5002-EN - France in the United Kingdom

5002-EN - France in the United Kingdom

5002-EN - France in the United Kingdom

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

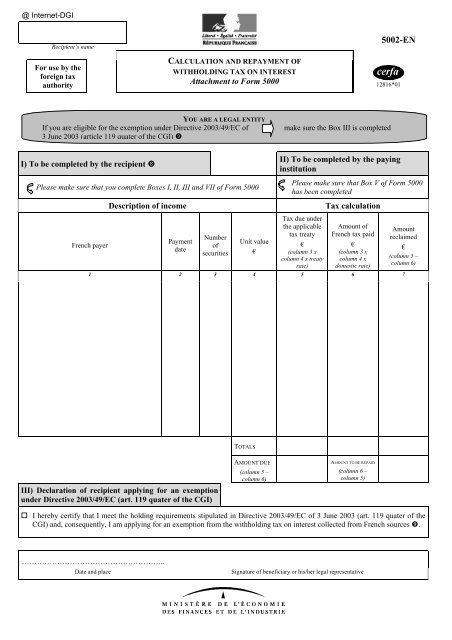

@ Internet-DGIRecipient’s nameFor use by <strong>the</strong>foreign taxauthorityCALCULATION AND REPAYM<strong>EN</strong>T OF<strong>5002</strong>-<strong>EN</strong>WITHHOLDING TAX ON INTERESTAttachment to Form 500012816*01YOU ARE A LEGAL <strong>EN</strong>TITYIf you are eligible for <strong>the</strong> exemption under Directive 2003/49/EC of3 June 2003 (article 119 quater of <strong>the</strong> CGI) make sure <strong>the</strong> Box III is completedI) To be completed by <strong>the</strong> recipient Please make sure that you complete Boxes I, II, III and VII of Form 5000French payerDescription of <strong>in</strong>comePaymentdateNumberofsecuritiesUnit value€II) To be completed by <strong>the</strong> pay<strong>in</strong>g<strong>in</strong>stitutionPlease make sure that Box V of Form 5000has been completedTax due under<strong>the</strong> applicabletax treaty€(column 3 xcolumn 4 x treatyrate)Tax calculationAmount ofFrench tax paid€(column 3 xcolumn 4 xdomestic rate)Amountreclaimed€(column 5 –column 6)1 2 3 4 5 6 7TOTALSIII) Declaration of recipient apply<strong>in</strong>g for an exemptionunder Directive 2003/49/EC (art. 119 quater of <strong>the</strong> CGI)AMOUNT DUE(column 5 –column 6)AMOUNT TO BE REPAID(column 6 –column 5) I hereby certify that I meet <strong>the</strong> hold<strong>in</strong>g requirements stipulated <strong>in</strong> Directive 2003/49/EC of 3 June 2003 (art. 119 quater of <strong>the</strong>CGI) and, consequently, I am apply<strong>in</strong>g for an exemption from <strong>the</strong> withhold<strong>in</strong>g tax on <strong>in</strong>terest collected from French sources .………………………………………………...Date and placeSignature of beneficiary or his/her legal representative

@ Internet-DGIRecipient’s nameTo be kept by<strong>the</strong> recipientCALCULATION AND REPAYM<strong>EN</strong>T OF<strong>5002</strong>-<strong>EN</strong>WITHHOLDING TAX ON INTERESTAttachment to Form 500012816*01YOU ARE A LEGAL <strong>EN</strong>TITYIf you are eligible for <strong>the</strong> exemption under Directive 2003/49/EC of3 June 2003 (article 119 quater of <strong>the</strong> CGI) make sure <strong>the</strong> Box III is completedI) To be completed by <strong>the</strong> recipient Please make sure that you complete Boxes I, II, III and VII of Form 5000French payerDescription of <strong>in</strong>comePaymentdateNumberofsecuritiesUnit value€II) To be completed by <strong>the</strong> pay<strong>in</strong>g<strong>in</strong>stitutionPlease make sure that Box V of Form 5000has been completedTax due under<strong>the</strong> applicabletax treaty€(column 3 xcolumn 4 x treatyrate)Tax calculationAmount ofFrench tax paid€(column 3 xcolumn 4 xdomestic rate)Amountreclaimed€(column 5 –column 6)1 2 3 4 5 6 7TOTALSIII) Declaration of recipient apply<strong>in</strong>g for an exemptionunder Directive 2003/49/EC (art. 119 quater of <strong>the</strong> CGI)AMOUNT DUE(column 5 –column 6)AMOUNT TO BE REPAID(column 6 –column 5) I hereby certify that I meet <strong>the</strong> hold<strong>in</strong>g requirements stipulated <strong>in</strong> Directive 2003/49/EC of 3 June 2003 (art. 119 quater of <strong>the</strong>CGI) and, consequently, I am apply<strong>in</strong>g for an exemption from <strong>the</strong> withhold<strong>in</strong>g tax on <strong>in</strong>terest collected from French sources .………………………………………………...Date and placeSignature of beneficiary or his/her legal representative

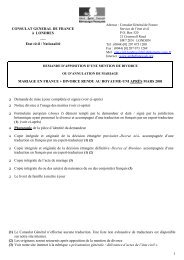

@ Internet-DGIReport du nom du créancierFor use by <strong>the</strong>French taxauthorityLIQUIDATION ET REMBOURSEM<strong>EN</strong>T<strong>5002</strong>-<strong>EN</strong>DU PRÉLÈVEM<strong>EN</strong>T À LA SOURCE SUR INTÉRÊTSAnnexe au formulaire n°5000 12816*01VOUS ETES UNE PERSONNE MORALESi vous pouvez bénéficier de l’exonération prévue par la directiven° 2003/49/CE du 3 ju<strong>in</strong> 2003 (art. 119 quater du CGI) N’oubliez pas de compléter le cadre IIII) A remplir par le créancier II) A remplir par l’établissement payeurN’oubliez pas de compléter les cadres I, II, III et VII du formulaire n°5000Débiteur françaisDésignation du revenuDate demise enpaiementNombrede titresValeurunitaireen €N’oubliez pas de compléter le cadre V duformulaire n°5000Montant del’impôt exigibleen applicationde la conventionen €(col 3 x col 4 xtaux convention)Liquidation de l’impôtMontant del’impôt françaispayéen €(col 3 x col 4 xtaux <strong>in</strong>terne)Montant dudégrèvementdemandéen €(col 5 – col 6)1 2 3 4 5 6 7TOTAUXIII) Déclaration du créancier demandant le bénéfice dela directive n° 2003/49/CE (art. 119 quater du CGI)A PAYERCol 5 – Col 6A REMBOURSERCol 6 – col 5 Je déclare satisfaire aux conditions de participation prévues par la directive n° 2003/49/CE du 3 ju<strong>in</strong> 2003 demande enconséquence l’exonération de retenue à la source au titre des <strong>in</strong>térêts de source française perçus .………………………………………………...Date and placeSignature du créancier ou de son représentant légal