FDI - Motilal Oswal

FDI - Motilal Oswal FDI - Motilal Oswal

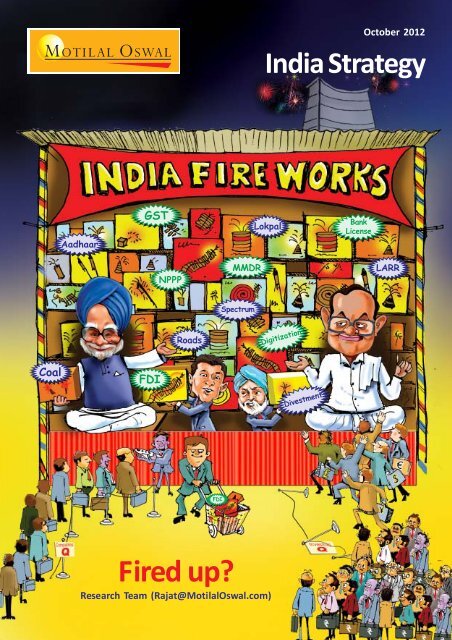

- Page 6 and 7: India Strategy | Fired up?MARKETSIn

- Page 8 and 9: -2 -3 -5 -9 -9 -12-13India Strategy

- Page 10 and 11: India Strategy | Fired up?• This

- Page 12 and 13: India Strategy | Fired up?A few fac

- Page 15 and 16: India Strategy | Fired up?INR appre

- Page 17 and 18: India Strategy | Fired up?Collapse

- Page 19 and 20: India Strategy | Fired up?PPA revie

- Page 21 and 22: India Strategy | Fired up?Loan grow

- Page 23 and 24: India Strategy | Fired up?#4 Teleco

- Page 25 and 26: India Strategy | Fired up?• Thoug

- Page 27 and 28: India Strategy | Fired up?FY14 Earn

- Page 29 and 30: India Strategy | Fired up?However,

- Page 31 and 32: India Strategy | Fired up?• Withi

- Page 33 and 34: India Strategy | Fired Up?Valuation

- Page 35 and 36: India Strategy | Fired Up?• We re

- Page 37 and 38: India Strategy | Fired Up?• We ha

- Page 39 and 40: India Strategy | Fired Up?could als

- Page 41 and 42: India Strategy | Fired Up?Our prefe

- Page 43 and 44: India Strategy | Fired Up?Key Risks

- Page 45 and 46: India Strategy | Fired Up?United Ph

- Page 47 and 48: India Strategy | Fired Up?Key Risks

- Page 49 and 50: India Strategy | Fired Up?MOSL mode

- Page 51 and 52: India Strategy | Fired up?Sectoral

India Strategy | Fired up?MARKETSIndian equities – Top performer in CY12 YTDIn 3QCY12, Indian markets yielded 8% return QoQ, after an almost flat 2QCY12. Withthis, the BSE Sensex is up by 21% YTD CY12, and among the best performing marketsglobally. As the recent series of reforms led to significant appreciation in currency,USD return of Sensex at 22% is also among the best.With this performance, India now trades at a marginal premium to the rest of theglobal markets, well supported by an expected rebound in FY14 corporate performance14% earnings growth coupled with a strong 17% RoE. The confidence of FIIs hasremained intact throughout CY12, despite a significant slowdown in macroeconomicparameters. They have bought another USD16b of Indian equities, while DIIs havebeen big sellers to the extent of over USD7b.Indian markets grew 8% in 3QCY12 after a flat 2QCY121661318 23 311120920171118 1712149No negative quarters in 2012 to date,despite several challenges facing theeconomy and corporate sector182 0 1132130816 18 -2-19-6-8-10-4-14-6-5-4-14-23 -25-5 -3 -6-13Sep-01Mar-02Sep-02Mar-03Sep-03Mar-04Sep-04Mar-05Sep-05Mar-06Sep-06Mar-07Sep-07Mar-08Sep-08Mar-09Sep-09Mar-10Sep-10Mar-11Sep-11Mar-12Sep-12World Equity Indices CY12YTD (local currency, %) World Equity Indices 3QCY12 (local currency, %)India - Sensex21Brazil9S&P 50015South Korea8MSCI EM9India - Sensex8India is amongst the topperforming marketsglobally in 2012South KoreaTaiwan99MSCI EMS&P 50067Japan5Taiwan6Russia MICEX4UK3Brazil4Chi na3UK3Russia MICEX2China (HSCEI)-1Japan-2October 2012A–4

India Strategy | Fired up?World Equity Indices CY12 YTD Perf (%) in USDWorld Equity Indices 3QCY12 Perf (%) in USDIndia - Sensex22India - Sensex13S&P 50015South Korea11South Korea14Brazil8Taiwan13Taiwan8MSCI EM9MSCI EM7Even in USD terms, India'sperformance has beenamongst the better onesRussia MICEXUKJapan477Russia MICEXUKS&P 500667China (HSCEI)-1Chi na (HSCEI)3Brazil-4Japan1India v/s World: Richer valuations supported by superior growth and profitabilityGlobal Indices EPS growth and PEGlobal Indices P/B and RoE58PE (x) CY13 / FY14 EPS Growth CY13/FY14 (%)910 10 10 12 13 13 13140.61.1P/B (x) CY13 / FY141.1 1.2 1.2 1.3RoE (%) CY13 / FY141.5 1.6 2.0 2.32.6-2Russia15China17Korea811 12 918Average P/E :10.9x32 Average EPS Growth: 14.7%BrazilUK-FTSEHongKongUS-S&P500SingaporeIndonesia14India28Taiwan11 121315Average P/B :1.5xAverage RoE: 13.6%RussiaBrazilKoreaChina12HongKong10Singapore15UK-FTSE11Taiwan16US-S&P50017India19IndonesiaSectoral Performance for 3QCY12 (%) Sectoral Performance for CY12 YTD (%)Pvt-Ba nks15Pvt-Ba nks43RealEstate11Consumer36Consumer10Capita l Goods36Auto10PSU-Ba nks35Healthcare9RealEstate34Banks and Consumer havebeen the top performersin 2012CapitalGoodsSensexBSEMid-CapOil9877BSEMid-CapHealthcareAutoSensex29282821PSU-Ba nks4Oil15Utilities3Utilities14Technology3Meta l13Metal-2Technology3Telecom-8Telecom-17October 2012A–5

-2 -3 -5 -9 -9 -12-13India Strategy | Fired up?Sensex Stock Performance CY12 YTD (%)60 54 50 47 47 40 38 35 34 27 23 21 21 20 19 19 19 15 11 11 9 5 4 4 3 0-1 -4 -6 -8-23L&T, ICICI Bankthe top performersin CY12L&TICICI BankTataMotorsHDFCBankMarutiSunPharmaSBIITCHULM&MTataPowerSENSEXRelianceTataSteelCoalIndiaCiplaHDFCBajaj AutoTCSSterliteONGCNTPCDr Reddy'sHindalcoBHELGAILHeroMotoWiproJSPLInfosysBhartiSensex Stock Performance 3QCY12 (%)22 20 20 18 18 17 15 14 13 12 10 9 9 8 6 5 5 43 2 1 1 1 0M&MCiplaHULHDFCICICI BankBajajAutoMarutiL&TRelianceInd.HDFC BankTataMotorsSunPharmaGAILSENSEXBHELNTPCITCSBICoal IndiaTataPowerTCSInfosysHindalcoDrReddy'sONGCSterliteWiproJSPLTataSteelHero MotoBhartiTrend in net FII Investment (USD b)Annual Trend1.5 2.7 0.7CY00CY01CY026.7 8.6 10.8 8.1CY03CY04CY05CY06Trend in net DII Investment (USD b)Annual Trend3.75.416.95.317.8CY07-12.2CY0817.6CY0929.3CY105.9-0.5CY1116.1CY12 YTDIndian institutional investors have beennet sellers of equities Jan-09 to dateQuarterly Trend-1.3-2.4-3.36.4 7.4 5.2 4.42.312.610.10.1 0.8 -1.0 -0.4 9.1Sep-08Dec-08Mar-09Jun-09Sep-09Dec-09Mar-10Jun-10Sep-10Dec-10Mar-11Jun-11Sep-11Dec-11Mar-12Jun-12Sep-12Quarterly Trend3.0 3.22.1 2.41.80.4 0.5 0.82.4 2.10.8 0.60.10.56.9CY06CY07CY08CY09-4.7CY10CY11-7.4CY12YTD-2.2-3.4-4.4-5.2Sep-08Dec-08Mar-09Jun-09Sep-09Dec-09Mar-10Jun-10Sep-10Dec-10Mar-11Jun-11Sep-11Dec-11Mar-12Jun-12Sep-12October 2012A–6

India Strategy | Fired up?MACRO ECONOMYRe-starting the policy engine; <strong>FDI</strong> in limelightFurther growth catalysts: Lower deficits, improved flows, monetary easingThe UPA-2 government had significantly disappointed the Indian markets byabstaining from any critical policy decisions to improve the looming macroeconomiccrisis - industrial production slump, high inflation, high interest rates, depressedinvestment climate and damaged global perception of India.India has a track record of initiating far-reaching reforms only when faced withextreme crisis. With a precipitous fall in the Indian rupee coupled with a ratingdowngrade staring India, the government finally bit the proverbial bullet with achange in Finance Minister and a series of policy measures, even at the cost ofsevering ties with the largest ally, TMC (Trinamool Congress led by Mamta Banerjee).<strong>FDI</strong>This, in turn, has catalyzed a slew of measures in the last few weeks that has led toan improvement in sentiment. These measure include (1) fuel price hike,(2) opening/relaxing <strong>FDI</strong> in multi-brand retail, aviation, broadcasting, (3) Cabinetapproval to raise <strong>FDI</strong> in insurance and pension fund, (5) easing of fundraising abroad,(6) proposed GAAR implementation, etc. It also appeared to wade through thepolitical fallout of these measures.Simultaneously, the government also sought to give a thrust to development byfinalizing the 12th Plan, putting in place a mechanism to monitor large infrastructureprojects at the PMO level, developing an airport hub, international airports, etc.While reality will take a lot longer to reflect the first round of reforms, and requireseveral more follow-up initiatives, the perception has undoubtedly started changingfor the better. To some extent, this is visible in INR appreciation, revival of flowsand market sentiment.In this backdrop, we attempt to reassess three factors that can act as significantcatalysts for further economic revival(1) fiscal situation(2) domestic flows into equity markets, and(3) possible shift towards a more accommodative monetary stance.A. Fiscal deficit slippage to be of lower order than envisaged earlierOctober 2012YTD FY13 fiscal situation has remained stressful• So far, the current financial year has displayed weaknesses on the fiscal front,with receipts falling short of expenditure, widening the fiscal gap (23% YoY).• On the receipts side, while tax revenue was buoyant (21% YoY), non-tax revenue(9% YoY) and capital receipts (-50% YoY) fell with spectrum sale and disinvestmentyet to take off.• On the expenditure front, subsidy ballooned resulting in highest ever non-planspend as a share of full-year budget in 15 years at 43%. Curtailment of planexpenditure (12% YoY) was not enough to bring the overall spending as apercentage of full-year budget at 38% higher than the long period average (LPA)of 35%.A–7

