Matth. Hohner AG

Matth. Hohner AG

Matth. Hohner AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the Consolidated Financial Statements for Business Year 2010/2011<br />

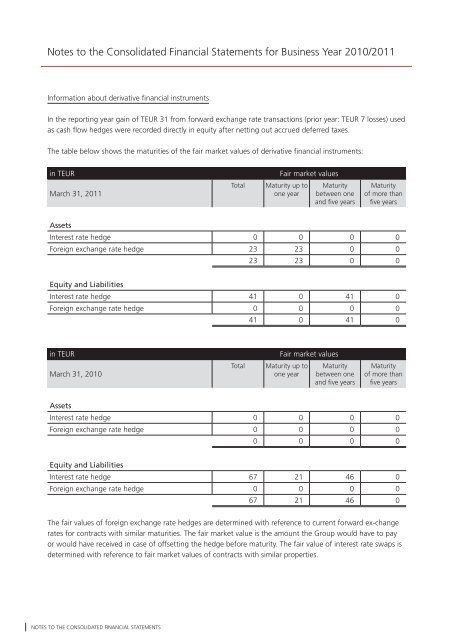

Information about derivative financial instruments<br />

In the reporting year gain of TEUR 31 from forward exchange rate transactions (prior year: TEUR 7 losses) used<br />

as cash flow hedges were recorded directly in equity after netting out accrued deferred taxes.<br />

The table below shows the maturities of the fair market values of derivative financial instruments:<br />

in TEUR Fair market values<br />

March 31, 2011<br />

Total Maturity up to<br />

one year<br />

Maturity<br />

between one<br />

and five years<br />

Maturity<br />

of more than<br />

five years<br />

Assets<br />

Interest rate hedge 0 0 0 0<br />

Foreign exchange rate hedge 23 23 0 0<br />

23 23 0 0<br />

Equity and Liabilities<br />

Interest rate hedge 41 0 41 0<br />

Foreign exchange rate hedge 0 0 0 0<br />

41 0 41 0<br />

in TEUR Fair market values<br />

March 31, 2010<br />

Total Maturity up to<br />

one year<br />

Maturity<br />

between one<br />

and five years<br />

Maturity<br />

of more than<br />

five years<br />

Assets<br />

Interest rate hedge 0 0 0 0<br />

Foreign exchange rate hedge 0 0 0 0<br />

0 0 0 0<br />

Equity and Liabilities<br />

Interest rate hedge 67 21 46 0<br />

Foreign exchange rate hedge 0 0 0 0<br />

67 21 46 0<br />

The fair values of foreign exchange rate hedges are determined with reference to current forward ex-change<br />

rates for contracts with similar maturities. The fair market value is the amount the Group would have to pay<br />

or would have received in case of offsetting the hedge before maturity. The fair value of interest rate swaps is<br />

determined with reference to fair market values of contracts with similar properties.<br />

23. Segment reporting<br />

The segment information is based on the same disclosure and measurement methods as the consolidated<br />

financial statements.<br />

The criterion used as a basis for allocating the various products to the segments is the way in which they<br />

produce sound. The segmentation is following:<br />

1. Percussion instruments Drums, glockenspiels, xylophones, timpani drums, cymbals etc.<br />

2. Wind instruments Harmonicas, accordions, recorders, melodicas<br />

3. Stringed instruments Acoustic guitars, electric-acoustic guitars, electric guitars,<br />

ukuleles, banjos and guitars accessories.<br />

4. Other Pianos, digital pianos, keyboards, amplifiers, racks etc.<br />

<strong>Matth</strong>. <strong>Hohner</strong> <strong>AG</strong> assesses the performance of the segments based on the progress of gross yield<br />

(= sales revenue +/- variance in inventories - cost of materials). 100 % of the expense and income items<br />

can be directly allocated to the segments.<br />

Notes to the CoNsolidated FiNaNCial statemeNts Notes to the CoNsolidated FiNaNCial statemeNts<br />

117