Personal Account Charges Form Huntington Plus Checking Account

Personal Account Charges Form Huntington Plus Checking Account

Personal Account Charges Form Huntington Plus Checking Account

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

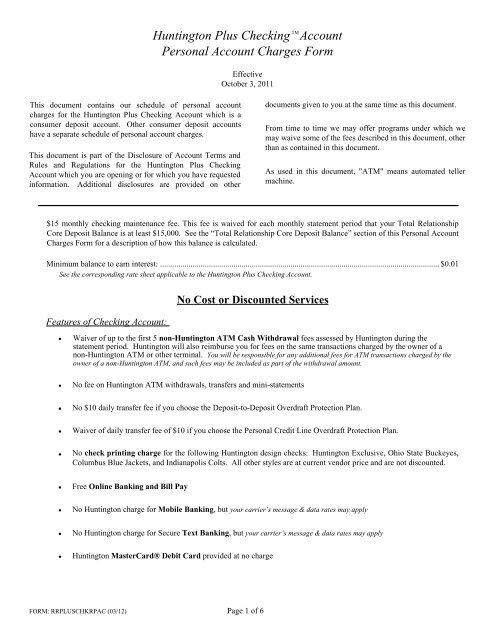

TM<strong>Huntington</strong> <strong>Plus</strong> <strong>Checking</strong> <strong>Account</strong><strong>Personal</strong> <strong>Account</strong> <strong>Charges</strong> <strong>Form</strong>EffectiveOctober 3, 2011This document contains our schedule of personal accountcharges for the <strong>Huntington</strong> <strong>Plus</strong> <strong>Checking</strong> <strong>Account</strong> which is aconsumer deposit account. Other consumer deposit accountshave a separate schedule of personal account charges.This document is part of the Disclosure of <strong>Account</strong> Terms andRules and Regulations for the <strong>Huntington</strong> <strong>Plus</strong> <strong>Checking</strong><strong>Account</strong> which you are opening or for which you have requestedinformation. Additional disclosures are provided on otherdocuments given to you at the same time as this document.From time to time we may offer programs under which wemay waive some of the fees described in this document, otherthan as contained in this document.As used in this document, "ATM" means automated tellermachine.$15 monthly checking maintenance fee. This fee is waived for each monthly statement period that your Total RelationshipCore Deposit Balance is at least $15,000. See the “Total Relationship Core Deposit Balance” section of this <strong>Personal</strong> <strong>Account</strong><strong>Charges</strong> <strong>Form</strong> for a description of how this balance is calculated.Minimum balance to earn interest: ......................................................................................................................................... $0.01See the corresponding rate sheet applicable to the <strong>Huntington</strong> <strong>Plus</strong> <strong>Checking</strong> <strong>Account</strong>.Features of <strong>Checking</strong> <strong>Account</strong>:No Cost or Discounted Services• Waiver of up to the first 5 non-<strong>Huntington</strong> ATM Cash Withdrawal fees assessed by <strong>Huntington</strong> during thestatement period. <strong>Huntington</strong> will also reimburse you for fees on the same transactions charged by the owner of anon-<strong>Huntington</strong> ATM or other terminal. You will be responsible for any additional fees for ATM transactions charged by theowner of a non-<strong>Huntington</strong> ATM, and such fees may be included as part of the withdrawal amount.• No fee on <strong>Huntington</strong> ATM withdrawals, transfers and mini-statements• No $10 daily transfer fee if you choose the Deposit-to-Deposit Overdraft Protection Plan.• Waiver of daily transfer fee of $10 if you choose the <strong>Personal</strong> Credit Line Overdraft Protection Plan.• No check printing charge for the following <strong>Huntington</strong> design checks: <strong>Huntington</strong> Exclusive, Ohio State Buckeyes,Columbus Blue Jackets, and Indianapolis Colts. All other styles are at current vendor price and are not discounted.• Free Online Banking and Bill Pay• No <strong>Huntington</strong> charge for Mobile Banking, but your carrier’s message & data rates may apply• No <strong>Huntington</strong> charge for Secure Text Banking, but your carrier’s message & data rates may apply• <strong>Huntington</strong> MasterCard® Debit Card provided at no chargeFORM: RRPLUSCHKRPAC (03/12) Page 1 of 6

• Unlimited check writing• Free Identity Theft Resolution with $10,000 CoverageIncludes identity theft resolution assistance, identity theft resolution toolkit, on-line identity theft resource center, and up to $10,000of expenses reimbursed, related to confirmed identity theft. See the Identity Theft Insurance Benefit Summary for the terms andconditions. Identity theft insurance underwritten by subsidiaries or affiliates of Chartis Inc. The description herein is a summaryand intended for informational purposes only and does not include all terms, conditions and exclusions of the policies described.Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in alljurisdictions.Not FDIC insured, Not insured by any federal government agency, Not obligations of, deposits of, or guaranteed by The<strong>Huntington</strong> National Bank or its affiliates.Other Companion Services Included with Your <strong>Account</strong>:• Money Market and Savings <strong>Account</strong>sWaiver of money market and savings account minimum balance fee and monthly maintenance fee. You will be responsible for anyfees for ATM transactions charged by the owner of a non-<strong>Huntington</strong> ATM or other terminal, and such fees may be included as partof the withdrawal amount.