Annual Financial Statements - First National Bank of Namibia

Annual Financial Statements - First National Bank of Namibia

Annual Financial Statements - First National Bank of Namibia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

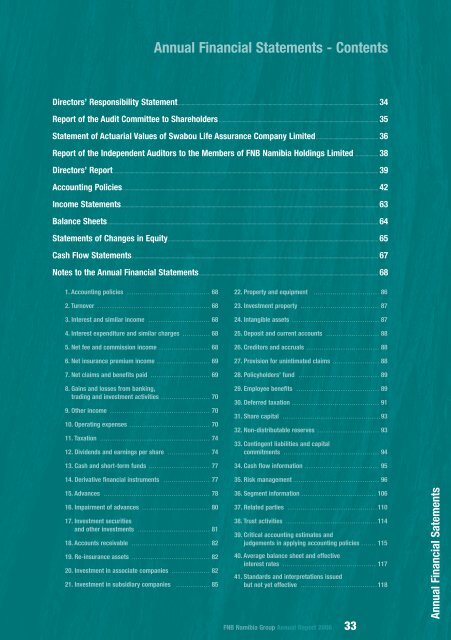

<strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong> - ContentsDirectors’ Responsibility Statement................................................................................................................................................................. 34Report <strong>of</strong> the Audit Committee to Shareholders ................................................................................................................................ 35Statement <strong>of</strong> Actuarial Values <strong>of</strong> Swabou Life Assurance Company Limited .................................................. 36Report <strong>of</strong> the Independent Auditors to the Members <strong>of</strong> FNB <strong>Namibia</strong> Holdings Limited ................... 38Directors’ Report ..................................................................................................................................................................................................................... 39Accounting Policies.............................................................................................................................................................................................................. 42Income <strong>Statements</strong>............................................................................................................................................................................................................... 63Balance Sheets.......................................................................................................................................................................................................................... 64<strong>Statements</strong> <strong>of</strong> Changes in Equity......................................................................................................................................................................... 65Cash Flow <strong>Statements</strong>...................................................................................................................................................................................................... 67Notes to the <strong>Annual</strong> <strong>Financial</strong> <strong>Statements</strong>................................................................................................................................................ 681. Accounting policies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 682. Turnover . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 683. Interest and similar income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 684. Interest expenditure and similar charges . . . . . . . . . . . . . 685. Net fee and commission income . . . . . . . . . . . . . . . . . . . . . . . . 686. Net insurance premium income . . . . . . . . . . . . . . . . . . . . . . . . . 697. Net claims and benefits paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . 698. Gains and losses from banking,trading and investment activities . . . . . . . . . . . . . . . . . . . . . . . 709. Other income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7010. Operating expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7011. Taxation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7412. Dividends and earnings per share . . . . . . . . . . . . . . . . . . . . 7413. Cash and short-term funds . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7714. Derivative financial instruments . . . . . . . . . . . . . . . . . . . . . . 7715. Advances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7816. Impairment <strong>of</strong> advances . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8017. Investment securitiesand other investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8118. Accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8219. Re-insurance assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8220. Investment in associate companies . . . . . . . . . . . . . . . . . . 8221. Investment in subsidiary companies . . . . . . . . . . . . . . . . 8522. Property and equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8623. Investment property . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8724. Intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8725. Deposit and current accounts . . . . . . . . . . . . . . . . . . . . . . . . . 8826. Creditors and accruals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8827. Provision for unintimated claims . . . . . . . . . . . . . . . . . . . . . . 8828. Policyholders’ fund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8929. Employee benefits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8930. Deferred taxation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9131. Share capital . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9332. Non-distributable reserves . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9333. Contingent liabilities and capitalcommitments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9434. Cash flow information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9535. Risk management . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9636. Segment information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10637. Related parties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11038. Trust activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11439. Critical accounting estimates andjudgements in applying accounting policies . . . . . . . 11540. Average balance sheet and effectiveinterest rates . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11741. Standards and interpretations issuedbut not yet effective . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 118FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200633<strong>Annual</strong> <strong>Financial</strong> Satements

Directors’ Responsibility StatementTo the members <strong>of</strong> FNB<strong>Namibia</strong> Holdings LimitedThese annual financial statements are theresponsibility <strong>of</strong> the company’s directors. We alsoacknowledge responsibility for establishingaccounting procedures that provide for themaintenance <strong>of</strong> documentation sufficient to supportthe annual financial statements. These annualfinancial statements present fairly the financialposition, results <strong>of</strong> operations and cash flows <strong>of</strong> theGroup and Company in accordance with International<strong>Financial</strong> Reporting Standards (‘IFRS’) and in themanner required by the Companies’ Act <strong>of</strong> <strong>Namibia</strong>and have been prepared on a basis consistent withthose <strong>of</strong> the prior year, except where specificallydisclosed in the annual financial statements. Theannual financial statements incorporate full andresponsible disclosure in line with the Group’sphilosophy on corporate governance and as requiredby the <strong>Namibia</strong>n Stock Exchange. The directorsreport that the Group’s internal controls are designedto provide reasonable assurance as to the integrityand reliability <strong>of</strong> the financial statements, toadequately safeguard, verify and maintainaccountability <strong>of</strong> assets and to prevent and detectfraudulent financial reporting. Such controls arebased on established written policies andprocedures. They are implemented by trained, skilledpersonnel with an appropriate segregation <strong>of</strong> dutiesand are monitored throughout the Group.The board members and employees are requiredto maintain the highest ethical standards and theGroup’s business practices are required to beconducted in a manner that is above reproach. Theboard has adopted and is committed to the principlesin the King II report on Corporate Governance.The board is responsible for internal controls.The controls throughout the Group are directedtowards risk areas. These areas are identified byoperational management, confirmed by Groupmanagement and tested by the internal auditors. Allcontrols relating to these critical risk areas are closelymonitored and subject to audit.Nothing has come to the attention <strong>of</strong> thedirectors to indicate that any material breakdown inthe functioning <strong>of</strong> these internal financial controlsoccurred during the year.The directors have reviewed the Group’s budget forthe year to 30 June 2007. On the basis <strong>of</strong> this reviewand in the light <strong>of</strong> the current financial position, thedirectors have no reason to believe that FNB <strong>Namibia</strong>Holdings Limited and its subsidiaries will not be agoing concern for the foreseeable future. The goingconcern basis has therefore been adopted inpreparing the financial statements.The Group’s external auditors, Deloitte & Touche,have audited the financial statements and their reportappears on page 38.The annual financial statements <strong>of</strong> the Group andCompany, which appear on pages 33 to 119 havebeen approved by the board <strong>of</strong> directors and aresigned on its behalf by:H-D VoigtsChairmanAdv VR RukoroChief Executive OfficerWindhoek17 August 200634 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Report <strong>of</strong> the Audit Committee to ShareholdersThe Audit Committee comprises <strong>of</strong> a majority <strong>of</strong>independent