Nova Scotia - Insurance Bureau of Canada

Nova Scotia - Insurance Bureau of Canada

Nova Scotia - Insurance Bureau of Canada

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

khuctuuhyaw tumr vjxhshoxprhahj," " "nkhuctuuhyazmuekkv v bcd n zh gfcus esua,vw,akWsnrjaui' cwkaWp kl kl jw nrjaui vw,agWs' 'humt-kturtsnu"r nbjo ngbskabhturxtvihumt ktur gk hsh ngrf," tumr vjxhsho"077 thxygri Ptreuuhh cruekhi' b/h/ab, jna, tkpho acg ntu, acgho utrcg kcrhtvnt,hho abv kvx,keu,-vhkukt ak fWe tsnuWr vzei●

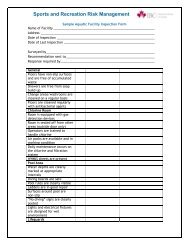

INSURANCE 101When people buy insurance policies, theyput money into a pool with many othersto help the few who will suffer a financialhardship (house fire, auto collision,business interruption, and other types <strong>of</strong>insurable claims) in that year.A premium is based on how likely it isthat the purchaser might collect from thepool by making a claim in a given year.Insurers gather information that theyknow from experience will help them setfair and accurate rates.For example, when calculating yourhome insurance premium, insurersconsider factors such as age, size andlocation <strong>of</strong> dwelling.For auto insurance, some factors thatimpact premiums include claims history,driving record (and the record <strong>of</strong> otherdrivers in the household), vehicle make,model and year. Ask your insurancerepresentative about your policies at leastonce a year.Did you know?Both federal and provincialgovernments closelyregulate the insuranceindustry. Provincialgovernments oversee andmust approve auto insurancerates and coverages.Questions to ask your representative:HOME1. What does my policy cover?2. Is there a specific kind <strong>of</strong> insurancefor a house? A condo? An apartment?3. Are there risks for which I can’t buyinsurance?4. Is optional coverage available for risksnot normally included?5. What can I do to keep my premiumsdown?AUTO1. What does my policy cover if I’minvolved in a collision?2. What optional coverage is available?3. Should I have collision insurance onan older car?4. What size <strong>of</strong> deductible is recommended?5. What can I do to keep my premiumsdown?BUSINESS1. What kind <strong>of</strong> insurance do I need?2. Are there perils for which I can’t buyinsurance?3. If my business is home-based do I needspecial coverage?4. What does errors and omissions ormalpractice insurance cover?5. What can I do to keep my premiumsdown?5

LEADERSHIPON ADAPTATIONSevereweatherisn’tgoingaway. A 2012study by NobelPrize-winningclimatologist Dr. GordonMcBean, commissioned byIBC, says <strong>Canada</strong> can expectmore extreme weather inthe next 40 years. That meansmore floods, storms, wildfires,droughts and hurricanes.For each <strong>of</strong> the past four years, insureddamage from natural catastrophesin <strong>Canada</strong> has been near or above$1 billion. In 2012, damage hit closeto $1.2 billion.Helping Canadians AdaptThe insurance industry is taking the leadon helping Canadian communities tobecome more resilient to severe weather.Our work includes:• IBC’s municipal risk assessment tool(MRAT) which identifies storm waterand sewer infrastructure weaknessesto help governments allocateinfrastructure dollars. Halifax is one<strong>of</strong> 10 municipalities across the countrythat is now helping test the MRAT.• Working with all levels <strong>of</strong> governmentand other stakeholders to ensure thatstorm water and sewer infrastructureis a priority in future spending.• A report on “the economic cost <strong>of</strong>doing nothing” about severe weatherrisks in specific regions, towns andcities in <strong>Canada</strong>, scheduled to becompleted in 2013.• Consumer education on how tominimize and prevent propertydamage. Examples include providingprevention tips on ibc.ca andpromoting the use <strong>of</strong> stormwatermanagement tools.6Heavy rain that hit Truro, N.S. inSeptember 2012 caused extensive flooding.

HELPING COMMUNITIESPREPAREThe McBean report warns that betweennow and 2050, Atlantic <strong>Canada</strong> is likelyto see more hurricanes, storms and stormsurges. <strong>Nova</strong> <strong>Scotia</strong> could see freezing rainevents increase by 20%.Along with assisting to rebuild in thewake <strong>of</strong> disaster, the insurance industry isactively helping <strong>Nova</strong> <strong>Scotia</strong>ns prepare forsevere weather and helping communitiesbecome more resilient:• During hurricane season in the Atlantic,especially in advance <strong>of</strong> HurricaneLeslie, IBC issued media releasesthat explained how to stay safe, howto prevent property damage and ifdamage did occur, what insurancepolicies would cover.• IBC partnered with the Ecology ActionCentre, Halifax Regional Municipalityplanners and Halifax Water Commissionengineers to develop a one-<strong>of</strong>a-kindstormwater managementdemonstration site in Halifax. Thegroup retr<strong>of</strong>itted an existing buildingusing the latest techniques to managestormwater run<strong>of</strong>f and reduceinfrastructure damage and flooding.Learn more at the consumer websitehttp://www.stormwatercentral.ca.At the stormwater demonstration site at 5988 Robie Street in Halifax, home and business owners canlearn more about tools including rain barrels, an infiltration trench and permeable pavers to help themadapt their property, protect it from water damage and keep water out <strong>of</strong> aging sewer infrastructure.7