• Annual fee waived for Small Safe Deposit Box- Limit one and subject to branch availability• No <strong>Huntington</strong> charge for Traveler’s Cheques, Money Orders, Cashier Checks and/or Notary Service, but<strong>Huntington</strong> charges for Traveler’s Cheques for Two.• First year annual fee waived on a <strong>Huntington</strong> Investment Company IRA if the investments in the IRA containat least $5,000 in <strong>Huntington</strong> Funds.Investing in <strong>Huntington</strong> money market funds not included in this offer. A <strong>Huntington</strong> Funds IRA Fee Waiver Coupon is to becompleted by a registered investment representative and attached to the <strong>Huntington</strong> Investment Company Application or TradeTicket. The funds are distributed by Unified Financial Securities, Inc. (Member FINRA) a wholly owned subsidiary of <strong>Huntington</strong>Bancshares Incorporated and an affiliate of <strong>Huntington</strong> Asset Advisors, Inc. the advisor to the <strong>Huntington</strong> Funds.The <strong>Huntington</strong> National Bank, a subsidiary of <strong>Huntington</strong> Bancshares Incorporated, is the Administrator and FinancialAdministrator of the <strong>Huntington</strong> Funds and is the custodian of The <strong>Huntington</strong> Money Market Funds. <strong>Huntington</strong> Asset Advisors,Inc., a subsidiary of The <strong>Huntington</strong> National Bank, serves as Investment Advisor to the Funds. <strong>Huntington</strong> Asset Services, Inc., isthe Sub-Administrator and Unified Financial Securities, Inc. is the Distributor of the <strong>Huntington</strong> Funds, and both are wholly ownedsubsidiaries of <strong>Huntington</strong> Bancshares Incorporated and an affiliate of <strong>Huntington</strong> Asset Advisors, Inc. the advisor to the<strong>Huntington</strong> Funds. <strong>Huntington</strong> Asset Services, Inc., an affiliate of The <strong>Huntington</strong> National Bank, provides transfer agencyservices. Federated Securities Corp. is the distributor of Federated money market fund.Mutual funds, including money market funds, are: Not FDIC insured, Not insured by any federal government agency, Notobligations of, deposits of, or guaranteed by The <strong>Huntington</strong> National Bank or its affiliates, May Lose value.Although money market funds seek to preserve the value of your investment at $1.00 per share, it is possible to lose money byinvesting in the Funds.For more complete information about the <strong>Huntington</strong> Funds, call 1-800-253-0412, see your investment representative or visitwww.huntingtonfunds.com for a prospectus. You should consider the fund’s investment objectives, risks, charges and expensescarefully before you invest. Information about these and other important subjects is in the fund’s prospectus, which you should readcarefully before investing.Page 2 of 6

OverdraftsAn overdraft occurs when you do not have enough money in your account to cover a transaction, but we pay it anyway. We may payoverdrafts at our sole discretion, but we are not required to do so and we may return the item or entry instead. We charge fees forpaying overdraft items or entries or for returning them. However, we will not charge any fees resulting from paying overdrafts forATM and one-time (everyday) debit card transactions if you have not asked us to authorize and pay these transactions.Overdraft Fee and Return FeeWe determine the amount of the fee for overdraft or returned items or entries on any given day based on the total number ofoccurrences during the 1-year period ending and including that day:Occurrences Overdraft Fee Return Fee1 $23.00 per item $23.00 per item2+ $37.50 per item $37.50 per itemOccurrences: An “occurrence” means a day for which there isat least one item or entry in your account to cover, whether wepay or return the item or entry and whether or not we charge afee.Overdraft Fee: For paying each item or entry that overdrawsyour account. Examples are overdrafts created by check, draft,in-person withdrawal, debit card purchase, ATMs withdrawalor other electronic means. There is a limit of 4 overdraft feesper day and we will not charge the fee unless your account isoverdrawn by $5.00 or more.Return Fee: For returning (and not paying) each item or entrywhen there are not enough funds in the account. Examples arereturns of checks, drafts, or transfers or withdrawals byelectronic means. There is a limit of 4 return fees per day.Extended Overdraft FeeIf your account is overdrawn by any amount for 5 or more