the PRI (ZP/ BP/ GP) needs to bepopulated4 Population Population details <strong>for</strong> the PRI (ZP/ BP/GP) available from 2001Census needs to be used5 Opening Balance Available funds (as closing balance <strong>of</strong> FY 2010-11 on 31 st . March,2011 <strong>for</strong> all the Centre Schemes, State Schemes, Own Resourceetc.) with the PRIs (ZP/ BP/GP) need to be quoted in this section.6 Target Receipts As the Accounting system is cashed based, furnishing <strong>of</strong>in<strong>for</strong>mation in this section is optional.7 Actual Receipts Sum total <strong>of</strong> all funds (i.e. Central Grants, State Grants & OwnResource) received by the PRIs (ZP/BP/GP) <strong>for</strong> FY 2011- 2012 (<strong>up</strong>to 31 st March, 2012) required to be filled here.8 Total Expenditure Sum total <strong>of</strong> all expenditure (i.e. from Central Grants, State Grants& Own Resource)done by the PRIs (ZP/ BP/ GP) <strong>for</strong> FY 2011- 2012(i.e. <strong>up</strong> to 31 st March, 2012) required to be filled here.9 Balance No manual entry required, Account balance <strong>for</strong> the PRI (ZP/BP/GP)would be automatically calculated based on the values inputted inColumns 5,7,8 (as above)10 Cash In HandBreak<strong>up</strong> <strong>of</strong> the Balance (Column 9 as on 31 st March 2012).11 Banki.e. Cash in hand/Bank/Treasury/Personal Ledger Account/Post12 TreasuryOffice as on 31 st March, 201213 PLA14 POPage 3 <strong>of</strong> 9

2. Format 2- Summary <strong>of</strong> Receipts & ExpenditureColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3 Tax Receipts** PRI (ZP/BP/GP) earnings from Tax Sources (Land Revenue, HouseTax, Liquor Cess , Stamp duty etc.) <strong>for</strong> FY 2011- 2012. For details<strong>of</strong> heads refer <strong>for</strong>mat 34 Non Tax Receipts** PRI (ZP/BP/GP) earnings from Non- Tax sources (interest receipts,Rent Receipt etc.) <strong>for</strong> FY 2011- 2012. For details <strong>of</strong> heads refer<strong>for</strong>mat 4.5 Central GovernmentGrants**Sum total <strong>of</strong> all grants received from the Central Government <strong>for</strong>FY 2011- 20126 State GovernmentGrants**Sum total <strong>of</strong> all grants received from the State Government <strong>for</strong> FY2011- 20127 Grants from OtherInstitutionsSum total <strong>of</strong> all grants received from any other institutions <strong>for</strong> FY2011- 20128 Total Receipts (3+4+5+6+7) No manual entry required, Total receipts <strong>for</strong> the PRI (ZP/BP/GP)would be automatically calculated based on the values inputtedin Columns 3,4,5,6,7 (as above)9 Total Revenue Expenditure Expenditure undertaken <strong>for</strong> maintenance <strong>of</strong> assets and/ or otherfunctions <strong>of</strong> Panchayat in FY 2011- 2012.10 Total Capital Expenditure Expenditure undertaken <strong>for</strong> creation <strong>of</strong> long term assets in FY2011- 2012.11 Total Expenditure (9+10) No manual entry required, Total receipts <strong>for</strong> the PRI (ZP/BP/GP)would be automatically calculated based on the values inputtedin Columns 9 & 10 (as above)** Note:-Tax Receipt: PRIs income due to taxation e.g. House Tax(MH 0035), Land Revenue(MH 0029), LiquorCess(MH 0045) etc.Non-Tax Receipt: Revenue not generated from tax e.g. Tower Fee (MH 0515) , rent from building(MH0515), Income from royalty(MH 0515), interest received(MH 0049), fee and fine(MH 0515) etc.Central Government Grant: Grant received from Government <strong>of</strong> India (Direct or through LineDepartment, PRIs)i.e MGNREGA, Indira Awas Yojna, 13 th Finance Commission, Total SanitationCampaign etc.State Government Grant: Grant received from State Government (Direct or through Line Department,PRIs)i.e 3 rd State Finance Commission, Vidhayak Kshetra Vikas Nidhi Yojna , Atal Awas Yojna etc.Revenue Expenditure: Revenue Expenditure is that expenditure which is generally used <strong>for</strong> day to daysmall expenses i.e purchase <strong>of</strong> small items & maintenance, Repairs etc.Capital Expenditure: is an amount spent to acquire or improve a long term asset or is money spent bya business as items that are going to be used more than on time i.e. machine, building etc.Page 4 <strong>of</strong> 9

