NEW ACCOUNT APPLICATION - Union Bank

NEW ACCOUNT APPLICATION - Union Bank

NEW ACCOUNT APPLICATION - Union Bank

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

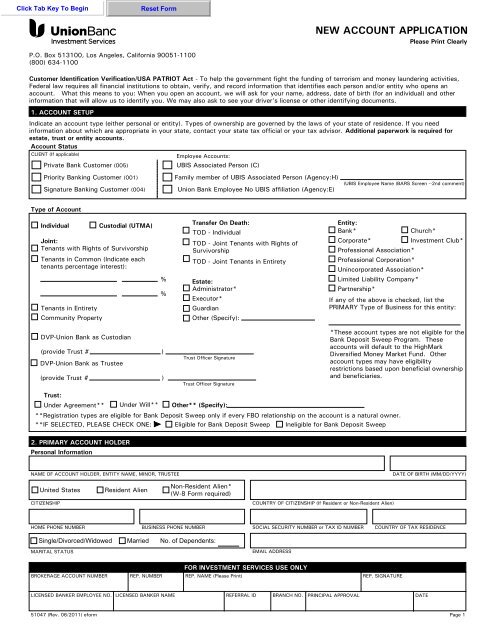

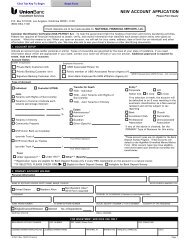

<strong>NEW</strong> <strong>ACCOUNT</strong> <strong>APPLICATION</strong>Please Print ClearlyP.O. Box 513100, Los Angeles, California 90051-1100(800) 634-1100Customer Identification Verification/USA PATRIOT Act - To help the government fight the funding of terrorism and money laundering activities,Federal law requires all financial institutions to obtain, verify, and record information that identifies each person and/or entity who opens anaccount. What this means to you: When you open an account, we will ask for your name, address, date of birth (for an individual) and otherinformation that will allow us to identify you. We may also ask to see your driver’s license or other identifying documents.1. <strong>ACCOUNT</strong> SETUPIndicate an account type (either personal or entity). Types of ownership are governed by the laws of your state of residence. If you needinformation about which are appropriate in your state, contact your state tax official or your tax advisor. Additional paperwork is required forestate, trust or entity accounts.Account StatusCLIENT (If applicable)Employee Accounts:Private <strong>Bank</strong> Customer (005)UBIS Associated Person (C)Priority <strong>Bank</strong>ing Customer (001)Signature <strong>Bank</strong>ing Customer (004)Family member of UBIS Associated Person (Agency:H)<strong>Union</strong> <strong>Bank</strong> Employee No UBIS affiliation (Agency:E)(UBIS Employee Name (BARS Screen --2nd comment)Type of AccountIndividualCustodial (UTMA)Joint:Tenants with Rights of SurvivorshipTenants in Common (Indicate eachtenants percentage interest):Tenants in EntiretyCommunity Property%%Transfer On Death:TOD - IndividualTOD - Joint Tenants with Rights ofSurvivorshipTOD - Joint Tenants in EntiretyEstate:Administrator*Executor*GuardianOther (Specify):Entity:<strong>Bank</strong>*Church*Corporate*Investment Club*Professional Association*Professional Corporation*Unincorporated Association*Limited Liability Company*Partnership*If any of the above is checked, list thePRIMARY Type of Business for this entity:DVP-<strong>Union</strong> <strong>Bank</strong> as Custodian(provide Trust # )DVP-<strong>Union</strong> <strong>Bank</strong> as Trustee(provide Trust # )Trust Officer SignatureTrust Officer Signature*These account types are not eligible for the<strong>Bank</strong> Deposit Sweep Program. Theseaccounts will default to the HighMarkDiversified Money Market Fund. Otheraccount types may have eligibilityrestrictions based upon beneficial ownershipand beneficiaries.Trust:Under Agreement** Under Will** Other** (Specify):**Registration types are eligible for <strong>Bank</strong> Deposit Sweep only if every FBO relationship on the account is a natural owner.**IF SELECTED, PLEASE CHECK ONE: Eligible for <strong>Bank</strong> Deposit Sweep Ineligible for <strong>Bank</strong> Deposit Sweep2. PRIMARY <strong>ACCOUNT</strong> HOLDERPersonal InformationNAME OF <strong>ACCOUNT</strong> HOLDER, ENTITY NAME, MINOR, TRUSTEEDATE OF BIRTH (MM/DD/YYYY)United StatesResident AlienNon-Resident Alien*(W-8 Form required)CITIZENSHIPCOUNTRY OF CITIZENSHIP (If Resident or Non-Resident Alien)HOME PHONE NUMBER BUSINESS PHONE NUMBERSOCIAL SECURITY NUMBER or TAX ID NUMBER COUNTRY OF TAX RESIDENCESingle/Divorced/WidowedMarriedNo. of Dependents:MARITAL STATUSEMAIL ADDRESSFOR INVESTMENT SERVICES USE ONLYBROKERAGE <strong>ACCOUNT</strong> NUMBER REP. NUMBER REP. NAME (Please Print)REP. SIGNATURELICENSED BANKER EMPLOYEE NO.LICENSED BANKER NAMEREFERRAL IDBRANCH NO.PRINCIPAL APPROVALDATE51047 (Rev. 06/2011) eformPage 1