consecutive days, we will charge an extended overdraft fee of $7.00 foreach day. We will not charge this fee for any day that your account is overdrawn by less than $10.00. We may limit the number ofconsecutive days for which this fee is charged. This fee is not charged on personal savings accounts.24-Hour GraceFor any business day that your account is overdrawn at the end of the day and one or more overdraft fees are incurred, we will waivethose overdraft fees if your account is not overdrawn by the end of the next business day. A “business day” does not includeSaturdays, Sundays or federal holidays even if one or more of our branches are open on those days. For example, we will waiveoverdraft fees incurred on Friday if your account is not overdrawn by the end of the day on the following Monday.Any deposit or transfer to cure the overdraft must be made prior to our applicable cut-off time on that next business day for themanner in which you deposit or transfer the funds. In figuring the amount needed to cure the overdraft, remember to take intoconsideration other checks, withdrawals, transfers, fees or debits that may be posted to your account that will affect the amount needto cure. Also, the full amount of any deposit or transfer may not be available to cure the overdraft depending on the circumstances,such as a deposit at an ATM.24-Hour Grace®does not apply to extended fees or return fees, nor does it affect the number of overdraft occurrences for purposes ofdetermining the amount of an overdraft fee.®Page 3 of 6

Overdraft Protection Transfer PlansOverdraft Protection PlansEach Deposit to Deposit Overdraft Protection Transfer .................................................................................................................. $0<strong>Personal</strong> checking account linked to a qualified, personal savings or money market accountEach <strong>Personal</strong> Credit Line Overdraft Protection Transfer.............................................................................................................. $10<strong>Personal</strong> Credit Line Overdraft Protection transfer fee does not apply to Overdraft Protection Lines ofCredit originated by Sky Bank.<strong>Checking</strong> Reserve <strong>Account</strong><strong>Checking</strong> Reserve <strong>Account</strong> monthly participation fee (charged to your <strong>Checking</strong> Reserve <strong>Account</strong>)........................................... $10Overdraft Protection Transfer PlansYou can choose one of our Overdraft Protection Transfer Plansfor any eligible checking account you have with us which is nota money market deposit account or a savings account. At yourrequest, we can link an eligible checking account with anyeligible deposit account, or personal credit line account that youhave with us which we make available as one of our OverdraftProtection Transfer Plans. Ask us about the types of accountsthat are available. The account you choose to link to yourchecking account for overdraft protection is called the fundingaccount. You may link only one funding account to a checkingaccount. A funding account cannot be linked to more than onechecking account.By choosing an Overdraft Protection Transfer Plan, youauthorize us to transfer funds from your funding account to yourchecking account to cover an overdraft balance in your checkingaccount at the end of the banking day. Transfers will normallybe in multiples of $100. For example, if the overdraft balancein your checking account is $128, we will transfer $200 fromyour funding account. However, if less than a multiple of $100is available from your funding account, we will transfer the fullamount available. For example, if the overdraft balance in yourchecking account is $128 and the amount available from yourfunding account is $180, we will transfer $180.We charge an Overdraft Protection Transfer Fee each time wetransfer funds to cover an overdraft balance. If your fundingaccount is a deposit account or a personal credit line account,we will charge the Overdraft Protection Transfer Fee to yourchecking account.If the overdraft balance in your checking account is greaterthan the amount available in your funding account, the entireavailable amount will still be transferred. In that case, we willnot charge an Overdraft Protection Transfer Fee for thetransfer unless the amount transferred is enough to cover atleast one of the items that caused your checking account tooverdraw.All transfers are subject to availability of funds in the fundingaccount and any other applicable conditions, such astransaction limitations if the funding account is a savingsaccount or a money market deposit account. If your fundingaccount is a personal credit line account, Overdraft ProtectionTransfer Plan provides credit under the terms previouslydisclosed for your personal credit line account. Transfers fromthe funding account will also be subject to applicable interestand fees for that account.