How Is The Net Asset Value (NAV) - ICICI Prudential Life Insurance

How Is The Net Asset Value (NAV) - ICICI Prudential Life Insurance

How Is The Net Asset Value (NAV) - ICICI Prudential Life Insurance

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Life</strong> Time Pension llRetire from work, not life

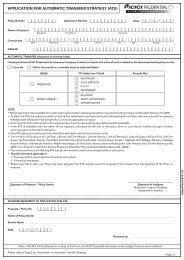

<strong>ICICI</strong> <strong>Prudential</strong> <strong>Life</strong> <strong>Insurance</strong>-Covering you at every step in life.pension plan that ensures safety, risk cover,income security and regular returns for yourRider: This is an additional benefit available ata nominal amount that you pay over and abovepost-retirement years. That’s why, we now the premium amount, to cover you against<strong>ICICI</strong> <strong>Prudential</strong>, India's No. 1 Private <strong>Life</strong>present <strong>Life</strong>Time Pension II. This regular other unfortunate circumstances during the<strong>Insurance</strong> Company is a joint venture premium, unit-linked pension plan offers you tenure of the policy and give your nominee anbetween <strong>ICICI</strong> Bank - a premier financialthe flexibility to invest in various investment additional sum of money, in the event of thatpowerhouse and <strong>Prudential</strong> Plc. a leadingfunds, to help you generate potentially higher circumstance occurring.international financial services group,headquartered in the United Kingdom. <strong>ICICI</strong>returns. <strong>The</strong> accumulated value of your policyAdvantages of <strong>Life</strong>Time Pension II<strong>Prudential</strong> was amongst the first private will be used to purchase an annuity, to provideyou with a regular income for life.at-a-glancesector life insurance companies to beginoperations in India. Choose from four investment funds toTerms you need to knowinvest your money, based on your risk<strong>ICICI</strong> <strong>Prudential</strong> constantly strives toPremium: <strong>The</strong> money one has to pay towards profile. You can switch between the fundsunderstand your needs and provide you withthe pension plan in order to subscribe to thesolutions that meet your every financial need:(4 free switches in a year) to takeplan and to enjoy the benefits under the plan.protection to your family, buying an asset,advantage of market movements.securing your child’s education, or planning Accumulation (deferment) period: This is a Regular premium payment and attractiveyour retirement. That’s why at <strong>ICICI</strong> period when you pay premiums every year to premium allocations for accumulation of<strong>Prudential</strong>, we have a range of retirement accumulate funds for your retirement.your retirement kitty.plans that are designed to ensure aVesting Age: <strong>The</strong> age at which you decide Top-up facility to invest additional fundscomfortable lifestyle for you, even when youto start receiving your pension is calledstop earning regularly.for increasing your retirement savings.vesting age. Protection to your family, with the choiceRetire from work, not life.Annuity: It is a regular pension payable to you of optional life insurance cover.When it comes to retirement, you think after the vesting age. Facility to take up to one-third of theyou will manage just fine. Are you making Sum Assured: This is the amount of moneyaccumulated value as a lump sumenough investments and savings towards that your nominee receives as a benefitpayment, at the time of retirement. Thisthat end? Ordinary savings can get frittered payment, in the unfortunate circumstance ofcan help to take care of your immediateaway due to unforseen expenses. Besides, your death during the accumulation period.financial requirements.even when you retire, you would still like tocontinue doing the things you have alwaysPension Investment Fund: <strong>The</strong> premium net 5 flexible options to receive yourenjoyed such as eating out, taking a holiday,of all charges is invested in a pensionretirement benefits.buying gifts for loved ones, pursuing your investment fund. <strong>The</strong> value of your investmentin such a fund is based on the value of units in Additional protection against accidenthobby, taking your grandchildren on outings,etc. After all, you would like to retire from the fund, which in turn is based on the <strong>Net</strong> and disability is available along with thework, not life.<strong>Asset</strong> <strong>Value</strong>, calculated on a daily basis.benefit of waiver of premium during theAccumulation Phase, with the help ofriders at a marginal extra cost.Presenting <strong>Life</strong>Time Pension II from<strong>ICICI</strong> <strong>Prudential</strong> : flexibility to investand enrich your futureSince it is so critical to plan adequatelyand wisely for future finances, you need aSurrender: Opting to end the policy before thedate of vesting is called surrendering the policy.Top-up: You can decide to increase yourinvestment by investing surplus money overand above your annual regular premiums, atyour convenience.Applicable tax benefits on premiumpaid and rider deduction, fortax- effective accumulation.