non-executive directors and it meets noless than four times a year. This committee assists theboard in observing its responsibility for ensuring thatthe Group’s financial and computer systems providereliable, accurate and up-to-date information tosupport the current financial position and that thepublished annual financial statements represent a fairreflection <strong>of</strong> its financial position. It also ensures thatappropriate accounting policies, control and complianceprocedures are in place. The internal and externalauditors attend its meetings and have unrestrictedaccess to the chairman <strong>of</strong> the committee.The primary objectives <strong>of</strong> thecommittee are:1. To assist the board <strong>of</strong> directors in its evaluation <strong>of</strong>the adequacy and efficiency <strong>of</strong> the internal controlsystems, accounting practices, informationsystems and auditing processes applied in the dayto-daymanagement <strong>of</strong> the business;2. To provide a forum for communication betweenthe board <strong>of</strong> directors, management and theinternal and external auditors; and3. To introduce such measures as in thecommittee’s opinion may serve to enhance thecredibility and objectivity <strong>of</strong> the annual financialstatements and affairs <strong>of</strong> the Group.The committee has met its objectives and has foundno material weakness in controls, and is satisfied withthe level <strong>of</strong> disclosure to it and to the stakeholders.H W P BöttgerChairmanFNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200635

Statement <strong>of</strong> Actuarial Values <strong>of</strong> Swabou LifeAssurance Company Limited as at 30 June 2006N$ thousand2006 2005A brief summary <strong>of</strong> the financial position as at this date is as follows:Policyholders’ fund 147 306 109 395Other liabilities 12 565 9 811Capital adequacy requirement 29 908 24 912Free assets 53 134 36 265Total funds (at actuarial value) 242 913 180 383The above split may also be represented by the following items:<strong>Financial</strong> soundness liabilities 159 870 119 206Shareholders’ funds 6 000 6 000Free reserves for published financials 77 043 55 177Total funds (at actuarial value) 242 913 180 383The movement in the free reserves is an increase <strong>of</strong> N$21 866 000.CertificationI have conducted an actuarial valuation <strong>of</strong> the SwabouLife Assurance Company Limited according togenerally accepted actuarial standards as at 30 June2006, and certify that the Company was financiallysound at that date.I am satisfied that the statement <strong>of</strong> actuarialvalues <strong>of</strong> assets and liabilities, read together with thefinancial statements, fairly presents the financialposition <strong>of</strong> the Company.Jacques MalanFellow <strong>of</strong> the Institute <strong>of</strong> ActuariesValuatorNotes to the Statement <strong>of</strong> ActuarialValues <strong>of</strong> Assets and LiabilitiesThis valuation was performed to assess theshareholders’ funds and the financial soundnessliability <strong>of</strong> the Company.1. Valuation basis <strong>of</strong> policy liabilitiesThe valuation was performed using the <strong>Financial</strong>Soundness Valuation method and was conducted inaccordance with the applicable guidelines <strong>of</strong> theActuarial Society <strong>of</strong> South Africa and taking intoaccount policyholders’ reasonable expectations. A<strong>Financial</strong> Soundness Valuation is intended to give aprudently realistic picture <strong>of</strong> the overall financialposition <strong>of</strong> the assurer, allowing explicitly for actualpremiums that will be received and future experiencethat may be expected in respect <strong>of</strong> interest rates,expenses, mortality, and other relevant factors.The <strong>Financial</strong> Soundness Valuation method wasused for valuing insurance contracts and forinvestment contracts on a discretionary basis. Thereare no investment contracts without discretionaryparticipation features.Assumptions regarding the future were on a bestestimate basis plus further allowance to statutorycontingency margins as required by Pr<strong>of</strong>essionalGuidance Note 104 <strong>of</strong> the Actuarial Society <strong>of</strong> SouthAfrica (‘PGN104’).36 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Statement <strong>of</strong> Actuarial Values <strong>of</strong> Swabou LifeAssurance Company Limited as at 30 June 2006In the calculation <strong>of</strong> liabilities, provision was made for:- the best-estimate <strong>of</strong> the future experience,plus- the margins prescribed by PGN104, plus- further margins as deemed necessary.The intention <strong>of</strong> the prescribed margins is tointroduce a degree <strong>of</strong> prudence to allow for possiblefuture adverse experience.The liabilities were calculated using the followingprinciples:- the actuarial liabilities <strong>of</strong> the Company consist<strong>of</strong> the capitalised value <strong>of</strong> the benefits theCompany expect to pay in future, plus thecapitalised value <strong>of</strong> expected future renewalcosts, less the capitalised value <strong>of</strong> theexpected future premiums.- the actuarial liabilities as determined are thencompared with the actuarial value <strong>of</strong> theCompany’s assets in order to determine thefree reserves.- assets and policy liabilities have been valuedon mutually consistent bases.expected increase in maintenance expenses at5.96% p.a.6. Investment returnIt was assumed that the Company would earn a netrate <strong>of</strong> return <strong>of</strong> 9.50% p.a. on its investments infuture. This rate will be revised from year to year asmarket conditions change. However, benefits,premiums and future expenses have been discountedat a rate <strong>of</strong> interest <strong>of</strong> 9.25% p.a. to provide acontingency margin.7. Statutory capital adequacyrequirementsThe capital adequacy requirement is calculated todetermine whether the excess <strong>of</strong> assets over liabilitiesis sufficient to provide for the possibility <strong>of</strong> severelynegative future experience. A requirement <strong>of</strong> N$29.9million (30 June 2005: N$24.9 million) has been established.The excess <strong>of</strong> assets over liabilities coversthe capital adequacy requirement 2.78 times (30 June2005: 2.45 times).2. Mortality, morbidity anddiscontinuance ratesThe best-estimate assumptions relating to futuremortality, morbidity and withdrawal rates were basedon standard tables and experience since inception <strong>of</strong>the life product, and were adjusted for anticipatedchanges in experience where appropriate. Provisionwas made for the potential adverse experience due toAIDS and other potential contingencies.3. Investment stabilisation reserveAdjustments are made to the market value <strong>of</strong> assets inorder to protect the policyholders’ fund, excluding theirinvestment balances, against fluctuations in marketvalues. An investment stabilisation reserve is held as abuffer against the impact <strong>of</strong> market fluctuations on theassets backing investment-linked liabilities.4. GuaranteesThe value <strong>of</strong> the reserves was calculated taking intoaccount all underlying guarantees, includingguaranteed maturity values.5. Maintenance expensesThe maintenance expense assumptions were basedon the results <strong>of</strong> an expense investigation by SwabouLife management and allowance was made for theFNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200637

Report <strong>of</strong> the Independent Auditors to the Members<strong>of</strong> FNB <strong>Namibia</strong> Holdings LimitedWe have audited the Company annual financialstatements and Group annual financial statements <strong>of</strong>FNB <strong>Namibia</strong> Holdings Limited set out on pages 39to 119 for the year ended 30 June 2006. Thesefinancial statements are the responsibility <strong>of</strong> thecompany’s directors. Our responsibility is to expressan opinion on these financial statements based onour audit.We conducted our audit in accordance withInternational Standards on Auditing. Those standardsrequire that we plan and perform the audit to obtainreasonable assurance about whether the financialstatements are free <strong>of</strong> material misstatement. Anaudit includes examining, on a test basis, evidencesupporting the amounts and disclosures in thefinancial statements. An audit also includes assessingthe accounting principles used and significant estimatesmade by management as well as evaluating the overallfinancial statement presentation. We believe that ouraudit provides a reasonable basis for our opinion.In our opinion, the financial statements presentfairly, in all material respects, the financial position <strong>of</strong>the Company and the Group at 30 June 2006, andthe results <strong>of</strong> their operations and cash flows for theyear then ended in accordance with International<strong>Financial</strong> Reporting Standards and in the mannerrequired by the Companies Act <strong>of</strong> <strong>Namibia</strong>.Deloitte & ToucheRegistered Accountants and AuditorsChartered Accountants (<strong>Namibia</strong>)Per J C KuehhirtPartnerWindhoek1 September 200638 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Directors’ ReportThe directors present their annual report, whichforms part <strong>of</strong> the annual financial statements <strong>of</strong> theGroup and <strong>of</strong> the Company for the