India Strategy | Fired up?• This resulted in the deficit indicators surpassing their 15-year averages by a fairlywide margin. Fiscal deficit reached 66% of full year target (v/s LPA of 52%) whilethe same for revenue deficit was as high as 79% (v/s LPA of 68%).• All these resulted in our prediction of a large fiscal slippage placed at 5.9% of GDP(as against the budgeted 5.1%), taking it closer to the FY12 level, indicating nofiscal correction YoY. If the current trend would have continued, the worst casefiscal deficit could stand as high as 6.3%.While tax trends have kept up with LPA, total receipts have lagged behindAs % of Budgeted Amount45%35%25%15%5%Tax Revenue (Ne t)Total Receipts5MFY985MFY995MFY005MFY015MFY025MFY035MFY045MFY055MFY065MFY075MFY085MFY095MFY105MFY115MFY125MFY13Highest ever non-plan expenditure along with lower than LPA plan expenditureAs % of B udgeted AmountNon-Plan Expenditure Plan Expe nditure Total Expe nditure48%44%40%36%32%28%24%20%5MFY985MFY995MFY005MFY015MFY025MFY035MFY045MFY055MFY065MFY075MFY085MFY095MFY105MFY115MFY125MFY13Deficit indicators stay well above the long period averageAs % of Budgeted Amount200%150%100%50%0%Fiscal DeficitReven ue De ficit5MFY985MFY995MFY005MFY015MFY025MFY035MFY045MFY055MFY065MFY075MFY085MFY095MFY105MFY115MFY125MFY13October 2012A–8

India Strategy | Fired up?Our initial fiscal deficit estimate for FY13 pegged it at 5.9%6.55.54.53.52.51.55.10.60.30.20.1-0.35.9FY13BEa dd fuelsubsidyadd food, fert.,droug htadd shortfallin spectrumadd shortfallindisinvestmentminus cashcarry forwardFY13EDivestmentRoadsSpectrumCoalSlew of measures taken may take fiscal deficit to GDP ratio to 5.5% in FY13• The recent policy measures taken by the government, however, have changedthe deficit outlook significantly for the remaining part of FY13.• As a first measure, the government increased the price of diesel and capped thesubsidized quantum of LPG, along with rationalization of taxes, resulting in a netgain of INR100b to the exchequer.• To kick-start the disinvestment program, the government has shortlisted four PSUs.Besides, it is considering alternative and fast track mode of disinvestment throughstrategic sale of Hindustan Zinc, Balco and SUUTI. All these may take thedisinvestment proceeds higher than the budgeted amount of INR300b.• The government has also alerted PSUs to transfer their huge cash reserves asspecial dividend or undertake fresh investment. Either way, it would help bridgethe fiscal gap.• As evidenced by recent experiences, the provision of planned expenditure hasexceeded actual expenditure by a fair margin. Continuation of this trend wouldprovide a cushion of INR200b buffer to spillover of non-plan spend, especially onsubsidies.• The recent Supreme Court opinion on Presidential reference has possibly givenadditional levers to the government for meeting its resource sale targets(eg. Spectrum, land, coal mines etc).• The above measures undertaken and contemplated have led us to reduce ourfiscal deficit estimate to 5.5% of GDP from 5.9% earlier. Further, we expect noadditional borrowing, as the extent of fiscal slippage is small and can be met byrecourse to short-term borrowing.Recent policy measures have rekindled hope of containing slippage at manageable levels6.5As % of GDP6.05.55.04.55.90. 10. 1 0.25.54.0FY13 - Earlierestimatelessdisinve stmentless lower oilbillless lowerplanexpenditureFY13E - Revis edOctober 2012A–9

India Strategy | Fired up?A few factors that can alter the fiscal scenario dramaticallyDisinvestment i) Government approved disinvestment of four PSUs includingthree mining and one OMC. This would mobilize INR150b.ii) Vedanta Group increases the offer for strategic sale ofHindustan Zinc and Balco to INR220b.iii) SUUTI stake sale to garner INR200b.Planned expenditureA curtailment in plan expenditure would free up sizable resources.For example, in FY12, planned expenditure grew 12.6% against 16.5%growth provided in the budget. A 4% scaling back on 22% growth inplan expenditure in FY13 would free resourses to the tune ofINR200b, or 0.2% of GDP.Special dividend from PSUs The nine cash rich PSUs have significant cash balance with them.Even if a part of this is ploughed back to the government, it wouldreduce fiscal deficit.Spectrum saleThe government has budgeted ~INR400b out of telecom spectrumsale. The recent Supreme Court opinion on Presidential referencehas possibly given additional levers to the government for meetingits resource sale targets (eg. Spectrum, land, coal mines etc).Expect fiscal consolidation in FY14 despite higher welfare bill• The fiscal consolidation attempt is likely to be carried forward to FY14, aided by afew additional factors.• We expect GDP growth to revive to 6.5% in FY14 from 5.8% in FY13. In the past, wehave seen that revenue buoyancy improves on the back of higher GDP growth.Imputing this trend, the tax-GDP ratio in FY14 should touch FY09 levels (close to8%), but be lower than the levels seen during the FY07-08 peak (8.2-8.8%).• Reform in petroleum product prices together with the oil and INR outlook wouldresult in lower petroleum subsidy bill in FY14 to INR660b than INR1.1t in FY13. Thiswould create the necessary headroom for implementing the Food Security Bill (ifonly on a limited scale to begin with) even if the principle of limiting subsidies to2% of GDP is broadly adhered to.• Additionally, as witnessed during the previous episode of fiscal correction, theplanned expenditure growth may be pruned to only 14-15% if need be.• These three factors, viz., higher revenue buoyancy on account of faster growth,reduction in petroleum subsidy and cutback on planned expenditure would seeFY14 fiscal deficit ratio improving to 4.5% to GDP as envisaged in the revised fiscalconsolidation framework (FRBM).With better growth in FY14, tax-GDP ratio is expected to inch up1086420Tax-GDPGDP growthFY90FY91FY92FY93FY94FY95FY96FY97FY98FY99FY00FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12REFY13BEFY14EOctober 2012A–10

India Strategy | Fired up?Containment of oil subsidy would create headroom for Food Security Bill and still keep subsidybill within 2.2% of GDPFertilizer Foo d Petroleum Oth ers Sub sidy a s % o f GDP (RHS)3,00032,00021,000100FY12RE FY13BE FY13E FY14EIndia plans to come back to revised FRBM track5.76.2 5.94.53.9 4.03.32.56.0 6.44.75.75.34.53.9FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12FY13EFY14 - FRBMFY15 - FRBMB. Likely revival of flows to equity market• Even during strong years for equity markets, a low share of savings actually getschannelized to the same.• While the average share of household equity investments stands at 5% of financialsavings, it goes down to half of that level and less than 2% when taken as a shareof household savings and overall savings of the country as a whole.• Even within that, there is a wide variation, with household savings as a percentageof financial savings varying between a negative 0.9% to a high of 12.8% in the lastdecade.• In recent years, flows to equity market (comprising of investments from mutualfunds, insurance, etc.) have been negligible due to GDP slowdown and nonperformanceof the domestic equity market.• With the revival in growth and recent market performance, interest in equitymarket should revive.• The government in recent weeks has been in active engagement with the domesticmutual fund and insurance sectors to initiate reforms and revive inflows. This,along with the likely drop in interest rates and improved GDP growth, shouldcreate a positive backdrop for domestic flows into Indian equities. These flowstypically come in phases, and the next 3-4 years could be one such significantlypositive phase.October 2012A–11

India Strategy | Fired up?INR appreciation would reduce the gap betweencommodity price trends in India and abroadCore inflation would go below 5% again by March 2013, if INRappreciates to 52 in 2HFY1320Ro gers USD (Yo Y %) Ro gers INR (YoY %)10India's core inflationRogers INR (RHS)40108250610‐104‐5‐202‐20Jan‐12Feb‐12Ma r‐12Apr‐12Ma y‐12Jun‐12Jul‐12Aug‐12Sep‐12Oct‐12Ma r‐10Ma y‐10Jul‐10Sep‐10Nov‐10Jan‐11Ma r‐11Ma y‐11Jul‐11Sep‐11Nov‐11Jan‐12Ma r‐12Ma y‐12Jul‐12Sep‐12Nov‐12Jan‐13Ma r‐13Inflationary pressures may ease somewhat on INRappreciation and easing commodity pricesLiquidity is coming close to neutral zone now9.0%8.5%8.0%7.5%7.0%6.5%FY13E ‐ EarlierFY13E ‐ Revise d900400‐100‐600‐1100LAF bala nce (ne t reverse repo ) (LHS)3mth CP rates (RHS)1272‐36.0%‐1600‐8Apr‐12Ma y‐12Jun‐12Jul‐12Aug‐12Sep‐12Oct‐12Nov‐12Dec‐12Jan‐13Feb‐13Ma r‐13Apr‐ 10Jun‐10Aug‐ 10Oct‐10Dec‐10Feb‐11Apr‐ 11Jun‐11Aug‐ 11Oct‐11Dec‐11Feb‐12Apr‐ 12Jun‐12Aug‐ 12LatestRBI would consider improved fiscaloutlook for monetary easing5.1FY13BE5.9FY13 (Earlierexpectations)5.3FY13 (Currentexpectations)Expect RBI to cut rates going forward9%8%7%6%5%4%3%Jan‐116.25%Feb‐11Ma r‐11Re po RateApr‐11Ma y‐11Jun‐11Jul‐116.00%Aug‐11Sep‐11Oct‐11Cash Res erve Ra tio8.50%Nov‐11Dec‐11Jan ‐125.50%Jan‐12Feb‐12Ma r‐12Mar‐124.75%Apr‐12Ma y‐12Jun‐12Apr‐128.00%Jul‐12R BI surprisedthe mktAug‐12Sep‐12Sep‐124.50%Oct‐12Nov‐12Oct‐127.50%Oct‐124.00%Dec‐12October 2012A–13

