financial planning 3. - Securities and Exchange Board of India

financial planning 3. - Securities and Exchange Board of India

financial planning 3. - Securities and Exchange Board of India

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

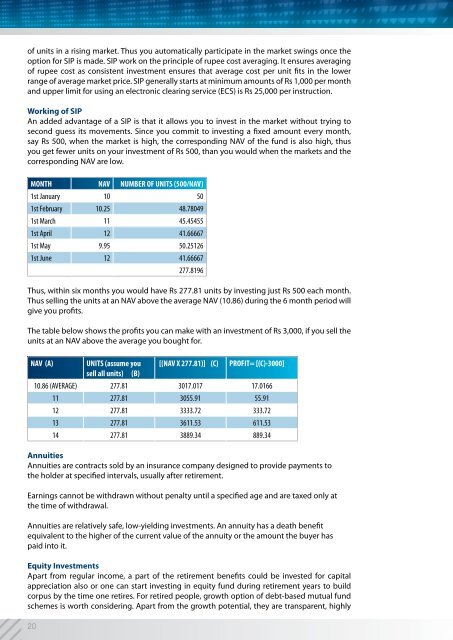

<strong>of</strong> units in a rising market. Thus you automatically participate in the market swings once theoption for SIP is made. SIP work on the principle <strong>of</strong> rupee cost averaging. It ensures averaging<strong>of</strong> rupee cost as consistent investment ensures that average cost per unit fits in the lowerrange <strong>of</strong> average market price. SIP generally starts at minimum amounts <strong>of</strong> Rs 1,000 per month<strong>and</strong> upper limit for using an electronic clearing service (ECS) is Rs 25,000 per instruction.Working <strong>of</strong> SIPAn added advantage <strong>of</strong> a SIP is that it allows you to invest in the market without trying tosecond guess its movements. Since you commit to investing a fixed amount every month,say Rs 500, when the market is high, the corresponding NAV <strong>of</strong> the fund is also high, thusyou get fewer units on your investment <strong>of</strong> Rs 500, than you would when the markets <strong>and</strong> thecorresponding NAV are low.MONTH NAV NUMBER OF UNITS (500/NAV)1st January 10 501st February 10.25 48.780491st March 11 45.454551st April 12 41.666671st May 9.95 50.251261st June 12 41.66667277.8196Thus, within six months you would have Rs 277.81 units by investing just Rs 500 each month.Thus selling the units at an NAV above the average NAV (10.86) during the 6 month period willgive you pr<strong>of</strong>its.The table below shows the pr<strong>of</strong>its you can make with an investment <strong>of</strong> Rs 3,000, if you sell theunits at an NAV above the average you bought for.NAV (A)UNITS (assume you [(NAV X 277.81)] (C) PROFIT= [(C)-3000]sell all units) (B)10.86 (AVERAGE) 277.81 3017.017 17.016611 277.81 3055.91 55.9112 277.81 333<strong>3.</strong>72 33<strong>3.</strong>7213 277.81 3611.53 611.5314 277.81 3889.34 889.34AnnuitiesAnnuities are contracts sold by an insurance company designed to provide payments tothe holder at specified intervals, usually after retirement.Earnings cannot be withdrawn without penalty until a specified age <strong>and</strong> are taxed only atthe time <strong>of</strong> withdrawal.Annuities are relatively safe, low-yielding investments. An annuity has a death benefitequivalent to the higher <strong>of</strong> the current value <strong>of</strong> the annuity or the amount the buyer haspaid into it.Equity InvestmentsApart from regular income, a part <strong>of</strong> the retirement benefits could be invested for capitalappreciation also or one can start investing in equity fund during retirement years to buildcorpus by the time one retires. For retired people, growth option <strong>of</strong> debt-based mutual fundschemes is worth considering. Apart from the growth potential, they are transparent, highly20