E-commerce Fulfillment Execution Essentials - Cognizant

E-commerce Fulfillment Execution Essentials - Cognizant

E-commerce Fulfillment Execution Essentials - Cognizant

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Since automationoften represents asignificant investment,we highly recommendconducting asimulation exerciseprior to committing toa solution.leveraged to achieve same-day shipping inmarkets where population density supportsit (i.e., major metropolitan areas).> > Locating EFCs near logistics clusters:Retailers should locate EFCs near logisticsclusters — ports, airports, carrier terminalsand/or competitor/noncompetitor facilities— to leverage labor availability and collaborativetransportation, andto increase the speed of gettinggoods into stock as wellas reduce the time to deliverproducts to the end customer.This network design willenable the low-volume, costeffective,high-frequency replenishment/deliverywhichis required in the volatile,less predictable direct-toconsumermodel.> > 3PL provider and offsite storage: E-<strong>commerce</strong> retail is characterized by sharpspikes in demand. To handle the spikes,retailers should build a network that hastemporary capacity by leveraging off-sitestorage, third-party logistics (3PL) providersor pop-up “tent” locations. This networkdesign reduces capital investment in plant,property and equipment (PP&E) that sitsidle most of the year.> > Shared inventory: Today’s consumers useomni-channels, and expect a seamless retailexperience across them. Many retailersface the high hurdles in handling inventoryacross channels (i.e., the blurring of inventoryallocation and ownership betweenstores and Web sites) in providing a seamlessretail experience to the customer. Anetwork that has the technology and financialsystems to support shared inventoryand fulfillment across different channelswill have a competitive advantage in thebattle for the minds and pocketbooks of onlineshoppers.• Automation: This means deploying a varietyof automated solutions such as automatedstorage and retrieval systems (AS/RS),horizontal and vertical carousels, stackercranes, conveyors, sorters, automated guidedvehicles, etc.Automation in EFCs has become an essentialenabler for retailers to meet the challengesof e-<strong>commerce</strong> fulfillment. Automation bringsseveral benefits to EFC operations — such asreduced order cycle time, increased accuracyof order fulfillment, increased inventory storagedensity and support for SKU proliferation. AnEFC can be fully automated or semi-automated.Retailers should determine the degree ofautomation to be used in an EFC based on variousattributes such as SKU count, SKU velocity, SKUtype (e.g., toteable vs. non-toteable) and orderprofile, to name a few. Since automation oftenrepresents a significant investment, we highlyrecommend conducting a simulation exerciseprior to committing to a solution.The following automation solutions are amongthose that retailers should consider implementingin their EFCs.> > AS/RS to support high-density materialstorage and optimize the use of the availablecubic space to support dramatic increasein SKU count. AS/RS also leads toreduction in labor costs and improves thepercentage of orders completed on time.> > Conveyor-based picking, sorting andpacking to allow rapid transmission ofproducts through the pick/pack/ship area.> > Robotics to complete order-filling andmaterial movement with increased efficiencyand accuracy.> > Dimensioning and cubing systems to captureitem dimension/weight of new SKUs.This helps in maximizing storage space byslotting items to the appropriate location,minimizing transportation waste by selectingthe appropriate carton for outboundshipments and supporting weight verificationof outbound shipments prior to customerdelivery.> > Outbound weight verification system tocompare the actual weight of the outboundcarton with the expected weight of the cartonto validate order accuracy.> > RF/RFID to enable real-time inventorytracking in the EFC.> > Automated packing machines to automatethe packing process, thus reducinglabor costs and increasing throughput.• Assortment/SKU proliferation: Customers’increasing comfort level in purchasing variousproduct categories online combined with competitionfrom online retail giants with hugebreadth and depth of product categories areforcing retailers to increase their productofferings.cognizant 20-20 Insights4