2. PRIMARY <strong>ACCOUNT</strong> HOLDER (continued)LEGAL STREET ADDRESS (No P.O. Boxes)MAILING ADDRESS (If different from Legal Street Address)CITY STATE/PROVINCE ZIP/POSTAL CODE CITY STATE/PROVINCE ZIP/POSTAL CODECOUNTRYCOUNTRYIdentification -- Provide identification as requiredPrimary Account Owners/Signer -- Select one:Legal U.S. Resident Driver's License or any other government issued photo identification (specify type):Non U.S. Resident - Passport or any other foreign government issued photo identification that is written in English (specify type):Copy is required.Form of identification:TYPE OF GOVERNMENT ISSUED IDEmployer Information and AffiliationsEmployed RetiredEMPLOYMENT STATUSID NUMBERNot EmployedSTATE/COUNTRY OF ID ISSUANCEID ISSUANCE DATEID EXPIRATION DATENeither I, nor anyone bearing a financial interest or discretionaryauthority over this account is employed by, or affiliated with, a stockexchange or member firm of either an exchange, FINRA, or amunicipal securities broker/dealer UNLESS SPECIFIED BELOW:OCCUPATION (or former occupation, if retired)NAME OF FIRMEMPLOYER NAMETYPE OF BUSINESSADDRESS OF FIRMNotification of your intent to open an account will be sent to youremployer in accordance with current regulations.ADDRESSCITY STATE/PROVINCE ZIP/POSTAL CODEFor purposes of assisting your employer comply with SEC section16 reporting, please list a contact name and number whom UBISwill contact upon transactions executed in your public company'sstock.COUNTRYNAME OF FIRMTICKER SYMBOLI am a control person or a affiliate of a public company under SECRule 144 (such as a director, 10% shareholder, or policy-makingofficer), or an immediate family or household member of such.Know Your Client (KYC) ProfileClient Introduction1) How was the client introduced to UBIS:Referral from <strong>Union</strong> <strong>Bank</strong>NAME OF REFERRERSolicitationReferral from existing UBIS clientNAME OF REFERRERUnsolicited Call-In2) Has the registered representative met withthe client(s)/account signer(s) in personand viewed their identification?Yes No3) Existing <strong>Union</strong> <strong>Bank</strong> Account/Relationship?Yes NoIf "Yes", Account Number:Account Funding SourceInitial Deposit$FUNDS$SECURITIESCONTACT NAMEPHONE NUMBERNAME OF FINANCIAL INSTITUTION(S) FUNDING THE<strong>ACCOUNT</strong>Check all that apply that describe the sourceof these funds:InvestmentsPersonal Income/Business RevenuePersonal/Business SavingsSale of Real Estate or Other PropertyLegal/Insurance SettlementInheritance/GiftsOther (specify):Purpose of AccountCheck all that apply that describe thepurpose of this account:Funding daily expensesLong term investment growthFunding retirementIntermediate investingFunding educationEstate PlanningBusiness Cash ManagementOther (specify):51047 (Rev. 06/2011) eformPage 2