<strong>Checking</strong> Reserve <strong>Account</strong><strong>Checking</strong> Reserve is an overdraft line of credit that requires acredit application. An eligible checking account is tied to the<strong>Checking</strong> Reserve for overdraft protection. Each day that thebalance in your checking account at the end of the day isoverdrawn, the exact amount required to cover that overdraftbalance is drawn from the <strong>Checking</strong> Reserve account (up to theamount of credit available) and transferred to your checkingaccount to cover the overdraft balance. As long as there is anoutstanding balance in the <strong>Checking</strong> Reserve account, theamount of any positive balance in your checking account at theend of the day will be automatically transferred to pay downthat <strong>Checking</strong> Reserve account balance until paid in full.Page 4 of 6

Fees for Other <strong>Checking</strong> <strong>Account</strong> and Miscellaneous Services• Each <strong>Huntington</strong> ATM extended statement ........................................................................................................................ $2.00• Each non-<strong>Huntington</strong> ATM transaction (waiver of up to the first 5 Non-<strong>Huntington</strong> ATM cash withdrawal feesassessed by <strong>Huntington</strong> during the statement period. <strong>Huntington</strong> will reimburse you for fees on the same transactionsthat are charged by the owner of a non-<strong>Huntington</strong> ATM or other terminal. ...................................................................You will be responsible for any additional fees for ATM transactions charged by the owner of a non-<strong>Huntington</strong> ATM, and suchfees may be included as part of the withdrawal amount.• For international debit card transactions (whether or not you use your PIN) and international ATMtransactions...................................................................................................................3% of the amount posted to your accountIf you use your card or card number for an international transaction, the transaction may be in a currency other than U.S. Dollars.We will post an international transaction to your account in U.S. Dollars based on the applicable currency exchange rate on theday we settle the transaction. The day we settle the transaction may be a different day than the day you used your card or cardnumber. Also, networks through which an international transaction occurs may charge fees that are added to the transactionamount. As a result, the amount posted to your account may be a different amount than the original amount of the transaction. Thetransaction is an international transaction if the network that presents the transaction to us processes it as occurring outside of theUnited States or its territories, possessions or facilities (such as a U.S. military base, U.S. embassy or U.S. consulate). Thetransaction is also an international transaction regardless of location if the transaction was in a currency other than U.S. Dollars.• Check Image Statement Fee (multiple front images per page)..................................................……………….................. $2.00• Returned Deposit Item Fee ............................................................................................................................................... $10.00• Stop Payment .................................................................................................................................................................... $31.00• Dormant <strong>Account</strong> Fee (per month)...................................................................................................................................... $5.00Applies when there is no customer initiated transaction for 24 months for personal money market and savings accounts or 6months for personal checking accounts. Exceptions to the fee: minor accounts or accounts with a minimum balance of $1,000. Notapplicable for accounts opened in Indiana and Florida.