EMPOWERING CONSUMERSSavvy insurance consumers can betterprotect themselves, their families and theirproperty.When Canadians know how their insuranceworks and have the right coverage, theyprotect their financial security and that<strong>of</strong> <strong>Canada</strong> as a whole. And when theyknow how to prepare for emergencies andprevent damages and injury, they are moreresilient. That’s why consumer educationis a major priority for the P&C insuranceindustry.Our work to empower consumersincludes:• Answering more than 60,000 inquiriesa year at five consumer informationcentres across the country.• Welcoming one million visits a yearto ibc.ca and getintheknow.ibc.ca, andmaking 10 million Twitter impressions(@insurancebureau) as <strong>of</strong> December2012.• Promoting injury prevention, roadsafety, climate adaptation andemergency preparedness to consumersand like-minded stakeholdersin Atlantic <strong>Canada</strong> via the@besmartbesafe Twitter pr<strong>of</strong>ile.• Partnering with police forces andother organizations to fight fraudand other insurance crimes.• Creating a free iPad app called DryHouse Challenge to show homeownershow to prevent water damage.• Advocating for consumers byencouraging federal and provincialgovernments to include insuranceeducation in their financial literacyinitiatives.IBC stafferTanya Whiltshiredemonstrates theDry House Challengeat the Union <strong>of</strong> <strong>Nova</strong><strong>Scotia</strong> Municipalities2012 Fall Conferencein Halifax.8

GIVING BACKThe P&C insurance industry is committedto building strong communities andworking with like-minded partners toensure our region is healthy and ourneighbours are safe.An example <strong>of</strong> this commitment isIBC’s partnership with the AtlanticCollaborative on Injury Prevention(ACIP) to support community-based injuryprevention programs throughout Atlantic<strong>Canada</strong>. IBC‘s funding for this partnership,now in its second year, is approximately$120,000.In 2011 and again in 2012, IBC gave agrant <strong>of</strong> $15,000 to an injury preventionorganization in each Atlantic province tosupport its programming.In <strong>Nova</strong> <strong>Scotia</strong>, IBC’s support is helpingChild Safety Link (based at the IWKHealth Centre in Halifax) to promote itsinjury prevention website and helmetsafety information to families across theprovince.Sarah Blades, Interim Executive Director <strong>of</strong> ACIP, helps a young friend adjust his hockey helmet.9

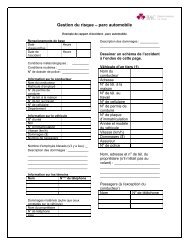

INVESTING WISELYHome, car and business insurers are safeinvestors – they have to be in order tocover their consumers’ claims.Most <strong>of</strong> the P&C insurance industry’sinvestments are in secure bonds,making the industry far less vulnerableto stock market fluctuations. This iswhy insurers fared better than otherfinancial services industries during therecent economic crisis.BREAKDOWN OF NATIONAL INSURANCEINDUSTRY INVESTMENTS (2011)MortgageLoans0.6%Bonds*82.8%Shares12.2%OtherInvestments2.0%Term Deposits2.4%Source: IBC, MSA Research (preliminary estimate)* Mostly federal, provincial and municipal bonds.THE INSURANCE DOLLAR-WHERE DOES YOUR MONEY GO?The <strong>Insurance</strong> Dollar chart shows how insurers spend each premium dollar averaged overthe seven years from 2006 to 2012. In total, more than 90 cents out <strong>of</strong> every dollar thatour industry collects is reinvested in <strong>Canada</strong>’s economy, communities and people.Back toCommunities(Taxes)Source: IBC, MSA ResearchOperating andRegulatoryCosts16.2% 20.6% 54.0% 9.2%INSURANCE DOLLARBack to Policyholders (Claims)Pr<strong>of</strong>it11

<strong>Insurance</strong> <strong>Bureau</strong> <strong>of</strong> <strong>Canada</strong> is the national industry association representing <strong>Canada</strong>’s privatehome, car and business insurers. Its member companies represent 90% <strong>of</strong> the property andcasualty (P&C) insurance market in <strong>Canada</strong>.QUESTIONS? WE’RE HERE.If you have questions, please contact:<strong>Insurance</strong> <strong>Bureau</strong> <strong>of</strong> <strong>Canada</strong>’sConsumer Information CentreToll-free: 1-800-565-7189 ext. 227 or 228(Atlantic provinces only)Hours: M–F 8:30 a.m. – 4:30 p.m.or visit ibc.caFor additional copies <strong>of</strong> this booklet,please contact:Amanda DeanVice-President, Atlantic902-429-2730 x225adean@ibc.caNS/05/2013