2. PRIMARY <strong>ACCOUNT</strong> HOLDER (continued)Know Your Client (KYC) Profile (continued)For All Customers:Are you any of the following?:Money Service Business (MSB) If Yes, Complete Form #02077-1Senior Foreign Political Figure (Individual or Entity) (SFPF)/Foreign Embassy or Consulate Employee If Yes, Complete Form #02077-2501(c)(3)Non-Governmental Organization/Charity (NGO) If Yes, Complete Form #02077-3NONE OF THE ABOVEIf "Yes", obtain KYC documentation from <strong>Union</strong> <strong>Bank</strong> business unit OR complete corresponding KYC Addendum and attach.Depletion Election for Cost Basis Purposes:All accounts will default to FIFO (First In, First Out),in which oldest lots are depleted first in a sell or transfer transaction. Mutual Funds willcontinue to default to Average Cost (the total dollar amount of shares owned divided by the total number of shares) as available on the day ofthe transaction. Unless customer specifies the shares to be converted to SPECIFIC ID (specific lots are identified for depletion). Note: allmethods, both existing and new, will deplete lots with unknown cost basis first, irrespective of the method selected. Please review theInvestment Services Agreement for more detailed information about cost basis. Please check one box.HICO (High Cost)HICO Long-TermHICO Short-TermINFI (Intra Day First In, First Out)LIFO (Last in first Out)LOCO (Low Cost)LOCO Long-TermLOCO Short-TermTXSN (Tax Sensitive)For Privately Held Business Entities Only:1) Is the Business Entity involved in any of the following business types (Check one):ATM Operator Vending Machines Cash Intensive BusinessRecyclerCasino/Gaming/Card ClubDealers of Jewels/Precious Metals/Stones/Numismatic Items/AntiquesManufacturer or Distributor of Weapons or Military EquipmentAny Non-U.S. Business Entity--List the country the Business Entity is organized under:NONE OF THE ABOVE2) Attach KYC documentation from <strong>Union</strong> <strong>Bank</strong> business unit OR complete the following:a) Complete Page 6, Additional Account Holders, for all Entity Account Signers, and Authorized Tradersb) Describe the Business Entity's primary operations/industry:c) Besides the U.S., list country(ies) where the Business Entity derives 50% or more of its revenue from a foreign country or iscontracted by a foreign government:d) Please list the full name and residence address of all Beneficial owners with 10% or more ownership:51047 (Rev. 06/2011) eformPage 3

2. PRIMARY <strong>ACCOUNT</strong> HOLDER (continued)Know Your Client (KYC) Profile (continued)Expected Level of Activity:Expected Monthly Deposits(including incoming wires)01- 56 - 1011+Expected Monthly Incoming Wires:01- 56 - 1011+Expected Monthly Withdrawals(including checks and outgoing wires)01- 56 - 1011+Expected Monthly Outgoing Wires:01- 56 - 1011+Expected Deposit Amount(including incoming wires)$0$1- $10,000$10,001 - $100,000$100,001+Select Origin of Wire ActivityDomesticInternationalList countries of origin for international wires:Expected Monthly Withdrawal Amount(including checks and outgoing wires)$0$1- $10,000$10,001 - $100,000$100,001+Select Destination of Wire ActivityDomesticInternationalList countries of destination for international wires:3. SUITABILITYFinancial ProfileAnnual Income Estimated Net Worth Investable/Liquid Assets Federal Tax BracketFrom all sources Excluding primary residence Including cash and securities15% or belowUnder $25,000$25,000 - $50,000$50,001 - $100,000Over $100,000Under $50,000$50,000 - $100,000$100,001 - $500,000Over $500,000Under $50,000$50,000 - $100,000$100,001 - $500,000Over $500,00025% - 27-1/2%27-1/2% or AboveEstimated Tax Bracket Required$ $ $Estimated Amount Required Estimated Amount Required Estimated Amount RequiredInvestment ProfileInvestment ObjectivesRisk ToleranceGeneral Investment KnowledgeRank your investment objectivesfor this account in order ofimportance (1 being the highest).Review the attached CustomerAgreement for importantinformation on investmentobjectives.Preservation of capitalIncomeCapital AppreciationSpeculationTrading profitsOther:Conservative (C)Moderate (M)Aggressive (A)Combination (X):Investment Time Horizon< 3 years (C)3-5 years (C)6-10 years (I)over 10 years (L)None Limited Good ExtensiveYears:Investment Product KnowledgeNone Limited Good ExtensiveStocksBondsMutual FundsOptionsVariable ContractsLimited Partnerships51047 (Rev. 06/2011) eformPage 4