• Monthly Hold Mail Fee....................................................................................................................................................... $5.00• Early <strong>Account</strong> Closing Fee (within 180 days of opening) ................................................................................................ $25.00• Money Order chargeNon-<strong>Huntington</strong> customers.................................................................................................................................................. $6.00$2.00• Cashier Check chargeNon-<strong>Huntington</strong> customers................................................................................................................................................ $15.00• Traveler’s Cheques charge for individualsNon-<strong>Huntington</strong> customers................................................................................................................................3% of face value• Traveler’s Cheques for Two charge<strong>Huntington</strong> customers..................................................................................................................................... 2.5% of face valueNon-<strong>Huntington</strong> customers................................................................................................................................ 3% of face value• Fee for Wire TransferDomestic Outgoing ........................................................................................................................................................... $21.00Domestic Incoming ........................................................................................................................................................... $15.00Foreign/ International Outgoing ........................................................................................................................................ $40.00Foreign/ International Incoming ....................................................................................................................................... $15.00Page 5 of 6

Total Relationship Core Deposit BalanceYour Total Relationship Core Deposit Balance for any checking account statement period is the sum of the following:• The average daily balance for the checking account for that statement period. This is determined by adding together thebalances at the end of each day in that statement period and dividing by the number of days in that statement period.• <strong>Plus</strong>, the average daily balance for each money market account and savings account you have with us that you ask us to includein this balance calculation. For each of these accounts separately, we determine the average daily balance by adding togetherthe balances at the end of each qualifying day and dividing by the number of qualifying days. Qualifying days are each day inthe time period of up to 31 days that ends on the statement date for the checking account. The number of qualifying days weuse to determine the average daily balance for any money market or savings account depends on the timing of the statementperiod for the applicable money market or savings account. Unless the statement period for the money market or savingsaccount is exactly the same as the statement period for the checking account, the number of qualifying days will be less thanthe full number of days in the statement period for the money market or savings account as illustrated by the followingexample:TOTAL RELATIONSHIP CORE DEPOSIT BALANCE EXAMPLE<strong>Checking</strong> account statement period = calendar month: 12/1 through 12/31.thSavings account statement period = 11 of the month to 10 of following month: 12/11 through 1/10.Average daily balance for the checking account is the checking account balances from the end of each day from12/1 through 12/31 (31 days) added together and divided by 31 = $X.Average daily balance for the savings account is the savings account balances from the end of each day from12/11 through 12/31 (21 qualifying days) added together and divided by 21 = $Y.Each of the two average daily balances are added together to get the “Total Relationship Core Deposit Balance”($Z) for that checking account statement period: $X + $Y = $Z.thThe <strong>Huntington</strong> National Bank is an Equal Housing Lender and Member FDIC. ® , <strong>Huntington</strong> ® , and24-Hour Grace ® are federally registered service marks of <strong>Huntington</strong> Bancshares Incorporated.Patent pending for the 24-Hour Grace ® system and method.©2012 <strong>Huntington</strong> Bancshares Incorporated.<strong>Plus</strong> 12MarPage 6 of 6