year ended30 June 2006.Nature <strong>of</strong> businessThe Company acts as an investment holdingcompany and the main investments are the 100%shareholding in:- <strong>First</strong> <strong>National</strong> <strong>Bank</strong> <strong>of</strong> <strong>Namibia</strong> Limited:a registered bank <strong>of</strong>fering a full range <strong>of</strong>banking services;- Swabou Life Assurance Company Limited:a life assurance company;- Swabou Insurance Company Limited:a short term insurance company;- Talas Properties (Windhoek) (Proprietary)Limited: a property-owning company;- <strong>First</strong> <strong>National</strong> Asset Management and TrustCompany <strong>of</strong> <strong>Namibia</strong> (Proprietary) Limited: aregistered trust company involved in theadministration <strong>of</strong> deceased estates; and- FNB <strong>Namibia</strong> Unit Trusts Limited: a unittrusts management company.Share capitalAt the annual general meeting <strong>of</strong> the company heldon 24 November 2005, the company passed aspecial resolution to convert 30 197 447 <strong>of</strong> itsauthorised cumulative convertible redeemablepreference shares to ordinary shares <strong>of</strong> 0.5 centseach. These shares were not in issue and theresolution was therefore only passed to change thenature <strong>of</strong> these unissued shares from cumulativeconvertible redeemable preference shares toordinary shares.The Company’s authorised share capitalremained unchanged at N$5 million.The Company’s authorised share capital at yearendconsists <strong>of</strong> 990 000 000 (2005: 959 802 553)ordinary shares <strong>of</strong> 0,5 cents each and 10 000 000(2005: 40 197 447) cumulative convertible redeemablepreference shares <strong>of</strong> 0,5 cents each.The issued ordinary share capital remainedunchanged at 267 593 250 ordinary shares and 2cumulative convertible redeemable preference shares.At the annual general meeting to be held on29 November 2006, members will be asked toconsider an ordinary resolution placing the number <strong>of</strong>un-issued ordinary and preference shares, exclusive<strong>of</strong> the number <strong>of</strong> shares reserved for purposes <strong>of</strong> theshare incentive scheme as at that date, under thecontrol <strong>of</strong> the directors as is currently the case, untilthe next annual general meeting.Share analysis – ordinary sharesBased on information disclosed by the <strong>Namibia</strong>nStock Exchange and investigations conducted onbehalf <strong>of</strong> the Company, the following shareholdershave a beneficial interest <strong>of</strong> 5% or more in the issuedordinary shares <strong>of</strong> the Company:<strong>First</strong>Rand <strong>Bank</strong> HoldingsLimited . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 60% (2005: 60%)Government InstitutionsPension Fund . . . . . . . . . . . . . . . . . . . . 16.7% (2005: 10%)A detailed analysis <strong>of</strong> shareholders is set out onpage 11.Share analysis – preference sharesRMB-SI Investments(Proprietary) Limited . . . . . . . . . . . . . 100% (2005: 100%)FNB Share Incentive SchemeNo new shares were allocated during the year (2005:1 926 295). The total number <strong>of</strong> shares allocated tothe share incentive trust at 30 June 2006 amounts to3 246 295 (2005: 3 246 295). Also refer to note 12.3in this regard.Directors’ interest inFNB <strong>Namibia</strong> Holdings LimitedDetails <strong>of</strong> the directors’ interest in the issued ordinaryshares <strong>of</strong> FNB <strong>Namibia</strong> Holdings Limited are reflectedin note 10 to the annual financial statements.Interest <strong>of</strong> directorsAt no time during the financial year were any contracts<strong>of</strong> significance entered into relative to theGroup’s business in which a director had an interest.Group resultsThe financial statements on pages 33 to 119 set out fullythe financial position, results <strong>of</strong> operations and cashflows <strong>of</strong> the Company and the Group. Your attention isalso drawn to the Chairman’s report, the Chief ExecutiveOfficer’s report and the Chief <strong>Financial</strong> Officer’s report onour financial results on pages 16 to 28.FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200639

Directors’ ReportN$ thousand2006 2005DividendsThe following dividends were declared in respect <strong>of</strong> the current and previousfinancial years:Ordinary dividendsDividend No. 20 <strong>of</strong> 15 cents per ordinary share to shareholdersregistered on 24 March 2005. 39 116Dividend No. 21 <strong>of</strong> 17 cents per ordinary share to shareholdersregistered on 23 September 2005. 45 491Dividend No. 22 <strong>of</strong> 17 cents per ordinary share to shareholdersregistered on 17 March 2006. 45 491Dividend No. 23 <strong>of</strong> 23 cents per ordinary share to shareholdersregistered on 29 September 2006. 61 546Total distribution for the 12 months <strong>of</strong> 40 cents per ordinary share(2005: 32 cents per ordinary share) 107 037 84 607Preference dividendsDividend No. 1 5 025Dividend No. 2 1 331DirectorateAt the Group’s annual general meeting held on24 November 2005, Mr HWP Böttger, who retired byrotation in accordance with the provisions <strong>of</strong> theCompany’s Articles <strong>of</strong> Association, made himselfavailable for re-election and was duly re-elected.The composition <strong>of</strong> the board <strong>of</strong> FNB <strong>Namibia</strong>Holdings Limited is as follows:H-D Voigts (Chairman)L S Ipangelwa (Chief Executive Officer)Deceased: 7 September 2005Adv VR Rukoro (Chief Executive Officer)Appointed: 1 March 2006J K Macaskill *Appointed Acting Chief Executive Officer:7 September 2005 to 28 February 2006H W P BöttgerP T NevongaI I Zaamwani (Ms)Dr MT Lategan *Appointed: 24 November 2005S H Moir *Appointed: 24 November 2005C L R HaikaliAppointed: 24 November 2005M N NdilulaAppointed: 24 November 2005E B Nieuwoudt *Resigned: 23 August 2005S V KatjiuanjoResigned: 8 December 2005* South AfricanAll directors appointed since the last annual generalmeeting have to be confirmed at the next annualgeneral meeting.Directors’ emolumentsDirectors’ emoluments are disclosed in note 10.1 tothe annual financial statements.Management by third partiesNone <strong>of</strong> the business <strong>of</strong> the Company or <strong>of</strong> anysubsidiary has been managed by a third party or by acompany in which a director had an interest duringthis financial year.40 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Directors’ ReportInsuranceComprehensive cover in respect <strong>of</strong> the bankers’bond, computer crime and pr<strong>of</strong>essional indemnity riskis in place.Property and equipmentThere was no material change in the nature <strong>of</strong>property and equipment or in the policy regarding itsuse during the year. The impact <strong>of</strong> the adoption <strong>of</strong>International <strong>Financial</strong> Reporting Standards onProperty and Equipment is explained in note 22 to theannual financial statements.Holding companyThe holding company <strong>of</strong> FNB <strong>Namibia</strong> HoldingsLimited is <strong>First</strong>Rand <strong>Bank</strong> Holdings Limited and itsultimate holding Company is <strong>First</strong>Rand Limited,both <strong>of</strong> which are incorporated in the Republic <strong>of</strong>South Africa.SubsidiariesInterest in and aggregate pr<strong>of</strong>its <strong>of</strong> subsidiaries areset out in note 21 to the annual financial statements.Company secretary andregistered <strong>of</strong>ficesCompany secretaryMs Roberta Brusa (Resigned: 30 June 2006)Mr Brian Katjaerua (Appointed: 14 August 2006)Registered <strong>of</strong>fice209 Independence AvenueWindhoekPostal addressP O Box 195Windhoek<strong>Namibia</strong>Events subsequent to thebalance sheet dateThere are no material events subsequent to thebalance sheet date to report.FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200641

Accounting PoliciesThe principal accounting policies that the Groupapplied during the 2006 financial year are set outbelow.IntroductionThe audited financial statements <strong>of</strong> the Groupcomprise the financial position, results and cash flow<strong>of</strong> the banking and insurance interests <strong>of</strong> the FNB<strong>Namibia</strong> Holdings Group.The Group adopts the following accountingpolicies in preparing its consolidated financialstatements.1.1. Basis <strong>of</strong> presentationThe Group’s audited consolidated financialstatements have been prepared in accordance withInternational <strong>Financial</strong> Reporting Standards (‘IFRS’)for the first time.The Group prepares its consolidated financialstatements on a going concern basis using thehistorical cost basis, except for certain financialassets and liabilities where it adopts the fair valuebasis <strong>of</strong> accounting.These financial assets and liabilities include:- financial assets and liabilities held for trading;- financial assets classified as available for sale;- derivative financial instruments; and- financial instruments elected to be carried atfair value.The preparation <strong>of</strong> consolidated financial statementsin conformity with IFRS requires the use <strong>of</strong> certaincritical accounting estimates. It also requiresmanagement to exercise its judgement in the process<strong>of</strong> applying the Group’s accounting policies.In accordance with the transitional provisionsset out in IFRS 1, ‘<strong>First</strong>-time Adoption <strong>of</strong>International <strong>Financial</strong> Reporting Standards’ andother relevant standards, the Group has appliedIFRS as at 30 June 2006 in its financial reportingwith effect from the Group’s transition date on 1 July2004, with the exception <strong>of</strong> the standards relating t<strong>of</strong>inancial instruments and insurance contracts whichwere applied with effect from 1 July 2005. Thereforethe impact <strong>of</strong> adopting IAS 32 – ‘<strong>Financial</strong>Instruments - Disclosure and Presentation’, IAS 39 –‘<strong>Financial</strong> Instruments – Recognition andMeasurement’ and IFRS 4 – ‘Insurance Contracts’are not included in the 2005 comparatives inaccordance with IFRS 1. The Group previouslyfollowed <strong>Namibia</strong>n <strong>Statements</strong> <strong>of</strong> GenerallyAccepted Accounting Practice.Changes in the presentation <strong>of</strong> prior year numbers,save for those changes resulting from the adoption <strong>of</strong>IFRS referred to above to conform to current yearpresentation, are set out in note 1.27.All monetary information and figures presented inthese financial statements are stated in thousands <strong>of</strong><strong>Namibia</strong> Dollar (N$ ’000), unless otherwise indicated.1.2. ConsolidationThe consolidated financial statements include theassets, liabilities and results <strong>of</strong> the operations <strong>of</strong> theholding company and its subsidiaries. Subsidiariesare companies in which the Group, directly orindirectly, has the power to exercise control over theoperations for its own benefit. The Group considersthe existence and effect <strong>of</strong> potential voting rights thatare presently exercisable or convertible in determiningcontrol. Subsidiaries are consolidated from the dateon which the Group acquires effective control.Consolidation is discontinued from the effective date<strong>of</strong> disposal.The Group consolidates a special purpose entity(‘SPE’) when the substance <strong>of</strong> the relationshipbetween the Group and the SPE indicates that theGroup controls the SPE.The Group uses the purchase method <strong>of</strong>accounting to account for the acquisition <strong>of</strong>subsidiaries. The cost <strong>of</strong> an acquisition is measuredas the fair value <strong>of</strong> the assets given, equityinstruments issued and liabilities incurred orassumed at the date <strong>of</strong> exchange, plus costsdirectly attributable to the acquisition. Identifiableassets acquired and liabilities and contingentliabilities assumed in a business combination aremeasured initially at their fair values at theacquisition date, irrespective <strong>of</strong> the extent <strong>of</strong> anyminority interest. The excess <strong>of</strong> the cost <strong>of</strong>acquisition over the fair value <strong>of</strong> the Group’s share<strong>of</strong> the identifiable net assets acquired is recordedas goodwill. If the cost <strong>of</strong> acquisition is less than thefair value <strong>of</strong> the net assets <strong>of</strong> the subsidiaryacquired, the difference is recognised directly in theincome statement.Inter-company transactions, balances andunrealised gains on transactions between groupcompanies are eliminated. Unrealised losses are alsoeliminated unless the transaction provides evidence<strong>of</strong> impairment <strong>of</strong> the asset transferred. Accountingpolicies <strong>of</strong> subsidiaries have been changed wherenecessary to ensure consistency with the policiesadopted by the Group.42 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Accounting Policies1.3. Associate companiesAssociate companies are entities in which the Groupholds an equity interest <strong>of</strong> between 20% and 50%, orover which it has the ability to exercise significantinfluence, but does not control. Investments acquiredand held exclusively with the view to disposal in thenear future (12 months) are not accounted for usingthe equity accounting method, but carried at fairvalue less cost to sell in terms <strong>of</strong> the requirements <strong>of</strong>IFRS 5 – ‘Non-current Assets Held for Sale andDiscontinued Operations’.The Group includes the results <strong>of</strong> associatecompanies in its consolidated financial statementsusing the equity accounting method, from theeffective date <strong>of</strong> acquisition to the effective date <strong>of</strong>disposal. The investment is initially recognisedat cost.Earnings attributable to ordinary shareholdersinclude the Group’s share <strong>of</strong> earnings <strong>of</strong> associatecompanies. The Group’s reserves include its share <strong>of</strong>post-acquisition movements in reserves <strong>of</strong> associatecompanies. The cumulative post-acquisitionmovements are adjusted against the cost <strong>of</strong> theinvestment in the associate companies.The Group discontinues equity accounting whenthe carrying amount <strong>of</strong> the investment in associatecompanies reaches zero, unless it has incurredobligations or guaranteed obligations in favour <strong>of</strong> theassociate undertaking.After discontinuing equity accounting the Groupapplies the requirements <strong>of</strong> IAS 39 to determinewhether it is necessary to recognise any additionalimpairment loss with respect to the net investmentin the associate as well as other exposures to theinvestee. Goodwill included in the carrying amount<strong>of</strong> the investment in associate companies isassessed for impairment in accordance with IAS 36as part <strong>of</strong> the entire carrying value <strong>of</strong> the investmentin the associate.The Group increases the carrying amount <strong>of</strong>investments with its share <strong>of</strong> the associate companyincome when equity accounting is resumed.Unrealised gains on transactions between theGroup and its associate companies are eliminated tothe extent <strong>of</strong> the Group’s interest in the entity.Unrealised losses are also eliminated unless thetransaction provides evidence <strong>of</strong> an impairment <strong>of</strong>the asset transferred. Accounting policies <strong>of</strong> theinvestees have been changed where necessary toensure consistency with the policies adopted bythe Group.1.4. Revenue recognition1.4.1 Interest income and expenseThe Group recognises interest income and expensein the income statement for all instruments measuredat amortised cost using the effective interest method.The effective interest method is a method <strong>of</strong>calculating the amortised cost <strong>of</strong> a financial asset ora financial liability and <strong>of</strong> allocating the interestincome or interest expense over the averageexpected life <strong>of</strong> the financial instruments or portfolios<strong>of</strong> financial instruments. The effective interest rate isthe rate that exactly discounts estimated future cashpayments or receipts through the expected life <strong>of</strong> thefinancial instrument or, when appropriate, a shorterperiod to the net carrying amount <strong>of</strong> the financialasset or financial liability. When calculating theeffective interest rate, the Group estimates cash flowsconsidering all contractual terms <strong>of</strong> the financialinstrument (for example, prepayment options) butdoes not consider future credit losses. Thecalculation includes all fees and points paid orreceived between parties to the contract that are anintegral part <strong>of</strong> the effective interest rate, transactioncosts and all other premiums or discounts.From an operational perspective, the Groupsuspends the accrual <strong>of</strong> contractual interest on nonrecoverableadvances. However, in terms <strong>of</strong> IAS 39,interest income on impaired advances is thereafterrecognised based on the original effective interestrate used to determine the discounted recoverableamount <strong>of</strong> the advance. The difference between thediscounted and undiscounted recoverable amount isreleased to interest income over the expectedcollection period <strong>of</strong> the advance.Instruments with characteristics <strong>of</strong> debt, such asredeemable preference shares, are included in loansand advances or long-term liabilities. Dividendsreceived or paid on these instruments are includedand accrued in interest income and expense.1.4.2 Trading incomeThe Group includes pr<strong>of</strong>its, losses and fair valueadjustments on trading financial instruments(including derivative instruments which do not qualifyfor hedge accounting in terms <strong>of</strong> IAS 39) as well asfinancial instruments designated at fair value intrading income as it is earned.1.4.3 Fee and commission incomeThe Group generally recognises fee and commissionincome on an accrual basis when the service is rendered.FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200643