4. <strong>ACCOUNT</strong> CHARACTERISTICSCore Account Investment VehicleConsult your Investment Advisor to discuss core account options.Please refer to the FDIC Insured <strong>Bank</strong> Deposit Sweep Programdisclosure document or the Mutual Fund (money market) prospectusfor specific product features. If you do not choose a core accountinvestment vehicle, UBIS will invest your cash balances in the FDIC-Insured bank Deposit Sweep Program while awaiting reinvestment.Different core account investment vehicles may have different ratesof return and different terms and conditions, such as FDIC Insuranceor SIPC protection. If you do not select a Core Investment Vehicle,UBIS may not consider these differences when selecting a defaultCore Account Vehicle for you.Entity and Non-Resident Alien account types are not eligible for the<strong>Bank</strong> Deposit Sweep Program. These accounts will default to theHighMark Diversified Money Market Fund. Other account types mayhave eligibility restrictions based upon beneficial ownership andbeneficiaries. Please consult with your agent regarding this issue.<strong>Bank</strong> Deposit Sweep (QPRMQ)HighMark California Tax-Free Money Market Fund (HMAXX)Other:Please read the Settlement section of the Customer Agreement formore information. For complete information about the moneymarket sweep oiption, including charges and expenses, please referto the product prospectus. Shares of the HighMark Funds are notendorsed nor guaranteed by, and do not constitute obligations of<strong>Union</strong> <strong>Bank</strong>, N.A. or <strong>Union</strong>Banc Investment Services LLC. Shares ofthe funds are not insured by the FDIC, or any governmental agencyand involve risk of loss of principal. HighMark Funds are distributedby SEI Investments Distribution Co., which is unaffiliated with theadviser, its parent or any affiliates. HighMark Capital Management,Inc. is a subsidiary of <strong>Union</strong> <strong>Bank</strong>, N.A. and serves as investmentadviser for HighMark Funds. <strong>Union</strong> <strong>Bank</strong>, N,A. provides certainservices to the funds and is compensated for these services.Proceeds from SalesSweep to <strong>Bank</strong> AccountI (we) agree to have all settlements including margin calls processedthrough the <strong>Union</strong> <strong>Bank</strong> account listed below (08):Proceeds from DVP SalesPlease Provide Delivery Instructions:Dividend/Distribution Income (choose one)Note that any dividend/distribution income sent to a DVP account willremain there pending additional instructions.Handle all dividends and distributions like sales proceeds (4)Reinvest mutual fund dividend/cap gains and equity dividends,handle all other distributions like sale proceeds (D)Reinvest mutual fund dividends/cap gains, handle all otherdistributions like sale proceeds (3)Reinvest equity dividends, handle all other distributions like saleproceeds (S)Note: Default is Reinvest if none of the boxes are checked.Electronic Services AgreementPlease be advised that we will send you a View enabled User Id andPIN to provide you access to your account information via our OnlineServices and our Automated Telephone Services unless you choose adifferent option below. The User ID and PIN will be sent to you to theaddress of record on this account.The Electronic Services section of the Customer Agreement will besent to you under a separate coverNote: All Pay by Check and NRA accounts will only be set up withthe Limited Access Option (view-only)Please review the additional options below and check any appropriatebox(es). For details about our pricing for electronic trades, pleaserefer www.mystreetscape.com/my/ubis or call us at 800-634-1100.TRADING ENABLED: I wish to enable trading capability to myelectronic services access.LINK TO AN EXISTING USER ID: I understand that I may chooseto have different User IDs for each account, however, I wish tolink this account to a User ID I already have for anotheraccount(s) with <strong>Union</strong>Banc Investment Services LLC. Iunderstand that I must be a signer on all accounts linked to myUser ID or a notarized trading authorization is required. I maynot combine trade-enabled, view-only and/or equity or mutualfund only trading accounts under a single User ID and/or equityonly trading accounts under a single User ID.Please link this account to my existing Online Investing/Telephone Investing User ID(s) listed below. List only your USERIDs. Do not include your PIN(s).USER IDNAME OF BANK<strong>ACCOUNT</strong> NUMBER<strong>ACCOUNT</strong> NUMBER<strong>ACCOUNT</strong> NUMBERID NUMBERAGENT NUMBERABA NUMBERSecurity PurchasesAll securities purchased will be held in your account unless DVPoption is checked.I agree to keep my User ID and PIN confidential in order toprevent unauthorized access to my account(s). I understand thatall individuals accessing accounts via this User ID and PIN areable to obtain account information and trade (if trade capabilityis enabled equally within any and all accounts linked to it.Additional trading authorization form may be required tocomplete this request).For Duplicate Confirms or StatementsConfirmsStatementsSend to:NAMEADDRESSCITYSTATEZIP CODE51047 (Rev. 06/2011) eformPage 5