<strong>How</strong> does <strong>Life</strong>Time Pension II work ?What are the benefits during theAccumulation Phase?Choose your protection level<strong>Life</strong> Cover BenefitDecide on your retirement dateInvest in a pension fund based on your prioritiesThis pension plan works in two phases:Choose a vesting date when you are 45 You decide how you would like youryears old. <strong>How</strong>ever, you have the option of investments to grow. We offer you a choice of 41 <strong>The</strong> first phase is the Accumulation Phase postponing this vesting date till the age of 75 pension investment funds.when you pay regular premium into the years. This enables you to take advantage ofpolicy and accumulate savings for Pension Maximiser II (Growth) : If highmarket-related movements. During theyour retirement.growth is your main objective, this is thepostponement period, you can make top-upright choice for you. Enjoy long-term2 <strong>The</strong> second phase is the Annuity (Pension)premiums. <strong>The</strong> postponement should becapital appreciation from a portfolio that isPhase when you start receiving pensionintimated 6 months before the originalinvested primarily in equity and equityvestingdate.from the accumulated amount via yourrelated securities.chosen annuity option.Increase your investments Pension Protector II (Income): If youDuring the Accumulation Phase, you enjoy Use your surplus funds to top-up yourprefer steady returns, opt for the Pensionthe freedom to choose the amount of premium investment during the deferment period. <strong>The</strong>Protector II fund. Accumulate a steadyand invest it in market-linked funds to generateminimum top-up amount is Rs.5,000.potentially higher returns. On the retirementdate, the accumulated value of the unitswill be used to purchase an annuity (pension)at the then prevailing annuity rates, which willprovide you with an income, post-retirement.You have two options of Sum Assuredat inception :Opt for a Zero Sum Assured and make it apure accumulation product.Opt for a Sum Assured which will beequal to the product of your annualpremium and term.In case of death before retirement, higherof the Sum Assured or the value of the units willbe the death benefit.<strong>How</strong>ever, no change in the Sum Assuredwill be allowed, once chosen, at the time ofinception of the policy.

Choose between FIVE different ways of What are the entry conditions? What are the charges?receiving your annuity You should be between 18 and 65 years of a) Premium Allocation: <strong>The</strong> allocation ofOn vesting, you have the flexibility to age, if you have chosen the Zero Death the premium will depend on the annualchoose from five diffferent annuity options: Benefit option. Otherwise, you have to be premium paid. <strong>The</strong> allocations will be <strong>Life</strong> Annuity: Annuity for life.between 18 and 60 years of age.as follows:<strong>The</strong> minimum annual premium is<strong>Life</strong> Annuity with Return of PurchaseAllocation Year Year Year <strong>The</strong>reafterRs. 10,000; half-yearly premium isPrice: <strong>Life</strong> Annuity for annuitant with the(Rs.) 1 2 3 -10Rs. 5,000; and monthly premium is Rs. 834.return of purchase price to the beneficiary.10,000 - <strong>Life</strong> Annuity Guaranteed for 5/10/15 Minimum term is 10 years. 49,999 78% 85% 99% 100%Years: Guaranteed Annuity is paid for the50,000 andchosen term (5/10/15 years) and afterabove 83% 88% 99% 100%that, the annuity continues as long as theannuitant is alive.Joint <strong>Life</strong>, Last Survivor with Return ofPurchase Price: <strong>The</strong> annuity is first paidto the annuitant. After the death of theannuitant, the spouse receives a pensionwhich is an amount that is equal to theannuity paid to the annuitant. After thedeath of the last survivor, the purchaseprice is returned to the beneficiary.Joint <strong>Life</strong>, Last Survivor without Returnof Purchase Price: <strong>The</strong> annuity is firstpaid to the annuitant. After the death ofthe annuitant, the spouse receives apension which is an amount equal to theannuity paid to the annuitant.Decide on your preferred Annuity ProviderThis option enables you to buy a pensionfrom any other insurer of your choice, at thetime of vesting. You have the freedom to takethe best offer available in the market.What are the Tax Benefits?<strong>The</strong> premiums paid by you for this planare eligible for tax benefits under Section80 CCC as per prevailing tax laws.