Accounting PoliciesCertain fees and transaction costs that form anintegral part <strong>of</strong> the yield <strong>of</strong> available for sale andamortised cost financial instruments are capitalisedand recognised as part <strong>of</strong> the effective yield <strong>of</strong> thefinancial instrument over the expected life <strong>of</strong> thefinancial instrument. These fees and transactioncosts are recognised as part <strong>of</strong> the net interestincome and not as non-interest revenue.Commission income on acceptances, bills andpromissory notes endorsed is credited to incomeover the lives <strong>of</strong> the relevant instruments on a timeapportionment basis.The impact <strong>of</strong> the adoption <strong>of</strong> IFRS on fee andcommission income is explained in note 1.27.1.4.4 DividendsThe Group recognises dividends when the Group’sright to receive payment is established. This is on the‘last day to trade’ for listed shares, and on the ‘date<strong>of</strong> declaration’ for unlisted shares. Dividend incomeincludes scrip dividends, irrespective <strong>of</strong> whether thereis an option to receive cash instead <strong>of</strong> shares.1.4.5 Services renderedThe Group recognises revenue for services renderedto customers based on the estimated outcome <strong>of</strong> thetransactions.When the outcome can be reliably estimated,transaction revenue is recognised by reference to thestage <strong>of</strong> completion <strong>of</strong> the transaction at the balancesheet date. The stage <strong>of</strong> completion is measuredbased on the amount <strong>of</strong> work performed.When the outcome cannot be reliably estimated,revenue is recognised only to the extent <strong>of</strong> theexpenses incurred that are recoverable.1.5. Foreign currency translation1.5.1 Functional and presentation currencyItems included in the financial statements <strong>of</strong> each <strong>of</strong>the Group’s entities are measured using the currency<strong>of</strong> the primary economic environment in which theentity operates (‘the functional currency’). Theconsolidated financial statements are presented in<strong>Namibia</strong> Dollar, which is the functional andpresentation currency <strong>of</strong> the holding company <strong>of</strong>the Group.1.5.2 Transactions and balancesForeign currency transactions are translated into thefunctional currency using the exchange rates prevailingat the dates <strong>of</strong> the transactions.Foreign exchange gains and losses resulting from thesettlement <strong>of</strong> such transactions and from thetranslation <strong>of</strong> monetary assets and liabilitiesdenominated in foreign currencies at year-endexchange rates are recognised in the incomestatement, except when deferred in equity asqualifying cash flow hedges and qualifying netinvestment hedges.1.6. Borrowing costsThe Group capitalises borrowing costs that aredirectly attributable to the acquisition, construction orproduction <strong>of</strong> a qualifying asset up to date on whichconstruction or installation <strong>of</strong> the assets is substantiallycompleted. Other borrowing costs are expensedwhen incurred.1.7. Direct and indirect taxationThe tax expense represents the sum <strong>of</strong> the taxcurrently payable and deferred tax. Direct taxescomprises <strong>Namibia</strong>n corporate tax payable.Indirect taxes include various other taxes paid tocentral and local governments, including value addedtax and stamp duties. Indirect taxes are disclosedseparately from direct tax in the income statement.The charge for current tax is based on the resultsfor the year as adjusted for items which are nontaxableor disallowed. The Group’s liability for currenttax is calculated using taxation rates that have beenenacted or substantively enacted by the balancesheet date.Deferred tax is the tax expected to be payable orrecoverable on differences between the carryingamounts <strong>of</strong> assets and liabilities in the financialstatements and the corresponding tax bases used inthe computation <strong>of</strong> taxable pr<strong>of</strong>it.The Group calculates deferred taxation on thecomprehensive basis using the liability method on abalance sheet based approach. It calculates deferredtax liabilities or assets by applying corporate tax ratesto the temporary differences existing at each balancesheet date between the tax values <strong>of</strong> assets andliabilities and their carrying amount, where suchtemporary differences are expected to result intaxable or deductible amounts in determining taxableincome for future periods when the carrying amount<strong>of</strong> the assets or liabilities are recovered or settled.The Group recognises deferred tax assets if thedirectors <strong>of</strong> FNB <strong>Namibia</strong> Holdings Limited consider itprobable that future taxable income will be availableagainst which the unused tax losses can be utilised.44 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Accounting PoliciesTemporary differences arise primarily from depreciation<strong>of</strong> property and equipment, revaluation <strong>of</strong> certainfinancial assets and liabilities including derivativecontracts, provisions for pensions and other postretirementbenefits and tax losses carried forward.However, deferred income tax is not accounted for if itarises from the initial recognition <strong>of</strong> an asset or liabilityin a transaction other than a business combination thatat the time <strong>of</strong> the transaction affects neither accountingnor taxable pr<strong>of</strong>it or loss.Deferred income tax is provided on temporarydifferences arising from investments in subsidiariesand associate companies, except where the timing <strong>of</strong>the reversal <strong>of</strong> the temporary difference is controlledby the Group and it is probable that the difference willnot reverse in the foreseeable future.Deferred tax related to fair value re-measurement<strong>of</strong> available for sale investments and cash flowhedges, which are charged or credited directly toequity, is also credited or charged directly to equityand is subsequently recognised in the incomestatement together with the deferred gain or loss.1.8. Recognition <strong>of</strong> assets, liabilitiesand provisions1.8.1 AssetsThe Group recognises assets when it obtains control<strong>of</strong> a resource as a result <strong>of</strong> past events, and fromwhich future economic benefits are expected to flowto the enterprise.1.8.2 Contingent assetsThe Group discloses a contingent asset where, as aresult <strong>of</strong> past events, it is highly likely that economicbenefits will flow to it, but this will only be confirmedby the occurrence or non-occurrence <strong>of</strong> one or moreuncertain future events which are not wholly withinthe Group’s control.1.9.2 Contingent liabilitiesThe Group discloses a contingent liability where:- it has a possible obligation arising from pastevents, the existence <strong>of</strong> which will beconfirmed only by the occurrence or nonoccurrence<strong>of</strong> one or more uncertain futureevents not wholly within the control <strong>of</strong> theenterprise, or- it is not probable that an outflow <strong>of</strong> resourceswill be required to settle an obligation, or- the amount <strong>of</strong> the obligation cannot bemeasured with sufficient reliability.1.9.3 Sale and repurchase agreements andlending <strong>of</strong> securitiesThe financial statements reflect securities soldsubject to a linked repurchase agreement (repos)as trading or investment securities. Theseinstruments are measured at fair value, withchanges in fair value reported in the incomestatement. The counterparty liability is included indeposits from other banks, other deposits, ordeposits due to customers, as appropriate.Securities purchased under agreements toresell (reverse repos) are recorded as loans andadvances to other banks or customers asappropriate. The difference between purchase andresale price is treated as interest and accrued overthe life <strong>of</strong> the reverse repos using the effectiveyield method.Securities lent to counterparties are retained inthe financial statements <strong>of</strong> the Group.The Group does not recognise securitiesborrowed in the financial statements, unless soldto third parties, in which case the purchase andsale are recorded with the gain or loss included intrading income. The obligation to return thesesecurities is recorded as a liability at fair value.1.9. Liabilities, provisions and contingentliabilities1.9.1 Liabilities and provisionsThe Group recognises liabilities, including provisions,when:- it has a present legal or constructive obligationas a result <strong>of</strong> past events, and- it is probable that an outflow <strong>of</strong> resourcesembodying economic benefits will be requiredto settle the obligation, and- a reliable estimate <strong>of</strong> the amount <strong>of</strong> theobligation can be made.1.10. Cash and cash equivalentsIn the cash flow statement, cash and cashequivalents comprise:- coins and bank notes;- money at call and short notice;- balances with central bank;- balances guaranteed by central bank; and- balances with other banks.All balances included in cash and cash equivalentshave a maturity date <strong>of</strong> less than three months.FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200645