Identity Theft Insurance Benefit SummaryUp to $10,000 in financial relief in the event Your identity is stolen.IDENTITY THEFT INSURANCESUMMARY DESCRIPTION OF BENEFITS FOR THE PERSONAL INTERNET AND IDENTITYCOVERAGE MASTER POLICYThe Master Policy of <strong>Personal</strong> Internet Identity Coverage for New York Insureds and non-New York Insureds (collectively, the “Master Policy”) have beenissued to: The <strong>Huntington</strong> National Bank (the “Master Policyholder”), Policy Numbers: 1423481 and 7078194, respectively, underwritten by insurancecompany subsidiaries or affiliates of Chartis Inc., to provide benefits as described in this Summary.This Summary is provided to inform You that You are entitled to benefits under the Master Policy as a member of The <strong>Huntington</strong> National Bank, which is amember of the Master Policyholder. This Summary Description of Benefits does not state all the terms, conditions, and exclusions of the Master Policy.Your benefits will be subject to all of the terms, conditions, and exclusions of the Master Policy, even if they are not mentioned in this Summary.INSURANCE COVERAGEInsured Aggregate Limit of Insurance: $10,000 per policy periodLost Wages: $1,500 per week, for 5 weeks maximum per policy periodDeductible: $0 per policy periodWe shall pay You for the following Losses incurred as a result of a Stolen Identity Event:a) Costs:i. Costs incurred by You for re-filing applications for loans, grants, and other credit or debt instruments that are rejected solely because thelender received from any source incorrect information as a result of a Stolen Identity Event;ii.iii.iv.ii.Costs for notarizing affidavits or other similar documents, long distance telephone calls, and postage reasonably incurred as a result of Yourefforts to report a Stolen Identity Event or amend or rectify records as to Your true name or identity as a result of a Stolen Identity Event;Costs incurred by You for a maximum of six (6) credit reports from an entity approved by Us. The first credit report may not be requested untilafter the discovery of a Stolen Identity Event;Actual lost wages that would have been earned in the United States, whether partial or whole days, for time reasonably and necessarily takenoff work and away from Your work premises solely as a result of Your efforts to amend or rectify records as to Your true name or identity as aresult of a Stolen Identity Event. Actual lost wages includes remuneration for vacation days, discretionary days, floating holidays, and paidpersonal days but not for sick days or any cost arising from time taken from self-employment. Coverage is limited to wages lost within twelve(12) months after Your discovery of a Stolen Identity Event.b) Legal Cost: Costs for reasonable fees for an attorney appointed by Us and related court fees, incurred by You with Our consent, for:i. Any legal action brought against You by a creditor or collection agency or entity acting on behalf of a creditor for non-payment of goods orservices or default on a loan as a result of a Stolen Identity Event;Removing any civil judgment wrongfully entered against You as a result of a Stolen Identity Event; andiii. Criminal defense for charges brought against You as a result of a Stolen Identity Event. However, We will only pay for Your criminal defenseafter it has been established by acquittal or dismissal of charges that You were not in fact the perpetrator.DEFINITIONSBodily Injury means: bodily harm, sickness or disease, including required care, loss of services and death that results.Business means: any employment, trade, profession, or occupation, including farm operation and the raising or care of animals.Customer Membership Period means: the period commencing on the date an Insured enrolls in a Membership Program of the Master Policyholder(provided the Master Policy is actively held by the Master Policyholder at such time) and ending on the earlier of the expiration date of the Master Policy,the date of cancellation of the Master Policy or the termination of such Insured's enrollment in a Membership Program.Family Member means: Your spouse, sibling, parent, grandparent, child, grandchild, niece or nephew.Insured, You, Your, and Yours means: the natural person on record with Us as enrolled in a Membership Program(s) of the Master Policyholder at thetime of a Stolen Identity EventLoss means: Costs and Legal Costs as described in sections a and b under Insurance Coverage.Membership Program means: those membership programs sponsored by the Master Policyholder and that are specifically listed by endorsement ascovered programs under the Master Policy.<strong>Personal</strong> Injury means the following injuries, and resulting death:1. Shock, humiliation, mental anguish, or mental injury;2. False arrest, imprisonment, or detention;3. Wrongful entry into, or eviction of a person from, a room, dwelling, or premises that the person occupies;4. Bodily Injury;5. Malicious prosecution;6. Libel, slander, defamation of character, or disparagement of a person’s or organization’s goods, products, or services; or7. Invasion of privacy.

