- Page 2 and 3: International TaxationHandbook

- Page 4 and 5: International TaxationHandbookPolic

- Page 6 and 7: ContentsAbout the editorsAbout the

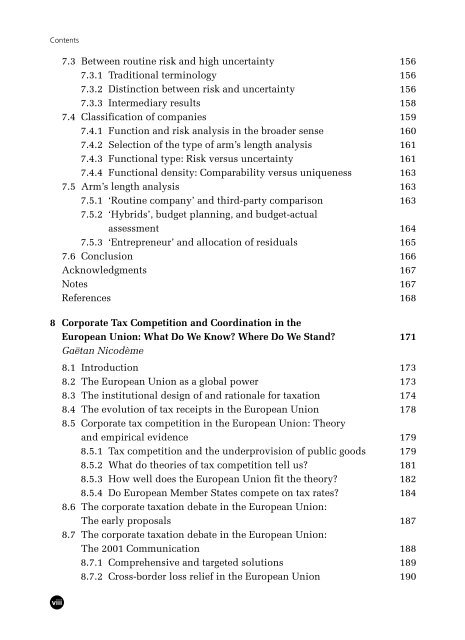

- Page 10 and 11: Contents8.7.3 Transfer pricing and

- Page 12 and 13: Contents13 Money Laundering: Every

- Page 14: About the editorsColin Read is the

- Page 17 and 18: About the contributorsJosé Antôni

- Page 19 and 20: About the contributorsSoviet, East

- Page 21 and 22: About the contributorsHe is a Partn

- Page 24 and 25: 1The Evolution ofInternational Taxa

- Page 26 and 27: Chapter 1AbstractInternational taxa

- Page 28 and 29: Chapter 1international tax policy i

- Page 30 and 31: Chapter 1today’s global marketpla

- Page 32 and 33: 2Summary, Description, andExtension

- Page 34 and 35: Chapter 2AbstractIn this paper we s

- Page 36 and 37: Chapter 2of an optimal investment p

- Page 38 and 39: Chapter 2Sinn (1988) correctly poin

- Page 40 and 41: If the project is financed by debt,

- Page 42 and 43: Chapter 2Defining the efficiency ca

- Page 44 and 45: Chapter 2andIt follows that:NPV*

- Page 46 and 47: appearance of future competitors at

- Page 48 and 49: We can see that the second term in

- Page 50 and 51: Chapter 2Assuming that the economy

- Page 52 and 53: Chapter 2is a difference between th

- Page 54 and 55: This condition, jointly with the pr

- Page 56 and 57: Chapter 2which shows that for very

- Page 58 and 59:

Chapter 211. Note that the firm wil

- Page 60 and 61:

Chapter 2Jacobs, O. and Spengel, C.

- Page 62 and 63:

Chapter 2●worldwide income and re

- Page 64 and 65:

3Empirical Models of InternationalC

- Page 66 and 67:

Chapter 3AbstractMany academic and

- Page 68 and 69:

Chapter 3asset mobility across juri

- Page 70 and 71:

Chapter 3institutions and structure

- Page 72 and 73:

Chapter 3candidate will win and set

- Page 74 and 75:

Chapter 3in the section after next,

- Page 76 and 77:

Chapter 3W is an NT NT block-diago

- Page 78 and 79:

Chapter 3explanations. Finally, thi

- Page 80 and 81:

Chapter 3Researchers interested in

- Page 82 and 83:

Chapter 3and its consensus-democrac

- Page 84 and 85:

Table 3.1Capital tax rates and inte

- Page 86 and 87:

Table 3.3Capital tax rates and inte

- Page 88 and 89:

Chapter 3lag drops from 0.280 to 0.

- Page 90 and 91:

Chapter 3share borders or be geogra

- Page 92 and 93:

Chapter 3Franzese, R. (2003). Multi

- Page 94 and 95:

4Labor Mobility and Income TaxCompe

- Page 96 and 97:

Chapter 4AbstractThis chapter provi

- Page 98 and 99:

Chapter 44.2 ModelFor tractability,

- Page 100 and 101:

Chapter 44.3 AutarkyThe results pre

- Page 102 and 103:

Chapter 4Definition 1. The tax poli

- Page 104 and 105:

two incentive constraints similar t

- Page 106 and 107:

Chapter 4higher, it is easier to pr

- Page 108 and 109:

Chapter 4σ 1σ 2ZAZBZC~σFigure 4.

