- Page 2 and 3: MESSAGE FROMTHE DIRECTORDear Reside

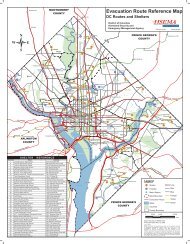

- Page 4 and 5: EVACUATIONThe District Department o

- Page 6: The mission of the Technical Servic

- Page 10 and 11: DISTRICT EMERGENCY SHELTERS (CONTIN

- Page 12 and 13: DISTRICT OF COLUMBIA PUBLIC SCHOOLS

- Page 14 and 15: IT’SADISASTER!…and what are YOU

- Page 16 and 17: DEDICATIONThis manual is dedicated

- Page 19 and 20: Winter Storm & Extreme Cold Mitigat

- Page 21 and 22: Section 3 - Information & Tips on B

- Page 23 and 24: Financial Assistance Programs . . .

- Page 25 and 26: GENERAL FACTS & FIGURES ON DISASTER

- Page 27 and 28: More than 90% of declared disasters

- Page 29 and 30: A tsunami is NOT a tidal wave — i

- Page 31 and 32: FAMILY EMERGENCY PLAN CHECKLISTThe

- Page 33 and 34: TIPS FOR ELDERLY & DISABLED FAMILY

- Page 35 and 36: FAMILY EMERGENCY PLANEMERGENCY CONT

- Page 37 and 38: DISASTER SUPPLIES KITDisasters happ

- Page 39 and 40: There are many different sizes of F

- Page 41 and 42: [ ] Aluminum foil and resealable pl

- Page 43 and 44: [ ] Blankets or sleeping bags (smal

- Page 45 and 46: [ ] Personal hygiene items (hand sa

- Page 47 and 48: THINK ABOUT SHELTERSheltering may t

- Page 49: WHAT TO DO BEFORE ADISASTER STRIKES

- Page 53 and 54: Find the right size for your home o

- Page 55 and 56: and winter storms include damaging

- Page 57 and 58: actually due to “ice dams”. Ice

- Page 59 and 60: WHO RESPONDS DURING A DISASTER OREM

- Page 61 and 62: Know your colors - Learn the Avalan

- Page 63 and 64: Another major factor is the world

- Page 65 and 66: What are YOU gonna do about…CIVIL

- Page 67 and 68: eginning of this Section.Reduce ris

- Page 69 and 70: a professional to turn it back on w

- Page 71 and 72: Paperwork & money - As discussed in

- Page 73 and 74: What are YOU gonna do about…EXTRE

- Page 75 and 76: What are YOU gonna do about…FIRES

- Page 77 and 78: No way out - If you can’t find a

- Page 79 and 80: Evacuate? - If you are told to leav

- Page 81 and 82: Learn to shut off - Know where and

- Page 83 and 84: What are YOU gonna do about…HAILS

- Page 85 and 86: What are YOU gonna do about…HAZAR

- Page 87 and 88: IF OUTDOORS - Stay upstream, uphill

- Page 89 and 90: What are YOU gonna do about…HURRI

- Page 91 and 92: • Eye wall - area that circles th

- Page 93 and 94: AFTER A HURRICANE:Stay put - Stay w

- Page 95 and 96: What are YOU gonna do about…ANUCL

- Page 97 and 98: Canada’s Provincial Nuclear Emerg

- Page 99 and 100: Pets & livestock - Get them in shel

- Page 101 and 102:

Until recently, most terrorist atta

- Page 103 and 104:

“Terrorist Threat Advisory System

- Page 105 and 106:

ELEVATED (Yellow) - an elevated ris

- Page 107 and 108:

(Orange) Security Measures for Busi

- Page 109 and 110:

• Maintain close contact with loc

- Page 111 and 112:

Business Continuity tips - See APPE

- Page 113 and 114:

Treatment: BZ is treated with an an

- Page 115 and 116:

• If swallowed - if someone drink

- Page 117 and 118:

• Digestive tract - abdominal pai

- Page 119 and 120:

BEFORE A CHEMICAL ATTACK:Watch & li

- Page 121 and 122:

show up so continue watching for si

- Page 123 and 124:

What are the names of some biologic

- Page 125 and 126:

used in attack but hard since sunli

- Page 127 and 128:

spread by infected bodily fluids (e

- Page 129 and 130:

Viral hemorrhagic [hem-o-RAJ-ik] fe

- Page 131 and 132:

Things to avoid:• powder - white

- Page 133 and 134:

you or someone in your office recei

- Page 135 and 136:

IF IN A VEHICLE - Keep windows up,

- Page 137 and 138:

By learning about potential threats

- Page 139 and 140:

adioactive fallout) are extremely d

- Page 141 and 142:

Radiation sickness - Exposure to hi

- Page 143 and 144:

• multi-story building or high-ri

- Page 145 and 146:

BEFORE A NUCLEAR ATTACK:Make a shel

- Page 147 and 148:

Pets & livestock - If possible, get

- Page 149 and 150:

ags around for folks to use as barf

- Page 151 and 152:

conduct electricity (could shock yo

- Page 153 and 154:

area, what the warning signals are,

- Page 155 and 156:

What are YOU gonna do about…ATSUN

- Page 157 and 158:

IF ON A BOAT - It depends where you

- Page 159 and 160:

MITIGATION tips at beginning of thi

- Page 161 and 162:

What are YOU gonna do about…WINTE

- Page 163 and 164:

• hypothermia - start shivering a

- Page 165 and 166:

TIPS ON RECOVERING FROM ADISASTERUn

- Page 167 and 168:

Reassurance - Let your kids and fam

- Page 169 and 170:

contaminated. Wells should be pumpe

- Page 171 and 172:

individuals after President declare

- Page 173 and 174:

TIPS ON SHELTER LIVINGDURING OR AFT

- Page 175 and 176:

TIPS ON WATER PURIFICATIONWater is

- Page 177 and 178:

TIPS ON HELPING OTHERSIN THEIR TIME

- Page 179 and 180:

certificates are easier to obtain f

- Page 181 and 182:

What are YOU gonna do about…AN EM

- Page 183 and 184:

TIPS ON CALLING 9-1-1 FOR AN AMBULA

- Page 185 and 186:

What are YOU gonna do about…BITES

- Page 187 and 188:

WEST NILE VIRUSWest Nile virus (WNV

- Page 189 and 190:

To relieve pain from a sea critter

- Page 191 and 192:

Possible Allergic reactions - troub

- Page 193 and 194:

INTERNAL BLEEDINGMinor internal ble

- Page 195 and 196:

Things to watch for…Grabbing at t

- Page 197 and 198:

What are YOU gonna do about…BURNS

- Page 199 and 200:

• Don’t move victim unless they

- Page 201 and 202:

What to do… for INFANTS (Newborn

- Page 203 and 204:

HYPOTHERMIAHypothermia starts setti

- Page 205 and 206:

What are YOU gonna do about…DIZZI

- Page 207 and 208:

What are YOU gonna do about…EAR I

- Page 209 and 210:

If the injury is from a chemical:

- Page 211 and 212:

What are YOU gonna do about…HEART

- Page 213 and 214:

CPR POSITION FOR ADULTS (9 YEARS &

- Page 215 and 216:

CPR POSITION FOR INFANTS (UNDER 1 Y

- Page 217 and 218:

• Put victim on their side to kee

- Page 219 and 220:

What are YOU gonna do about…INFEC

- Page 221 and 222:

most hospital cleaners won’t kill

- Page 223 and 224:

What are YOU gonna do about…POISO

- Page 225 and 226:

a long time if the sap stays dry (w

- Page 227 and 228:

Illustration 3-6Poison SumacIllustr

- Page 229 and 230:

What are YOU gonna do about…SHOCK

- Page 231 and 232:

What are YOU gonna do about…TOOTH

- Page 233 and 234:

ABOUT THE RED CROSSThe Red Cross di

- Page 235 and 236:

ABOUT THE FEDERAL EMERGENCYMANAGEME

- Page 237 and 238:

Indiana Department of Homeland Secu

- Page 239 and 240:

Tennessee Emergency Management Agen

- Page 241 and 242:

ABOUT PUBLIC SAFETY CANADAAs Canada

- Page 243 and 244:

• TRAINING AND EDUCATIONThe Canad

- Page 245 and 246:

APPENDIX ACitizen Corps / CERT(Volu

- Page 247 and 248:

Disaster (NVOAD) and many others. T

- Page 249 and 250:

Travel - Stay current on travel upd

- Page 251 and 252:

at your building when an event occu

- Page 253 and 254:

Protect assets - There are some thi

- Page 255 and 256:

facilities will be overwhelmed and

- Page 257 and 258:

APPENDIX CSchool Safety Resources(T

- Page 259 and 260:

END NOTES1 U. S. Department of Comm

- Page 261 and 262:

Centers for Disease Control and Pre

- Page 263 and 264:

Guide to Civil Defense and Self-Pro

- Page 265 and 266:

Global Volcanism Program. Frequentl

- Page 267 and 268:

ADDITIONAL RESOURCES& WEB SITESWEB

- Page 269 and 270:

efore an attack, 106-107during an a

- Page 271 and 272:

detectors, 52generator safety, 30pr

- Page 273 and 274:

how spread, 91signs and symptoms of

- Page 275 and 276:

contact numbers, 12-13for business,

- Page 277 and 278:

internal bleeding, 170marine animal

- Page 279 and 280:

hypothermia, first aid treatment, 1

- Page 281 and 282:

National Response Framework (NRF),

- Page 283 and 284:

poison ivy, 201, (illustrated), 203

- Page 285 and 286:

International, about, 211sanitation

- Page 287 and 288:

tooth injuries, first aid treatment

- Page 289 and 290:

This Manual is available through th

- Page 291 and 292:

NOTES______________________________