Accounting Policies1.11. <strong>Financial</strong> instruments1.11.1 General<strong>Financial</strong> instruments carried on the balance sheetinclude all assets and liabilities, including derivativeinstruments, but exclude investments in associatecompanies, property and equipment, deferredtaxation, taxation payable, intangible assets, deferredstaff costs and post-retirement liabilities.1.11.2 <strong>Financial</strong> assetsThe Group classifies its financial assets in thefollowing categories: financial assets at fair valuethrough pr<strong>of</strong>it or loss, loans and receivables, held tomaturity investments and available for sale financialassets. Management determines the classification <strong>of</strong>its investments at initial recognition.<strong>Financial</strong> assets are initially recognised at fairvalue plus transaction costs for all financial assets notcarried at fair value through pr<strong>of</strong>it or loss.Available for sale financial assets and financialassets at fair value through pr<strong>of</strong>it or loss aresubsequently carried at fair value. Loans andreceivables and held to maturity investments arecarried at amortised cost using the effectiveinterest method.Gains and losses arising from changes in the fairvalue <strong>of</strong> the ‘financial assets at fair value throughpr<strong>of</strong>it or loss’ category are included in the incomestatement in the period in which they arise.Gains and losses arising from changes in the fairvalue <strong>of</strong> available for sale financial assets arerecognised directly in equity, until the financial asset isderecognised or impaired at which time thecumulative gain or loss previously recognised inequity should be recognised in pr<strong>of</strong>it or loss.However, interest calculated on available for salefinancial assets using the effective interest method isrecognised in the income statement.Dividends on available for sale equityinstruments are recognised in the income statementwhen the entity’s right to receive payment isestablished.The Group recognises purchases and sales <strong>of</strong>financial instruments that require delivery within thetime frame established by regulation or marketconvention (regular way purchases and sales) atsettlement date, which is the date the asset isdelivered to or by it. Otherwise such transactions aretreated as derivatives until settlement.The fair values <strong>of</strong> quoted investments in activemarkets are based on current bid prices. If themarket for a financial asset is not active (and forunlisted securities), the Group establishes fair valueby using valuation techniques. These include theuse <strong>of</strong> recent arm’s length transactions, discountedcash flow analysis, option pricing models and othervaluation techniques commonly used by marketparticipants.1.11.2.1 <strong>Financial</strong> assets at fair valuethrough pr<strong>of</strong>it or lossThis category has two sub-categories: financialassets held for trading, and those designated at fairvalue through pr<strong>of</strong>it or loss at inception.A financial asset is classified as a tradinginstrument if acquired principally for the purpose <strong>of</strong>selling in the short term or if so designated bymanagement. Derivatives are also categorised asheld for trading unless they are designatedas hedges.Assets are classified on initial recognition as‘At fair value through pr<strong>of</strong>it and loss’ to the extent thatthis produces more relevant information becauseit either:- Results in the reduction <strong>of</strong> measurementinconsistency (or accounting mismatch) thatwould arise as a result <strong>of</strong> measuring assetsand liabilities and the gains and losses onthem on a different basis; or- A group <strong>of</strong> financial assets and/or financialliabilities is managed and its performance isevaluated on a fair value basis, in accordancewith a documented risk management orinvestment strategy, and this is the basis onwhich information about the assets and/orliabilities is provided internally to the entity’skey management personnel; or- A financial asset or liability containingsignificant embedded derivatives.The Group recognises fair value adjustments onfinancial assets classified as fair value through pr<strong>of</strong>itand loss in trading income. Interest income on theseassets is included in the fair value adjustment.1.11.2.2 Loans and receivablesLoans and receivables are non-derivative financialassets with fixed or determinable payments that arenot quoted in an active market.This category also includes purchased loans andreceivables, where the Group has not designatedsuch loans and receivables in any <strong>of</strong> the otherfinancial asset categories.46 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Accounting Policies1.11.2.3 Held to maturityHeld to maturity investments are non-derivativefinancial assets with fixed or determinable paymentsand fixed maturities that the Group’s managementhas the positive intention and ability to hold tomaturity. Were the Group to sell other than aninsignificant amount <strong>of</strong> held to maturity assets, theentire category would be tainted and reclassified asavailable for sale.The Group carries held to maturity financialassets and investments at amortised cost using theeffective interest method, less any impairment.1.11.2.4 Available for saleAvailable for sale investments are those intended tobe held for an indefinite period <strong>of</strong> time, which may besold in response to needs for liquidity or changes ininterest rates, exchange rates or equity prices.The Group recognises unrealised gains andlosses arising from changes in the fair value <strong>of</strong>available for sale assets, in equity. It recognisesinterest income on these assets as part <strong>of</strong> interestincome, based on the instrument’s original effectiverate. Interest income is excluded from the fair valuegains and losses reported in equity. When theadvances and receivables or investment securitiesare disposed <strong>of</strong> or impaired, the related accumulatedfair value adjustments are included in the incomestatement as gains and losses from investmentsecurities.1.11.3 Embedded derivativesThe Group treats derivatives embedded in otherfinancial instruments, such as the conversion optionin a convertible bond, as separate derivatives when:- their risks and characteristics are not closelyrelated to those <strong>of</strong> the host contract; and- the host contract is not carried at fair value,with gains and losses reported in income.Where embedded derivatives meet the criteria forhedge accounting, they are accounted for in terms<strong>of</strong> the applicable hedge accounting rules (Refernote 1.13).consequently transfers substantially all the risks andbenefits associated with the asset.Where the Group retains substantially all therisks and rewards <strong>of</strong> ownership <strong>of</strong> the financial asset,the Group continues to recognise the financial asset.If a transfer does not result in derecognition becausethe Group has retained substantially all the risks andrewards <strong>of</strong> ownership <strong>of</strong> the transferred asset, theGroup shall continue to recognise the transferredasset in its entirety and shall recognise a financialliability for the consideration received. In subsequentperiods, the Group shall recognise any income on thetransferred asset and any expense incurred on thefinancial liability.Where the Group neither transfers nor retainssubstantially all the risks and rewards <strong>of</strong> ownership <strong>of</strong>the financial asset, the Group shall determine whetherit has retained control <strong>of</strong> the financial asset.In this case:(i) if the Group has not retained control, it shallderecognise the financial asset and recogniseseparately as assets or liabilities any rights andobligations created or retained in the transfer;or(ii) if the Group has retained control, it shallcontinue to recognise the financial asset to theextent <strong>of</strong> its continuing involvement in thefinancial asset.1.11.5 Offsetting financial instrumentsThe Group <strong>of</strong>fsets financial assets and liabilities andreports the net balance in the balance sheet where:- there is a legally enforceable right to set <strong>of</strong>f,and- there is an intention to settle on a net basis orto realise the asset and settle the liabilitysimultaneously.1.11.6 Trade receivables and trade payablesTrade receivables are stated at their nominal value asreduced by appropriate allowances for estimatedirrecoverable amounts.Trade payables are stated at their nominal value.1.11.4 Derecognition <strong>of</strong> assetsThe Group derecognises an asset when the contractualrights to the asset expires, where there is atransfer <strong>of</strong> the contractual rights that comprise theasset, or the Group retains the contractual rights <strong>of</strong>the assets but assumes a corresponding liability totransfer these contractual rights to another party and1.11.7 BorrowingsThe Group initially recognises borrowings, includingdebentures, at the fair value <strong>of</strong> the considerationreceived. Borrowings are subsequently measured atamortised cost. Discounts or premiums on debenturesissued are amortised on a basis that reflectsthe effective yield on the debentures over their lifeFNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200647