India Strategy | Fired up?INVESTMENTAddressing logjam the next big challengeRequires more involved decision making process• After a long hiatus during which the government was widely criticized for policy inaction,and the opposition and coalition politics too were blamed for stalling key reforms, thegovernment seems to have tightened its belt to streamline the decision making process.• The first round of reforms has centered around <strong>FDI</strong> approvals, subsidy rationalization anddiscussions on improving capital market flows.• The next big challenge is to address the investment logjam. However, unlike the initial setof reforms that have been largely addressed through policy decisions, the investmentphase requires a more involved decision making process, as land, water, resources, etc,are the prerogatives of the state governments.Crystal gazing: What can possibly revive the investment climate?The investment climate has worsened over the past 18 months due to structuralimpediments, policy uncertainty, persistent inflation and rising interest rates. Webelieve that the government will kick-start its efforts towards reviving the investmentclimate by accelerating public spending. Our action wish list includes:• Successful resolution of the contentious issues in the Power sector (through SEBdebt recast, standard bidding document, and coal price pooling)• Close monitoring of CPSU capex (FY13 investment target at INR1.8t is double thehighest ever - INR931b in FY11)• Take-off of large public expenditure projects (like Dedicated Freight Corridor,railways, urban transport, etc). Addressing structural issues impactinginfrastructure investments has become important.• Acceleration of financial sector reforms, including corporate bond market andaccess to Insurance / Pension money for investment projects. Also, an expenditureswitching strategy is required that reduces government revenue spending bycutting subsidies and steps up capital expenditure to crowd-in private investments.• Successful implementation of the National Investment Board that will provide"single window" clearance. The government has identified 89 projects worthUSD20b for fast track clearance.Rays of hope include…• Decline in global commodity prices• Currency appreciation• Moderation in interest rates• Fiscal consolidation, leading to possible crowd-in of private investmentsSlowdown more pronounced for industry, particularly in core sectorsThe investment climate has worsened over the past 18 months due to structuralimpediments, policy uncertainty, persistent inflation and rising interest rates. Theslowdown has had a pronounced impact on GDP growth rate. Addressing the currentlogjam is the next big challenge.Industrial sector has acted as a continued drag on the overall GDP growth with itscontribution to GDP dropping to 10-20% currently from 30-50% earlier. Moreover,industry has been particularly stuck by the empty middle structure with investmentfacing sectors dragging industrial growth to near zero level.October 2012A–14

India Strategy | Fired up?Collapse in the Industrial growth had triggereda downgrade in GDPEmpty middle structure continues to haunt1612Share of Industry in overall growth (%, RHS)Industry growthGDP growth604520100FY11 FY12 YTDFY13840FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12Jun-11Sep-11Dec-11Mar-12Jun-1230150-10-20Basic goodsCapitalgoodsIntermediategoodsConsumergoodsDurablesNondurablesStructural issues impacting growth remain unaddressedThe next big challenge is to address the investment logjam, but this is easier said thandone. Unlike the initial set of reforms that have been largely addressed throughpolicy decisions, the investment phase requires a more involved decision makingprocess, as land, water, resources, etc, are the prerogatives of the state governments.Execution is the key challenge, as several structural issues impacting growth remainunaddressed.We identify the key structural issues in core segments like Utilities, Metals, Financials,Telecom, Oil & Gas and Infrastructure:#1 UTILITIES: Initial steps encouraging, but new investments sometime away#2 METALS & MINING: Huge investments stuck; will require close monitoring#3 FINANCIALS: Loan growth moderating; revival will ease asset quality concerns#4 TELECOM: Spectrum pricing and allocation, conducive M&A policy critical#5 OIL & GAS: Rational product pricing, gas reforms imperative#6 INFRASTRUCTURE: Creating conducive environment for large scale development#7 MEGA PROJECTS: DFC, railways, urban transport can accelerate investment spend#1 UtilitiesInitial steps encouraging, but new investments sometime awayThe Indian Utilities sector has seen step-up in capacity addition under the 11th Plan to52GW v/s ~20GW in the earlier plan period. However, the fuel supply ramp-up, bothfor coal and gas projects has been below par, impacting project economics.Additionally, higher commercial losses of DISCOMs have also impacted affordability,investments in T&D and growth in demand for power.Over the last 12 months, the Prime Minister's Office (PMO), Ministry of Petroleum(MoP) and Ministry of Coal (MoC) have taken several measures to put the sector backon track. These include (1) financial restructuring plan (FRP) for DISCOMs, (2) steps toenhance rake availability / easing of environment norms to help ramp up domesticcoal production, and (3) steps being taken to formulate new bid document, whichwould have fuel cost as pass-through under tariff. While these measures areOctober 2012A–15

India Strategy | Fired up?encouraging, their successful implementation would first boost current/upcomingcapacity additions under the 12th Plan. We believe new investments in the Powersector, particularly by the private sector, are still sometime away. Private developersmight face issues, given higher DER, existing PPA/FSA issues, ventures like overseasmine acquisition, etc.(a) DISCOMs: Weakest link in value chain but recent initiatives to driveimprovementCommercial losses atINR600b+-209-271-319-537-635-669-596FY06FY07FY08FY09FY10FY11EFY12EKey measures that will drive improvementParticularsRemarksTariff increase Loss making states like Tamil Nadu, Rajasthan and Haryana have raisedtariffs. UP too has filed tariff petition. Fuel adjustment on quarterly basis.State regulator empowered to carry out suo moto tariff hike.FinancialState government (50%) and lenders (50%) to recast debt of INR1.9t.restructuring plan Conditions include (1) abolition of any gaps between revenue and cost, (2)(FRP)annual tariff revision, (3) audit of books, (4) reduction in T&D losses, etc.Central government support of INR240b for debt to be assumed by state.Incentive-based scheme for T&D loss reduction.LT powerHigher availability at lower rates given sizable capacity addition.availability /ST power cap ST power procurement monitored and now through bids only.Cap on ST procurement as also regulatory approval.OUR VIEW: PositiveImpact of above measures• DISCOMs would have higher cash inflows through tariff, while moratorium wouldprovide cushion in cash outflows, which would drive growth in power demand.• Lenders relatively secured now, as state government is made party torestructuring - should start incremental disbursement/growth.• Kick-start investment in T&D sector, as reduction in AT&C losses is a preconditionto avail benefits.(b) Fuel, PPA issues at the forefront; domestic production ramp-up is key;new bid document to allow fuel cost pass-throughShortfall in meeting capacity addition beyond FY10FSA Qty Cumulative Requirement CIL's total OLD FSA Supply to ShortfallQuantity @ 80% supply Comm.# new FSAFY10 24 24 19 298 274 24 0FY11 25 49 39 304 274 30 -9FY12 72 121 97 312 274 38 -59FY13E 40 161 128 347 274 73 -55FY14E 44 205 164 377 274 103 -61FY15E 47 252 201 407 274 133 -68#Assumed old FSA will be given coal only up to 90% ACQ levels till FY09. * Calculatedassuming 65% domestic supply and 15% import for 80% trigger level are sacrosanct numbersOctober 2012A–16

India Strategy | Fired up?PPA review soughtDeveloper Cap (MW) RemarksAdani Power 1,000 GUVNL PPA signed at INR2.39/unit is proposed to be reviewedJSW Energy 300 PPA with MSEDCL under contest, given change in Indonesian lawsTata Power 4,000 Mundra UMPP tariff review sought; INR0.67/unit increase on levelizedtariff bid of INR2.26/unitReliance Power 4,000 Krishnapatnam UMPP progress halted due to Indonesia priceregulationLanco Infratech 600 Amarkantak project PPA in dispute with state over cost, tariff cap, etcJaiprakash Power 1,000 Karcham Wangtoo project PPA under review due to cost escalationKey measures taken to address issuesParticulars RemarksCoal production CEPI and No-Go hurdle removedRake availability enhancedGreater focus on captive coal developmentMandate to sign FSA to bring accountabilityPPAsReview taken up for discussion at various levelsAuditor General's view sought - PPA can be reviewedNew bid document under preparation - bid on capacity charge ONLY, fuel costpass-throughOUR VIEW: Steps in right direction; would watch for milestone/improvementImpact of above measures• Coal India's production has begun to look up - production/dispatches up 7.6%/6.2% YTD FY13 v/s near-zero growth in FY12. Domestic coal supply improvementto enable low cost power availability to DISCOMs.• Coal price pooling would be inevitable to tide over domestic shortfall throughimports - states' consent crucial.• New projects would have significantly lower risk, as developers bid on capacitycharge and fuel cost pass-through - an important enabler to kick-start investmentprocess.• Captive coal block development now being monitored and developers madeaccountable; several instances of de-allocation, forfeiture of bank guarantees.#2 Metals & MiningHuge investments stuck; will require close monitoringMetals & Mining is another sector that will require close monitoring to restart theinvestment cycle. The huge investments made by various companies are stuck atdifferent levels. Various projects of Vedanta, Hindalco, JSPL, JSW Steel, Tata Steel, etcstill face delays because of issues relating to land acquisition, mining clearances,availability of water, etc. These issues are yet to be addressed in the current wave ofreforms. Vedanta has served notice for its closure, as it is unable to source bauxitedespite proximity to mines in Odisha and has already run losses of INR25b. Operatingassets are closing down and projects are getting delayed.October 2012A–17

India Strategy | Fired up?The following examples highlight the deteriorating state of investmentsEconomic activity/Projects IssuesMahan 359ktpa smelterCoal block was allocated in JV with Essar Energyand 900MW CPPin 2006. Production was expected to start in2009. The Mahan Coal Block was declared inno-go area in 2010. EGOM gave the coal blockstage-I forest clearance in May 2012.Mining ban in GoaJSPL, Angul(Greenfield project)Iron ore mining in Goa is largely meant forexports. The low grade ore can be used afterblending it with high grade ore. High cost oflogistics makes it unviable for Indian steelproducers. Ineffective administration wasunable to check illegal mining. The ShahCommission report made numerousallegations. Clueless state and centralgovernments put a blanket ban on mining,impacting even the disciplined players.JSPL's 1.6mtpa steel expansion in Angulinvolves a coal gasification based DRI plant.The Utkal B1 coal mine is essential for theprofitability of the project.Current statusINR86b has already been spent from the totalINR107b. Without stage-I approval, productionis not expected in the next two years. Theproject NPV is negative without captive coalblock. There is no further communication bythe government on coal block clearance sinceMay 2012.The Goa government temporarily suspendedall mining operations in the state inSeptember. In a tug of war between the stateand the center, the MoEF later suspendedenvironmental clearances for iron ore mines.This has complicated the matter further forrestart of mining in the state.JSPL is yet to sign mining lease despite mostapprovals in place for the last one year. Theissue keeps moving between the state andcentral governments, as officials are reluctantto take any action in light of the controversyover various mine allotments. The mantraseems to be "no decision is a good decision".#3 FinancialsLoan growth moderating; economic revival will ease asset quality concernsDearth of deployment opportunities leading to moderation in loan growth: Given thebackdrop of slowing economic growth, policy logjam and issues related to documentalclearances, corporate capital spending has slowed down significantly. CMIE dataindicates that new project investments in FY12 have declined 35% and are lower thanin FY07. The deceleration continued in 1HFY13 as well, with new investments decliningby as much as 50% YoY. This has also translated into moderate loan growth, withdeceleration in key sectors like Infrastructure (especially Power), Metals and Services.New project additions slowing down Incremental loan growth decelerating (INR b)Quarterly project additions in the quarter ended September2012 lowest since June 2004Added Revi ved Shelved DeletedOn a quarterly basis, incremental loans decelerated in FY12except in 4Q and the trend of deceleration continues in FY13FY08 FY09 FY10 FY11 FY12 FY138,0006,0004,0002,00001,6341,461-874372565611,1091,454791171605561,2111,0661,4993,4012,1702,1541,1242,2021,7673,279Mar-10May-10Jul-10Sep-10Nov-10Jan-11Mar-11May-11Jul-11Sep-11Nov-11Jan-12Mar-12May-12Jul-12Sep-121Q 2Q 3Q 4QOctober 2012A–18

