SRCA MRCA

SRCA MRCA

SRCA MRCA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

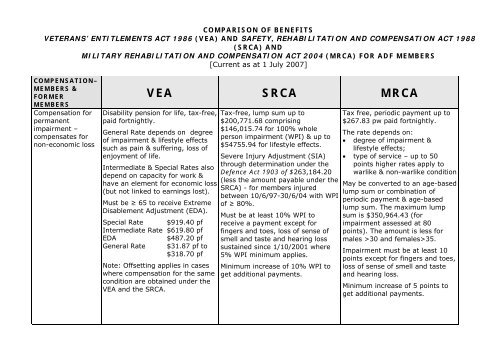

COMPARISON OF BENEFITSVETERANS’ ENTITLEMENTS ACT 1986 (VEA) AND SAFETY, REHABILITATION AND COMPENSATION ACT 1988(<strong>SRCA</strong>) ANDMILITARY REHABILITATION AND COMPENSATION ACT 2004 (<strong>MRCA</strong>) FOR ADF MEMBERS[Current as at 1 July 2007]COMPENSATION–MEMBERS &FORMERMEMBERSCompensation forpermanentimpairment –compensates fornon-economic lossVEA <strong>SRCA</strong> <strong>MRCA</strong>Disability pension for life, tax-free,paid fortnightly.General Rate depends on degreeof impairment & lifestyle effectssuch as pain & suffering, loss ofenjoyment of life.Intermediate & Special Rates alsodepend on capacity for work &have an element for economic loss(but not linked to earnings lost).Must be ≥ 65 to receive ExtremeDisablement Adjustment (EDA).Special Rate $919.40 pfIntermediate Rate $619.80 pfEDA $487.20 pfGeneral Rate $31.87 pf to$318.70 pfNote: Offsetting applies in caseswhere compensation for the samecondition are obtained under theVEA and the <strong>SRCA</strong>.Tax-free, lump sum up to$200,771.68 comprising$146,015.74 for 100% wholeperson impairment (WPI) & up to$54755.94 for lifestyle effects.Severe Injury Adjustment (SIA)through determination under theDefence Act 1903 of $263,184.20(less the amount payable under the<strong>SRCA</strong>) - for members injuredbetween 10/6/97-30/6/04 with WPIof ≥ 80%.Must be at least 10% WPI toreceive a payment except forfingers and toes, loss of sense ofsmell and taste and hearing losssustained since 1/10/2001 where5% WPI minimum applies.Minimum increase of 10% WPI toget additional payments.Tax free, periodic payment up to$267.83 pw paid fortnightly.The rate depends on:• degree of impairment &lifestyle effects;• type of service – up to 50points higher rates apply towarlike & non-warlike conditionMay be converted to an age-basedlump sum or combination ofperiodic payment & age-basedlump sum. The maximum lumpsum is $350,964.43 (forimpairment assessed at 80points). The amount is less formales >30 and females>35.Impairment must be at least 10points except for fingers and toes,loss of sense of smell and tasteand hearing loss.Minimum increase of 5 points toget additional payments.