) Top-up charges: Top-up charges will be1% of the top-up value. After 10 years, thetop-up allocation is 100%. <strong>The</strong> Company reserves the right to revisecalculated?the charges, including the right to changec) Switch charges: Except for the 4 free the manner in which charges are to be<strong>NAV</strong> of your pension investment fund isswitches allowed every policy year, allrecovered. <strong>The</strong> Company also reserves thecalculated daily on a forward pricing basis:other switches will be charged at Rs. 100right to introduce new charges. Anyper switch.revision or introduction will be withprospective effect with approval from40 2.3950 5.59<strong>How</strong> is the <strong>Net</strong> <strong>Asset</strong> <strong>Value</strong> (<strong>NAV</strong>)of your pension investment fundRevision of chargesMarket / Fair <strong>Value</strong> of the relevantfund's Investments plus Currentd) Administrative charges: A fixed charge<strong>Asset</strong>s less Current Liabilities andof Rs. 20 per month will be levied byIRDA, if necessary (not being the statutoryProvisionscancellation of units.charges) and after giving a notice of 3<strong>NAV</strong> = --------------------------------------------------months to the policyholders, if required.e) Fund-related charges: <strong>The</strong> annual fund-Number of Units outstanding underrelated chargesare as follows:<strong>The</strong> Company reserves the right to changethe relevant fundthe Fund-related charge at any time withFund type Investment ChargeTerms & Conditionsprior approval from the IRDA, up to aMaximiser II 1.50%Conditions related to Annuitymaximum of 1.75% per annum of theBalancer II 1.00%<strong>Net</strong> <strong>Asset</strong>s. On commencement and at the end of everyProtector II 0.75%<strong>The</strong> Company reserves the right to changeguaranteed period (5 or 7 years), thethe fixed monthly charge at any time withPreserver 0.75%amount of annuity payable for the nextprior approval from the IRDA, up to aguaranteed period and the Residual<strong>The</strong>se charges will be adjusted from the <strong>Net</strong>maximum of Rs.100/- per month. <strong>The</strong>Purchase Price* on survival, will be fixed.<strong>Asset</strong> <strong>Value</strong>s.policyholder who does not agree with the Once you are 75 years old, the annuityf) Mortality charges: Mortality chargesabove, shall be allowed to withdraw thewill be fixed for life and will not bewill be deducted on a monthly basis on theunits in the Funds at the then prevailingreviewed thereafter.calculated value of life cover. <strong>Life</strong> cover isunit value and terminate the Policy.the difference between the Sum AssuredAt the time of reset of the annuity, youat that time and the value of investments.have an Open Market Option which<strong>The</strong>se are renewable charges, dependingenables you to get your annuity from anyupon the age of the policyholder, at theother annuity provider, should our ratestime of deduction of mortality charges.not be as competitive. <strong>How</strong>ever, there willAge-wise mortality rates are available inbe a charge of 1% of the residual purchasethe mortality table.price, if you choose this option. (Pleaserefer to the "Decide on your preferredAge at entry Mortality Charges (perAnnuity Provider" section).(years) Rs. 1000 Sum at Risk)* <strong>The</strong> residual purchase will be available for calculation of the30 1.44annuity rate at the end of the guaranteed and annuity period.

Customer Service Helpline (9 a.m. to 9 p.m.)Andhra Pradesh 98495-77766 Maharashtra (Rest) 98904-47766Chattisgarh 98931-27766 Punjab 98159-77766Delhi 98181-77766 Rajasthan 98292-77766Goa 98904-47766 Tamil Nadu (Chennai) 98408-77766Gujarat 98982-77766 Tamil Nadu (Rest) 98944-77766Haryana (Karnal) 98961-77766 Uttar Pradesh (Agra, Bareilly,Haryana (Faridabad) 98181-77766 Meerut, Varanasi) 98973-07766Karnataka 98455-77766 Uttar Pradesh (Kanpur,Kerala 98954-77766Lucknow) 99352-77766Madhya Pradesh 98931-27766Uttaranchal 98973-07766Maharashtra (Mumbai) 98925-77766West Bengal (Kolkata,<strong>How</strong>rah) 98313-77766You can also call us on our Toll Free Number 1600 22 2020or visit us at www.iciciprulife.comRegistered Office: <strong>ICICI</strong> <strong>Prudential</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited, <strong>ICICI</strong> Pru<strong>Life</strong> Towers, 1089 Appasaheb Marathe Marg, Prabhadevi, Mumbai 400 025.This product brochure is indicative of the terms, conditions, warranties and exceptions contained in the insurance policy. Investments are subjectto market risks. Refer to the policy document for risk factors & further details. <strong>Insurance</strong> is the subject matter of the solicitation.<strong>ICICI</strong> <strong>Prudential</strong> <strong>Life</strong> <strong>Insurance</strong> Company Limited. <strong>Life</strong>Time Pension II: Form No. U21.Ver. No. 01 LTP2 01, w.e.f. 1st Oct.05