3. Format 3- Pr<strong>of</strong>ile <strong>of</strong> Income from Tax Receipts (Own Source)Amounts quoted in this <strong>for</strong>mat should match and be equal to the Tax Receipts (Column 3) <strong>of</strong><strong>for</strong>mat 2ColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3, 4 Taxes on Pr<strong>of</strong>ession,Trades etc.5, 6 Land Revenue7, 8 Stamps & RegistrationFees9, 10 Taxes on Property otherthan agriculture Land11, 12 Taxes on Vehicles 13, 14 Taxes on Goods &Passengers15, 16 Service Tax17, 18 Taxes on Duties &Commodities19, 20 Other Tax Receipts21, 22,23,24Total Income from Tax-Receipts (Own Source)In Column No.3 to 20, Collection means actual collectionsHouse Tax(MH 0035), Land Revenue(MH 0029), LiquorCess(MH 0045) etc. (excluding figures under Minor Head '901-Share <strong>of</strong> net proceeds assigned to Panchayats' since theassignment by state government cannot be treated as ownreceipts <strong>of</strong> Panchayats. The assigned revenue will be shown inFormat no. 5 column no.5)In Column No.19&20, Tax Receipts, if any, other than thosecaptured in other columns are to be given.Target <strong>of</strong> Income means Demand+ arrearsFurnishing <strong>of</strong> in<strong>for</strong>mation about ‘target’ under each column isnot mandatory. Column 21 to be sum total <strong>of</strong> columns 3, 5, 7, 9, 11, 13, 15, 17& 19.Furnishing <strong>of</strong> in<strong>for</strong>mation about ‘target’ column is notmandatory. Column 22 to be sum total <strong>of</strong> columns 4,6,8,10,12,14,16,18 &20. Column 23 would be auto populated deriving the requisitein<strong>for</strong>mation from column 21 & 22. Column 24 would be the difference between target amount(column 21) & Collection (column 22). Amount quoted in column 22 should match and be equal tothe Tax Receipts (Column 3) <strong>of</strong> <strong>for</strong>mat 2Page 5 <strong>of</strong> 9