COMPENSATION– MEMBERS &FORMERMEMBERS (Cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>Incapacity forservice or work –compensates foreconomic lossLoss of Earnings Allowance (LOE)is paid where treatment for anaccepted disability, or attending amedical appointment in relation toa disability, results in an actualloss of earnings which has notbeen compensated from anothersource.LOE tops up the disability pensionto the Special Rate, or, pays theamount of salary, wages orearnings actually lost, whicheveris the lesser amount.Temporary Incapacity Allowance(TIA) is paid where hospital orinstitutional treatment hasresulted in an incapacity for workfor a period of at least 28 days.TIA tops up the disability pensionto the Special Rate.Note: SR, LOE and TIA paymentsare offset by the fortnightlyequivalent of any lump sumreceived under the <strong>SRCA</strong>regardless of whether that lumpsum was for a VEA accepteddisability or not.Weekly, taxable, incapacitypayments for loss of earnings at100% of normal weekly earningsreducing to 75%, after 45 weeks’worth of incapacity payments havebeen paid.Payments cease at age 65Payments offset by anyCommonwealth superannuation theperson receivesWeekly, taxable, incapacity paymentsfor loss of earnings paid at 100% ofnormal earnings reducing to aminimum of 75% after 45 weeks’worth of incapacity payments havebeen paid after discharge.Normal earnings calculation boostedby $123.85 per week for dischargedmembersPayments normally cease at age 65.Payments offset by Commonwealthfunded component of anysuperannuation the member isreceiving.Option to receive Special RateDisability Pension for life ( = to VEASpecial Rate less permanentimpairment compensation) instead ofincapacity payments where member:• has injury or disease assessed as≥ 50 impairment points which islikely to continue indefinitely;• is receiving incapacity payments;and• is assessed as unable toundertake paid work for morethan 10 hours pw and isunlikely to be assisted byrehabilitation to undertake paid workfor more than 10 hours pwNote: <strong>MRCA</strong> incapacity payments made to injured ADF personnel will reflect the ADF pay allowances received at the timethey suffered their injury or contracted their disease. In the case of personnel deployed on peacekeeping or peaceenforcementoperations this will include allowances such as hardship, sea-going etc2

COMPENSATION– MEMBERS &FORMERMEMBERS (cont.)Attendant Services Attendant Allowance paid in casesof service related multipleamputations, blindness, diseaseaffecting the cerebro-spinalsystem or a condition accepted asbeing similar in effect or severity.$129.40 pf (low)$259.10 pf (high)Household Services Low level domestic supportservices according to assessedneed (Gold Card) or assessedneed related to accepted disability(White Card).Up to 15 hours per year of gardenmaintenance (safety related only)and home maintenance.Vehicle purchase,modification,replacement andmaintenanceVEA <strong>SRCA</strong> <strong>MRCA</strong>Vehicle Assistance Schemeincluding up to $39,810 for a newvehicle (only available to certainamputees, complete paraplegics,or someone who has a conditionaccepted as being similar in effectand severity to certain amputees).Modifications necessary foraccepted disabilities.Maintenance allowance towardsrunning costs $1,796.60 pa.Reimbursement of up to $365.03pw for the cost of a personalattendant reasonably required as aresult of the accepted conditions.Reimbursement of up to $365.03pw for the cost of householdservices reasonably required as aresult of the accepted conditions.Reasonable cost of anymodifications to the vehicle whichare reasonably required as a resultof accepted injury.Assistance to purchase a new orsecond hand vehicle may beprovided for someone whosevehicle cannot be modified or whodoes not own a vehicle, and willderive real benefit from the vehicle.Reimbursement of up to $379.22pw for the cost of a personalattendant reasonably required asa result of the acceptedconditions.Reimbursement of up to $379.22pw for the cost of householdservices reasonably required as aresult of the accepted conditions.Reasonable cost of anymodifications to the vehicle whichare reasonably required as aresult of accepted injury.Assistance to purchase a new orsecond hand vehicle will beprovided for someone whosevehicle cannot be modified or whodoes not own a vehicle, and willderive real benefit from thevehicle.3

COMPENSATION– MEMBERS &FORMERMEMBERS (cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>Compensation forloss of, or damageto, property usedby employee whereemployee is NOTinjuredNoClothing Allowance For exceptional wear & tear toclothing due to war or defencecausedconditionLow $5.00 pfMid $7.40 pfHigh $10.80 pfDecorationAllowance andVictoria CrossAllowanceTelephoneAllowanceDecoration Allowance$2.10 pfVictoria Cross Allowance$3444 paFor veterans eligible for:• Special Rate• EDA• disability pensioners receivingan increased amount unders.27 as double amputees;• World War 1 veterans• Commonwealth Seniors healthCard holders• Service pensioners$21.40 pq singles$10.70 pq couples (each)Reimbursement of the cost of Reimbursement of the cost ofreplacing or repairing property used replacing medical aid or applianceby the employee which was lost or used by the employee which was lostdamaged as a result of an accident or damaged as a result of an accidentarising out of and in the course of arising out of and in the course ofemployment, but in which the employment, but in which theemployee was not injured.employee was not injured.NoNoNo - through VEANoNo -through VEAFor members & former memberseligible for:• Special Rate Disability Pension• maximum permanent impairmentcompensation$21.40 pq singles$10.70 pq couples (each)Others can be eligible under the VEAif they are eligible for CommonwealthSeniors Health Card or servicepension4