5. ADDITIONAL <strong>ACCOUNT</strong> HOLDERSUse this section to provide personal information on any additional individuals associated with this account (such as a joint owner, authorizedindividual, minor, administrator, trustee, partner, or participant).Copy and complete this page for each additional owner. Number each copied page as follows: 6.1, 6.2, 6.3 etc.Personal InformationNAME OF <strong>ACCOUNT</strong> HOLDER, ENTITY NAME, MINOR, TRUSTEEDATE OF BIRTH (MM/DD/YYYY)United StatesResident AlienNon-Resident Alien*(W-8 Form required)CITIZENSHIPCOUNTRY OF CITIZENSHIP (If Resident or Non-Resident Alien)HOME PHONE NUMBERBUSINESS PHONE NUMBERSOCIAL SECURITY NUMBER or TAX ID NUMBERCOUNTRY OF TAX RESIDENCESingle/Divorced/WidowedMarriedNo. of Dependents:MARITAL STATUSEMAIL ADDRESSLEGAL STREET ADDRESS (No P.O. Boxes)MAILING ADDRESS (If different from Legal Street Address)CITY STATE/PROVINCE ZIP/POSTAL CODECITY STATE/PROVINCE ZIP/POSTAL CODECOUNTRYCOUNTRYIdentification -- Provide identification as requiredAdditional Account Owners/Signer -- Select one:Legal U.S. Resident Driver's License or any other government issued photo identification (specify type):Non U.S. Resident - Passport or any other foreign government issued photo identification that is written in English (specify type):Copy is required.Form of identification:TYPE OF GOVERNMENT ISSUED ID ID NUMBERSTATE/COUNTRY OF ID ISSUANCE ID ISSUANCE DATE ID EXPIRATION DATEEmployer Information and AffiliationsEmployed Retired Not EmployedEMPLOYMENT STATUSNeither I, nor anyone bearing a financial interest or discretionaryauthority over this account is employed by, or affiliated with, astock exchange or member firm of either an exchange, FINRA, or amunicipal securities broker/dealer UNLESS SPECIFIED BELOW:OCCUPATION (or former occupation, if retired)NAME OF FIRMEMPLOYER NAMETYPE OF BUSINESSADDRESS OF FIRMNotification of your intent to open an account will be sent to youremployer in accordance with current regulations.ADDRESSCITY STATE/PROVINCE ZIP/POSTAL CODEFor purposes of assisting your employer comply with SEC section16 reporting, please list a contact name and number whom UBISwill contact upon transactions executed in your public company'sstock.COUNTRYI am a control person or a affiliate of a public company under SECRule 144 (such as a director, 10% shareholder, or policy-makingofficer), or an immediate family or household member of such.NAME OF FIRMCONTACT NAMEPHONE NUMBERTICKER SYMBOL*These account types are not eligible for the <strong>Bank</strong> Deposit Sweep Program. These accounts will default to the HighMark DiversifiedMoney Market Fund. Other account types may have eligibility restrictions based upon beneficial ownership and beneficiaries.51047 (Rev. 06/2011) eformPage 6