4. Format 4- Pr<strong>of</strong>ile <strong>of</strong> income from non-tax receipts (own sources)Amounts quoted in this <strong>for</strong>mat should match and be equal to the Non Tax Receipts (Column 4) <strong>of</strong><strong>for</strong>mat 2ColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.22 PRI Level & Number Leave blank3, 4 Interest Receipt In Column No.3 to 18, Collection means actual collections5, 6 Rent Receipts(Maintenance <strong>of</strong>Community Assets +Tower Fee (MH 0515), rent from building (MH 0515), Incomefrom royalty (MH 0515), interest received (MH 0049), fee andfine (MH 0515) etc.Market & Fairs) Figures under “others” would be sum total <strong>of</strong> MH- 02027, 8 Contribution & RecoveriesTowards (Pension andother Retirement Benefits)(Education) +0210(Health & Family Welfare ) +0216 (RuralHousing)+0403 (Animal Husbandry, Dairying, Poultry and Fueland Fodder ) +0405 (Fisheries ) +0406 (Forestry ) +04359, 10 User Charges ( WaterS<strong>up</strong>ply & Sanitation)(Agriculture including Agriculture Extension ) +0702 (MinorIrrigation ) +0801 (Rural Electrification ) +0810 (Non-11, 12 Royalty on minor minerals Conventional Sources <strong>of</strong> Energy ) +0851 (Village and Small13, 14 Fée etc. (Panchayati Raj Scale industries ) + 0075 ( Other Misc. Receipts).Programmes) Target <strong>of</strong> Income means Demand+ arrears15, 16 Others Furnishing <strong>of</strong> in<strong>for</strong>mation about ‘target’ under each column is17, 18 Capital Receiptsnot mandatory.19, 20,21,223Total Income from Non-Tax Receipts(Own Source) Column 19 to be sum total <strong>of</strong> columns 3, 5, 7, 9, 11, 13, 15 &17. Furnishing <strong>of</strong> in<strong>for</strong>mation about ‘target’ column is notmandatory. Column 20 to be sum total <strong>of</strong> columns 4, 6, 8, 10, 12, 14, 16,18. Column 21 would be auto populated deriving the requisitein<strong>for</strong>mation from column 19 & 20. Column 223 would be the difference between target amount(column 19) & Collection (column 20). Amount quoted in column 20 should match and be equal tothe Non Tax Receipts (Column 4) <strong>of</strong> <strong>for</strong>mat 2Page 6 <strong>of</strong> 9

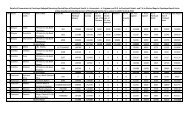

5. Format 5- Total ReceiptsColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3 Own Tax Receipt Should match column 22 <strong>for</strong>mat 3 i.e. figures to be taken from<strong>for</strong>mat-3, Column 224 Own Non Tax Receipt Should match column 20 <strong>for</strong>mat 4 i.e. figures to be taken from<strong>for</strong>mat-4, Column 205 Assigned Taxes figures to be taken from Receipts and Payments Accounts (minorHead '901- Share <strong>of</strong> net proceeds assigned to Panchayats' under allReceipts).Any tax imposed by the Panchayat under the provisions <strong>of</strong> thevarious acts. Such as Liquor Cess(MH 0045)6 Share in State Taxes There is no provision <strong>for</strong> sharing <strong>of</strong> tax with state7 General Purpose Grants All Grants except SFCother than SFC8 Special Purpose Grants Any Grant <strong>for</strong> special activities which is provided by the StateGovt.9 State Finance Commission Grants received under 3 rd State Finance CommissionGrants10 Transfers under Agency Fund transferred to the Panchayat <strong>for</strong> Agency Functions by StateFunctions11 Total State Govt. Transfers Total Amount column 5 to 1012 General Purpose Grants All Grants except CFCother than CFC13 Special Purpose Grants Any Grant <strong>for</strong> special activities which is provided by the CentreGovt.14 Central FinanceGrants received under 13 th Finance CommissionCommission Grants15 Agency Functions Fund transferred to the Panchayat <strong>for</strong> Agency Functions by Centre16 Total Central Govt. Total Amount column 12 to 15Transfers17 Transfer from Otherinstitutions In Column No. 17 , figures are to be taken from MH 1601-103<strong>of</strong> Receipts and Payments Accounts18 Capital A/c Receipts Capital A/C Receipt MH -400019 Total Receipts(3+4+11+16+17+18) Column would be auto populated deriving the requisitein<strong>for</strong>mation from columns 3, 4, 11, 16, 17 & 18.Note: SFC : State Finance Commission i.e 3 rd State Finance CommissionCFC: Central Finance Commission i.e. 12 th & 13 th Finance CommissionPage 7 <strong>of</strong> 9