COMPENSATION– MEMBERS &FORMERMEMBERS (cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>Financial advicecompensationRecreationTransportAllowanceNo Up to $1,315.99available through determinationunder the Defence Act 1903 forfinancial advice obtained bymember eligible for SIA.Paid to veterans suffering fromsevere and permanent war ordefence-caused disabilities (suchas amputations and blindness)that affect mobility, to promoteaccess to recreational activities.The veteran must be able to incurtransportation costs (for example,must be able to be driven in acar).Low rate $34.40 pfHigh rate $69.10 pfNoUp to $1,378.98 for financial adviceobtained by:• a member whose permanentimpairment is assessed at orabove 50 points who is making thechoice between receivingpermanent impairmentcompensation as a lump sum,periodic payment or acombination; or• a member making the choicebetween receiving SRDP orincapacity payments.No5

HEALTH ,TREATMENT &REHABILITATION- MEMBERS &FORMER MEMBERSVEA <strong>SRCA</strong> <strong>MRCA</strong>Treatment foraccepted injury ordisease onlyTreatment for allconditionsRepatriation Health Card – for SpecificConditions (White Card) for thetreatment of accepted disabilities only.Repatriation Health Card – For AllConditions (Gold Card):• eligible for disability pension ≥ 100%of the General Rate;• eligible for disability pension ≥ 50%of the General Rate + any servicepension;• aged ≥ 70 years + qualifying service;• ex-POWs & WWII mariners & eligiblecivilians detained by the enemy;• eligible for disability pension +additional amount under s.27 forspecific service-related amputationsor blindness;• receive service pension & satisfytreatment income & assets reductionlimit;• receive service pension & arepermanently blind in both eyes;• receive service pension & have animpairment rating of ≥ 30 pointsunder the <strong>MRCA</strong>Reimbursement for medicalexpenses for treatmentreasonably required as aresult of accepted injury.NoOngoing medical expenses arisingfrom the accepted medical conditionwill be met through either:• payment of expenses fortreatment reasonably required or• provision of a White Card.Repatriation Health Card – For AllConditions (Gold Card):• permanent impairment rating of60 or more points;• eligible to choose to receive theSpecial Rate Disability Pension.s.85(2) and s.88A of the VEA provide treatment to veterans for certain non-service related conditions. This includes veterans with warlike or nonwarlikeservice post 1/7/20046

HEALTH ,TREATMENT &REHABILITATION- MEMBERS &FORMERMEMBERS(cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>PharmaceuticalbenefitsCost of attendancefor medicaltreatmentRehabilitationHome modificationPharmaceutical Allowance forholders of Repatriation HealthCard - $5.80 pfReimbursement of travel &accommodation at specified rates.Veterans’ Vocational RehabilitationScheme - limited in scope andassistance.Home modifications for acceptedcondition (White Card holders) orany condition (Gold Card holders)where there is a clinical need.Aids and appliances Appropriate aids & appliances for:accepted condition (White Cardholders) or any condition (GoldCard holders) where there is aclinical need.WorkplacemodificationsUnder Veterans VocationalRehabilitation Scheme.Cost of all reasonablepharmaceuticals is reimbursed foraccepted conditionsReimbursement of travel &accommodation at specified ratesfor travel > 50 km return.All rehabilitation required ordeemed appropriate to return theperson to their best possiblefunctioning in their home & worklife.Alterations to the home that arereasonably required due to theperson’s injury.All reasonable cost of aids andappliances reasonably required as aresult of the person’s injury.All reasonable costs for necessaryalterations requested as a result ofthe client’s accepted condition.Pharmaceutical Allowance for holderof Repatriation Health Card-$2.90 pwFor others - cost of all reasonablepharmaceuticals is reimbursed foraccepted conditionsReimbursement of travel &accommodation at specified rates fortravel > 50km return. (Some travel

