Contents

Contents Contents

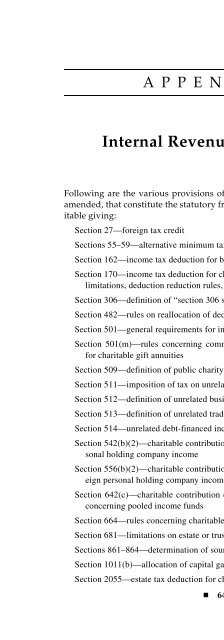

A P P E N D I X BAInternal Revenue Code SectionsFollowing are the various provisions of the Internal Revenue Code of 1986, asamended, that constitute the statutory framework for the federal tax law of charitablegiving:Section 27—foreign tax creditSections 55–59—alternative minimum tax rulesSection 162—income tax deduction for business expensesSection 170—income tax deduction for charitable contributions, including percentagelimitations, deduction reduction rules, and partial-interest gift rulesSection 306—definition of “section 306 stock”Section 482—rules on reallocation of deductionsSection 501—general requirements for income tax exemptionSection 501(m)—rules concerning commercial-type insurance, including exceptionfor charitable gift annuitiesSection 509—definition of public charity and private foundation statusSection 511—imposition of tax on unrelated business incomeSection 512—definition of unrelated business taxable incomeSection 513—definition of unrelated trade or businessSection 514—unrelated debt-financed income rulesSection 542(b)(2)—charitable contribution deduction in computing undistributed personalholding company incomeSection 556(b)(2)—charitable contribution deduction in computing undistributed foreignpersonal holding company incomeSection 642(c)—charitable contribution deduction for certain estates or trusts; rulesconcerning pooled income fundsSection 664—rules concerning charitable remainder trustsSection 681—limitations on estate or trust charitable contribution deductionSections 861–864—determination of sources of incomeSection 1011(b)—allocation of capital gain rules, applicable in bargain sale contextSection 2055—estate tax deduction for charitable contributions 649

- Page 1288: SPECIAL EVENTS AND CORPORATE SPONSO

- Page 1292: SPECIAL EVENTS AND CORPORATE SPONSO

- Page 1296: SPECIAL EVENTS AND CORPORATE SPONSO

- Page 1300: STATE FUNDRAISING REGULATION• A s

- Page 1304: STATE FUNDRAISING REGULATIONprincip

- Page 1308: STATE FUNDRAISING REGULATIONAs note

- Page 1312: STATE FUNDRAISING REGULATIONmay law

- Page 1316: STATE FUNDRAISING REGULATIONtheir o

- Page 1322: PART SEVENAAppendices

- Page 1328: APPENDIX Athis history is in congre

- Page 1332: APPENDIX Aprivate letter ruling, or

- Page 1336: APPENDIX APublishing Company and th

- Page 1344: APPENDIX BSection 2106(a)(2)(A)—e

- Page 1348: APPENDIX C 652

- Page 1354: A P P E N D I X EAInflation-Adjuste

- Page 1362: A P P E N D I X GAInflation-Adjuste

- Page 1368: APPENDIX HMonthly Federal Interest

- Page 1372: APPENDIX HMonthly Federal Interest

- Page 1378: A P P E N D I X IADeemed Rates of R

- Page 1384: APPENDIX JCHAPTER 5PLANNED GIVING

- Page 1388: APPENDIX JTemple, “Using Deferred

A P P E N D I X BAInternal Revenue Code SectionsFollowing are the various provisions of the Internal Revenue Code of 1986, asamended, that constitute the statutory framework for the federal tax law of charitablegiving:Section 27—foreign tax creditSections 55–59—alternative minimum tax rulesSection 162—income tax deduction for business expensesSection 170—income tax deduction for charitable contributions, including percentagelimitations, deduction reduction rules, and partial-interest gift rulesSection 306—definition of “section 306 stock”Section 482—rules on reallocation of deductionsSection 501—general requirements for income tax exemptionSection 501(m)—rules concerning commercial-type insurance, including exceptionfor charitable gift annuitiesSection 509—definition of public charity and private foundation statusSection 511—imposition of tax on unrelated business incomeSection 512—definition of unrelated business taxable incomeSection 513—definition of unrelated trade or businessSection 514—unrelated debt-financed income rulesSection 542(b)(2)—charitable contribution deduction in computing undistributed personalholding company incomeSection 556(b)(2)—charitable contribution deduction in computing undistributed foreignpersonal holding company incomeSection 642(c)—charitable contribution deduction for certain estates or trusts; rulesconcerning pooled income fundsSection 664—rules concerning charitable remainder trustsSection 681—limitations on estate or trust charitable contribution deductionSections 861–864—determination of sources of incomeSection 1011(b)—allocation of capital gain rules, applicable in bargain sale contextSection 2055—estate tax deduction for charitable contributions 649