6. Format 6- Details <strong>of</strong> ExpenditureColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3 Water S<strong>up</strong>ply & Sanitation Total revenue expenditure (from Centre Schemes, State4 Street LightingSchemes &/ or Own Resources)should be noted against these5 Total Core Functions (3+4) heads Column 5 would be auto populated deriving the requisitein<strong>for</strong>mation from columns 3 & 4.6 Administration Total revenue expenditure (from Centre Schemes, State7 Interest PaymentsSchemes &/ or Own Resources) should be noted against these8 Maintenance <strong>of</strong>headsCommunity Assets Column 11 would be auto populated deriving the requisite9 Pension and otherretirement benefitsin<strong>for</strong>mation from columns 6, 7, 8, 9&10.10 Other Revenueexpenditure11 Total Non-Core Functions(6+7+8+9+10)121314Water S<strong>up</strong>ply & SanitationStreet LightingOther capital Expenditure Total capital expenditure (from Centre Schemes, StateSchemes &/ or Own Resources) should be noted against theseheads15 Expenditure underSchemes Assigned by stateGovt.16 Expenditure underSchemes Assigned bycentral Govt.17 Total Expenditure(5+11+12+13+14)The expenditures booked under columns3,4,6,7,8,9,10,12,13,& 14 would be required to be splitbetween Expenditure incurred by State Govt. (i.e. StateSchemes & Own Resources) & Central Government (CentralSchemes) Sum total <strong>of</strong> all expenditures (Column 5, 11, 12, 13, 14)Page 8 <strong>of</strong> 9

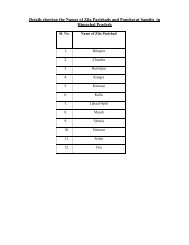

7. Format 7- Physical progress <strong>of</strong> funds allocated by Central Finance Commission CFC)/State FinanceCommission (SFC)ColumnFieldDescriptionNo.1 Code Number <strong>of</strong> ZP/BP/GP Already derived and populated from the NPD data.2 Name <strong>of</strong> ZP/ BP/ GP Already derived and populated from the NPD data.3 Funds received under CFC Total funds received under 13 th FC <strong>for</strong> FY 2011- 20124 Funds received under SFC Total funds received under 3 rd SFC <strong>for</strong> FY 2011- 20125 Total Funds received under Sum total <strong>of</strong> funds listed in column 3 & 4CFC/ SFC6 Not in used.7 Panchayat Buildings Expenditure details (from 13 th FC funds)<strong>for</strong> Asset classes as8 Other Buildingslisted in column 7- 109 Roads/Bridges Column 11 would be auto populated deriving the requisite10 Othersin<strong>for</strong>mation from columns 7, 8, 9 & 10.11 Total Assets created12 Staff/Manpower Expenditure details (from 13 th FC funds) <strong>for</strong> O&M as listed incolumn 12- 19 Column 20 would be auto populated deriving the requisitein<strong>for</strong>mation from columns 12, 13, 14, 15, 16, 17, 18& 19.13 Water S<strong>up</strong>ply14 Sanitation15 Street Lighting16 ICT/e-Panchayat/egovernance17 Data-base18 Repairs and Maintenance19 Others20 Total O&M21 Grand total Column 20 would be auto populated deriving the requisitein<strong>for</strong>mation from columns 11&20.22 Panchayat Buildings Expenditure details (from 3rdSFC funds) <strong>for</strong> Asset classes as23 Other Buildingslisted in column 22- 2524 Roads/Bridges Column 26 would be auto populated deriving the requisite25 Othersin<strong>for</strong>mation from columns 22, 23, 24&25.26 Total Assets created27 Staff/Manpower Expenditure details (from 3 rd SFC funds) <strong>for</strong> O&M as listed in28 Water S<strong>up</strong>ply29 Sanitation30 Street Lighting31 ICT/e-Panchayat/egovernance32 Data-base33 Repairs and Maintenance34 Others35 Total O&Mcolumn 27- 34Column 35 would be auto populated deriving the requisitein<strong>for</strong>mation from columns 27, 28, 29, 30, 31, 32, 33&34.36 Grand total Column 36 would be auto populated deriving the requisitein<strong>for</strong>mation from columns 26&35.Page 9 <strong>of</strong> 9