India Strategy | Fired up?Loan growth has moderated across key segments (%)YoY GrowthIncremental ContributionMar-09 Mar-10 Mar-11 Mar-12 YTD* Mar-09 Mar-10 Mar-11 Mar-12 YTD*Loans 17.8 16.6 20.8 17.2 4.4 100.0 100.0 100.0 100.0 100.0Industry 20.9 24.4 23.6 21.3 2.4 45.6 58.4 48.1 53.9 24.3within whichInfrastrcuture 31.5 40.7 38.6 17.6 9.8 16.1 24.9 22.8 14.4 31.4Of which Power 30.9 50.9 43.3 22.2 19.3 7.3 14.4 12.7 9.3 32.8Of which Telecom 31.5 18.0 69.2 -6.8 -13.6 3.0 2.1 6.4 -1.1 -6.5Of which Roads and Ports 36.5 56.3 25.8 23.6 13.9 3.1 6.0 3.0 3.4 8.2Metals 19.7 26.5 28.8 21.8 12.7 5.3 7.8 7.3 7.1 16.8Textiles 6.5 18.2 19.2 10.4 -5.6 1.6 4.2 3.6 2.4 -4.6Services 18.3 12.5 23.9 14.7 -0.3 24.9 18.3 27.1 20.6 -1.9Real Estate 48.4 -0.3 21.4 7.8 -9.6 7.5 -0.1 3.1 1.4 -6.0NBFCs 31.3 14.8 54.8 26.3 20.3 5.9 3.3 9.7 7.2 23.2Personal Loans 10.1 4.1 17.0 12.1 13.6 12.9 5.3 15.5 13.0 53.9Housing Loans 9.3 7.7 15.0 12.1 18.7 5.9 4.9 7.0 6.5 37.3Agriculture 23.8 22.9 10.6 13.5 2.1 16.2 17.6 6.9 9.7 5.8* till August 2012: annualizedCost of funds in the system needs to be lowered: With inflation being relatively stickyand above comfort zone, RBI has refrained from aggressive cuts in repo rate. Headlineinterest rates have remained at an elevated level. This is also reflected in higher termdeposit cost (+160bp YoY) for banks under our coverage. Coupled with sharp fall inincremental CASA ratio (especially due to decline in CA deposits), cost of funds forthe banking system has gone up significantly. With the current growth-inflationdynamics and government actions being pro-growth, it is important for interest ratesin the system to go down to boost the improving sentiment.Incremental CASA ratio lowestReduction in CRR to bring down negativein a decade (%) Cost of deposits has increased (%) carry by 3-4bps48.344.850.337.629.9 34.2 36.123.219.510.08.57.05.54.0Cos t of Depos i tsCos t of Term Depos i tsRepo RateNega tive Carry on CRR0 3 6 9 13161922262933364043475054FY04FY05FY06FY07FY08FY09FY10FY11FY12FY04FY05FY06FY07FY08FY09FY10FY11FY120.00.51.01.52.02.53.03.54.04.55.05.56.06.57.07.58.0Repo rate/CRR cut would help the cause: Under the current base rate regime, forlending rate to decline, it becomes imperative for cost of funds to go down first.However, with repo rate at the current level of 8%, it is unlikely that term depositrates (blended rate at ~8% v/s 6.5% in FY11; implies that cost of incremental termdeposits is even higher) would decline. Hence, RBI action in the form of reduction inrepo rate and CRR is warranted, which could ease pressure on systemic interest ratesand in-turn, a gradual decline in lending rates as well. Government action along withsupportive actions by the RBI is a must to combat the slowdown in the economy.October 2012A–19

India Strategy | Fired up?How did we derive incrementalcost of deposits (includingnegative carry) of 8.7%?• Incremental SA ratio of20% and CA ratio of 0%(due to sharp moderationin corporate profitabilityand better treasurymanagement). Thusweighted average CASAcost stood at 0.4%• Share of retail termdeposits in overalldeposits at 60% and costof deposits at 9%, thusweighted average cost ofdeposits at 5.4%• Share of bulk deposits at20% with the cost ofdeposits at 9.8%, thusweighted average cost ofdeposits at 1.96%• Negative carry on accountof CRR (50bp) and SLR (at8% Yield on Investmentsat 10bp)Incremental cost of fund have increased in the system5.4Retail TD Cost0.1-ve Carry onSLR0.5-ve Ca rry onCRRStress loans ex-AI and SEBs have increased 110bp v/s reported increase of 280bp:Stress loans for state-owned banks (MOSL coverage) have increased to 7.7% in 1QFY13as compared to 4.9% in FY11. However, it is important to note that restructuring of SEBand Air India (state-owned entities) loans constituted bulk of the stress loans (1.7%),excluding which the increase would have been 110bp. The stated stress loans appearhigher even on account of loans restructured prior to FY10 (2.1% of loan book), whichwould be eligible for removal from the restructured loan category if the MahapatraCommittee recommendations on restructuring are approved in the current form.Stress loans would decline significantly to 3.8% (ex-AI and SEBs) as against headlinenumbers of 7.7% (6% ex-AI and SEBs).0.82.08.7CASA Cos t Bul k Dep. Cos t Incr. Cos t ofDep.SEB and AI forms bulk of new restructer loans( %) 1QFY11 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 3QFY12 4QFY12 1QFY13NNPA 1.1 1.1 1.1 1.1 1.2 1.5 1.6 1.5 1.8OSRL 4.2 4.1 4.0 3.8 3.8 3.8 4.1 5.3 6.0Of which AI and SEB - - - - - - 0.1 1.2 1.7Of Prior to FY10 - - - - - - - 2.1 2.1OSRL ex AI and SEB 4.2 4.1 4.0 3.8 3.8 3.8 4.0 4.2 4.2Stress loans 5.3 5.2 5.1 4.9 4.9 5.3 5.7 6.8 7.7Stress Loans ex AI and SEB 5.3 5.2 5.1 4.9 4.9 5.3 5.6 5.6 6.0Stress Loans ex AI and SEB and - - - - - - - 3.5 3.8loans restructured prior to FY10Growth revival will assuage asset quality concerns: The key feature of the currenteconomic slowdown is that it is particularly severe for the industrial sector. IIP growthdecelerated to 3.1% in FY12 and is expected to decelerate to sub-2% in FY13. This isimportant from the Banking sector's perspective because the industrial sector accountsfor ~45% of bank loans and improvement in economic growth could help assuage a lotof asset quality issues. Within Industry, we note that the proportion Power sectorloans has increased to 7.5% in FY12 as against 4.2% in FY08. There could be increasedstress in Power sector loans. However, the silver lining of the government's seriousintent to improve the health of SEBs and resolve issues relating to the Power sectorcould be a big boost to the health of banks.October 2012A–20

India Strategy | Fired up?#4 TelecomSpectrum pricing and allocation, conducive M&A policy criticalOver FY07-12, private telecom operators invested ~USD60b, including the outlay for 3Gand BWA spectrum. Hypercompetition and lack of regulatory clarity has significantlyimpacted the return ratios of all operators, with the challengers currently incurringsignificant losses. Listed operators require an RPM increase of 12-64% to reach even thebase RoCE level of 12%. Further investments in the sector have been curtailed due tolow returns and lower availability of funding due to stressed balance sheets of mostoperators. Investment activity is unlikely to resume, unless balance sheets get repaired.RPM increase required to reach 12% RoCE (FY13 basis)Bharti (India & SA) Idea RComAvg Capital Employed (INRb) 783 272 692EBIT for 12% ROCE (INRb) 140 49 124Wirelss traffic (b min) 997 556 426Wireless revenue (INRb) 444 231 185EBIT (INRb) 75 26 29Wireless RPM (INR) 0.43 0.41 0.43Incremental EBIT required (INRb) 66 22 95Incremental revenue required (INRb) 82 28 119Incremental RPM required (INR) 0.08 0.05 0.28Wireless RPM required (INR) 0.51 0.46 0.71% increase required 19 12 64Some of the initiatives that the government can take to restore financial health of thesector are:1) Clear policy on spectrum pricing and allocation, with visibility on roadmap for allspectrum blocks to be made available in the future2) Putting all available spectrum to auction upfront rather than creating artificialscarcity by putting limited amounts for auction3) Conducive M&A policy which can support transfer of spectrum from inefficientoperators to efficient ones4) Negotiation-based settlement on 3G intra-circle roaming and Vodafone tax case5) Removal of policy overhangs like spectrum re-farming that might result insignificant operational disruption as well as financial burden for the industry#5 Oil & GasRational product pricing, gas reforms imperativePetroleum product under-recoveries have been continuously rising in the last fewyears, led by increasing oil prices and a depreciating rupee. Gross under-recoveriesfor FY13 are likely to be at a new high of INR1.6t v/s INR1.4t in FY12. However, with oilprice at ~USD110/bbl and the rupee appreciating, the outlook for the sector appearsbetter. More importantly, over the years, the Indian economy has acquired increasedresilience to high oil prices and high under-recoveries. If the average oil price were toremain at USD105-110/bbl in FY13/FY14, the import bill as well as subsidy estimate asa percentage of GDP would be well below FY09 levels, when oil prices had averagedat USD85-90/bbl. Recent steps by the Indian government to hike diesel prices andlimit subsidized LPG cylinders are bold (though inevitable!), in our view. Further policyfollow-up by fast-tracking the implementation of subsidy through cash transfer ispositive.October 2012A–21

