ANNUAL REPORT 2004â05 - V/Line

ANNUAL REPORT 2004â05 - V/Line

ANNUAL REPORT 2004â05 - V/Line

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

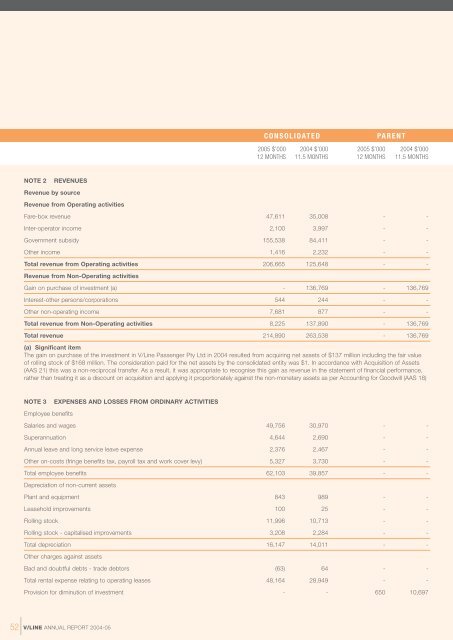

CONSOLIDATED PARENT2005 $’000 2004 $’000 2005 $’000 2004 $’00012 MONTHS 11.5 MONTHS 12 MONTHS 11.5 MONTHSNOTE 2 REVENUESRevenue by sourceRevenue from Operating activitiesFare-box revenue 47,611 35,008 - -Inter-operator income 2,100 3,997 - -Government subsidy 155,538 84,411 - -Other income 1,416 2,232 - -Total revenue from Operating activities 206,665 125,648 - -Revenue from Non-Operating activitiesGain on purchase of investment (a) - 136,769 - 136,769Interest-other persons/corporations 544 244 - -Other non-operating income 7,681 877 - -Total revenue from Non-Operating activities 8,225 137,890 - 136,769Total revenue 214,890 263,538 - 136,769(a) Significant itemThe gain on purchase of the investment in V/<strong>Line</strong> Passenger Pty Ltd in 2004 resulted from acquiring net assets of $137 million including the fair valueof rolling stock of $168 million. The consideration paid for the net assets by the consolidated entity was $1. In accordance with Acquisition of Assets(AAS 21) this was a non-reciprocal transfer. As a result, it was appropriate to recognise this gain as revenue in the statement of financial performance,rather than treating it as a discount on acquisition and applying it proportionately against the non-monetary assets as per Accounting for Goodwill (AAS 18)NOTE 3 EXPENSES AND LOSSES FROM ORDINARY ACTIVITIESEmployee benefitsSalaries and wages 49,756 30,970 - -Superannuation 4,644 2,690 - -Annual leave and long service leave expense 2,376 2,467 - -Other on-costs (fringe benefits tax, payroll tax and work cover levy) 5,327 3,730 - -Total employee benefits 62,103 39,857 - -Depreciation of non-current assetsPlant and equipment 843 989 - -Leasehold improvements 100 25 - -Rolling stock 11,996 10,713 - -Rolling stock - capitalised improvements 3,208 2,284 - -Total depreciation 16,147 14,011 - -Other charges against assetsBad and doubtful debts - trade debtors (63) 64 - -Total rental expense relating to operating leases 48,164 28,949 - -Provision for diminution of investment - - 650 10,697