INCOMESUPPORT –MEMBERS &FORMERMEMBERSVEA <strong>SRCA</strong> <strong>MRCA</strong>Service pensionIncome supportallowancesCommonwealthSeniors Health CardSeniors ConcessionAllowanceVeteran must be:• of qualifying age, bepermanently incapacitated forwork or blind;• have “qualifying service”;• satisfy income and assets test(exempt if blinded)Defence Force Income SupportSupplementCommonwealth Seniors HealthCardFor service pensioners;• rent assistance if rentingprivately subject to income &rent test;• Remote Area Allowance;• Utilities Allowance $106.00 pa;• Telephone Allowance.Available where veteran has‘qualifying service” and alsosubject to age & income testprovides PBS pharmaceuticals atconcession rate, TelephoneAllowance & other concessionsFor CSHC and Gold Card holdersaged ≥ 60 (males) or ≥58(females) & not receiving UtilitiesAllowance - $214.00 paNo -through VEA & subject to VEAeligibility provisions.No but could be eligible throughVEANo but could be eligible throughVEANo but could be eligible throughVEANo -through VEA & subject to VEAeligibility provisions.No but could be eligible through VEANo but could be eligible through VEANo but could be eligible through VEA8

BENEFITS FORDEPENDANTS VEA <strong>SRCA</strong> <strong>MRCA</strong>Compensation forwidow(er)’sTreatment forwidow (er)sWar or defence widow(er)’spension, tax-free war, payable forlife where:• veteran’s death accepted aswar or defence-caused• veteran was an ex-POW• veteran was entitled to SpecialRate or Extreme DisablementAdjustment• veteran was entitled to anincreased rate under s.27 formultiple amputations.Base $506.80 pfSupplemnt $ 18.30 pfNon-indexed $ 25.00 pfNote: For deaths between 10/6/977 1/7/04 are the result of injurysuffered as a result of service,Additional Death Benefit isavailable through a determinationthe Defence Act 1903.War widow(er)’s pension is offsetby other compensation payablefor death – most commonly DeathBenefit payable under the <strong>SRCA</strong>.For those eligible for war ordefence widow(er)’s pensionGold CardDeath Benefit tax-free lump sum of$219,023.62 for widowed partnerwhere liability for member’s deathis accepted. Amount shared withwholly dependent child(ren) if any,but minimum of 75% to spouse.Additional Death Benefit (ADB) taxfree lump sum of $263,184.20 (lessthe amount payable under the<strong>SRCA</strong>) for widowed partner (or adependent child if no widowedpartner) through a determinationunder the Defence Act 1903 wheremember dies between 10/6/97 &1/7/04 from injury suffered as aresult of service & <strong>SRCA</strong> deathbenefit is payable.NoDeath benefit tax free periodicpayment of $275.05 pw for a“wholly dependent partner” of adeceased member where:• liability for the death isaccepted; or• the deceased was entitled tomaximum permanentimpairment compensation orSpecial Rate Disability Pension.The partner may elect to convertthe payment to its lifetimeequivalent in an age based lumpsum. For example, a 29 year oldwidow of a member who died todaywould receive $420,909.01 and awidower would receive$400,307.77.An Additional Death Benefit as anage-based lump sum is providedwhere the death is service caused.The maximum of $114,915.33 isavailable to a widow /er aged 40 orless at the time of the member’sdeath. The lump sum reduces forwidow/ers aged >40 at the time ofthe member’s death.For wholly dependent partnerseligible for death benefitGold Card9