Accounting Policiesspan. Interest paid is recognised in the income statementon an effective interest basis.The Group separately measures and recognisesthe fair value <strong>of</strong> the debt component <strong>of</strong> an issuedconvertible bond in liabilities, with the residual valueseparately allocated to equity. It calculates interest onthe debt portion <strong>of</strong> the instrument based on themarket rate for a non-convertible instrument at theinception there<strong>of</strong>.Instruments with characteristics <strong>of</strong> debt, suchas redeemable preference shares, are included inliabilities. Dividends paid on such instruments areincluded in interest expense. Where the <strong>Bank</strong>ingGroup purchases its own debt, the debt isderecognised from the balance sheet and anydifference between the carrying amount <strong>of</strong> theliability and the consideration paid is included intrading income.1.12. Impairments <strong>of</strong> financial assets1.12.1 GeneralA financial asset is impaired if its carrying amount isgreater than its estimated recoverable amount.The impact <strong>of</strong> the adoption <strong>of</strong> IFRS on Impairment<strong>of</strong> financial assets is explained in note 1.27.1.12.2 Assets carried at amortised costThe Group assesses at each balance sheet datewhether there is objective evidence that a financialasset or group <strong>of</strong> financial assets is impaired. Afinancial asset or a group <strong>of</strong> financial assets isimpaired and impairment losses are incurred if, andonly if, there is objective evidence <strong>of</strong> impairment asa result <strong>of</strong> one or more events that occurred afterthe initial recognition <strong>of</strong> the asset (a ‘loss event’)and that loss event (or events) has an adverseimpact on the estimated future cash flows <strong>of</strong> thefinancial asset or group <strong>of</strong> financial assets that canbe reliably estimated.The Group first assesses whether objectiveevidence <strong>of</strong> impairment exists individually for financialassets that are individually significant, and individuallyor collectively for financial assets that are notindividually significant. If the Group determines thatno objective evidence <strong>of</strong> impairment exists for anindividually assessed financial asset, whethersignificant or not, it includes the asset in a group <strong>of</strong>financial assets with similar credit risk characteristicsand collectively assesses them for impairment.Assets that are individually assessed for impairmentand for which an impairment loss is or continues tobe recognised are not included in a collectiveassessment <strong>of</strong> impairment.If there is objective evidence that animpairment loss on loans and receivables or held tomaturity investments carried at amortised cost hasbeen incurred, the amount <strong>of</strong> the loss is measuredas the difference between the asset’s carryingamount and the present value <strong>of</strong> estimated futurecash flows (excluding future credit losses that havenot been incurred) discounted at the financialasset’s original effective interest rate. The carryingamount <strong>of</strong> the asset is reduced and the amount <strong>of</strong>the loss is recognised in the income statement. If aloan or held to maturity investment has a variableinterest rate, the discount rate for measuring anyimpairment loss is the current effective interest ratedetermined under the contract. As a practicalexpedient, the Group may measure impairment onthe basis <strong>of</strong> an instrument’s fair value using anobservable market price.The calculation <strong>of</strong> the present value <strong>of</strong> theestimated future cash flows <strong>of</strong> a collateralisedfinancial asset reflects the cash flows that mayresult from foreclosure less costs for obtaining andselling the collateral, whether or not foreclosureis probable.For the purposes <strong>of</strong> a collective evaluation <strong>of</strong>impairment, financial assets are grouped on thebasis <strong>of</strong> similar credit risk characteristics (i.e. on thebasis <strong>of</strong> the Group’s grading process that considersasset type, industry, geographical location,collateral type, past-due status and other relevantfactors).Those characteristics are relevant to theestimation <strong>of</strong> future cash flows for groups <strong>of</strong> suchassets by being indicative <strong>of</strong> the debtors’ ability topay all amounts due according to the contractualterms <strong>of</strong> the assets being evaluated.Future cash flows in a group <strong>of</strong> financial assetsthat are collectively evaluated for impairment areestimated on the basis <strong>of</strong> the contractual cash flows<strong>of</strong> the assets in the Group and historical lossexperience for assets with credit risk characteristicssimilar to those in the Group. Historical lossexperience is adjusted on the basis <strong>of</strong> currentobservable data to reflect the effects <strong>of</strong> currentconditions that did not affect the period on which thehistorical loss experience is based and to remove theeffects <strong>of</strong> conditions in the historical period that donot exist currently.Estimates <strong>of</strong> changes in future cash flows forgroups <strong>of</strong> assets should reflect and be directionally48 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Accounting Policiesconsistent with changes in related observable datafrom period to period (for example, changes inunemployment rates, property prices, paymentstatus, or other factors indicative <strong>of</strong> changes in theprobability <strong>of</strong> losses in the group and theirmagnitude). The methodology and assumptionsused for estimating future cash flows are reviewedregularly by the Group to reduce any differencesbetween loss estimates and actual lossexperience.When a loan is uncollectible, it is written <strong>of</strong>fagainst the related provision for loan impairment.Such loans are written <strong>of</strong>f after all the necessaryprocedures have been completed and the amount <strong>of</strong>the loss has been determined. Subsequentrecoveries <strong>of</strong> amounts previously written <strong>of</strong>f decreasethe amount <strong>of</strong> the provision for loan impairment in theincome statement.If, in a subsequent period, the amount <strong>of</strong> theimpairment loss decreases and the decrease can berelated objectively to an event occurring after theimpairment was recognised (such as an improvementin the debtor’s credit rating), the previouslyrecognised impairment loss is reversed by adjustingthe allowance account. The amount <strong>of</strong> the reversal isrecognised in the income statement.1.12.3 Assets carried at fair valueThe Group assesses at each balance sheet datewhether there is objective evidence that a financialasset or a group <strong>of</strong> financial assets is impaired. Inthe case <strong>of</strong> equity investments classified asavailable for sale, a significant or prolonged declinein the fair value <strong>of</strong> the security below its cost isconsidered in determining whether the assets areimpaired. If any such evidence exists for availablefor sale financial assets, the cumulative loss –measured as the difference between the acquisitioncost and the current fair value, less any impairmentloss on that financial asset previously recognised inpr<strong>of</strong>it or loss – is removed from equity andrecognised in the income statement. If, in asubsequent period, the fair value <strong>of</strong> a debtinstrument classified as available for sale increasesand the increase can be objectively related to anevent occurring after the impairment loss wasrecognised in pr<strong>of</strong>it or loss, the impairment loss isreversed through the income statement.Impairment losses recognised in the incomestatement in equity instruments are not reversedthrough the income statement.1.13. Derivative financial instrumentsand hedgingThe Group initially recognises derivative financialinstruments, including foreign exchange contracts,interest rate futures, forward rate agreements,currency and interest rate swaps, currency andinterest rate options (both written and purchased) andother derivative financial instruments, in the balancesheet at fair value and subsequently re-measuresthese instruments at their fair value.The fair value <strong>of</strong> publicly traded derivatives isbased on quoted bid prices for assets held orliabilities to be issued, and current <strong>of</strong>fer prices forassets to be acquired and liabilities held.The fair value <strong>of</strong> non-traded derivatives is basedon discounted cash-flow models and option pricingmodels as appropriate. The Group recognisesderivatives as assets when the fair value is positiveand as liabilities when the fair value is negative.The best evidence <strong>of</strong> the fair value <strong>of</strong> a derivativeat initial recognition is the transaction price (i.e. thefair value <strong>of</strong> the consideration given or received)unless the fair value <strong>of</strong> that instrument is evidencedby comparison with other observable current markettransactions in the same instrument (i.e. withoutmodification or repackaging) or based on a valuationtechnique whose variables include only data fromobservable markets. When such evidence exists, theGroup recognises pr<strong>of</strong>its/losses on day one.Where fair value is determined using valuationtechniques whose variables include non-observablemarket data, the difference between the fair value andthe transaction price (‘the day one pr<strong>of</strong>it/loss’) isdeferred and released over the life <strong>of</strong> the instrument.However, where observable market factors thatmarket participant would consider in setting a pricesubsequently become available, the balance <strong>of</strong> thedeferred day one pr<strong>of</strong>it/loss is released to income.The method <strong>of</strong> recognising the resulting fair valuegain or loss depends on whether the derivative isdesignated as a hedging instrument, and if so, thenature <strong>of</strong> the item being hedged. The Groupdesignates certain derivatives as either: (1) hedges <strong>of</strong>the fair value <strong>of</strong> recognised assets or liabilities or firmcommitments (fair value hedge); or, (2) hedges <strong>of</strong>highly probable future cash flows attributable to arecognised asset or liability, or a forecastedtransaction (cash flow hedge).The hedge <strong>of</strong> a foreign currency firmcommitment can either be accounted for as a fairvalue or a cash flow hedge.FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200649