6. TRANSFER ON DEATH (TOD) BENEFICIARY INFORMATIONThis section is required for Transfer on Death, Custodial, Estate, Trust and Non Prototype accounts, and does not apply to other types ofaccounts.Share percentages must total 100% for primary and 100% for contingent. Use percentages only, not dollar amounts.Before making a Per Stirpes designation, consult with an estate planning attorney and see the Customer Agreement for important information. Ifyou make any Per Stirpes designation, provide name of executor or other contact:CONTACT/EXECUTOR NAMEIf beneficiary is a trust, provide trust name, names of all trustees, beneficiaries, and date trust was established.PRIMARY Beneficiaries/FBOCONTINGENT BeneficiariesNAME OF BENEFICIARYNAME OF BENEFICIARYSpouse Non-Spouse Trust EntitySpouse Non-Spouse Trust EntityCHECK ONECHECK ONESOCIAL SECURITY NUMBER OR TAXPAYER ID NO.DATE OF BIRTH/TRUST (MM/DD/YYYY)SOCIAL SECURITY NUMBER OR TAXPAYER ID NO.DATE OF BIRTH/TRUST (MM/DD/YYYY)COUNTRY OF CITIZENSHIP/ORGANIZATION% SHARECOUNTRY OF CITIZENSHIP/ORGANIZATION% SHARENAME OF TRUSTEES (if applicable)Per StirpesNAME OF TRUSTEES (if applicable)Per StirpesNAME OF BENEFICIARYNAME OF BENEFICIARYSpouse Non-Spouse Trust EntitySpouse Non-Spouse Trust EntityCHECK ONECHECK ONESOCIAL SECURITY NUMBER OR TAXPAYER ID NO.DATE OF BIRTH/TRUST (MM/DD/YYYY)SOCIAL SECURITY NUMBER OR TAXPAYER ID NO.DATE OF BIRTH/TRUST (MM/DD/YYYY)COUNTRY OF CITIZENSHIP/ORGANIZATION% SHARECOUNTRY OF CITIZENSHIP/ORGANIZATION% SHARENAME OF TRUSTEES (if applicable)Per StirpesNAME OF TRUSTEES (if applicable)Per Stirpes7. CUSTOMER AGREEMENT AND SIGNATURENotice to National Financial Services, LLCThis is to advise you that I have instructed <strong>Union</strong>Banc Investment Services LLC to establish, in my behalf, an account with you. I haveappointed <strong>Union</strong>Banc Investment Services LLC as my exclusive agent to act for and on my behalf with respect to all matters regarding myaccount with you, including but not limited to the placing of securities, purchase and sale orders, the selection of my Core Account InvestmentVehicle, including a <strong>Bank</strong> Deposit Sweep Program and to act in all respects in connection with such Core Account Investment Vehicle, providemargin and/or option trading approved for the account, delivery of margin and or option instructions for my (our) account. I acknowledge thatno fiduciary relationship exists. You shall look solely to <strong>Union</strong>Banc Investment Services LLC and not me with respect to any such orders orinstructions, and you are hereby instructed to deliver confirmations, statements, and all written or other notices, with respect to my account, to<strong>Union</strong>Banc Investment Services LLC. Any such communications delivered to <strong>Union</strong>Banc Investment Services LLC shall be deemed to have beendelivered to me, and you shall be entitled to rely on <strong>Union</strong>Banc Investment Services LLC to forward the substance of any such communicationsto me. I agree to hold you harmless from and against any losses, costs, or expenses arising in connection with the delivery or receipt of anysuch communication(s), provided you have acted in accordance with the above. The foregoing shall be effective as to my account until writtennotice to the contrary is received by you and by <strong>Union</strong>Banc Investment Services LLC.51047 (Rev. 06/2011) eformPage 7

