Council Minutes - Town of Cambridge

Council Minutes - Town of Cambridge

Council Minutes - Town of Cambridge

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

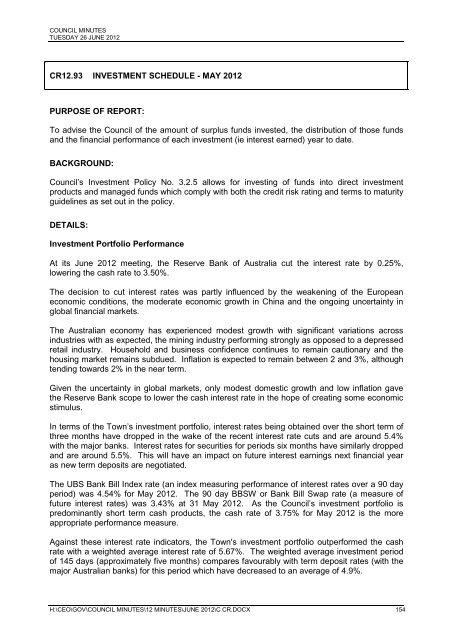

COUNCIL MINUTESTUESDAY 26 JUNE 2012CR12.93 INVESTMENT SCHEDULE - MAY 2012PURPOSE OF REPORT:To advise the <strong>Council</strong> <strong>of</strong> the amount <strong>of</strong> surplus funds invested, the distribution <strong>of</strong> those fundsand the financial performance <strong>of</strong> each investment (ie interest earned) year to date.BACKGROUND:<strong>Council</strong>’s Investment Policy No. 3.2.5 allows for investing <strong>of</strong> funds into direct investmentproducts and managed funds which comply with both the credit risk rating and terms to maturityguidelines as set out in the policy.DETAILS:Investment Portfolio PerformanceAt its June 2012 meeting, the Reserve Bank <strong>of</strong> Australia cut the interest rate by 0.25%,lowering the cash rate to 3.50%.The decision to cut interest rates was partly influenced by the weakening <strong>of</strong> the Europeaneconomic conditions, the moderate economic growth in China and the ongoing uncertainty inglobal financial markets.The Australian economy has experienced modest growth with significant variations acrossindustries with as expected, the mining industry performing strongly as opposed to a depressedretail industry. Household and business confidence continues to remain cautionary and thehousing market remains subdued. Inflation is expected to remain between 2 and 3%, althoughtending towards 2% in the near term.Given the uncertainty in global markets, only modest domestic growth and low inflation gavethe Reserve Bank scope to lower the cash interest rate in the hope <strong>of</strong> creating some economicstimulus.In terms <strong>of</strong> the <strong>Town</strong>’s investment portfolio, interest rates being obtained over the short term <strong>of</strong>three months have dropped in the wake <strong>of</strong> the recent interest rate cuts and are around 5.4%with the major banks. Interest rates for securities for periods six months have similarly droppedand are around 5.5%. This will have an impact on future interest earnings next financial yearas new term deposits are negotiated.The UBS Bank Bill Index rate (an index measuring performance <strong>of</strong> interest rates over a 90 dayperiod) was 4.54% for May 2012. The 90 day BBSW or Bank Bill Swap rate (a measure <strong>of</strong>future interest rates) was 3.43% at 31 May 2012. As the <strong>Council</strong>’s investment portfolio ispredominantly short term cash products, the cash rate <strong>of</strong> 3.75% for May 2012 is the moreappropriate performance measure.Against these interest rate indicators, the <strong>Town</strong>'s investment portfolio outperformed the cashrate with a weighted average interest rate <strong>of</strong> 5.67%. The weighted average investment period<strong>of</strong> 145 days (approximately five months) compares favourably with term deposit rates (with themajor Australian banks) for this period which have decreased to an average <strong>of</strong> 4.9%.H:\CEO\GOV\COUNCIL MINUTES\12 MINUTES\JUNE 2012\C CR.DOCX 154