India Strategy | Fired up?Oil @ USD110 now is oil @ USD85-90 in FY09Brend Oil price (USD/BL)1209060300Brent Crude Price (USD/bbl) - LHSNet petroleum imports (% to GDP)Petroleum Subs idy (% to GDP)FY99FY00FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12FY13EFY14E9.06.54.01.5-1.0Oil imports & subsidy(% to GDP)India's high oil dependence (~80%)overshadows the increased resilienceof the Indian economy to high oilprices and high under-recoveries.Brent price of USD110/bbl now…India's net oil import bill andgovernment subsidy burden as apercentage of GDP… is similar to Brent at USD85-90/bblin FY09Model diesel price hike of INR2/liter in FY14, exchange rate of INR54/52/USD for FY13/14Rational petroleum product prices imperative for healthy economic growth:Controlling (under-pricing) petroleum products not only results in inefficiencies suchas (i) substitution of low value products (e.g. fixed price diesel replacing marketpricedfuel oil), and (ii) adulteration, but also impacts (a) India's energy security, (b)financial health of oil companies (increased debt, reduced profitability), and (c)government finances (high fiscal deficit). If India's GDP were to grow by 9%, energyconsumption would grow by 6-7%. Rational energy prices are necessary for healthyeconomic growth. They would also incentivize domestic producers to increase theirproduction.Under-recoveries and their sharing (INR b) Sensitivity of under-recoveries to oil price/exchange rate (INR b)Auto FuelsDomestic FuelsTotal1,5771,3851,2031,033773780 812 968575 461695426375144347 458 316 405 573 610 508FY08 FY09 FY10 FY11 FY12 FY13EFY14E1,8001,2006000-600OMC's sharingOil Bonds/CashUpstreamTotalFY08FY09FY10FY11FY12FY13EFY14E2,0001,5001,0005000Gross Under recoveries (INRb)80* 90* 100* 105* 110* 120*50 191 296 709 921 1,134 1,55852 216 447 888 1,109 1,330 1,77154 242 609 1,068 1,297 1,526 1,98556 296 772 1,247 1,485 1,722 2,19858 441 934 1,426 1,673 1,919 2,411Brent (USD/bbl)*Fx Rate (INR /USDRecent policy actions are positive• The recent Kelkar Committee report had recommended immediate price hikesand had also provided a roadmap of policy goals to reduce under-recoveries.‣ Diesel: Aim to eliminate half the diesel subsidy per unit in FY13 and theremaining half over FY14.‣ LPG: To eliminate LPG subsidy by FY15 by reducing it by 25% by FY13, with theremaining 75% over the next two years.‣ Kerosene: To reduce the subsidy by one-third by FY15.October 2012A–22

India Strategy | Fired up?• Though government has been largely aware of the path required to reduce underrecoveriesand in turn the subsidy burden, it has not been able to follow a clearroadmap. Nevertheless, despite all the political constraints, the government hasin part put itself on a path to reduce under-recoveries. Few of its steps include:‣ Decontrol of petrol prices (with small hiccups, petrol is now largelyderegulated).‣ Limiting of subsidized LPG cylinders (real impact would be seen over themedium term).‣ Subsidy by cash transfer to beneficiaries' accounts (reduce leakages and subsidythrough direct targeting). For instance, a study by NCAER indicates that ~40%of the PDS kerosene is diverted for non-PDS use.Gas price reforms to boost domestic production: Domestic gas price has beenhistorically controlled by the government. Against the price of imported gas at USD11/mmbtu, domestic gas price is limited at USD4.2-5.7/mmbtu. The last hike inadministered gas price was in June 2011, post KG-D6 gas pricing. With domestic gasprices at a significant discount to imported gas prices, there is little incentive forupstream companies to invest at the fixed gas price of USD4.2/mmbtu. Also, thebreakeven price for new deepwater discoveries in the country is pegged at USD5-6/mmbtu.While there is no clear policy roadmap to increase or rationalize domestic gas price,we expect the next price revision to take place in sync with the scheduled pricerevision for KG-D6 gas in March 2014 or earlier in view of declining KG-D6 productionand dire need for gas in India. Though it would be difficult to estimate the likely pricerevision, it is easy to identify the beneficiaries. Higher gas price is likely to facilitatethe development of RIL's discoveries in KG-D6 and NEC-25, but from the earningsperspective, we believe ONGC will be the largest beneficiary.ONGC's EPS is more sensitive to increase in gas price than RIL'sGas Price (USD/mmbtu) 4.2 6.0 7.0 8.0 9.0Exchange rate (INR/USD) 55.0 55.0 55.0 55.0 55.0Gas Price (INR/mscm) 8,085 11,550 13,475 15,400 17,325ONGC - FY14 basisStandalone gas sales (mmscmd) 53 53 53 53 53Standalone gas sales (bcm) 19 19 19 19 19Incremental PBT (INRb) - cumulative 67 104 141 178Incremental PAT (INRb) - cumulative* 45 70 95 119Incremental EPS (INR/sh) - cumulative 33.4 5.2 8.1 11.1 14.0% increase over base FY14 EPS 16 24 33 42RIL - FY14 basis; 60% stake in KG-D6Gas production (mmscmd) 25.0 25.0 25.0 25.0 25.0Gas production (bcm) 9.1 9.1 9.1 9.1 9.1Incremental PBT (INRb) - cumulative 19 30 40 51Incremental PAT (INRb) - cumulative** - 15 24 32 40Incremental EPS (INR/sh) - cumulative 69.7 5.2 8.1 10.9 13.8% increase over base FY14 EPS 7 12 16 20* Full tax rate assumed; **tax rate of 20% assumed; Sensitivity would be in favor of RIL if itsproduction increases beyond 40mmscmdOctober 2012A–23

India Strategy | Fired up?#6 InfrastructureCreating conducive environment for large scale developmentInfrastructure spending in India was targeted at USD500b (7.5% of GDP) under the11th Plan, up from USD227b in the 10th Plan (5% of GDP). The initial estimate for the12th Plan suggested infrastructure spending at USD1t, representing 9% of GDP. Theshare of the private sector was expected to increase from 24% in the 10th Plan to36.2% in the 11th Plan and to 51% in the 12th Plan. This, in our view, is difficult, withseveral policy/regulatory hindrances, lack of established models for PPP framework,lack of initiatives to establish long-term funding for the sector, etc. Except for theRoads sector, other major areas of infrastructure are languishing. In Roads too,developers, particularly those that bid aggressively, are witnessing financial crunch.#7 Mega projectsDFC, railways, urban transport can accelerate investment spendTake-off of large public expenditure projects (like DFC, railways, urban transport, etc)has become important at the current juncture. In this context, the ruling coalitionregaining control over the Railway Ministry (contributing ~12% of the infrastructurespending in 12th Plan) raises hopes of an accelerated spending program.• Urban infrastructure development is now becoming an important priority, giventhe haphazard urbanization in various cities. There are 30 cities in India with apopulation of over 2m each, and according to the Planning Commission, thesecities might implement Metro Rail at some stage or the other. There are 14 citieswith a population of over 3m each and 7 cities with a population of over 5m each.Several of these cities are actively planning Metro Rail. Delhi has completed itsMetro Rail project, while Bangalore has opened a section. Metro Rail projects areunder construction in Chennai, Kolkata, Mumbai, Jaipur and Hyderabad. Duringthe 12th Plan (FY13-17), the Working Group of Urban Transportation estimatesinvestments in Metro Rail projects at INR1.3t.• Capacity addition in transport infrastructure (particularly railways) sinceindependence has been woefully inadequate. The railway route kilometers haveincreased at a CAGR of 0.3% and running track kilometers at a CAGR of 0.7%. Incomparison, net ton kilometers have increased at a CAGR of 4.5%. This has led tomassive pressure on the existing infrastructure, and the accumulated deficienciesare acting as key growth bottlenecks for several segments. Coal availability topower projects has been impacted, given the evacuation constraints, though CoalIndia continues to carry a large inventory of 60m tons. There is an urgent need toaddress the logistics issue, given that a large part of India's mineral resources islocated in the eastern states of Jharkhand, Chhattisgarh and Orissa, while westernand southern India are the major consumption and industrial centers. IndianRailways has planned a steep increase in spending in the 12th Plan to INR5t+ v/s~INR2.2t in the 11th Plan, but funding remains a key challenge.• The Dedicated Freight Corridor (DFC) is an important project that attempts topartly correct the under-investment in railway infrastructure, and we expectproject awards to commence in FY13. The project is being funded by multilateralagencies from Japan and World Bank. Hence, funding is not expected to be amajor challenge. We believe that the DFC combined with the Delhi MumbaiIndustrial Corridor will have a meaningful multiple effects on the economy.October 2012A–24

India Strategy | Fired up?FY14 EarningsEarly signs of a rebound in earnings growthSensex EPS growth reverts to LPA of 15%; Earnings downgrades bottoming out• Expect FY14 earnings growth of 14%• Sensex EPS growth has reverted to LPA of 15%• Is FY14 the beginning of a new earnings cycle? There are some early signs:#1 Earnings downgrade cycle has bottomed out#2 Our FY14 assumptions far from aggressive#3 FY14 earnings mix is less vulnerable than that of FY13 initial estimates#4 More stocks have a bias for earnings upgrade than downgradeExpect FY14 earnings growth of 14%Our bottom-up estimates for the MOSL universe of companies (ex RMs) suggests FY14sales growth of 8%, EBITDA growth of 15% and PAT growth of 14%. This growth isdriven mainly by –1. Bounceback in sectors which were affected in FY13 (Auto, Telecom); and2. Steady growth in secular sectors (Consumer, Healthcare, Financials) offsettinglow growth in specific sectors like Oil & Gas, Technology and Capital Goods.Annual Performance - MOSL UniverseSector Sales (INR B) EBIDTA (INR B) PAT (INR B)FY13E FY14E CH. CH. FY13E FY14E CH. CH. FY13E FY14E CH. CH.(%) # (%) @ (%) # (%) @ (%) # (%) @High PAT Growth YoY 5,309 5,989 14 13 952 1,114 9 17 324 420 -6 30Telecom (4) 1,264 1,386 11 10 376 423 4 12 48 73 -23 50Retail (4) 281 328 17 17 27 32 18 21 10 14 18 32Real Estate (11) 232 294 3 26 95 123 2 30 46 60 -1 30Auto (5) 3,532 3,981 16 13 454 537 14 18 219 274 -4 25Medium PAT Growth YoY 8,408 9,308 8 11 2,923 3,436 12 18 1,583 1,865 14 18Media (5) 112 128 11 14 36 41 10 17 17 20 15 20Health Care (17) 880 966 19 10 205 223 17 8 127 152 22 20Others (4) 173 192 10 11 34 39 6 16 19 22 4 19Consumer (12) 1,175 1,360 17 16 247 292 21 18 166 198 20 19Metals (10) 3,962 4,179 1 5 717 844 3 18 381 451 4 18Financials (27) 2,106 2,482 14 18 1,685 1,997 14 19 874 1,022 16 17NBFC (8) 272 323 23 19 265 315 21 19 176 209 19 19Private Banks (8) 484 583 21 20 410 499 22 22 248 294 20 18PSU Banks (11) 1,350 1,576 10 17 1,010 1,184 10 17 449 519 14 16Low PAT Growth YoY 14,216 14,807 15 4 2,695 2,984 8 11 1,675 1,800 9 7Cement (8) 963 1,104 13 15 228 260 20 14 118 134 19 13Utilities (10) 2,185 2,413 15 10 621 726 19 17 384 428 10 11Technology (6) 1,864 2,083 23 12 468 503 22 7 352 382 23 8Excl. RMs (10) 7,546 7,422 14 -2 1,166 1,275 -2 9 677 712 4 5Oil & Gas (13) 16,160 16,193 11 0 1,421 1,577 -2 11 761 810 -4 7Capital Goods (9) 1,659 1,785 9 8 212 222 2 5 144 146 1 1MOSL (145) 36,547 38,875 11 6 6,824 7,837 9 15 3,666 4,184 8 14MOSL Excl. RMs (142) 27,933 30,104 13 8 6,570 7,534 10 15 3,583 4,085 10 14Sensex (30) 9,740 10,314 13 6 1,902 2,160 9 14 1,039 1187 10 14Nifty (50) 10,978 11,605 11 6 2,183 2,474 10 13 1,199 1363 11 14*Growth FY12 over FY11; # Growth FY13 over FY12; @ Growth FY14 over FY13. For Banks : Sales = Net Interest Income, EBIDTA =Operating Profits; Note: Sensex & Nifty Numbers are Free FloatOctober 2012A–25