One of the main challenges faced by onlineretailers is the demand for increased productcategories and greater SKU assortment/selection. In addition to the factors mentionedabove, this is being fueled by technologicaladvancements that lead to continuous productinnovation in certain categories. Increasing thebreadth of product offerings also makes goodbusiness sense for retailers as a way to lead intime-to-market, increase the ability to expandin new markets and new geographies and buildoverall market share.The following strategic enablers can helpretailers navigate the challenge of increasingSKU assortment/selection.> > SKU analysis: Retailers should analyze theSKUs by item velocity and inventory turnsto identify the “A,” “B,” “C” and “D” movers.Classifying the SKUs in this manner willhelp to decide the fulfillment channel (e.g.,carry inventory in the DC, order on demand,ship direct from vendor, etc.), understandDC/network capacity required to supportthe SKU count and determine inventory levelsrequired to support demand.> > SKU segmentation: The Pareto Principleapplies to SKUs’ sales volume (i.e., 80% ofyour sales come from 20% of your SKUs).This helps retailers define SKUs as musthavevs. nice-to-have, and assists in determiningthe appropriate sourcing and fulfillmentstrategy required (e.g., sourcing locallyvs. globally, air vs. ground shipping, etc.).> > SKU rationalization or exit strategy forslow-moving items: Retailers must definepolicies and procedures to move merchandisewithin the network, make items availableto sell in brick-and-mortar stores ifthere is local demand, discontinue obsoleteSKUs or discontinue carrying product inthe DC and ship direct from the vendor. Inan ecosystem of over 500k unique items/SKUs, turn and productivity rates are criticalto utilize DC space efficiently.> > Cross-pillar alignment and integratedplanning: Retailers should create structuredprocesses for sales and operationsplanning to integrate e-<strong>commerce</strong> fulfillmentcenter planning with sourcing, productdevelopment, finance, logistics andsales. It is critical to understand demandand plan accordingly to accommodate anincreased SKU base.• Reverse logistics: A simple and convenientreturn process that incorporates the abilityto return in a manner most convenient to thecustomer (return by mail, return in store, returnto vendor, drop locations) without payingadditional cost, irrespective of the purchasechannel, will pay incredible dividends.A majority of e-<strong>commerce</strong> customers considerthe retailer’s return policy as one of the differentiatingfactors for online purchases whencomparing competitor Web sites, or similarlypriced multichannel options. With increasedSKU proliferation, and reduced brand loyalty,effective returns management becomes a keycustomer retention factor for e-tailers. Wehave observed an increase in conversion ratiosfor e-tailers that have a comprehensive returnsstrategy. The increase in return percentagesis partially fueled by a growing percentage ofapparel purchases being made online.We believe that retailers should adopt thefollowing strategies to build a reverse logisticsnetwork to drive competitive advantage ine-<strong>commerce</strong> fulfillment.> > Preempt returns: The information providedto customers at the point of purchase(Web site, mobile app, etc.) plays an importantrole in preempting returns in the “notouch” online world. The virtual fitting roomfor apparel/shoes, ability to view/zoomproducts, photographs of products fromdifferent angles, detailed product description/specificationsand customer reviewsall help customers make the right choice,thereby reducing the probability of returns.> > Define return strategies: Retailers shouldhave clear strategies in place for makingdecisions quickly regarding returns authorization,customer credit authorization andproduct disposition.> > Explore partnerships with third-partyreturns processors and/or integrate withparcel carriers for a faster, scalable andcost-effective returns management process.Returns are typically not a core competencefor retailers.> > Implement an integrated return network:Retailers should build systemic/technologicalcapabilities to enable dot-com merchandiseto be returned as per the customer’sconvenience (e.g., return by mail, return instore, drop locations) both efficiently and atlow cost.cognizant 20-20 Insights 5