7. CUSTOMER AGREEMENT AND SIGNATURE (Continued)Taxpayer CertificationUnder penalties of perjury, I certify that (1) the number shown on this form is my correct taxpayer identification number; (2) I am not subjectto backup withholding because: (a) I am exempt from backup withholding; or (b) I have not been notified by the Internal Revenue Services(IRS) that I am subject to backup withholding as a result of a failure to report all interest or dividends; and (3) I am a U.S. person (including aU.S. resident alien) or (4) If I am not a U.S. person, I am submitting a W-8 as advised by my tax advisor with this form.If I have been notified by the IRS that I am subject to backup withholding as a result of dividend or interest underreporting, I must cross out (2)in this certification.The Internal Revenue Service does not require the customer’s consent to any provision of this document other than the certifications requiredto avoid backup withholding.• By signing below, I agree to be bound by the terms and conditions of this account and of the Customer Agreement.• I attest that the information provided in this application was completed prior to signing and is true and correct.• I acknowledge receipt of a copy of this application.To <strong>Union</strong>Banc Investment Services LLC and National Financial Services LLCI understand that it is my responsibility to read the prospectus or disclosure document, as applicable, I understand that it is my responsibility toread the product prospectus or disclosure document, as applicable for the <strong>Bank</strong> Deposit Sweep Program or money market mutual fund sweepoption, which I may select, purchase or exchange. I will refer to the applicable prospectus or disclosure document for specific informationabout the core account in which I am investing.If I choose a <strong>Bank</strong> Deposit Sweep Program for my core account investment vehicle, I represent that I am: (1) a natural person or (2) if I am afiduciary, including trustee, custodian, agent, administrator or executor, each of the beneficial owners of the account is a natural person or (3)if this account is being established as a TOD account, any such beneficiary is a natural person.If I do not choose a Core Account Investment vehicle for my account, I authorize my Broker/Dealer to, in its sole discretion, select a defaultCore Account Investment Vehicle for me and I shall hold my Broker/Dealer and NFS harmless for such default selection and any consequencesresulting therefrom. I understand that different Core Account Investment Vehicles may have different rates of return and terms andconditions, such as FDIC insurance or SIPC protection, and that my Broker/Dealer may not consider these differences when making a defaultCore Account Investment Vehicle selection for me.I am at least 18 years of age and am of full legal capacity in the state in which I reside. In consideration of your accepting one or moreaccounts, I hereby acknowledge that I have read, understood and agreed to the terms set forth in the Customer Agreement herein. Iunderstand that <strong>Union</strong>Banc Investment Services LLC will disclose my name to issuers of securities if securities are held in my account so that Ican receive important information unless I do not consent to disclosure, and I will notify <strong>Union</strong>Banc Investment Services LLC if I do notconsent. I certify under penalties of perjury (1) that the Social Security or Taxpayer Identification Number provided herein is correct, and (2)that the IRS has never notified me that I am subject to backup withholding, or has notified me that I am no longer subject to such backupwithholding. (Note: If part (2) is not true, please strike out that part before signing.) I understand that telephone calls to <strong>Union</strong>Banc InvestmentServices LLC may be recorded, and I hereby consent to such recording. Reports of executions of orders and statements of my account shall beconclusive if not objected to in writing within five (5) days and ten (10) days, respectively, after transmitted to me by mail or otherwise. Iunderstand that investments other than deposits in a <strong>Bank</strong> (a) are not FDIC insured, (b) are not obligations of any <strong>Bank</strong> or <strong>Union</strong>BancInvestment Services LLC, (c) are not guaranteed by any <strong>Bank</strong>, and (d) involve investment risks, including possible loss of principal.I HEREBY AGREE TO READ AND BE BOUND BY THE TERMS OF THE CUSTOMER AGREEMENT AS CURRENTLY IN AFFECT AND AS MAY BEAMENDED FROM TIME TO TIME. THIS <strong>ACCOUNT</strong> IS GOVERNED BY A PRE-DISPUTED ARBITRATION AGREEMENT HEREWITH PROVIDED. IACKNOWLEDGE THAT I HAVE RECEIVED AND READ THE PRE-DISPUTE ARBITRATION AGREEMENT.THE INTERNAL REVENUE SERVICE DOES NOT REQUIRE YOUR CONSENT TO ANY PROVISION OF THIS DOCUMENT OTHER THAN THECERTIFICATIONS REQUIRED TO AVOID BACKUP WITHHOLDING.SIPC InformationSecurities in accounts carried by National Financial Services LLC (NFS) are in accordance with the Securities Investor Protection Corporation("SIPC") up to $500,000. For claims filed on or after July 22, 2010, the $500,000 total amount of SIPC protection is inclusive of up to$250,000 protection for claims for cash awaiting reinvestment, subject to periodic adjustments for inflation in accordance with terms of theSIPC statue and approval by SIPC's Board of Directors. NFS also has arranged for coverage above these limits. Neither coverage protectsagainst a decline in the market value of securities, nor does either coverage extend to certain securities that are considered ineligible forcoverage.For more details on SIPC, or to request a brochure, visit www.sipc.org or call 1-202-371-8300.SignaturesAll account holders (owners and individuals) must sign in accordance with the signature requirements outlined in the accounts supportingdocuments.X1. SIGNATURE DATE (MM/DD/YYYY)X4. SIGNATUREDATE (MM/DD/YYYY)X2. SIGNATUREDATE (MM/DD/YYYY)X5. SIGNATURE DATE (MM/DD/YYYY)XX3. SIGNATURE DATE (MM/DD/YYYY) 6. SIGNATURE DATE (MM/DD/YYYY)51047 (Rev. 06/2011) eformPage 8