Accounting PoliciesHedge accounting is used for derivatives designated inthis way provided certain criteria are met.The Group documents, at the inception <strong>of</strong> thetransaction, the relationship between hedginginstruments and hedged items, as well as its riskmanagement objective and strategy for undertakingvarious hedge transactions. The Group alsodocuments its assessment, both at hedge inceptionand on an ongoing basis, <strong>of</strong> whether the derivativesthat are used in hedging transactions are highlyeffective in <strong>of</strong>fsetting changes in fair values or cashflows <strong>of</strong> hedged items.1.13.1 Fair value hedgeChanges in the fair value <strong>of</strong> derivatives that aredesignated and qualify as fair value hedges arerecorded in the income statement, together with anychanges in the fair value <strong>of</strong> the hedged asset orliability that are attributable to the hedged risk.If the hedge no longer meets the criteria for hedgeaccounting, the adjustment to the carrying amount <strong>of</strong>a hedged item for which the effective interest methodis used, is amortised to pr<strong>of</strong>it or loss over the period tomaturity. The adjustment to the carrying amount <strong>of</strong> ahedged equity security remains in retained earningsuntil the disposal <strong>of</strong> the equity security.1.13.2 Cash flow hedgeThe effective portion <strong>of</strong> changes in the fair value <strong>of</strong>derivatives that are designated and qualify as cashflow hedges are recognised in equity. The gain or lossrelating to the ineffective portion is recognisedimmediately in the income statement.Amounts accumulated in equity are recycled tothe income statement in the periods in which thehedged item will affect pr<strong>of</strong>it or loss (for example,when the forecast sale that is hedged takes place).When a hedging instrument expires or is sold, orwhen a hedge no longer meets the criteria for hedgeaccounting, any cumulative gain or loss existing inequity at that time remains in equity and is recognisedwhen the forecast transaction is ultimately recognisedin the income statement. When a forecast transactionis no longer expected to occur, the cumulative gain orloss that was reported in equity is immediatelytransferred to the income statement.The Group recognises fair value changes <strong>of</strong>derivatives that are designated and qualify as cashflow hedges and prove to be highly effective inrelation to the hedged risk, in the cash flow hedgingreserve in equity.Where the forecasted transaction or a foreigncurrency firm commitment results in the recognition <strong>of</strong>a non-financial asset or a liability, the gains and lossespreviously deferred in equity are transferred fromequity and included in the initial measurement <strong>of</strong> thecost <strong>of</strong> the non-financial asset or liability. For financialassets and liabilities, the Group transfers amountsdeferred in equity to the income statement andclassifies them as revenue or expense in the periodsduring which the hedged firm commitment orforecasted transaction affects the income statement.1.14. Property and equipmentThe Group carries property and equipment athistorical cost less depreciation and impairment,except for land which is carried at cost lessimpairment. Historical cost includes expenditure thatis directly attributable to the acquisition <strong>of</strong> the items.Subsequent costs are included in the asset’scarrying amount or are recognised as a separateasset, as appropriate, only when it is probable thatfuture economic benefits associated with the item willflow to the Group and the cost <strong>of</strong> the item can bemeasured reliably.Property and equipment are depreciated on astraight-line basis at rates calculated to reduce thebook value <strong>of</strong> these assets to estimated residualvalues over their expected useful lives.Freehold properties and properties held underfinance lease are further broken down into significantcomponents that are depreciated to their respectiveresidual values over economic lives <strong>of</strong> thesecomponents.The periods <strong>of</strong> depreciation used are as follows:LeaseholdShorter <strong>of</strong> estimatedpremiseslife or period <strong>of</strong> leaseFreehold property and propertyheld under finance lease:- Buildings and structures 50 years- Mechanical and electrical 20 years- Components 20 years- Sundries 20 yearsComputer equipment3 yearsFurniture and fittings10 yearsMotor vehicles5 yearsOffice equipment4 yearsThe assets’ residual values and useful lives arereviewed, and adjusted if appropriate, at eachbalance sheet date. Assets that are subject to50 FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 2006

Accounting Policiesamortisation are reviewed for impairment wheneverevents or changes in circumstances indicate that thecarrying amount may not be recoverable. An asset’scarrying amount is written down immediately to itsrecoverable amount if the asset’s carrying amount isgreater than its estimated recoverable amount. Therecoverable amount is the higher <strong>of</strong> the asset’s fairvalue less costs to sell and value in use.Repairs and maintenance are charged to theincome statement during the financial period in whichthey are incurred.Gains or losses on disposals are determined byreference to the carrying amount <strong>of</strong> the asset and thenet proceeds received, and are recorded in theincome statement on disposal.The impact <strong>of</strong> the adoption <strong>of</strong> IFRS on Propertyand equipment is explained in note 1.27.1.15. Investment propertiesThe Group classifies investment properties asproperties held to earn rental income and/or forcapital appreciation. It carries investment propertiesat fair value based on valuations by pr<strong>of</strong>essionalvaluators. Valuations are carried out annually. Fairvalue movements are recorded in income in the yearin which they arise.The Group carries properties under developmentat cost less adjustments to reduce the cost to openmarket value, if appropriate.1.16. Leases1.16.1 A group company is the lesseeFinance leasesThe Group classifies leases as finance leases where itassumes substantially all the benefits and risks<strong>of</strong> ownership.Finance leases are capitalised as assets at thefair value <strong>of</strong> the leased asset at the inception <strong>of</strong> thelease, or, if lower, at the estimated present value <strong>of</strong>the underlying lease payments. The Group allocateseach lease payment between the liability and financecharges to achieve a constant rate on the financebalance outstanding. The interest component <strong>of</strong> thefinance charge is charged to the income statementover the lease period. Property and equipmentacquired are depreciated over the useful life <strong>of</strong> theassets, unless it is not probable that the Group willtake ownership <strong>of</strong> the assets, in which case theassets are depreciated over the shorter <strong>of</strong> the usefullife <strong>of</strong> the asset or the lease period, on a basisconsistent with similar owned fixed assets.Operating leasesThe Group classifies leases <strong>of</strong> assets, where thelessor effectively retains the risks and benefits <strong>of</strong>ownership, as operating leases. It charges operatinglease payments to the income statement on astraight-line basis over the period <strong>of</strong> the lease.Minimum rentals due after year-end are reflectedunder commitments.The Group recognises as an expense any penaltypayment to the lessor for early termination <strong>of</strong> anoperating lease before the lease period has expired, inthe period in which termination takes place.1.16.2 A group company is the lessorFinance leasesThe Group recognises as advances assets sold undera finance lease at the present value <strong>of</strong> the leasepayments. The difference between the grossreceivable and the present value <strong>of</strong> the receivablerepresents unearned finance income. Lease incomeis recognised over the term <strong>of</strong> the lease using theeffective interest rate method, which reflects aconstant periodic rate <strong>of</strong> return.Operating leasesThe Group includes in a separate category as ‘assetsheld under operating lease’ property and equipmentassets leased out under operating leases. Itdepreciates these assets over their expected usefullives on a basis consistent with similar fixed assets.Rental income is recognised on a straight-line basisover the lease term.1.16.3 Instalment credit agreementsThe Group regards instalment credit agreements asfinancing transactions and includes the total rentalsand instalments receivable thereunder, less unearnedfinance charges, in advances.It calculates finance charges using the effectiveinterest rates as detailed in the contracts and creditsfinance charges to income in proportion to capitalbalances outstanding.1.17. Intangible assets1.17.1 GoodwillGoodwill represents the excess <strong>of</strong> the cost <strong>of</strong> anacquisition over the attributable fair value <strong>of</strong> theGroup’s share <strong>of</strong> the net assets <strong>of</strong> the acquiredsubsidiary/associate at the date <strong>of</strong> acquisition.Goodwill on acquisition <strong>of</strong> subsidiaries is included inintangible assets. Goodwill on acquisition <strong>of</strong>FNB <strong>Namibia</strong> Group <strong>Annual</strong> Report 200651