Property Damage means: physical injury to, destruction of, or loss of use of tangible property.Stolen Identity Event means: the theft of Your personal identification, social security number, or other method of identifying You, which has resulted in orcould reasonably result in the wrongful use of such information, including but not limited to Stolen Identity Events occurring on or arising out of Your use ofthe Internet. Stolen Identity Event shall not include the theft or wrongful use of Your Business name, d/b/a or any other method of identifying a Businessactivity of Yours.We, Us, Our and Company means: The insurance company providing this insurance.COVERAGE SCOPEThe Master Policy provides benefits to You only if You report a Stolen Identity Event to Us by the contact number stated below as soon as You becomeaware of a Stolen Identity Event, but in no event later than ninety (90) days after Your discovery of the Stolen Identity Event, and You follow theinstructions given to You in a claims kit that You will be provided. These instructions will include notifying major credit bureaus, the Federal TradeCommission’s Identity Theft Hotline and appropriate law enforcement authorities. This claims kit will also instruct You how to file for benefits under theMaster Policy if the Stolen Identity Event results in Losses covered under the Master Policy.You will only be covered if a Stolen Identity Event first occurs while You are a member of the Master Policyholder’s Membership Program and is reportedto Us within ninety (90) days after Your discovery of a Stolen Identity Event. You will not be covered if the Stolen Identity Event first occurs after expirationor termination of the Master Policy or termination of Your membership in the Master Policyholder’s Membership Program.LIMITS OF INSURANCEThe most We shall pay You are the Limits of Insurance shown above. All Legal Costs shall be part of and subject to the Aggregate Limit of Insurance.LEGAL COSTS ARE PART OF, AND NOT IN ADDITION TO, THE LIMIT OF INSURANCE.The Lost Wages Limit of Insurance shown above is a sublimit of the Insured Aggregate Limit of Insurance and is the most We shall pay You for lost wages.OTHER INSURANCEWe shall be excess over any other insurance, including, without limitation, homeowner’s or renter’s insurance. If You have other insurance that applies to aLoss under the Master Policy, the other insurance shall pay first. The Master Policy applies to the amount of Loss that is in excess of the Limit of Insuranceof Your other insurance and the total of all Your deductibles and self-insured amounts under all such other insurance. In no event shall We pay more thanOur Limit of Insurance as shown above.DUPLICATE COVERAGESShould You be enrolled in more than one Membership Program insured by Us, or any of our affiliates, We will reimburse You under each MembershipProgram:a) subject to the applicable deductibles and limits of liability of each insured Membership Program,b) but in no event shall the total amount reimbursed to You under all Membership Programs exceed the actual amount of Loss.EXCLUSIONS:Intentional Loss - We do not cover any Loss for any act committed at Your direction or with Your knowledge.Dishonest Acts - We do not cover any Loss arising out of any dishonest or criminal act by You or a Family Member.Confiscation - We do not cover any Loss caused by the confiscation, destruction, or seizure of property by any government or public entity or theirauthorized representative.Business or Professional Services - We do not cover any Loss arising out of a Business or professional service engaged in by You, including Lossconnected to <strong>Account</strong>s used for Business purposes.Late Reporting - We do not cover any Loss reported to Us more than ninety (90) days after Your discovery of a Stolen Identity Event.Property Damage, Bodily Injury, or <strong>Personal</strong> Injury - We do not cover any Bodily Injury, Property Damage, or <strong>Personal</strong> Injury.Family Member - Any Stolen Identity Event of which a Family Member participated in, directed or had prior knowledge.GENERAL INFORMATIONShould You have any questions regarding the Membership Program provided by the Master Policyholder, please call the member service number locatedin Your membership materials.FILING A CLAIMTo file a claim under the Master Policy, You should contact: 1-866-921-2541 24 hours a day.DUTIES OF THE INSUREDYou shall promptly, but no later than ninety (90) days after Your discovery of a Stolen Identity Event notify Us of the Stolen Identity Event by calling1-866-921-2541 or contacting Us at ID Theft & Fraud Group, 175 Water Street, 8th Floor, New York, NY 10038. You shall also follow Our writteninstructions to mitigate potential Loss, which will be provided to You in a claims kit and which will include the prompt notification of the major creditbureaus, the Federal Trade Commission’s Identity Theft Hotline and appropriate law enforcement agencies.FORM: RRPLUSCHKRPAC (IDTheft) (08/11)