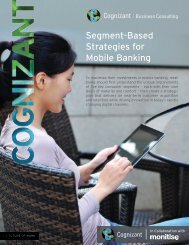

<strong>Fulfillment</strong>Holistic E-<strong>commerce</strong> <strong>Fulfillment</strong>E-<strong>commerce</strong>SpeedReverseLogisticsAssortmentPerfectE-<strong>commerce</strong>Order<strong>Fulfillment</strong>AccuracyNetworkDesignAutomationStrategyFigure 2> > Supply-chain networks should be designedto accommodate the volume andprocessing time of customer returnsbased on customer demand patterns.> > Track return rates at customer/item/departmentlevel to formulate action plansfocused on reducing return rate percentage.Connecting the DotsIn this paper, we have identified six focus areasthat present discrete challenges for e-<strong>commerce</strong>fulfillment, and interlinked strategic enablers tohelp retailers overcome them. In our view, retailerswill need to develop a holistic approach to buildsuccessful e-<strong>commerce</strong> fulfillment strategies(see Figure 2).E-<strong>commerce</strong> continues to grow in importance asa sales channel, and customer expectations havenever been higher. Implementing the strategieslaid out above will make the difference betweenstanding out in the crowd of online retailers, orgetting lost in the “white noise.”Footnotes1Sucharita Mulpuru, Forrester Research, “U.S. Online Retail Forecast 2011 To 2016,” February 2012.2ibid3Pareto Analysis is a statistical technique in decision-making that is used for selection of a limited numberof tasks that produce significant overall effect. It uses the Pareto Principle — the idea that doing 20% ofwork can generate 80% of the advantage of doing the entire job. Or in terms of quality improvement, alarge majority of problems (80%) are produced by a few key causes (20%) — http://en.wikipedia.org/wiki/Pareto_analysis.cognizant 20-20 Insights 6

About the AuthorsJohn Lowe is a Senior Manager within <strong>Cognizant</strong> Business Consulting’s Retail Practice. He is responsiblefor advising on logistics and supply chain management projects across multiple Fortune 100 clients.He previously led DC operations for multiple Fortune 500 organizations, including Amazon.com, TJX,Gap Inc. and Rockwell Automation. John received his M.B.A. from the University of Illinois at Urbana-Champaign. He can be reached at John.Lowe@cognizant.com.Atif Ali Khan is a Manager within <strong>Cognizant</strong> Business Consulting’s Retail Practice. He has over eightyears of international consulting experience in retail and supply chain and holds CPIM accreditation, abachelor of technology degree from AMU, Aligarh, India, and an M.B.A. in marketing and finance fromLBSIM, New Delhi. He can be reached at AtifAli.Khan@cognizant.com.About <strong>Cognizant</strong><strong>Cognizant</strong> (NASDAQ: CTSH) is a leading provider of information technology, consulting, and business process outsourcingservices, dedicated to helping the world’s leading companies build stronger businesses. Headquartered inTeaneck, New Jersey (U.S.), <strong>Cognizant</strong> combines a passion for client satisfaction, technology innovation, deep industryand business process expertise, and a global, collaborative workforce that embodies the future of work. With over 50delivery centers worldwide and approximately 156,700 employees as of December 31, 2012, <strong>Cognizant</strong> is a member ofthe NASDAQ-100, the S&P 500, the Forbes Global 2000, and the Fortune 500 and is ranked among the top performingand fastest growing companies in the world. Visit us online at www.cognizant.com or follow us on Twitter: <strong>Cognizant</strong>.World Headquarters500 Frank W. Burr Blvd.Teaneck, NJ 07666 USAPhone: +1 201 801 0233Fax: +1 201 801 0243Toll Free: +1 888 937 3277Email: inquiry@cognizant.comEuropean Headquarters1 Kingdom StreetPaddington CentralLondon W2 6BDPhone: +44 (0) 20 7297 7600Fax: +44 (0) 20 7121 0102Email: infouk@cognizant.comIndia Operations Headquarters#5/535, Old Mahabalipuram RoadOkkiyam Pettai, ThoraipakkamChennai, 600 096 IndiaPhone: +91 (0) 44 4209 6000Fax: +91 (0) 44 4209 6060Email: inquiryindia@cognizant.com© Copyright 2013, <strong>Cognizant</strong>. All rights reserved. No part of this document may be reproduced, stored in a retrieval system, transmitted in any form or by anymeans, electronic, mechanical, photocopying, recording, or otherwise, without the express written permission from <strong>Cognizant</strong>. The information contained herein issubject to change without notice. All other trademarks mentioned herein are the property of their respective owners.