1 MINUTES Castor Valley Elementary School Council Meeting ...

1 MINUTES Castor Valley Elementary School Council Meeting ...

1 MINUTES Castor Valley Elementary School Council Meeting ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

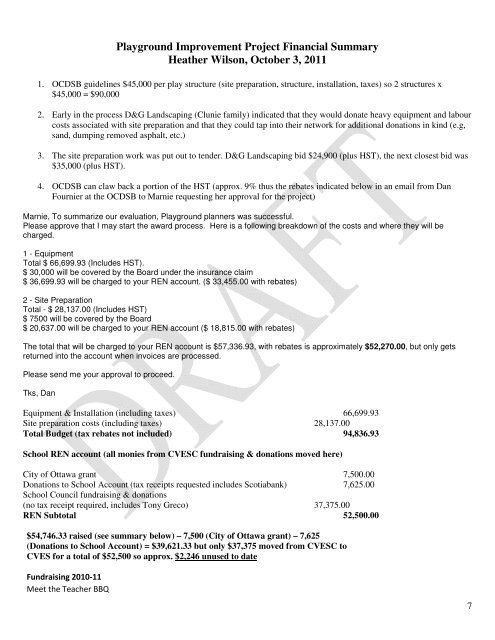

Playground Improvement Project Financial SummaryHeather Wilson, October 3, 20111. OCDSB guidelines $45,000 per play structure (site preparation, structure, installation, taxes) so 2 structures x$45,000 = $90,0002. Early in the process D&G Landscaping (Clunie family) indicated that they would donate heavy equipment and labourcosts associated with site preparation and that they could tap into their network for additional donations in kind (e.g,sand, dumping removed asphalt, etc.)3. The site preparation work was put out to tender. D&G Landscaping bid $24,900 (plus HST), the next closest bid was$35,000 (plus HST).4. OCDSB can claw back a portion of the HST (approx. 9% thus the rebates indicated below in an email from DanFournier at the OCDSB to Marnie requesting her approval for the project)Marnie, To summarize our evaluation, Playground planners was successful.Please approve that I may start the award process. Here is a following breakdown of the costs and where they will becharged.1 - EquipmentTotal $ 66,699.93 (Includes HST).$ 30,000 will be covered by the Board under the insurance claim$ 36,699.93 will be charged to your REN account. ($ 33,455.00 with rebates)2 - Site PreparationTotal - $ 28,137.00 (Includes HST)$ 7500 will be covered by the Board$ 20,637.00 will be charged to your REN account ($ 18,815.00 with rebates)The total that will be charged to your REN account is $57,336.93, with rebates is approximately $52,270.00, but only getsreturned into the account when invoices are processed.Please send me your approval to proceed.Tks, DanEquipment & Installation (including taxes) 66,699.93Site preparation costs (including taxes) 28,137.00Total Budget (tax rebates not included) 94,836.93<strong>School</strong> REN account (all monies from CVESC fundraising & donations moved here)City of Ottawa grant 7,500.00Donations to <strong>School</strong> Account (tax receipts requested includes Scotiabank) 7,625.00<strong>School</strong> <strong>Council</strong> fundraising & donations(no tax receipt required, includes Tony Greco) 37,375.00REN Subtotal 52,500.00$54,746.33 raised (see summary below) – 7,500 (City of Ottawa grant) – 7,625(Donations to <strong>School</strong> Account) = $39,621.33 but only $37,375 moved from CVESC toCVES for a total of $52,500 so approx. $2,246 unused to dateFundraising 2010-11Meet the Teacher BBQ7