India Strategy | Fired up?Sensex EPS trend: Distinct boom-bust cyclesSensex EPS growth has reverted to LPA of 15%For the 5 years ending FY13, Sensex EPS CAGR has been muted at 8%. However, itbecomes more interesting when seen from a longer term perspective. India’s longperiodaverage (LPA) earnings growth is 15%. However, the last 20 years’ earnings canbe bracketed into 4 distinct cycles of 5 years each as shown below.1 2 3 4FY93-13: 15% CAGR81FY93-98: 29% CAGR129 181 250 266 291FY98-03: -1% CAGR278 280216 236 272FY03-08: 25% CAGR833718348 450 5231,395FY08-12: 8% CAGR 1,2211,1251,024820 834FY93FY94FY95FY96FY97FY98FY99FY00FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12FY13EFY14EIs FY14 the beginning of a new earnings cycle?Post Cycle 3 i.e. the FY03-08 boom, the 15-year Sensex EPS CAGR scaled up to 17%.However, the slowdown since then has caused the same to revert to the LPA of 15%.Now, our bottom-up earnings estimates for Sensex companies suggest FY14 SensexEPS growth of 14%, close to the LPA. The key question: Is FY14 the beginning of a newearnings cycle?A definitive yes or no is tough, given the high level of global and domestic uncertaintyon several macroeconomic and business variables – resolution of Eurozone crisis,GDP growth (both global and for India), commodity prices especially oil, exchangerate, etc. Still, we believe that there are a few early signs that this is a distinctpossibility:1. Earnings downgrade cycle has bottomed out2. Our FY14 assumptions are far from aggressive3. FY14 earnings mix is less vulnerable than that of FY13 initial estimates4. More stocks have a bias for earnings upgrade than downgrade.Early sign #1Earnings downgrade cycle has bottomed outWe introduced our FY13 estimates in December 2010 when bottom-up aggregation ofSensex companies’ PAT suggested FY13 EPS of 1,492. Since then, a combination ofglobal headwinds (mainly sovereign debt crisis in Eurozone) and domestic politicoeconomiclogjam has led to an 18% downgrade in Sensex EPS to 1,218 currently.October 2012A–26

India Strategy | Fired up?However, the pace of downgrade has slowed down considerably. In the last 9 months,Sensex EPS downgrade is less than 4%, and in the last 3 months, there is actually aminiscule upgrade. Equally important, if not more, FY14 earnings estimates have notseen any meaningful downgrade in the last 6 months. Clearly, the last two quartersare some evidence of a possible end to the earnings downgrade cycle.Earnings downgrade cycle seems to have bottomed out for FY13 …FY13 EPS (INR) FY13 EPS Growth YoY (%)15% downgrade in the first 12 months Less than 4% downgradein last 9 months1,492 1,471 1,397 1,337 1,267 1,259 1,218 1,221… and also FY14FY14 EPS (INR) FY14 EPS YoY (%)1,4311,387 1,39514 14 1418 18 18 1714 148 9Dec 10 Mar 11 Jun 11NewSeriesSep 11 Dec 11NewSeriesMa r 12 June 12 Sep 12Mar 12 June 12 Sep 12Bharti, Reliance and Tata Steel led the downgrade of FY13 Sensex EPS1,4923518-13-16-17-18-18-19-20-21-43-54-64-211,221Sensex EPS(Dec-10)CoalIndiaTCSMarutiL&TONGCSterliteSBIBHELNTPCJSPLTataSteelRILBhartiOthers(net)Sensex EPS(Current)Early sign #2Our FY14 assumptions far from aggressiveWe believe most of our underlying assumptions for FY14 estimates are far fromaggressive, impacted by the current macroeconomic slowdown and weak businesssentiment. Thus, in most sectors, key operating metrics are assumed at the samedepressed levels of FY13 or lower e.g. Capital Goods order intake, Consumer revenuegrowth, prices of most metals and oil, credit offtake, credit cost, wireless traffic,power tariff, etc. The only metrics where some recovery is modeled in are Auto/Cement volumes and USD revenue growth for Technology sector.October 2012A–27

India Strategy | Fired up?Key Operating Metrics / AssumptionsFY12A FY13E FY14E RemarksAuto2 Wheeler Volume Growth 12% 3% 12% FY13 volume growth downgraded to 3%4 Wheeler Volume Growth 10% 5% 15% Recovery in FY14 on low base (strike in Maruti’s Manesar plant)CV Volume Growth 19% 8% 14% M&HCV to grow -2.5%/+12% in FY13/FY14, LCVs 15%/15%.Capital GoodsAvg order intake growth (%) -26% 21% 8% Industrial capex, orders to remain sluggish on high cost of capital.CementVolume Growth (%) 7.0 8.0 10.0 FY14 volumes to be driven by pre-election developmental activities,Price Change (INR/bag) 23.0 20.0 10.0 as well as demand from individual housing.ConsumerValue Growth (%) 19.0 17.0 16.0 Marginally revised the gross margin assumptions upwardEBITDA Margins (%) 20.0 21.0 21.0FinancialsCredit Growth (%) 17.0 16.0 16.0 Unchanged as investment climate is yet to improveCredit cost (% of average loans) 0.9 1.0 1.0 We continue to build higher credit cost in FY14MediaAd Revenue Growth (%) 2 10 12 Ad growth to recover in FY13 on a low base and improve in FY14MetalsSteel (USD/ton) 863 720 672 Domestic steel price assumptions lowered by 10%-15% given sluggishAluminium (USD/ton) 2,346 1,996 2,100 demand, significant decline in RM prices and increased threat ofCopper (USD/ton) 8,501 7,898 7,500 cheaper imports, especially from China.Zinc (USD/ton) 2,121 1,910 2,000 No major change in Base metals assumptions.Oil & GasBrent Oil Price (USD/bbl) 114.5 110 105 High uncertainty in oil market fundamentals: demand growth (peggedat 0.8mmbbl/d in 2012, 2013), geopolitics (Iran situation, US election).OPEC (ex Iran) producing at historically high levels.Singapore GRM (USD/bbl) 8.3 8.0 8.0 Unless meaningful closures happen. GRMs unlikely to rise above USD7-9/bbl. Global operating rates (ex of US) are likely to remain low led bylower demand and commissioning of new refineries.TechnologyUSD Rev. Growth (top-tier) 21% 12% 16% Sluggish beginning to CY12 marred growth rates for FY13. ContinuedUSD / INR 48.2 54.5 53 budget spends albeit at a slower pace imply some pick up in growth inFY14, though still not enough to match that in FY12TelecomWireless traffic growth (%) 16 11 8 Wireless traffic growth to impacted by withdrawal of promotions andlower subscriber additionsRPM change (%) -0.9 -1.9 2.4 Pricing pressures to recede on corrective actions by the industryUtilitiesMerchant Power Rate 3.5 4.0 4.0 Our assumptions for Utilities sector remain unchangedPLF 66 67 67Early sign #3FY14 earnings mix is less vulnerable than that of FY13 initial estimatesWe compared the FY14 earnings mix with that of our initial FY13 initial estimates(which saw sharp downgrades subsequently). We believe that the current earningsmix has lower likelihood of major downgrades. Our key observations:• Earnings mix has marginally improved in favor of domestic plays over global plays.• More importantly, with both domestic and global plays, share of non-cyclicals hasincreased. Thus, share of overall non-cyclical earnings has increased from 55% inFY13IE (initial estimates in Dec-2010) to 60% for FY14E.October 2012A–28

India Strategy | Fired up?• Within Domestic Non-cyclicals, the share of Telecom is lower in FY14E vis-à-visFY13IE, whereas share of Financials, Utilities and Consumer is higher.• Likewise, within Global cyclicals, share of volatile Oil & Gas and Metals is lower,whereas share of Tata Motors (which has majorly turned around) is higher.• Finally, there is no chunky contributor to the build-up of Sensex EPS from 1,221for FY13 to 1,395 for FY14. This, we believe, further reduces the risk of downgradedue to adverse developments in 1-2 companies.FY14 earnings mix suggests FY13 kind of downgrades unlikely to recurMOSL Universe PAT mix (%) Sensex EPS mix (%)FY13IE FY13CE FY14E FY13IE FY13CE FY14EDomestic Plays 57 54 55 48 48 49Domestic Non-cylical 47 45 47 41 43 44Financials 24 24 25 16 18 19Utilities 9 11 10 11 13 13Auto Ex Tata Motors 4 3 3 6 5 6Telecom 4 1 2 4 1 2Consumer 4 5 5 4 5 5Others 3 1 1 - - -Domestic Cyclical 10 9 9 6 5 4Capital Goods 5 4 4 6 5 4Cement 3 3 3 - - -Real Estate 2 1 2 - - -Global Plays 43 46 45 52 52 51Global Non-Cyclical 12 13 13 14 16 16Technology 9 10 9 12 14 13Health Care 3 4 4 2 3 3Global Cyclical 32 33 32 39 36 35Oil & Gas ex RMs 18 19 17 24 23 22Metals 11 11 11 11 7 8Tata Motors 3 3 3 4 5 6Total Non-cyclical 58 59 60 55 59 60Total Cylical 42 41 40 45 41 40Total PAT (INR b)/Sensex EPS (INR) 3,934 3,583 4,085 1,492 1,221 1,395Growth YoY (%) 17 10 14 18 9 14IE - Initial Estimates; CE - Current Estimates; Note: Others Include Media, RetailFY14 Sensex EPS build-up is well diversified22 20 16 14 14 12 11 9 8 8 5 5 5 4 4 4 4 3 3 3 2 2 2 2 1 1 11,395-1 -3 -51,221FY13E EPSTata MotorsTata SteelHDFC BankSBIICICI BankHDFCITCONGCInfosysM&MTCSMarutiBhartiBajaj AutoL&TNTPCReliance Ind.HULHindalcoSterlite Inds.Dr Reddy’sHero MotoWiproCoal IndiaSun PharmaCiplaGAILJSPLTata PowerBHELFY14E EPSOctober 2012A–29