BENEFITS FORDEPENDANTS VEA <strong>SRCA</strong> <strong>MRCA</strong>TelephoneAllowance forwidow(er)sFinancial advicecompensationIncome support forwidow(e’r)’sSeniors ConcessionAllowanceFor those eligible for war ordefence widow(er)’s pension$21.40 pq singles$10.70 pq couples (each)NoIncome support supplement (ISS)income & assets tested where waror defence a widow(er)s:• is of qualifying age;• is permanently blind; orincapacitated for work; or• has a dependant child(ren); or• is the partner of a personreceiving an income supportpensionUp to $156.60 pfIncome support allowances:• rent assistance• Remote Area Allowance• Utilities AllowanceIf aged ≥ 60 (males) or ≥58(females) & not receiving UtilitiesAllowance - $214.00 paNoUp to $1,315.99 available throughdetermination under the DefenceAct 1903 for financial advicewidow/er eligible for ADB.NoNoFor wholly dependent partnerseligible for death benefit$21.40 pq singles$10.70 pq couples (each)Up to $1,378.98 for financialadvice obtained when making thechoice between lump sum orperiodic payment of Death Benefit.ISS through VEANo10

BENEFITS FORDEPENDANTS VEA <strong>SRCA</strong> <strong>MRCA</strong>Compensation fordependent childrenOrphan’s pension & Gold Card forchildren of a veteran where:• veteran’s death accepted aswar or defence-caused• veteran was an ex-POW• veteran was entitled to SpecialRate or Extreme DisablementAdjustment• veteran who was entitled to anincreased rate under s.27 formultiple amputations.Child must be under 16 orbetween 16 & 25 & in full-timeeducation.Orphan’s pension =$79.10 pf if service parentdeceased$158.20 pf if both parentsdeceasedNote: Child of a deceased veteranwhose death was not war-causedbut who had operational servicemay also qualify , if the child isnot being cared for by theremaining parent.Orphan’s pension not payable inaddition to VCES or otherCommonwealth educationassistance.Periodic payment of $72.98 pwwhere liability for the member’sdeath is accepted:Child must be under 16 or between16 & 25 & full time education butnot normally in full-time work &wholly or mainly dependent.Dependant child tax free lump sumof $65,796.06 throughdetermination under Defence Act1903 where member dies between10/6/97 & 1/7/04 from injurysuffered as a result of service:Note: Determination under DefenceAct 1903 also provides $65,796.06for each child dependent a memberwho is eligible for Severe InjuryAdjustment.Death Benefit tax free lump sum of$68, 949.20 for child wholly orpartly dependent on memberwhere:• liability for the death isaccepted; or• the deceased was entitled tomaximum permanentimpairment compensation orSpecial Rate Disability Pension.Child must be under 16 or between16 & 25 & full time education butnot normally in full-time work &wholly or mainly dependent.If the child is wholly or mainlydependent, the following additionalbenefits are provided:• a tax-free periodic payment of$75.84 pw;• a Gold Card;• Pharmaceutical Allowance.Note: These benefits are providedin addition to education assistance.A tax-free lump sum of$68,949.20 is also available for achild dependent on a membereligible for maximum permanentimpairment compensation.11

BENEFITS FORDEPENDANTS(cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>Children’sEducation benefitsVeterans’ Children EducationScheme (VCES) benefits (nonmeanstested) for eligible childrenof:• veteran who receives ordeceased veteran who receivedSpecial Rate, EDA or increasedrate under s.27 for multipleamputations or blindness ;• veterans whose death isaccepted as war or defencecaused• deceased veteran was an ex-POW.VCES has various rates ofeducation allowances:• Primary education rate of$209.70 pa;• Secondary/Tertiary rates rangefrom $43.10 pf for a studentaged under 16 & living at homeup to a maximum $348.10 pwfor those aged 16 to 25, whomust live away from home foreducational purposes (basedon Centrelink Youth Allowancerates.)No - would have to apply foreducation assistance throughCentrelink. These are generallyincome & assets tested.Military Rehabilitation andCompensation Act Education andTraining Scheme (<strong>MRCA</strong>ETS) fordependant children of• a member eligible for maximumpermanent impairmentcompensation or Special RateDisability Pension• a deceased member whereliability for the death isaccepted;• a deceased member who waseligible for Special RateDisability Pension; or• a deceased member who waseligible for maximum permanentimpairment compensation.<strong>MRCA</strong>ETS rates reflect VCES rates.12