- Page 110 and 111:

Chapter 4This could have interestin

- Page 112 and 113:

Chapter 4The Lagrangian of the prob

- Page 114 and 115:

Chapter 4We keep the same methodolo

- Page 116 and 117:

Part 2Optimal InternationalTaxation

- Page 118 and 119:

5Taxable Asset Sales inSecuritizati

- Page 120 and 121:

Chapter 5AbstractSecuritization is

- Page 122 and 123:

Chapter 55.3 Bankruptcy remoteness

- Page 124 and 125:

Chapter 5either or both of the abov

- Page 126 and 127:

Chapter 5it is the writing that evi

- Page 128 and 129:

Chapter 5only to equitable interest

- Page 130 and 131:

Chapter 5a sub-trust. This would ef

- Page 132 and 133:

6Globalization, Multinationals,and

- Page 134 and 135:

Chapter 6AbstractThis chapter elabo

- Page 136 and 137:

Chapter 6Transfer pricing refers to

- Page 138 and 139:

Chapter 6the tax base. If, for exam

- Page 140 and 141:

administration, whereas in an APA t

- Page 142 and 143:

Chapter 6Table 6.1Office structure

- Page 144 and 145:

Chapter 6●●●●The selection

- Page 146 and 147:

Chapter 6APAs normally bind both th

- Page 148 and 149:

Chapter 6the transaction cost-effic

- Page 150 and 151:

Chapter 6money subtraction from the

- Page 152 and 153:

Chapter 6with its underdeveloped in

- Page 154 and 155:

Chapter 66.3.5 Factors explaining t

- Page 156 and 157:

Principle of Source-based versus So

- Page 158 and 159:

income taxation tax authorities’

- Page 160 and 161:

Chapter 6●transactions affiliated

- Page 162 and 163:

Chapter 6APAs are intended to suppl

- Page 164 and 165:

Chapter 6p. 65). Tanzi and Zee (200

- Page 166 and 167:

Chapter 6Neighbour, J. (2002). Tran

- Page 168 and 169:

7Documentation of TransferPricing:

- Page 170 and 171:

Chapter 7AbstractGiven the arm’s

- Page 172 and 173:

Chapter 7that as of September 1992

- Page 174 and 175:

Doc.provisionapplicabilitytest (PAT

- Page 176 and 177:

Chapter 7units are made accountable

- Page 178 and 179:

Chapter 7to account for the nature

- Page 180 and 181:

Chapter 7unit of the multinational

- Page 182 and 183:

Chapter 77.4.2 Selection of the typ

- Page 184 and 185:

Chapter 77.4.4 Functional density:

- Page 186 and 187:

Chapter 7function features (cf. Par

- Page 188 and 189:

Chapter 7Further work is needed to

- Page 190 and 191:

Chapter 7Eden, L. (1998). Taxing Mu

- Page 192 and 193:

8Corporate Tax Competition andCoord

- Page 194 and 195:

Chapter 8AbstractThis chapter revie

- Page 196 and 197:

Chapter 8prerogatives to the EU. Op

- Page 198 and 199:

Chapter 8Member States, reflect the

- Page 200 and 201:

Chapter 844%, GDP424038363432Figure

- Page 202 and 203:

Chapter 8matter corporate taxation

- Page 204 and 205:

Chapter 8equilibrium, large Member

- Page 206 and 207:

Chapter 8States and so have tax rat

- Page 208 and 209:

Chapter 8Relative CIT rate change 1

- Page 210 and 211:

Chapter 8problems and other tax-rel

- Page 212 and 213:

Chapter 8Table 8.2 Fiscal consolida

- Page 214 and 215:

Chapter 8locate their production -

- Page 216 and 217:

Chapter 82003a). Because it consist

- Page 218 and 219:

Chapter 8Parry (2003) used a model

- Page 220 and 221:

Chapter 8and tax authorities. In ad

- Page 222 and 223:

Chapter 810. That is, with taxation

- Page 224 and 225:

Chapter 8Clausing, K.A. (1993). The

- Page 226 and 227:

Chapter 8Gordon, R.H. and MacKie-Ma

- Page 228 and 229:

Chapter 8Ruding Report (1992). Repo

- Page 230 and 231:

9Corporate Taxation in Europe:Compe

- Page 232 and 233:

Chapter 9AbstractIn this chapter we

- Page 234 and 235:

Chapter 9Table 9.1 Statutory tax ra

- Page 236 and 237:

Chapter 9the UE-15 countries averag

- Page 238 and 239:

Chapter 9EU’s objective is to ens

- Page 240 and 241:

Chapter 9more burdensome than immed

- Page 242 and 243:

Chapter 9literature dealing with co

- Page 244 and 245:

Chapter 94. Group relief, according

- Page 246 and 247:

Table 9.3 Tax treatment of company

- Page 248 and 249:

Portugal Individual shareholders an

- Page 250 and 251:

Table 9.4 Thin capitalization and a

- Page 252 and 253:

Chapter 9evolution, in which the pr

- Page 254 and 255:

Chapter 9Many experts (e.g Cnossen,

- Page 256 and 257:

Chapter 95. It is worth noting, how

- Page 258 and 259:

Chapter 9Commission of the European

- Page 260 and 261:

10The Economics of TaxingCross-bord

- Page 262 and 263:

Chapter 10AbstractThe deepening glo

- Page 264 and 265:

Chapter 10economics of information

- Page 266 and 267:

Chapter 10The desire to maintain eq

- Page 268 and 269:

Chapter 10information: (i) Benefici

- Page 270 and 271:

Chapter 10international tax evasion

- Page 272 and 273:

Chapter 10consequence of informatio

- Page 274 and 275:

Chapter 10of either providing tax i

- Page 276 and 277:

Chapter 10Table 10.3Overview of jur

- Page 278 and 279:

Chapter 10regime; 26 jurisdictions

- Page 280 and 281:

Taiwan China - 24.7 - 8.1 48.0Denma

- Page 282 and 283:

Chapter 10The range of savings inst

- Page 284 and 285:

Chapter 10owner. Due to tax crediti

- Page 286 and 287:

Chapter 10European Commission (2001

- Page 288 and 289:

11Tax Misery and Tax Happiness:A Co

- Page 290 and 291:

Chapter 11AbstractThis article exam

- Page 292 and 293:

Table 11.1 Tax misery for selected

- Page 294 and 295:

Table 11.2 measures relative tax mi

- Page 296 and 297:

Chapter 11Table 11.4Happiness Index

- Page 298 and 299:

Chapter 11Table 11.5Happiness Index

- Page 300 and 301:

Table 11.6(Continued)Rank Country N

- Page 302 and 303:

Chapter 11Figure 11.2 shows the shi

- Page 304 and 305:

Chapter 11Table 11.9(Continued)Rank

- Page 306 and 307:

Chapter 11Which index is a better m

- Page 308 and 309:

Chapter 1111.7 ConclusionMost of th

- Page 310 and 311:

Part 3Global Challenges andGlobal I

- Page 312 and 313:

12The Ethics of Tax Evasion:Lessons

- Page 314 and 315:

Chapter 12AbstractTransitional econ

- Page 316 and 317:

Chapter 12one must concede that the

- Page 318 and 319:

Chapter 12circumstances, this tax m

- Page 320 and 321:

Chapter 12Table 12.1Combined scores

- Page 322 and 323:

Chapter 12Table 12.2 Ranking of the

- Page 324 and 325:

Chapter 12Table 12.4S no.Wilcoxon t

- Page 326 and 327:

Chapter 12Table 12.7Views by gender

- Page 328 and 329:

Chapter 12(ed.) (1998). The Ethics

- Page 330 and 331:

Chapter 12McGee, R.W. (2005a). The

- Page 332 and 333:

13Money Laundering: EveryFinancial

- Page 334 and 335:

Chapter 13AbstractIn this chapter w

- Page 336 and 337:

Chapter 13institutions. In some cas

- Page 338 and 339:

Chapter 13●●Layering. This is t

- Page 340 and 341:

Chapter 13●●●Private banking

- Page 342 and 343:

Chapter 1313.8 Conclusion: Big Brot

- Page 344 and 345:

14Tax Effects in the Valuation ofMu

- Page 346 and 347:

Chapter 14AbstractThis chapter exam

- Page 348 and 349:

Chapter 14In some countries, to pre

- Page 350 and 351:

Chapter 14Tax benefits could influe

- Page 352 and 353:

Chapter 14The dividends will be pai

- Page 354 and 355:

For companies engaged in rural acti

- Page 356 and 357:

After 2003 and 2004, new rules were

- Page 358 and 359:

Chapter 14Desai, M., Fritz Foley, C

- Page 360 and 361:

15The Economic Impacts of TradeAgre

- Page 362 and 363:

Chapter 15AbstractThis chapter uses

- Page 364 and 365:

Chapter 15is that the USA has nonta

- Page 366 and 367:

Chapter 15while the production set

- Page 368 and 369:

Chapter 15Table 15.1Calibrated tari

- Page 370 and 371:

Chapter 15The tradable output went

- Page 372 and 373:

Chapter 15The aforementioned fall i

- Page 374 and 375:

Chapter 15government needs and not

- Page 376 and 377:

IndexAccounting systemsemerging nat

- Page 378 and 379:

Indexrace-to-the-bottom concerns, 4

- Page 380 and 381:

IndexEffective tax rates (ETRs), 5-

- Page 382 and 383:

IndexGeneral equilibrium model, tax

- Page 384 and 385:

Indexdeindustrialization changes, 5

- Page 386 and 387:

IndexPayPal, 321PCSEs see Panel-cor

- Page 388 and 389:

IndexSpain, 184-91, 212-33, 255-8,

- Page 390:

IndexTucha, Thomas, 7, 111-46, 147-