India Strategy | Fired up?Early sign #4More stocks have a bias for earnings upgrade than downgradeAs things stand, we believe more stocks in the Sensex are likely to see an upgrade intheir FY14 estimates, based on the impact of recently announced policy measuresand expected macroeconomic developments (e.g. rate cut). More importantly, thestocks account for 48% of aggregate Sensex PAT v/s 24% of PAT for those with potentialdowngrades. Also, stocks like Bharti, Tata Steel and BHEL could see a swing in eitherdirection depending on 1-2 key triggers playing out. Such stocks account for 6% ofSensex PAT.FY14 Sensex EPS: Favorable Upgrade-Downgrade equationPotential Upgrades Potential Downgrades Potential swings either side(48% of Sensex PAT) (24% of Sensex PAT (6% of Sensex PAT)Dr Reddy’ s Labs Coal India Bharti AirtelICICI Bank Hero Motocorp BHELLarsen & Toubro Infosys Tata SteelMaruti SuzukiJSPLNTPCTCSONGCReliance Inds.State BankTata MotorsOctober 2012A–30

India Strategy | Fired Up?Valuations and Model PortfolioIndian markets have staged a strong comeback in September 2012 to end the quarterwith a gain of 8%. Our June quarter strategy report had focused on RAY OF HOPE as weexpected the changing political realignments to lead to some positive reforms. Andindeed, the Indian government, post the monsoon session of Parliament, has pursueda hectic agenda of reforms to kickstart growth and infuse confidence among investorsand corporates.Most of the measures announced till date have been largely confidence boosters.However, the government needs to act now on 2 key issues: (1) Strong steps to curbfiscal deficit, and (2) Re-starting the investment/capex cycle. Concrete actions onboth these fronts hold the key to further re-rating of the markets. Recent currencyappreciation will help ease inflation, and also enable RBI do its bit to stimulate growth.Combined action of government and RBI could lead to upgrades in FY13 GDP growthestimate (currently at 6.5%).Our earnings estimates for FY13 and FY14 have been stable for the last 2 quarters. Webelieve the downgrade cycle is now behind us. Recent government measures alongwith more to come, monetary easing, and stable to declining commodities can driveupgrades going forward. Valuations remain below historical averages (FY14 PE of 13.5xv/s 10-year average of 14.8x). We see more upsides in markets from here.Sensex PE (x): 12-month forwardSensex PB (x): 12-month forward272224.64.83.94.21712710 Year Avg:14.8x10.714.33.02.11.210 Year Avg:2.7x1.62.4Sep-02Sep-03Sep-04Sep-05Sep-06Sep-07Sep-08Sep-09Sep-10Sep-11Sep-12Sep-02Sep-03Sep-04Sep-05Sep-06Sep-07Sep-08Sep-09Sep-10Sep-11Sep-12Indian market Cap to GDP Sensex RoE (%)Average of 62%for the period4226 26 235282 83103559589706525.022.520.017.515.024.210 Year Avg: 20.2%15.817.2FY01FY02FY03FY04FY05FY06FY07FY08FY09FY10FY11FY12FY13ESep-02Sep-03Sep-04Sep-05Sep-06Sep-07Sep-08Sep-09Sep-10Sep-11Sep-12October 2012A–31

India Strategy | Fired Up?We make the following changes in our Model Portfolio for 2QFY13:• We marginally raise our weight in Financials through PSU Banks, and increase ourweight in Autos, and Infrastructure/related sectors• We cut weights in Technology, Consumer and Healthcare.• Our biggest Overweight is Infrastructure & related sectors, and our biggestUnderweight is Consumer.• We have further increased our exposure to mid-caps.Sensex v/s Autos indexSensex v/s Consumer index130Se nse xBse Auto145Sen sexBs e Cons ume r11510013011510085Sep-11Sep-11Oct-11Nov-11Dec-11Dec-11Jan-12Feb-12Ma r-12Ma r-12Apr-12Ma y-12Jun-12Jun-12Jul-12Aug-12Sep-12Sep-12Sensex v/s Bankex85Sep-11Sep-11Oct-11Nov-11Dec-11Dec-11Jan-12Feb-12Ma r-12Ma r-12Apr-12Ma y-12Jun-12Jun-12Jul-12Aug-12Sep-12Sep-12Sensex v/s BSE Mid-caps135Sen sexBs e Ba nke x126Sens exBs e Midcap12011210598908475Sep-11Sep-11Oct-11Nov-11Dec-11Dec-11Jan-12Feb-12Ma r-12Ma r-12Apr-12Ma y-12Jun-12Jun-12Jul-12Aug-12Sep-12Sep-1270Sep-11Sep-11Oct-11Nov-11Dec-11Dec-11Jan-12Feb-12Ma r-12Ma r-12Apr-12Ma y-12Jun-12Jun-12Jul-12Aug-12Sep-12Sep-12October 2012Financials +Financials: Biggest weight; ICICI Bank, SBI top picksFinancials remain the biggest weight in the Model Portfolio (in-line with thebenchmark) as recent policy measures by government and expected monetary easingwill lower asset quality pressures. We have raised our stance to Overweight as webelieve that credit costs have peaked and valuations will gain further.• ICICI Bank is our top bet in the sector. Re-rating of ICICI will be led by expansion inRoEs over the next 2 years coupled with strong capital adequacy of above 10%.Any release of capital in Insurance JV will be an added catalyst.• Among other private banks, we have kept our weights unchanged on HDFC Bankand Yes Bank, despite strong gains in CY12. Fall in deposit rates and growing loanbook will drive earnings for the sector.• SBI remains our second biggest Overweight in Financials. Despite high slippages,the bank has been able to show strong profits and improve RoE. As credit costspeak in FY13, earnings upgrade cycle can be strong for SBI in FY14. Valuations areattractive (FY14E P/B of 1.2x), and the stock could get re-rated in a falling interestrate scenario.A–32

India Strategy | Fired Up?• We retain Union Bank as we expect 22% EPS CAGR over FY12-14 (led by lowercredit costs) and improvement in RoE to 16.9%. Stock trades at 0.7x FY14 book andoffers dividend yield of 4%.• We have removed M&M Financial Services post a strong stock performance.• We have added LIC Housing (valuations now attractive at 1.8xP/B FY14, beneficiaryof fall in rates, and steady business growth).• Power Finance is another addition as SEB loan restructuring eases bad loan worriesand loan disbursements resume. The stock trades at 0.9x P/B FY14.ICICI Bank P/BYes Bank P/B3.32.6P/B (x) Avg(x) Peak (x) Min(x)2.96.04.5P/B (x) Avg(x) Pe ak(x) Mi n(x)4.81.91.71.83.02.22.11.20.50.71.50.00.5Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12SBI P/BLIC HSF P/B2.6P/B (x) Avg(x) Peak(x) Min(x)2.3 3.2P/B (x) Avg(x) Pe a k(x) Min(x)2.12.42.92.0Infrastructure +1.61.61.41.61.21.10.80.80.60.00.5Infrastructure & related: Biggest Overweight; add L&T, Jaiprakash, DLFSep‐07Ma r‐08Sep‐08Ma r‐09Sep‐09Ma r‐10Sep‐10Ma r‐11Sep‐11Ma r‐12Sep‐12Sep-07Ma r-08Sep-08Last quarter, we had changed our stance on Infrastructure and related sectors fromUnderweight to Overweight after several quarters. Now, we have added furtherweight to the sector.• L&T remains the top stock (upgraded to Buy a quarter back) on the back of continuedstrong order intake (led by Infrastructure and Overseas orders), excellent riskmanagement, expected stable margins, and management commitment to correctcapital structure.• We have added our exposure to Jaiprakash as the stock benefits from strongcement realizations, de-leveraging of balance sheet, and fall in interest rate.• DLF is a new addition as it benefits from positive macro, improving operatingleverage and financial de-leveraging. Its favorable near-term market-mix andproduct-mix offer high conviction on meaningful uptick in FY13 sales (we estimate~INR60b v/s INR53b in FY12). Operating cash deficit to improve in FY13 to INR8.1b(v/s INR20.4b in FY12) before breakeven in FY14. Our target price is INR286.Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12October 2012A–33

India Strategy | Fired Up?L&T P/EDLF P/B54P/E (x) Avg(x) Pe a k(x) Mi n(x)10.5P/B (x) Avg(x) Peak(x) Min(x)3645.98.08.85.5180Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-1022.210.1Sep-10Ma r-11Sep-11Ma r-1218.1Sep-123.00.5Sep-07Ma r-08Sep-08Ma r-092.50.9Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-121.4Sep-12Technology –Tech P/E relative to Sensex P/ETechnology: Remain Underweight; concerns on volumes, marginsOur stance on Technology remains Underweight with restricted exposure to Infosysand HCL Tech.• Our FY14 USD revenue growth estimate across the top-tier is 15%, up from 10% inFY13. However, signs of meaningful demand pick-up remain elusive, implyingdowngrade risk to current volume estimates for FY14.• INR has appreciated to 51.75/USD, which could trigger a 4-8% downgrade in ourFY14 EPS estimates (currently based on INR53/USD).• Despite ~22% INR depreciation from 1QFY12 to 1QFY13, margins across the toptierhardly benefited, as the currency gains got reinvested in lower-margincontracts and high-cost workforce onsite. As most of these investments areirrevocable in nature, offsets to margin headwinds appear limited in an appreciatingcurrency environment. Margin sustainability is a key concern.Infosys P/E40200-20-40Technology PE Relative to Se nse x PE (%)23.2LPA o f -2%-32.45.1302418126P/E (x) Avg Pea k (x) Mi n24.717.514.610.4Sep-07Apr-08Nov-08Ma y-09Dec-09Jul-10Jan-11Aug-11Ma r-12Sep-12Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12Oil & Gas –Oil & Gas: Remain Underweight; cut Reliance, add ONGCWe remain Underweight on the Oil & Gas sector.• Expect RIL to deliver strong 2QFY13 earnings led by high GRMs; however, recentrefining margins have again turned weak. Core businesses remain volatile withvery limited upside potential. Upgrade in Reliance could come from hike in gasprices, which remains an event risk. As the stock has delivered a strong return of20% from the recent lows, we have cut our exposure.October 2012A–34