BENEFITS FORDEPENDANTS(cont.)VEA <strong>SRCA</strong> <strong>MRCA</strong>Benefits for otherdependantsNoShare of death benefit lump sumamountto certain family members(other than partner & children)wholly or partly dependent on themember immediately before his orher death where liability for themember’s death is accepted.Amount available depends on thefinancial losses suffered by eachdependant as a consequence of thecessation of the member’searnings.Tax-free, lump sum of up to$218,339.14 available fordistribution amongst certain familymembers (other than whollydependent partner & children)wholly or partly dependent on thedeceased member immediatelybefore his or her death where:• liability for the member’s deathis accepted; or• the deceased member wasentitled to maximum permanentimpairment compensation orSpecial Rate Disability Pension.The maximum amount payable toeach person who was whollydependant on the member is$68,949.20.The amount of compensationpayable to each “other dependant”is assessed having regard to:• financial losses suffered by eachdependant as a consequence ofthe member’s death;• degree of their dependency onthe member; and• the length of time thedependant would have remaineddependent on the member butfor the members’ death.13

BENEFITS FORDEPENDANTS(cont)VEA <strong>SRCA</strong> <strong>MRCA</strong>Funeral assistance Funeral benefit up to $2,000where the deceased veteran wasreceiving at the time of death:• Special Rate disability pension;• EDA;• increased rate of disabilitypension under s.27 for multipleamputations; or• was a prisoner of war.Also payable for the funeralexpenses of a veteran:• who died in needycircumstances; or• whose treatment wasprovided under VEA or <strong>MRCA</strong>health care arrangements &who died in an institution;travelling to or from aninstitution; or after dischargefrom an institution in whichs/he was being treated for aterminal illness; or while beingtreated for a terminal illnessat home.• whose death is accepted aswar or defence-caused.Also payable for funeral of a warwidow/er, <strong>MRCA</strong> wholly dependentpartner or a child, of a deceasedmember where the dependantdied in severe financial need.Funeral assistance up to $9,297.00where liability for death isaccepted.Funeral assistance up to $9,297.00where:• liability for the deceasedmember’s death has beenaccepted under the <strong>MRCA</strong>;• the deceased member satisfiedthe criteria for receiving SpecialRate Disability Pension (SRDP)during some period of his or herlife; or• the deceased member wasentitled to maximumpermanent impairmentcompensation immediatelybefore their death.Note: The ADF currently bears thecost of a military funeral of ADFmembers who die in-service. If thecost is borne by the ADF, no funeralassistance will be payable.14

BENEFITS FORDEPENDANTS(cont)VEA <strong>SRCA</strong> <strong>MRCA</strong>BereavementpaymentSurviving partner of disabilitypensioner receives assistanceequal to 6 instalments of thefortnightly rate of disabilitypension that would have beenpayable on the first pension payday after DVA become aware ofthe veteran’s death.Surviving partner of a personreceiving service pension, DFISAor ISS receives assistance equalto the difference between thedaily combined rate of pension ofeach member of the couple lessthe daily rate of pension payablefollowing death, multiplied by 98days – no payment if DVA told ofdeath within 98 days.No.A wholly dependent partner of adeceased member is entitled to abereavement payment where themember was entitled to receive:• incapacity payment;• permanent impairmentperiodic payments; or• Special Rate Disability Pensionat the time of death.The payment is equal to 12instalments of the weekly amountof incapacity payments, permanentimpairment periodic paymentsand/or SRDP payments that thedeceased member was receiving orentitled to receive.15