Computer Assignment 2 - Stockholms universitet

Computer Assignment 2 - Stockholms universitet

Computer Assignment 2 - Stockholms universitet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

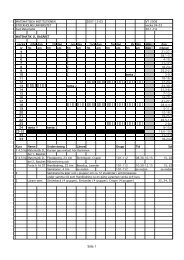

Note that τ = 1/250 in this case since there were 250 trading days during the year.Assume that the risk-free interest rate is constant and 10 % during this period, whichgives the daily rate r = 0.10/250, and that the exercise price X of an option with exercisetime one year is determined asX = S(0)(1 + 0.10)i.e. that the stock is assumed to increase according to the risk-free interest rate during theyear.a. Determine the price of a European call option on your chosen stock at September1st, 2006 with exercise time one year and exercise price X.b. Calculate the value of the option after three, six and nine months. (Assume that thetrading days are evenly distributed over the year.)c. Determine the price of a European put option on your chosen stock at September1st, 2006 with exercise time one year and exercise price X.d. Calculate the value of the option after three, six and nine months.e. What happens to the initial prices if the interest rate drops to 5 % while X isunchanged?f. What happens to the initial prices if the volatility is doubled?(In reality, future prices of the stock are of course unknown when the price of the optionis determined. Usually, parameters are estimated from historical data from the time pointwhen the option is issued and backwards and then the value of the option is calculated asfuture stock prices become available. The method in this assignment is therefore circularand produces better results than it should, but the purpose of the exercise is to give practicein using the Cox-Ross-Rubinstein Formulae so we allow this simplification.)2.2 Black-Scholes FormulaeIn this exercise you are going to carry out the same calculations as in the previous exercisebut with the Black-Scholes formulae instead. These formulae are based on the geometricBrownian motionS(t) = S(0) exp(mt + σW (t))where W (t) is a Brownian motion and the drift m and volatility σ are the same as before.Assume the same constant risk-free interest rate r and exercise price X as before and carryout the exercisesa. Determine the price of a European call option on your chosen stock at September1st, 2006 with exercise time one year and exercise price X.5