India Strategy | Fired Up?• We have added exposure to ONGC at current levels. Recent policy actions ofdiesel price hike/limiting subsidized cylinders, coupled with appreciating INR/USD, augur well for ONGC as its subsidy burden reduces. Despite subsidy burden,ONGC's RoE is at a respectable 18% level. The stock trades at P/E of 8.4x FY14 EPSof INR33.4, attractive EV/BOE of 5.3x (1P basis; >40% discount to global peers),and offers a dividend yield of 3.5%.Oil & Gas Sector P/EONGC P/B231711520.49.0Oil & Gas Se ctor - PELPA of 12.3x10.03.72.81.91.0P/B (x) Avg(x) Pe a k(x) Min(x)3.12.01.51.4Sep-07Apr-08Nov-08Ma y-09Dec-09Jul-10Jan-11Aug-11Ma r-12Sep-12Consumer: Biggest Underweight; valuations rich; ITC only exposureAfter a massive outperformance, Consumer sector now trades at historical highvaluations relative to the markets. We are Underweight on the sector due to slowingdemand growth led by weakening rural buoyancy. Our only exposure in the sector isITC (which is also an Underweight).Consumer P/E relative to Sensex P/EHUVR P/E16012080400Cons ume r PE Re lative to Sensex PE73 LPA of 50%10105-40Sep-07Apr-08Nov-08Ma y-09Dec-09Jul-10Jan-11Aug-11Ma r-12Sep-12Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12Consumer –362820P/E (x) Avg(x) Pea k(x) Min(x)32.432.424.818.712Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12Healthcare–Healthcare: Cutting weight; hit by recent headwindsWe have reduced our weight on Healthcare, given recent headwinds of new drugpricing policy, currency appreciation, and strong outperformance of the sector YTDCY12.• Our top bet in the sector is Dr Reddy's as we expect strong performance in FY13leading to earnings upgrade; valuations remain attractive.• We continue to like Divi's as it benefits from its core abilities of good chemistryskills coupled with strong customer relationships, leading to ramp-up in orderinflows. Strong order-backed capex and healthy guidance (25% topline growth forFY13) are the key positives from a near-to-medium term perspective.October 2012A–35

India Strategy | Fired Up?Healthcare Sector P/E Dr Reddy's P/E3326191230.0Healthcare Sector ‐ PE (x)LPA of 22.5x15.920.6846444244P/E (x) Avg(x) Pea k(x) Mi n(x)NegativeEarnings Cycle17.824.277.217.8Sep‐07Apr‐08Nov‐08May‐09Dec‐09Jul‐10Jan‐11Aug‐11Mar‐12Sep‐12Sep‐07Mar‐08Sep‐08Mar‐09Sep‐09Mar‐10Sep‐10Mar‐11Sep‐11Mar‐12Sep‐12Autos: Overweight; bet on Tata Motors, Maruti, Bajaj AutoWe raise our weight in Autos to Overweight in this quarter.• Tata Motors is our top bet in Autos and we have further raised our exposure to thestock. JLR volumes will retain volume momentum (15%) and profitability. Domesticvolumes should see recovery in FY14. Strong FCF will further help the balancesheet. Our target price of INR370 has over 40% upside.• Maruti is another top pick as it benefits from currency appreciation and stablecommodity prices including oil. Resolution of labor issues has led to stronger thanexpected volumes recently, driving upgrades. We expect earnings to rebound inFY14 with growth of14%. Our target price has 19% upside.• Within 2-wheelers, we prefer Bajaj Auto as FY14 volumes should grow 13% andmargins remain strong due to hedges at higher levels. Strong cash flow will driveINR300/share cash on books and high dividends. The stock trades at P/E of 14xFY14 EPS.Autos Sector P/EMaruti Cash P/E352729.2Auto Sector ‐ PE (x)1814Ca s h P/E (x) Avg(x) Pe ak(x) Mi n(x)14.9191136.1Autos +9.2LPA of 12x10.9106210.34.4Sep‐07Apr‐08Nov‐08May‐09Dec‐09Jul‐10Jan‐11Aug‐11Mar‐12Sep‐12Jul-03Feb-04Sep-04Apr-05Nov-05Jun-06Jan-07Aug-07Feb-08Sep-08Apr-09Nov-09Jun-10Jan-11Aug-11Feb-12Sep-12Utilities –Utilities: Cutting weight; remove Coal India on multiple concernsWe have cut our weight on Utilities as we remove Coal India from the portfolio.• For Coal India, lower international coal prices coupled with appreciating rupeewill impact PAT from market-linked e-auction sales (15%+ of volume, 40-45% atPBT level). We see risk to our FY13/14E earnings, as current realizations aremarginally higher than FY12 average, and have a downside risk. Importantly, currentearnings already factor superior production/dispatch growth. Negative surpriseOctober 2012A–36

India Strategy | Fired Up?could also come from implementation of MMDR Act. Valuations at 12x FY14E P/E(downside risk to EPS of INR31) and 3.6x P/BV (RoE of 25%) limit potential upside.• NTPC remains our preferred bet as capacity addition delays are now gettingaddressed and FY13-15 could see capacity addition of 4GW per annum v/s historicaverage of 2GW. Over FY12-15, NTPC would add 15GW of commercial capacity,which could drive FY14E EPS to ~INR14 FY14E (18 months from now). The stock istrading attractive at 1.7x FY14E BV of INR103/share.Utilities Sector P/BNTPC P/B4.03.33.7Utilities Sector - PB4.33.6P/B (x) Avg(x) Pe ak(x) Mi n(x)3.72.5LPA of 2.1x2.82.31.81.01.71.62.11.31.51.7Sep-07Apr-08Nov-08May-09Dec-09Jul-10Jan-11Aug-11Mar-12Sep-12Sep-07Mar-08Sep-08Mar-09Sep-09Mar-10Sep-10Mar-11Sep-11Mar-12Sep-12Telecom –Telecom: Wait & watch; concerns, stock prices bottomed out;We had cut our weight in Telecom last quarter and retain the lower weight. Pricingseems to have bottomed-out given renewed industry attempts to raise tariffs andlower promotions/discounting. Significant balance sheet stress, continued high levelof losses for challengers, and potential large payments towards spectrum shouldprevent irrational competition. We await outcome of upcoming 2G spectrum auctionin November which could provide visibility on future competitive structure as well asliability for spectrum payments. While stocks may have bottomed out, we would waitfor the earnings cycle to improve for any change in view.Bharti EV/EBITDAIdea EV/EBITDA16.013.010.07.04.0Sep-07EV/EBDITA(x) Pea k(x) Avg(x) Mi n(x)14.59.16.16.3Mar-08Sep-08Mar-09Sep-09Mar-10Sep-10Mar-11Sep-11Mar-12Sep-12EV/EBDITA(x) Pea k(x) Avg(x) Mi n(x)18.014.010.016.98.66.06.05.52.0Sep-07Mar-08Sep-08Mar-09Sep-09Mar-10Sep-10Mar-11Sep-11Mar-12Sep-12October 2012A–37

India Strategy | Fired Up?Metals –Metals: Underweight; but still like Hindalco, SterliteWe are Underweight on Metals as we have negative outlook for steel stocks, whilebase metal stocks still have to bear near-to-medium term pain of low returns on largeinvestment in greenfield aluminum projects in India. We believe that steel intensityof the world is on decline once again after a decade of high growth. China, which wasthe sole driver of demand, has already achieved high level of per capita steelconsumption vis-a-vis peak levels achieved by developed countries. Historically,decline in world steel intensity has resulted in stock underperformance. We believethat base metal stocks are better placed over steel stocks because (1) monetaryexpansion (e.g. QE3) boosts LME prices, earnings and stock valuations, and (2) thefundamentals of steel pricing are more dependent on return of high fixed assets.• We continue to like Hindalco because its conversion business provides 70% ofoperating cash flows and is insulated from LME volatility. Investments in low RoIaluminum greenfield projects in India have led to the stock's underperformance.We believe current valuations already factor in most negatives. Strong spotpremium and LME have improved earnings outlook. Valuation at 1x P/B FY14Eadjusted for goodwill (RoE 18.5%) is attractive.• We have introduced Sterlite in the portfolio. Sterlite is likely to get re-rated as itsinvestment cycle is now behind and Hindustan Zinc's cash flows after minoritybuy-out will de-stress the balance sheet of merged Sesa-Sterlite. Any visibility onavailability of bauxite in Odisha could be catalyst as well.Hindalco P/BSterlite P/B4.9P/B (x) Avg(x) Peak(x) Min(x)3.2P/B (x) Avg(x) Pe a k(x) Min(x)3.74.52.42.52.52.01.61.41.31.10.80.60.70.10.60.0Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12Sep-07Ma r-08Sep-08Ma r-09Sep-09Ma r-10Sep-10Ma r-11Sep-11Ma r-12Sep-12October 2012A–38

India Strategy | Fired Up?Our preferred mid-capsYes Bank [YES IN, Mkt Cap USD2.6b, CMP INR382]Investment Argument• YES is effectively using the current phase of moderation in economic growth tode-risk and de-bulk its balance sheet, expand its retail franchise, and improve riskmanagement systems. In the process, growth is expected to be lower than historicallevels, but liability mix is likely to improve.• Rapid branch expansion, acquisition of new customers and deepening of existingcustomer relationships would ensure healthy growth across parameters. With50% of the existing branches less than 18 months old, we expect strong productivitygains to occur going forward.• Post deregulation of savings deposit rates, share of SA in overall deposits increasedto 6% v/s ~2% as on 1HFY12 and CASA ratio improved from 11% to 16.3%. Weexpect CASA ratio to further improve to 18.6%/20.9% in FY13/14.• Asset quality of the bank remains one of the best in the industry with stress assetsmerely 0.6% of the loan book.12-month Outlook• As rates decline and liquidity improves, YES (being a wholesale borrower) wouldbe a key beneficiary on margins.• Healthy core income growth, control over opex, and healthy asset quality willdrive PAT growth of 28%.• CRAR stood at 16.5%, with tier-I ratio at 9.2%. We expect the bank to raise capitalover next 12 months, which will further be book accretive.Key Risks• Deterioration in SME business outlook could increase YES's risk quotient.• Delay in capital raising could hurt growth prospects and expansion plans.Valuations• We expect earnings CAGR of 25% over FY12-14. RoA/RoE are expected to be strongat ~1.5%/23%+.• In an easy liquidity environment, the stock can see further re-rating from thecurrent P/B of 1.9x FY14E. Buy.Union Bank [UNBK IN, Mkt Cap USD2.2b, CMP INR208]Investment Argument• UNBK has been able to deliver impressive margins of 3%+ despite higher slippages(which led to higher interest income reversal) and tight liquidity conditions (FY12NIM was 3.2%, down just 10bp YoY). Management expects to maintain 3% margingoing forward led by fall in cost of funds and improvement in asset quality. LoanCAGR is expected to be ~16% during FY12-14 which would lead to similar NII CAGR.October 2012A–39